Global Nickel Metal Hydride Battery Market

Market Size in USD Million

CAGR :

%

USD

550.77 Million

USD

665.85 Million

2025

2033

USD

550.77 Million

USD

665.85 Million

2025

2033

| 2026 –2033 | |

| USD 550.77 Million | |

| USD 665.85 Million | |

|

|

|

|

Nickel Metal Hydride Battery Market Size

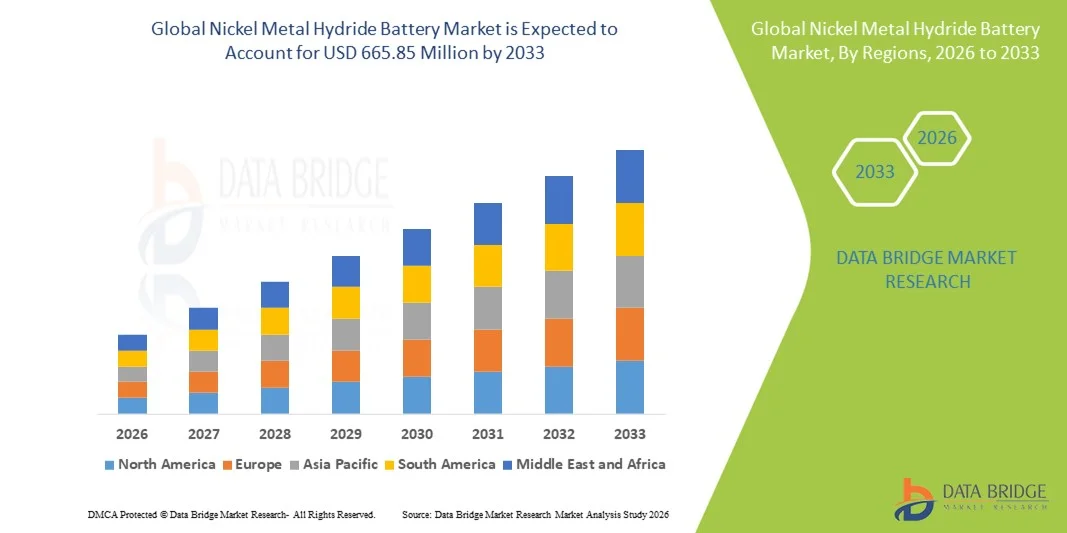

- The global nickel metal hydride battery market size was valued at USD 550.77 million in 2025 and is expected to reach USD 665.85 million by 2033, at a CAGR of 2.40% during the forecast period

- The market growth is largely driven by the sustained adoption of nickel metal hydride batteries in hybrid electric vehicles, supported by their proven safety, long cycle life, and stable performance under repetitive charge–discharge conditions

- Furthermore, increasing demand for reliable and rechargeable power sources in consumer electronics, industrial tools, and backup power applications is reinforcing the continued use of NiMH batteries. These combined factors are supporting steady market expansion despite the rising presence of alternative battery chemistries

Nickel Metal Hydride Battery Market Analysis

- Nickel metal hydride batteries are rechargeable energy storage systems that use hydrogen-absorbing alloys and nickel-based electrodes to deliver reliable power with strong thermal stability and environmental advantages over disposable batteries

- The growing demand for NiMH batteries is primarily supported by their extensive deployment in hybrid electric vehicles, cost-effectiveness, recyclability, and suitability for applications requiring durability and operational safety across automotive, consumer, and industrial sectors

- North America dominated the nickel metal hydride battery market with a share of 41.5% in 2025, due to the strong presence of hybrid electric vehicle production, established automotive OEMs, and long-term use of Ni-MH batteries in HEV platforms

- Asia-Pacific is expected to be the fastest growing region in the nickel metal hydride battery market during the forecast period due to high hybrid vehicle adoption, expanding consumer electronics manufacturing, and strong battery production capabilities

- Large-sized Ni-MH battery for HEV segment dominated the market with a market share of 55.5% in 2025, due to its extensive use in hybrid electric vehicles due to high reliability, proven safety profile, and strong tolerance to overcharging and temperature variations. Automotive manufacturers continue to prefer large-sized Ni-MH batteries for HEVs because of their long cycle life and stable performance under repetitive charge–discharge conditions

Report Scope and Nickel Metal Hydride Battery Market Segmentation

|

Attributes |

Nickel Metal Hydride Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Nickel Metal Hydride Battery Market Trends

Rising Use of Nickel Metal Hydride Batteries in Hybrid Electric Vehicles

- A prominent trend in the nickel metal hydride battery market is the sustained use of these batteries in hybrid electric vehicles, driven by their proven safety profile, thermal stability, and long operational life under repeated charge–discharge cycles. Automakers continue to rely on nickel metal hydride technology for hybrid platforms where durability and reliability are prioritized over high energy density

- For instance, Toyota has consistently used nickel metal hydride batteries supplied by Primearth EV Energy in popular hybrid models such as the Prius and Corolla Hybrid. This long-term adoption demonstrates confidence in the technology’s performance under real-world driving conditions and large-scale deployment

- The ability of nickel metal hydride batteries to perform efficiently across a wide temperature range is supporting their continued integration into hybrid powertrains. This characteristic is especially valuable in regions with varying climatic conditions where battery degradation risks are higher

- Nickel metal hydride batteries are also favored in hybrid vehicles for their tolerance to frequent shallow charging cycles, which aligns well with regenerative braking systems. This compatibility enhances overall energy efficiency and contributes to extended battery lifespan

- Automotive manufacturers value the mature supply chain and established manufacturing processes associated with nickel metal hydride batteries. This reduces production risks and supports stable sourcing for long-term vehicle programs

- The continued presence of nickel metal hydride batteries in hybrid electric vehicles reinforces their role as a dependable energy storage solution. This trend highlights their ongoing relevance despite the broader industry shift toward alternative battery chemistries

Nickel Metal Hydride Battery Market Dynamics

Driver

Demand for Safe and Long-Life Rechargeable Batteries

- The demand for safe and long-life rechargeable batteries is a key driver for the nickel metal hydride battery market, particularly in automotive, industrial, and consumer applications where reliability is critical. These batteries are widely recognized for their resistance to thermal runaway and robust cycle life, supporting long-term use

- For instance, Panasonic manufactures nickel metal hydride batteries that are widely used in hybrid vehicles and industrial backup systems due to their safety and durability characteristics. Their deployment in demanding applications underscores market confidence in the technology

- Nickel metal hydride batteries offer stable performance over thousands of charge cycles, reducing the need for frequent replacement and lowering lifecycle costs. This advantage is driving adoption in applications that require consistent power delivery over extended periods

- The chemistry’s lower risk of overheating compared to some alternative batteries supports its use in safety-sensitive environments. This is particularly important for automotive systems where battery failure can impact overall vehicle performance

- The emphasis on safety, durability, and long service life continues to support the growth of nickel metal hydride batteries. These attributes position the technology as a reliable solution in applications where operational stability is a priority

Restraint/Challenge

Growing Competition from Lithium-Ion Batteries

- The nickel metal hydride battery market faces increasing challenges from the rapid adoption of lithium-ion batteries, which offer higher energy density and lighter weight for many applications. This shift is influencing purchasing decisions across automotive and consumer electronics sectors

- For instance, Tesla relies exclusively on lithium-ion battery technology for its electric vehicle lineup, highlighting the industry’s preference for higher energy density solutions in fully electric platforms. This trend limits the expansion of nickel metal hydride batteries beyond established hybrid applications

- Lithium-ion batteries enable longer driving ranges and more compact designs, which are critical factors in modern electric vehicle development. These advantages are reducing the competitiveness of nickel metal hydride batteries in new vehicle programs

- Cost reductions and technological improvements in lithium-ion manufacturing are further intensifying competitive pressure. As economies of scale improve, lithium-ion solutions are becoming more accessible across a wider range of applications

- The growing dominance of lithium-ion technology presents a significant restraint for the nickel metal hydride battery market. Overcoming this challenge will require continued focus on niche applications where safety, durability, and long-term reliability outweigh energy density considerations

Nickel Metal Hydride Battery Market Scope

The market is segmented on the basis of type, application, and component.

- By Type

On the basis of type, the Nickel Metal Hydride Battery market is segmented into small-sized Ni-MH batteries for consumer electronics and large-sized Ni-MH batteries for HEV. The large-sized Ni-MH battery segment dominated the largest market revenue share of 55.5% in 2025, driven by its extensive use in hybrid electric vehicles due to high reliability, proven safety profile, and strong tolerance to overcharging and temperature variations. Automotive manufacturers continue to prefer large-sized Ni-MH batteries for HEVs because of their long cycle life and stable performance under repetitive charge–discharge conditions. These batteries are widely deployed in established hybrid platforms, where durability and operational consistency are critical. The mature supply chain and large-scale manufacturing capabilities further support the dominance of this segment.

The small-sized Ni-MH battery segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by steady demand from consumer electronics and household devices. Increasing use of rechargeable batteries in wireless peripherals, personal gadgets, and compact electronic products is supporting segment growth. Small-sized Ni-MH batteries offer cost-effective energy storage with reliable performance for low-to-moderate power applications. Their environmental advantage over disposable batteries is also encouraging adoption across consumer-focused markets.

- By Application

On the basis of application, the Nickel Metal Hydride Battery market is segmented into automotive, cordless phone, dust collector, personal care, lighting tools, and electric tool. The automotive segment accounted for the largest market revenue share in 2025, primarily due to the continued deployment of Ni-MH batteries in hybrid electric vehicles. Automakers value Ni-MH technology for its robustness, thermal stability, and ability to deliver consistent power output over extended usage cycles. The long service life and recyclability of these batteries further strengthen their position in automotive applications.

The personal care segment is expected to register the fastest CAGR during the forecast period, supported by rising consumption of rechargeable grooming and hygiene devices. Products such as electric shavers, trimmers, and toothbrushes increasingly rely on Ni-MH batteries for dependable daily-use performance. Growing consumer preference for rechargeable personal care devices and replacement battery demand is accelerating adoption. Compact size, safety, and cost efficiency are key factors driving growth in this segment.

- By Component

On the basis of component, the Nickel Metal Hydride Battery market is segmented into positive electrode, negative electrode, and others. The positive electrode segment dominated the market revenue share in 2025, owing to its critical role in determining battery capacity, energy density, and overall performance. Continuous improvements in electrode material composition are enhancing charge retention and cycle stability, supporting widespread adoption across applications. The high material value and technological importance of the positive electrode contribute significantly to segment revenue.

The negative electrode segment is projected to witness the fastest growth rate from 2026 to 2033, driven by ongoing advancements in hydrogen-absorbing alloy technologies. Manufacturers are increasingly focusing on improving negative electrode efficiency to enhance battery lifespan and charging characteristics. Innovations aimed at reducing degradation and improving energy absorption are accelerating demand. This component-level optimization is expected to play a key role in next-generation Ni-MH battery development.

Nickel Metal Hydride Battery Market Regional Analysis

- North America dominated the nickel metal hydride battery market with the largest revenue share of 41.5% in 2025, driven by the strong presence of hybrid electric vehicle production, established automotive OEMs, and long-term use of Ni-MH batteries in HEV platforms

- The region shows sustained demand due to the proven reliability, safety, and durability of Ni-MH batteries, particularly in automotive and industrial applications

- Supportive regulatory frameworks for vehicle electrification, high R&D spending, and a mature recycling infrastructure further reinforce the adoption of Ni-MH batteries across automotive and consumer applications

U.S. Nickel Metal Hydride Battery Market Insight

The U.S. nickel metal hydride battery market captured the largest revenue share within North America in 2025, supported by widespread deployment of Ni-MH batteries in hybrid electric vehicles. Major automotive manufacturers continue to rely on Ni-MH technology for its stable performance and long operational life. The country’s strong focus on emission reduction, coupled with consistent demand for replacement batteries, continues to drive market stability.

Europe Nickel Metal Hydride Battery Market Insight

The Europe nickel metal hydride battery market is projected to expand at a steady CAGR during the forecast period, driven by stringent emission regulations and sustained production of hybrid vehicles. European automakers emphasize safety, recyclability, and lifecycle efficiency, which aligns well with Ni-MH battery characteristics. Growing adoption across industrial tools and backup power applications is also supporting regional growth.

U.K. Nickel Metal Hydride Battery Market Insight

The U.K. nickel metal hydride battery market is anticipated to grow at a notable CAGR, supported by ongoing demand for hybrid vehicles and rechargeable battery-powered consumer devices. Government initiatives promoting low-emission transportation and continued use of HEVs are sustaining Ni-MH battery adoption. The market also benefits from steady replacement demand in consumer and industrial applications.

Germany Nickel Metal Hydride Battery Market Insight

The Germany nickel metal hydride battery market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong automotive manufacturing base and emphasis on engineering reliability. German automakers continue to deploy Ni-MH batteries in hybrid systems due to their safety and long cycle life. Industrial automation and power tool applications further contribute to market demand.

Asia-Pacific Nickel Metal Hydride Battery Market Insight

The Asia-Pacific nickel metal hydride battery market is poised to grow at the fastest CAGR from 2026 to 2033, driven by high hybrid vehicle adoption, expanding consumer electronics manufacturing, and strong battery production capabilities. Countries such as Japan, China, and South Korea play a critical role in both production and consumption. Cost-effective manufacturing and rising domestic demand are accelerating regional growth.

Japan Nickel Metal Hydride Battery Market Insight

The Japan nickel metal hydride battery market holds a significant share in the Asia-Pacific region, supported by the country’s early adoption of hybrid electric vehicles. Japanese manufacturers have extensively used Ni-MH batteries due to their reliability and long-term performance. Continuous production of HEVs and replacement battery demand remain key growth drivers.

China Nickel Metal Hydride Battery Market Insight

The China nickel metal hydride battery market accounted for a substantial revenue share in Asia-Pacific in 2025, driven by large-scale battery manufacturing and broad application across consumer electronics and industrial tools. While lithium-ion adoption is rising, Ni-MH batteries maintain demand due to cost advantages and established use cases. Strong domestic manufacturing capabilities and export demand continue to support market expansion.

Nickel Metal Hydride Battery Market Share

The nickel metal hydride battery industry is primarily led by well-established companies, including:

- Duracell Inc. (U.S.)

- Energizer Holdings, Inc. (U.S.)

- Panasonic India Pvt. Ltd. (India)

- Primearth EV Energy Co., Ltd. (Japan)

- Spectrum Brands, Inc. (U.S.)

- GP Batteries International Limited (Singapore)

- Harding Energy Inc. (U.S.)

- Cell-Con, Inc. (U.S.)

- BASF SE (Germany)

- Johnson Controls International plc (Ireland)

- Supreme Batteries Pvt. Ltd. (India)

- Taurac Ltd. (U.K.)

- Uniross Batteries SAS (France)

- Tianjin Peace Bay Telecom Battery Co., Ltd. (China)

- Shenyang Sanpu Precision Casting Co., Ltd. (China)

Latest Developments in Global Nickel Metal Hydride Battery Market

- In November 2024, Toshiba strengthened momentum in the nickel metal hydride and advanced battery ecosystem through the integration of its SCiB Energy Storage System into critical infrastructure, reinforcing the broader rechargeable battery market by demonstrating the role of high-reliability battery technologies in ensuring uninterrupted power for data centers and healthcare facilities. This development highlights increasing demand for durable, fast-charging, and long-life battery solutions, indirectly supporting sustained investment and innovation across established chemistries, including NiMH, for mission-critical applications

- In June 2024, Samsung SDI advanced the rechargeable battery market by unveiling the upgraded SAMSUNG Battery Box 1.5 at Inter Battery Europe 2024, underscoring growing demand for safe, high-performance energy storage solutions. This development reflects the industry’s focus on reliability, safety, and scalability, trends that continue to support nickel metal hydride batteries in hybrid vehicles and backup power systems where proven safety and long cycle life remain key decision factors

- In September 2023, Panasonic Energy announced the expansion of its nickel metal hydride battery supply for hybrid electric vehicles, reinforcing long-term OEM confidence in NiMH technology. This development supported market stability by ensuring consistent availability of high-quality NiMH batteries, driven by ongoing demand for durable, safe, and cost-effective energy storage solutions in global hybrid vehicle platforms

- In April 2020, Honda Motor Europe expanded its partnership with SNAM to recycle end-of-life nickel metal hydride batteries from hybrid vehicles, significantly strengthening the circular economy for NiMH technology. This initiative improved battery recycling efficiency, reduced environmental impact, and reinforced the long-term sustainability of NiMH batteries, supporting their continued use in hybrid electric vehicles across Europe

- In March 2020, Saft introduced Intelli-Connect, a digital monitoring platform enabling remote performance tracking of nickel-technology battery fleets, enhancing operational efficiency and predictive maintenance capabilities. This innovation improved lifecycle management and reliability of NiMH batteries, increasing their attractiveness for industrial, transportation, and backup power applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nickel Metal Hydride Battery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nickel Metal Hydride Battery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nickel Metal Hydride Battery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.