Global O Phenylenediamine Market

Market Size in USD Million

CAGR :

%

USD

211.50 Million

USD

293.94 Million

2024

2032

USD

211.50 Million

USD

293.94 Million

2024

2032

| 2025 –2032 | |

| USD 211.50 Million | |

| USD 293.94 Million | |

|

|

|

|

O-Phenylenediamine Market Size

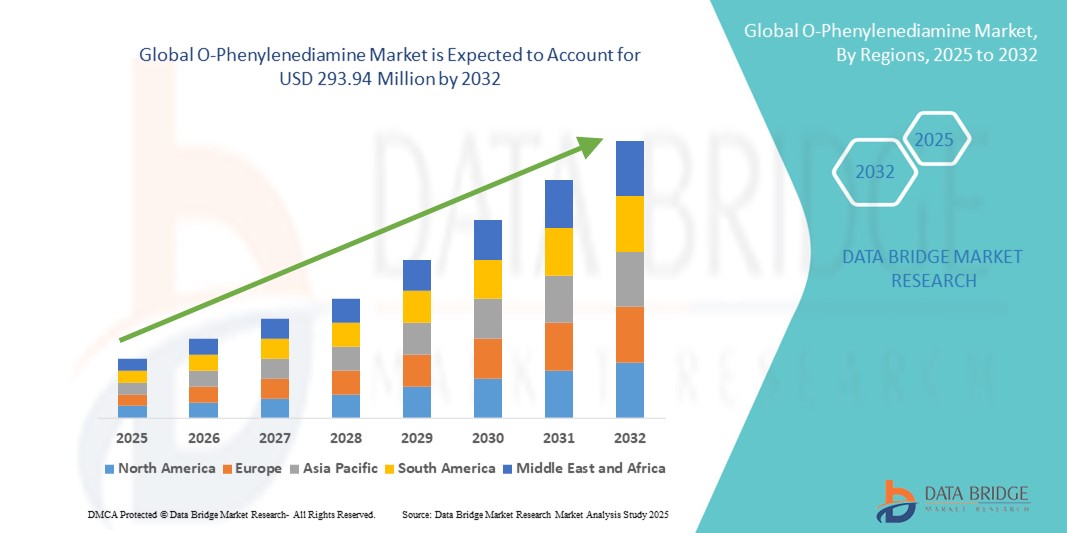

- The global o-phenylenediamine market size was valued at USD 211.5 million in 2024 and is expected to reach USD 293.94 million by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fuelled by increasing demand from the rubber and chemical intermediate industries, as well as rising applications in antioxidants, corrosion inhibitors, and dyes

- Increasing investments in research and development for advanced applications in electronics and pharmaceuticals are further supporting the growth of the o-phenylenediamine market globally

O-Phenylenediamine Market Analysis

- The expanding automotive and manufacturing sectors are driving demand for o-phenylenediamine as a key raw material in rubber additives and polymer production

- Growing awareness regarding the benefits of improved product durability and chemical resistance is boosting its use across various industrial applications

- Asia-Pacific dominated the global O-Phenylenediamine market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, expanding textile manufacturing hubs, and growing demand from personal care industries

- North America region is expected to witness the highest growth rate in the global o-phenylenediamine market, driven by technological advancements in cosmetic formulations, strong pharmaceutical sector growth, and increasing investments in specialty chemicals. In addition, growing awareness of product safety and quality fuels market expansion

- The industrial grade segment dominated the market with the largest market revenue share of 58.6% in 2024, driven by its extensive use in manufacturing dyes and chemical intermediates. Industries prefer industrial grade O-Phenylenediamine for its consistent quality and cost efficiency in large-scale production processes. This grade’s versatility makes it suitable for a wide range of chemical syntheses, ensuring its sustained demand across multiple industrial applications. In addition, the availability of industrial grade O-Phenylenediamine in various purity levels supports different manufacturing requirements, further cementing its dominant position

Report Scope and O-Phenylenediamine Market Segmentation

|

Attributes |

O-Phenylenediamine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

O-Phenylenediamine Market Trends

Increasing Use of O-Phenylenediamine in Chemical Intermediates and Rubber Additives

- The rising application of o-phenylenediamine as a key intermediate in dyes, antioxidants, and corrosion inhibitors is reshaping the market by expanding its industrial relevance. Its critical role in improving product durability and chemical resistance enhances demand across automotive and manufacturing sectors

- Growing adoption in the rubber industry for producing high-performance additives is accelerating market growth, especially in tire manufacturing and industrial rubber goods. This trend is supported by increasing automotive production and stricter quality standards

- The demand for o-phenylenediamine in electronics and pharmaceutical sectors is also increasing due to its chemical versatility, leading to novel application development. Enhanced R&D activities are driving innovation, expanding its usage scope

- For instance, in 2023, several chemical manufacturers introduced improved antioxidant formulations containing o-phenylenediamine, resulting in longer-lasting rubber products and better corrosion resistance, thereby boosting customer confidence and reducing maintenance costs

- While these trends stimulate market growth, sustained innovation and regulatory compliance remain essential for maximizing the compound’s industrial potential. Producers must focus on environmentally friendly processes and application diversification to meet evolving market demands

O-Phenylenediamine Market Dynamics

Driver

Increasing Demand From Automotive And Chemical Industries

- The expanding automotive sector is driving demand for o-phenylenediamine-based antioxidants and additives that improve tire and rubber product performance, enhancing vehicle safety and durability. This growth is fueled by increasing vehicle production globally, especially in emerging economies, and the need for materials that withstand harsh operating conditions. The enhanced performance characteristics reduce maintenance costs and extend product life cycles

- Chemical manufacturers are prioritizing o-phenylenediamine due to its effectiveness in corrosion inhibitors and dye intermediates, supporting growth in coatings and textile industries. The compound’s versatility enables the development of high-quality, durable products with improved chemical resistance, appealing to various industrial applications. Increasing investments in specialty chemicals to meet evolving market demands further bolster this trend

- Rising awareness of product quality and durability among end users is encouraging regular use of o-phenylenediamine-enhanced products, especially in emerging markets with growing industrial bases. Consumers and manufacturers alike are demanding materials that offer longevity and safety, driving the adoption of advanced chemical additives. This heightened demand is also supported by government initiatives promoting industrial modernization and quality standards

- Government regulations promoting safer, longer-lasting materials are also boosting the market, as o-phenylenediamine contributes to product compliance and environmental performance. Regulations targeting improved material safety and environmental impact push manufacturers to adopt additives that meet these standards. Compliance with such policies often results in better market access and increased consumer trust, benefiting companies using o-phenylenediamine

- For instance, in 2022, regulatory changes in Europe mandating stricter quality standards in rubber manufacturing led to increased procurement of o-phenylenediamine-based additives, expanding market opportunities. These regulations aimed to reduce defects and improve product safety across industries. As a result, manufacturers increased their focus on additives that enhance durability and environmental compliance, propelling market growth

- Despite strong drivers, challenges such as volatile raw material prices and environmental concerns require strategic management to sustain market growth. Fluctuating costs can impact production margins and pricing strategies, necessitating efficient supply chain management. In addition, balancing regulatory compliance with cost-effectiveness remains critical for long-term market sustainability

Restraint/Challenge

Health And Environmental Concerns Alongside Price Volatility

- The toxicity and handling risks associated with o-phenylenediamine pose health and environmental challenges, prompting strict regulatory scrutiny and limiting widespread adoption in certain regions. Exposure concerns for workers and communities lead to stringent safety protocols and use restrictions. This regulatory environment increases compliance costs and necessitates investment in safer handling and disposal practices

- Fluctuating raw material costs and supply chain disruptions impact pricing stability, making procurement unpredictable for manufacturers and end-users. Global geopolitical tensions, raw material scarcity, and transportation challenges contribute to this volatility. Manufacturers must adopt flexible sourcing strategies and maintain inventory buffers to mitigate production interruptions and cost surges

- Limited availability of eco-friendly and safer alternatives also restrains market expansion, as industries seek compliant and sustainable solutions. Growing consumer preference and regulatory pressure for green chemistry drive the search for substitutes. However, the complexity of developing effective, sustainable alternatives that match o-phenylenediamine’s performance limits immediate replacement options

- For instance, in 2023, several regions imposed tighter regulations on chemical handling and emissions, increasing compliance costs for o-phenylenediamine producers and affecting market accessibility. These regulations required investments in pollution control technologies and process improvements. The increased operational costs led some producers to reevaluate production scales or explore alternative markets

- In addition, inadequate awareness and training regarding safe use and disposal limit adoption in smaller manufacturing units, especially in developing countries. Lack of technical expertise can result in improper handling, leading to health hazards and environmental contamination. Capacity-building initiatives and educational programs are essential to improve safety and compliance at the grassroots level

- Addressing these challenges through innovation in green chemistry, improved safety protocols, and stable supply chains is critical to unlocking the full market potential of o-phenylenediamine. Research into less toxic variants and biodegradable formulations is ongoing to reduce environmental impact. Collaboration among industry stakeholders, regulators, and researchers is necessary to balance growth with sustainability and safety goals

O-Phenylenediamine Market Scope

The market is segmented on the basis of grade, application, end-user industry, form, and distribution channel.

- By Grade

On the basis of grade, the global O-Phenylenediamine market is segmented into industrial grade and pharma grade. The industrial grade segment dominated the market with the largest market revenue share of 58.6% in 2024, driven by its extensive use in manufacturing dyes and chemical intermediates. Industries prefer industrial grade O-Phenylenediamine for its consistent quality and cost efficiency in large-scale production processes. This grade’s versatility makes it suitable for a wide range of chemical syntheses, ensuring its sustained demand across multiple industrial applications. In addition, the availability of industrial grade O-Phenylenediamine in various purity levels supports different manufacturing requirements, further cementing its dominant position.

The pharma grade segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in pharmaceutical applications that require higher purity and stringent quality standards. Increasing research and development activities in the pharmaceutical sector are contributing to the growth of this segment. The emphasis on safety and efficacy in drug manufacturing also boosts the demand for pharma grade O-Phenylenediamine. Regulatory compliance and certifications required for pharmaceutical ingredients further drive investments in this grade, supporting long-term growth prospects.

- By Application

On the basis of application, the market is segmented into textile dyeing and hair dyes. The textile dyeing segment held the largest market revenue share in 2024, owing to the growing demand for synthetic dyes in the global textile industry. O-Phenylenediamine’s ability to produce vibrant, durable colors drives its preference in this sector. The segment benefits from the increasing global textile production and the rising preference for synthetic fibers that require high-quality dyes. Moreover, the adoption of eco-friendly dyeing processes and innovations in dye chemistry continue to support the demand for O-Phenylenediamine in textile applications.

The hair dyes segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer interest in hair coloring products and expanding personal care markets. The rise in fashion consciousness and self-expression among younger demographics is fueling demand. In addition, innovations in hair dye formulations, focusing on safety and longer-lasting colors, are driving market expansion. Growth in emerging economies with rising disposable incomes also presents significant opportunities for this segment.

- By End-User Industry

On the basis of end-user industry, the market is segmented into chemicals and personal care & cosmetics. The chemicals segment dominated the market in 2024 due to its broad application in dye manufacturing and other chemical processes. This segment’s growth is supported by the continuous demand for high-performance chemicals used in industrial applications worldwide. The integration of O-Phenylenediamine in producing antioxidants, polymers, and other specialty chemicals also contributes to its strong market share. Industrial expansion in developing regions further boosts consumption in this sector.

The personal care & cosmetics segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising demand for innovative hair dye products and cosmetic formulations containing O-Phenylenediamine. Increasing consumer awareness about personal grooming and aesthetic appeal drives this growth. The launch of safer, dermatologically tested products containing this compound enhances consumer confidence. Furthermore, the expansion of retail and online distribution channels provides easy access to these products, accelerating market penetration.

- By Form

On the basis of form, the market is segmented into liquid O-Phenylenediamine and solid O-Phenylenediamine. The solid form segment held the largest market revenue share in 2024, favored for its ease of handling, stability, and wide industrial acceptance. Solids are preferred for their longer shelf life and cost-effective storage, making them a staple in large-scale manufacturing setups. The solid form’s adaptability in various synthesis processes and ease of transportation further supports its market dominance. Moreover, the established supply chains for solid O-Phenylenediamine enable reliable availability globally.

The liquid O-Phenylenediamine segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased adoption in specialized applications requiring precise dosing and ease of mixing. This form is gaining traction in cosmetics and pharmaceutical industries where formulation accuracy is critical. The liquid form’s ability to facilitate faster chemical reactions and integration into automated processes boosts its popularity. In addition, advancements in packaging and storage solutions are making liquid O-Phenylenediamine more user-friendly and commercially viable.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and distributors. The direct sales segment dominated the market in 2024 due to strong manufacturer relationships with large industrial clients and bulk purchasing agreements. This channel ensures cost advantages and personalized services for key accounts, fostering long-term contracts. Manufacturers often prefer direct sales for better control over pricing, quality, and supply chain logistics. The direct sales approach also facilitates customized solutions tailored to client specifications, enhancing customer loyalty.

The distributors segment is expected to witness the fastest growth rate from 2025 to 2032, benefiting from its wide reach in regional markets and ability to serve diverse customer segments, especially in emerging economies and smaller-scale applications. Distributors provide flexibility and faster delivery times for customers with lower volume requirements. Their established networks enable penetration into untapped markets and remote regions. The growing importance of e-commerce and digital platforms is also supporting distributors in expanding their market footprint. In addition, distributors offer value-added services such as technical support and after-sales assistance, contributing to their rising preference among end-users.

O-Phenylenediamine Market Regional Analysis

• Asia-Pacific dominated the global O-Phenylenediamine market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, expanding textile manufacturing hubs, and growing demand from personal care industries.

• Countries such as China, India, and Japan are key contributors to the region’s market dominance due to increasing investments in chemical production facilities and rising consumer awareness of hair dye products.

• The region’s competitive manufacturing capabilities, coupled with supportive government initiatives promoting the chemical and personal care sectors, are accelerating the adoption of O-Phenylenediamine across multiple applications.

China O-Phenylenediamine Market Insight

The China O-Phenylenediamine market accounted for the largest revenue share in the Asia-Pacific region in 2024, fueled by the country’s expanding textile industry and growing demand for hair dyes and cosmetic products. Strong domestic chemical manufacturing infrastructure and availability of raw materials support cost-effective production. In addition, increasing consumer spending on personal grooming and rising exports of textile and cosmetic products contribute to sustained growth. Government policies encouraging innovation and sustainable manufacturing further enhance market prospects.

Japan O-Phenylenediamine Market Insight

Japan’s O-Phenylenediamine market is expected to witness the fastest growth rate from 2025 to 2032 due to rising demand from the personal care sector and textile industry. The country’s technologically advanced manufacturing processes and emphasis on product safety help maintain high-quality standards. Growing consumer preference for innovative and safe hair dye products, coupled with Japan’s aging population, is expected to drive demand for easy-to-use cosmetic solutions containing O-Phenylenediamine. In addition, Japan’s investments in sustainable chemical production contribute to the market’s positive outlook.

North America O-Phenylenediamine Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, led by strong demand from the personal care & cosmetics industry and specialty chemical manufacturers. The region’s focus on high-quality and regulatory-compliant products drives demand for pharma grade O-Phenylenediamine. Technological advancements, innovation in hair dye formulations, and increasing consumer preference for premium personal care products support market growth. In addition, the well-established distribution network and presence of key market players enhance accessibility and supply chain efficiency.

U.S. O-Phenylenediamine Market Insight

The U.S. O-Phenylenediamine market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong demand from the personal care & cosmetics and specialty chemicals industries. Increasing consumer focus on hair care and cosmetic products with advanced formulations fuels the uptake of pharma grade O-Phenylenediamine. The presence of major manufacturers and suppliers, combined with advanced R&D infrastructure, supports innovation and product development. In addition, growing awareness about product safety and regulatory compliance encourages the adoption of high-purity O-Phenylenediamine in pharmaceutical and personal care applications.

Europe O-Phenylenediamine Market Insight

The Europe O-Phenylenediamine market is expected to witness the fastest growth rate from 2025 to 2032, supported by growing demand for sustainable and safe hair dye products and stringent regulations on chemical safety. Countries such as Germany, France, and the U.K. are prominent markets, driven by consumer awareness regarding product safety and eco-friendly formulations. The region’s emphasis on innovation in personal care and cosmetics also fuels growth. Furthermore, Europe’s well-developed chemical industry infrastructure and increasing investments in green chemistry initiatives provide additional momentum.

Germany O-Phenylenediamine Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by its robust chemical manufacturing sector and growing demand for high-purity pharma grade products. Increasing adoption of eco-conscious manufacturing practices and regulatory compliance further influence market growth. Germany’s strong R&D capabilities and presence of leading cosmetic brands contribute to innovation and steady consumption of O-Phenylenediamine in personal care applications. The demand for advanced hair dye products and industrial dyes also supports steady market expansion.

U.K. O-Phenylenediamine Market Insight

The U.K. O-Phenylenediamine market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for hair dyes and textile dyes. Rising consumer interest in premium personal care products and stringent regulations on chemical safety drive demand for pharma grade and industrial grade O-Phenylenediamine. The U.K.’s strong retail and e-commerce sectors facilitate product availability to end-users, while investments in sustainable and eco-friendly chemical manufacturing practices contribute to market growth. Furthermore, the expanding cosmetics and pharmaceutical sectors bolster the overall demand within the country.

O-Phenylenediamine Market Share

The o-phenylenediamine industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Lanxess AG (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Wanhua Chemical Group Co., Ltd. (China)

- Hubei Xinsan Chemistry Co., Ltd. (China)

- CABB Group GmbH (Germany)

- Rita Chemical Co., Ltd. (China)

- LORD Corporation (U.S.)

- Johnson Matthey Plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.