Global Nutrients And Micronutrient Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

12.42 Billion

USD

24.20 Billion

2024

2032

USD

12.42 Billion

USD

24.20 Billion

2024

2032

| 2025 –2032 | |

| USD 12.42 Billion | |

| USD 24.20 Billion | |

|

|

|

|

Global Nutrients and Micronutrient Fertilizers Market Size

- The global nutrients and micronutrient fertilizers market size was valued at USD 12.42 billion in 2024 and is expected to reach USD 24.20 billion by 2032, growing at a CAGR of 8.70% during the forecast period

- Market expansion is primarily driven by increasing awareness among farmers regarding soil health and the critical role of micronutrients in enhancing crop yield and quality

- Additionally, supportive government initiatives, advancements in precision agriculture, and rising demand for sustainable farming practices are collectively fueling the adoption of nutrient-rich fertilizers, significantly propelling market growth

Global Nutrients and Micronutrient Fertilizers Market Analysis

- Nutrients and micronutrient fertilizers, essential for improving soil fertility and boosting crop productivity, are becoming increasingly critical in modern agriculture due to growing food demand, soil degradation, and the need for sustainable farming practices across both developed and developing regions

- The rising demand for these fertilizers is primarily driven by increasing awareness of micronutrient deficiencies in soils, expanding global population pressures on food systems, and the rapid adoption of precision farming techniques for optimized nutrient application

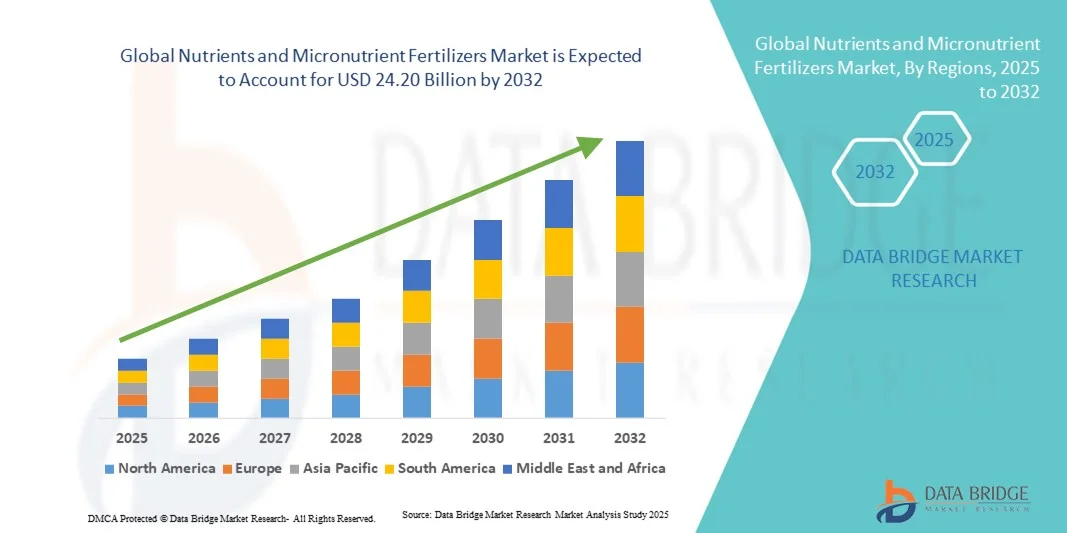

- Asia-Pacific dominated the Global Nutrients and Micronutrient Fertilizers Market with the largest revenue share of 39.1% in 2024, due to high demand for food grains, coupled with decreasing nutrient levels in the soil, prompting greater use of micronutrient-based fertilizers to improve crop yields, particularly in emerging economies like India and China.

- North America is expected to witness significant growth in the global nutrients and micronutrient fertilizers market during the forecast period of 2025 to 2032, driven by increased awareness about soil health and high adoption of advanced crop nutrition practices across the region

- The Zinc segment dominated the Global Nutrients and Micronutrient Fertilizers Market with a market share of 28.5% in 2024, owing to its widespread deficiency in agricultural soils, critical role in plant enzyme systems, and growing demand for zinc-based fertilizers across cereal and horticultural crops

Report Scope and Global Nutrients and Micronutrient Fertilizers Market Segmentation

|

Attributes |

Details |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Nutrients and Micronutrient Fertilizers Market Trends

Enhanced Precision Through AI and Smart Agriculture Integration

- A significant and accelerating trend in the Global Nutrients and Micronutrient Fertilizers Market is the deepening integration with artificial intelligence (AI), machine learning, and smart agriculture platforms, transforming how nutrients are applied and managed across farming operations. This fusion of technologies is significantly enhancing efficiency, accuracy, and sustainability in nutrient delivery systems.

- For instance, AI-powered platforms like CropX and IBM’s Watson Decision Platform for Agriculture utilize data from sensors, drones, and satellite imagery to provide farmers with real-time recommendations on micronutrient application based on crop needs, soil variability, and weather patterns. Similarly, precision ag tools integrated with AI can autonomously adjust nutrient levels to match crop requirements at a micro level.

- AI integration in nutrient management systems enables features such as predictive soil analytics, early detection of nutrient deficiencies, and smart alerts for imbalanced fertilization. For example, platforms like Taranis can identify early signs of zinc or iron deficiencies through aerial imagery and alert farmers to take corrective action before yields are impacted.

- The seamless integration of AI with IoT devices, farm management software, and drone technologies facilitates centralized control over various agricultural operations. Through a unified digital platform, farmers can manage nutrient scheduling, irrigation, crop health, and pest control, creating a data-driven and automated farm ecosystem.

- This trend toward more intelligent, precise, and interconnected nutrient management systems is fundamentally reshaping farmer expectations and approaches to soil health. Consequently, companies such as Yara International, Nutrien, and Haifa Group are investing in AI-driven platforms that offer customized micronutrient solutions and integrate seamlessly with smart farming infrastructure.

- The demand for AI-enabled nutrient management solutions is growing rapidly across both developed and emerging agricultural markets, as farmers increasingly prioritize resource optimization, environmental sustainability, and higher crop yields through data-centric farming practices.

Global Nutrients and Micronutrient Fertilizers Market Dynamics

Driver

Rising Demand for Higher Crop Yields and Sustainable Farming Practices

-

The growing global population and the resulting pressure on food production are driving a significant increase in demand for nutrients and micronutrient fertilizers to improve soil fertility and maximize crop yields. As arable land becomes increasingly limited, efficient nutrient management has become a top priority for farmers worldwide.

- For instance, in March 2024, Yara International launched a new line of micronutrient-enriched fertilizers aimed at enhancing nutrient use efficiency and supporting sustainable agriculture. Such innovations by leading industry players are expected to fuel the market's growth during the forecast period.

- Micronutrients such as zinc, boron, and iron are critical for plant health and development, yet their deficiencies are widespread in soils across Asia-Pacific, Latin America, and parts of Africa. This has led to increased awareness and adoption of micronutrient-enriched fertilizers, especially in regions experiencing soil nutrient depletion due to intensive farming.

- Moreover, the rising emphasis on sustainable agriculture, precision farming, and climate-resilient crop production is encouraging farmers to adopt customized nutrient management strategies. These fertilizers not only boost yields but also reduce the environmental impact of excessive fertilizer U.S.ge.

- Technological advancements, including the integration of AI and IoT in agriculture, have further simplified nutrient monitoring and application, making micronutrient fertilizers an essential component of modern, data-driven farming practices. Government subsidies and awareness campaigns are also supporting adoption, especially among smallholder farmers in emerging economies.

Restraint/Challenge

High Costs and Limited Awareness Among Smallholder Farmers

- Despite growing demand, the high cost of micronutrient fertilizers, especially chelated or specialty formulations, remains a major barrier to adoption, particularly in developing countries where a large portion of farming is done by smallholders with limited financial resources.

- For instance, micronutrient-enriched products often cost significantly more than conventional NPK fertilizers, which can discourage price-sensitive farmers from making the switch—especially in regions where short-term returns on investment are prioritized over long-term soil health.

- Additionally, limited awareness about the benefits and correct application of micronutrients continues to impede growth. Many farmers are either unaware of micronutrient deficiencies in their soil or lack access to proper soil testing services, leading to underuse or misuse of these products.

- The market also faces challenges related to infrastructure, supply chain limitations, and distribution inefficiencies in rural and remote areas. Even when products are available, inadequate extension services and limited technical guidance often hinder proper utilization.

- Addressing these challenges through targeted farmer education programs, affordable product innovations, government incentives, and the expansion of digital advisory platforms will be crucial for unlocking the full potential of the market and ensuring equitable growth across different farming segments.

Global Nutrients and Micronutrient Fertilizers Market Scope

The market is segmented on the basis of type, crop type, form, and mode of application.

- By Type

On the basis of type, the nutrients and micronutrient fertilizers market is segmented into zinc, boron, iron, manganese, molybdenum, copper, and others. Zinc dominated the market with the largest revenue share of 28.5% in 2024, owing to its critical role in enhancing crop growth and yield, especially in cereal and grain cultivation. Its widespread deficiency in soils globally has driven demand for zinc-based fertilizers. Additionally, zinc’s compatibility with various crops and forms makes it a preferred choice among farmers.

The boron segment is expected to witness the fastest CAGR of 15.3% from 2025 to 2032, fueled by its increasing application in fruits and vegetables, where boron is essential for reproductive growth and fruit quality. The rising awareness about micronutrient deficiencies in different soils and targeted supplementation through boron fertilizers are driving its market growth.

- By Crop Type

On the basis of crop type, the market is segmented into cereals and grains, and fruits and vegetables. Cereals and grains held the largest market revenue share of 60.7% in 2024, supported by their status as staple crops worldwide requiring significant nutrient inputs to meet global food demand. The extensive cultivation area and the need to replenish soil nutrients after successive cropping cycles underpin the dominance of this segment.

The fruits and vegetables segment is expected to witness the fastest CAGR of 18.1% during the forecast period from 2025 to 2032, driven by the growing consumer preference for nutrient-rich and high-quality produce. Increasing adoption of micronutrient fertilizers in horticulture for improving crop quality, shelf life, and resistance to diseases is further propelling growth in this segment.

- By Form

On the basis of form, the nutrients and micronutrient fertilizers market is segmented into non-chelated and chelated forms. The non-chelated segment dominated the market with the largest revenue share of 65.4% in 2024, attributed to its cost-effectiveness and broad U.S.ge in conventional fertilization practices. Non-chelated fertilizers remain popular among large-scale farmers due to their ease of application and availability.

However, the chelated segment is projected to witness the fastest CAGR of 16.7% from 2025 to 2032, driven by its superior nutrient availability and effectiveness in overcoming soil pH-related nutrient deficiencies. Chelated fertilizers are increasingly preferred in high-value crops and regions with alkaline or calcareous soils, where nutrient uptake is typically challenging.

- By Mode of Application

On the basis of mode of application, the market is segmented into soil, foliar, and fertigation. The soil application segment accounted for the largest market revenue share of 58.9% in 2024, as it remains the traditional and most widely used method for delivering nutrients directly to the root zone, supporting sustained crop growth. The segment benefits from ease of integration with existing farming practices and compatibility with various fertilizer types.

The fertigation segment is expected to register the fastest CAGR of 20.4% during the forecast period from 2025 to 2032, driven by increasing adoption of precision agriculture and advanced irrigation systems that enable efficient nutrient delivery. Fertigation offers improved nutrient use efficiency and reduced environmental impact, making it attractive for high-value crops and commercial farming operations.

Global Nutrients and Micronutrient Fertilizers Market Regional Analysis

- Asia-Pacific dominated the global nutrients and micronutrient fertilizers market with the largest revenue share of 39.1% in 2024, driven by advanced agricultural practices and extensive use of high-efficiency fertilizers.

- Farmers in the region prioritize soil health and crop nutrition, supported by advancements in soil testing and precision agriculture techniques.

- This widespread adoption is further fueled by government support, increased R&D investments, and growing awareness of sustainable farming, establishing these fertilizers as essential for improving crop yield and quality across diverse farming operations.

Japan Nutrients and Micronutrient Fertilizers Market Insight

The Japan Global Nutrients and Micronutrient Fertilizers Market is gaining momentum due to the country’s focus on high-tech agriculture, aging farming population, and limited arable land that demands maximum productivity from small plots. Japan’s agricultural sector is investing heavily in smart farming, and micronutrient fertilizers are a key component of this strategy. The integration of these fertilizers with sensor-based soil analysis, automated fertigation systems, and the use of vertical farming and greenhouses is fueling the growth. Additionally, the market is supported by government incentives and strong R&D in crop-specific nutrition.

China Nutrients and Micronutrient Fertilizers Market Insight

The China Global Nutrients and Micronutrient Fertilizers Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country's large-scale agricultural output, growing middle class, and focus on agricultural modernization. China is aggressively tackling soil nutrient depletion through national programs and promotes the use of balanced fertilizers to enhance productivity and food quality. The country also leads in the domestic production of micronutrient fertilizers, with strong support from local manufacturers and government initiatives like the “Zero Growth of Fertilizer Use” policy, which encourages more efficient nutrient use through innovative products and digital farming techniques.

Europe Nutrients and Micronutrient Fertilizers Market Insight

The Europe Global Nutrients and Micronutrient Fertilizers Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations, the EU’s focus on sustainable farming, and increasing consumer demand for organic and nutrient-rich food products. Farmers across Europe are shifting toward balanced fertilization techniques and eco-friendly solutions, which include the growing use of chelated micronutrient fertilizers. The market is also being supported by CAP subsidies, rising adoption of smart farming practices, and significant growth in horticultural and greenhouse farming across the region.

U.K. Nutrients and Micronutrient Fertilizers Market Insight

The U.K. Global Nutrients and Micronutrient Fertilizers Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s transition to sustainable agriculture and growing concerns over soil nutrient depletion. Increasing investments in agri-tech innovations, rising popularity of regenerative agriculture, and expanding demand for high-quality produce are key market drivers. Furthermore, government initiatives encouraging the use of environmentally sound inputs and digital advisory platforms are supporting micronutrient adoption among British farmers, especially in the horticulture and cereal crop sectors.

Germany Nutrients and Micronutrient Fertilizers Market Insight

The Germany Global Nutrients and Micronutrient Fertilizers Market is expected to expand at a considerable CAGR during the forecast period, propelled by advanced farming technologies, research-backed nutrient management, and high environmental awareness among German farmers. Germany’s strong emphasis on agricultural innovation, coupled with its leadership in precision agriculture and automation, promotes the use of customized micronutrient blends for soil enrichment. The country also benefits from a well-established fertilizer supply chain, government support for organic farming, and increasing interest in carbon-efficient nutrient practices.

North America Nutrients and Micronutrient Fertilizers Market Insight

The North America Nutrients and Micronutrient Fertilizers Market is anticipated to grow at a significant CAGR during the forecast period, fueled by heightened awareness of soil health, large-scale adoption of advanced crop nutrition practices, and strong technological integration in farming. The region benefits from its leadership in precision agriculture, digital farming platforms, and variable-rate application technologies, which are driving demand for tailored micronutrient blends. An established fertilizer supply chain, ongoing investments in sustainable agriculture, and government-backed programs supporting efficient nutrient use further enhance market expansion. Additionally, increasing focus on climate-smart and carbon-efficient farming practices positions North America as a key growth hub in the global nutrients and micronutrient fertilizers market.

U.S. Nutrients and Micronutrient Fertilizers Market Insight

The U.S. Nutrients and Micronutrient Fertilizers Market is expected to expand at a substantial CAGR during the forecast period, driven by widespread adoption of precision agriculture, increasing focus on soil health, and strong investments in crop nutrition technologies. The country’s large-scale farming operations, combined with advanced data-driven nutrient management practices, are accelerating the demand for customized micronutrient solutions. Additionally, a robust agri-input distribution network, farmer awareness campaigns on micronutrient deficiencies, and product innovations such as chelated and controlled-release formulations further support market growth. Growing sustainability initiatives, alongside regulatory encouragement for efficient fertilizer use, are also reinforcing adoption trends across U.S. agriculture.

Canada Nutrients and Micronutrient Fertilizers Market Insight

The Canada Nutrients and Micronutrient Fertilizers Market is projected to witness steady growth during the forecast period, supported by rising awareness of soil fertility challenges, government-backed sustainable agriculture initiatives, and the adoption of modern nutrient application practices. Canadian farmers are increasingly integrating micronutrient-enriched fertilizers into crop management systems to enhance yield, quality, and resilience against environmental stress. The country benefits from a strong agricultural research ecosystem and partnerships promoting innovative crop nutrition practices, particularly in cereals, oilseeds, and horticulture. Furthermore, growing interest in organic and eco-friendly inputs, coupled with the need for climate-smart nutrient solutions, is expected to accelerate market adoption in Canada.

Global Nutrients and Micronutrient Fertilizers Market Share

The global nutrients and micronutrient fertilizers market is primarily led by well-established companies, including:

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- UPL (India)

- Yara (Norway)

- Coromandel International Limited (India)

- FMC Corporation (U.S.)

- Nutrien Ltd. (Canada)

- FEECO International, Inc. (U.S.)

- Borealis AG (Austria)

- EuroChem Group (Switzerland)

- Petrobras (Brazil)

- Helena Agri-Enterprises, LLC (U.S.)

- Olam International (Singapore)

What are the Recent Developments in Global Nutrients and Micronutrient Fertilizers Market ?

- In April 2024, Yara International ASA, a global leader in crop nutrition, announced a major expansion of its micronutrient fertilizer portfolio tailored for African and Southeast Asian markets. The initiative focuses on delivering sustainable nutrient solutions that address critical soil deficiencies and boost crop yields amid climate challenges, reinforcing Yara’s leadership in the fast-growing Global Nutrients and Micronutrient Fertilizers Market.

- In March 2024, Haifa Group launched an innovative range of chelated micronutrient fertilizers optimized for precision agriculture. These products are engineered to improve nutrient use efficiency for cereals, fruits, and vegetables under diverse climatic conditions. This launch exemplifies Haifa’s commitment to supporting sustainable farming with next-generation fertilizer technologies.

- In March 2024, SQM partnered with multiple governmental agricultural agencies in India and Latin America to implement targeted micronutrient supplementation programs. Utilizing advanced application methods, the program aims to combat widespread soil nutrient depletion, enhancing food security and sustainable crop production in emerging economies.

- In February 2024, ICL Group Ltd. entered into strategic collaborations with regional agricultural cooperatives in Southeast Asia to expand access to affordable micronutrient fertilizers. This partnership integrates farmer training and digital tools for precision nutrient management, positioning ICL as a key driver of agricultural modernization and productivity enhancement.

- In January 2024, Nutrien Ltd. unveiled its latest micronutrient formulations at the International Fertilizer Association (IFA) Summit 2024, featuring enhanced bioavailability and eco-friendly compositions suitable for soil, foliar, and fertigation applications. Nutrien’s product rollout underscores its strategy to deliver innovative, sustainable solutions addressing evolving crop nutrition needs worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.