Global Non Destructive Market For Construction Industry Market

Market Size in USD Billion

CAGR :

%

USD

3.87 Billion

USD

6.19 Billion

2024

2032

USD

3.87 Billion

USD

6.19 Billion

2024

2032

| 2025 –2032 | |

| USD 3.87 Billion | |

| USD 6.19 Billion | |

|

|

|

|

Non-Destructive Testing Market for Construction Industry Size

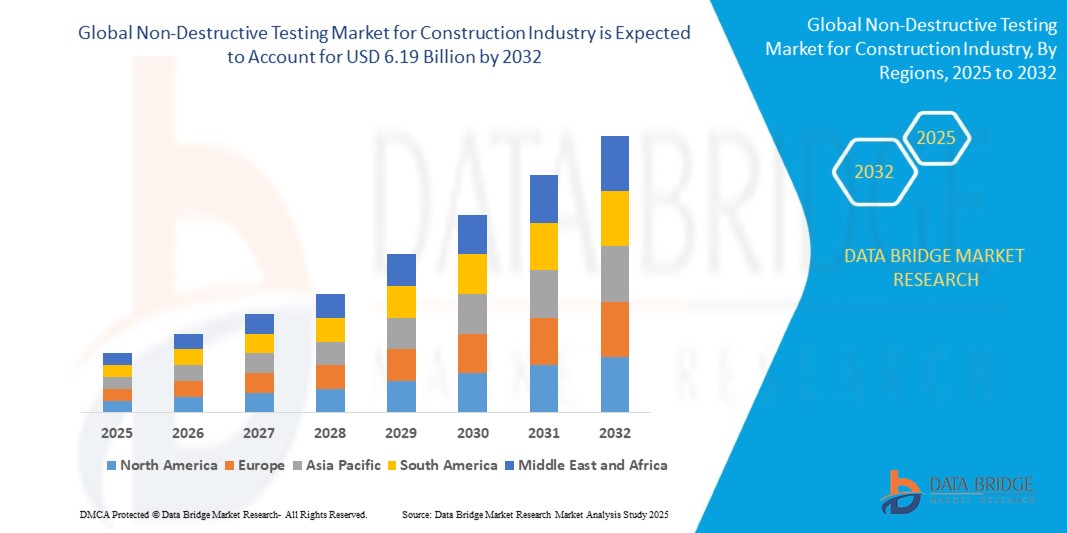

- The global non-destructive testing market for construction industry was valued at USD 3.87 billion in 2024 and is projected to reach USD 6.19 billion by 2032, growing at a steady CAGR of 7.50% during the forecast period.

- Growth is driven by increasing infrastructure investments, stringent safety regulations, and the adoption of advanced NDT technologies such as ultrasonic testing, radiography, and digital inspection tools—ensuring structural integrity and long-term durability across construction and civil engineering projects.

Non-Destructive Testing Market for Construction Industry Analysis

- Global non-destructive testing market for construction industry solutions are essential tools used to evaluate the structural integrity of materials and components in the construction industry without causing any damage to the assets being inspected.

- As the global construction sector expands with increasing investments in infrastructure, commercial buildings, and smart cities Non-Destructive Testing methods are gaining widespread adoption for ensuring safety, regulatory compliance, and quality assurance.

- Industries are leveraging NDT techniques such as ultrasonic testing, radiographic inspection, magnetic particle testing, and visual inspection for cost-effective monitoring of concrete structures, steel reinforcements, pipelines, and weld joints.

- The growing emphasis on predictive maintenance and asset lifecycle management is driving demand for advanced NDT systems that offer real-time data, digital traceability, and remote monitoring capabilities.

- The integration of NDT technologies with drones, robotics, and AI analytics is reshaping inspection processes enabling faster assessments, minimizing downtime, and supporting safer working environments in complex or hazardous construction zones.

Report Scope and Global Non-Destructive Testing Market for Construction Industry Segmentation

|

Attributes |

Non-Destructive Testing Market for Construction Industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated for the Global Non-Destructive Testing (NDT) Market for Construction Industry also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.. |

Non Destructive Market Trends

Emergence of Smart, Resilient, and Tech-Driven Testing Solutions in Construction

- Adoption of Advanced Materials and Composite Structures: The increasing use of complex composites, high-strength concrete, and advanced alloys in modern infrastructure requires sophisticated NDT methods such as phased array ultrasonic testing and guided wave techniques for effective quality assurance.

- Integration of Robotics and Drones for Inspection Efficiency: Remote-controlled drones and robotic crawlers are becoming mainstream for conducting NDT in hard-to-reach or hazardous construction zones, reducing downtime and enhancing worker safety in bridge, tunnel, and high-rise inspections.

- Sustainability-Focused Inspection Practices: The NDT market is seeing a shift toward environmentally conscious practices, including reusable sensors, non-toxic inspection chemicals, and energy-efficient equipment—aligning with green construction norms and sustainable infrastructure goals.

- Rise of Real-Time Monitoring and Digital Twins: Construction companies are embedding sensors during build phases to support real-time structural health monitoring. Coupled with digital twin platforms, NDT data is enabling predictive maintenance and lifecycle extension for critical infrastructure assets.

- IoT-Enabled Asset Integrity and Remote Testing: With increasing adoption of IoT and cloud platforms, NDT tools are now capable of streaming data remotely, supporting centralized oversight and diagnostics across large-scale construction projects—enhancing accountability and compliance.

Non-Destructive Testing Market for Construction Industry Dynamics

Driver

Rising Demand for Safety-Driven, Cost-Optimized Infrastructure Monitoring in Construction

- The increasing emphasis on structural integrity, public safety, and longevity of civil assets is propelling the adoption of non-destructive testing technologies across residential, commercial, and public infrastructure projects.

- Construction firms are deploying NDT methods such as ultrasonic, radiographic, and magnetic particle testing to inspect welds, concrete, pipelines, and steel reinforcements without damaging the underlying materials.

- Accelerated urbanization and megaprojects across emerging economies are fostering demand for cost-efficient and time-saving testing solutions that can be seamlessly integrated into project timelines.

- Regulatory bodies and government agencies are mandating more stringent inspection standards and third-party testing protocols, thereby encouraging investment in portable, automated, and AI-enhanced NDT equipment tailored for on-site construction environments..

Restraint/Challenge

Performance Limitations and Lack of Standardization for Mass-Scale Applications

- Non-destructive testing methods in the construction industry often encounter performance gaps when deployed in complex or large-scale infrastructure, especially where irregular surfaces, variable material compositions, or high ambient noise environments affect inspection accuracy.

- A lack of universally accepted standards across regions and project types leads to inconsistencies in test results, equipment calibration, and technician certification, hindering the reliability and repeatability of evaluations on large public projects.

- Small and mid-sized construction firms frequently struggle to access or adopt advanced NDT technologies—such as phased array ultrasonic testing or digital radiography—due to the high capital expenditure required and limited technical expertise, reducing scalability across broader infrastructure portfolios.

- Challenges also persist in inspecting composite materials, evaluating internal defects in reinforced concrete, or performing in-situ testing under dynamic site conditions, where maintaining probe alignment, data integrity, and consistent power sources is difficult over extended durations..

Non-Destructive Testing Market for Construction Industry Scope

The market is segmented by Technique, Method, Service Type, Application, and End User reflecting its versatility across sectors and product categories.

- By Technique

Includes Visual Testing, Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Acoustic Emission Testing, and Others.

Ultrasonic testing leads the market in 2025, widely used for its high accuracy in flaw detection and thickness measurements across concrete and metal structures. Visual testing remains foundational due to its simplicity, cost-effectiveness, and routine inspection utility. Radiographic and Eddy Current testing are preferred for critical weld and corrosion inspections, while Acoustic Emission is gaining momentum for real-time structural monitoring in bridges and tunnels.

- By Method

Includes Traditional NDT and Advanced NDT (such as Phased Array Ultrasonic Testing, Time of Flight Diffraction, Digital Radiography, and Infrared Thermography).

Traditional methods dominate in 2025, especially visual, magnetic particle, and liquid penetrant testing due to established protocols and technician familiarity. However, Advanced NDT methods are growing rapidly, driven by the demand for deeper structural insights, higher resolution imaging, and digital data capture. Phased Array Ultrasonic Testing and Digital Radiography are particularly popular in large-scale infrastructure projects where precision and automation are prioritized..

- By Service Type

Includes Inspection Services, equipment rental services, training services, and calibration services.

Inspection services account for the largest share, as many construction firms and government agencies outsource safety audits and compliance inspections. Equipment rental is growing, fueled by small to mid-size contractors seeking access to high-end NDT tools without ownership costs. Meanwhile, training and calibration services are essential to support regulatory compliance and ensure operator proficiency across project sites.

- By Application

Key applications include Structural Analysis, Concrete Testing, Weld Integrity Assessment, Corrosion Mapping, Dimensional Measurement, Surface Crack Detection, Pipe and Pipeline Inspection, and Others.

Structural analysis and concrete testing lead in 2025, due to their critical role in ensuring the safety and longevity of buildings, bridges, and tunnels. Weld integrity and corrosion mapping are extensively used in steel infrastructure and utility pipelines, especially in aging assets. Surface crack detection and dimensional measurement also play a vital role in modern construction quality control workflows.

- By End User

Covers Residential Construction, Commercial Buildings, Industrial Facilities, Transportation Infrastructure (bridges, roads, rail), Utilities (water and energy pipelines), Government and Public Sector, and Others.

Transportation infrastructure and government/public sector dominate the end-user segment, driven by large-scale investments in national infrastructure renewal and regulatory oversight. Commercial and industrial facilities also contribute significantly, especially where structural integrity impacts occupancy safety or operational uptime. Residential construction, though smaller in comparison, increasingly integrates basic NDT for quality assurance in high-rise and high-value projects.

Non-Destructive Testing Market for Construction Industry Regional Analysis

- North America leads the global market in 2025, driven by widespread deployment of NDT technologies in infrastructure maintenance, bridge inspection, and transportation safety. The U.S. remains at the forefront of innovation, with robust government investment, growing use of AI-integrated inspection tools, and an established ecosystem of certified NDT professionals and service providers.

- Europe follows closely, supported by strict regulatory frameworks and rising investments in public infrastructure renewal. Countries like Germany, France, and the U.K. are prioritizing non-invasive structural testing in smart city development, railway modernization, and green building initiatives, leveraging advancements in digital radiography and ultrasonic testing.

- Asia-Pacific is the fastest-growing region, with China, India, South Korea, and Japan accelerating their infrastructure expansion. These countries are heavily investing in roads, airports, railways, and urban development, where NDT plays a critical role in quality assurance, longevity, and safety compliance. The region benefits from strong manufacturing capabilities and rising adoption of automated inspection systems.

- Middle East & Africa (MEA) is witnessing increasing adoption of NDT technologies in large-scale infrastructure and energy projects, especially in the UAE, Saudi Arabia, and South Africa. Non-destructive methods are being used to ensure the integrity of pipelines, water distribution systems, and public construction projects aligned with national development visions.

- South America, led by Brazil and Chile, is incorporating NDT solutions into transportation, urban planning, and utility infrastructure. The region is gradually embracing advanced testing tools to support asset life extension, reduce maintenance costs, and enhance structural reliability in public infrastructure..

United States

The U.S. leads in 2025 with high adoption of NDT in construction and infrastructure safety, including bridge condition assessments, airport runways, and highway systems. Strong collaboration between government agencies, technology developers, and private contractors supports continuous innovation and deployment.

Germany

Germany’s NDT market in construction industry is propelled by its strong industrial base and commitment to infrastructure quality. Applications in rail infrastructure, highway tunnels, and smart buildings are backed by rigorous compliance standards and integration with Industry 4.0 practices.

China

China dominates large-scale infrastructure deployment, using NDT extensively in highways, metros, tunnels, and urban structures. Government-led urbanization programs and mass-scale construction projects fuel demand for cost-efficient and scalable inspection solutions.

India

India is emerging as a high-growth market for NDT in construction, supported by government-driven programs in smart cities, affordable housing, and railway modernization. Non-destructive methods are being adopted to ensure material integrity and monitor structural health in resource-sensitive environments.

South Korea

South Korea is investing in cutting-edge NDT applications for intelligent infrastructure, with a focus on robotics, IoT-enabled monitoring systems, and predictive maintenance across bridges, roads, and public facilities. The market is supported by strong exports and domestic innovation in testing equipment.

Non-Destructive Testing Market for Construction Industry Share

The global non-destructive testing market for construction industry is primarily led by well-established companies, including:

- Baker Hughes Company (Waygate Technologies) (U.S.)

- Mistras Group, Inc. (U.S.)

- Olympus Corporation (Japan)

- Nikon Metrology Inc. (U.S.)

- Zetec Inc. (U.S.)

- Previan Technologies, Inc. (Canada)

- Fischer Technology Inc. (U.S.)

- Bureau Veritas S.A. (France)

- Intertek Group plc (U.K.)

- SGS S.A. (Switzerland)

Latest Developments in Global Non-Destructive Testing Market for Construction Industry

- June 2025, Olympus Corporation unveiled a next-generation portable ultrasonic flaw detector tailored for civil infrastructure inspections, offering enhanced signal-to-noise ratio and AI-guided defect interpretation for bridge and concrete structure assessments.

- May 2025, Applus+ signed a strategic agreement with a European infrastructure group to deliver advanced radiographic and phased array ultrasonic testing services for metro tunnel expansion and high-speed rail projects across Spain and France.

- March 2025, Eddyfi Technologies introduced a new line of robotic scanners specifically designed for vertical concrete walls and complex geometries, aimed at improving NDT efficiency in high-rise construction and industrial facilities.

- February 2025, MISTRAS Group launched its construction-focused digital inspection platform, integrating real-time NDT data capture, drone-based imaging, and AI defect recognition to optimize compliance reporting for public infrastructure.

- January 2025, Bureau Veritas expanded its construction NDT services in Southeast Asia by establishing a dedicated civil infrastructure testing hub in Kuala Lumpur, Malaysia, focused on ultrasonic and acoustic emission testing of bridges and tunnels.

- December 2024, TWI Ltd. announced successful field trials of its autonomous ultrasonic crawler robot on reinforced concrete columns, showcasing potential for rapid, non-invasive inspection of structural integrity on large-scale public works.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Destructive Market For Construction Industry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Destructive Market For Construction Industry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Destructive Market For Construction Industry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.