Global Non Hodgkin Lymphoma Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

12.34 Billion

USD

23.71 Billion

2024

2032

USD

12.34 Billion

USD

23.71 Billion

2024

2032

| 2025 –2032 | |

| USD 12.34 Billion | |

| USD 23.71 Billion | |

|

|

|

|

Non-Hodgkin Lymphoma Diagnostics Market Size

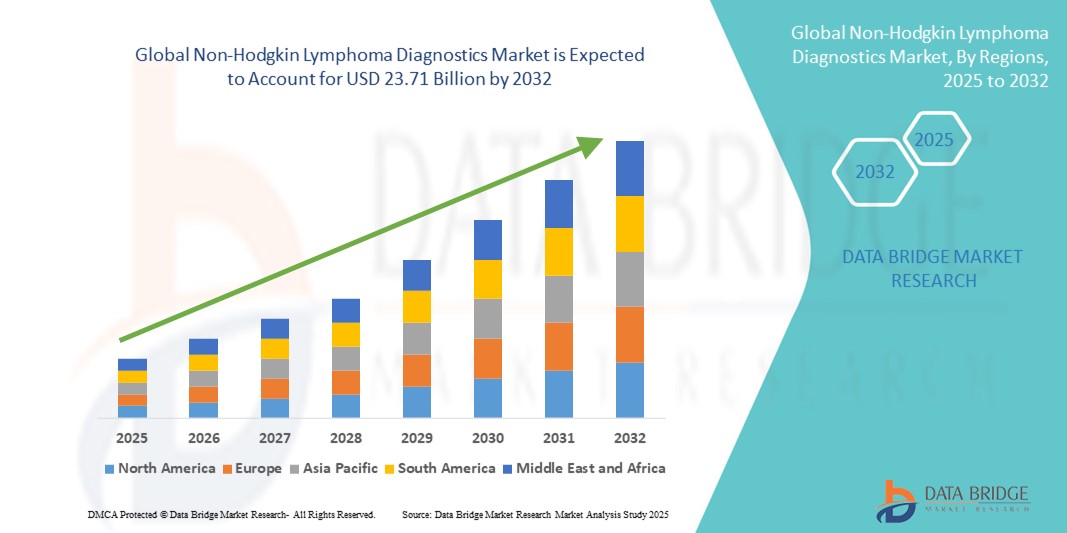

- The global Non-Hodgkin lymphoma diagnostics market size was valued at USD 12.34 billion in 2024 and is expected to reach USD 23.71 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is primarily driven by the increasing incidence of Non-Hodgkin lymphoma worldwide and growing awareness of early cancer detection, which is enhancing demand for advanced diagnostic techniques

- In addition, the expansion of molecular diagnostics, rising healthcare expenditure, and continuous innovation in biomarker-based testing are improving diagnostic accuracy and accessibility. These dynamics are strengthening the adoption of Non-Hodgkin lymphoma diagnostics, contributing significantly to market expansion

Non-Hodgkin Lymphoma Diagnostics Market Analysis

- Non-Hodgkin lymphoma (NHL) diagnostics encompass a range of tools and technologies used to detect and classify various subtypes of this cancer, playing a critical role in early detection, personalized treatment planning, and improved patient outcomes across global healthcare systems

- The growing demand for NHL diagnostics is largely driven by the rising global prevalence of lymphoma, advancements in molecular diagnostic techniques, and increased emphasis on early and precise cancer detection by healthcare providers

- North America dominated the Non-Hodgkin lymphoma diagnostics market with the largest revenue share of 42.5% in 2024, supported by high awareness levels, robust healthcare infrastructure, and active research initiatives in the U.S., where innovative technologies such as next-generation sequencing and biomarker-based assays are increasingly being adopted

- Asia-Pacific is projected to be the fastest growing region in the NHL diagnostics market during the forecast period due to improving healthcare access, increasing cancer screening programs, and rising cancer burden in countries such as China and India

- Immunohistochemistry (IHC) segment dominated the Non-Hodgkin lymphoma diagnostics market with a market share of 39.2% in 2024, attributed to its widespread use in determining lymphoma subtypes and its critical role in accurate pathological diagnosis

Report Scope and Non-Hodgkin Lymphoma Diagnostics Market Segmentation

|

Attributes |

Non-Hodgkin Lymphoma Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Hodgkin Lymphoma Diagnostics Market Trends

“Precision Medicine and AI-Driven Diagnostic Advancements”

- A notable and evolving trend in the global Non-Hodgkin lymphoma (NHL) diagnostics market is the integration of precision medicine principles and artificial intelligence (AI) into diagnostic workflows. These innovations are transforming how clinicians detect, classify, and monitor NHL by enhancing diagnostic accuracy and enabling tailored treatment strategies

- For instance, companies such as F. Hoffmann-La Roche Ltd. and Thermo Fisher Scientific offer AI-powered digital pathology platforms and next-generation sequencing (NGS) solutions that assist in identifying genetic mutations and lymphoid cell profiles more precisely. Such tools are critical in differentiating among more than 60 NHL subtypes, improving patient-specific care plans

- AI-driven software is increasingly used to analyze complex biomarker and imaging data, helping clinicians detect early morphological changes that may indicate disease progression. In addition, digital pathology solutions integrated with AI can streamline workflows by automating slide analysis and enhancing diagnostic reproducibility, especially in resource-constrained settings

- The use of liquid biopsy and circulating tumor DNA (ctDNA) assays is also gaining traction as a non-invasive diagnostic option, offering real-time monitoring of disease progression or relapse. Leading diagnostic firms are combining AI with these novel techniques to enhance sensitivity and specificity

- This trend toward precision, speed, and non-invasiveness is reshaping the NHL diagnostic landscape, enabling earlier intervention and improving outcomes. Consequently, firms such as Illumina and Agilent Technologies are investing in AI-enabled, high-throughput diagnostic tools that support real-time disease tracking, thereby reinforcing their role in future-ready cancer diagnostics

- The rising demand for AI-integrated, precision-driven diagnostic solutions is expanding across both developed and emerging markets, as healthcare systems seek cost-effective, high-efficiency approaches to manage the growing burden of lymphomas

Non-Hodgkin Lymphoma Diagnostics Market Dynamics

Driver

“Rising Global Cancer Incidence and Demand for Early Detection”

- The increasing global incidence of Non-Hodgkin lymphoma and the prioritization of early cancer detection by healthcare providers are key drivers for the growth of the NHL diagnostics market

- For instance, according to the World Health Organization (WHO), NHL remains among the top ten most common cancers worldwide, prompting governments and institutions to ramp up screening efforts and diagnostic infrastructure

- Advancements in diagnostic technologies such as immunophenotyping, flow cytometry, and molecular testing now enable more accurate identification of lymphoma subtypes, facilitating earlier and more effective treatment initiation

- Moreover, the increasing awareness among patients and healthcare professionals about the importance of early diagnosis and the expanding availability of insurance coverage for cancer diagnostics are further accelerating market adoption

- Hospitals, cancer specialty clinics, and diagnostic laboratories are actively upgrading their capabilities with automated systems and integrated platforms to meet the growing demand for quick and precise diagnoses

- The trend toward personalized oncology care and biomarker-driven decision-making also supports increased uptake of advanced diagnostic tools for NHL across both public and private healthcare settings

Restraint/Challenge

“High Diagnostic Costs and Limited Accessibility in Low-Income Regions”

- The high cost associated with advanced diagnostic tests, including NGS, immunohistochemistry, and molecular profiling, presents a major challenge for widespread adoption, particularly in low- and middle-income countries (LMICs)

- For instance, the infrastructure required for comprehensive molecular diagnostics often demands significant investment in equipment, reagents, and skilled personnel resources that may not be readily available in rural or underserved healthcare systems

- In addition, the shortage of trained hematopathologists and the complexity of accurately diagnosing and subclassifying NHL can lead to diagnostic delays or misdiagnoses, further complicating timely treatment

- Although international health agencies and public-private partnerships are working to bridge these gaps, disparities in healthcare access continue to hinder uniform market growth

- Reducing the cost of tests through technological innovation, increasing global funding for cancer diagnostics, and expanding telepathology and AI-assisted diagnostic platforms may help mitigate these challenges. Broader adoption will rely on improving accessibility and affordability while ensuring consistent diagnostic quality across all geographies

Non-Hodgkin Lymphoma Diagnostics Market Scope

The market is segmented on the basis of test type, cancer stage, tumor type, product, technology, application, end user, and distribution channel.

- By Test Type

On the basis of test type, the Non-Hodgkin lymphoma diagnostics market is segmented into imaging, biopsy, immunohistochemistry, biomarker, genetic test, cytogenetics, lumbar puncture, blood test, cytochemistry, and others. The immunohistochemistry segment dominated the market with the largest market revenue share of 39.2% in 2024, as it plays a pivotal role in identifying lymphoma cell markers and determining the subtype classification essential for treatment planning. Its wide adoption in diagnostic laboratories, cost-effectiveness, and compatibility with formalin-fixed tissue samples make it a preferred choice among clinicians for Non-Hodgkin lymphoma diagnosis.

The genetic test segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increased focus on personalized medicine and the growing need to identify gene mutations and translocations specific to various lymphoma subtypes. Advancements in next-generation sequencing (NGS) and its ability to detect minimal residual disease are further propelling the demand for genetic testing in clinical oncology.

- By Cancer Stage

On the basis of cancer stage, the market is segmented into Stage IV, Stage III, Stage II, Stage I, and Stage 0. The Stage IV segment held the largest market revenue share in 2024, due to the high number of patients diagnosed at an advanced stage of disease where systemic spread requires thorough and sophisticated diagnostic evaluation. Increased use of imaging and biomarker profiling in Stage IV cases contributes to this segment's dominance.

The Stage I segment is expected to witness the fastest CAGR from 2025 to 2032, driven by improved early detection rates owing to growing awareness campaigns, enhanced screening programs, and wider accessibility to diagnostic services in both developed and developing regions.

- By Tumor Type

On the basis of tumor type, the Non-Hodgkin lymphoma diagnostics market is segmented into aggressive lymphomas and indolent lymphomas. The aggressive lymphomas segment dominated the market with the largest market revenue share in 2024, as these subtypes including diffuse large B-cell lymphoma (DLBCL) require rapid and accurate diagnostic confirmation to initiate timely and intensive treatment regimens.

The indolent lymphomas segment is anticipated to witness steady growth from 2025 to 2032, as these slow-growing lymphomas require continuous diagnostic monitoring and follow-up testing to assess disease progression or transformation to a more aggressive form.

- By Product

On the basis of product, the market is segmented into instrument-based products, platform-based products, kits and reagents, and other consumables. The kits and reagents segment dominated the market with the largest market revenue share in 2024, driven by their repeated and essential use in various diagnostic procedures such as immunohistochemistry, flow cytometry, and molecular tests. Their critical role in sample preparation, staining, and detection makes them indispensable in both routine diagnostics and research applications.

The platform-based products segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to increased adoption of automated, high-throughput platforms in molecular laboratories. The demand for integrated, scalable solutions for multiplex testing and precision oncology is fueling the adoption of advanced platforms in hospitals and diagnostic labs.

- By Technology

On the basis of technology, the Non-Hodgkin lymphoma diagnostics market is segmented into fluorescent in situ hybridization (FISH), next-generation sequencing (NGS), fluorimmunoassay, comparative genomic hybridization, immunohistochemical, and others. The immunohistochemical segment dominated the market with the largest market revenue share in 2024, as it remains a cornerstone in lymphoma diagnostics by enabling precise identification of cell markers and differentiation of NHL subtypes. Its widespread use across pathology labs and compatibility with FFPE tissue samples support its continued relevance.

The next-generation sequencing (NGS) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its ability to provide comprehensive genomic data, detect rare mutations, and support personalized treatment strategies. Ongoing advancements in NGS accuracy and cost-efficiency are expanding its clinical applications in oncology.

- By Application

On the basis of application, the market is segmented into screening, diagnostic and predictive, prognostic, and research. The diagnostic and predictive segment dominated the market with the largest market revenue share in 2024, driven by the central role of accurate diagnosis and subtype classification in initiating effective treatment. Predictive testing also helps determine patient eligibility for targeted therapies, contributing to better clinical outcomes.

The prognostic segment is anticipated to witness the fastest growth rate from 2025 to 2032, as increasing focus on personalized medicine and risk stratification requires identifying biomarkers that predict disease progression and response to treatment.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centers, cancer research centers, academic institutes, ambulatory surgical centers, and others. The hospitals segment dominated the market with the largest market revenue share in 2024, due to their ability to offer a comprehensive range of diagnostic services, including imaging, pathology, and molecular testing. Hospitals are also typically the first point of contact for patients presenting with lymphoma symptoms, leading to higher testing volumes.

The cancer research centers segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing clinical trials, translational research programs, and collaborations with biotech firms to explore new diagnostic tools and therapeutic targets.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with the largest market revenue share in 2024, driven by high-volume purchasing by government hospitals, healthcare systems, and diagnostic labs, which rely on centralized procurement for cost efficiency and compliance.

The retail sales segment is expected to witness the fastest growth rate from 2025 to 2032, as decentralization of diagnostics and rising consumer interest in at-home cancer testing kits and third-party lab services become more prevalent, particularly in urban markets and developed countries.

Non-Hodgkin Lymphoma Diagnostics Market Regional Analysis

- North America led the Non-Hodgkin lymphoma diagnostics market with the largest revenue share of 42.5% in 2024, supported by high awareness levels, robust healthcare infrastructure, and active research initiatives in the U.S., where innovative technologies such as next-generation sequencing and biomarker-based assays are increasingly being adopted

- Patients and providers in the region prioritize precision diagnostics, leveraging tools such as immunohistochemistry, flow cytometry, and next-generation sequencing for accurate subtype classification and treatment planning

- This strong market position is further supported by substantial healthcare expenditure, growing awareness of early cancer detection, and ongoing research initiatives, positioning North America as a key hub for innovation and adoption in lymphoma diagnostics across hospitals, cancer centers, and academic institutions

U.S. Non-Hodgkin Lymphoma Diagnostics Market Insight

The U.S. Non-Hodgkin lymphoma diagnostics market captured the largest revenue share of 79.3% in 2024 within North America, driven by the country’s high prevalence of lymphoma and advanced diagnostic infrastructure. The presence of leading biotechnology and diagnostics firms, along with robust investment in cancer research, is fostering innovation in diagnostic platforms. Growing awareness about early cancer detection, along with wide accessibility to molecular and imaging technologies, is supporting continued market growth. Furthermore, the U.S. healthcare system's emphasis on precision medicine and personalized therapies enhances the demand for accurate diagnostic tools.

Europe Non-Hodgkin Lymphoma Diagnostics Market Insight

The Europe Non-Hodgkin lymphoma diagnostics market is projected to grow at a significant CAGR during the forecast period, primarily driven by increasing cancer screening programs and an aging population. The region’s emphasis on standardized diagnostic protocols and early detection is fueling demand for advanced technologies such as flow cytometry and IHC. Rising governmental support for oncology research and healthcare digitization, alongside growing awareness initiatives, is expanding the adoption of NHL diagnostics across hospitals and laboratories in the region.

U.K. Non-Hodgkin Lymphoma Diagnostics Market Insight

The U.K. Non-Hodgkin lymphoma diagnostics market is anticipated to grow at a robust CAGR during the forecast period, owing to a strong public healthcare system and active government initiatives aimed at improving cancer diagnostics. Increasing investments in biomarker research and rising patient preference for early and accurate detection methods are further driving market expansion. In addition, strategic collaborations between academic institutions and diagnostic companies are enhancing the development of novel testing technologies.

Germany Non-Hodgkin Lymphoma Diagnostics Market Insight

The Germany Non-Hodgkin lymphoma diagnostics market is expected to witness considerable growth throughout the forecast period, supported by a highly developed healthcare infrastructure and advanced laboratory capabilities. The country’s focus on precision diagnostics, along with a strong emphasis on clinical research and personalized medicine, is accelerating the adoption of genomic and molecular testing methods. Furthermore, Germany’s healthcare reimbursement policies and technological innovation are promoting market penetration across both public and private diagnostic facilities.

Asia-Pacific Non-Hodgkin Lymphoma Diagnostics Market Insight

The Asia-Pacific Non-Hodgkin lymphoma diagnostics market is projected to grow at the fastest CAGR of 23.6% during the forecast period of 2025 to 2032, driven by rising cancer incidence, increasing healthcare access, and expanding diagnostic infrastructure. Countries such as China, Japan, and India are witnessing greater uptake of advanced diagnostic techniques due to government-led health initiatives and growing investment in oncology. As the region continues to adopt digital and molecular diagnostics, the market is expanding rapidly across urban and semi-urban settings.

Japan Non-Hodgkin Lymphoma Diagnostics Market Insight

The Japan Non-Hodgkin lymphoma diagnostics market is gaining traction due to the nation’s aging population and strong inclination toward early disease detection. Japan’s healthcare system emphasizes quality diagnostics, and there is a high adoption rate of technologies such as immunohistochemistry and next-generation sequencing. In addition, the country’s integration of AI-driven diagnostic tools and its culture of preventive healthcare are bolstering demand for reliable NHL diagnostic solutions in hospitals and oncology centers.

India Non-Hodgkin Lymphoma Diagnostics Market Insight

The India Non-Hodgkin lymphoma diagnostics market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by growing healthcare infrastructure, a large patient population, and increasing awareness of cancer diagnostics. Rapid urbanization, rising affordability of diagnostic tests, and government-backed screening programs are driving demand across metropolitan and tier-2 cities. Local innovation and the growing presence of private diagnostic laboratories are further contributing to the market's upward trajectory.

Non-Hodgkin Lymphoma Diagnostics Market Share

The Non-Hodgkin Lymphoma Diagnostics industry is primarily led by well-established companies, including:

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthcare AG (Germany)

- Danaher Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- General Electric Company (U.S.)

- Sysmex Corporation (Japan)

- Grail (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Neusoft Corporation (China)

- Agilent Technologies, Inc. (U.S.)

- NeoGenomics Laboratories (U.S.)

- Hologic, Inc. (U.S.)

- Integrated DNA Technologies, Inc. (U.S.)

- CENTOGENE N.V. (Germany)

- Merit Medical Systems (U.S.)

- Labcorp Genetics Inc. (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (U.S.)

- GeneDx, LLC (U.S.)

What are the Recent Developments in Global Non-Hodgkin Lymphoma Diagnostics Market?

- In April 2023, Roche Diagnostics announced the expansion of its immunohistochemistry (IHC) portfolio with a new set of companion diagnostic assays designed specifically for hematological malignancies, including Non-Hodgkin lymphoma (NHL). This innovation aims to improve diagnostic precision and treatment selection, reinforcing Roche’s leadership in oncology diagnostics and supporting the growing demand for personalized medicine in cancer care

- In March 2023, Thermo Fisher Scientific launched an advanced multiplexed flow cytometry panel tailored for the accurate identification and classification of Non-Hodgkin lymphoma subtypes. This new diagnostic solution enhances laboratory efficiency while delivering deeper insights into complex hematologic malignancies, underlining Thermo Fisher's dedication to precision diagnostics and research advancement in hematopathology

- In March 2023, Agilent Technologies Inc. entered a collaborative agreement with a global cancer research consortium to accelerate the development and validation of molecular diagnostic assays for early detection of NHL. This initiative integrates Agilent’s high-throughput genomics platforms with real-world clinical data, aiming to improve disease prognosis and enable timely therapeutic interventions through targeted diagnostics

- In February 2023, Bio-Rad Laboratories, Inc. introduced a next-generation digital PCR assay for the detection of minimal residual disease (MRD) in Non-Hodgkin lymphoma patients. This technology supports early relapse prediction and personalized treatment monitoring, marking a significant advancement in disease management and post-treatment surveillance within hematologic oncology

- In January 2023, Abbott Laboratories unveiled a strategic partnership with major oncology centers in Asia-Pacific to expand access to its lymphoma diagnostic platforms, particularly in resource-constrained settings. This partnership focuses on scaling immunoassay and molecular testing capabilities across emerging markets, demonstrating Abbott’s commitment to global health equity and the early detection of hematological cancers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.