Global Noise Vibration And Harshness Nvh Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

4.79 Billion

2025

2033

USD

2.89 Billion

USD

4.79 Billion

2025

2033

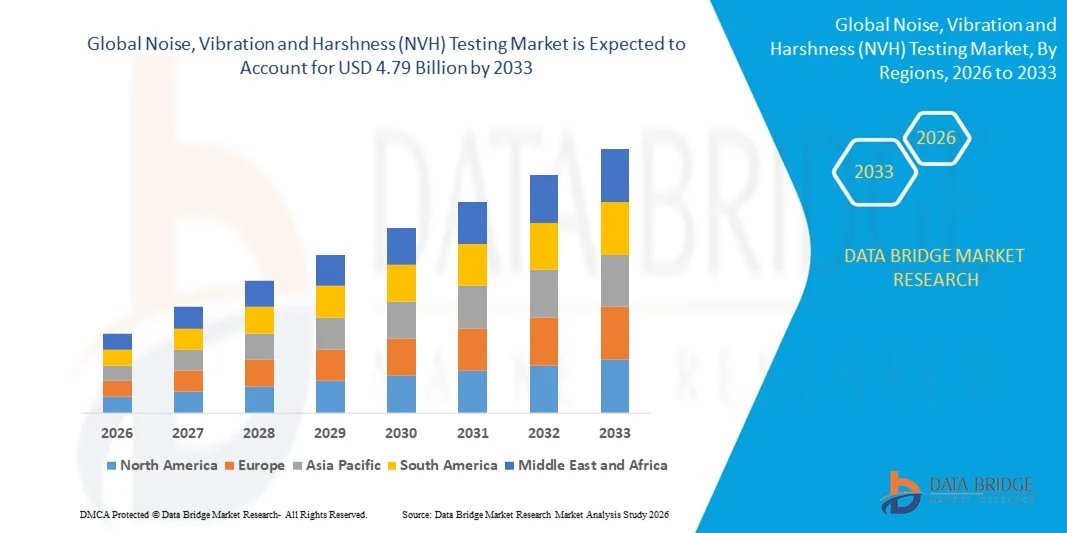

| 2026 –2033 | |

| USD 2.89 Billion | |

| USD 4.79 Billion | |

|

|

|

|

Noise, Vibration and Harshness (NVH) Testing Market Size

- The global Noise, Vibration and Harshness (NVH) testing market size was valued at USD 2.89 billion in 2025 and is expected to reach USD 4.79 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is primarily driven by increasing demand for quieter and more comfortable vehicles, prompting OEMs to adopt advanced Noise, Vibration and Harshness (NVH) testing solutions for automotive, aerospace, and industrial equipment applications

- Furthermore, rising focus on electric and hybrid vehicles, stricter regulatory standards for noise and vibration, and the need for high-precision testing are accelerating the adoption of Noise, Vibration and Harshness (NVH) testing technologies, significantly boosting market expansion

Noise, Vibration and Harshness (NVH) Testing Market Analysis

- Noise, Vibration and Harshness (NVH) testing solutions, encompassing hardware, software, and services, are essential for assessing and optimizing noise, vibration, and harshness in vehicles, industrial machinery, and consumer products, ensuring compliance with regulatory standards and enhancing product quality and comfort

- The escalating demand for Noise, Vibration and Harshness (NVH) testing is primarily fueled by increasing automotive electrification, growing industrial automation, and rising expectations for acoustic comfort and product reliability across end-use industries

- Asia-Pacific dominated the Noise, Vibration and Harshness (NVH) testing market with a share of 37.5% in 2025, due to rapid automotive production, growing aerospace and industrial equipment sectors, and increasing adoption of advanced NVH testing technologies

- North America is expected to be the fastest growing region in the Noise, Vibration and Harshness (NVH) testing market during the forecast period due to strong automotive and aerospace industries, increasing EV adoption, and advanced industrial testing requirements

- Hardware segment dominated the market with a market share of 47% in 2025, due to strong demand for sensors, analyzers, DAQ systems, and vibration meters used in automotive, aerospace, and industrial operations. Industries depend on hardware for accurate physical data capture essential for NVH evaluation and regulatory compliance. Continuous improvements in sensor accuracy, durability, and multi-channel capability strengthen its adoption. Expansion of EV and advanced manufacturing activities further increases hardware requirements. The segment concludes its lead due to its foundational role in every NVH test setup

Report Scope and Noise, Vibration and Harshness (NVH) Testing Market Segmentation

|

Attributes |

Noise, Vibration and Harshness (NVH) Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Noise, Vibration and Harshness (NVH) Testing Market Trends

Rising Adoption of NVH Testing in Electric and Hybrid Vehicles

- A significant trend in the Noise, Vibration and Harshness (NVH) testing market is the increasing adoption of advanced Noise, Vibration and Harshness (NVH) solutions in electric and hybrid vehicles, driven by the growing need to optimize vehicle acoustics, vibration, and ride comfort in low-noise powertrain environments. This trend is positioning NVH testing as a critical step in vehicle development to ensure compliance with regulatory standards and deliver enhanced passenger experience

- For instance, Bosch Engineering GmbH and Hyundai Motor Group are expanding their Noise, Vibration and Harshness (NVH) facilities with semi-anechoic chambers and advanced dynos for precise evaluation of electric and hybrid drivetrains. These investments strengthen testing accuracy and accelerate development cycles for next-generation vehicles

- The integration of Noise, Vibration and Harshness (NVH) in the automotive sector is rapidly increasing as manufacturers focus on electric vehicle cabin comfort and vibration reduction in chassis and powertrain systems. This is elevating Noise, Vibration and Harshness (NVH) solutions as essential tools for OEMs in emerging mobility markets

- Industrial applications are also expanding Noise, Vibration and Harshness (NVH) adoption to ensure machinery, industrial equipment, and consumer products meet noise and vibration standards, enhancing operational safety and product reliability

- Rising technological advancements in NVH measurement hardware, sensors, and simulation software are enabling engineers to detect and mitigate noise and vibration issues at early design stages. This is supporting more predictive and efficient NVH analysis across industries

- The market is witnessing strong growth in integrating Noise, Vibration and Harshness (NVH) with digital simulation, AI-driven analysis, and real-time data acquisition systems. This trend is reinforcing the shift toward more accurate, efficient, and proactive noise and vibration management in automotive, aerospace, and industrial applications

Noise, Vibration and Harshness (NVH) Testing Market Dynamics

Driver

Growing Demand for Quieter and More Comfortable Vehicles

- The growing emphasis on reducing vehicle noise, vibration, and harshness is driving the demand for Noise, Vibration and Harshness (NVH) solutions that ensure superior ride comfort and acoustic performance. This driver is fueled by increasing consumer expectations, stricter emission and noise regulations, and the rise of electric and hybrid vehicles that require optimized cabin acoustics

- For instance, Siemens Digital Industries Software provides simulation-based NVH prediction tools that allow automakers to anticipate vehicle NVH performance before physical prototyping. These solutions accelerate development cycles while improving product quality

- Automotive manufacturers are increasingly investing in Noise, Vibration and Harshness (NVH) hardware, sensors, and software to detect, analyze, and mitigate noise and vibration issues in engines, drivetrains, and chassis components. This is enhancing the overall passenger experience and brand competitiveness

- Rising industrial automation and advanced manufacturing processes are also contributing to demand for NVH solutions, enabling companies to maintain equipment performance, comply with regulations, and reduce operational noise in factories

- The focus on vehicle electrification is further strengthening this driver, as EVs produce less engine noise but require precise vibration and tonal analysis to maintain acoustic comfort and regulatory compliance

Restraint/Challenge

High Cost and Complexity of Advanced NVH Testing Equipment

- The Noise, Vibration and Harshness (NVH) market faces challenges due to the high cost and technical complexity associated with advanced hardware, sensors, simulation software, and integrated testing platforms. These factors can limit adoption, especially among small and medium enterprises

- For instance, companies such as Dewesoft and Hottinger Brüel & Kjær (Spectris) offer highly specialized DAQ systems and integrated software platforms, but the sophisticated technology and precision calibration requirements increase investment costs and operational complexity

- Setting up complete Noise, Vibration and Harshness (NVH) facilities involves costly infrastructure such as semi-anechoic and hemi-anechoic chambers, multi-axis shakers, and high-speed data acquisition systems. This adds capital expenditure constraints and maintenance requirements

- The reliance on skilled personnel and advanced technical knowledge for operating NVH systems further complicates deployment and scaling, impacting smaller manufacturers or emerging market players

- The market continues to encounter limitations in balancing high-precision testing capabilities with affordability and accessibility, placing pressure on vendors to develop cost-efficient solutions without compromising measurement accuracy or reliability

Noise, Vibration and Harshness (NVH) Testing Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Noise, Vibration and Harshness (NVH) market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest share of 47% in 2025, supported by strong demand for sensors, analyzers, DAQ systems, and vibration meters used in automotive, aerospace, and industrial operations. Industries depend on hardware for accurate physical data capture essential for NVH evaluation and regulatory compliance. Continuous improvements in sensor accuracy, durability, and multi-channel capability strengthen its adoption. Expansion of EV and advanced manufacturing activities further increases hardware requirements. The segment concludes its lead due to its foundational role in every NVH test setup.

The software segment is expected to witness the fastest growth from 2026 to 2033, driven by rising use of simulation and real-time analysis tools. For instance, Siemens Digital Industries Software enhances predictive NVH modeling platforms that reduce prototyping costs and accelerate design cycles. Growing reliance on AI-based analytics and cloud data processing boosts software integration with hardware systems. Industries seek advanced visualization and automated reporting capabilities for faster decision-making. The segment concludes its growth through its expanding role in digital NVH engineering.

- By Application

On the basis of application, the Noise, Vibration and Harshness (NVH) market includes environmental, noise measurement, pass-by noise testing, noise source mapping, sound intensity measurement, telecom testing, sound quality testing, building acoustics, mechanical vibration testing, product vibration testing, and others. The mechanical vibration testing segment dominated the market in 2025, due to its critical role in assessing component durability, structural integrity, and product reliability across automotive, aerospace, and industrial equipment. Growing EV production increases the need for vibration validation of batteries and drivetrains. High reliance on shakers and multi-axis analyzers strengthens demand. The segment concludes with its importance in ensuring long-term product performance.

The noise measurement segment is anticipated to grow the fastest from 2026 to 2033, driven by rising requirements for precision sound testing across industrial and environmental applications. For instance, Brüel & Kjær expands smart acoustic meters used for cabin acoustics, aircraft interiors, and urban noise monitoring. Increasing noise regulations and urban development fuel continuous noise assessment needs. Wireless noise logging and real-time monitoring improve operational efficiency. The segment concludes its growth through increasing focus on acoustic comfort and regulatory compliance.

- By End User

On the basis of end user, the Noise, Vibration and Harshness (NVH) market is segmented into automotive and transportation, aerospace and defense, construction, industrial equipment, power generation, consumer electronics, mining and metallurgy, and others. The automotive and transportation segment dominated the market in 2025, supported by extensive NVH evaluation for engines, drivetrains, and vehicle interiors. EV adoption increases testing for motor acoustics and battery vibration behavior. High production volumes and strict noise regulations accelerate demand. The segment concludes with its position as the largest consumer of NVH systems.

The consumer electronics segment is projected to experience the fastest growth from 2026 to 2033, driven by rising need to optimize noise and vibration performance in smartphones, appliances, wearables, and audio devices. For instance, Samsung strengthens NVH-focused quality analysis to enhance sound quality and reduce internal rattling. Miniaturized components require precise vibration and noise mapping during design. Growing consumer demand for quiet, smooth-operating devices supports segment expansion. The segment concludes with its increasing relevance in enhancing product acoustic performance.

Noise, Vibration and Harshness (NVH) Testing Market Regional Analysis

- Asia-Pacific dominated the Noise, Vibration and Harshness (NVH) testing market with the largest revenue share of 37.5% in 2025, driven by rapid automotive production, growing aerospace and industrial equipment sectors, and increasing adoption of advanced NVH testing technologies

- The region’s cost-effective manufacturing landscape, rising investments in automotive and electronics R&D, and expanding industrial base are accelerating market growth

- The availability of skilled labor, supportive government policies, and rapid industrialization across developing economies are contributing to increased adoption of NVH testing solutions

China Noise, Vibration and Harshness (NVH) Testing Market Insight

China held the largest share in the Asia-Pacific Noise, Vibration and Harshness (NVH) testing market in 2025, owing to its status as a global leader in automotive and industrial manufacturing. The country’s strong industrial infrastructure, government support for advanced testing technologies, and high adoption of electric vehicles are major growth drivers. Demand is further boosted by continuous investments in aerospace, consumer electronics, and precision engineering sectors.

India Noise, Vibration and Harshness (NVH) Testing Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid automotive expansion, growing industrial equipment manufacturing, and increased adoption of Noise, Vibration and Harshness (NVH) testing in R&D centers. Initiatives promoting advanced manufacturing and “Make in India” strategies are strengthening the demand for NVH solutions. In addition, rising EV production and increasing focus on vehicle cabin comfort and regulatory compliance contribute to robust market expansion.

Europe Noise, Vibration and Harshness (NVH) Testing Market Insight

The Europe Noise, Vibration and Harshness (NVH) testing market is expanding steadily, supported by stringent automotive and industrial standards, rising focus on vehicle electrification, and high demand for precision vibration and noise measurement solutions. The region emphasizes compliance with environmental and noise regulations, enhancing demand for advanced Noise, Vibration and Harshness (NVH) testing equipment. Growing adoption of simulation and predictive analysis tools further strengthens market growth.

Germany Noise, Vibration and Harshness (NVH) Testing Market Insight

Germany’s Noise, Vibration and Harshness (NVH) testing market is driven by leadership in automotive manufacturing, advanced industrial equipment production, and strong R&D capabilities. The country’s well-established networks between research institutes and manufacturers foster continuous innovation in NVH testing solutions. Demand is particularly high for electric and hybrid vehicle testing, mechanical vibration analysis, and acoustic validation.

U.K. Noise, Vibration and Harshness (NVH) Testing Market Insight

The U.K. market is supported by a mature automotive sector, growing aerospace industry, and increasing emphasis on sustainable and low-noise product design. Investments in R&D centers and adoption of advanced NVH simulation and measurement technologies strengthen the market. The country continues to play a significant role in specialized NVH testing for high-value industrial and consumer applications.

North America Noise, Vibration and Harshness (NVH) Testing Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong automotive and aerospace industries, increasing EV adoption, and advanced industrial testing requirements. Focus on reducing vehicle noise, improving product durability, and stringent regulatory standards are boosting demand. In addition, reshoring of manufacturing and collaborations between automotive OEMs and NVH solution providers support market expansion.

U.S. Noise, Vibration and Harshness (NVH) Testing Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive automotive and aerospace industries, robust R&D infrastructure, and high investment in advanced Noise, Vibration and Harshness (NVH) testing technologies. The country’s focus on EVs, precision engineering, and regulatory compliance drives demand for hardware, software, and service solutions. Presence of key NVH solution providers and mature industrial networks further solidify the U.S.’s leading position in the region.

Noise, Vibration and Harshness (NVH) Testing Market Share

The Noise, Vibration and Harshness (NVH) testing industry is primarily led by well-established companies, including:

- National Instruments Corp. (U.S.)

- Brüel & Kjær (Denmark)

- Siemens Industry Software Inc. (Germany)

- HEAD acoustics GmbH (Germany)

- imc Test & Measurement GmbH (Germany)

- Dewesoft d.o.o. (Slovenia)

- GRAS Sound & Vibration (Denmark)

- Prosig Ltd (U.K.)

- m+p international Mess- und Rechnertechnik GmbH (Germany)

- Signal.X Technologies LLC (U.S.)

- Honeywell International Inc. (U.S.)

- ESI Group (France)

- Thermotron Industries (U.S.)

- Kistler Group (Switzerland)

- Sciemetric Instruments ULC (Canada)

- IMV Corporation (Japan)

- DYTRAN Instruments Incorporated (U.S.)

- ECON Technologies Co., Ltd. (Japan)

- Polytec GmbH (Germany)

- Benstone Instruments (U.S.)

- PCB Piezotronics, Inc. (U.S.)

Latest Developments in Global Noise, Vibration and Harshness (NVH) Testing Market

- In November 2025, Bosch Engineering GmbH inaugurated a state-of-the-art acoustics test centre near Abstatt, featuring a full NVH chassis-dynamometer and hemi-anechoic chamber. This facility enables highly precise, reproducible NVH measurements for combustion-engine, hybrid, and electric vehicles under controlled laboratory conditions. The centre is expected to significantly accelerate vehicle NVH optimization, reduce development cycles, and improve acoustic comfort, allowing automakers to refine noise and vibration characteristics before full-scale production, thereby strengthening Bosch’s position in advanced NVH testing solutions globally

- In January 2025, Hyundai Motor Group expanded its European testing and R&D facility, the “Square Campus,” at its Technical Center in Rüsselsheim. The facility incorporates a large semi-anechoic chamber for full-vehicle NVH testing and drive-by noise assessment, alongside advanced dynos for chassis and powertrain evaluation. This expansion increases Hyundai’s ability to perform rigorous NVH validation for EVs, hybrids, and high-performance vehicles, ensuring compliance with stringent regulatory standards and enhancing passenger comfort. The investment reinforces Hyundai’s commitment to integrating NVH optimization early in the vehicle design process, improving product quality and market competitiveness

- In June 2023, Bertrandt inaugurated its first North African site in Rabat, Morocco, focusing on electrical and product development, electronic systems, and industrialization services tailored to the local market. This new facility enhances Bertrandt’s transnational development network, enabling closer collaboration with regional automotive and industrial clients. By expanding its NVH testing and engineering capabilities in North Africa, Bertrandt can provide faster, localized support for vehicle acoustics and vibration analysis, helping manufacturers meet performance and regulatory standards while reducing lead times

- In April 2022, Dewesoft d.o.o. and Hottinger Brüel & Kjær (Spectris) launched a joint venture named Blueberry (OpenDAQ), combining their expertise to deliver a unified data acquisition system with a common Software Development Kit (SDK) and standardized interfaces. This collaboration aims to accelerate the deployment of next-generation DAQ platforms, enhancing interoperability, precision, and real-time analysis in NVH testing. The partnership allows industries to streamline data acquisition workflows, reduce compatibility challenges, and enable faster, more accurate vehicle and product noise and vibration assessments, strengthening innovation across NVH testing solutions

- In November 2021, Siemens Digital Industries Software introduced its Simcenter system NVH prediction application, allowing engineers to predict NVH performance of electric, hybrid, and internal combustion engine vehicles prior to physical prototyping. This software provides accurate early-stage simulation of noise, vibration, and harshness characteristics, helping manufacturers optimize vehicle design, reduce prototyping costs, and accelerate product development cycles. By integrating predictive NVH analysis, Siemens enables engineers to identify and mitigate potential acoustic or vibration issues earlier, enhancing product quality, passenger comfort, and overall market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Noise Vibration And Harshness Nvh Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Noise Vibration And Harshness Nvh Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Noise Vibration And Harshness Nvh Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.