Global Next Generation Solar Cell Market

Market Size in USD Billion

CAGR :

%

USD

3.03 Billion

USD

12.95 Billion

2024

2032

USD

3.03 Billion

USD

12.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.03 Billion | |

| USD 12.95 Billion | |

|

|

|

|

What is the Global Next-Generation Solar Cell Market Size and Growth Rate?

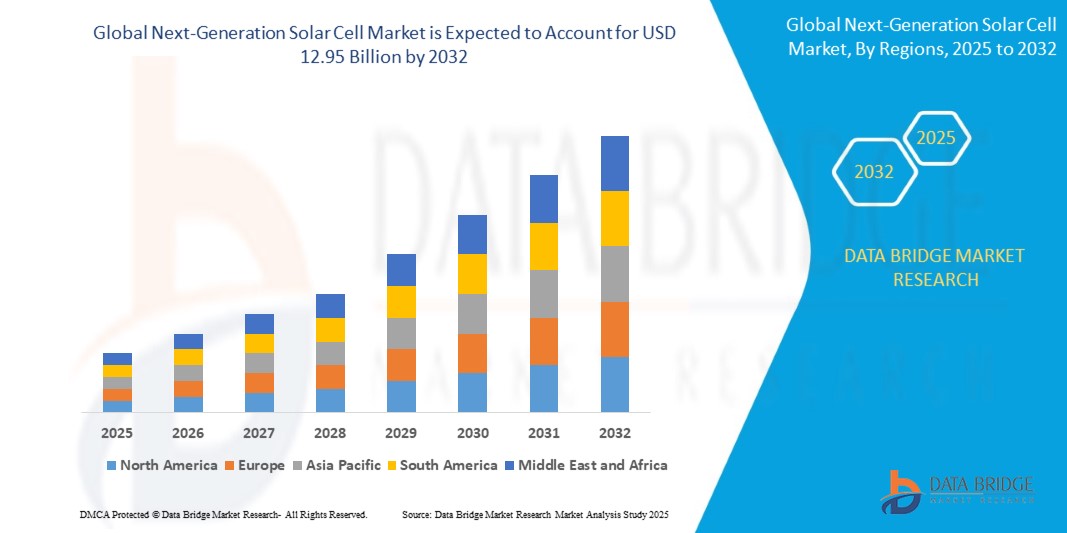

- The global next-generation solar cell market size was valued at USD 3.03 billion in 2024 and is expected to reach USD 12.95 billion by 2032, at a CAGR of 19.90% during the forecast period

- Next-generation solar cells are advanced technologies that improve classic silicon-based solar cells' efficiency, cost-effectiveness, and adaptability. These technologies provide novel techniques for capturing and converting sunlight into electricity, frequently overcoming the limitations of traditional solar cells

- Improving manufacturing techniques and utilizing novel materials can potentially lower the manufacturing costs of next-generation solar cells. This lowers the cost of solar energy and makes it more competitive with other energy generation sources

- Rapid advances in materials science, nanotechnology, and manufacturing techniques drive the development of next-generation solar cell technologies. Efficiency, stability, and scalability innovations are critical for achieving a competitive advantage in the market

What are the Major Takeaways of Next-Generation Solar Cell Market?

- Materials science, nanotechnology, and manufacturing process advancements have enabled the creation of novel solar cell technologies with increased efficiency and stability

- However, manufacturing firms encountered difficulties in keeping operations running while complying with safety procedures. Reduced workforce, slower output, and changes in work arrangements may have hampered the production of next-generation solar cells

- Asia-Pacific dominated the next-generation solar cell market with the largest revenue share of 41.3% in 2024, driven by rapid urbanization, large-scale renewable energy projects, and strong government initiatives promoting solar adoption

- North America next-generation solar cell market is projected to grow at the fastest CAGR of 13.4% from 2025 to 2032, fueled by increasing federal incentives, rising corporate investments in clean energy, and growing residential adoption of solar technologies

- The Perovskite segment dominated the next-generation solar cell market with the largest market revenue share of 39.6% in 2024, driven by its superior energy conversion efficiency, low production costs, and flexibility for diverse applications including building-integrated photovoltaics (BIPV) and portable devices

Report Scope and Next-Generation Solar Cell Market Segmentation

|

Attributes |

Next-Generation Solar Cell Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Next-Generation Solar Cell Market?

Technological Advancements Driving Higher Efficiency and Versatility

- A significant and accelerating trend in the global next-generation solar cell market is the focus on high-efficiency materials such as perovskite and tandem solar cells, enabling superior energy conversion rates compared to traditional silicon-based cells

- For instance, Oxford PV has been scaling its perovskite-silicon tandem technology, achieving record-breaking efficiency levels that aim to make solar power cheaper and more accessible. Similarly, Hanwha Q CELLS is investing in quantum dot technology to enhance low-light performance, widening solar application possibilities

- These advancements allow solar cells to be integrated into diverse applications, including building-integrated photovoltaics (BIPV), flexible electronics, and portable devices. By combining higher efficiency with adaptable form factors, Next-Generation Solar Cells are reshaping how solar energy is harvested and used across industries

- Companies such as First Solar and Trina Solar are spearheading research into environmentally sustainable materials, reducing production costs while improving performance

- This trend toward efficiency, adaptability, and sustainability is fundamentally redefining the role of solar technology, creating opportunities beyond traditional utility-scale projects and driving the market toward mass adoption across residential, commercial, and industrial sectors

What are the Key Drivers of Next-Generation Solar Cell Market?

- The rising global demand for renewable energy, coupled with government incentives and carbon reduction targets, is a major driver for next-generation solar cell adoption

- For instance, in March 2024, Trina Solar announced the commercialization of its high-efficiency Vertex S+ series for distributed generation, aligning with the growing demand for sustainable energy in residential and commercial spaces

- The increasing need for lightweight and flexible solar panels for applications such as electric vehicles, wearables, and aerospace is also pushing market growth, with companies such as Heliatek developing organic solar films for versatile deployments

- Furthermore, the trend toward urbanization and smart infrastructure is fueling demand for BIPV, where solar cells double as functional building materials, enhancing aesthetics and energy output

- Advancements in manufacturing scalability and cost reduction, particularly in perovskite and thin-film technologies, are expected to accelerate the adoption of Next-Generation Solar Cells globally

Which Factor is challenging the Growth of the Next-Generation Solar Cell Market?

- Stability and durability issues of emerging technologies, particularly perovskite and organic solar cells, remain a key challenge hindering widespread adoption

- For instance, high-profile research findings in 2024 highlighted concerns about the long-term performance of perovskite cells under extreme weather conditions, making some investors cautious about large-scale deployments

- In addition, high initial costs of advanced manufacturing processes and intellectual property barriers pose hurdles for new entrants, limiting competition and scalability

- Environmental concerns regarding the use of toxic materials, such as lead in perovskites, have also raised regulatory scrutiny in several regions

- Overcoming these challenges through material innovation, lifecycle testing, and improved recycling methods will be essential for sustained market growth, with companies such as First Solar and Panasonic Corporation actively investing in safer and more robust solutions

How is the Next-Generation Solar Cell Market Segmented?

The market is segmented on the basis of material type, installation, and end-users.

• By Material Type

On the basis of material type, the next-generation solar cell market is segmented into Perovskite, Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si), Gallium Arsenide (GaAs), and Others. The Perovskite segment dominated the next-generation solar cell market with the largest market revenue share of 39.6% in 2024, driven by its superior energy conversion efficiency, low production costs, and flexibility for diverse applications including building-integrated photovoltaics (BIPV) and portable devices. Cadmium Telluride (CdTe) technology is expected to witness significant growth due to its cost-effectiveness for large-scale utility projects and advancements in thin-film deposition techniques.

Meanwhile, CIGS is gaining traction for niche applications such as aerospace and automotive due to its lightweight and flexible properties, although it currently holds a smaller share compared to Perovskite and CdTe.

• By Installation

On the basis of installation, the next-generation solar cell market is segmented into On-Grid and Off-Grid. The On-Grid segment captured the largest market revenue share of 68.4% in 2024, supported by extensive deployment in urban infrastructures, government-backed renewable energy initiatives, and the rising adoption of smart grids.

The Off-Grid segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rural electrification programs, growing demand for solar-powered portable systems, and applications in remote industrial operations such as mining and oil exploration.

• By End-Users

On the basis of end-users, the next-generation solar cell market is segmented into Residential, Commercial & Industrial, Utilities, and Others. The Utilities segment held the dominant market revenue share of 47.2% in 2024, fueled by large-scale solar farms and increasing government investments in renewable energy to meet carbon neutrality goals. The Commercial & Industrial segment is expected to expand at the fastest CAGR during the forecast period, supported by corporate sustainability initiatives and the integration of solar cells into manufacturing and logistics operations.

The Residential segment is also growing steadily as homeowners adopt rooftop solar solutions, boosted by declining costs and the availability of subsidies in emerging economies.

Which Region Holds the Largest Share of the Next-Generation Solar Cell Market?

- Asia-Pacific dominated the next-generation solar cell market with the largest revenue share of 41.3% in 2024, driven by rapid urbanization, large-scale renewable energy projects, and strong government initiatives promoting solar adoption

- Consumers and industries in the region are increasingly favoring high-efficiency and cost-effective solar technologies, supported by robust manufacturing capabilities in countries such as China, Japan, and India

- This dominance is further reinforced by the presence of key producers, substantial investments in research and development, and a rising focus on sustainability and energy independence, positioning Asia-Pacific as the central hub for next-generation solar cells

China Next-Generation Solar Cell Market Insight

The China next-generation solar cell market accounted for the largest share within Asia-Pacific in 2024, driven by the expansion of solar farms, smart cities, and industrial electrification initiatives. China’s strong domestic production capacity, rapid advancements in perovskite and thin-film technologies, and ambitious carbon neutrality targets are accelerating adoption. Favorable government policies, including subsidies for solar infrastructure, are expected to keep China at the forefront of the global market.

Japan Next-Generation Solar Cell Market Insight

The Japan next-generation solar cell market is witnessing steady growth due to the country’s technological innovation and demand for high-efficiency solar modules. Integration of solar cells into building materials, coupled with rising interest in floating solar projects, is driving adoption. Furthermore, Japan’s focus on disaster-resilient and decentralized energy systems strengthens demand for advanced solar solutions across residential and commercial sectors.

India Next-Generation Solar Cell Market Insight

The India next-generation solar cell market is gaining momentum as government-led renewable energy programs and falling solar installation costs spur adoption. Large-scale investments in solar parks, coupled with an increasing shift toward off-grid and hybrid systems in rural areas, are key growth enablers. India’s growing manufacturing base and collaborations with global players are expected to further enhance its position in the Asia-Pacific market.

Which Region is the Fastest Growing Region in the Next-Generation Solar Cell Market?

North America next-generation solar cell market is projected to grow at the fastest CAGR of 13.4% from 2025 to 2032, fueled by increasing federal incentives, rising corporate investments in clean energy, and growing residential adoption of solar technologies. The recent solar Investment Tax Credit (ITC) expansion has been a game-changer, encouraging residential and commercial solar technology investments. Furthermore, as more utilities integrate solar into their energy portfolios, the market is poised for sustained growth, reflecting a broader shift toward sustainability across the region

U.S. Next-Generation Solar Cell Market Insight

The U.S. market dominated North America’s revenue share in 2024, supported by the expansion of utility-scale solar farms and integration of advanced technologies such as tandem and multi-junction cells. Corporate sustainability goals, combined with the Inflation Reduction Act incentives, are driving widespread adoption across residential, commercial, and industrial applications.

Canada Next-Generation Solar Cell Market Insight

The Canada market is experiencing strong growth due to government-backed renewable energy mandates and the push for carbon-neutral infrastructure projects. Rising interest in building-integrated photovoltaics (BIPV) and cold-climate solar solutions is expected to further boost market demand in the coming years.

Which are the Top Companies in Next-Generation Solar Cell Market?

The next-generation solar cell industry is primarily led by well-established companies, including:

- Hanwha Q CELLS (South Korea)

- Oxford PV (U.K.)

- Kaneka Solar Energy (Japan)

- Flisom (Switzerland)

- Mitsubishi Chemical Group (Japan)

- Hanergy Thin Film Power Group (China)

- Heliatek (Germany)

- 3D-Micromac (Germany)

- Suntech Power Holdings (China)

- Sharp Corporation (Japan)

- Trina Solar (China)

- Panasonic Corporation (Japan)

- Sol Voltaics (Sweden)

- Geo Green Power (England)

- Jinko Solar (China)

- Canadian Solar (Canada)

- Yingli Solar (China)

- REC Group (Norway)

- First Solar (U.S.)

- Ascent Solar Technologies (U.S.)

- Solactron (U.S.)

- MiaSole (U.S.)

- Polysolar Technology (U.S.)

- NanoPV Technologies (U.S.)

- SunPower Corporation (U.S.)

What are the Recent Developments in Global Next-Generation Solar Cell Market?

- In August 2024, Tongwei introduced its TNC-G12/G12R series modules, marking a major advancement in the solar industry. These modules deliver superior power output, efficiency, and quality by utilizing the company’s proprietary solar cell technology, setting a new standard for high-performance solar solutions. This launch positions Tongwei as a frontrunner in next-generation solar innovations

- In July 2024, First Solar, Inc. secured the intellectual property rights for TetraSun, Inc.’s advanced thin-film solar technology. This acquisition has empowered the company to initiate legal action against several crystalline silicon solar manufacturers for alleged patent infringements, reinforcing its position in solar technology protection. This move strengthens First Solar’s competitive edge and technological leadership in the global market

- In February 2024, ECOKRAFT completed the acquisition of Fenix Solar, a specialist in solar panel monitoring and optimization. By integrating Fenix Solar’s proactive troubleshooting and real-time data analytics capabilities, ECOKRAFT aims to deliver enhanced performance, reliability, and efficiency across its solar installations. This acquisition enables ECOKRAFT to expand its portfolio with smarter and more efficient solar solutions

- In December 2023, Qcells finalized the acquisition of full intellectual property rights for LECO technology. Known for its ability to significantly enhance the efficiency of PERC and TOPCon solar cells, this technology is expected to boost Qcells’ manufacturing competitiveness. This strategic acquisition reinforces Qcells’ commitment to driving high-efficiency solar advancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Next Generation Solar Cell Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Next Generation Solar Cell Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Next Generation Solar Cell Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.