Global Nitrogen Fixing Biofertilizers Market

Market Size in USD Billion

CAGR :

%

USD

2.05 Billion

USD

4.69 Billion

2025

2033

USD

2.05 Billion

USD

4.69 Billion

2025

2033

| 2026 –2033 | |

| USD 2.05 Billion | |

| USD 4.69 Billion | |

|

|

|

|

Nitrogen-Fixing Biofertilizers Market Size

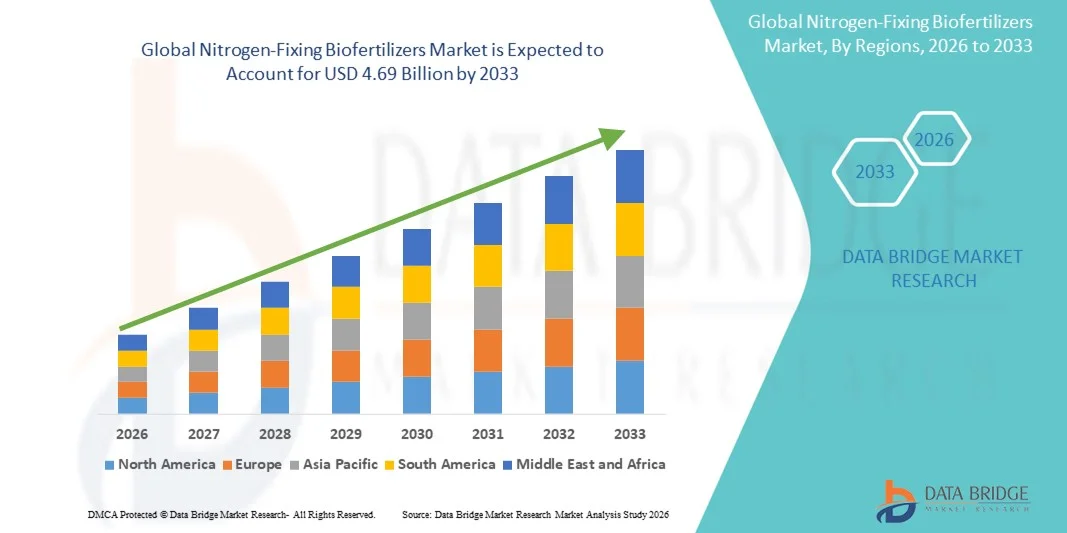

- The global nitrogen-fixing biofertilizers market size was valued at USD 2.05 billion in 2025 and is expected to reach USD 4.69 billion by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and organic farming practices, coupled with rising awareness among farmers regarding soil health, crop productivity, and environmental impact. The integration of nitrogen-fixing biofertilizers in crop management helps reduce dependency on chemical fertilizers while improving yield and soil fertility, thereby driving widespread adoption across smallholder and commercial farms

- Furthermore, government initiatives, subsidies, and policies promoting eco-friendly and bio-based crop inputs are establishing nitrogen-fixing biofertilizers as a preferred solution for farmers globally. For instance, programs in India and Europe incentivize the use of microbial fertilizers in cereals, pulses, and oilseeds, which is accelerating market penetration and supporting the growth of biofertilizer manufacturers

Nitrogen-Fixing Biofertilizers Market Analysis

- Nitrogen-fixing biofertilizers, which enhance soil nitrogen content and improve crop productivity through microbial action, are increasingly vital components of modern sustainable agriculture practices. They are extensively used in cereals, pulses, oilseeds, and vegetable crops due to their ability to fix atmospheric nitrogen, reduce chemical fertilizer use, and maintain long-term soil health

- The escalating demand for nitrogen-fixing biofertilizers is primarily fueled by the growing need for sustainable food production, rising consumer preference for organic and chemical-free produce, and increasing agricultural intensification. Farmers are progressively adopting microbial fertilizers to optimize nutrient use efficiency, reduce input costs, and meet regulatory requirements for environmentally friendly farming practices

- North America dominated the nitrogen-fixing biofertilizers market with a share of 37.3% in 2025, due to increasing awareness of sustainable agriculture practices and government initiatives promoting eco-friendly crop inputs

- Asia-Pacific is expected to be the fastest growing region in the nitrogen-fixing biofertilizers market during the forecast period due to rising food demand, urbanization, and the need for sustainable crop production in countries such as India, China, and Japan

- Liquid segment dominated the market with a market share of 52.4% in 2025, due to its ease of application, faster nutrient availability, and better uniformity in soil coverage. Farmers often prefer liquid biofertilizers due to their ability to mix with other fertilizers and agrochemicals, ensuring integrated nutrient management. The liquid form also supports higher microbial viability, leading to improved nitrogen fixation efficiency. Its compatibility with modern irrigation systems such as drip and sprinkler systems further strengthens adoption. The widespread awareness of precision agriculture techniques is also contributing to the preference for liquid formulations

Report Scope and Nitrogen-Fixing Biofertilizers Market Segmentation

|

Attributes |

Nitrogen-Fixing Biofertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nitrogen-Fixing Biofertilizers Market Trends

Growing Adoption of Sustainable and Organic Farming Practices

- The global nitrogen-fixing biofertilizers market is witnessing a significant shift toward sustainable and organic farming practices as farmers increasingly seek alternatives to chemical fertilizers that maintain soil health and improve long-term productivity. This trend is being fueled by a rising awareness of environmental impact and the growing need to reduce the carbon footprint associated with conventional agriculture.

- For instance, companies such as Novozymes and National Fertilizers Limited are actively promoting microbial-based fertilizers in cereals, pulses, and oilseeds, helping farmers transition toward eco-friendly practices and enhancing acceptance of biofertilizers in large-scale commercial farming.

- The increasing adoption of integrated nutrient management strategies that combine biofertilizers with organic composts and reduced chemical inputs is further strengthening the trend. Farmers are observing improved soil structure, higher nutrient retention, and increased crop yields, which collectively reinforce the shift toward sustainable cultivation.

- Rising consumer preference for organic and chemical-free food products is also indirectly driving adoption, as farmers align production methods to meet the growing market demand for healthier and safer crops. This alignment encourages wider utilization of nitrogen-fixing biofertilizers in high-value crops and vegetables, boosting their prominence in the agriculture sector.

- The trend is further supported by government initiatives and policy frameworks in countries such as India and several European nations, which provide subsidies, training programs, and awareness campaigns to promote biofertilizer usage. These measures enhance accessibility and adoption, especially among small and medium-scale farmers.

- Overall, the growing adoption of sustainable and organic farming practices is fundamentally reshaping nutrient management in agriculture, establishing nitrogen-fixing biofertilizers as essential components of eco-conscious farming systems and setting the stage for long-term market growth

Nitrogen-Fixing Biofertilizers Market Dynamics

Driver

Increasing Demand for Eco-Friendly and Soil-Enhancing Fertilizers

- The rising global focus on sustainable agriculture and soil fertility improvement is driving the demand for nitrogen-fixing biofertilizers, which offer a natural means of enhancing nitrogen availability and crop productivity. Farmers are increasingly seeking solutions that improve soil health while reducing reliance on chemical fertilizers, which can degrade soil over time.

- For instance, in 2024, ICL and BioPrime AgriSolutions partnered to scale the BioNexus microbial platform in India, targeting nutrient efficiency in cereals and pulses. Such initiatives demonstrate how companies are enabling widespread adoption of eco-friendly biofertilizers while improving farm productivity and cost efficiency.

- The adoption of nitrogen-fixing biofertilizers helps maintain soil microbiome balance and enhances nutrient cycling, ensuring long-term fertility and sustainability. These benefits are particularly important for smallholder and large-scale farmers aiming to optimize yield without compromising soil quality.

- Growing awareness among farmers about the economic and environmental advantages of microbial fertilizers is encouraging broader adoption, supported by training programs, workshops, and field demonstrations organized by manufacturers and agricultural agencies.

- The combined benefits of improved crop yield, reduced chemical input costs, and environmentally sustainable farming practices are positioning nitrogen-fixing biofertilizers as a key driver of modern agriculture and a central solution in global nutrient management strategies

Restraint/Challenge

Limited Awareness and Adoption Among Smallholder Farmers

- Despite their benefits, nitrogen-fixing biofertilizers face adoption challenges among smallholder farmers who often lack awareness of microbial solutions and their long-term advantages over chemical fertilizers. Limited technical knowledge and hesitation to try new farming inputs slow the market penetration in certain regions.

- For instance, many small-scale farmers in rural India and Africa remain unaware of the proper application techniques and potential yield benefits of rhizobium- or azotobacter-based biofertilizers, restricting adoption despite government promotion programs.

- The lack of widespread distribution channels in remote and underserved areas further limits access to high-quality nitrogen-fixing biofertilizers, making it difficult for farmers to obtain and apply these products effectively.

- Price sensitivity and perceived risks of switching from traditional chemical fertilizers also act as barriers, as farmers may be concerned about initial investments and uncertainty regarding crop performance outcomes.

- Overcoming these challenges requires targeted awareness campaigns, farmer training programs, demonstration plots, and collaboration with local agricultural cooperatives to educate and incentivize adoption. Enhancing accessibility, reducing perceived risks, and building trust among smallholder farmers are critical to sustaining market growth and ensuring that nitrogen-fixing biofertilizers achieve broader adoption across diverse agricultural landscapes

Nitrogen-Fixing Biofertilizers Market Scope

The market is segmented on the basis of form, crop type, application, and microbe type.

- By Form

On the basis of form, the Nitrogen-Fixing Biofertilizers market is segmented into liquid and carrier-based forms. The liquid segment dominated the market with the largest market revenue share of 52.4% in 2025, driven by its ease of application, faster nutrient availability, and better uniformity in soil coverage. Farmers often prefer liquid biofertilizers due to their ability to mix with other fertilizers and agrochemicals, ensuring integrated nutrient management. The liquid form also supports higher microbial viability, leading to improved nitrogen fixation efficiency. Its compatibility with modern irrigation systems such as drip and sprinkler systems further strengthens adoption. The widespread awareness of precision agriculture techniques is also contributing to the preference for liquid formulations.

The carrier-based segment is anticipated to witness the fastest growth rate of 19.3% from 2026 to 2033, fueled by increasing adoption in small-scale and traditional farming setups. Carrier-based biofertilizers offer longer shelf life and easier storage and transportation compared to liquid forms. For instance, companies such as Novozymes are promoting carrier-based formulations for pulse crops due to their robustness under diverse climatic conditions. The simplicity of application using soil broadcasting or seed coating methods supports their growing popularity among farmers in rural regions. The lower initial investment required for carrier-based forms makes them accessible to a wider farming community.

- By Crop Type

On the basis of crop type, the market is segmented into cereals and grains, pulses and oilseeds, fruits and vegetables, and others. The cereals and grains segment dominated the market with the largest revenue share of 47.8% in 2025, driven by the extensive cultivation of rice, wheat, and maize across Asia-Pacific and North America. Farmers increasingly adopt nitrogen-fixing biofertilizers to improve yields, reduce chemical fertilizer dependency, and enhance soil fertility in cereal crops. The high nutrient demand of cereals encourages consistent application of biofertilizers to support sustainable farming practices. For instance, companies such as Bayer CropScience are actively promoting nitrogen-fixing solutions for wheat and maize cultivation to boost productivity. The integration of biofertilizers with modern mechanized farming practices also accelerates adoption.

The pulses and oilseeds segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing focus on protein-rich and oilseed crop cultivation. Pulses such as chickpeas and lentils greatly benefit from microbial nitrogen fixation, improving soil health and reducing input costs. Rising government initiatives in India and Africa supporting pulse and oilseed production further fuel growth. For instance, IFFCO has been promoting Rhizobium-based inoculants for chickpeas and soybean, resulting in higher farmer adoption. The segment’s growth is also supported by increasing demand for sustainable and organic food products globally.

- By Application

On the basis of application, the market is segmented into seed treatment, soil treatment, and others. The soil treatment segment dominated the market with the largest market revenue share in 2025, driven by its ability to enhance soil fertility, promote microbial activity, and provide uniform nutrient distribution. Soil application of nitrogen-fixing biofertilizers supports the growth of diverse crops by improving nitrogen availability and reducing dependence on chemical fertilizers. Farmers also prefer soil treatment for large-scale crop fields due to ease of mechanized application methods such as spraying and broadcasting. For instance, Novagro and BioFertilizer Inc. promote soil treatment solutions for cereals and pulses to optimize nitrogen fixation efficiency. The long-term benefits of improved soil health contribute to the sustained demand for soil-applied biofertilizers.

The seed treatment segment is anticipated to witness the fastest growth rate of 20.5% from 2026 to 2033, driven by increasing adoption among smallholder and precision farmers. Seed inoculation ensures direct contact between seeds and nitrogen-fixing microbes, enhancing germination and early crop vigor. For instance, companies such as BASF are offering advanced seed coating solutions incorporating Rhizobium and Azotobacter strains to improve yield performance. The convenience, reduced labor, and targeted microbial delivery make seed treatment an attractive choice for farmers. Rising awareness of sustainable agricultural practices further supports the growth of seed-applied biofertilizers.

- By Microbe Type

On the basis of microbe type, the market is segmented into Rhizobium, Azotobacter, Azospirillum, Cyanobacteria, Phosphate-Solubilizing Bacteria, and others. The Rhizobium segment dominated the market with the largest revenue share of 48.7% in 2025, driven by its proven effectiveness in leguminous crops such as pulses and oilseeds. Rhizobium biofertilizers improve nitrogen fixation efficiency, enhance soil fertility, and reduce the need for synthetic nitrogen fertilizers. For instance, IFFCO and Rallis India are promoting Rhizobium-based inoculants for chickpea and soybean cultivation. The microbial strain’s compatibility with diverse soil types and environmental conditions further accelerates adoption. Farmers also value Rhizobium for its long-standing research-backed results in increasing crop productivity.

The Azotobacter segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising demand for non-leguminous crops requiring nitrogen supplementation. Azotobacter enhances soil nitrogen content and supports growth in cereals, vegetables, and fruits. For instance, Biocare Technologies has introduced Azotobacter formulations for maize and wheat cultivation, promoting sustainable farming practices. The free-living nature of Azotobacter makes it suitable for various soils and climates, contributing to its increasing popularity. Growth is further supported by farmers’ interest in organic and eco-friendly crop inputs.

Nitrogen-Fixing Biofertilizers Market Regional Analysis

- North America dominated the nitrogen-fixing biofertilizers market with the largest revenue share of 37.3% in 2025, driven by increasing awareness of sustainable agriculture practices and government initiatives promoting eco-friendly crop inputs

- Farmers in the region highly value the efficiency, soil fertility enhancement, and yield improvement offered by nitrogen-fixing biofertilizers in cereals, pulses, and oilseeds

- This widespread adoption is further supported by advanced agricultural infrastructure, high adoption of precision farming techniques, and growing consumer demand for organic and sustainable food products, establishing nitrogen-fixing biofertilizers as a preferred solution across commercial and large-scale farms

U.S. Nitrogen-Fixing Biofertilizers Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by rising demand for sustainable and chemical-free farming practices and government subsidies supporting biofertilizer use. Farmers are increasingly adopting nitrogen-fixing biofertilizers to reduce synthetic fertilizer dependency, enhance soil health, and improve crop productivity. The growing focus on organic crop production, combined with advanced irrigation systems and mechanized farming practices, further supports market expansion. In addition, integration of biofertilizers with modern agricultural technologies is accelerating adoption across large-scale cereal and pulse farms.

Europe Nitrogen-Fixing Biofertilizers Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent agricultural regulations, rising awareness of sustainable farming methods, and growing demand for organic food products. Countries such as France, Germany, and Spain are witnessing increased adoption of nitrogen-fixing biofertilizers across cereals, oilseeds, and vegetable crops. The region’s supportive government incentives, research initiatives, and presence of advanced agricultural infrastructure are fostering the integration of microbial solutions in both conventional and organic farming systems.

U.K. Nitrogen-Fixing Biofertilizers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of sustainable agriculture, increasing consumer preference for organic produce, and supportive government policies promoting eco-friendly crop inputs. Farmers are embracing nitrogen-fixing biofertilizers to improve soil fertility, enhance crop yields, and reduce reliance on chemical fertilizers. In addition, the strong agri-tech ecosystem and growing awareness of microbial solutions among smallholder and commercial farmers are expected to further stimulate market growth.

Germany Nitrogen-Fixing Biofertilizers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sustainable crop production, adoption of eco-conscious farming practices, and government-backed organic farming programs. Farmers are increasingly integrating nitrogen-fixing biofertilizers with mechanized planting, precision farming, and soil health management practices. The well-developed agricultural infrastructure and focus on innovation in crop productivity and sustainability are further contributing to market growth.

Asia-Pacific Nitrogen-Fixing Biofertilizers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2026–2033, driven by rising food demand, urbanization, and the need for sustainable crop production in countries such as India, China, and Japan. Government initiatives promoting organic and sustainable agriculture, along with increasing awareness among smallholder farmers, are driving adoption. The availability of affordable biofertilizer products and strong domestic manufacturing in India and China is expanding access to a wider farming base, supporting growth across cereals, pulses, and vegetable crops.

Japan Nitrogen-Fixing Biofertilizers Market Insight

The Japan market is gaining momentum due to high focus on advanced agricultural technologies, limited arable land, and demand for high-quality crop output. Farmers are increasingly adopting nitrogen-fixing biofertilizers for vegetables, cereals, and rice to maintain soil fertility and reduce chemical fertilizer usage. Integration with precision farming systems, modern irrigation, and eco-friendly farming practices enhances adoption across commercial and high-value crop farms.

China Nitrogen-Fixing Biofertilizers Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding farmland productivity needs, and high technological adoption in agriculture. Nitrogen-fixing biofertilizers are increasingly used in cereals, pulses, and vegetable crops to boost yields and improve soil health. Strong government support for sustainable agriculture and the presence of domestic biofertilizer manufacturers promoting low-cost microbial solutions are key factors propelling the market in China.

Nitrogen-Fixing Biofertilizers Market Share

The nitrogen-fixing biofertilizers industry is primarily led by well-established companies, including:

- Novozymes (Denmark)

- National Fertilizers Limited (India)

- MADRAS FERTILIZERS LIMITED (India)

- Gujarat State Fertilizers & Chemicals Limited (GSFC) (India)

- Rashtriya Chemicals and Fertilizers Limited (India)

- Vegalab SA (Switzerland)

- Chr. Hansen Holding A/S (Denmark)

- Kiwa Bio-Tech Products Group Corporation (China)

- Rizobacter (Argentina)

- T. Stanes and Company Limited (India)

- INTERNATIONAL PANNACEA LIMITED (India)

- Lallemand Inc. (Canada)

- Nutramax Laboratories Consumer Care, Inc. (U.S.)

- Kan Biosys (India)

- Symborg (Spain)

- Mapleton Agri Biotec Pvt Ltd (India)

- Manidharma Biotech Private Limited (India)

- Biomaxnaturals (India)

- Jaipur Bio Fertilizers (India)

Latest Developments in Global Nitrogen-Fixing Biofertilizers Market

- In September 2025, ICL (Israel Chemicals Ltd.) announced a long-term strategic alliance with BioPrime AgriSolutions to deploy BioPrime’s BioNexus microbial platform in India. The partnership aims to provide nitrogen-fixing and nutrient-enhancing solutions to improve soil fertility and boost crop productivity, particularly for cereals, pulses, and oilseeds. This development is pivotal for the market as it targets one of the largest agricultural bases globally, providing scalable microbial biofertilizer solutions to smallholder and commercial farmers. The collaboration enhances the reach of innovative biofertilizers, promotes sustainable agriculture, and positions India as a high-growth market for microbial solutions due to rising awareness and adoption of eco-friendly inputs

- In August 2025, BioConsortia raised US$ 15 million to accelerate the global launch of its Always‑N nitrogen-fixing seed treatment for corn. This funding allows the company to expand its production capabilities, strengthen distribution networks, and support large-scale commercialization. The development is significant for the nitrogen-fixing biofertilizer market as it introduces a next-generation product capable of improving nitrogen fixation efficiency, reducing dependency on chemical fertilizers, and offering farmers a more sustainable and cost-effective alternative. The investment also enables BioConsortia to enhance research and development for additional microbial solutions, potentially increasing market competition and driving innovation across the segment

- In June 2025, Syngenta announced the launch of a large-scale biomanufacturing and R&D facility in South Carolina, USA, aimed at producing advanced microbial and nature-inspired solutions, including nitrogen-fixing biofertilizers. This facility increases production capacity, accelerates product development, and strengthens Syngenta’s ability to meet growing global demand for sustainable crop inputs. The development is significant for the nitrogen-fixing biofertilizer market because it supports rapid commercialization, encourages innovation in microbial strains, and facilitates wider adoption of eco-friendly biofertilizers. By scaling manufacturing and expanding research capabilities, Syngenta is positioned to influence market trends, improve accessibility of high-efficiency microbial solutions, and drive sustainable agricultural practices across multiple crop types and regions

- In May 2025, Syngenta acquired Intrinsyx Bio, providing access to Intrinsyx’s proprietary nitrogen-fixing endophyte technology. This acquisition allows Syngenta to expand its portfolio of biological solutions, strengthen its position in the fast-growing microbial biofertilizer market, and offer farmers products that enhance nitrogen availability directly within plants. The integration of this technology supports sustainable agriculture by reducing synthetic nitrogen fertilizer use, improving crop yields, and enhancing soil health. It also enables Syngenta to accelerate commercialization of endophyte-based products across multiple crops and regions, strengthening its competitive advantage in the biologicals sector

- In July 2024, Syngenta and Intrinsyx Bio formed a strategic partnership to commercialize endophyte-based formulations that fix atmospheric nitrogen inside the plant. These products, applied as seed treatments and foliar sprays, improve nitrogen uptake, increase crop productivity, and reduce reliance on conventional fertilizers. This collaboration expands the availability of high-efficiency nitrogen-fixing solutions globally and strengthens the adoption of sustainable and eco-friendly farming practices. By combining Syngenta’s global distribution capabilities with Intrinsyx’s microbial expertise, the partnership is expected to drive broader market penetration, particularly in regions seeking cost-effective solutions for nutrient management and yield enhancement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.