Global Nonwoven Materials And Products Market

Market Size in USD Billion

CAGR :

%

USD

68.90 Billion

USD

103.36 Billion

2025

2033

USD

68.90 Billion

USD

103.36 Billion

2025

2033

| 2026 –2033 | |

| USD 68.90 Billion | |

| USD 103.36 Billion | |

|

|

|

|

Nonwoven Materials and Products Market Size

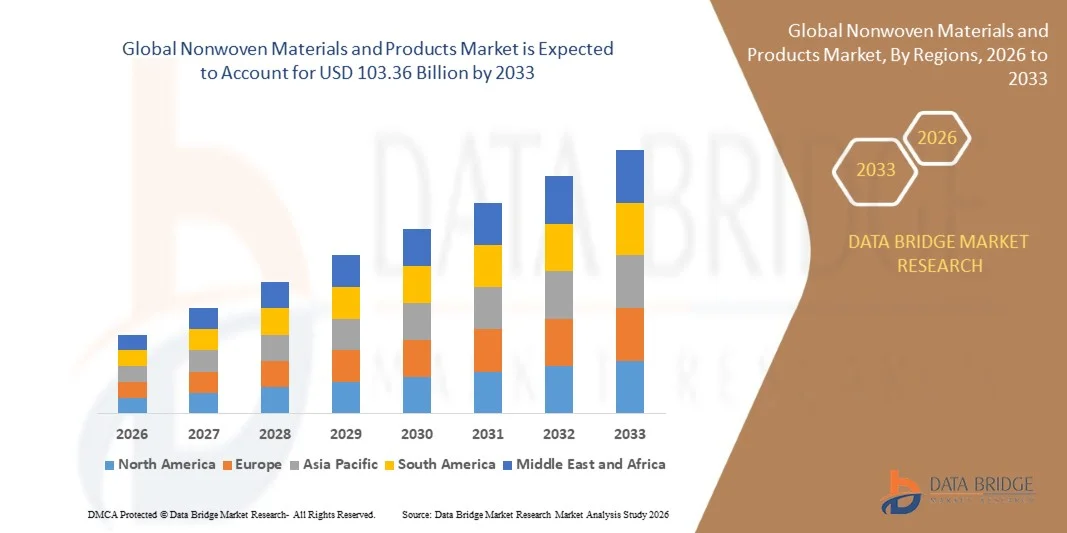

- The Nonwoven Materials and Products Market size was valued at USD 68.90 billion in 2025 and is expected to reach USD 103.36 billion by 2033, at a CAGR of 5.20% during the forecast period.

- The market growth is primarily driven by increasing demand across the healthcare, hygiene, automotive, and construction sectors, where nonwoven materials are favored for their versatility, durability, and cost-effectiveness.

- Additionally, technological advancements in production processes, such as spunbond and meltblown techniques, are enabling the creation of high-performance nonwoven products, further fueling adoption across diverse end-use applications. These factors collectively are propelling the market expansion, thereby significantly enhancing the industry’s growth trajectory.

Nonwoven Materials and Products Market Analysis

- Nonwoven materials, used in applications ranging from hygiene products and medical supplies to automotive and construction, are increasingly essential due to their versatility, cost-effectiveness, and performance characteristics, making them a key component across multiple end-use industries.

- The rising demand for nonwoven materials is primarily driven by growth in healthcare and personal care sectors, increasing industrial applications, and a focus on lightweight, durable, and disposable solutions.

- North America dominated the Nonwoven Materials and Products Market with the largest revenue share of 34.8% in 2025, characterized by strong industrial infrastructure, high demand for hygiene and medical products, and the presence of leading manufacturers, with the U.S. witnessing significant adoption in medical disposables and construction materials driven by technological innovations and sustainability initiatives.

- Asia-Pacific is expected to be the fastest-growing region in the Nonwoven Materials and Products Market during the forecast period due to rapid urbanization, expanding healthcare and hygiene sectors, and increasing disposable incomes.

- The hygiene products segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the rising global demand for disposable diapers, wipes, and sanitary products, where nonwoven fabrics offer superior absorbency, comfort, and cost-effectiveness.

Report Scope and Nonwoven Materials and Products Market Segmentation

|

Attributes |

Nonwoven Materials and Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nonwoven Materials and Products Market Trends

“Enhanced Performance Through Advanced Manufacturing and Functionalization”

- A significant and accelerating trend in the Nonwoven Materials and Products Market is the increasing adoption of advanced manufacturing technologies and functionalization techniques, including spunbond, meltblown, and electrospinning processes. These innovations are significantly enhancing product performance, versatility, and application potential across multiple industries.

- For instance, meltblown nonwovens are widely used in high-efficiency filtration applications such as medical face masks and air filters, while spunbond nonwovens are preferred for durable hygiene products and automotive interiors due to their strength and flexibility.

- Functionalization techniques, such as adding antimicrobial, water-repellent, or flame-retardant properties, enable nonwoven materials to meet specialized requirements across healthcare, construction, and industrial applications. For example, certain medical gowns and wound care products utilize antimicrobial-treated nonwovens to enhance patient safety and hygiene.

- The integration of advanced manufacturing with functionalization allows manufacturers to produce high-performance nonwoven fabrics that are tailored to specific end-use requirements. This capability supports the growing demand for disposable, lightweight, and durable solutions in sectors such as personal care, healthcare, automotive, and construction.

- This trend towards more efficient, multifunctional, and application-specific nonwoven products is fundamentally reshaping industry standards and end-user expectations. Consequently, companies such as Freudenberg, Berry Global, and Ahlstrom-Munksjö are investing in RandD to develop nonwoven materials with superior strength, filtration efficiency, and functional performance.

- The demand for high-performance, functionally enhanced nonwoven products is rising rapidly across both developed and emerging markets, as industries increasingly prioritize durability, safety, and specialized performance characteristics.

Nonwoven Materials and Products Market Dynamics

Driver

“Growing Demand Driven by Expanding Healthcare, Hygiene, and Industrial Applications”

- The increasing demand for hygiene products, medical disposables, and industrial materials, coupled with rapid urbanization and rising consumer awareness, is a significant driver for the growth of the nonwoven materials market.

- For instance, in 2025, Berry Global launched a line of antimicrobial nonwoven fabrics for medical and personal care applications, highlighting how innovations by key players are expected to drive market expansion during the forecast period.

- As industries and consumers increasingly prioritize hygiene, durability, and performance, nonwoven products such as surgical masks, wipes, diapers, and filtration media provide compelling advantages over traditional materials, including cost-effectiveness, lightweight design, and single-use convenience.

- Furthermore, the growing adoption of industrial nonwovens in automotive interiors, construction, and packaging applications is contributing to market growth by offering high-performance, customizable, and sustainable solutions.

- The versatility of nonwoven products, combined with innovations in functionalization (e.g., antimicrobial, water-repellent, or flame-retardant treatments), ensures broad applicability across healthcare, personal care, and industrial sectors, driving adoption in both developed and emerging markets.

Restraint/Challenge

“Environmental Concerns and Production Costs”

- Environmental concerns related to the disposal of nonwoven materials, particularly single-use and synthetic variants, pose a significant challenge to broader market adoption. Growing consumer and regulatory pressure for sustainable alternatives is reshaping production priorities.

- For instance, reports highlighting the environmental impact of polypropylene-based nonwovens in disposable hygiene products have encouraged manufacturers to explore biodegradable and recycled materials.

- Addressing these concerns through sustainable material sourcing, biodegradable alternatives, and recycling initiatives is crucial for long-term market growth. Companies such as Ahlstrom-Munksjö and Freudenberg are investing in eco-friendly nonwoven solutions to meet sustainability standards and consumer expectations.

- Additionally, relatively high production costs for specialized or functionalized nonwovens can limit adoption among price-sensitive end users, particularly in emerging markets or for large-scale industrial applications. While basic nonwoven fabrics are cost-effective, advanced products with antimicrobial, filtration, or flame-retardant properties come at a premium.

- Overcoming these challenges through innovation in sustainable materials, cost-efficient production methods, and increased awareness of nonwoven benefits will be vital for sustained market growth.

Nonwoven Materials and Products Market Scope

The market is segmented on the basis of application, material type, Technology, end use.

• By Application

On the basis of application, the Nonwoven Materials and Products Market is segmented into hygiene products, medical products, geotextiles, automotive, and industrial. The hygiene products segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the rising global demand for disposable diapers, wipes, and sanitary products, where nonwoven fabrics offer superior absorbency, comfort, and cost-effectiveness. Consumers increasingly prefer disposable and hygienic solutions, particularly in emerging markets with growing population and disposable incomes.

The medical products segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by heightened demand for surgical masks, gowns, and wound care products, as well as innovations in antimicrobial and sterile nonwoven fabrics that enhance safety and compliance in healthcare environments. The growing focus on infection control and patient safety is further accelerating adoption in hospitals, clinics, and home care settings.

• By Material Type

On the basis of material type, the Nonwoven Materials and Products Market is segmented into polypropylene, polyester, rayon, cellulose, and polyethylene. The polypropylene segment held the largest revenue share of 41.3% in 2025, due to its versatility, low cost, and suitability for hygiene, filtration, and industrial applications. Polypropylene nonwovens are widely used in disposable diapers, face masks, and air/water filtration media.

The polyester segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by increasing adoption in automotive interiors, geotextiles, and durable industrial applications where high tensile strength, thermal stability, and moisture resistance are required. The growing preference for polyester nonwovens in construction, automotive, and apparel applications is boosting demand globally.

• By Technology

On the basis of technology, the Nonwoven Materials and Products Market is segmented into spunbond, needle punch, hot air, wet laid, and thermal bonding. The spunbond segment dominated the market with a revenue share of 42.7% in 2025, attributed to its high production efficiency, durability, and suitability for hygiene, medical, and filtration applications. Spunbond nonwovens provide excellent strength-to-weight ratios and are widely used in disposable hygiene products, surgical gowns, and industrial filtration media.

The needle punch segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, driven by demand in geotextiles, automotive insulation, and construction materials where superior mechanical properties and thickness control are critical. Needle-punched nonwovens are increasingly adopted for durable and high-performance industrial applications.

• By End Use

On the basis of end use, the Nonwoven Materials and Products Market is segmented into consumer goods, construction, healthcare, and agriculture. The consumer goods segment accounted for the largest revenue share of 39.2% in 2025, fueled by widespread adoption in hygiene and personal care products such as wipes, diapers, and sanitary items. Rising consumer awareness of hygiene and convenience continues to drive demand in this sector.

The healthcare segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by demand for surgical disposables, protective apparel, and medical filtration products, particularly in hospitals and clinics. Growing concerns around infection control, coupled with innovations in functionalized nonwoven fabrics, are accelerating adoption in healthcare environments globally.

Nonwoven Materials and Products Market Regional Analysis

- North America dominated the Nonwoven Materials and Products Market with the largest revenue share of 34.8% in 2025, driven by high demand for hygiene, medical, and industrial nonwoven products, as well as increasing adoption of advanced manufacturing technologies.

- Consumers and industries in the region highly value the performance, durability, and versatility offered by nonwoven fabrics across applications such as surgical masks, wipes, diapers, automotive interiors, and construction materials.

- This widespread adoption is further supported by strong manufacturing infrastructure, high disposable incomes, stringent hygiene standards, and a growing focus on sustainable and functional materials, establishing nonwoven products as a preferred choice across healthcare, consumer goods, and industrial sectors in North America.

U.S. Nonwoven Materials and Products Market Insight

The U.S. nonwoven materials and products market captured the largest revenue share of 38% in 2025 within North America, driven by strong demand for hygiene products, medical disposables, and industrial applications. Consumers and industries are increasingly prioritizing nonwoven fabrics for their lightweight, durable, and cost-effective properties. The growing adoption of advanced manufacturing technologies, combined with innovations in antimicrobial, biodegradable, and functionalized nonwovens, further propels market growth. Moreover, rising awareness of healthcare hygiene and increasing use of nonwovens in automotive, construction, and filtration applications significantly contribute to the market’s expansion.

Europe Nonwoven Materials and Products Market Insight

The Europe nonwoven materials and products market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent hygiene regulations, rising healthcare expenditure, and increasing industrial demand. Urbanization and the shift toward sustainable and functional materials are fostering adoption across hygiene, medical, and industrial applications. European consumers and businesses increasingly prefer nonwoven fabrics for their durability, lightweight nature, and cost-effectiveness. The region is experiencing significant growth across healthcare, personal care, construction, and automotive sectors, with nonwoven materials being incorporated into both new product lines and retrofitting applications.

U.K. Nonwoven Materials and Products Market Insight

The U.K. nonwoven materials and products market is anticipated to grow at a noteworthy CAGR, driven by increasing consumer awareness of hygiene, healthcare standards, and environmental sustainability. The rising demand for disposable hygiene products, surgical disposables, and industrial nonwovens encourages adoption among both businesses and households. Additionally, strong manufacturing infrastructure, technological advancements in production processes, and e-commerce-driven accessibility are expected to continue supporting market growth in the U.K.

Germany Nonwoven Materials and Products Market Insight

The Germany nonwoven materials and products market is expected to expand at a considerable CAGR, fueled by rising industrial and healthcare applications, growing emphasis on environmental sustainability, and demand for high-performance materials. Germany’s well-developed manufacturing base, focus on innovation, and adoption of eco-friendly nonwoven solutions promote growth, particularly in hygiene, automotive, and construction sectors. Increasing use of nonwovens in medical, filtration, and insulation applications aligns with local consumer and regulatory expectations.

Asia-Pacific Nonwoven Materials and Products Market Insight

The Asia-Pacific nonwoven materials and products market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding healthcare and industrial sectors in countries such as China, India, and Japan. The region’s growing inclination toward hygiene, medical, and industrial nonwoven applications, supported by government initiatives promoting healthcare and sanitation, is accelerating adoption. Furthermore, as APAC emerges as a manufacturing hub for nonwoven fabrics and products, affordability and accessibility are increasing, expanding the consumer and industrial base.

Japan Nonwoven Materials and Products Market Insight

The Japan nonwoven materials and products market is gaining momentum due to high consumer awareness of hygiene, technological advancements, and the demand for high-quality, functional nonwoven materials. Increasing adoption in medical disposables, personal care products, and industrial applications is driving growth. Integration of innovative features such as antimicrobial treatment, enhanced absorbency, and eco-friendly materials is further boosting demand in both residential and commercial sectors.

China Nonwoven Materials and Products Market Insight

The China nonwoven materials and products market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding middle-class population, and high industrial and healthcare demand. China is a key hub for the production and consumption of nonwoven products, including hygiene items, medical disposables, and industrial fabrics. Government initiatives promoting healthcare, sanitation, and smart manufacturing, along with the availability of affordable, high-quality products, are key factors propelling market growth across residential, commercial, and industrial sectors.

Nonwoven Materials and Products Market Share

The Nonwoven Materials and Products industry is primarily led by well-established companies, including:

- Freudenberg Performance Materials (Germany)

- Berry Global Inc. (U.S.)

- Ahlstrom-Munksjö (Finland)

- Domtar Corporation (Canada)

- Sandler AG (Germany)

- Beaulieu Technical Textiles (Belgium)

- Avgol Nonwovens (Israel)

- Terra Nonwovens (Luxembourg)

- Globus Nonwovens (U.S.)

- Coventry Nonwovens (U.K.)

- Georgia-Pacific Nonwovens (U.S.)

- Essity AB (Sweden)

- Johns Manville (U.S.)

- Lydall Inc. (U.S.)

- Propex Nonwovens (U.S.)

- Shandong Dongfang Nonwoven Co., Ltd. (China)

- Hunan Zhongda Nonwoven Co., Ltd. (China)

- Wuxi Yinyu Nonwoven Co., Ltd. (China)

- Nobel Hygiene (India)

- Technical Nonwovens (Italy)

What are the Recent Developments in Nonwoven Materials and Products Market?

- In April 2024, Freudenberg Performance Materials, a global leader in nonwoven solutions, launched a strategic initiative in South Africa aimed at expanding the supply of high-performance nonwoven fabrics for hygiene and medical applications. This initiative highlights the company’s commitment to addressing regional healthcare and sanitation challenges while reinforcing its position in the rapidly growing Nonwoven Materials and Products Market. By leveraging its global expertise and advanced manufacturing technologies, Freudenberg is providing durable, high-quality nonwovens tailored to local industry needs.

- In March 2024, Berry Global Inc., a U.S.-based packaging and nonwoven materials provider, introduced a new line of spunbond polypropylene fabrics specifically designed for industrial filtration and hygiene products. This innovation underscores Berry Global’s focus on functional, high-performance nonwovens that meet evolving safety and operational standards in commercial and industrial sectors.

- In March 2024, Ahlstrom-Munksjö successfully launched its “Smart Hygiene Fabric” project in Bengaluru, India, aimed at enhancing healthcare and sanitation infrastructure through advanced nonwoven materials. The initiative demonstrates the growing significance of functional nonwovens in urban healthcare and hygiene applications, contributing to safer and more resilient communities.

- In February 2024, Sandler AG, a leading European nonwoven manufacturer, announced a strategic partnership with major automotive OEMs to supply innovative lightweight nonwoven composites for vehicle interiors. This collaboration is designed to improve sustainability, reduce vehicle weight, and enhance acoustic insulation, reflecting Sandler’s commitment to innovation and operational efficiency within the automotive sector.

- In January 2024, Domtar Corporation, a key North American nonwoven materials provider, unveiled a new line of cellulose-based nonwovens for disposable hygiene products at the International Textile and Nonwovens Expo 2024. These environmentally friendly materials, offering high absorbency and durability, underscore Domtar’s dedication to sustainable solutions while providing end-users with superior performance and reliability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nonwoven Materials And Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nonwoven Materials And Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nonwoven Materials And Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.