Global Nutraceuticals Phenolic Compounds Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

2.02 Billion

2025

2033

USD

1.18 Billion

USD

2.02 Billion

2025

2033

| 2026 –2033 | |

| USD 1.18 Billion | |

| USD 2.02 Billion | |

|

|

|

|

Nutraceuticals Phenolic Compounds Market Size

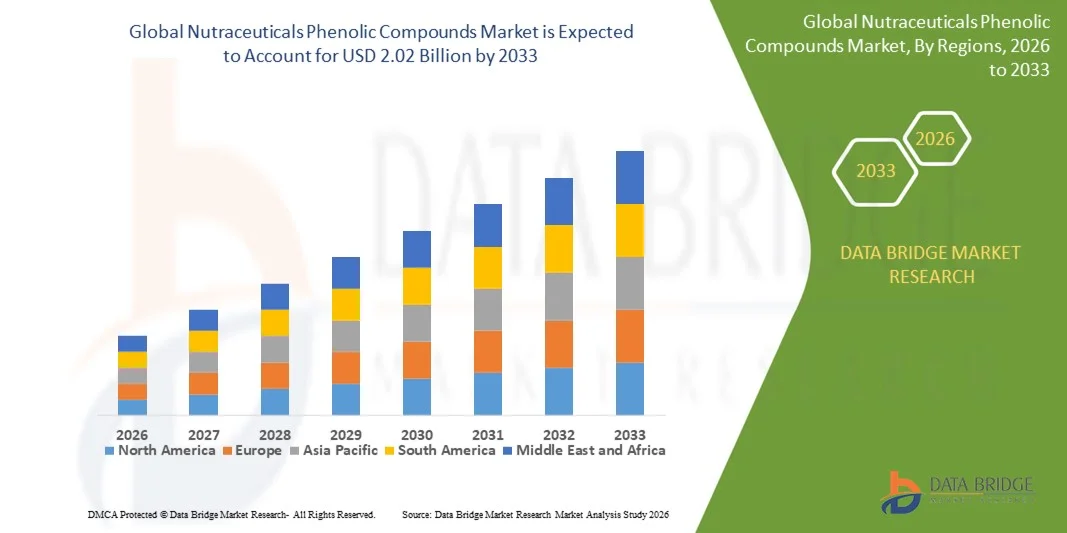

- The global nutraceuticals phenolic compounds market size was valued at USD 1.18 billion in 2025 and is expected to reach USD 2.02 billion by 2033, at a CAGR of 7.9% during the forecast period

- The market growth is largely driven by increasing consumer awareness regarding the health benefits of phenolic compounds, including their antioxidant, anti-inflammatory, and cardioprotective properties, leading to higher incorporation in dietary supplements, functional foods, and beverages

- Furthermore, rising demand for natural and plant-based nutraceuticals, coupled with innovations in extraction and formulation technologies by companies such as ADM and BASF, is enhancing product efficacy and bioavailability, thereby accelerating market adoption and fueling overall growth

Nutraceuticals Phenolic Compounds Market Analysis

- Phenolic compounds, found in fruits, vegetables, and plant extracts, are increasingly utilized in nutraceutical formulations due to their role in promoting human health, preventing chronic diseases, and improving overall wellness, making them essential ingredients in dietary supplements and functional foods

- The growing market demand is primarily supported by heightened consumer focus on preventive healthcare, increasing prevalence of lifestyle-related diseases, and rising interest in natural antioxidants, which together are driving manufacturers to expand their phenolic compound offerings and invest in research for innovative, high-potency products

- North America dominated the nutraceuticals phenolic compounds market with a share of 32.3% in 2025, due to increasing consumer preference for functional foods, dietary supplements, and natural antioxidants

- Asia-Pacific is expected to be the fastest growing region in the nutraceuticals phenolic compounds market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing awareness of health and wellness in countries such as China, Japan, and India

- Powder segment dominated the market with a market share of 61.7% in 2025, due to its stability, long shelf life, and versatility for incorporation into dietary supplements, functional foods, and nutraceutical formulations. Powdered phenolic compounds allow precise dosing, easy handling, and compatibility with capsules, tablets, and granules, making them highly preferred by manufacturers and consumers seeking convenience and efficacy

Report Scope and Nutraceuticals Phenolic Compounds Market Segmentation

|

Attributes |

Nutraceuticals Phenolic Compounds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nutraceuticals Phenolic Compounds Market Trends

Rising Consumer Preference for Natural and Plant-Based Nutraceuticals

- A significant trend in the nutraceuticals phenolic compounds market is the increasing consumer shift toward natural and plant-derived ingredients due to growing health consciousness and preference for clean-label products. This trend is encouraging manufacturers to focus on sourcing high-quality phenolic compounds from fruits, vegetables, and botanical extracts for use in functional foods, beverages, and dietary supplements

- For instance, ADM and BASF are actively supplying high-purity plant-derived phenolic compounds that are widely incorporated in dietary supplements and functional beverages. These offerings enhance product appeal to health-conscious consumers and support bioactive efficacy in formulations

- The demand for phenolic compounds is further bolstered by their established antioxidant, anti-inflammatory, and cardioprotective benefits, which consumers increasingly seek to prevent chronic diseases and improve wellness. This is positioning phenolic compounds as essential ingredients for nutraceutical product innovation

- Manufacturers are investing in advanced extraction and purification technologies to maintain the stability, potency, and bioavailability of phenolic compounds, reinforcing their value proposition in health-oriented applications

- The market is witnessing strong growth in functional food and beverage applications where phenolic compounds are added to juices, fortified snacks, and plant-based beverages to enhance nutritional profiles and extend product differentiation

- Increasing research collaborations between nutraceutical companies and academic institutions are driving the development of high-efficacy phenolic formulations. These collaborations are enhancing scientific validation and consumer confidence in phenolic-enriched products, thereby accelerating market expansion

Nutraceuticals Phenolic Compounds Market Dynamics

Driver

Growing Awareness of Health Benefits of Phenolic Compounds

- The rising awareness of phenolic compounds’ health-promoting properties, including antioxidative and anti-inflammatory effects, is driving market demand across functional foods, beverages, and dietary supplements. Consumers are increasingly seeking nutraceuticals that support preventive healthcare and overall wellness

- For instance, Kemin Industries supplies natural phenolic extracts used in functional foods and beverages that emphasize heart health and immunity support. These solutions help brands meet growing consumer interest in scientifically backed natural ingredients

- Increasing prevalence of lifestyle-related diseases such as cardiovascular disorders and metabolic syndrome is reinforcing the adoption of phenolic-based nutraceuticals. Manufacturers are responding with innovative formulations that provide targeted health benefits and improved consumer outcomes

- Companies are also leveraging phenolic compounds in personalized nutrition products, where high-antioxidant formulations are tailored to individual health needs. This approach is strengthening consumer engagement and expanding market reach

- Rising collaborations between nutraceutical companies and health-focused retailers are driving education and awareness campaigns that promote phenolic-rich products. These initiatives are facilitating wider adoption and reinforcing the health benefits of phenolic compounds

Restraint/Challenge

High Cost and Complexity of Extraction and Formulation Processes

- The nutraceuticals phenolic compounds market faces challenges due to the technical complexity and high cost associated with extracting, purifying, and stabilizing bioactive phenolic compounds. These processes require specialized equipment, advanced technology, and stringent quality control, elevating production costs

- For instance, DSM employs advanced extraction techniques to obtain standardized phenolic compounds for nutraceutical applications, which involve meticulous processing to preserve bioactivity. These high standards increase manufacturing time and operational expenses

- Maintaining the stability and bioavailability of phenolic compounds in end products is challenging, particularly in functional beverages and fortified foods where heat, pH, and light can degrade active ingredients. This necessitates careful formulation and packaging considerations

- Limited availability of high-quality plant sources and fluctuations in raw material supply further exacerbate production costs and market entry barriers. Manufacturers must balance sourcing strategies with consistent product quality to sustain competitiveness

- The market continues to face constraints in scaling production of high-potency phenolic formulations while keeping products affordable for consumers. These challenges collectively drive companies to invest in process optimization, technology innovation, and cost-efficient extraction methods

Nutraceuticals Phenolic Compounds Market Scope

The market is segmented on the basis of source and form.

- By Source

On the basis of source, the nutraceuticals phenolic compounds market is segmented into fruits, vegetables, cereals, pulses and oilseeds, herbs and trees, and others. The fruits segment dominated the market with the largest revenue share in 2025, driven by the high polyphenol content in fruits and the increasing consumer preference for natural antioxidants to support health and immunity. Fruits such as berries, grapes, and apples are widely recognized for their bioactive properties, encouraging manufacturers to prioritize fruit-derived phenolic compounds in supplements and functional foods. The demand is further reinforced by research highlighting their potential benefits in reducing oxidative stress, cardiovascular support, and anti-inflammatory effects, making fruit-based sources highly preferred in the nutraceutical industry.

The herbs and trees segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer awareness of traditional and plant-based remedies. For instance, companies such as Euromed are leveraging herbal sources such as green tea, rosemary, and turmeric for high-potency phenolic extracts that cater to dietary supplements and functional beverages. Herbal and tree-derived compounds are gaining traction due to their unique polyphenolic profiles, potent antioxidant activity, and incorporation into premium nutraceutical products that target wellness-conscious consumers. The ease of extraction and formulation flexibility for capsules, powders, and tinctures further supports the growth of this segment.

- By Form

On the basis of form, the nutraceuticals phenolic compounds market is segmented into powder and liquid. The powder segment held the largest revenue share of 61.7% in 2025, driven by its stability, long shelf life, and versatility for incorporation into dietary supplements, functional foods, and nutraceutical formulations. Powdered phenolic compounds allow precise dosing, easy handling, and compatibility with capsules, tablets, and granules, making them highly preferred by manufacturers and consumers seeking convenience and efficacy. The segment also benefits from widespread awareness regarding the antioxidant properties of powdered extracts and their role in supporting general health and wellness.

The liquid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for ready-to-consume functional beverages and nutraceutical syrups. For instance, companies such as Naturex are producing liquid phenolic formulations that provide enhanced bioavailability and rapid absorption, catering to consumers who prefer convenient, on-the-go health solutions. Liquid phenolic compounds also offer ease of blending with other ingredients, improved flavor masking, and suitability for pediatric or elderly consumption, supporting their adoption in both retail and clinical nutraceutical applications.

Nutraceuticals Phenolic Compounds Market Regional Analysis

- North America dominated the nutraceuticals phenolic compounds market with the largest revenue share of 32.3% in 2025, driven by increasing consumer preference for functional foods, dietary supplements, and natural antioxidants

- Consumers in the region are highly focused on health, wellness, and preventive care, boosting the demand for phenolic-rich nutraceuticals derived from fruits, vegetables, and herbs

- This widespread adoption is further supported by high disposable incomes, growing awareness of lifestyle-related diseases, and the presence of leading nutraceutical manufacturers, establishing phenolic compounds as a preferred ingredient for both dietary supplements and functional food products

U.S. Nutraceuticals Phenolic Compounds Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by rising health-consciousness, a preference for plant-based ingredients, and a strong dietary supplement industry. Consumers increasingly favor phenolic compounds for their antioxidant and anti-inflammatory benefits. The growing trend of preventive healthcare, coupled with robust e-commerce penetration and easy access to premium nutraceutical products, further propels the market. Moreover, research-backed formulations and fortified foods are significantly contributing to the expansion of phenolic compounds in the U.S.

Europe Nutraceuticals Phenolic Compounds Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing awareness of chronic disease prevention and demand for functional foods. Urbanization and rising disposable incomes are fostering adoption across dietary supplements, beverages, and fortified foods. European consumers are drawn to the natural, plant-based origin of phenolic compounds. The region is witnessing notable growth in countries such as Germany, France, and Italy, supported by stringent food safety regulations and health-conscious dietary trends.

U.K. Nutraceuticals Phenolic Compounds Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising consumer interest in wellness, preventive nutrition, and plant-derived antioxidants. Health concerns and lifestyle diseases are encouraging the adoption of phenolic-rich supplements. In addition, the country’s strong retail and online nutraceutical infrastructure, coupled with growing demand for convenient functional beverages and fortified foods, is expected to continue stimulating market growth.

Germany Nutraceuticals Phenolic Compounds Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing health awareness, preventive care practices, and demand for high-quality nutraceutical ingredients. Consumers prefer scientifically validated, safe, and eco-friendly phenolic sources. Germany’s well-developed supplement manufacturing sector, focus on innovation, and high-quality standards support the adoption of phenolic compounds in functional foods, beverages, and dietary supplements.

Asia-Pacific Nutraceuticals Phenolic Compounds Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness of health and wellness in countries such as China, Japan, and India. The region’s growing inclination toward preventive nutrition, supported by government health initiatives and expanding functional food sectors, is driving demand. Furthermore, Asia-Pacific is emerging as a manufacturing and export hub for phenolic-rich ingredients, making them more accessible and affordable for consumers across the region.

Japan Nutraceuticals Phenolic Compounds Market Insight

The Japan market is gaining momentum due to high health consciousness, an aging population, and increasing demand for functional foods and dietary supplements. Japanese consumers emphasize scientifically validated benefits and convenience in supplement intake. The integration of phenolic compounds into beverages, capsules, and fortified foods is fueling growth. In addition, preventive healthcare trends and technological advancements in nutraceutical production support market expansion in both residential and commercial applications.

China Nutraceuticals Phenolic Compounds Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rapid urbanization, and strong interest in health and wellness products. China is a key market for functional foods and dietary supplements, with phenolic compounds increasingly incorporated into beverages, snacks, and capsules. The government’s push for health promotion, coupled with strong domestic nutraceutical manufacturing capabilities, is propelling market growth. Affordable, locally produced phenolic ingredients and rising consumer trust in natural products further enhance adoption across the country.

Nutraceuticals Phenolic Compounds Market Share

The nutraceuticals phenolic compounds industry is primarily led by well-established companies, including:

- Allied Biotech Corporation (U.S.)

- Arboris (Finland)

- ADM (Archer Daniels Midland Company) (U.S.)

- Pharmachem Laboratories (U.S.)

- Raisio (Finland)

- Cyanotech Corporation (U.S.)

- BASF (Germany)

- Doehler Group (Germany)

- FMC Corporation (U.S.)

- Cargill (U.S.)

- Kemin Industries (U.S.)

- Chr. Hansen (Denmark)

- DSM (Netherlands)

- Carotech Berhad (Malaysia)

- D.D. Williamson & Co. (U.S.)

Latest Developments in Global Nutraceuticals Phenolic Compounds Market

- In February 2026, at Vitafoods India 2026, Brenntag showcased an expanded portfolio of nutrition ingredients and advanced formulation solutions for nutraceutical brands across Asia-Pacific, with a focus on phenolic-rich compounds and high-performance antioxidants. This initiative provides formulators with access to innovative delivery systems, improved bioavailability, and application expertise, facilitating the development of functional foods, beverages, and dietary supplements. The market-facing visibility from this showcase enhances collaboration opportunities between ingredient suppliers and manufacturers, accelerating adoption of phenolic compounds in emerging nutraceutical markets

- In January 2026, Naturex expanded its polyphenol production facility in France in April 2025, significantly enhancing production capacity and ensuring a more resilient supply of plant‑based antioxidants for global nutraceutical, food, and beverage industries. This expansion allows Naturex to meet growing demand for phenolic-rich ingredients in dietary supplements, functional foods, and beverages, while supporting consistent quality and sustainable sourcing practices. The increased production capability strengthens Naturex’s position as a leading supplier of natural antioxidants, enabling formulators to develop products with enhanced health benefits and improved market reach.

- In August 2025, Lubrizol expanded its strategic partnership with Arihant Innochem to include the full portfolio of nutraceutical ingredients in India and South Asia, which now encompasses high-performance phenolic extracts. This expansion allows for broader distribution and easier access to premium ingredients, supporting the rapid growth of the functional food and dietary supplement sectors in the region. By strengthening supply chains and regional market presence, this partnership accelerates product innovation, enabling manufacturers to create advanced phenolic-based formulations that cater to the health-conscious and wellness-focused consumer base

- In May 2025, Indena highlighted new botanical ingredient developments at major industry events, introducing next-generation natural solutions such as PUREBKALE™ and other plant-derived extracts targeted at detoxification, skin health, and chronic inflammation relief. These innovations provide nutraceutical formulators with high-potency phenolic compounds and scientifically backed ingredients to enhance product functionality and consumer appeal. The launch of such ingredients strengthens Indena’s market position, accelerates the adoption of natural phenolic solutions, and enables the development of differentiated products that cater to a growing global demand for wellness-oriented dietary supplements

- In April 2025, Lubrizol entered a distribution partnership with Palmer Holland, Inc. to expand the availability of its microencapsulation-enhanced nutraceutical ingredients across the Northeastern United States. The collaboration enhances the reach of phenolic-rich compounds in functional supplements and fortified foods, ensuring improved bioavailability, stability, and sensory properties. This partnership supports manufacturers in developing high-quality nutraceutical products that meet consumer demand for natural antioxidants and health-promoting ingredients, while increasing Lubrizol’s market penetration and influence in a key geographic region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nutraceuticals Phenolic Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nutraceuticals Phenolic Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nutraceuticals Phenolic Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.