Global Nuclear Decommissioning Services Market

Market Size in USD Billion

CAGR :

%

USD

7.37 Billion

USD

12.99 Billion

2025

2033

USD

7.37 Billion

USD

12.99 Billion

2025

2033

| 2026 –2033 | |

| USD 7.37 Billion | |

| USD 12.99 Billion | |

|

|

|

|

Nuclear Decommissioning Services Market Size

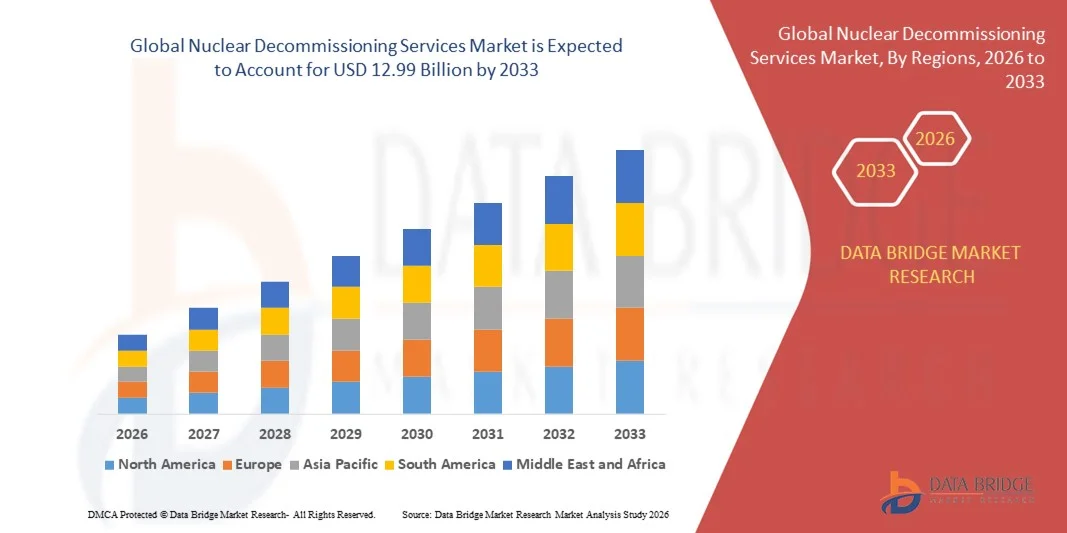

- The global nuclear decommissioning services market size was valued at USD 7.37 billion in 2025 and is expected to reach USD 12.99 billion by 2033, at a CAGR of 7.33% during the forecast period

- The market growth is largely fuelled by the increasing number of aging nuclear reactors approaching the end of their operational life, requiring safe and systematic decommissioning processes

- Rising government initiatives and regulatory frameworks mandating proper nuclear waste management and environmental safety are further driving market adoption

Nuclear Decommissioning Services Market Analysis

- The market is witnessing significant technological advancements, including automated dismantling systems, remote monitoring solutions, and innovative waste treatment methods that enhance efficiency and safety

- Increasing collaborations between governments, private contractors, and technology providers are creating opportunities for optimized project execution and knowledge transfer across the nuclear decommissioning ecosystem

- North America dominated the nuclear decommissioning services market with the largest revenue share of 36.75% in 2025, driven by the growing number of aging nuclear facilities, stringent regulatory requirements, and high investments in safe and efficient decommissioning solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global nuclear decommissioning services market, driven by rapid nuclear expansion, modernization of old reactors, and rising awareness of environmental and safety compliance

- The PWR segment held the largest market revenue share in 2025, driven by the high global prevalence of PWRs and the increasing need for safe and efficient decommissioning of aging reactors. PWR decommissioning projects often involve complex planning and advanced technological solutions, making them a major revenue contributor for service providers.

Report Scope and Nuclear Decommissioning Services Market Segmentation

|

Attributes |

Nuclear Decommissioning Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nuclear Decommissioning Services Market Trends

Rise of Advanced Decommissioning Technologies

- The growing adoption of advanced decommissioning technologies is transforming the nuclear services landscape by enabling safer, faster, and more cost-effective dismantling of nuclear facilities. Remote-operated robotics, automated waste handling systems, and innovative demolition techniques allow precise operations while minimizing human exposure to radiation, resulting in enhanced safety, reduced operational delays, and improved project predictability. Increasing integration of real-time monitoring and predictive analytics further supports operational efficiency and risk mitigation

- The increasing focus on compliance with environmental and safety regulations is accelerating the adoption of specialized decommissioning solutions. These technologies help operators adhere to regulatory mandates, manage radioactive waste effectively, and ensure that decommissioning activities meet national and international safety standards. Enhanced regulatory compliance also reduces legal liabilities and supports public trust in nuclear energy management

- The integration of digital monitoring, simulation, and AI-driven planning tools is making decommissioning projects more efficient, reducing project timelines, and optimizing resource utilization. Real-time data analytics and predictive maintenance systems enhance operational oversight, minimize risks, and support cost-effective allocation of labor and machinery. These innovations also facilitate scenario planning for complex decommissioning challenges

- For instance, in 2024, several European nuclear operators reported accelerated project completion times and reduced workforce exposure after implementing robotics and digital monitoring platforms for reactor dismantling and radioactive waste management. The adoption of these technologies enabled smoother coordination between contractors, improved documentation, and ensured consistent adherence to safety protocols

- While advanced technologies are driving efficiency, market growth depends on continued innovation, workforce training, and investment in specialized equipment. Service providers must focus on scalable, safe, and cost-efficient solutions to fully leverage the expanding market demand, enhance operational performance, and meet the evolving needs of nuclear facility owners

Nuclear Decommissioning Services Market Dynamics

Driver

Rising Need for Safe, Efficient, and Regulatory-Compliant Decommissioning

- The increasing number of aging nuclear facilities worldwide is pushing governments and operators to prioritize decommissioning services. Outdated reactors, spent fuel storage, and environmental risks are accelerating investments in specialized decommissioning solutions. The growing emphasis on sustainable decommissioning practices is also prompting increased spending on technology-driven methods that minimize environmental impact

- Regulatory pressure and public safety concerns are driving adoption of automated, remote, and environmentally responsible decommissioning techniques. Governments are mandating rigorous safety protocols, creating strong demand for qualified service providers. This has also encouraged operators to invest in long-term monitoring solutions and environmentally friendly waste disposal systems

- Technological advancements, including robotics, digital modeling, and waste management systems, are enabling more efficient and safer operations, reducing human exposure and minimizing environmental impact. Innovations such as remote cutting, automated handling of high-level waste, and modular dismantling strategies improve project precision while lowering operational risks and enhancing safety culture

- For instance, in 2023, Japan’s nuclear operators deployed advanced robotic cutting and waste handling systems during plant decommissioning, enhancing safety and operational efficiency while meeting regulatory requirements. The integration of digital planning tools helped reduce downtime and improved coordination between multiple contractor teams, ensuring compliance and reducing overall project cost

- While rising safety awareness and regulatory mandates are propelling the market, continuous R&D, technology adoption, and skilled workforce development are essential to ensure sustainable growth. Companies that invest in innovation, training, and eco-conscious practices are better positioned to capitalize on increasing global decommissioning demand

Restraint/Challenge

High Cost of Decommissioning Projects and Technical Complexity

- The high capital and operational costs associated with decommissioning nuclear facilities limit adoption, particularly in emerging economies. Specialized equipment, highly trained personnel, and regulatory compliance contribute to significant expenditure. These costs can delay project initiation and restrict smaller operators from participating in the market

- Complex technical requirements, including handling of radioactive waste, containment, and dismantling of reactors, pose significant operational challenges. The need for precision and safety increases project timelines and costs. In addition, unforeseen site-specific conditions can result in schedule disruptions and require additional contingency planning

- Limited availability of skilled professionals in nuclear decommissioning hinders project execution, especially in regions with few experienced service providers. Training and retaining qualified personnel remain critical barriers. Workforce shortages also impact the adoption of advanced technologies and limit the capacity to execute multiple projects simultaneously

- For instance, in 2024, several small-scale nuclear operators in Eastern Europe faced project delays and cost overruns due to limited access to certified decommissioning experts and advanced equipment. These constraints resulted in slower waste removal, longer reactor dismantling timelines, and increased operational expenditures

- While technological solutions are evolving, addressing cost pressures, workforce scarcity, and operational complexities is vital for expanding market penetration and ensuring safe, timely decommissioning globally. Stakeholders must focus on integrated project management, partnerships, and technology-driven efficiencies to overcome these challenges and maximize market potential

Nuclear Decommissioning Services Market Scope

The market is segmented on the basis of reactor type, strategy, capacity, and application.

- By Reactor Type

On the basis of reactor type, the nuclear decommissioning services market is segmented into Pressurized Water Reactor (PWR), Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), and Others. The PWR segment held the largest market revenue share in 2025, driven by the high global prevalence of PWRs and the increasing need for safe and efficient decommissioning of aging reactors. PWR decommissioning projects often involve complex planning and advanced technological solutions, making them a major revenue contributor for service providers.

The BWR segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing number of aging BWR facilities reaching the end of their operational life. The adoption of advanced dismantling techniques, robotics, and AI-assisted project planning is accelerating BWR decommissioning activities, enabling safer operations, reduced human exposure, and optimized project timelines.

- By Strategy

On the basis of strategy, the market is segmented into Immediate Dismantling, Deferred Dismantling, and Entombment. Immediate Dismantling held the largest share in 2025, as operators aim to minimize long-term maintenance costs and radiation hazards. This strategy involves rapid execution using advanced technologies and specialized workforce.

Deferred Dismantling is expected to witness the fastest growth from 2026 to 2033, driven by operators’ preference to allow radioactive decay before dismantling. This approach reduces radiation exposure risks and provides time for technology development, making it increasingly popular in several regions.

- By Capacity

On the basis of capacity, the market is segmented into Up to 800 MW, 801 MW–1,000 MW, and Above 1,000 MW. Reactors above 1,000 MW held the largest market revenue share in 2025, attributed to their widespread deployment and the high complexity of decommissioning large-capacity reactors, which generates significant demand for specialized services.

The 801 MW–1,000 MW segment is expected to witness the fastest growth rate from 2026 to 2033, owing to the increasing number of mid-capacity reactors nearing end-of-life and requiring technologically advanced decommissioning solutions. Service providers are focusing on efficient, cost-effective strategies for these reactors to optimize project duration and safety.

- By Application

On the basis of application, the market is segmented into Commercial Power Reactor, Prototype Reactor, and Research Reactor. Commercial Power Reactors held the largest share in 2025, driven by the large number of operational power reactors reaching decommissioning stage and the high regulatory requirements associated with their safe dismantling.

Research Reactors are expected to witness the fastest growth from 2026 to 2033, fueled by the rising focus on academic and experimental nuclear facilities. The adoption of remote-controlled dismantling and advanced waste management technologies in research reactors ensures minimal risk and enhanced operational efficiency.

Nuclear Decommissioning Services Market Regional Analysis

- North America dominated the nuclear decommissioning services market with the largest revenue share of 36.75% in 2025, driven by the growing number of aging nuclear facilities, stringent regulatory requirements, and high investments in safe and efficient decommissioning solutions

- Operators and governments in the region prioritize compliance with environmental and safety regulations, which increases demand for advanced decommissioning technologies such as robotics, automated waste handling systems, and digital monitoring platforms

- This widespread adoption is further supported by well-established nuclear infrastructure, availability of skilled professionals, and strong government funding, establishing North America as a key market for decommissioning projects

U.S. Nuclear Decommissioning Services Market Insight

The U.S. nuclear decommissioning services market captured the largest revenue share in 2025 within North America, fueled by the increasing retirement of older reactors and the growing focus on nuclear safety and environmental compliance. Utilities are increasingly investing in immediate and deferred dismantling strategies, supported by advanced digital and robotic solutions. The adoption of predictive maintenance, AI-based project planning, and automated waste management systems further enhances project efficiency and safety. Moreover, government incentives and regulatory oversight continue to drive market expansion in the U.S.

Europe Nuclear Decommissioning Services Market Insight

The Europe nuclear decommissioning services market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the planned shutdown of legacy reactors across France, Germany, and the U.K. The strong regulatory framework, public safety concerns, and high focus on environmental sustainability are accelerating adoption of advanced decommissioning technologies. European operators are increasingly employing immediate dismantling and entombment strategies, while integrating robotics and digital monitoring for efficient and safe project execution.

U.K. Nuclear Decommissioning Services Market Insight

The U.K. nuclear decommissioning services market is expected to witness the fastest growth rate from 2026 to 2033, driven by ongoing decommissioning of older reactors and government initiatives promoting safe dismantling practices. Increasing public awareness of nuclear safety, combined with investment in advanced technologies, encourages utilities to adopt automated and remote decommissioning solutions. The U.K.’s regulatory environment and funding support continue to propel market growth, particularly in commercial power and research reactor projects.

Germany Nuclear Decommissioning Services Market Insight

The Germany nuclear decommissioning services market is expected to witness significant growth from 2026 to 2033, fueled by the country’s nuclear phase-out policy and focus on sustainable and safe dismantling methods. Germany’s technologically advanced infrastructure supports the adoption of robotics, AI-driven project planning, and high-efficiency waste handling systems. Operators are increasingly favoring immediate and deferred dismantling strategies, ensuring compliance with stringent environmental and safety regulations.

Asia-Pacific Nuclear Decommissioning Services Market Insight

The Asia-Pacific nuclear decommissioning services market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing number of aging nuclear facilities in countries such as China, Japan, and India. Rising investment in nuclear energy, combined with government support for safe decommissioning practices, is promoting market adoption. The region is leveraging advanced decommissioning technologies, including robotics, automated waste management, and digital monitoring systems, to enhance operational efficiency and reduce human exposure to radiation.

Japan Nuclear Decommissioning Services Market Insight

The Japan nuclear decommissioning services market is expected to witness strong growth from 2026 to 2033 due to the country’s high safety standards, aging nuclear reactors, and increasing government investment in decommissioning initiatives. Advanced technologies, including remote-controlled robotics and AI-based project planning tools, are increasingly being used to improve safety and efficiency. The adoption of these solutions in both commercial and research reactors is further driving market expansion.

China Nuclear Decommissioning Services Market Insight

The China nuclear decommissioning services market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid nuclear expansion, growing number of operational reactors, and regulatory push for safe decommissioning practices. China is focusing on immediate and deferred dismantling strategies, integrating advanced robotics and automated waste handling systems to enhance safety and operational efficiency. Strong government support, rising public awareness, and domestic technological capabilities are key factors propelling the market in China.

Nuclear Decommissioning Services Market Share

The Nuclear Decommissioning Services industry is primarily led by well-established companies, including:

- AECOM (U.S.)

- Orano USA (U.S.)

- Babcock International Group PLC (U.K.)

- Studsvik AB (Sweden)

- Westinghouse Electric Company LLC (U.S.)

- Ansaldo Energia (Italy)

- Enercon (Germany)

- EnergySolutions (U.S.)

- The State Atomic Energy Corporation ROSATOM (Russia)

- KDC (Veolia) (France)

- NUVIA (France)

- Groupe ONET (SA) (France)

- Sogin S.p.A. (Italy)

- Fluor Corporation (U.S.)

- NorthStar Group Services, Inc. (U.S.)

- SNC-Lavalin Group (Canada)

- PreussenElektra GmbH (Germany)

- NUKEM Technologies (Germany)

- GNS (Germany)

- Manafort Brothers Incorporated (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nuclear Decommissioning Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nuclear Decommissioning Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nuclear Decommissioning Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.