Global Next Generation Tobacco Products Market

Market Size in USD Billion

CAGR :

%

USD

37.29 Billion

USD

79.93 Billion

2025

2033

USD

37.29 Billion

USD

79.93 Billion

2025

2033

| 2026 –2033 | |

| USD 37.29 Billion | |

| USD 79.93 Billion | |

|

|

|

|

What is the Global Next Generation Tobacco Products Market Size and Growth Rate?

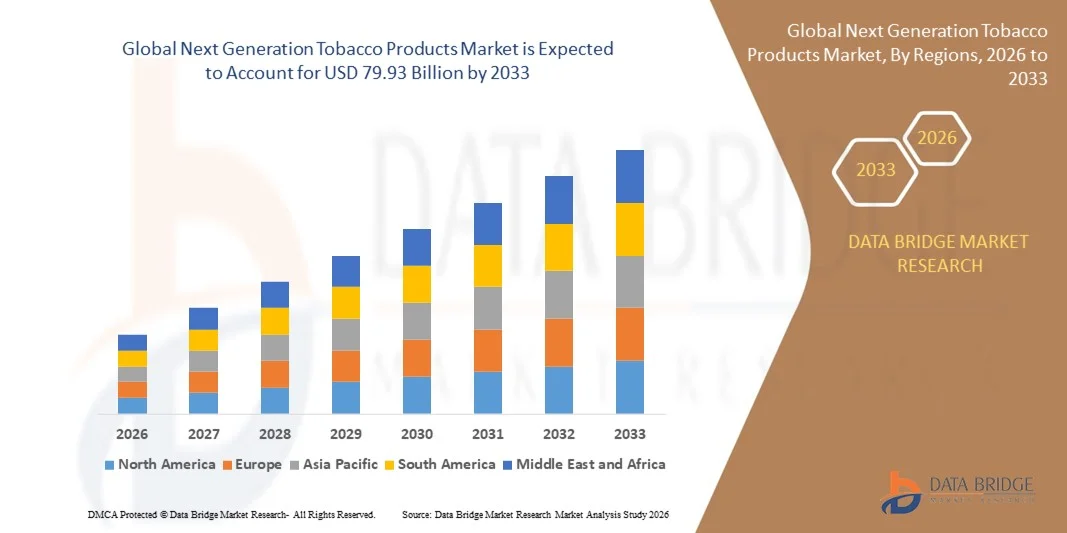

- The global next generation tobacco products market size was valued at USD 37.29 billion in 2025 and is expected to reach USD 79.93 billion by 2033, at a CAGR of 10.00% during the forecast period

- The next generation tobacco products market is rising in demand due to rapidly increasing number of product launches. The easy availability of superior-quality products is also highly impacting the growth of the next generation tobacco products

- The rising consumption of tobacco products amongst females and students as well as rising investments in next-generation tobacco products are projected to grow substantially during the forecast period

What are the Major Takeaways of Next Generation Tobacco Products Market?

- The high development and commercialization of new generation products such as snus, tobacco heating products and vapor products are also expected to push the growth of next generation tobacco products market in the above mentioned forecast period

- The major factor which actively drives the demand of next generation tobacco products market is the high demand owing to rising consumer disposable income

- Asia-Pacific dominated the next generation tobacco products market with a 41.36% revenue share in 2025, supported by widespread adoption of e-cigarettes, vapes, and tobacco heating products in China, Japan, India, and Southeast Asia

- North America is projected to register the fastest CAGR of 8.1% from 2026 to 2033, driven by increasing adoption of e-cigarettes, vapes, and heated tobacco products in the U.S. and Canada

- The e-Cigarettes segment dominated the market with a revenue share of 44.8% in 2025, driven by high consumer awareness, easy availability, and convenience for nicotine consumption

Report Scope and Next Generation Tobacco Products Market Segmentation

|

Attributes |

Next Generation Tobacco Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Next Generation Tobacco Products Market?

Rising Adoption of Reduced-Risk and High-Performance Tobacco Alternatives

- The next generation tobacco products market is witnessing a key trend of increasing adoption of reduced-risk, innovative tobacco alternatives such as heated tobacco products, e-cigarettes, and nicotine pouches. This trend is driven by growing health awareness among consumers, regulatory encouragement for harm reduction, and demand for modern, convenient tobacco consumption solutions

- Companies such as BAT Group, Philip Morris International, Japan Tobacco Inc., JUUL Labs, and Imperial Brands are introducing advanced products with improved safety profiles, customizable nicotine delivery, and enhanced user experience to capture market share

- Rising interest in smoke-free alternatives and stricter regulations on combustible cigarettes accelerate product adoption

- Manufacturers are integrating cutting-edge heating systems, nicotine formulation technologies, and digital device connectivity for real-time monitoring

- Increased R&D in flavor innovations, battery efficiency, and device ergonomics is boosting consumer engagement

- As health-conscious consumers prioritize harm-reduction, next generation tobacco products are expected to remain central to tobacco industry growth globally

What are the Key Drivers of Next Generation Tobacco Products Market?

- Growing consumer preference for reduced-risk products and alternatives to conventional cigarettes is driving market adoption worldwide

- In 2025, companies such as BAT Group, JUUL Labs, Philip Morris International, and Imperial Brands expanded product portfolios and launched next-generation devices with advanced heating technology to meet demand for safer tobacco options

- Rising regulations and taxation on combustible cigarettes encourage smokers to switch to e-cigarettes, heated tobacco, and nicotine pouches

- Technological advancements in device safety, nicotine delivery precision, flavor variety, and battery life enhance product appeal

- Increased investment in marketing, awareness campaigns, and retail accessibility strengthens consumer adoption

- With continued focus on innovation, harm-reduction, and regulatory compliance, the Next Generation Tobacco Products market is expected to maintain robust growth over the coming years

Which Factor is Challenging the Growth of the Next Generation Tobacco Products Market?

- High device costs, research-intensive development, and premium product pricing limit adoption in price-sensitive markets

- Fluctuations in regulatory frameworks across regions, including advertising restrictions and flavor bans, create operational uncertainties

- Public perception, limited awareness about reduced-risk products, and skepticism among older smokers hinder market penetration

- Competition from conventional cigarettes, heated tobacco alternatives, and illicit products affects pricing and market share

- Supply chain complexities for nicotine formulations and electronic components pose production challenges

- To overcome these issues, manufacturers are focusing on cost-efficient manufacturing, global regulatory alignment, user education, and product diversification to drive adoption of next generation tobacco products

How is the Next Generation Tobacco Products Market Segmented?

The market is segmented on the basis of product type, application, end-user, and distribution channel.

- By Device Type

On the basis of device type, the next generation tobacco products market is segmented into e-Cigarettes, Vaps, Mods, e-Hookahs, Pens, and Other devices. The e-Cigarettes segment dominated the market with a revenue share of 44.8% in 2025, driven by high consumer awareness, easy availability, and convenience for nicotine consumption. E-cigarettes are preferred for their portability, variety of flavors, and user-friendly design. Continuous product innovation in battery life, heating mechanisms, and compact designs is further driving adoption globally.

The Mods segment is projected to register the fastest CAGR between 2026 and 2033, fueled by rising demand for customizable, high-performance vaping devices among enthusiasts and tech-savvy users. Advanced features, aesthetic designs, and compatibility with multiple e-liquids are accelerating growth of this segment across North America, Europe, and Asia-Pacific markets.

- By System

On the basis of vaping system, the market is segmented into Open Vaping System, Closed Vaping System, Semi-Closed System, and Other systems. The Closed Vaping System segment dominated with a 48.5% revenue share in 2025, supported by ease of use, pre-filled pods, and leak-proof design, appealing to beginners and casual users. Closed systems ensure consistent performance and reduce maintenance, making them ideal for mass-market adoption.

The Open Vaping System segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by experienced users seeking refillable pods, multiple flavor options, and high customization. Technological innovations in refillable pods, leak-resistant designs, and adjustable airflow are fueling growth of open systems globally.

- By Product Type

On the basis of product type, the market is segmented into Tobacco Heating Products, Vapour Products, Snus Products, and Other alternatives. The Tobacco Heating Products segment dominated with a revenue share of 42.7% in 2025, owing to rising adoption in countries with strict smoking regulations and growing preference for reduced-risk alternatives. These products offer heat-not-burn technology, minimizing harmful emissions while retaining flavor and nicotine delivery.

The Vapour Products segment is projected to register the fastest CAGR from 2026 to 2033, fueled by expanding consumer base, innovative e-liquids, and increasing social acceptance. Continuous advancements in device efficiency, flavor profiles, and battery longevity are further driving global adoption of vapour products.

- By Component

On the basis of component, the market is segmented into Atomizer, Vape Mod, Cartomizer, E-liquid, Battery, and Other components. The E-liquid segment dominated the market with a revenue share of 39.5% in 2025, supported by growing demand for flavor variety, nicotine customization, and ease of use across all vaping devices. Premium and artisanal e-liquids with organic and synthetic blends enhance user experience and drive market adoption.

The Battery component is projected to grow at the fastest CAGR from 2026 to 2033, owing to technological advancements in longer-lasting, safer, and faster-charging battery solutions compatible with multiple devices, accelerating global market penetration.

- By Age Group

On the basis of age group, the market is segmented into 18–30, 31–44, 45–60, and 61 and above. The 18–30 Age Group dominated the market with a revenue share of 46.3% in 2025, fueled by rising interest in alternative nicotine products, trendy device designs, and flavored e-liquids. Young adults are increasingly adopting vaping as a lifestyle choice, replacing conventional cigarettes.

The 31–44 Age Group is projected to register the fastest CAGR between 2026 and 2033, driven by health-conscious consumers seeking reduced-risk alternatives to traditional tobacco, alongside disposable and easy-to-use vaping solutions. Social media marketing, influencer campaigns, and awareness programs further boost adoption in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Buying, Retail Stores, Convenience Stores, Drug Stores, Newsstands, Tobacconist Stores, Specialty E-cigarette Stores, and Other channels. The Retail Stores segment dominated with a revenue share of 52.1% in 2025, supported by widespread accessibility, in-store trials, and direct consumer engagement. Retail presence allows hands-on inspection of devices and personalized recommendations, increasing purchase confidence.

The Online Buying segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by the rise of e-commerce platforms, subscription services, direct-to-consumer models, and global shipping capabilities, making vaping products accessible to remote and international consumers while offering convenience and competitive pricing.

Which Region Holds the Largest Share of the Next Generation Tobacco Products Market?

- Asia-Pacific dominated the next generation tobacco products market with a 41.36% revenue share in 2025, supported by widespread adoption of e-cigarettes, vapes, and tobacco heating products in China, Japan, India, and Southeast Asia. Strong regulatory support for harm-reduction products, high consumer awareness, and growing demand from adult smokers switching to next-generation alternatives contribute to regional leadership

- Key players are leveraging product innovation, technological advancements in heating and vaporizing systems, and strategic partnerships to meet rising demand. Expansion of manufacturing facilities and distribution networks further strengthens market dominance

- Rising urbanization, increased disposable income, and growing health consciousness among adult smokers are accelerating adoption of next-generation tobacco products across Asia-Pacific

China Next Generation Tobacco Products Market Insight

China is the largest contributor to the Asia-Pacific market, driven by high adoption of heated tobacco products and e-cigarettes. Leading manufacturers are investing in advanced device technologies, flavored e-liquids, and strict quality standards to enhance consumer experience and safety. Expanding retail and online channels support continued growth.

Japan Next Generation Tobacco Products Market Insight

Japan holds significant share due to early adoption of heat-not-burn devices. Government regulations favoring harm-reduction alternatives, coupled with high consumer preference for technologically advanced products, drive market expansion. Continuous innovation in device design, flavors, and battery efficiency supports growth.

India Next Generation Tobacco Products Market Insight

India is emerging as a key market, fueled by increasing awareness of alternatives to combustible tobacco, rising disposable income, and growing e-commerce penetration for nicotine-containing devices. Regulatory approvals for adult-use products and strategic partnerships with global manufacturers are driving adoption.

North America Next Generation Tobacco Products Market Insight

North America is projected to register the fastest CAGR of 8.1% from 2026 to 2033, driven by increasing adoption of e-cigarettes, vapes, and heated tobacco products in the U.S. and Canada. Consumer demand for reduced-risk products, strong distribution networks, and awareness campaigns supporting harm reduction accelerate growth.

U.S. Next Generation Tobacco Products Market Insight

The U.S. is the largest contributor in North America, supported by premium e-cigarettes, mod systems, and flavored devices. Leading manufacturers are investing in device innovation, regulatory compliance, and direct-to-consumer marketing. Rising consumer focus on smoking alternatives and convenience fuels expansion.

Canada Next Generation Tobacco Products Market Insight

Canada contributes steadily, driven by adult smokers switching to vaping and heated tobacco products. Regulatory frameworks supporting harm-reduction alternatives and increased availability through retail and online channels boost market adoption.

Europe Next Generation Tobacco Products Market Insight

Europe holds significant share, with the U.K., Germany, France, and Italy driving demand for vaping devices and heated tobacco products. Strong regulations on safety, labeling, and marketing, along with consumer preference for reduced-risk products, support adoption. Continuous product innovation, flavor diversification, and sustainable device designs enhance market growth.

Germany Next Generation Tobacco Products Market Insight

Germany leads Europe, driven by high adoption of heated tobacco products and modern vaping devices in urban and corporate markets. Manufacturers focus on technological innovation, quality assurance, and regulatory compliance to maintain market growth.

U.K. Next Generation Tobacco Products Market Insight

The U.K. market is expanding steadily, supported by public health endorsement of e-cigarettes as smoking alternatives and rising consumer preference for vaping products. Online sales, retail availability, and diverse product portfolios further drive growth.

Which are the Top Companies in Next Generation Tobacco Products Market?

The next generation tobacco products industry is primarily led by well-established companies, including:

- BAT Group / British American Tobacco (U.K.)

- Imperial Brands (U.K.)

- Japan Tobacco Inc. (Japan)

- JUUL Labs, Inc. (U.S.)

- Reynolds American Inc. / R. J. Reynolds (U.S.)

- Swedish Match AB (Sweden)

- Turning Point Brands (U.S.)

- Universal Corporation (U.S.)

- Eastern Company SAE (Egypt)

- PT. Gudang Garam Tbk (Indonesia)

- ITC Limited (India)

- Scandinavian Tobacco Group A/S (Denmark)

- Pyxus International, Inc. (U.S.)

- Philip Morris International (Switzerland)

- British American Tobacco Kenya plc (Kenya)

- Vector Group Ltd. (U.S.)

- Körber AG (Germany)

- Altria Group, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Next Generation Tobacco Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Next Generation Tobacco Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Next Generation Tobacco Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.