Global Non Starch Polysaccharides In Animal Feed Market

Market Size in USD Million

CAGR :

%

USD

670.55 Million

USD

1,109.77 Million

2025

2033

USD

670.55 Million

USD

1,109.77 Million

2025

2033

| 2026 –2033 | |

| USD 670.55 Million | |

| USD 1,109.77 Million | |

|

|

|

|

Non-Starch Polysaccharides in Animal Feed Market Size

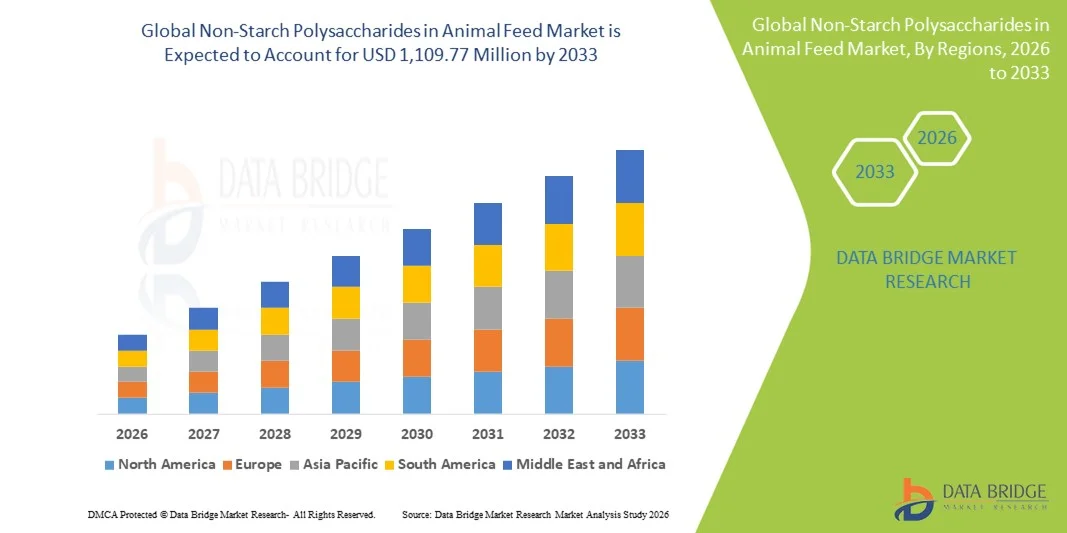

- The global non-starch polysaccharides in animal feed market size was valued at USD 670.55 million in 2025 and is expected to reach USD 1,109.77 million by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality animal feed that enhances gut health and nutrient absorption in livestock

- Rising focus on sustainable livestock farming practices and the need for natural feed additives to replace antibiotics are further driving market expansion

Non-Starch Polysaccharides in Animal Feed Market Analysis

- The market is witnessing increasing incorporation of NSPs such as beta-glucans, arabinoxylans, and cellulose in feed formulations for poultry, swine, and ruminants

- Technological advancements in feed processing and enzyme supplementation are enabling better digestibility and utilization of NSPs in animal diets

- North America dominated the global non-starch polysaccharides (NSPs) in animal feed market with the largest revenue share in 2025, driven by increasing awareness of gut health in livestock, rising adoption of natural feed additives, and demand for antibiotic-free animal products.

- Asia-Pacific region is expected to witness the highest growth rate in the global non-starch polysaccharides in animal feed market, driven by increasing meat and dairy consumption, rising livestock production, and growing awareness of the benefits of NSPs in improving feed efficiency and animal health

- The Organic segment held the largest market revenue share in 2025, driven by growing demand for natural and sustainable feed additives that enhance livestock health and meet consumer preferences for antibiotic-free animal products. Organic NSPs are increasingly preferred due to their eco-friendly production methods and alignment with regulatory standards for natural feed components

Report Scope and Non-Starch Polysaccharides in Animal Feed Market Segmentation

|

Attributes |

Non-Starch Polysaccharides in Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• DSM (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Starch Polysaccharides in Animal Feed Market Trends

Rising Adoption of NSPs in Livestock Feed

- The growing incorporation of non-starch polysaccharides (NSPs) in animal feed is transforming the livestock nutrition landscape by enhancing gut health and nutrient absorption. NSPs such as beta-glucans, arabinoxylans, and cellulose improve digestive efficiency, supporting higher weight gain and productivity in livestock. This also helps reduce feed wastage and optimize overall feed conversion ratios, contributing to more sustainable livestock operations

- The demand for NSP-enriched feed is rising in remote and under-resourced regions where conventional feed additives may be limited. These natural additives help reduce digestive disorders, enhance feed utilization, and ensure better overall health in poultry, swine, and ruminants. Increasing awareness among farmers about their long-term economic and productivity benefits is further driving adoption

- NSPs are increasingly favored for their cost-effectiveness and ease of inclusion in feed formulations. Livestock producers can adopt them without significant changes in feed processing, leading to better herd performance and lower feed-related losses. The ability to integrate NSPs with enzyme supplementation and other feed technologies enhances their value proposition for commercial feed producers

- For instance, in 2023, several poultry farms reported improved feed conversion ratios and reduced incidence of gut-related diseases after integrating NSP-based feed additives. This resulted in higher productivity and reduced veterinary expenses. The positive outcomes have prompted broader adoption across small and mid-sized farms, reinforcing the market’s growth trajectory

- While NSP adoption is accelerating, its impact depends on continued research, optimal dosage determination, and education of feed manufacturers. Producers must focus on tailored NSP formulations for different livestock to fully leverage market potential. Ongoing innovations in NSP extraction and processing technologies are expected to further enhance their effectiveness and market penetration

Non-Starch Polysaccharides in Animal Feed Market Dynamics

Driver

Growing Focus on Animal Health and Sustainable Livestock Practices

- Increasing awareness of gut health and the role of NSPs in improving nutrient absorption is driving their adoption in animal feed. Livestock producers are prioritizing feed additives that enhance performance without relying on antibiotics or synthetic additives. The emphasis on animal welfare and regulatory encouragement of natural feed components is also supporting growth

- Rising demand for high-quality meat, dairy, and poultry products is encouraging the use of NSPs to improve feed efficiency, weight gain, and overall livestock health. This shift is supported by consumer preference for safer and natural animal-derived products. Producers are increasingly integrating NSPs into feed strategies to meet global food safety standards and market expectations

- Government initiatives and international programs promoting sustainable livestock production are supporting NSP utilization. Subsidized feed programs and awareness campaigns are encouraging farmers to adopt NSP-enriched feed formulations. These initiatives also aim to reduce environmental impacts from livestock operations by improving feed efficiency and reducing nutrient runoff

- For instance, in 2022, several European countries implemented guidelines encouraging natural feed additives, boosting the adoption of NSPs in commercial feed production. This has encouraged feed manufacturers to invest in R&D for enhanced NSP products and expand their distribution networks to new markets

- While awareness and institutional support are driving growth, there is a need for continued innovation in feed formulations, effective distribution channels, and education on optimal NSP usage to ensure long-term adoption. Collaboration between feed producers, veterinarians, and farmers is key to maximizing NSP benefits and achieving sustainable livestock production goals

Restraint/Challenge

High Cost of Advanced NSP Feed Additives and Limited Access in Rural Areas

- The high price of advanced NSP-enriched feed formulations restricts adoption among smallholder farmers and low-margin operations. These premium feed additives are often adopted primarily by large commercial farms. The cost factor limits the ability of smaller operators to benefit from improved feed efficiency and productivity

- Limited availability and distribution challenges in rural and remote regions hinder access to NSP-based feed. Lack of supply chain infrastructure and logistical support reduces timely availability for smaller farms. Seasonal and geographic constraints further exacerbate access issues, especially in developing regions

- Inadequate technical knowledge among farmers regarding NSP benefits and optimal usage can lead to underutilization or inconsistent feed performance. This limits the full potential impact of NSP supplementation. The absence of localized training programs and guidance from feed experts contributes to suboptimal application in livestock diets

- For instance, in 2023, surveys in Sub-Saharan Africa revealed that over 60% of small-scale livestock producers had limited access to NSP-based feed additives due to cost and supply constraints. As a result, many farmers continued using traditional feed options, missing out on the productivity and health benefits of NSP integration

- While NSP technologies continue to evolve, overcoming cost, accessibility, and awareness barriers is critical. Market stakeholders must focus on scalable production, cost-effective formulations, and educational initiatives to unlock sustained market growth. Partnerships with local distributors, feed cooperatives, and agricultural extension services can play a key role in expanding reach and adoption

Non-Starch Polysaccharides in Animal Feed Market Scope

The market is segmented on the basis of nature, type, and application.

- By Nature

On the basis of nature, the non-starch polysaccharides (NSPs) in animal feed market is segmented into Organic and Conventional. The Organic segment held the largest market revenue share in 2025, driven by growing demand for natural and sustainable feed additives that enhance livestock health and meet consumer preferences for antibiotic-free animal products. Organic NSPs are increasingly preferred due to their eco-friendly production methods and alignment with regulatory standards for natural feed components.

The Conventional segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by cost-effectiveness and wide availability. Conventional NSPs are commonly used in commercial feed formulations to improve digestibility, gut health, and overall feed efficiency, making them attractive for large-scale livestock operations.

- By Type

On the basis of type, the market is segmented into Cellulose, Non-Cellulosic Polymers, and Pectic Polysaccharides. The Cellulose segment held the largest share in 2025, supported by its high abundance, effectiveness in improving digestive efficiency, and widespread inclusion in poultry, swine, and ruminant feed. Cellulose-based NSPs are valued for their ability to regulate gut motility and support nutrient absorption.

The Non-Cellulosic Polymers segment is expected to register the fastest growth from 2026 to 2033, driven by their functional benefits in enhancing immunity, reducing digestive disorders, and improving overall animal performance. Feed manufacturers increasingly incorporate these polymers to meet the rising demand for high-quality, performance-enhancing additives.

- By Application

On the basis of application, the market is segmented into Food & Beverages, Dietary Supplements, Pharmaceuticals, Pet Food, Animal Feed, Cosmetics, Nutraceuticals, and Others. The Animal Feed segment dominated the market in 2025, owing to the growing focus on livestock productivity, feed efficiency, and sustainable farming practices. NSPs are extensively used to enhance gut health, nutrient utilization, and overall animal growth.

The Pet Food segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing pet ownership, rising awareness of pet nutrition, and demand for functional feed ingredients that support digestion, immunity, and overall wellness in companion animals.

Non-Starch Polysaccharides in Animal Feed Market Regional Analysis

- North America dominated the global non-starch polysaccharides (NSPs) in animal feed market with the largest revenue share in 2025, driven by increasing awareness of gut health in livestock, rising adoption of natural feed additives, and demand for antibiotic-free animal products.

- Livestock producers in the region prioritize feed additives that enhance nutrient absorption, improve growth performance, and support sustainable farming practices.

- High investments in research and development, coupled with well-established feed manufacturing infrastructure, are further supporting widespread adoption of NSPs in poultry, swine, and ruminant feed.

U.S. Non-Starch Polysaccharides in Animal Feed Market Insight

The U.S. non-starch polysaccharides market captured the largest revenue share in North America in 2025, fueled by the growing focus on improving feed efficiency and livestock health. Producers are increasingly incorporating NSPs to enhance gut health, reduce digestive disorders, and support higher weight gain. Strong awareness of sustainable and natural feed solutions, combined with advanced feed processing technologies, continues to drive market growth.

Canada Non-Starch Polysaccharides in Animal Feed Market Insight

The Canada non-starch polysaccharides market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of natural feed additives and government initiatives promoting sustainable livestock production. Rising demand for high-quality meat and dairy products, along with improvements in feed formulation practices, is accelerating NSP incorporation in commercial and small-scale livestock operations.

Europe Non-Starch Polysaccharides in Animal Feed Market Insight

The Europe non-starch polysaccharides market is projected to experience significant growth from 2026 to 2033, owing to stringent regulations regarding antibiotic use in animal feed and the rising preference for natural feed additives. Livestock producers across the region are adopting NSPs to improve feed efficiency, nutrient absorption, and overall animal health, with strong demand in poultry, swine, and dairy sectors.

U.K. Non-Starch Polysaccharides in Animal Feed Market Insight

The U.K. market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness among farmers regarding the benefits of NSPs in improving livestock productivity and gut health. Increasing demand for safe, natural, and high-quality animal-derived products, along with supportive government policies, is boosting the adoption of NSPs in feed formulations.

Germany Non-Starch Polysaccharides in Animal Feed Market Insight

The Germany market is expected to witness notable growth from 2026 to 2033, fueled by technological advancements in feed processing and a focus on sustainable livestock farming. Increasing awareness of gut health and natural feed solutions is encouraging livestock producers to incorporate NSPs into commercial feed, particularly for poultry and swine.

Asia-Pacific Non-Starch Polysaccharides in Animal Feed Market Insight

The Asia-Pacific non-starch polysaccharides market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing livestock production, rising meat and dairy consumption, and growing adoption of natural feed additives in countries such as China, Japan, and India. Government initiatives promoting sustainable farming and the expansion of feed manufacturing infrastructure are further propelling market adoption.

Japan Non-Starch Polysaccharides in Animal Feed Market Insight

The Japan market is expected to witness substantial growth from 2026 to 2033 due to rising focus on animal health, increasing demand for high-quality livestock products, and the adoption of advanced feed formulations incorporating NSPs. Producers are increasingly utilizing NSPs to improve digestive efficiency and nutrient absorption in poultry, swine, and ruminants.

China Non-Starch Polysaccharides in Animal Feed Market Insight

The China non-starch polysaccharides market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid growth in livestock production, rising awareness of gut health, and strong adoption of natural feed additives. Increasing demand for antibiotic-free and high-quality meat and dairy products, combined with investments in feed processing technologies, is supporting NSP market expansion across poultry, swine, and ruminant feed sectors.

Non-Starch Polysaccharides in Animal Feed Market Share

The Non-Starch Polysaccharides in Animal Feed industry is primarily led by well-established companies, including:

Here’s the list of top companies with headquarters and country in the format you requested:

• DSM (Netherlands)

• Advanced Enzyme Technologies (India)

• BASF SE (Germany)

• DuPont (U.S.)

• Associated British Foods plc (U.K.)

• Novozymes (Denmark)

• Alltech (U.S.)

• Sichuan Guolong Group (China)

• Amano Enzyme Inc (Japan)

• Adisseo (France)

• Dyadic International Inc (U.S.)

• AB Enzymes (Germany)

• Merck KGaA (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.