Global Non Dairy Beverages Market

Market Size in USD Billion

CAGR :

%

USD

21.16 Billion

USD

52.41 Billion

2024

2032

USD

21.16 Billion

USD

52.41 Billion

2024

2032

| 2025 –2032 | |

| USD 21.16 Billion | |

| USD 52.41 Billion | |

|

|

|

|

Non-Dairy Beverages Market Size

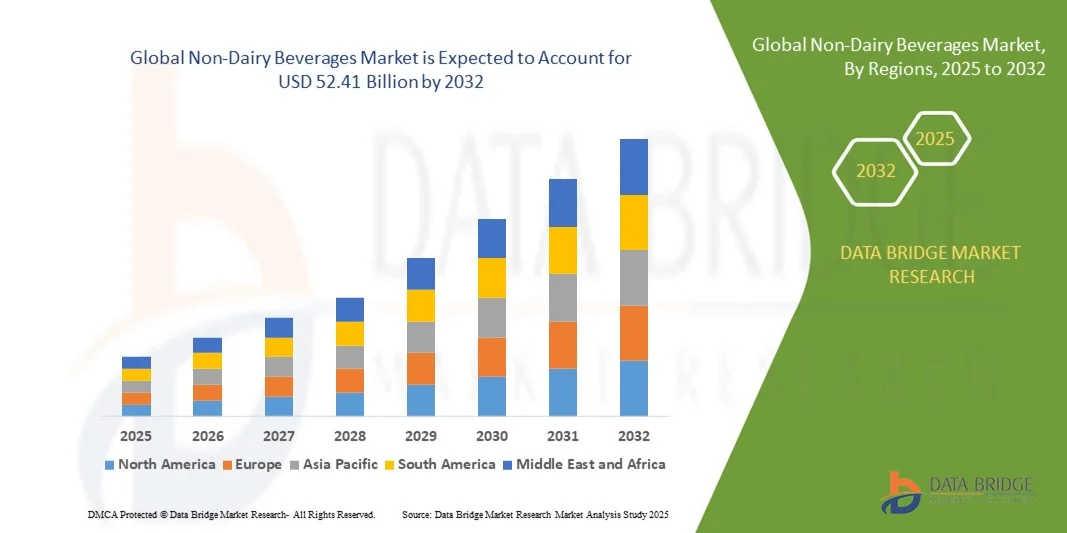

- The global non-dairy beverages market size was valued at USD 21.16 billion in 2024 and is expected to reach USD 52.41 billion by 2032, at a CAGR of 12.00% during the forecast period

- The market growth is largely fueled by the increasing consumer preference for plant-based and lactose-free alternatives, driven by rising health awareness, dietary restrictions, and vegan lifestyles. The adoption of functional ingredients such as probiotics, vitamins, and minerals in non-dairy beverages is further propelling market expansion

- Furthermore, rising product innovation and diversification by key players to offer almond, oat, soy, rice, and other plant-based beverages is enhancing consumer choice and accessibility. For instance, GOOD KARMA FOODS, INC. and Health-Ade Kombucha have introduced new flavors and fortified variants, boosting adoption across different age groups

Non-Dairy Beverages Market Analysis

- Non-dairy beverages are liquid products derived from plant sources such as almonds, soy, oats, rice, coconut, and other functional ingredients. These beverages serve as alternatives to traditional dairy drinks and are often enriched with nutrients, probiotics, and flavors to cater to health-conscious consumers

- The escalating demand for non-dairy beverages is primarily fueled by increasing lactose intolerance cases, growing vegan and flexitarian populations, and rising awareness of the environmental benefits of plant-based diets. Consumers are also attracted to clean-label and fortified beverage options that support immunity, gut health, and overall wellness

- Asia-Pacific dominated the non-dairy beverages market with a share of 67.7% in 2024, due to rising health awareness, increasing plant-based diet adoption, and a strong presence of leading beverage manufacturers

- North America is expected to be the fastest growing region in the non-dairy beverages market during the forecast period due to increasing health consciousness, rising lactose intolerance awareness, and strong demand for functional and fortified beverages

- Fruits segment dominated the market with a market share of 42.3% in 2024, due to the high consumer preference for natural flavors, vitamins, and antioxidants. Fruit-based beverages are often perceived as a healthier alternative, appealing to health-conscious consumers seeking functional and refreshing drinks. The segment also benefits from the wide availability of fruit extracts and blends, enabling innovative flavor profiles and seasonal variants. Manufacturers are increasingly investing in fruit-based formulations that provide immunity-boosting and energy-enhancing benefits, reinforcing consumer trust and adoption

Report Scope and Non-Dairy Beverages Market Segmentation

|

Attributes |

Non-Dairy Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Dairy Beverages Market Trends

Rising Adoption of Plant-Based and Functional Beverages

- A leading trend in the non-dairy beverages market is the growing mainstream adoption of plant-based and functional beverages, supported by consumer demand for healthier, eco-friendly, and diverse dietary choices. Plant-based drinks formulated from nuts, grains, legumes, and seeds such as almond, oat, soy, and coconut are rapidly replacing conventional dairy, with unique flavors and enhanced nutritional profiles appealing to a widened consumer base

- For instance, Danone’s Silk brand introduced Silk Kids in December 2024, a nutrient-optimized oat milk blend tailored for children, reflecting rapid product innovation in formulation and niche targeting. Such launches are part of a broader industry response, with brands and manufacturers expanding product portfolios to include protein-enriched, fortified, and botanically functional non-dairy beverage options designed for both adults and children

- Adoption of non-dairy beverages is reinforced by the recognized health benefits and lower environmental impact compared to traditional dairy, with production methods demanding fewer natural resources and yielding reduced greenhouse gas emissions. This sustainability narrative amplifies the appeal of plant-based options in both developed and emerging markets, aligning the sector with global ecological objectives

- In addition, the role of regulatory support for plant-based alternatives and ongoing research into processing technologies are catalyzing the development of texture-enhanced, flavor-optimized, and shelf-stable offerings that closely mimic dairy experiences while providing functional ingredients such as added vitamins and probiotics

- Market penetration is further accelerated through the expansion of retail channels, improved accessibility in foodservice and specialty outlets, and strategic partnerships with cafes and restaurant chains introducing specialty plant-based drinks

- The convergence of health-driven trends, versatility of plant-based ingredients, and innovation in functional beverage categories is reshaping consumption habits globally. This transition is poised to drive sustained growth and competitive differentiation for non-dairy beverages, securing their status as staple nutrition sources for a variety of lifestyles and dietary preferences

Non-Dairy Beverages Market Dynamics

Driver

Increasing Health Awareness and Dietary Restrictions Among Consumers

- Significant growth of the non-dairy beverages market is propelled by rising health consciousness and increased prevalence of dietary restrictions such as lactose intolerance and dairy allergies. Consumers actively seek products that support wellness, prevent metabolic disorders, and provide nutritional enhancement without animal-derived ingredients

- For instance, the Asia-Pacific region saw rapid adoption of plant-based beverages driven by dietary diversity, with growing disposable incomes and urbanization fueling demand for fortified, lighter, and nutrient-rich beverage alternatives in China, Japan, and India

- The elimination of cholesterol and inclusion of vitamins, minerals, and antioxidants make plant-based beverages attractive for heart health, weight control, and general well-being. Flexitarian and vegan diets are driving product uptake among millennials and Gen Z consumers, who are attuned to environmental, ethical, and health considerations in food choices

- In addition, innovation in flavor, format, and nutritional fortification is broadening appeal across consumer segments, removing the stigma of compromise and reinforcing the value proposition of non-dairy beverages as everyday nutrition sources

- The interplay of global health trends, urban lifestyle shifts, and growing prevalence of special diets is expected to maintain robust demand for non-dairy and plant-based beverages as core elements in balanced nutrition going forward

Restraint/Challenge

High Product Cost and Supply Chain Complexities

- The high cost of non-dairy beverages relative to traditional dairy options presents a key challenge hampering wider adoption, especially in price-sensitive markets and among lower-income consumers. Production costs are elevated by the expense of premium plant ingredients, processing innovations, and the absence of subsidies that benefit the dairy industry in many regions

- For instance, plant-based milks such as almond, hemp, and oat tend to be priced significantly higher than standard cow’s milk, with pricing volatility driven by fluctuations in raw ingredient supply and global commodity markets

- Complicating matters further, supply chain complexities arise due to the seasonality and regional sourcing of key botanicals. Risks include climate impacts, harvest variability, and competitive demand from other food and beverage sectors utilizing the same plant-based ingredients

- In addition, consumer concerns around artificial additives and the environmental footprint of specific crops can influence purchasing decisions, requiring increased transparency and innovation in supply management and sustainability practices

- Efforts to enhance affordability, improve logistical resilience, and educate consumers about ingredient sourcing and sustainability credentials will be vital to overcoming current restraints and enabling market scalability for non-dairy beverage producers worldwide

Non-Dairy Beverages Market Scope

The market is segmented on the basis of source, type, and distribution channel.

- By Source

On the basis of source, the non-dairy beverages market is segmented into fruits, vegetables, cereals, and others. The fruit-based segment dominated the largest market revenue share of 42.3% in 2024, driven by the high consumer preference for natural flavors, vitamins, and antioxidants. Fruit-based beverages are often perceived as a healthier alternative, appealing to health-conscious consumers seeking functional and refreshing drinks. The segment also benefits from the wide availability of fruit extracts and blends, enabling innovative flavor profiles and seasonal variants. Manufacturers are increasingly investing in fruit-based formulations that provide immunity-boosting and energy-enhancing benefits, reinforcing consumer trust and adoption.

The cereal-based segment is anticipated to witness the fastest growth rate of 19.6% from 2025 to 2032, fueled by rising awareness of plant-based protein sources and fiber-rich diets. For instance, companies such as Oatly and Alpro are expanding their cereal-based beverage portfolios, attracting consumers seeking nutritious breakfast and snack alternatives. Cereal-based drinks offer functional benefits such as improved digestion, heart health support, and long-lasting satiety, enhancing their appeal among health-conscious adults and parents. The segment also gains traction from innovations in taste and texture, enabling dairy-like creaminess without animal-derived ingredients.

- By Type

On the basis of type, the non-dairy beverages market is segmented into dairy-free drinkable yogurts, fermented soft drinks, fermented juices, and non-dairy kefir. The dairy-free drinkable yogurt segment dominated the largest market revenue share in 2024, driven by strong consumer adoption of probiotic-rich beverages that promote gut health. These beverages are often preferred for their creamy texture and versatility as on-the-go nutrition options. Manufacturers are focusing on enhanced formulations using almond, soy, and oat bases, offering additional nutrients such as protein, calcium, and vitamins. The growing trend of functional foods and the influence of social media on health-conscious lifestyles also contribute to the segment’s popularity.

The fermented soft drinks segment is anticipated to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by increasing consumer interest in digestive health and natural fermentation. For instance, brands such as Kombucha Wonder Drink and GT’s Living Foods are expanding their fermented soft drink lines to meet rising demand for probiotic beverages. Fermented soft drinks provide unique flavors, antioxidants, and gut-friendly benefits, appealing to millennials and Gen Z consumers seeking wellness-oriented alternatives. The segment also benefits from innovations in low-sugar and organic options, making these beverages suitable for broader consumer demographics.

- By Distribution Channel

On the basis of distribution channel, the non-dairy beverages market is segmented into online retail, supermarket/hypermarket, specialty stores, departmental stores, and others. The supermarket/hypermarket segment dominated the largest market revenue share in 2024, driven by the wide availability of product variants and convenient shopping experiences for consumers. Supermarkets often provide opportunities for promotional campaigns, in-store sampling, and brand visibility, boosting product trial and repeat purchases. This channel also enables manufacturers to target mass-market consumers seeking affordable and accessible non-dairy options.

The online retail segment is anticipated to witness the fastest growth rate of 24.3% from 2025 to 2032, fueled by increasing e-commerce penetration and the convenience of doorstep delivery. For instance, companies such as Amazon and Thrive Market are expanding their non-dairy beverage offerings to cater to digitally savvy consumers. Online retail platforms allow consumers to access a wide range of niche and premium products, including specialty formulations and limited-edition flavors. Personalized recommendations, subscription models, and discounts further enhance online adoption, making it an attractive channel for both brands and consumers.

Non-Dairy Beverages Market Regional Analysis

- Asia-Pacific dominated the non-dairy beverages market with the largest revenue share of 67.7% in 2024, driven by rising health awareness, increasing plant-based diet adoption, and a strong presence of leading beverage manufacturers

- The region’s cost-effective production, growing retail penetration, and expanding e-commerce platforms are accelerating market expansion

- Increasing disposable incomes, urbanization, and favorable government initiatives promoting plant-based nutrition are contributing to higher consumption of non-dairy beverages across the region

China Non-Dairy Beverages Market Insight

China held the largest share in the Asia-Pacific non-dairy beverages market in 2024, owing to its large consumer base, rising preference for healthy and functional drinks, and growing plant-based product launches. The country’s expanding manufacturing capabilities, strong distribution networks, and increasing investments in R&D for innovative formulations are major growth drivers. Demand is further bolstered by rising awareness of lactose intolerance and shifting dietary preferences toward sustainable alternatives.

India Non-Dairy Beverages Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing health consciousness, growing urban population, and rising disposable incomes. For instance, companies such as Paper Boat and Epigamia are expanding their non-dairy beverage portfolios, catering to diverse consumer tastes. Government initiatives supporting nutritional awareness and plant-based alternatives, along with rising online retail adoption, are further contributing to market growth.

Europe Non-Dairy Beverages Market Insight

The Europe non-dairy beverages market is expanding steadily, supported by high health awareness, stringent food safety regulations, and increasing demand for organic and functional beverages. Consumers are seeking plant-based alternatives with added nutrients, promoting product innovation in dairy-free yogurts, fermented drinks, and kefir. The region’s focus on sustainability, clean-label products, and eco-friendly packaging is enhancing market growth, particularly in Western European countries.

Germany Non-Dairy Beverages Market Insight

Germany’s non-dairy beverages market is driven by strong health-conscious consumer behavior, high per capita consumption of plant-based foods, and established retail infrastructure. For instance, Alpro and Provamel are leading the market with innovative non-dairy yogurt and beverage products. Rising awareness of digestive health, lactose intolerance, and functional nutrition are fueling steady adoption across supermarkets, specialty stores, and online channels.

U.K. Non-Dairy Beverages Market Insight

The U.K. market is supported by growing vegan and flexitarian populations, increasing demand for functional beverages, and high retail penetration. Rising focus on sustainability and plant-based diets is encouraging the development of diverse flavors and formulations. Investments in R&D, collaborations between manufacturers and retailers, and expanding online sales channels are further driving market growth.

North America Non-Dairy Beverages Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing health consciousness, rising lactose intolerance awareness, and strong demand for functional and fortified beverages. The popularity of plant-based diets, online retail expansion, and innovation in dairy-free drinkable yogurts, fermented drinks, and kefir are boosting market adoption.

U.S. Non-Dairy Beverages Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by high consumer awareness of health and wellness trends, strong retail and e-commerce infrastructure, and extensive product innovation. For instance, companies such as Silk, Oatly, and Califia Farms are expanding portfolios with functional, fortified, and flavored non-dairy beverages. The country’s focus on plant-based nutrition, lifestyle-driven consumption, and widespread distribution networks further solidify its leading position in the region.

Non-Dairy Beverages Market Share

The non-dairy beverages industry is primarily led by well-established companies, including:

- Thurella AG (Switzerland)

- GOOD KARMA FOODS, INC. (U.S.)

- Health-Ade Kombucha (U.S.)

- Millennium Products Inc (U.S.)

- Fentimans (U.K.)

- Konings (Netherlands)

- GT’S LIVING FOODS (U.S.)

- Lifeway Foods, Inc. (U.S.)

- KeVita (U.S.)

- Boston Beer Co (U.S.)

- Nestlé (Switzerland)

- Yakult Honsha Co., Ltd (Japan)

- PepsiCo (U.S.)

- Beverage Dynamics (U.S.)

- Bionade GmbH (Germany)

- Danone (France)

- Biosa Inc. (U.S.)

- DuPont (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Mother Dairy Fruit & Vegetable Pvt. Ltd. (India)

Latest Developments in Global Non-Dairy Beverages Market

- In November 2024, abCoffee, a leading grab-and-go coffee chain in India, launched the country’s first-ever range of 13 coconut-based, non-dairy beverages. This initiative addresses the rising demand for plant-based alternatives among urban consumers and strengthens abCoffee’s position in the fast-growing non-dairy segment. By offering both coffee and non-coffee options, the launch caters to modern, health-conscious consumers, potentially boosting the adoption of plant-based beverages in India’s retail and café markets

- In October 2024, Alc-A-Chino, a prominent spiked coffee brand, introduced the first-to-market spiked non-dairy oat milk iced latte within the beverage alcohol sector. This product expands the functional beverage and plant-based alcoholic offerings, tapping into consumers’ growing preference for innovative, dairy-free indulgences. The launch is expected to drive category growth by combining the appeal of non-dairy alternatives with the premium alcoholic beverage segment

- In September 2024, Oxbow Brands launched its new brand, Vegan Drink Company (VDC), targeting the increasing demand for dairy-free alternatives among lactose-intolerant individuals and consumers embracing vegan lifestyles. This launch enhances Oxbow’s presence across offline retail and food service channels in India, supporting expansion in both urban and semi-urban markets. The move is likely to accelerate awareness and adoption of plant-based beverages in the country

- In June 2024, Country Delight introduced its all-new Oats Beverage, marking its entry into the rapidly growing plant-based drink segment. Designed for health-conscious consumers seeking affordable and nutritious alternatives, the launch strengthens Country Delight’s positioning in India’s dairy-free beverage market. By leveraging its reputation for purity, quality, and freshness, the brand is expected to capture increased market share in both household and on-the-go consumption segments

- In March 2023, Life Health Foods (India) expanded its plant-based beverage portfolio with the launch of the So Good Oat Unsweetened vegan drink. Fortified with essential vitamins, free from added sugar, cholesterol, and preservatives, the launch reinforces Life Health Foods’ leadership in the non-dairy segment. The product’s availability in Almond, Cashew, Coconut, Soy, and Oat variants across multiple pack sizes is likely to boost consumer trial and penetration, supporting overall growth in India’s plant-based beverage market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Dairy Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Dairy Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Dairy Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.