Global Non Invasive Monitoring Device Market

Market Size in USD Billion

CAGR :

%

USD

23.90 Billion

USD

38.75 Billion

2025

2033

USD

23.90 Billion

USD

38.75 Billion

2025

2033

| 2026 –2033 | |

| USD 23.90 Billion | |

| USD 38.75 Billion | |

|

|

|

|

Non-Invasive Monitoring Device Market Size

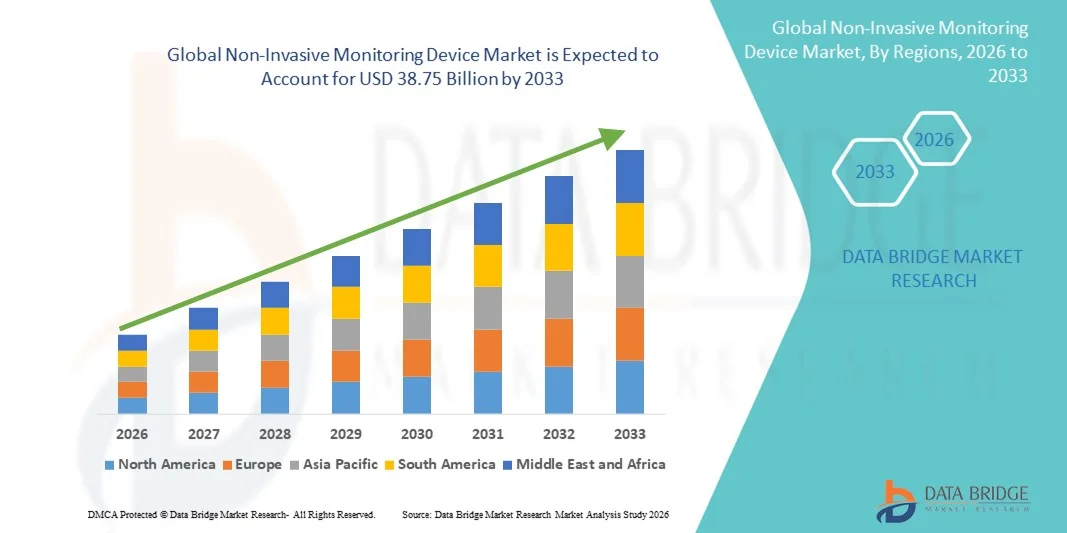

- The global non-invasive monitoring device market size was valued at USD 23.9 billion in 2025 and is expected to reach USD 38.75 billion by 2033, at a CAGR of 6.23% during the forecast period

- The market growth is largely fueled by advancements in healthcare technologies, increased prevalence of chronic diseases, and rising demand for patient‑centric, non‑invasive health monitoring solutions. These technologies enhance patient comfort while enabling continuous monitoring of vital signs such as blood pressure, cardiac activity, and other physiological parameters in both clinical and home care settings

- Furthermore, growing adoption of remote patient monitoring, wearable health devices, and connected healthcare systems, combined with an aging global population and heightened health awareness, is driving demand for non‑invasive monitoring devices. These converging factors are accelerating the uptake of non‑invasive solutions, thereby significantly boosting the industry’s growth

Non-Invasive Monitoring Device Market Analysis

- Non-invasive monitoring devices, enabling the measurement of vital signs and physiological parameters without penetrating the skin, are increasingly vital components of modern healthcare, home care, and remote patient monitoring systems due to their enhanced patient comfort, real-time data collection, and integration with wearable and connected health technologies

- The escalating demand for non-invasive monitoring devices is primarily fueled by the rising prevalence of chronic diseases, growing health awareness among patients, and increasing adoption of remote and continuous patient monitoring solutions in hospitals and home care settings

- North America dominated the non-invasive monitoring device market with the largest revenue share of 38.8% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key device manufacturers, with the U.S. leading growth driven by innovations in wearable sensors, AI-enabled monitoring, and integration with telehealth platforms

- Asia-Pacific is expected to be the fastest growing region in the non-invasive monitoring device market during the forecast period due to rising healthcare infrastructure investments, increasing prevalence of chronic diseases, and growing adoption of digital health solutions

- Wearable devices segment dominated the non-invasive monitoring device market with a market share of 45.2% in 2025, driven by their convenience, continuous monitoring capabilities, and ease of integration with mobile and cloud-based health platforms

Report Scope and Non-Invasive Monitoring Device Market Segmentation

|

Attributes |

Non-Invasive Monitoring Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Non-Invasive Monitoring Device Market Trends

Integration with AI and Wearable Health Platforms

- A significant and accelerating trend in the global non-invasive monitoring device market is the integration with artificial intelligence (AI) and wearable health platforms, enhancing real-time patient monitoring and predictive health insights

- For instance, the BioBeat wearable device integrates AI algorithms with cloud-based health platforms to continuously monitor vital signs and alert healthcare providers in case of anomalies

- AI integration enables features such as personalized health recommendations, trend analysis of patient vitals, and early detection of potential health risks. For instance, Viatom CheckMe Pro uses AI to track heart rate and blood oxygen trends over time and generates predictive alerts for unusual patterns

- Integration with mobile apps and health ecosystems facilitates centralized monitoring of multiple physiological parameters, enabling patients and providers to manage data from a single interface, improving care efficiency and convenience

- This trend toward more intelligent, connected, and predictive monitoring devices is reshaping patient expectations for home and clinical healthcare. Consequently, companies such as iRhythm and Empatica are developing AI-enabled devices with continuous monitoring and cloud analytics capabilities

- The demand for non-invasive monitoring devices with AI-enabled predictive and wearable integration is growing rapidly across hospitals, clinics, and home healthcare sectors as healthcare providers prioritize proactive and patient-centric care

Non-Invasive Monitoring Device Market Dynamics

Driver

Rising Chronic Disease Prevalence and Remote Monitoring Adoption

- The increasing prevalence of chronic diseases and growing adoption of remote patient monitoring solutions is a significant driver for the heightened demand for non-invasive monitoring devices

- For instance, in March 2025, BioBeat announced a collaboration with home care providers to expand AI-based vital signs monitoring for patients with cardiovascular conditions, supporting early intervention strategies

- As healthcare systems focus on reducing hospital visits and improving patient outcomes, non-invasive devices offer continuous monitoring of vital signs such as blood pressure, heart rate, and oxygen saturation, providing a reliable alternative to traditional invasive methods

- Furthermore, the growing popularity of wearable health devices and telemedicine platforms is making non-invasive monitoring an integral component of connected healthcare solutions, allowing seamless integration with digital health records and mobile apps

- Convenience, real-time alerts, and continuous monitoring capabilities are key factors propelling adoption across hospitals, clinics, and home care settings. The trend toward patient-centric care and increasing acceptance of DIY health monitoring solutions further contribute to market growth

Restraint/Challenge

Data Accuracy Concerns and Regulatory Compliance Hurdle

- Concerns surrounding the accuracy and reliability of non-invasive monitoring devices pose a significant challenge to broader market penetration. As these devices rely on sensors and algorithms, measurement deviations may occur under certain conditions, creating hesitancy among healthcare providers

- For instance, high-profile studies reporting discrepancies in wearable blood pressure readings have made some clinicians cautious about relying solely on non-invasive devices for diagnosis

- Addressing these concerns through rigorous clinical validation, advanced sensor technology, and calibration standards is crucial for building trust. Companies such as Masimo and iRhythm emphasize validated accuracy and FDA-clearance in their devices to reassure healthcare providers

- In addition, navigating complex regulatory requirements and ensuring compliance with regional medical device standards can be time-consuming and costly, slowing product launches. While regulatory frameworks are gradually improving, approval timelines remain a barrier for some device manufacturers

- Overcoming these challenges through improved sensor accuracy, robust clinical testing, and streamlined regulatory compliance will be vital for sustained adoption and market growth

Non-Invasive Monitoring Device Market Scope

The market is segmented on the basis of type, modality, application, and end-user.

- By Type

On the basis of type, the non-invasive monitoring device market is segmented into cardiac monitoring devices, brain monitoring devices, blood pressure monitoring devices, anaesthesia monitoring devices, and blood glucose monitoring devices. The cardiac monitoring devices segment dominated the market with the largest revenue share of 35% in 2025, driven by the high prevalence of cardiovascular diseases globally and increasing demand for continuous, non-invasive heart monitoring. Hospitals and clinics prefer cardiac monitoring devices for their ability to provide real-time heart rate, ECG, and arrhythmia data without invasive procedures. Continuous monitoring is particularly valuable in ICUs, cardiac wards, and home care settings, offering both patient comfort and clinical efficiency. The integration of these devices with mobile apps and cloud platforms allows clinicians to track patient health remotely, enhancing early intervention opportunities. Cardiac monitoring devices are also favored due to their established regulatory approval and reliability, making them a trusted choice for physicians and caregivers.

The blood glucose monitoring devices segment is anticipated to witness the fastest growth rate of 16% from 2026 to 2033, fueled by rising diabetes prevalence, increasing awareness of blood sugar management, and technological advances in non-invasive glucose sensors. Patients and clinicians increasingly prefer wearable and painless solutions over traditional finger-prick methods. Continuous glucose monitoring devices offer real-time alerts, trend analysis, and integration with smartphones and telehealth systems, empowering patients for self-management. The convenience, safety, and enhanced user experience associated with non-invasive blood glucose devices are driving their rapid adoption, particularly in home healthcare and outpatient care markets.

- By Modality

On the basis of modality, the non-invasive monitoring device market is segmented into table-top devices and wearable devices. The wearable devices segment dominated the non-invasive monitoring device market with a market share of 45.2% in 2025, driven by rising adoption of remote patient monitoring and home healthcare solutions. Wearable devices such as smartwatches, wristbands, and patches provide continuous, real-time monitoring of vital signs, enabling patients and clinicians to track health trends and detect anomalies early. Integration with mobile apps, AI analytics, and cloud platforms enhances predictive healthcare capabilities and patient engagement. The convenience, portability, and non-intrusive design make wearable devices highly attractive for chronic disease management, wellness monitoring, and telehealth applications. Increasing awareness of proactive health monitoring and the ability to remotely share data with healthcare providers are further accelerating their adoption across hospitals, clinics, and home care settings.

The table-top devices segment is expected to witness the fastest growth rate of 16% from 2026 to 2033, fueled by increasing adoption in hospitals, diagnostic centers, and research institutes for multi-parameter monitoring of vital signs. Table-top devices are favored for their higher accuracy, reliability, and capability to monitor multiple patients simultaneously in clinical settings. Integration with hospital information systems and electronic medical records allows seamless data management and real-time alerts for healthcare professionals. They are particularly valuable in ICUs, cardiology, neurology, and anaesthesia monitoring applications. The rising demand for advanced, clinically validated non-invasive solutions, along with technological advancements such as AI analytics and remote connectivity, is driving the rapid growth of table-top devices in both developed and emerging markets.

- By Application

On the basis of application, the non-invasive monitoring device market is segmented into cardiology, neurology, and oncology. The cardiology segment dominated the market with a revenue share of 37% in 2025, owing to the high global burden of heart diseases and the critical need for continuous cardiac monitoring. Devices in this segment include ECG monitors, Holter monitors, and wearable cardiac trackers, which provide accurate and real-time monitoring. Cardiology applications benefit from integration with hospital monitoring systems and telemedicine platforms, facilitating early intervention and improved patient outcomes. Continuous monitoring reduces hospitalization costs and improves patient comfort compared to traditional invasive methods. Hospitals, clinics, and home care settings rely heavily on these devices for both acute and chronic cardiac conditions.

The neurology segment is projected to witness the fastest growth rate of ~15% from 2026 to 2033, driven by rising cases of neurological disorders such as epilepsy, sleep apnea, and brain injuries. Devices for neurology applications include EEG monitors, sleep trackers, and brain activity monitoring solutions that are increasingly non-invasive and wearable. Remote monitoring and AI-based predictive analytics are boosting adoption among hospitals and research institutes. The growing interest in personalized neurological care and early diagnosis of cognitive disorders is further accelerating demand. Non-invasive neurology monitoring devices also support home-based care, reducing patient dependency on hospital visits.

- By End-User

On the basis of end-user, the non-invasive monitoring device market is segmented into hospitals & clinics, diagnostic centers, research & academic institutes, and others. The hospitals & clinics segment dominated the market in 2025 with a revenue share of 50%, due to the critical requirement for accurate, continuous monitoring of patient vitals and integration with hospital systems. Hospitals use these devices across ICUs, cardiology, neurology, and general wards to enhance clinical decision-making. The devices facilitate remote monitoring, reduce invasive procedures, and improve patient comfort, making them indispensable for modern healthcare facilities. Their adoption is supported by strong regulatory approvals and clinical validation, which increases trust among healthcare professionals. Large hospital chains and multi-specialty clinics are investing in advanced non-invasive monitoring technologies to improve patient outcomes and operational efficiency.

The diagnostic centers segment is expected to witness the fastest growth rate of 17% from 2026 to 2033, driven by the rising demand for outpatient monitoring, early disease detection, and preventive healthcare services. Diagnostic centers are increasingly offering non-invasive monitoring as part of routine health checkups and specialized tests. Portable and wearable devices allow these centers to expand service offerings and reduce dependency on hospital infrastructure. The convenience, speed, and non-intrusive nature of these devices make them highly suitable for high-volume diagnostic workflows. Integration with telehealth platforms and AI analytics further enhances the value proposition for patients and providers alike.

Non-Invasive Monitoring Device Market Regional Analysis

- North America dominated the non-invasive monitoring device market with the largest revenue share of 38.8% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key device manufacturers, with the U.S. leading growth driven by innovations in wearable sensors, AI-enabled monitoring, and integration with telehealth platforms

- Healthcare providers and patients in the region highly value the accuracy, real-time monitoring, and integration capabilities of non-invasive devices with electronic medical records, telehealth platforms, and AI-based predictive analytics

- This widespread adoption is further supported by strong regulatory frameworks, a technologically inclined population, and increasing awareness of proactive health management, establishing non-invasive monitoring devices as essential tools in both hospital and home care settings

U.S. Non-Invasive Monitoring Device Market Insight

The U.S. non-invasive monitoring device market captured the largest revenue share of 80% in North America in 2025, fueled by the rapid adoption of remote patient monitoring solutions, wearable devices, and hospital-based multi-parameter monitoring systems. Healthcare providers and patients increasingly prioritize continuous, non-invasive tracking of vital signs for chronic disease management and early intervention. The rising integration of AI-powered predictive analytics, telehealth platforms, and mobile health applications further propels the market. Moreover, growing awareness of patient-centric care models and advancements in FDA-approved wearable sensors are significantly contributing to market expansion.

Europe Non-Invasive Monitoring Device Market Insight

The Europe non-invasive monitoring device market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established healthcare infrastructure, aging populations, and the rising burden of chronic diseases. Increasing urbanization, coupled with high adoption of connected healthcare devices, is fostering the uptake of non-invasive monitoring solutions. European healthcare providers value the integration of these devices with hospital systems, electronic health records, and telemedicine platforms. The region is experiencing significant growth across hospitals, clinics, and home care applications, with non-invasive monitoring devices increasingly incorporated into both routine diagnostics and patient management programs.

U.K. Non-Invasive Monitoring Device Market Insight

The U.K. non-invasive monitoring device market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on preventive healthcare and remote patient monitoring. Rising prevalence of cardiovascular and metabolic disorders is encouraging hospitals, clinics, and home care providers to adopt non-invasive solutions. The U.K.’s robust healthcare infrastructure, digital health adoption, and well-developed e-health systems are expected to continue stimulating market growth. Integration with AI-driven analytics and wearable platforms further enhances patient engagement and clinical decision-making, boosting adoption across both residential and commercial healthcare settings.

Germany Non-Invasive Monitoring Device Market Insight

The Germany non-invasive monitoring device market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of chronic disease management, technological advancements, and demand for accurate, non-invasive diagnostic solutions. Germany’s strong healthcare system, emphasis on innovation, and focus on patient safety support the adoption of these devices in hospitals, diagnostic centers, and research institutions. Integration with telemedicine platforms and hospital IT systems is becoming more prevalent, enabling efficient remote patient monitoring and data management. Regulatory support and preference for reliable, clinically validated devices further promote market expansion.

Asia-Pacific Non-Invasive Monitoring Device Market Insight

The Asia-Pacific non-invasive monitoring device market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing healthcare infrastructure investments, rising prevalence of chronic diseases, and technological adoption in countries such as China, Japan, and India. The region’s growing focus on telemedicine, remote patient monitoring, and digital health initiatives is driving adoption of wearable and table-top devices. Furthermore, as APAC emerges as a hub for medical device manufacturing and cost-effective solutions, accessibility and affordability of non-invasive monitoring devices are expanding, enabling broader adoption across hospitals, clinics, and home care settings.

Japan Non-Invasive Monitoring Device Market Insight

The Japan non-invasive monitoring device market is gaining momentum due to the country’s high-tech healthcare ecosystem, aging population, and increasing demand for convenient and continuous health monitoring. Adoption is driven by smart hospital initiatives, integration with wearable health devices, and advanced telehealth platforms. Japan’s focus on preventive care, early detection of chronic diseases, and home-based healthcare monitoring is fueling market growth. Non-invasive monitoring devices are increasingly incorporated into hospital wards, elderly care facilities, and home care programs, aligning with the country’s emphasis on efficient, patient-centric healthcare solutions.

India Non-Invasive Monitoring Device Market Insight

The India non-invasive monitoring device market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to expanding healthcare infrastructure, rapid urbanization, and high adoption of digital health technologies. India is witnessing growing demand for remote patient monitoring, wearable devices, and cost-effective non-invasive solutions across hospitals, clinics, and home care. Government initiatives promoting telemedicine and smart health programs, combined with strong domestic manufacturing capabilities, are key factors propelling the market. Affordability, increasing awareness of chronic disease management, and rising middle-class population further accelerate adoption across residential, commercial, and diagnostic applications.

Non-Invasive Monitoring Device Market Share

The Non-Invasive Monitoring Device industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- GE HealthCare (U.K.)

- Masimo Corporation (U.S.)

- Nonin Medical, Inc. (U.S.)

- OMRON HEALTHCARE, INC. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- NIHON KOHDEN CORPORATION (Japan)

- Mindray Medical International Limited (China)

- Schiller AG (Switzerland)

- Welch Allyn (U.S.)

- Baxter (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Nihon Seimitsu Sokki Co., Ltd. (Japan)

- Edan Instruments, Inc. (China)

- Spacelabs Healthcare (U.S./U.K.)

- Abbott (U.S.)

- Contec Medical Systems Co., Ltd. (China)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

What are the Recent Developments in Global Non-Invasive Monitoring Device Market?

- In November 2025, PreEvnt’s isaac device, a non‑invasive glucose alert system that detects blood glucose levels using breath analysis and a smartphone app, advanced into clinical trials at Indiana University a major milestone toward real‑world adoption and regulatory evaluation for needle‑free glucose monitoring

- In October 2025, UK‑based startup CoMind secured over USD 100 million in funding to develop a non‑invasive brain monitoring device using infrared laser‑based technology to measure cerebral blood flow and intracranial pressure aiming for FDA approval and improved patient monitoring without invasive procedures

- In June 2025, LifePlus, a Silicon Valley health‑tech startup, announced the clinical validation of LifeLeaf, its first‑of‑its‑kind non‑invasive and cuffless wearable device capable of continuous glucose and blood pressure monitoring through AI‑powered sensing without needles or cuffs. This global multi‑center validation involved prestigious institutions such as Mayo Clinic and Cleveland Clinic, demonstrating the technology’s potential to transform chronic disease management and proactive care

- In January 2025, PreEvnt (a subsidiary of Scosche Industries) unveiled the isaac device at CES 2025, showcasing a breath‑based non‑invasive blood glucose alert monitor that links to a smartphone app for real‑time tracking, significantly reducing reliance on traditional finger‑prick tests

- In October 2024, the Dexcom G7 15‑Day Continuous Glucose Monitor received FDA approval, extending wear time to around 15.5 days and improving glucose tracking accuracy — advancing continuous monitoring technology that pushes the boundaries toward less invasive patient‑centric care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.