Global Nursing And Residential Care Market

Market Size in USD Billion

CAGR :

%

USD

596.50 Billion

USD

1,171.22 Billion

2025

2033

USD

596.50 Billion

USD

1,171.22 Billion

2025

2033

| 2026 –2033 | |

| USD 596.50 Billion | |

| USD 1,171.22 Billion | |

|

|

|

|

Nursing and Residential Care Market Size

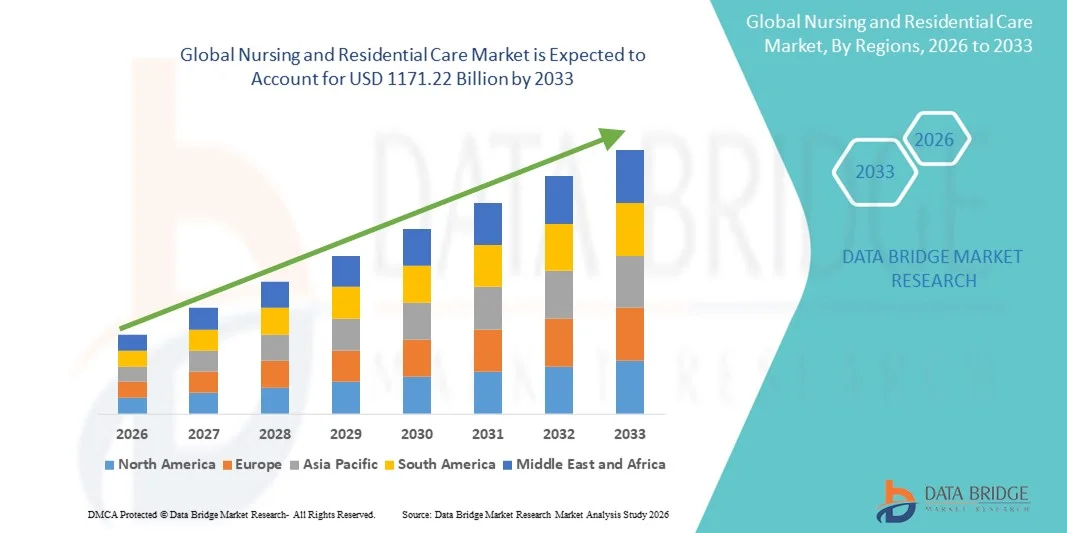

- The global nursing and residential care market size was valued at USD 596.5 billion in 2025 and is expected to reach USD 1171.22 billion by 2033, at a CAGR of 8.80% during the forecast period

- The market growth is largely fueled by the increasing aging population, rising prevalence of chronic diseases, and growing demand for long-term care solutions, leading to expanded adoption of nursing and residential care services in both urban and rural settings

- Furthermore, rising consumer demand for patient-centric, high-quality, and integrated care solutions is establishing nursing and residential care facilities as the preferred choice for elderly and dependent populations. These converging factors are accelerating the uptake of Nursing and Residential Care solutions, thereby significantly boosting the industry's growth

Nursing and Residential Care Market Analysis

- Nursing and residential care services, offering long-term and short-term care for elderly, chronically ill, and dependent individuals, are increasingly vital components of healthcare and social support systems in both residential and institutional settings due to their enhanced patient-centric care, professional oversight, and integration with healthcare management programs

- The escalating demand for nursing and residential care is primarily fueled by the growing aging population, rising prevalence of chronic diseases, and a heightened focus on quality of life and personalized care

- North America dominated the nursing and residential care market with the largest revenue share of 44% in 2025, characterized by high healthcare spending, well-established care infrastructure, and a strong presence of key industry players, with the U.S. experiencing substantial growth in nursing and residential care services due to government initiatives, advanced healthcare facilities, and increasing private investments

- Asia-Pacific is expected to be the fastest-growing region in the nursing and residential care market during the forecast period, registering a CAGR from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing awareness about professional eldercare solutions

- The Private Expenditure segment dominated the largest market revenue share of 57.8% in 2025, due to increasing preference for high-quality, personalized care services and premium residential facilities

Report Scope and Nursing and Residential Care Market Segmentation

|

Attributes |

Nursing and Residential Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Brookdale Senior Living (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Nursing and Residential Care Market Trends

Growing Demand Due to Aging Population and Chronic Disease Management

- The rising global geriatric population and increasing prevalence of chronic diseases are key drivers for the Nursing and Residential Care market. According to the UN, the number of people aged 65 and above is expected to reach 1.6 billion by 2050, intensifying demand for long-term care services

- For instance, in March 2025, Brookdale Senior Living expanded its residential care facilities across the U.S., aiming to meet the growing needs of elderly patients with comorbidities. Such expansions highlight the increasing institutional response to demographic shifts. Chronic conditions such as diabetes, cardiovascular diseases, and dementia require ongoing monitoring and care, further pushing the adoption of residential care services

- The shift from institutional hospital care to home-based and community-based nursing care is accelerating due to patient preference for comfort, familiarity, and personalized services. Increasing government support and insurance coverage for eldercare services also act as catalysts for market growth

- Technological adoption in care management, such as electronic health records and remote patient monitoring (non-AI applications), enhances service quality, improving patient outcomes and operational efficiency

- Healthcare providers and non-profit organizations are launching awareness campaigns to educate families about the benefits of professional residential care, driving uptake. Increasing life expectancy and improved survival rates for chronic illnesses are creating long-term demand for skilled nursing and residential care facilities

- International healthcare chains are investing in modern, accessible, and specialized residential care infrastructure to accommodate the aging population

- The trend towards integrated care models combining medical, rehabilitation, and personal care strengthens the demand outlook

- Public and private funding initiatives further incentivize facility expansion and quality improvements. Patient-centric care and personalized nursing services remain a significant driver, fostering loyalty and sustained utilization

Nursing and Residential Care Market Dynamics

Driver

Rising Awareness of Quality Care and Safety Standards

- Growing awareness among patients and families regarding high-quality nursing and residential care standards is driving market growth globally

- For instance, in June 2024, Genesis HealthCare in the U.S. implemented an advanced patient safety and quality assurance program across its facilities, ensuring compliance with federal standards

- Regulatory requirements and accreditation by organizations such as the Joint Commission promote consistent and high-quality care delivery. Patients and families increasingly prioritize facilities with well-trained staff, comprehensive care plans, and specialized services for conditions like dementia and post-operative recovery

- Educational campaigns highlighting the importance of continuous monitoring, fall prevention, and medication management improve market trust. Institutional investments in staff training and professional development ensure better patient outcomes, enhancing reputation and demand

- Healthcare quality ratings and performance benchmarking influence consumer choice, encouraging facilities to upgrade services. Consumer preference for transparent care metrics is prompting providers to implement advanced reporting and monitoring systems

- Partnerships between hospitals and residential care facilities facilitate smooth patient transitions, increasing facility utilization. Public awareness of the psychological and emotional benefits of professional caregiving drives preference for well-established nursing homes

- The demand for high-quality nutritional support, physical therapy, and recreational activities also supports market expansion. Facilities demonstrating superior patient safety, compliance, and service quality continue to attract higher occupancy rates

Restraint/Challenge

High Operational Costs and Workforce Shortages

- The Nursing and residential care market faces significant challenges due to high operational costs, including staffing, facility maintenance, and medical equipment procurement

- For instance, in January 2025, a report by the American Health Care Association noted that rising labor costs contributed to operational strains across U.S. nursing facilities, affecting profitability

- Workforce shortages, particularly of skilled nurses and certified caregivers, limit the capacity of facilities to meet growing demand

- Retention challenges and high staff turnover impact service quality, leading to operational inefficiencies

- In developing regions, limited funding and infrastructure constraints restrict the expansion of residential care facilities

- Regulatory compliance costs, including licensing, safety audits, and health inspections, further add financial pressure on providers

- The rising cost of specialized care for chronic and complex conditions increases overall service pricing, limiting accessibility for lower-income patients

- Economic downturns and budget constraints in public health sectors can delay facility development or service expansion

- Lack of standardized training programs for caregivers in certain regions results in inconsistent care quality, impacting market perception

- Competition from informal caregiving at home poses a challenge for professional residential care providers

- Insurance coverage gaps and out-of-pocket expenses discourage some families from opting for institutional care

- Overcoming these challenges through government subsidies, staff training programs, and operational efficiency initiatives is crucial for sustained market growth

Nursing and Residential Care Market Scope

The market is segmented on the basis of service type, end-user gender, and type of expenditure.

- By Service Type

On the basis of service type, the Nursing and Residential Care market is segmented into Home Health Care Providers, Nursing Care Facilities, Group Care Homes, and Retirement Communities. The Nursing Care Facilities segment dominated the largest market revenue share of 46.5% in 2025, driven by the increasing demand for skilled nursing and medical support among the elderly and chronically ill patients. Facilities offering round-the-clock medical supervision, rehabilitation services, and chronic disease management are preferred by families and healthcare providers. For instance, Genesis HealthCare expanded its nursing care facilities in North America in 2025 to meet rising patient demand. The segment also benefits from growing regulatory compliance and accreditation programs, which improve service quality and consumer trust. Rising life expectancy, an increase in post-surgery recovery requirements, and higher adoption of long-term care insurance further support revenue growth. Moreover, these facilities often provide specialized services for dementia, Alzheimer’s, and other age-related conditions, making them indispensable for elderly care. Continuous workforce training and integration of electronic medical records enhance operational efficiency and patient satisfaction. Government programs and subsidies also incentivize the use of licensed nursing care facilities. The segment’s structured infrastructure and access to medical professionals position it as the primary choice among end-users.

The Home Health Care Providers segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by the increasing preference for home-based care among aging populations. Home care services offer personalized attention, reduced hospitalization rates, and cost-effective care solutions. For example, in 2024, BAYADA Home Health Care expanded its home nursing services across the U.S., addressing the growing elderly population. Rising awareness of remote monitoring, chronic disease management, and palliative care at home further drives adoption. Families prefer home health care due to convenience, comfort, and flexibility in scheduling nursing visits. Telehealth integration (non-AI applications) and professional caregiver availability improve care quality. The rising prevalence of chronic illnesses, postoperative care needs, and mobility limitations also contribute to market growth. Public and private health programs are promoting home-based interventions, enhancing adoption rates. The flexibility to choose care duration and intensity strengthens the market appeal. The segment also benefits from increased insurance coverage and government incentives for home healthcare provision.

- By End-User Gender

On the basis of end-user gender, the market is segmented into Female Nursing Care, Male Nursing Care, and Others. The Female Nursing Care segment dominated the largest market revenue share of 51.3% in 2025, primarily due to the longer life expectancy of women and higher prevalence of age-related conditions requiring assisted living. Women are more likely to require long-term residential care for chronic diseases such as osteoporosis, arthritis, and Alzheimer’s. In April 2025, Sunrise Senior Living reported that female residents accounted for over 55% of its total facility occupancy in North America. The segment benefits from a growing focus on gender-specific healthcare programs and social support initiatives. Female-centric wellness programs, rehabilitation services, and community engagement activities further enhance adoption. Rising awareness of safety, nutrition, and mental health support also drives demand. Government and private healthcare programs increasingly target female elderly populations, creating more specialized care options. Caregiver training programs emphasize sensitivity to female-specific health needs. Residential planning and service offerings in facilities often cater to female lifestyle and wellness requirements. The segment’s dominance reflects a combination of longevity, health awareness, and structured care availability.

The Male Nursing Care segment is expected to witness the fastest CAGR of 17.5% from 2026 to 2033, driven by the increasing male life expectancy and higher prevalence of chronic illnesses such as cardiovascular diseases and diabetes. Growing awareness among families and caregivers regarding male-specific health needs is contributing to the adoption of professional care services. For instance, in 2024, Bupa Senior Care in the UK introduced male-focused wellness and rehabilitation programs to improve engagement and health outcomes. Increasing male participation in residential care is supported by insurance coverage expansion and government incentives for elderly care. Lifestyle-related chronic conditions are more frequently addressed in professional care settings, boosting demand. Rehabilitation after surgeries and chronic disease management at specialized facilities strengthens market growth. Public awareness campaigns for male eldercare, along with facility-based male-centric social activities, also enhance adoption.

- By Type of Expenditure

On the basis of expenditure type, the Nursing and Residential Care market is segmented into Public Expenditure and Private Expenditure. The Private Expenditure segment dominated the largest market revenue share of 57.8% in 2025, due to increasing preference for high-quality, personalized care services and premium residential facilities. Families opting for private care prioritize personalized nursing, better amenities, and access to specialized medical support. For example, in 2025, Amedisys reported a 15% increase in private home health care clients in the U.S. Private expenditure is also driven by rising disposable incomes and willingness to invest in enhanced eldercare services. Premium facilities offering rehabilitation, physiotherapy, and chronic care management continue to attract paying clients. Private insurance coverage and out-of-pocket spending for customized care options further bolster market growth.

The Public Expenditure segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, fueled by government-funded healthcare initiatives and social welfare programs targeting the aging population. For instance, the Canadian government increased public funding for long-term residential care facilities in 2024 to improve accessibility. Public expenditure supports subsidized nursing homes, community-based care programs, and chronic disease management facilities. Rising government investment in rural and underserved regions improves adoption rates. Policies promoting affordable elderly care, preventive health programs, and medical monitoring in public institutions drive market expansion. Public-private partnerships are also increasingly supporting facility upgrades and operational efficiency.

Nursing and Residential Care Market Regional Analysis

- North America dominated the nursing and residential care market with the largest revenue share of 44% in 2025

- Supported by high healthcare spending, well-established care infrastructure, and a strong presence of key industry players

- The region’s growth is fueled by increasing government initiatives, advanced healthcare facilities, and substantial private investments, driving demand for both nursing and residential care services

U.S. Nursing and Residential Care Market Insight

The U.S. nursing and residential care market captured the largest revenue share within North America in 2025, fueled by an aging population, growing demand for professional eldercare services, and the expansion of advanced healthcare facilities. Increasing adoption of technologically supported care systems, rising government support for long-term care, and private sector investments are further contributing to market growth.

Europe Nursing and Residential Care Market Insight

The Europe nursing and residential care market is projected to expand at a substantial CAGR during the forecast period. Growth is driven by an aging population, increasing urbanization, and rising demand for structured care services across residential and nursing facilities. The region is witnessing adoption of modern healthcare technologies, combined with government regulations supporting elderly care.

U.K. Nursing and Residential Care Market Insight

The U.K. nursing and residential care market is anticipated to grow steadily due to increasing awareness of professional care services, growing geriatric population, and expansion of healthcare infrastructure. The country’s robust healthcare regulations and adoption of integrated care models are encouraging investments in nursing and residential care facilities.

Germany Nursing and Residential Care Market Insight

The Germany nursing and residential care market is expected to expand at a notable CAGR during the forecast period. Market growth is supported by a strong healthcare system, advanced care facilities, increasing awareness of professional eldercare, and a focus on integrating technology for improved patient management and quality of care.

Asia-Pacific Nursing and Residential Care Market Insight

The Asia-Pacific nursing and residential care market is poised to grow at the fastest CAGR from 2026 to 2033. Growth is driven by rapid urbanization, rising disposable incomes, expanding healthcare infrastructure, and increasing awareness about professional eldercare solutions. Countries such as China, India, and Japan are witnessing heightened demand for both private and government-supported nursing and residential care services.

Japan Nursing and Residential Care Market Insight

Japan’s nursing and residential care market is gaining momentum due to its rapidly aging population, high demand for professional eldercare, and well-established healthcare infrastructure. Integration of modern care technologies and increasing preference for high-quality residential care facilities are key factors propelling market growth.

China Nursing and Residential Care Market Insight

China nursing and residential care market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by the country’s expanding middle class, rising disposable incomes, and growing urban population. Expansion of healthcare facilities, increasing government initiatives supporting elderly care, and a strong presence of private care providers are contributing to the rapid growth of nursing and residential care services.

Nursing and Residential Care Market Share

The Nursing and Residential Care industry is primarily led by well-established companies, including:

• Brookdale Senior Living (U.S.)

• Genesis HealthCare (U.S.)

• Kindred Healthcare (U.S.)

• Sunrise Senior Living (U.S.)

• Amedisys (U.S.)

• LHC Group (U.S.)

• Extendicare (Canada)

• Orpea Group (France)

• Korian Group (France)

• Bupa Care Services (U.K.)

• HC-One (U.K.)

• Care UK (U.K.)

• Colisée Group (France)

• Ryman Healthcare (New Zealand)

• Regis Healthcare (Australia)

• Japara Healthcare (Australia)

• NMC Health (U.A.E.)

• Aster DM Healthcare (U.A.E.)

• Life Healthcare Group (South Africa)

• Fortis Healthcare (India)

Latest Developments in Global Nursing and Residential Care Market

- In April 2023, AvaSure, a U.S.-based healthcare technology company, introduced a novel virtual nursing application and care model that integrates telehealth technology with clinical nursing support to enhance patient care and safety within residential and nursing care settings. The solution facilitates remote monitoring and collaboration between virtual teams and on‑site caregivers, addressing evolving demands for technology‑enhanced eldercare services

- In March 2024, Epoch Elder Care — a major assisted living and eldercare provider in India — opened a new residential care facility called Epoch Picasso House in Pune, specifically designed to support elderly individuals needing assistance with daily tasks or ongoing medical conditions. This expansion reflects broader growth in nursing and residential care infrastructure in Asia

- In July 2024, Atria Senior Living launched “Atria ConnectCare”, an advanced telehealth and remote care coordination platform aimed at improving communication between residents, family members, and clinicians. The platform supports more integrated care delivery in assisted living and residential care communities

- In January 2025, Masonicare, a major senior living and healthcare organization based in Connecticut (U.S.), expanded its footprint through the acquisition of United Methodist Homes and Atria Greenridge Place, significantly increasing capacity and service offerings across multiple new facilities, and broadening care access across more communities

- In March 2025, Brookdale Senior Living announced a strategic partnership with Philips to implement a digital care platform across its portfolio of nursing and residential care communities, aimed at improving resident safety and reducing emergency room visits using integrated digital health technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.