Global Non Radiographic Axial Spondyloarthritis Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

5.37 Billion

USD

7.99 Billion

2024

2032

USD

5.37 Billion

USD

7.99 Billion

2024

2032

| 2025 –2032 | |

| USD 5.37 Billion | |

| USD 7.99 Billion | |

|

|

|

|

Non-Radiographic Axial Spondyloarthritis Therapeutics Market Size

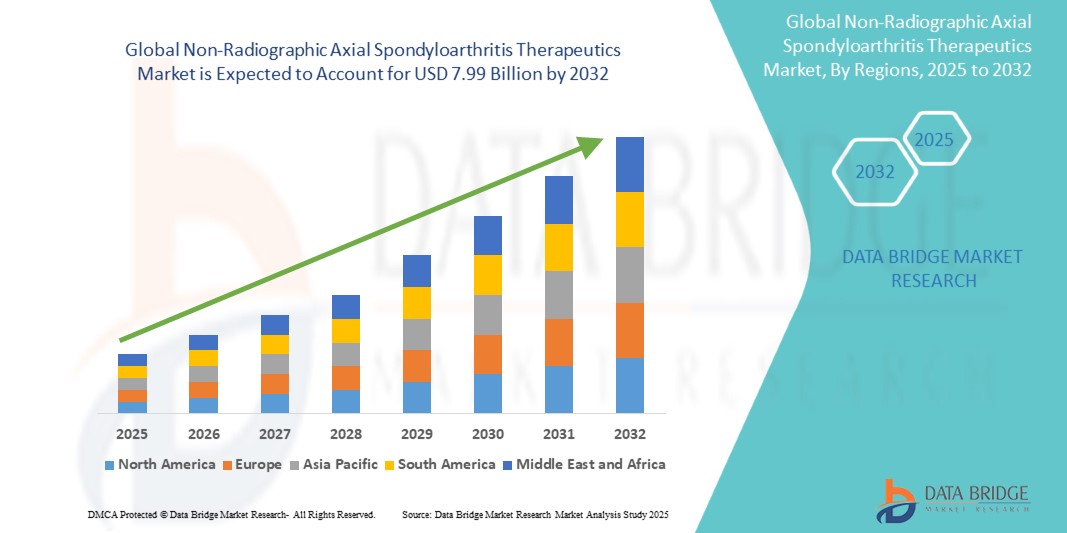

- The global non-radiographic axial spondyloarthritis therapeutics market size was valued at USD 5.37 billion in 2024 and is expected to reach USD 7.99 billion by 2032, at a CAGR of 5.1% during the forecast period

- This growth is driven by the increasing prevalence of chronic inflammatory conditions, expansion of diagnostic criteria, and growing adoption of targeted biologics.

Non-Radiographic Axial Spondyloarthritis Therapeutics Market Analysis

- Non-radiographic axial spondyloarthritis (nr-axSpA) is a chronic inflammatory disease affecting the axial skeleton, primarily managed through anti-inflammatory and biologic therapies. These approaches focus on reducing disease activity, alleviating symptoms, and improving functional ability

- The growing recognition of nr-axSpA as a distinct clinical entity, supported by improved MRI diagnostics and global clinical guidelines, is fueling demand for effective therapeutic solutions. The rise in rheumatology referrals and updated ASAS criteria are contributing to increased patient identification

- North America is expected to dominate the nr-axSpA therapeutics market with a share of 38.6%, attributed to advanced biologics availability, high screening rates, and an established specialist network

- Asia-Pacific is expected to be the fastest growing region in the nr-axSpA therapeutics market during the forecast period due to the expansion of healthcare access, rising awareness of early inflammatory arthritis, and growing use of biosimilars

- IL-17 inhibitors are expected to dominate the market with a market share of 45.3% due to their favorable clinical profile, high patient satisfaction scores, and recommendation in updated treatment guidelines. Despite the emergence of biosimilars and newer agents, IL-17 inhibitors maintain their position as first-line biologics in many practices, offering durable disease control, particularly in HLA-B27-positive populations

Report Scope and Non-Radiographic Axial Spondyloarthritis Therapeutics Market Segmentation

|

Attributes |

Non-Radiographic Axial Spondyloarthritis Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Radiographic Axial Spondyloarthritis Market Trends

"Rise in Adoption of Biologic Agents for Early Disease Control"

- One prominent trend in the non-radiographic axial spondyloarthritis market is the rising adoption of biologic therapies in early-stage patients

- The increasing awareness of disease burden and improved diagnostic technologies such as MRI are contributing to greater use of advanced biologics that can halt or delay disease progression

- For instance, rheumatology centers are increasingly favoring IL-17 inhibitors and TNF inhibitors for patients who do not respond to NSAIDs, offering targeted, mechanism-specific action with proven clinical benefits

- This trend is significantly transforming chronic inflammatory disease management, enhancing patient-reported outcomes and preserving mobility and quality of life

- The market is poised for continued growth driven by physician education, clinical guideline updates, and broader insurance coverage for early biologic intervention A key trend is the increased adoption of IL-17 and TNF inhibitors to manage early-stage nr-axSpA

- Clinical trials continue to validate their role in reducing disease progression and functional impairment

Non-Radiographic Axial Spondyloarthritis Market Dynamics

Driver

"Increased Use of MRI and Updated Classification Criteria"

- Technological advancements in imaging and classification criteria are accelerating early diagnosis of nr-axSpA

- The ASAS criteria have broadened diagnostic eligibility, while MRI has enabled early visualization of sacroiliitis before radiographic changes appear

- These innovations are helping clinicians initiate timely biologic treatment, improving disease control and reducing long-term joint damage

- New imaging and classification tools also improve patient stratification for clinical trials and enable development of precision therapies

- For instance, the 2023 EULAR update emphasized MRI findings for diagnosis and biologic eligibility, resulting in broader access to targeted treatment for high-risk patients

- As MRI use expands and classification criteria evolve, demand for precise and early therapeutic strategies is expected to increase globally In 2023, the European League Against Rheumatism (EULAR) issued updated guidelines supporting biologics for nr-axSpA treatment in patients unresponsive to NSAIDs

Opportunity

"High Strategic Partnerships"

- The expansion of targeted therapeutics in nr-axSpA has encouraged strategic partnerships between pharmaceutical companies, research institutes, and hospitals

- These collaborations accelerate development and access to new biologic and biosimilar options, especially in emerging economies

- Strategic alliances also promote post-marketing surveillance and real-world data sharing, improving long-term outcomes and affordability

- For instance, UCB’s partnership with rheumatology networks in Asia-Pacific enabled expanded access to certolizumab and bolstered research into early nr-axSpA interventions

- Such high-value collaborations will continue to shape innovation pipelines, regulatory strategies, and treatment accessibility across the market In 2024, a multinational study funded by the WHO mapped cost-saving potentials of biosimilars in nr-axSpA management across low- and middle-income countries

Restraint/Challenge

"Limited Access and High Cost of Biologic Therapy"

- Biologic therapies for nr-axSpA are expensive, posing challenges for health systems and uninsured patients in many countries

- The high cost of treatment limits patient access, particularly in rural and low-resource settings, delaying optimal care

- Many advanced therapies are also restricted to tertiary care centers, creating a logistical barrier for early intervention

- For instance, in several Latin American and African countries, public hospitals struggle to provide IL-17 inhibitors due to budget constraints and distribution issues

- As a result, disparity in access remains a significant barrier to widespread adoption of biologics, potentially hindering market growth and patient

Non-Radiographic Axial Spondyloarthritis Therapeutics Market Scope

The market is segmented on the basis of drug class, route of administration, indication, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Treatment Type |

|

|

By Drugs |

|

|

By Route of Administration |

|

|

By End User |

|

In 2025, the Secukinumab is projected to dominate the market with a largest share in drug segment

In 2025, Secukinumab is projected to dominate the drug segment in 2025 with a projected market share of 28.7%. This leadership is attributed to its robust clinical efficacy and increasing preference in clinical settings for the management of non-radiographic axial spondyloarthritis (nr-axSpA). As the first IL-17A inhibitor approved by the FDA for nr-axSpA, it provides significant symptom relief, improved mobility, and reduced inflammation, particularly in HLA-B27-positive patients. Its rapid onset of action, long-term disease control, and subcutaneous administration contribute to its growing patient adherence and physician confidence. Secukinumab's favorable safety profile and increasing real-world evidence further strengthen its reputation as the drug of choice, sustaining its dominance in the global therapeutic landscape for nr-axSpA.

The Hospitals is expected to account for the largest share during the forecast period in End User segment

In 2025, Hospitals are projected to account for the largest share of 49.6% in 2025 in the end user segment due to centralized care delivery, infusion facilities, and access to multidisciplinary specialists. This dominance is driven by the growing reliance on hospital settings for the administration of biologic therapies, which often require controlled environments, trained healthcare personnel, and infusion infrastructure. Hospitals serve as centralized care hubs that offer integrated services, including diagnostic imaging, rheumatologic consultations, laboratory support, and post-treatment monitoring, all under one roof. Furthermore, the availability of multidisciplinary specialists, such as rheumatologists, physiotherapists, and pain management experts, positions hospitals as the preferred treatment centers for complex and chronic autoimmune conditions like nr-axSpA.

Non-Radiographic Axial Spondyloarthritis Therapeutics Market Regional Analysis

“North America Holds the Largest Share in the Non-Radiographic Axial Spondyloarthritis Therapeutics Market”

- North America dominates the non-radiographic axial spondyloarthritis therapeutics market with a share of 38.6%, driven by advanced diagnostic capabilities, high biologic uptake, and robust healthcare infrastructure

- The U.S. holds a significant share of 77.9% due to widespread use of MRI diagnostics, strong clinical awareness, and rapid adoption of advanced biologics such as IL-17 and TNF inhibitors

- The presence of major pharmaceutical companies like AbbVie, Amgen, and Johnson & Johnson in North America ensures consistent investment in research and development, clinical trials, and treatment innovation

- The increasing demand for early intervention and patient-friendly treatment options continues to support North America’s dominant position, alongside payer reimbursement for chronic inflammatory conditions

“Asia-Pacific is Projected to Register the Highest CAGR in the Non-Radiographic Axial Spondyloarthritis Therapeutics Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the non-radiographic axial spondyloarthritis therapeutics market, driven by expanding healthcare infrastructure, improved diagnostic access, and rising biologic approvals

- Countries such as China, India, and Japan are emerging as key markets due to growing awareness of nr-axSpA, development of rheumatology networks, and rollout of updated treatment guidelines

- Japan, with its technologically advanced healthcare system and established specialist base, remains at the forefront of adopting innovative diagnostic tools and targeted therapies for nr-axSpA

- As government initiatives and private sector investment increase, the Asia-Pacific market is poised for sustained growth in therapeutic access, making it the fastest-growing region in the forecast period

Non-Radiographic Axial Spondyloarthritis Therapeutics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novartis AG (Switzerland)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- UCB S.A. (Belgium)

- Amgen Inc. (U.S.)

- Biogen Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Samsung Bioepis (South Korea)

- GlaxoSmithKline plc (U.K.)

- Janssen Pharmaceuticals (U.S.)

- Kyowa Kirin Co., Ltd. (Japan)

- Affibody AB (Sweden)

- Acelyrin, Inc. (U.S.)

- Inmagene Biopharmaceuticals (China)

- Qyuns Therapeutics (China)

- Suzhou Zelgen Biopharmaceuticals (China)

Latest Developments in Global Non-Radiographic Axial Spondyloarthritis Therapeutics Market

- In January 2025, Novartis received expanded FDA approval for secukinumab in adult nr-axSpA patients with inadequate response to NSAIDs. This approval supports broader use of IL-17 inhibitors in early inflammatory arthritis management

- In October 2024, UCB launched a digital therapeutic platform for remote patient monitoring in axial spondyloarthritis. The platform enhances real-time data collection and supports treatment optimization for biologic users

- In August 2024, AbbVie published long-term safety results of its adalimumab biosimilar in nr-axSpA, reaffirming its sustained efficacy and safety profile for patients undergoing chronic treatment

- In March 2024, Eli Lilly initiated a global Phase IV study comparing ixekizumab and NSAIDs in biologic-naive nr-axSpA patients, aiming to establish evidence-based pathways for first-line therapy selection

- In December 2023, Amgen partnered with academic centers across Europe to expand real-world evidence generation for its biosimilar etanercept in non-radiographic populations, focusing on adherence and quality-of-life outcomes

- In September 2023, Pfizer launched a new support program in Asia-Pacific to enhance patient access and adherence for tofacitinib, offering digital onboarding and consultation support for nr-axSpA patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.