Global Non Destructive Testing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

18.57 Billion

USD

31.35 Billion

2024

2032

USD

18.57 Billion

USD

31.35 Billion

2024

2032

| 2025 –2032 | |

| USD 18.57 Billion | |

| USD 31.35 Billion | |

|

|

|

|

Global Non-Destructive Testing Equipment Market Size

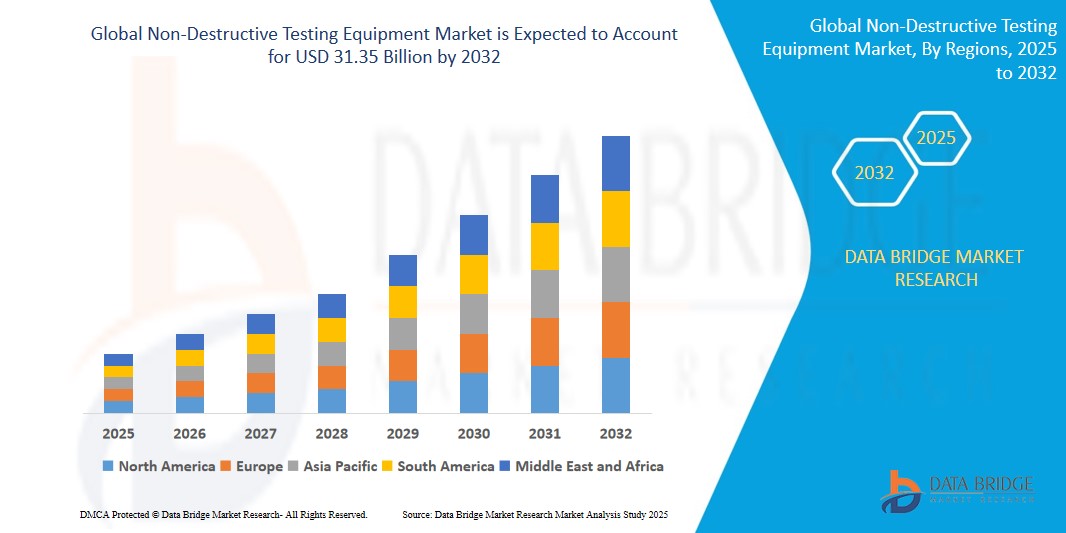

- The Global Non-Destructive Testing Equipment market size was valued at USD 17.88 Billion in 2024 and is expected to reach USD 31.35 Billion by 2032, at a CAGR of 7.1% during the forecast period

- The Non-Destructive Testing (NDT) Equipment market is driven by growing safety regulations, infrastructure development, aging assets in industries, and increasing demand for advanced inspection technologies across aerospace, oil & gas, and manufacturing sectors.

Global Non-Destructive Testing Equipment Market Analysis

- Non-Destructive Testing (NDT) Equipment refers to tools and devices used to evaluate the properties of materials or structures without causing damage, ensuring safety, reliability, and performance in various industries.

- The NDT Equipment market is propelled by rising safety standards, stringent regulatory compliance, and the need for accurate diagnostics in critical industries like aerospace, oil & gas, and power generation. Additionally, aging infrastructure, technological advancements in testing methods, and growing adoption of automation further contribute to the market’s sustained growth.

- North America is expected to dominate the Global Non-Destructive Testing Equipment market due to is driven by stringent safety regulations, a mature industrial base, and high adoption of advanced testing technologies. The U.S. leads with strong aerospace, automotive, and oil & gas sectors. Demand for preventive maintenance and the inspection of aging infrastructure further accelerates market expansion.

- Asia-Pacific is expected to be the fastest growing country in the Non-Destructive Testing Equipment market during the forecast period due rapid industrialization, expanding infrastructure projects, and increasing investments in manufacturing and energy sectors. Countries like China, India, and Japan emphasize safety and quality control, fueling demand. Government regulations and a growing focus on asset life extension further boost market growth in the region.

- The Ultrasonic Testing segment is expected to dominate the Non-Destructive Testing Equipment market, with a market share of 35.23% during the forecast period. The Ultrasonic Testing segment in the NDT Equipment market is driven by its high accuracy, ability to detect internal flaws, and growing use in critical industries like aerospace, automotive, and oil & gas. Its non-invasive nature and technological advancements further boost adoption.

Report Scope and Global Non-Destructive Testing Equipment Market Segmentation

|

Attributes |

Global Non-Destructive Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Non-Destructive Testing Equipment Market Trends

“AI, machine learning, and automation revolutionize NDT processes across industries”

- AI, machine learning, and automation are transforming Non-Destructive Testing (NDT) by enabling faster, more accurate defect detection and real-time data analysis. These technological advancements are revolutionizing industries like aerospace, automotive, and manufacturing, increasing efficiency and reducing human error.

- Automation and machine learning are reducing the dependency on manual intervention, allowing industries to perform more accurate inspections at a fraction of the time. These innovations enhance both safety and productivity, reshaping traditional NDT workflows in critical sectors.

- For instance, In February 2025, MISTRAS Group launched an AI-powered NDT system that enhances real-time defect detection accuracy, streamlining the inspection process and improving operational efficiency across various industries.

- As AI and automation integrate into NDT solutions, industries will see improved operational efficiency, driving technological advancements and fostering significant market growth across sectors reliant on precise, real-time inspection technologies.

Global Non-Destructive Testing Equipment Market Dynamics

Driver

“Increasing Safety Standards and Aging Infrastructure”

- As safety regulations tighten and aging infrastructure across industries like aerospace, oil & gas, and manufacturing requires ongoing maintenance, the demand for Non-Destructive Testing (NDT) equipment is growing. Companies are responding to this need with innovative solutions.

- • These sectors, particularly those with critical assets, rely on NDT technologies to ensure safety and reliability. The increasing focus on preventive maintenance and safety is pushing for advanced testing equipment that can effectively assess the condition of aging infrastructure.

- For instance,In January 2025, MISTRAS Group introduced a next-generation ultrasonic testing system to address the growing demand for real-time, precise inspections in high-risk industries.

- With increasing safety regulations and the need for infrastructure preservation, NDT equipment companies are poised for long-term market expansion, emphasizing technological advancements to meet industry standards and ensure asset longevity.

Opportunity

“Growing infrastructure needs and robotic solutions”

- As infrastructure development accelerates globally, industries like oil & gas, aerospace, and construction are increasingly turning to advanced Non-Destructive Testing (NDT) equipment. Robotic solutions are being adopted to improve inspection accuracy and safety, further driving market growth.

- The growing complexity of infrastructure projects and the need for ongoing maintenance create a significant demand for efficient, automated NDT solutions. Robotic systems are particularly valued in hazardous environments, reducing human intervention while enhancing inspection precision.

- For instance, In March 2025, Zetec launched a new robotic NDT inspection system designed for high-risk environments, emphasizing increased safety and automation.

- As infrastructure needs continue to rise, robotic NDT technologies are expected to play a pivotal role in revolutionizing inspections, ensuring more accurate, cost-effective, and safer solutions across various industries.

Restraint/Challenge

“High costs and complexity limit adoption by small to medium enterprises”

- The high initial investment and operational complexity of Non-Destructive Testing (NDT) equipment create barriers for small to medium enterprises (SMEs), limiting their ability to adopt advanced testing technologies. These companies often struggle with the significant upfront costs of such systems.

- Additionally, the specialized training required to operate NDT equipment adds to the challenges SMEs face in fully integrating these technologies into their operations, further slowing adoption in industries where budget constraints are more prevalent.

- For instance, In February 2025, Olympus Corporation introduced a cost-effective portable ultrasonic testing device aimed at smaller enterprises, helping them access high-quality NDT without excessive financial investment.

- The advancements in both affordability and ease of use, smaller enterprises are increasingly able to incorporate advanced NDT solutions into their operations. This trend is expected to foster widespread adoption across various sectors, including construction, automotive, and manufacturing, broadening the scope of NDT applications.

Global Non-Destructive Testing Equipment Market Scope

The market is segmented on the basis type, substrate material, application, form factor, panel size.

|

Segmentation |

Sub-Segmentation |

|

By Testing Method |

|

|

By Technique |

|

|

By Services |

|

|

By Industry Vertical |

|

In 2025, the Ultrasonic Testing is projected to dominate the market with a largest share in by testing method segment

The ultrasonic testing segment is expected to dominate the Global Non-Destructive Testing Equipment market, with a market share of 35.23% during the forecast period. The growing ability to provide accurate, real-time inspection of materials without causing damage. Its applications in aerospace, manufacturing, and energy sectors ensure high demand and market growth.

The Volumetric Examination is expected to account for the largest share during the forecast period in Global Non-Destructive Testing Equipment market

In 2025, the volumetric examination segment in the Global Non-Destructive Testing Equipment Market is projected to hold the largest share of approximately 48.1%. The capability to inspect internal material structures for hidden defects, such as cracks or voids, without compromising the integrity of the object. This technique is essential in critical industries like aerospace, oil & gas, and power generation, where safety and equipment reliability are paramount. All these factor drive the volumetric examination segment during the forecast period.

Global Non-Destructive Testing Equipment Market Country Analysis

“North America Holds the Largest Share in the Global Non-Destructive Testing Equipment Market”

- The United States and Canada are leading the North American Non-Destructive Testing (NDT) market due to their strict safety standards and high demand for infrastructure maintenance. Key industries such as aerospace, automotive, and energy drive this growth.

- The U.S. government’s investments in infrastructure projects and the oil & gas sector's expansion are further fueling NDT equipment demand. Additionally, technological advancements in AI and automation are enhancing the region’s NDT capabilities, making inspections faster, safer, and more accurate.

- Additionally, advancements in AI, automation, and robotics are enhancing inspection capabilities, boosting demand for more efficient and accurate NDT equipment. These innovations cater to industries like oil & gas and energy, where the need for reliable, cost-effective testing solutions continues to rise.

“Asia-Pacific is Projected to Register the Highest CAGR in the Global Non-Destructive Testing Equipment Market”

- In countries like China, India, and Japan, the Non-Destructive Testing (NDT) market is growing due to rapid industrialization and infrastructure development, especially in construction, automotive, and energy sectors, driving the demand for advanced NDT solutions.

- The increasing focus on safety standards and quality control in these countries, along with rising investments in manufacturing and energy sectors, further boosts NDT adoption. Additionally, technological advancements in AI and automation are enhancing inspection capabilities, further supporting market growth in the region.

Global Non-Destructive Testing Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GE Company LLC (USA)

- Olympus Corporation (Japan)

- YXLON International (Germany)

- MISTRAS Group, Inc. (USA)

- Zetec, Inc. (USA)

- FOERSTER Holding GmbH (Germany)

- Nikon Metrology NV (Belgium)

- SGS Group (SGS SA) (Switzerland)

- Fujifilm Holdings Corporation (Japan)

- Bureau Veritas S.A. (France)

- Acuren (Canada)

- NDT Global (Ireland)

- Cygnus Instruments Inc. (United Kingdom)

- Magnaflux (USA)

- Eddyfi (Canada)

- Bosello High Technology Srl (Italy)

- T.D. Williamson, Inc.(USA)

- Sonaspection (USA)

- LynX Inspection (USA)

- Fischer Technology, Inc. (USA)

Latest Developments in Global Non-Destructive Testing Equipment Market

- In February 2025, MISTRAS Group introduced an AI-powered NDT system that enhances real-time defect detection accuracy, streamlining the inspection process and improving operational efficiency across various industries.

- In February 2025, Olympus Corporation launched a cost-effective portable ultrasonic testing device aimed at smaller enterprises, helping them access high-quality NDT without excessive financial investment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

TABLE OF CONTENTS GLOBAL NON- DESTRUCTIVE TESTING EQUIPMENT MARKET

1. INTRODUCTION

1.1. OBJECTIVES OF THE STUDY 1.2. MARKET DEFINITION 1.3. OVERVIEW OF GLOBAL NON DESTRUCTIVE TESTING EQUIPMENT MARKET 1.4. CURRENCY AND PRICING 1.5. LIMITATION 1.6. MARKETS COVERED

2. MARKET SEGMENTATION

2.1. MARKETS COVERED 2.2. GEOGRAPHIC SCOPE 2.3. YEARS CONSIDERED FOR THE STUDY 2.4. CURRENCY AND PRICING 2.5. RESEARCH METHODOLOGY 2.6. PRIMARY INTERVIEWS WITH KEY OPINION LEADERS 2.7. SECONDARY SOURCES 2.8. ASSUMPTIONS

3. EXECUTIVE SUMMARY 4. PREMIUM INSIGHTS 5. GLOBAL NON DESTRUCTIVE TESTING EQUIPMENT MARKET, BY EQUIPMENT TYPE

5.1. OVERVIEW 5.2. ULTRASONIC TEST EQUIPMENT 5.3. MAGNETIC PARTICLE TESTING 5.4. VISUAL INSPECTION EQUIPMENT 5.5. RADIOGRAPHY TESTING EQUIPMENT 5.6. PENETRANT TEST EQUIPMENT 5.7. EDDY CURRENT TESTING EQUIPMENT 5.8. ACCOUSTIC EMMISION TESTING EQUIPMENT 5.9. OTHERS

6. GLOBAL NON DESTRUCTIVE TESTING EQUIPMENT MARKET, BY INDUSTRY

6.1. OVERVIEW 6.2. AUTOMOTIVE 6.3. OIL AND GAS 6.4. ENERGY AND POWER 6.5. AEROSPACE AND DEFENCE 6.6. OTHERS

7. GLOBAL NON DESTRUCTIVE TESTING EQUIPMENT MARKET, BY APPLICATION

7.1. OVERVIEW 7.2. PHYSICAL ANALYSIS 7.3. LEAK DETECTION 7.4. FLAW DETECTION 7.5. DIMENSIONAL MEASUREMENT 7.6. CHEMICAL ANALYSIS 7.7. CORROSION EMISSION TESTING 7.8. PLASMA EMISSION TESTING 7.9. OTHERS

8. GLOBAL NON DESTRUCTIVE TESTING EQUIPMENT MARKET, BY INDUSTRY

8.1. OVERVIEW 8.2. AUTOMOTIVE 8.3. OIL AND GAS 8.4. ENERGY AND POWER 8.5. AEROSPACE AND DEFENCE 8.6. OTHERS

9. GLOBAL NON-DESTRUCTIVE TESTING EQUIPMENT MARKET, BY GEOGRAPHY

9.1. GLOBAL

9.2. NORTH AMERICA

9.2.1. U.S. 9.2.2. CANADA 9.2.3. MEXICO

9.3. EUROPE

9.3.1. GERMANY 9.3.2. FRANCE 9.3.3. U.K. 9.3.4. ITALY 9.3.5. SPAIN 9.3.6. SWITZERLAND 9.3.7. NETHERLANDS 9.3.8. BELGIUM 9.3.9. TURKEY 9.3.10. RUSSIA 9.3.11. REST OF EUROPE

9.4. ASIA-PACIFIC

9.4.1. JAPAN 9.4.2. CHINA 9.4.3. INDIA 9.4.4. SOUTH KOREA 9.4.5. AUSTRALIA 9.4.6. SINGAPORE 9.4.7. THAILAND 9.4.8. MALAYSIA 9.4.9. INDONESIA 9.4.10. PHILIPPINES NON-DESTRUCTIVE EQUIPMENT MARKET 9.4.11. REST OF ASIA

9.5. SOUTH AMERICA

9.5.1. BRAZIL 9.5.2. REST OF SOUTH AMERICA

9.6. MIDDLE EAST AND AFRICA

9.6.1. SOUTH AFRICA 9.6.2. REST OF MIDDLE EAST AND AFRICA

10. GLOBAL NON-DESTRUCTIVE TESTING EQUIPMENT MARKET, COMPANY LANDSCAPE

10.1. COMPANY SHARE ANALYSIS: GLOBAL 10.2. COMPANY SHARE ANALYSIS: NORTH AMERICA 10.3. COMPANY SHARE ANALYSIS: EUROPE 10.4. COMPANY SHARE ANALYSIS: APAC

11. COMPANY PROFILES

11.1. FUJIFILM HOLDINGS CORPORATION

11.1.1. COMPANY OVERVIEW 11.1.2. FUJIFILM HOLDINGS CORPORATION: REVENUE ANALYSIS 11.1.3. PRODUCT PORTFOLIO 11.1.4. RECENT DEVELOPMENTS

11.2. OLYMPUS CORPORATION

11.2.1. COMPANY OVERVIEW 11.2.2. OLYMPUS CORPORATION: REVENUE ANALYSIS 11.2.3. PRODUCT PORTFOLIO 11.2.4. RECENT DEVELOPMENTS

11.3. GENERAL ELECTRIC

11.3.1. COMPANY OVERVIEW 11.3.2. GENERAL ELECTRIC: REVENUE ANALYSIS 11.3.3. PRODUCT PORTFOLIO 11.3.4. RECENT DEVELOPMENTS

11.4. SONATEST

11.4.1. COMPANY OVERVIEW 11.4.2. SONATEST: COMPANY SNAPSHOT 11.4.3. PRODUCT PORTFOLIO 11.4.4. RECENT DEVELOPMENTS

11.5. PFINDER KG

11.5.1. PFINDER KG: COMPANY SNAPSHOT 11.5.2. PRODUCT PORTFOLIO 11.5.3. RECENT DEVELOPMENTS

11.6. SOCOMORE

11.6.1. SOCOMORE: COMPANY SNAPSHOT 11.6.2. PRODUCT PORTFOLIO 11.6.3. RECENT DEVELOPMENTS

11.7. MISTRAS GROUP, INC.

11.7.1. COMPANY OVERVIEW 11.7.2. MISTRAS GROUP, INC.: REVENUE ANALYSIS 11.7.3. PRODUCT PORTFOLIO 11.7.4. RECENT DEVELOPMENTS

11.8. NIKON CORPORATION

11.8.1. COMPANY OVERVIEW 11.8.2. NIKON CORPORATION: REVENUE ANALYSIS 11.8.3. PRODUCT PORTFOLIO 11.8.4. RECENT DEVELOPMENTS

11.9. ASHTEAD GROUP PLC

11.9.1. COMPANY OVERVIEW 11.9.2. ASHTEAD GROUP PLC: COMPANY SNAPSHOT 11.9.3. PRODUCT PORTFOLIO 11.9.4. RECENT DEVELOPMENTS

11.10. BOSELLO HIGH TECHNOLOGY SRL

11.10.1. COMPANY OVERVIEW 11.10.2. BOSELLO HIGH TECHNOLOGY SRL : COMPANY SNAPSHOT 11.10.3. PRODUCT PORTFOLIO 11.10.4. RECENT DEVELOPMENTS

11.11. COMET GROUP

11.11.1. COMPANY OVERVIEW 11.11.2. COMET GROUP: COMPANY SNAPSHOT 11.11.3. PRODUCT PORTFOLIO 11.11.4. RECENT DEVELOPMENTS

11.12. ZETEC, INC. (ROPER TECHNOLOGIES)

11.12.1. COMPANY OVERVIEW 11.12.2. ZETEC, INC. : COMPANY SNAPSHOT 11.12.3. PRODUCT PORTFOLIO 11.12.4. RECENT DEVELOPMENTS

11.13. MAGNAFLUX (ILLINOIS TOOL WORKS INC.)

11.13.1. COMPANY OVERVIEW 11.13.2. MAGNAFLUX: COMPANY SNAPSHOT 11.13.3. PRODUCT PORTFOLIO 11.13.4. RECENT DEVELOPMENTS

12. RELATED REPORTS

Global Non Destructive Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Destructive Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Destructive Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.