Global Non Steroidal Anti Inflammatory Drugs Nsaids Lymphedema Therapy Market

Market Size in USD Million

CAGR :

%

USD

56.29 Million

USD

119.28 Million

2025

2033

USD

56.29 Million

USD

119.28 Million

2025

2033

| 2026 –2033 | |

| USD 56.29 Million | |

| USD 119.28 Million | |

|

|

|

|

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Size

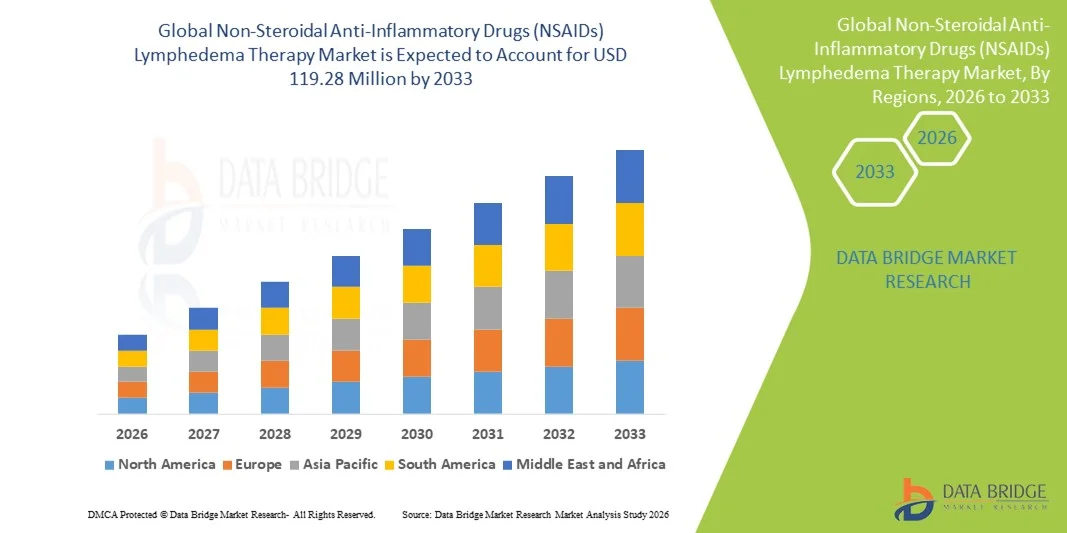

- The global Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy market size was valued at USD 56.29 Million in 2025 and is expected to reach USD 119.28 Million by 2033, at a CAGR of9.84% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic inflammatory conditions, rising geriatric population, and growing awareness regarding effective lymphedema management therapies

- Furthermore, increasing adoption of Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) in lymphedema therapy, coupled with advancements in drug formulations and targeted treatment options, is accelerating the uptake of Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy solutions, thereby significantly boosting the industry's growth

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Analysis

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), offering targeted anti-inflammatory and analgesic effects, are increasingly vital components of modern lymphedema therapy in both clinical and home-care settings due to their efficacy in reducing swelling, inflammation, and associated discomfort

- The escalating demand for Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) is primarily fueled by the growing prevalence of lymphedema, rising geriatric population, and increasing awareness about effective therapeutic interventions

- North America dominated the non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market with the largest revenue share of 40.22% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative NSAID therapies, and the presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth due to proactive lymphedema management programs and rising awareness about early intervention

- Asia-Pacific is expected to be the fastest growing region in the non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market during the forecast period due to increasing healthcare expenditure, growing population, rising prevalence of lymphedema, and improving access to advanced treatment options in countries such as China, India, and Japan

- The oral segment dominated the largest market revenue share of 52.8% in 2025, driven by ease of use, patient compliance, and widespread availability. Oral NSAIDs are standard therapy for both acute and chronic lymphedema, often integrated with lifestyle and physiotherapy interventions

Report Scope and Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Segmentation

|

Attributes |

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Trends

Rising Adoption of Targeted Anti-Inflammatory Regimens

- A notable trend in the global non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is the increasing adoption of targeted anti-inflammatory regimens for reducing edema and improving lymphatic function. Patients and healthcare providers are increasingly favoring therapies that combine efficacy with lower side effect profiles

- For instance, In March 2025, a leading pharmaceutical company introduced a modified-release NSAID formulation specifically designed for chronic lymphedema, allowing sustained anti-inflammatory action with reduced gastrointestinal risks. This has accelerated adoption in outpatient and hospital settings

- Medical institutions are increasingly implementing patient-specific NSAID dosing protocols to optimize outcomes, especially for individuals with comorbidities such as diabetes or cardiovascular conditions

- There is growing interest in combination therapies that integrate NSAIDs with physical therapy and compression techniques to enhance lymphatic drainage, creating more comprehensive treatment strategies

- Healthcare professionals are emphasizing evidence-based treatment pathways that incorporate NSAIDs for long-term management of lymphedema in both upper and lower extremities

- Pharmaceutical research is focusing on developing safer topical NSAID formulations, reducing systemic exposure while maintaining therapeutic efficacy. The trend is also influenced by patient awareness campaigns highlighting the benefits of early intervention in chronic lymphedema cases

- Clinical studies reporting improved limb function, reduced inflammation, and better quality of life outcomes have encouraged wider adoption across hospitals and clinics. Integration of NSAID therapy with telehealth monitoring programs is also emerging, allowing remote assessment of edema reduction and adherence to medication regimens

- Healthcare providers in developed regions are increasingly including NSAID therapy as a standard part of lymphedema management protocols

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Dynamics

Driver

Growing Prevalence of Lymphedema and Associated Complications

- The rising prevalence of lymphedema globally, driven by surgical interventions, cancer treatments, and chronic venous insufficiency, is a significant driver for the increased demand for NSAIDs

- For instance, In January 2025, a multi-center study highlighted that nearly 30% of breast cancer survivors experience upper-limb lymphedema, prompting clinicians to incorporate NSAID therapy as a first-line intervention

- Rising awareness about early management and the prevention of secondary complications, such as fibrosis and infection, further contributes to market growth

- The growing geriatric population, who are more susceptible to lymphatic disorders, also expands the potential patient pool for NSAID therapy. Hospitals and clinics are increasingly adopting standardized treatment protocols that include NSAIDs to manage inflammation effectively and improve patient quality of life

- Advances in pharmacology have resulted in NSAIDs with improved safety profiles, which encourages physicians to prescribe them more confidently. Outpatient care settings and home healthcare providers are supporting therapy adherence, driving sustained usage

- Clinical education programs for healthcare providers emphasize early NSAID intervention to limit chronic tissue damage and improve treatment outcomes. The availability of multiple formulations, including oral, topical, and combination therapies, enhances patient compliance and expands market penetration

Restraint/Challenge

Safety Concerns and Regulatory Restrictions

- Concerns regarding the long-term safety of NSAIDs, particularly the risks of gastrointestinal bleeding, cardiovascular complications, and renal issues, present a major challenge to market growth

- For instance, In February 2025, regulatory authorities in Europe issued updated guidelines restricting high-dose NSAID usage in patients with comorbid heart conditions, influencing prescription practices

- Healthcare providers are increasingly monitoring for adverse events, which can complicate treatment regimens and reduce overall patient adherence. The relatively high cost of modified-release and safer NSAID formulations compared to standard NSAIDs can be a barrier for price-sensitive patients, especially in developing regions

- Increasing awareness of alternative therapies, such as physiotherapy or compression therapy, sometimes reduces reliance on pharmacological interventions. Pharmaceutical companies must invest in post-marketing surveillance and safety studies to maintain physician and patient confidence

- Strict regulatory approvals for new NSAID formulations can delay market entry, affecting revenue growth for innovative products. Patient reluctance due to fear of side effects may limit adoption, despite clinical recommendations

- Insurance reimbursement for premium NSAID therapies can be inconsistent, impacting access. Education programs are required to guide appropriate NSAID use and minimize risk of complications

- Managing polypharmacy in elderly patients further complicates NSAID prescription and adherence. Overall, safety considerations and regulatory compliance challenges are critical factors constraining market growth

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Scope

The market is segmented on the basis of type, administration route, end-users, and distribution channel.

- By Type

On the basis of type, the Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy market is segmented into NSAIDs, Corticosteroids, Analgesics, and Others. The NSAIDs segment dominated the largest market revenue share of 46.5% in 2025, driven by their widespread clinical adoption for reducing inflammation and improving lymphatic drainage. Hospitals and clinics favor NSAIDs due to their proven efficacy and established safety profiles in both acute and chronic lymphedema management. Patient preference for NSAIDs is also influenced by ease of administration, availability in multiple formulations, and affordability relative to other therapies. The segment benefits from strong prescriber confidence and extensive inclusion in treatment protocols. Furthermore, ongoing clinical studies reinforce their effectiveness, promoting continued adoption. Key pharmaceutical companies have enhanced formulations, including modified-release and topical NSAIDs, boosting patient compliance. Global awareness campaigns about lymphedema management emphasize NSAID use as a first-line therapy. The availability of NSAIDs in hospital, retail, and online pharmacies ensures easy access, further supporting market leadership. The growing geriatric population, cancer survivors, and post-surgical patients contribute to sustained demand. Overall, the NSAIDs segment remains dominant due to clinical preference, efficacy, accessibility, and ongoing innovation.

The corticosteroids segment is anticipated to witness the fastest growth rate of CAGR 19.3% from 2026 to 2033, driven by their potent anti-inflammatory effect in severe or resistant lymphedema cases. Corticosteroids are increasingly prescribed in short-term therapy regimens for rapid edema reduction. The rising incidence of complex lymphedema in post-surgical or cancer patients is fueling demand. Newer formulations with reduced systemic side effects, including localized injectable corticosteroids, are improving patient acceptance. Adoption is higher in hospital and clinic settings with specialist supervision. Pharmaceutical companies are focusing on safer corticosteroid options, increasing availability in emerging markets. Awareness programs educating physicians about dosing optimization and patient monitoring encourage usage. The combination of corticosteroids with physiotherapy and compression therapy also enhances treatment outcomes. Their versatility in acute management positions corticosteroids as a high-growth segment. Additionally, expanded insurance coverage and reimbursement in developed markets further accelerate adoption. Rising physician confidence and positive clinical outcomes are key drivers of CAGR. Overall, the corticosteroids segment is rapidly gaining traction in the global market due to clinical demand and therapeutic effectiveness.

- By Administration Route

On the basis of administration route, the market is segmented into oral, topical, injectable, and others. The oral segment dominated the largest market revenue share of 52.8% in 2025, driven by ease of use, patient compliance, and widespread availability. Oral NSAIDs are standard therapy for both acute and chronic lymphedema, often integrated with lifestyle and physiotherapy interventions. Hospitals, clinics, and home care settings prefer oral administration due to simplicity and proven efficacy. Clinical guidelines often prioritize oral formulations for first-line management. The segment benefits from strong distribution through hospital and retail pharmacies, ensuring consistent patient access. Availability in generic and branded options makes therapy cost-effective. Global awareness of early lymphedema intervention increases reliance on oral NSAIDs. Oral routes also allow flexible dosing adjustments based on severity and patient tolerance. Overall, oral administration remains dominant due to convenience, accessibility, and clinical trust.

The injectable segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by rapid therapeutic action and targeted delivery for severe lymphedema cases. Injectable NSAIDs and corticosteroids are increasingly utilized in hospital and rehabilitation centers. Demand is rising in post-operative patients requiring immediate edema control. New formulations with minimized systemic effects are improving safety and adoption. Specialist-administered therapy ensures precision dosing and reduced complications. Injectable routes also support combination therapy strategies with physiotherapy or compression treatments. The growing number of outpatient infusion clinics and home-based care services is expanding access. Physician preference for injectable therapy in critical cases is a key adoption driver. Insurance coverage and reimbursement support further encourage use. The segment’s growth is fueled by high efficacy, clinical need, and adoption in advanced healthcare settings.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, clinics, home care settings, rehabilitation centers, and others. The hospitals segment dominated the largest market revenue share of 58.3% in 2025, driven by bulk procurement, centralized treatment protocols, and the high prevalence of complex lymphedema cases. Hospitals provide both inpatient and outpatient care, integrating NSAID therapy with physiotherapy and surgical interventions. Clinical guidelines and insurance coverage favor hospital-based treatment. Strategic partnerships with pharmaceutical companies ensure steady supply. Hospitals also maintain adherence monitoring and patient education programs. Rising prevalence of post-surgical lymphedema and cancer-related edema further supports hospital demand. Advanced diagnostic facilities and trained healthcare professionals increase therapy adoption. Large-scale procurement ensures cost-effectiveness and availability of multiple formulations. Hospitals dominate due to patient volume, comprehensive care facilities, and protocol-driven therapy.

The home care segment is expected to witness the fastest CAGR of 17.5% from 2026 to 2033, driven by increasing patient preference for convenient and continuous lymphedema management at home. Oral and topical NSAID formulations facilitate self-administration. Home-based care adoption is rising in elderly populations and chronic lymphedema patients. Telemedicine integration allows remote monitoring, boosting confidence in home therapy. Easy access via online pharmacies and retail outlets encourages adherence. Growing awareness campaigns educate patients and caregivers on home-based management. Home care services and nurse-assisted administration are expanding, particularly in North America and Europe. Rising demand is supported by shorter hospital stays and post-discharge management needs. Affordability of oral and topical NSAIDs enhances adoption. Overall, home care settings represent a high-growth segment due to convenience, patient autonomy, and healthcare trends.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the largest market revenue share of 57.4% in 2025, owing to bulk procurement for inpatient and outpatient use, adherence to regulatory standards, and guaranteed quality. Hospitals maintain centralized distribution systems and strategic partnerships with manufacturers. Hospital pharmacies ensure consistent availability of oral, topical, and injectable NSAID therapies. The segment is supported by prescription-based sales, insurance reimbursement, and integrated patient care programs. Hospitals benefit from economies of scale and bulk purchasing discounts. High patient footfall and therapy monitoring requirements further strengthen dominance. The hospital pharmacy remains the preferred channel for prescribers due to reliability, protocol compliance, and accessibility.

The online pharmacy segment is expected to witness the fastest CAGR of 19.1% from 2026 to 2033, fueled by the rising adoption of e-commerce platforms for healthcare products. Patients increasingly prefer convenient home delivery of NSAID and corticosteroid therapies. Online pharmacies provide discreet, 24/7 access and subscription-based delivery models. Telemedicine integration with online ordering facilitates prescription verification and continuous supply. Emerging markets are experiencing rapid growth in online pharmacy penetration. Convenience, cost-effectiveness, and access to multiple brands encourage patient preference. Digital platforms also promote therapy adherence through reminders and refill notifications. The segment benefits from increasing smartphone and internet penetration globally. Patient confidence in online reviews and brand reputation enhances adoption. Overall, online pharmacies represent the fastest-growing channel due to convenience, accessibility, and digital integration.

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Regional Analysis

- North America dominated the non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market with the largest revenue share of 40.22% in 2025

- Supported by advanced healthcare infrastructure, high adoption of innovative NSAID therapies, and the presence of leading pharmaceutical companies

- The market experiencing substantial growth due to proactive lymphedema management programs and rising awareness about early intervention

U.S. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

The U.S. non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market captured the largest revenue share of 82% in 2025 within North America, driven by early adoption of advanced NSAID therapies, proactive screening and management programs for lymphedema, and growing awareness among healthcare providers and patients. The increasing focus on patient-centric care and integration of novel therapeutic protocols is significantly contributing to market growth.

Europe Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

The Europe non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is projected to expand at a substantial CAGR, fueled by increasing prevalence of inflammatory conditions, well-established healthcare systems, and growing adoption of advanced treatment protocols. Countries such as Germany, France, and the U.K. are witnessing significant growth due to rising demand for effective lymphedema management and NSAID-based therapies.

U.K. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

The U.K. non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by robust healthcare infrastructure, government initiatives promoting early diagnosis and management of lymphedema, and rising awareness of NSAID therapy benefits.

Germany Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

Germany non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is expected to expand at a considerable CAGR, driven by high healthcare expenditure, advanced pharmaceutical R&D, and increasing demand for innovative NSAID formulations for lymphedema management.

Asia-Pacific Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

The Asia-Pacific non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is poised to grow at the fastest CAGR during 2026–2033, driven by rising prevalence of lymphedema, increasing healthcare infrastructure, expanding pharmaceutical manufacturing capabilities, and improving access to advanced NSAID therapies in countries such as China, India, and Japan.

Japan Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

Japan non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market is experiencing significant growth due to its aging population, increasing incidence of lymphedema, and rising adoption of innovative NSAID treatments, particularly in outpatient and home care settings.

China Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Insight

China non-steroidal anti-inflammatory drugs (NSAIDs) lymphedema therapy market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing prevalence of lymphedema, growing healthcare access, and the availability of affordable NSAID therapies, along with strong domestic pharmaceutical manufacturers.

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market Share

The Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy industry is primarily led by well-established companies, including:

• Pfizer (U.S.)

• Johnson & Johnson (U.S.)

• Novartis (Switzerland)

• Roche (Switzerland)

• GlaxoSmithKline (U.K.)

• Merck & Co. (U.S.)

• AbbVie (U.S.)

• Sanofi (France)

• Bayer (Germany)

• Eli Lilly (U.S.)

• Bristol-Myers Squibb (U.S.)

• Teva Pharmaceuticals (Israel)

• Takeda Pharmaceutical (Japan)

• Amgen (U.S.)

• Boehringer Ingelheim (Germany)

• Astellas Pharma (Japan)

• Hikma Pharmaceuticals (Jordan)

• Fresenius Kabi (Germany)

• Sun Pharmaceutical (India)

Latest Developments in Global Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Lymphedema Therapy Market

- In October 2023, a clinical observational study (NCT03783715) at Stanford University investigated the effect of oral ketoprofen (200 mg once daily) over six months in lymphedema patients, measuring changes in skin thickness, limb volume, and systemic inflammation (G‑CSF levels)

- In August 2023, a pilot open-label trial and a follow-up randomized, placebo-controlled study demonstrated that taking ketoprofen 75 mg three times daily for 4 months significantly reduced skin thickness and improved histopathological markers in lymphedema patients, with a good safety profile (no serious adverse events)

- In June 2024, a systematic review of pharmacotherapy agents in lymphedema highlighted ketoprofen, among other anti‑inflammatory agents, as one of the most promising repurposed therapies — showing both clinical and preclinical evidence of reducing inflammation in lymphedematous tissue

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.