Global Noc As A Service Market

Market Size in USD Billion

CAGR :

%

USD

3.15 Billion

USD

6.90 Billion

2024

2032

USD

3.15 Billion

USD

6.90 Billion

2024

2032

| 2025 –2032 | |

| USD 3.15 Billion | |

| USD 6.90 Billion | |

|

|

|

|

NOC as a Service Market Size

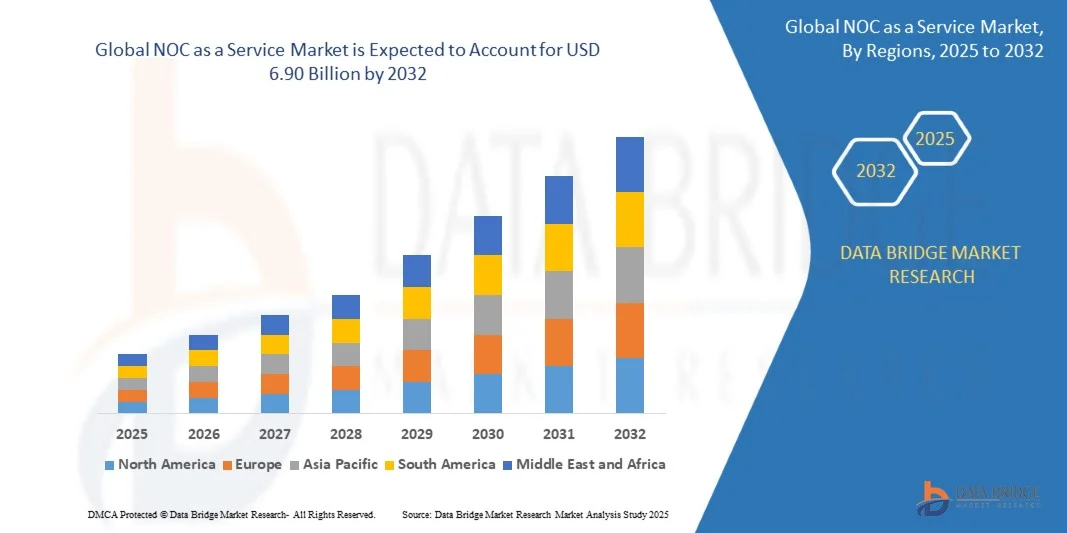

- The NOC as a Service Market size was valued at USD 3.15 billion in 2024 and is projected to reach USD 6.90 billion by 2032, growing at a CAGR of 10.31% during the forecast period.

- Market expansion is primarily driven by the increasing demand for remote network monitoring and management solutions across various industries, coupled with advancements in cloud computing and AI technologies.

- Additionally, the rising need for cost-effective, scalable, and efficient IT infrastructure management solutions is propelling the adoption of NOC as a Service, supporting businesses in maintaining continuous network performance and minimizing downtime.

NOC as a Service Market Analysis

- NOC as a Service provides remote network monitoring and management solutions, playing a critical role in ensuring seamless IT operations for businesses across various sectors due to its scalability, real-time issue resolution, and cost-efficiency.

- The growing demand for reliable, 24/7 network oversight, combined with increasing complexity of IT infrastructures and the rise of cloud-based services, is driving rapid adoption of NOC as a Service globally.

- North America led the NOC as a Service market with the largest revenue share of 36% in 2024, supported by early technology adoption, a mature IT infrastructure, and the presence of major service providers delivering innovative AI-driven and automated network management solutions.

- Asia-Pacific is anticipated to be the fastest-growing region in the NOC as a Service market during the forecast period, fueled by expanding digital transformation initiatives, increasing cloud adoption, and growing IT investments in emerging economies.

- The monitoring segment dominated the market with the largest revenue share of 37.5% in 2024, owing to the growing demand for real-time surveillance and activity tracking features

Report Scope and NOC as a Service Market Segmentation

|

Attributes |

NOC as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

NOC as a Service Market Trends

“Enhanced Network Management Through AI and Automation Integration”

- A significant and accelerating trend in the NOC as a Service Market is the deepening integration with artificial intelligence (AI) and automation technologies, enabling proactive network monitoring, predictive maintenance, and faster issue resolution. This fusion is greatly enhancing operational efficiency and reducing downtime for enterprises.

- For instance, leading providers like IBM and Cisco leverage AI-powered analytics and machine learning algorithms to detect anomalies in real-time, automatically prioritize incidents, and recommend optimized network configurations. Similarly, Ericsson’s AI-driven platforms enable dynamic traffic management and fault prediction to maintain seamless connectivity.

- AI integration in NOC services enables features such as automated root cause analysis, predictive alerts based on network behavior patterns, and intelligent resource allocation. For example, Nokia’s AI-enabled systems continuously learn from network data to improve performance and security, while also minimizing manual intervention.

- The seamless integration of AI with cloud-based network management platforms facilitates centralized control and real-time visibility over complex IT infrastructures. Through unified dashboards, network administrators can monitor performance, security, and compliance across multiple sites, ensuring more efficient and reliable operations.

- This trend towards more intelligent, automated, and interconnected network management solutions is fundamentally transforming enterprise IT expectations. Consequently, companies such as HPE and DXC Technology are developing AI-powered NOC services featuring automated remediation, predictive maintenance, and integration with popular IT service management tools.

- The demand for NOC as a Service solutions that incorporate advanced AI and automation capabilities is rapidly growing across industries, as organizations prioritize network resilience, cost efficiency, and scalability in increasingly digital business environments.

NOC as a Service Market Dynamics

Driver

“Growing Need Due to Rising Network Security Concerns and Digital Transformation”

- The increasing prevalence of cybersecurity threats and the rapid digital transformation across industries are significant drivers for the growing demand for NOC as a Service solutions. Organizations seek robust network monitoring and management to safeguard critical infrastructure and ensure business continuity.

- For instance, in early 2024, Cisco announced enhancements to its AI-driven NOC platforms aimed at integrating advanced threat detection and automated response capabilities, reinforcing network security for enterprise clients. Such innovations by leading companies are expected to propel market growth during the forecast period.

- As businesses face increasingly sophisticated cyberattacks and network complexities, NOC as a Service offers features such as real-time threat detection, automated incident response, and compliance monitoring, providing a vital upgrade over traditional, manual network management approaches.

- Furthermore, the surge in cloud adoption, remote work, and IoT deployments are intensifying the need for integrated network oversight, making NOC as a Service an essential component of modern IT infrastructure strategies.

- The demand for scalable, cost-effective network management solutions that provide 24/7 visibility, predictive analytics, and rapid troubleshooting is accelerating adoption across sectors including healthcare, finance, and manufacturing. The shift towards managed IT services and the focus on minimizing downtime further support market expansion.

Restraint/Challenge

“Concerns Regarding Cybersecurity Risks and Integration Complexities”

- Concerns about potential cybersecurity vulnerabilities within outsourced NOC services pose a notable challenge to broader adoption. As NOC providers manage critical network functions remotely, fears about data breaches, unauthorized access, and compliance risks remain significant hurdles for enterprises.

- For Instance, incidents of misconfigured remote access or insider threats have made some organizations cautious about fully relying on third-party NOC providers.

- Addressing these concerns through strict security protocols, end-to-end encryption, regular audits, and compliance certifications is essential to build trust. Companies such as IBM and HPE emphasize their robust security frameworks and dedicated incident response teams to reassure clients.

- Additionally, the complexity of integrating NOC as a Service with existing legacy systems and varied IT environments can pose operational challenges and increase implementation costs. For smaller enterprises or those with limited IT expertise, this can hinder adoption despite the potential benefits.

- While cloud-native NOC solutions are becoming more streamlined, integration and customization requirements can still delay deployment and increase upfront investments.

- Overcoming these challenges through enhanced security measures, comprehensive client education, and development of flexible, easy-to-integrate NOC solutions will be critical for sustained growth in the market.

NOC as a Service Market Scope

The market is segmented on the basis of service type, organization size, deployment mode, end user industry.

- By Service Type

On the basis of service type, the smart lock market is segmented into monitoring, management, support, security, and others. The monitoring segment dominated the market with the largest revenue share of 37.5% in 2024, owing to the growing demand for real-time surveillance and activity tracking features. Monitoring services allow users to receive instant alerts on unauthorized access attempts and keep logs of entry activities, enhancing overall security.

The management segment is expected to witness the fastest CAGR of 20.9% from 2025 to 2032, driven by increasing consumer preference for remote access control and centralized management of multiple locks via smartphone applications or cloud platforms. The rising adoption of AI-powered analytics in managing smart lock systems also propels growth in this segment, enabling predictive maintenance and enhanced security management.

- By Organization Size

Based on organization size, the smart lock market is segmented into small and medium enterprises (SMEs) and large enterprises. Large enterprises accounted for the dominant market revenue share of 54.8% in 2024, driven by their extensive facility footprints and heightened security requirements. These enterprises prioritize scalable and integrated smart lock solutions for employee access control across multiple locations.

The SME segment is expected to register the fastest CAGR of 23.4% over the forecast period, fueled by increasing digitization and security awareness among smaller businesses. SMEs are adopting smart lock solutions due to their ease of installation, cost-effectiveness, and ability to integrate with other smart office systems, providing improved operational flexibility and security.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into on-premises, cloud-based, and hybrid models. The cloud-based segment led the market with the largest revenue share of 48.6% in 2024, attributable to its flexibility, scalability, and seamless remote management capabilities. Cloud deployment allows users to control smart locks from anywhere, integrating with IoT ecosystems and voice assistants.

The hybrid segment is expected to witness the fastest CAGR of 21.1% from 2025 to 2032, as it offers the combined benefits of local control and cloud accessibility. This model appeals particularly to security-sensitive organizations that require data privacy alongside remote functionality, promoting adoption in both commercial and residential settings.

- By End-User Industry

On the basis of end-user industry, the smart lock market is segmented into IT and telecommunications, BFSI, healthcare, government, manufacturing, retail, and others. The residential sector dominated the market with the largest revenue share of 42.3% in 2024, driven by rising smart home adoption and increasing concerns around home security. Consumers value the convenience and safety smart locks offer in managing property access remotely.

The commercial sector is anticipated to witness the fastest CAGR of 22.6% from 2025 to 2032, supported by the growing need for centralized access control, enhanced employee security, and audit compliance. Industries such as IT, BFSI, and healthcare are actively deploying smart locks to secure sensitive areas while improving operational efficiency.

NOC as a Service Market Regional Analysis

- North America dominated the NOC as a Service Market with the largest revenue share of 36% in 2024, driven by increasing adoption of cloud-based services and the growing need for round-the-clock network monitoring and management.

- Enterprises in the region prioritize proactive network performance management, rapid incident response, and cost-effective IT infrastructure outsourcing, which fuel the demand for NOC as a Service solutions.

- This widespread adoption is further supported by advanced IT infrastructure, a mature digital ecosystem, and the presence of major service providers, alongside high IT budgets and a focus on minimizing network downtime, establishing NOC as a Service as a preferred choice for businesses across various industries including BFSI, IT & telecommunications, and healthcare.

U.S. NOC as a Service Market Insight

The U.S. NOC as a Service market captured the largest revenue share of 78% in 2024 within North America, driven by rapid digital transformation and the widespread adoption of cloud computing across enterprises. Organizations are increasingly relying on outsourced network operations to ensure uninterrupted network performance and minimize downtime. The rising demand for real-time network monitoring, automation, and advanced analytics is propelling market growth. Furthermore, growing investments in IT infrastructure and a strong focus on cybersecurity are reinforcing the adoption of NOC as a Service solutions across industries such as BFSI, healthcare, and IT services.

Europe NOC as a Service Market Insight

The Europe NOC as a Service market is projected to expand at a significant CAGR during the forecast period, supported by stringent regulatory compliance requirements and the growing need for operational efficiency. Increasing cloud adoption and digital initiatives among enterprises are key drivers. The market growth is further boosted by the rising complexity of IT environments and the need for 24/7 network monitoring to ensure seamless business operations. Countries like Germany, the U.K., and France are witnessing increased deployment of managed network services across industries including manufacturing, retail, and government.

U.K. NOC as a Service Market Insight

The U.K. NOC as a Service market is expected to grow at a notable CAGR during the forecast period, fueled by the country’s strong emphasis on digital transformation and cloud adoption. Enterprises are focused on reducing network downtime and enhancing network security through managed services. The U.K.’s robust IT infrastructure and a mature service provider ecosystem support the growing demand for scalable and cost-effective NOC solutions. Increased adoption in sectors such as BFSI, healthcare, and telecommunications further drives market expansion.

Germany NOC as a Service Market Insight

The Germany NOC as a Service market is anticipated to witness substantial growth, supported by rising investments in IT modernization and network automation. The country’s strong industrial base, coupled with the increasing adoption of IoT and Industry 4.0 technologies, fuels demand for proactive network monitoring and management. Germany’s focus on data privacy and compliance also encourages enterprises to outsource their network operations to specialized service providers offering secure and compliant solutions.

Asia-Pacific NOC as a Service Market Insight

The Asia-Pacific NOC as a Service market is poised to grow at the fastest CAGR of 26% during the forecast period from 2025 to 2032. Rapid digital adoption, expanding IT infrastructure, and increasing cloud migration are key growth drivers in countries such as China, India, Japan, and Australia. Government initiatives promoting smart cities and digital economies are accelerating demand for NOC services. Additionally, the rise of SMEs and large enterprises adopting managed network services to optimize costs and enhance network reliability is propelling market growth in the region.

Japan NOC as a Service Market Insight

The Japan NOC as a Service market is gaining traction due to the country’s advanced IT landscape and emphasis on innovation. Enterprises in Japan are increasingly leveraging NOC services to manage complex, hybrid IT environments and improve operational efficiency. The growing integration of AI and automation in network management is further boosting demand. Additionally, the aging workforce in Japan encourages automation-driven NOC solutions that ensure continuity and reliability across industries such as manufacturing and telecommunications.

China NOC as a Service Market Insight

The China NOC as a Service market held the largest revenue share in Asia-Pacific in 2024, driven by the country’s rapid industrialization, digital transformation, and expanding cloud adoption. The strong presence of domestic service providers and competitive pricing models enhance market penetration. China’s focus on building smart cities and expanding 5G infrastructure also propels the demand for continuous network monitoring and management. Enterprises across sectors such as BFSI, retail, and government increasingly outsource network operations to improve scalability and reduce operational risks.

NOC as a Service Market Share

The NOC as a Service industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Ericsson AB (Sweden)

- Nokia Corporation (Finland)

- Hewlett Packard Enterprise (HPE) (U.S.)

- AT&T Inc. (U.S.)

- Verizon Communications Inc. (U.S.)

- NTT Communications Corporation (Japan)

- Huawei Technologies Co., Ltd. (China)

- Fujitsu Limited (Japan)

- DXC Technology (U.S.)

- Tata Communications (India)

- Wipro Limited (India)

- Infosys Limited (India)

- Capgemini SE (France)

- Dimension Data (NTT Ltd.) (South Africa)

- CenturyLink (Lumen Technologies) (U.S.)

- HCL Technologies (India)

- Tech Mahindra (India)

- Orange Business Services (France)

What are the Recent Developments in NOC as a Service Market?

- In April 2023, Cisco Systems, Inc., a global leader in networking and IT solutions, launched a comprehensive NOC as a Service platform tailored for the South African market. This initiative aims to enhance network reliability and security for enterprises by leveraging Cisco’s advanced network management technologies. By addressing region-specific challenges and offering scalable, cloud-native solutions, Cisco strengthens its foothold in the rapidly expanding NOC as a Service Market, supporting digital transformation across commercial and government sectors.

- In March 2023, AT&T Inc. introduced a next-generation managed NOC service designed specifically for educational institutions and public sector organizations. The service focuses on delivering real-time network monitoring, threat detection, and rapid incident response to ensure continuous network uptime and enhanced cybersecurity. This launch reinforces AT&T’s commitment to providing robust, reliable network management solutions that safeguard critical infrastructure and improve operational efficiency.

- In March 2023, IBM Corporation successfully deployed its AI-powered NOC as a Service solution for the Bengaluru Smart City Project. This initiative utilizes IBM’s cognitive automation and analytics to proactively monitor and manage urban network infrastructure, aiming to improve service quality and reduce downtime. The project highlights IBM’s leadership in integrating AI with network operations to support smarter, more resilient urban ecosystems worldwide.

- In February 2023, NTT Ltd., a global IT services provider, announced a strategic partnership with the European Telecommunications Network Operators’ Association (ETNO) to develop a shared NOC as a Service marketplace. This collaboration aims to streamline network monitoring services for telecom operators across Europe, enhancing network performance and reducing operational costs. The partnership emphasizes NTT’s commitment to driving innovation and operational excellence in the managed network services space.

- In January 2023, Huawei Technologies Co., Ltd. unveiled its Cloud NOC platform at the Mobile World Congress 2023. The platform integrates cloud computing, AI, and automation to provide end-to-end network management solutions for large enterprises and service providers. Huawei’s Cloud NOC enables remote network visibility, predictive maintenance, and rapid fault resolution, reflecting the company’s focus on delivering advanced, scalable solutions that empower digital transformation and improve network agility globally.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.