Global Non Clinical Homecare Software Market

Market Size in USD Billion

CAGR :

%

USD

8.21 Billion

USD

24.37 Billion

2025

2033

USD

8.21 Billion

USD

24.37 Billion

2025

2033

| 2026 –2033 | |

| USD 8.21 Billion | |

| USD 24.37 Billion | |

|

|

|

|

Non-Clinical Homecare Software Market Size

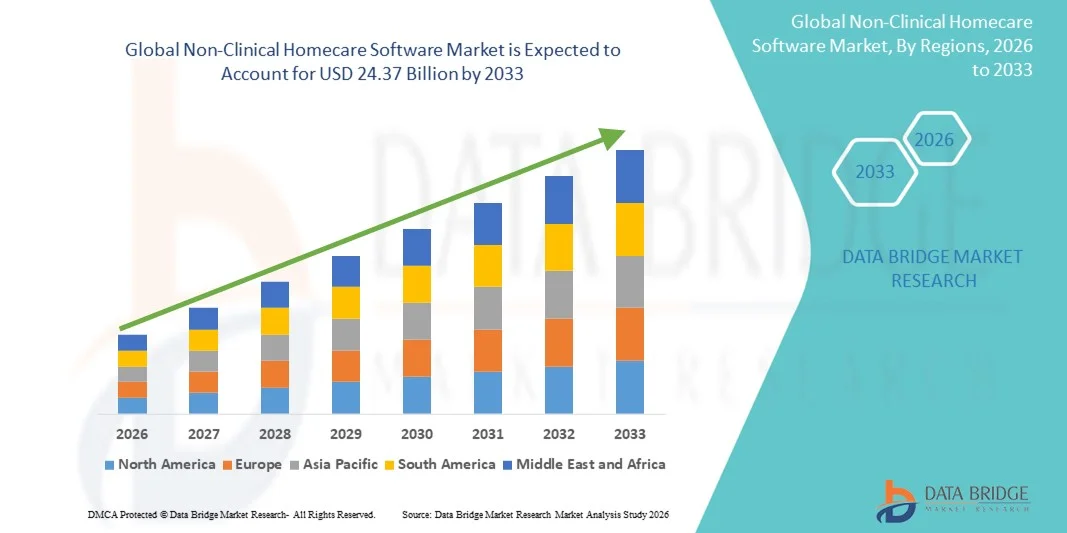

- The global non-clinical homecare software market size was valued at USD 8.21 billion in 2025 and is expected to reach USD 24.37 billion by 2033, at a CAGR of 14.57% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital technologies and advanced software solutions in homecare settings, enabling efficient management of patient data, scheduling, and administrative operations. The integration of cloud-based platforms, mobile applications, and analytics tools is improving operational efficiency, compliance, and care coordination for non-clinical homecare providers

- Furthermore, rising demand for cost-effective, user-friendly, and interoperable solutions is establishing Non-Clinical Homecare Software as a critical tool for homecare agencies, thereby significantly boosting the market’s growth

Non-Clinical Homecare Software Market Analysis

- Non-Clinical Homecare Software, including scheduling platforms, billing systems, workforce management tools, and patient engagement applications, is becoming increasingly vital in modern homecare settings due to its ability to streamline administrative processes, enhance care coordination, and improve operational efficiency for homecare agencies

- The escalating demand for non-clinical homecare software is primarily fueled by the growing adoption of digital solutions in homecare, increasing emphasis on regulatory compliance, and the need for efficient patient and staff management systems

- North America dominated the non-clinical homecare software market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of digital tools among homecare agencies, and a strong presence of key software providers. The U.S. experienced substantial growth in software deployment, driven by innovations in cloud-based platforms, AI-enabled scheduling, and mobile workforce management applications

- Asia-Pacific is expected to be the fastest-growing region in the non-clinical homecare software market during the forecast period, registering a CAGR supported by rapid urbanization, increasing disposable incomes, and government initiatives promoting digital healthcare solutions

- The Agency Systems segment dominated the largest market revenue share of 41.5% in 2025, driven by the increasing adoption of comprehensive management platforms that streamline scheduling, billing, caregiver management, and compliance reporting

Report Scope and Non-Clinical Homecare Software Market Segmentation

|

Attributes |

Non-Clinical Homecare Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Non-Clinical Homecare Software Market Trends

Enhanced Efficiency and Patient-Centric Care

- A significant and accelerating trend in the global non-clinical homecare software market is the increasing adoption of platforms that enhance administrative efficiency, patient scheduling, care coordination, and remote monitoring of non-clinical services. These solutions streamline operations for homecare agencies, enabling real-time task assignment and tracking, improving caregiver productivity, and reducing administrative error

- For instance, in March 2024, MatrixCare launched its updated non-clinical homecare software platform, featuring integrated care management, automated scheduling, and patient engagement modules designed to simplify daily workflows and improve service quality

- The integration of mobile and cloud-based platforms allows caregivers and administrators to access patient information, task lists, and care updates from anywhere, enhancing operational flexibility. By centralizing care documentation, billing, and reporting, agencies can maintain compliance while optimizing resource allocation

- Non-clinical homecare software platforms are increasingly providing patient engagement modules that allow family members to receive real-time updates, schedule visits, and track care quality, which significantly improves transparency and satisfaction

- Furthermore, interoperability with EHR systems, billing platforms, and telehealth modules facilitates seamless data exchange across different stakeholders, improving coordination and minimizing duplication of efforts

- This trend toward efficiency and patient-centric care is fundamentally transforming operational workflows and stakeholder expectations within the homecare ecosystem. Consequently, companies such as Alora and CareSmartz360 are expanding their software capabilities to include remote monitoring, automated notifications, and predictive scheduling

- The growing focus on digital transformation and process automation in homecare services is accelerating the adoption of Non-Clinical Homecare Software across agencies of all sizes. Organizations are increasingly prioritizing platforms that offer comprehensive task management, caregiver assignment, and compliance reporting functionalities to enhance productivity and service quality

Non-Clinical Homecare Software Market Dynamics

Driver

Rising Demand for Streamlined Operations and Quality Care

- The rising need for operational efficiency, improved caregiver productivity, and higher quality patient care is a key driver for the adoption of Non-Clinical Homecare Software

- For instance, in April 2025, MatrixCare announced a strategic enhancement of its homecare software platform with advanced task scheduling, electronic documentation, and mobile care management features, aimed at improving operational efficiency and reducing administrative workload. Such developments by leading software providers are expected to drive market growth in the forecast period

- Homecare agencies and care providers are increasingly leveraging digital platforms to automate routine administrative tasks, optimize caregiver assignment, and enhance coordination between patients, families, and caregivers

- Growing awareness about the importance of patient engagement, compliance, and operational transparency is further propelling software adoption. Non-Clinical Homecare Software enables agencies to monitor service quality, track caregiver performance, and generate detailed reports for regulatory compliance

- In addition, the increasing demand for remote care management solutions and mobile-enabled platforms is driving growth, as providers seek tools that support both field-based and administrative workflows

- The convenience of centralized management, real-time updates, and performance analytics encourages organizations to adopt Non-Clinical Homecare Software solutions across residential and commercial care settings

- The trend toward digital transformation in homecare services is making Non-Clinical Homecare Software a crucial investment for organizations seeking to improve efficiency, patient outcomes, and service quality

Restraint/Challenge

High Implementation Costs and Integration Complexity

- High initial investment costs for advanced Non-Clinical Homecare Software solutions can pose challenges for smaller agencies or budget-conscious providers

- Some organizations face difficulties in integrating new software with legacy systems, EHR platforms, and billing infrastructure, which can limit adoption rates

- For instance, agencies without dedicated IT support may experience delays in deployment, data migration challenges, or workflow disruption during implementation

- Ensuring staff training and user adoption is another critical challenge, as caregivers and administrative personnel must be familiarized with new interfaces and processes

- In addition, concerns about data security, regulatory compliance, and privacy management are prominent, as these platforms handle sensitive patient information

- While cloud-based and subscription models are increasingly available to reduce upfront costs, smaller agencies may still perceive Non-Clinical Homecare Software as a premium investment

- Addressing these challenges through scalable solutions, simplified integration, robust data security measures, and comprehensive training programs will be essential for sustained market growth in the Non-Clinical Homecare Software industry

Non-Clinical Homecare Software Market Scope

The market is segmented on the basis of Application and End Users.

- By Application

On the basis of application, the Non-Clinical Homecare Software market is segmented into Agency Systems, EVV (Electronic Visit Verification), Non-Clinical Health Management Systems, Telehealth Systems, and Others. The Agency Systems segment dominated the largest market revenue share of 41.5% in 2025, driven by the increasing adoption of comprehensive management platforms that streamline scheduling, billing, caregiver management, and compliance reporting. Agency systems are highly preferred by private homecare providers and rehabilitation centers due to their ability to consolidate multiple administrative processes into a single platform. They enhance operational efficiency, reduce errors in documentation, and provide detailed reporting for regulatory compliance. The widespread adoption is also supported by cloud-based deployment, enabling remote monitoring and management. Features such as automated visit scheduling, real-time task tracking, and performance analytics make Agency Systems indispensable for agencies of all sizes. Integration with mobile applications further improves caregiver coordination and patient engagement. The ability to manage multiple client accounts, monitor care delivery, and track caregiver productivity enhances both quality of care and operational cost-effectiveness. In addition, agencies are increasingly leveraging analytics modules to predict workforce needs and optimize staffing schedules. Agency Systems also facilitate better coordination with families and payers, providing transparency and timely updates. The comprehensive functionality and measurable ROI continue to drive Agency Systems as the leading application segment.

The EVV (Electronic Visit Verification) segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by regulatory mandates in multiple regions requiring verification of caregiver visits and service delivery. EVV solutions provide real-time geolocation tracking, time-stamped visit confirmations, and electronic signatures, ensuring compliance and reducing fraud. Providers are adopting EVV to improve billing accuracy and operational accountability. The growing demand for mobile-enabled verification, remote workforce management, and integration with existing agency systems further fuels adoption. EVV systems also enhance patient satisfaction by providing transparency and real-time updates to families. Increasing government initiatives to standardize EVV processes across states and countries are expected to sustain high adoption rates. Advanced EVV solutions now incorporate analytics to optimize caregiver routes, monitor visit durations, and predict scheduling conflicts. As the market for home-based services expands, EVV adoption becomes critical for agencies aiming to maintain compliance and operational efficiency. This ensures that EVV remains the fastest-growing application segment in the Non-Clinical Homecare Software market.

- By End Users

On the basis of end users, the Non-Clinical Homecare Software market is segmented into Private Home Care Agencies, Therapy Centers, Rehabilitation Centers/Therapy Centers, Hospice Care, and Others. The Private Home Care Agencies segment dominated the largest market revenue share of 46.8% in 2025, due to the rapidly increasing number of home-based care recipients and the need for software solutions that manage patient care, scheduling, billing, and compliance efficiently. Private agencies benefit from centralized dashboards, mobile caregiver access, and real-time reporting to improve operational efficiency and client satisfaction. The ability to automate routine administrative tasks, monitor caregiver performance, and integrate with EVV systems further strengthens adoption. The segment is supported by the rising trend of aging populations, chronic disease management at home, and the preference for personalized homecare services. Agencies also leverage reporting tools for regulatory compliance, reimbursement claims, and performance tracking. The combination of improved caregiver coordination, patient engagement, and operational cost savings positions private homecare agencies as the dominant end-user segment.

The Therapy Centers segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, fueled by increasing demand for outpatient rehabilitation, physical therapy, and occupational therapy services. Therapy centers are adopting Non-Clinical Homecare Software for scheduling, patient progress tracking, and integration with telehealth platforms. Real-time updates, automated reminders, and reporting modules improve operational workflow and patient outcomes. The expansion of outpatient services, increased government support for therapy programs, and the need for compliance and documentation drive rapid adoption. Integration with mobile applications enables therapists to access patient data, monitor progress remotely, and share updates with caregivers and families. The scalability of software solutions for multi-location therapy centers also contributes to this segment’s growth. With the rising focus on patient-centered care, operational efficiency, and regulatory compliance, therapy centers are expected to maintain the highest growth rate among end users.

Non-Clinical Homecare Software Market Regional Analysis

- North America dominated the non-clinical homecare software market with the largest revenue share of 41.5% in 2025

- Driven by the region’s advanced healthcare infrastructure, widespread adoption of digital tools among homecare agencies, and the strong presence of key software providers

- The market experienced significant growth due to increasing investments in cloud-based platforms, AI-enabled scheduling, mobile workforce management applications, and seamless integration with electronic health record (EHR) systems, enhancing operational efficiency and care quality

U.S. Non-Clinical Homecare Software Market Insight

The U.S. non-clinical homecare software market captured the largest revenue share within North America in 2025, fueled by high adoption of mobile and cloud-based platforms, supportive regulatory frameworks, and growing demand for digital solutions that optimize caregiver scheduling, compliance tracking, and patient engagement in homecare services.

Europe Non-Clinical Homecare Software Market Insight

The Europe non-clinical homecare software market is projected to expand at a substantial CAGR during the forecast period, driven by increasing digitization of homecare operations, stringent regulatory compliance requirements, and the growing preference for telehealth-enabled administrative management systems across residential and commercial care services.

U.K. Non-Clinical Homecare Software Market Insight

The U.K. non-clinical homecare software market is expected to grow at a noteworthy CAGR, supported by the adoption of digital workforce management platforms, integration with telehealth systems, and the increasing focus of homecare agencies on improving operational efficiency, patient satisfaction, and care quality.

Germany Non-Clinical Homecare Software Market Insight

The Germany non-clinical homecare software market is anticipated to expand at a considerable CAGR during the forecast period, driven by the need for technologically advanced, compliant, and user-friendly software solutions that support efficient management of homecare operations, enhance caregiver productivity, and streamline reporting for regulatory compliance.

Asia-Pacific Non-Clinical Homecare Software Market Insight

The Asia-Pacific non-clinical homecare software market is expected to grow at the fastest CAGR during the forecast period, fueled by rapid urbanization, rising disposable incomes, technological advancements, and government initiatives promoting digital healthcare solutions. Countries such as China, India, and Japan are witnessing increasing adoption of cloud-based platforms and mobile applications to improve homecare efficiency and patient monitoring.

Japan Non-Clinical Homecare Software Market Insight

The Japan non-clinical homecare software market is gaining momentum due to the country’s aging population, high penetration of technology, and rising demand for efficient, user-friendly software platforms that support homecare agencies, rehabilitation centers, and therapy services, improving workforce management and patient outcomes.

China Non-Clinical Homecare Software Market Insight

The China non-clinical homecare software market accounted for the largest revenue share in Asia-Pacific in 2025, supported by the rapid digitalization of homecare services, expanding middle-class access to technology, increasing adoption of cloud-based management solutions, and the presence of strong domestic software providers offering scalable platforms for scheduling, patient tracking, and administrative workflow optimization.

Non-Clinical Homecare Software Market Share

The Non-Clinical Homecare Software industry is primarily led by well-established companies, including:

• CareCloud (U.S.)

• Alora Homecare (U.S.)

• Kinnser Software (U.S.)

• HHAeXchange (U.S.)

• Alora Health (U.S.)

• MatrixCare (U.S.)

• WellSky (U.S.)

• Complia Health (U.S.)

• HomeCare HomeBase (U.S.)

• PointClickCare (Canada)

• Alora EVV (U.S.)

• SwiftCare (U.S.)

• CareSmartz360 (U.S.)

• Meditech (U.S.)

• AccuCare (U.S.)

Latest Developments in Global Non-Clinical Homecare Software Market

- In January 2025, Homecare Homebase (HCHB) published a press release outlining its year‑end growth, product innovation, and expanded capabilities in non‑clinical homecare software for home health, hospice, and personal care agencies globally

- In July 2024, HHAeXchange announced the acquisition of Cashé Software, a move to strengthen its homecare operations, billing, and management platform offerings for thousands of agencies and individual care providers

- In April 2023, HCHB highlighted how its software platform was being leveraged by home‑based care agencies to improve task management, scheduling, and compliance across large‑scale home health operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.