Global Nut Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

20.10 Billion

USD

27.98 Billion

2024

2032

USD

20.10 Billion

USD

27.98 Billion

2024

2032

| 2025 –2032 | |

| USD 20.10 Billion | |

| USD 27.98 Billion | |

|

|

|

|

Nut ingredients Market Size

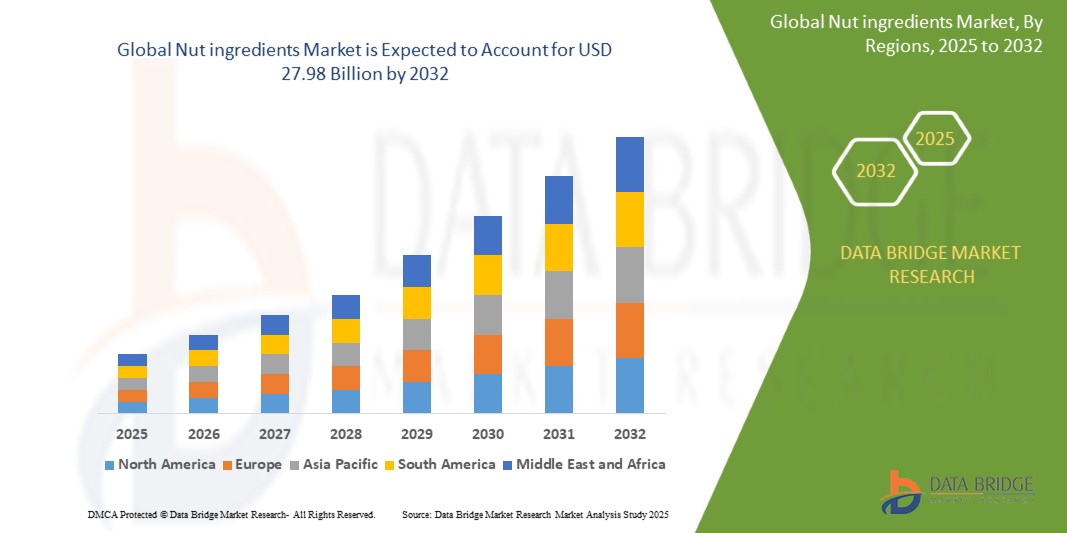

- The global nut ingredients market was valued at USD 20.1 billion in 2024 and is expected to reach USD 27.98 billion by 2032.

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.90%, primarily driven by the increasing use of nuts in plant-based and functional foods as consumers seek healthier, more natural alternatives to animal-derived products.

- This growth is driven by factors such as the increasing demand for nuts as a meat alternative and increasing consumer preference for healthy nuts in country globally

Nut ingredients Market Analysis

- The global nut ingredients market is fueled by increasing consumer preference for natural, nutrient-dense foods that align with plant-based, clean-label, and functional nutrition trends. Nuts are widely incorporated into bakery, confectionery, dairy alternatives, snacks, and health supplements due to their protein, fiber, and healthy fat content.

- While almonds and cashews are gaining traction in premium and plant-based formulations, peanuts remain the most consumed nut globally due to their affordability, versatility, and high protein content. They are extensively used in spreads, bars, sauces, and snack products across developed and emerging markets.

- North America and Europe lead in innovation with nut-based protein snacks and dairy alternatives, while the Asia-Pacific region is experiencing robust growth driven by urbanization, rising disposable incomes, and the influence of Western diets.

- The peanut segment is expected to account for approximately 40% of the global market share in 2025, supported by its widespread use in both mass-market and health-oriented products, particularly in the U.S., China, and India.

Report Scope and Nut ingredients Market Segmentation

|

Attributes |

Nut ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nut Ingredients Market Trends

Rise in Plant-Based and Functional Food Demand Across Key Consumer Segments

- A major trend in the global nut ingredients market is the increasing use of nuts in plant-based and functional foods as consumers seek healthier, more natural alternatives to animal-derived products. Almonds, walnuts, cashews, and other nuts are being integrated into non-dairy milks, meat substitutes, and clean-label snacks to meet evolving dietary preferences.

- Manufacturers are leveraging the natural nutrient density of nuts—rich in protein, fiber, and unsaturated fats—to develop functional products that support heart health, weight management, and satiety without artificial additives.

- Nut-based ingredients such as nut flours, butters, and milks are also finding growing applications in vegan, paleo, and keto diets, with formulations tailored for improved digestibility and nutritional value.

- For instance, Danish biotech company Kaffe Bueno has developed Kafflour, an upcycled, gluten-free flour made from spent coffee grounds. Kafflour is rich in protein, dietary fibers, and minerals, and is designed for use in healthy baking. The company plans to scale up production to meet demand from food makers in the Nordics and Western Europe.

Nut Ingredients Market Dynamics

Driver

Increasing Demand for Nuts as a Meat Alternative

- The global shift toward plant-based diets has significantly increased the demand for nuts as a viable alternative to animal-based proteins, especially among flexitarians, vegetarians, and vegans.

- Nuts such as almonds, walnuts, cashews, and pistachios are rich in protein, healthy fats, fiber, and essential micronutrients, making them ideal substitutes for meat in various meals and snack formulations.

- Food manufacturers are increasingly incorporating nut-based ingredients into plant-based meat alternatives, dairy substitutes, and protein-enriched snacks to meet the evolving consumer preferences for clean-label and sustainable products.

For instance,

- In September 2021, according to a research article published in researchgate, vegans are more likely than other diet categories to have healthier lifestyle characteristics such as >3 times/week exercise (standardised residual = 3.55) and >7 hours of sleep (standardised residual = 2.44). Vegans appear to have a better health rating and lifestyle than omnivores.

- As consumer interest in sustainable and ethical food sources continues to rise, nuts are gaining traction not just as snacks, but as core ingredients in innovative, plant-forward meals.

Opportunity

Innovative Product Launches with Nuts

- The growing demand for plant-based protein and clean-label products is creating significant opportunities for innovative product launches featuring nuts. Nuts are being used not only as standalone snacks but also as key ingredients in new protein-rich formulations, offering diverse textures and flavors.

- Nuts' versatility allows them to be incorporated into a wide range of products, such as protein bars, beverages, dairy alternatives, and baked goods, tapping into the increasing consumer interest in healthy, functional food options.

- With the rise of flexitarian diets and a shift toward more sustainable food sources, nut-based products are becoming more appealing to consumers who want to reduce their meat consumption while maintaining high-protein intake.

- The global trend toward clean-label products, which feature minimal and recognizable ingredients, gives nuts a competitive edge, as they align well with consumer expectations for transparency and health-focused choices.

For instance,

- A unique product with dates stuffed with fresh almonds covered with white chocolate is available in the Saudi Arabia for consumers. The dates are packed in airtight containers and are available for the consumers on retail stores and online websites.

- As consumers continue to prioritize sustainability and traceability in their food choices, nuts' natural, whole-food appeal provides an opportunity for brands to capitalize on clean-label trends and differentiate themselves in the market.

Restraint/Challenge

Health Issues Caused Due to Aflatoxins Present In Nuts

- Aflatoxins, toxic compounds produced by certain molds, are a significant concern in the nut industry, especially in products like peanuts, almonds, and pistachios, which are highly susceptible to contamination during storage and transport.

- The presence of aflatoxins in nuts can lead to serious health risks for consumers, including liver damage, immune system suppression, and potential carcinogenic effects, posing a challenge to manufacturers in ensuring product safety.

- Stringent regulations and testing requirements imposed by food safety authorities, such as the FDA and EFSA, make it critical for nut processors to adopt rigorous quality control measures to prevent contamination

For instance,

- In February 2019, according to a research article published in ELSEVIER journal, in a survey conducted in Riyadh, Saudi Arabia, various nut samples were collected in summer season including pistachios, walnuts, cashews and almonds. The aflatoxins present in the nuts were 67% of the total samples.

Nut Ingredients Market Scope

The market is segmented on the basis of type, form, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

By End User |

|

In 2025, the Snacks and Bars segment is projected to dominate the market with the largest share in the application segment.

The Snacks and Bars segment is expected to lead the Global Nut Ingredients Market with the largest share of approximately 46% in 2025. This dominance is driven by the rising demand for healthy snacking options and protein-enriched convenience foods. Nut ingredients such as almonds, peanuts, and cashews are increasingly used in granola bars, trail mixes, and energy bites to deliver satiety, nutrition, and clean-label appeal to health-conscious consumers.

In 2025, the Peanut segment is expected to account for the largest share during the forecast period in the type segment.

In 2025, the Peanut segment is anticipated to hold the largest share by type, accounting for approximately 40% of the global revenue. Peanuts remain the most widely used nut ingredient globally due to their cost-effectiveness, nutritional density, and broad application across both indulgent and functional food products, particularly in markets such as the U.S., China, and India.

Nut Ingredients Market Regional Analysis

North America is the Dominant Region in the Nut ingredients Market

-

North America dominates the global nut ingredients market, driven by rising consumer awareness of the health benefits of nuts, increasing demand for plant-based products, and the region’s well-established food processing industry.

- The U.S., in particular, holds a significant market share, accounting for approximately 36% of the global nut ingredients market due to its strong demand for nut-based snacks, health foods, and protein alternatives.

- The growing popularity of snacking, coupled with increasing interest in clean-label and natural ingredients, has bolstered the consumption of nuts like almonds, cashews, and peanuts in the U.S.

- The availability of advanced manufacturing technologies and a well-developed distribution network further supports North America's dominance in the market. Additionally, the region's focus on innovation in nut-based food products continues to drive growth.

- Regulatory support, including initiatives from the USDA and FDA, and the region's strong retail infrastructure continue to enhance the growth prospects of the nut ingredients market in North America.

Asia-Pacific is Projected to Register the Highest Growth Rate

-

Asia-Pacific is expected to witness the highest growth in the nut ingredients market, fueled by rising urbanization, a growing middle class, and increasing health awareness in emerging economies like China, India, and Southeast Asia.

- The demand for plant-based foods and dairy alternatives, particularly nut-based beverages and nut butters, is rapidly growing in countries like China and India. These regions are also seeing an increasing focus on wellness and fitness trends.

- In Southeast Asia, countries such as Thailand, Indonesia, and Vietnam are seeing a rise in the consumption of snacks and products enriched with nut ingredients, such as nut-based protein bars, smoothies, and energy drinks.

- Japan and South Korea are leveraging advanced food technology to develop nut-based functional foods, with an emphasis on heart health, brain health, and weight management.

- As consumer preferences shift toward vegan and vegetarian diets, coupled with increasing awareness of the environmental and nutritional benefits of nuts, Asia-Pacific is emerging as both a major consumer and producer of nut ingredients.

Nut ingredients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ADM (U.S.)

- Royal Nut Company (Australia)

- TREEHOUSE ALMONDS (U.S.)

- The Wonderful Company LLC (U.S.)

- Kanegrade (U.K.)

- SAVENCIA SA (France)

- BORGES AGRICULTURAL & INDUSTRIAL NUTS, S.A (Spain)

- JOHN B. SANFILIPPO & SON, INC. (U.S.)

- Blue Diamond Growers (U.S.)

- Barry Callebaut (Switzerland)

- Olam International (Singapore)

- Sahale Snacks, Inc. (U.S.)

- THE HERSHEY COMPANY (U.S.)

- Russell Stover Chocolates, LLC. (U.S.)

- Sanitarium (Australia)

- Bob’s Red Mill Natural Foods (U.S.)

- Döhler (Germany)

- OLOMOMO Nut Company (U.S.)

- Jonny Almond Nut Company (U.S.)

Latest Developments in Global Nut ingredients Market

- In June 2022, McCann's campaign assisted Britannia in launching Good Day Harmony. The TVC featured a girl biting into a cookie, with the nutty aroma attracting a group of squirrels to follow her. This campaign contributed to the successful introduction of the product.

- In May 2022, VKC Nuts launched pasteurized dried fruits under the Nutraj brand. Nutraj Bactopure claims its products are 99.99% free from bacteria and other pathogens, thanks to advancements in space science and technology.

- In April 2024, Denmark-based Arla Foods amba announced its plans to acquire the UK’s Volac Whey Nutrition business, including Volac Whey Nutrition Holdings Limited and its subsidiaries. Subject to regulatory approval, the transaction is expected to be finalized later this year. The acquisition is intended to transform the Felinfach facility into a global production hub, strengthening Arla Foods Ingredients' position in the sports nutrition, health, and food industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nut Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nut Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nut Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.