Global Non Phthalate Plasticizers Market

Market Size in USD Million

CAGR :

%

USD

984.75 Million

USD

1,557.74 Million

2024

2032

USD

984.75 Million

USD

1,557.74 Million

2024

2032

| 2025 –2032 | |

| USD 984.75 Million | |

| USD 1,557.74 Million | |

|

|

|

|

Non-Phthalate Plasticizers Market Size

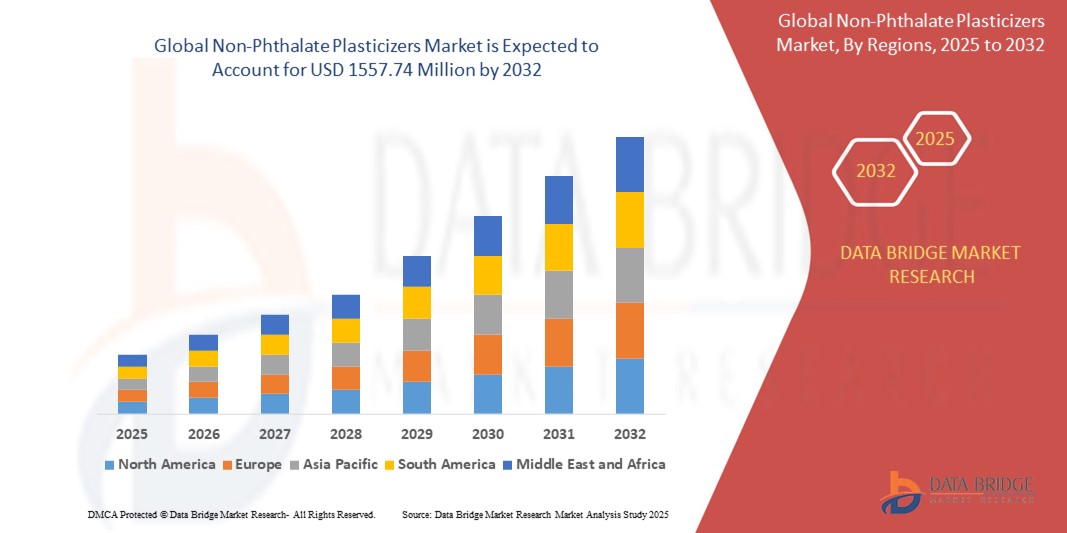

- The global non-phthalate plasticizers market size was valued at USD 984.75 million in 2024 and is expected to reach USD 1557.74 million by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is driven by increasing regulatory restrictions on phthalate-based plasticizers due to health and environmental concerns, coupled with rising demand for eco-friendly and sustainable alternatives in various industries

- Growing consumer awareness of safer materials and the shift toward green building practices are further accelerating the adoption of non-phthalate plasticizers, positioning them as a preferred choice for manufacturers

Non-Phthalate Plasticizers Market Analysis

- Non-phthalate plasticizers, used as additives to enhance the flexibility and durability of PVC materials, are gaining traction across industries due to their non-toxic and environmentally friendly properties, making them critical in applications such as flooring, cables, and medical devices

- The surge in demand is fueled by stringent regulations banning phthalates in regions such as Europe and North America, alongside increasing consumer preference for sustainable and safe materials in consumer goods and healthcare products

- North America dominated the non-phthalate plasticizers market with the largest revenue share of 38.5% in 2024, driven by strict regulatory frameworks, high adoption of sustainable materials, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing construction activities, and rising demand for non-toxic materials in emerging economies such as China and India

- The monomeric plasticizers segment held the largest market share of 55.6% in 2024, attributed to their cost-effectiveness, versatility, and widespread use in applications such as films and sheets

Report Scope and Non-Phthalate Plasticizers Market Segmentation

|

Attributes |

Non-Phthalate Plasticizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Phthalate Plasticizers Market Trends

“Increasing Adoption of Bio-Based and Sustainable Plasticizers”

- The global non-phthalate plasticizers market is experiencing a notable trend toward the integration of bio-based and sustainable plasticizers, driven by environmental concerns and regulatory restrictions on traditional phthalate-based compounds

- These eco-friendly plasticizers, derived from renewable sources such as vegetable oils or citric acid, offer comparable performance to conventional plasticizers while reducing environmental impact and toxicity

- Advanced bio-based solutions are being developed to meet the growing demand for safer, sustainable materials in applications such as flooring, packaging, and medical devices

- For instance, companies are innovating with plant-based monomeric and polymeric plasticizers that ensure compatibility with PVC while adhering to stringent environmental standards, such as REACH and RoHS regulations

- This trend is enhancing the appeal of non-phthalate plasticizers for manufacturers and end-users aiming to align with sustainability goals and consumer preferences for green products

- The monomeric plasticizers segment dominated the largest market revenue share of 74.95% in 2024, driven by increasing demand for lightweight and flexible polymer products across industries such as construction, automotive, and healthcare

Non-Phthalate Plasticizers Market Dynamics

Driver

“Stringent Regulations and Growing Demand for Safe, Non-Toxic Materials”

- Increasing regulatory restrictions on phthalate plasticizers, particularly in regions such as Europe, North America, and Asia-Pacific, are a major driver for the non-phthalate plasticizers market. Regulations such as REACH, EPA guidelines, and bans on phthalates in consumer goods are pushing manufacturers to adopt safer alternatives

- Rising consumer awareness of health and environmental risks associated with phthalates is fueling demand for non-toxic plasticizers in applications such as food packaging, medical devices, and children’s toys

- The growth of end-use industries, including building and construction, automotive, and healthcare, is further driving the adoption of non-phthalate plasticizers for applications such as flooring, wire insulation, and medical tubing

- Advancements in material science and the development of high-performance non-phthalate plasticizers with improved PVC compatibility are enabling manufacturers to meet diverse application requirements

- The shift toward sustainable construction and green building certifications, such as LEED, is also encouraging the use of non-phthalate plasticizers in flooring and wall coverings

Restraint/Challenge

“High Production Costs and Limited Availability of Raw Materials”

- The higher production costs of non-phthalate plasticizers, particularly bio-based and specialty polymeric types, pose a significant barrier to widespread adoption, especially in cost-sensitive markets

- The limited availability of raw materials for bio-based plasticizers, such as specific vegetable oils or bio-derived chemicals, can lead to supply chain constraints and price volatility

- In addition, compatibility issues with certain PVC formulations and performance limitations in extreme conditions (e.g., high temperatures or chemical exposure) can restrict the use of some non-phthalate plasticizers in demanding applications such as automotive or electrical components

- The lack of standardized regulations across regions for non-phthalate plasticizers creates challenges for manufacturers operating in global markets, as they must navigate varying compliance requirements

- These factors can slow market growth, particularly in emerging economies where cost considerations and limited awareness of non-phthalate benefits are prevalent

Non-Phthalate Plasticizers market Scope

The market is segmented on the basis of type, PVC compatibility, application, and end-user.

- By Type

On the basis of type, the market is segmented into monomeric plasticizers and polymeric plasticizers. The monomeric plasticizers segment dominated the largest market revenue share of 74.95% in 2024, driven by increasing demand for lightweight and flexible polymer products across industries such as construction, automotive, and healthcare. Their versatility and cost-effectiveness make them a preferred choice for various applications.

The polymeric plasticizers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their superior performance in high-temperature and high-durability applications. Their enhanced resistance to migration and volatility makes them ideal for demanding environments, boosting adoption in automotive and electrical industries.

- By PVC Compatibility

On the basis of PVC compatibility, the market is segmented into primary and secondary. The primary segment dominated the largest market revenue share of 68.2% in 2024, primarily due to its critical role in ensuring wire protection in the electrical and electronics industry, where high compatibility with PVC is essential for performance and safety.

The secondary (low solvation) segment is anticipated to experience the fastest growth rate of 6.8% from 2025 to 2032, driven by increasing demand for specialized applications requiring lower solvation properties, such as in adhesives and sealants, where flexibility and stability are prioritized.

- By Application

On the basis of application, the market is segmented into flooring and wall coverings, wire and cable, films and sheets, coated fabrics, adhesives and sealants, and others. The flooring and wall coverings segment dominated the largest market revenue share of 35.83% in 2024, fueled by rising consumer spending on interior decoration for residential and commercial buildings, particularly in urbanizing regions.

The films and sheets segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand in the packaging industry for flexible, transparent, and durable materials. The shift toward non-toxic, sustainable packaging solutions further accelerates the adoption of non-phthalate plasticizers in this segment.

- By End-User

On the basis of end-user, the market is segmented into building and construction, automotive, consumer goods, sports and leisure, healthcare, electrical and electronics, food and beverages, and others. The building and construction segment dominated the market with a revenue share of 32.2% in 2024, driven by the extensive use of non-phthalate plasticizers in flooring, wall coverings, and insulation materials for large-scale infrastructure and urbanization projects.

The automotive segment is expected to witness rapid growth at a CAGR of 5.8% from 2025 to 2032, fueled by the increasing adoption of non-phthalate plasticizers in vehicle interiors, such as dashboards and seat covers, to meet stringent safety and environmental regulations while enhancing durability and comfort.

Non-Phthalate Plasticizers Market Regional Analysis

- North America dominated the non-phthalate plasticizers market with the largest revenue share of 38.5% in 2024, driven by strict regulatory frameworks, high adoption of sustainable materials, and the presence of major industry players

- Consumers prioritize non-phthalate plasticizers for their safety, sustainability, and compatibility with diverse applications such as flooring, wire insulation, and medical devices, particularly in regions with strict environmental standards

- Market growth is fueled by innovations in monomeric and polymeric plasticizers, increasing adoption in primary and secondary PVC applications, and expanding use across building, automotive, and healthcare sectors

U.S. Non-Phthalate Plasticizers Market Insight

The U.S. non-phthalate plasticizers market captured the largest revenue share of 77.1% in 2024 within North America, fueled by robust demand in the construction and automotive aftermarket, alongside growing awareness of health and environmental benefits. Regulatory restrictions on phthalates and a trend toward sustainable materials boost market expansion. The integration of non-phthalate plasticizers in applications such as wire and cable insulation and coated fabrics supports a diverse product ecosystem.

Europe Non-Phthalate Plasticizers Market Insight

The Europe non-phthalate plasticizers market is expected to witness the fastest growth rate, propelled by stringent EU regulations on phthalates and a focus on sustainability in consumer goods and construction. Demand is high for plasticizers that enhance product safety and environmental performance in applications such as flooring and films. Countries such as Germany and France lead adoption due to advanced manufacturing and eco-conscious consumer preferences.

U.K. Non-Phthalate Plasticizers Market Insight

The U.K. market for non-phthalate plasticizers is expected to witness the fastest growth rate, driven by demand for safe and sustainable materials in building, automotive, and consumer goods sectors. Increased awareness of health risks associated with phthalates and regulatory support for greener alternatives encourage adoption. Applications in adhesives, sealants, and coated fabrics are gaining traction in urban and industrial settings.

Germany Non-Phthalate Plasticizers Market Insight

Germany is expected to witness the fastest growth rate in the non-phthalate plasticizers market, attributed to its advanced manufacturing capabilities and strong emphasis on sustainability in automotive and construction industries. German consumers favor high-performance plasticizers that improve product durability and reduce environmental impact. The integration of these plasticizers in premium applications and aftermarket solutions drives sustained market growth.

Asia-Pacific Non-Phthalate Plasticizers Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, fueled by rapid industrialization, expanding construction activities, and rising demand for non-toxic materials in countries such as China, India, and Japan. Growing awareness of health and environmental concerns, coupled with government initiatives promoting sustainable manufacturing, boosts demand for non-phthalate plasticizers in flooring, wire, and consumer goods applications.

Japan Non-Phthalate Plasticizers Market Insight

Japan’s non-phthalate plasticizers market is expected to witness the fastest growth rate, driven by consumer preference for high-quality, eco-friendly plasticizers that enhance product safety and performance. The presence of major manufacturers and the integration of non-phthalate plasticizers in automotive and electronics applications accelerate market penetration. Rising interest in sustainable aftermarket solutions also contributes to growth.

China Non-Phthalate Plasticizers Market Insight

China holds the largest share of the Asia-Pacific non-phthalate plasticizers market, propelled by rapid urbanization, increasing construction projects, and growing demand for safe and sustainable materials. The country’s expanding middle class and focus on green manufacturing support the adoption of non-phthalate plasticizers in films, sheets, and adhesives. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Non-Phthalate Plasticizers Market Share

The non-phthalate plasticizers industry is primarily led by well-established companies, including:

- Plastics Corp (U.S.)

- Harman Corporation (U.S.)

- Evonik Industries AG (Germany)

- Eastman Chemical Company (U.S.)

- DIC CORPORATION (Japan)

- Kao Corporation (Japan)

- LG Chem (South Korea)

- Perstorp (Sweden)

- UPC Technology Corporation (Taiwan)

- Kaifeng Jiuhong Chemical Co., Ltd. (China)

- Henan GO Biotech Co.,Ltd (China)

- Valtris Specialty Chemicals (U.S.)

- Velsicol Chemical LLC (U.S.)

- Ferro Corporation (U.S.)

- Mitsubishi Chemical Corporation (Japan)

What are the Recent Developments in Global Non-Phthalate Plasticizers Market?

- In January 2024, Evonik Industries expanded its sustainable chemicals portfolio with the launch of a high-performance non-phthalate plasticizer designed for sensitive applications such as medical tubing and food wraps. This innovation aligns with Evonik’s commitment to environmentally friendly solutions, offering enhanced safety and performance while reducing reliance on traditional phthalates. The new plasticizer ensures low migration and durability, making it ideal for industries requiring stringent material standards

- In January 2024, Perstorp introduced Pevalen Pro 100, a revolutionary non-phthalate plasticizer made from 100% renewable carbon using mass balance principles. This innovation significantly improves the sustainability of flexible PVC applications, reducing the product’s carbon footprint by approximately 80% compared to fossil-based alternatives. Designed to uphold high performance while enhancing environmental impact, Pevalen Pro 100 redefines PVC plasticizing technology. Its development reflects Perstorp’s dedication to sustainable solutions, ensuring durability and efficiency without compromising safety or quality

- In December 2023, South Korea’s Aekyung Chemical acquired a 50% stake in VPCHEM, LG Chem’s Vietnam-based subsidiary specializing in plasticizer production and sales. This strategic move aims to strengthen Aekyung Chemical’s presence in the plasticizers market, including non-phthalate alternatives. With this acquisition, Aekyung Chemical expands its production capacity, positioning itself to meet growing global demand for environmentally friendly plasticizers. The deal enhances its ability to supply sustainable solutions to North American and European markets while maintaining a strong foothold in Asia

- In December 2022, Hanwha Solutions introduced Eco-DEHCH, a phthalate-free plasticizer designed for exceptional heat and cold resistance, making it ideal for outdoor applications. This innovation aligns with Hanwha Solutions’ commitment to sustainable materials, offering an eco-friendly alternative to traditional plasticizers. By expanding its product range, the company aims to meet growing global demand for safer, high-performance plasticizers. Eco-DEHCH is recognized for its durability and environmental benefits, reinforcing Hanwha’s position in the market

- In April 2021, Eastman Chemical Company acquired 3F Feed & Food, a European leader in additives for animal feed and human food. This strategic acquisition strengthens Eastman’s animal nutrition business, integrating 3F’s expertise into its Additives & Functional Products segment. The move enhances Eastman’s ability to develop next-generation solutions, supporting global sustainability trends and improving farm productivity. With 3F’s organic acid derivatives and phytogenics, Eastman expands its portfolio to meet growing demand for safer, high-performance additives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Phthalate Plasticizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Phthalate Plasticizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Phthalate Plasticizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.