Global Oat Based Snacks Market

Market Size in USD Billion

CAGR :

%

USD

20.62 Billion

USD

29.36 Billion

2024

2032

USD

20.62 Billion

USD

29.36 Billion

2024

2032

| 2025 –2032 | |

| USD 20.62 Billion | |

| USD 29.36 Billion | |

|

|

|

|

Global Oat-Based Snacks Market Size

- The global Oat-Based Snacks Market size was valued at USD 20.62 billion in 2024 and is projected to reach USD 29.36 billion by 2032, growing at a CAGR of 4.52% during the forecast period.

- The market expansion is primarily driven by rising health consciousness and the increasing preference for clean-label, plant-based, and nutrient-rich snack options among consumers worldwide.

- Additionally, the growing availability of innovative oat-based products across supermarkets and online channels is enhancing consumer access, while ongoing product diversification by key players is further propelling market demand and accelerating global growth.

Global Oat-Based Snacks Market Analysis

- Oat-based snacks, made primarily from oats and often enriched with natural ingredients, are becoming essential components of modern healthy diets in both individual and commercial consumption settings due to their nutritional benefits, versatility, and alignment with clean-label and plant-based food trends.

- The rising demand for oat-based snacks is primarily fueled by increasing health awareness, growing incidences of lifestyle-related diseases, and a global shift toward convenient, high-fiber, and on-the-go snacking alternatives.

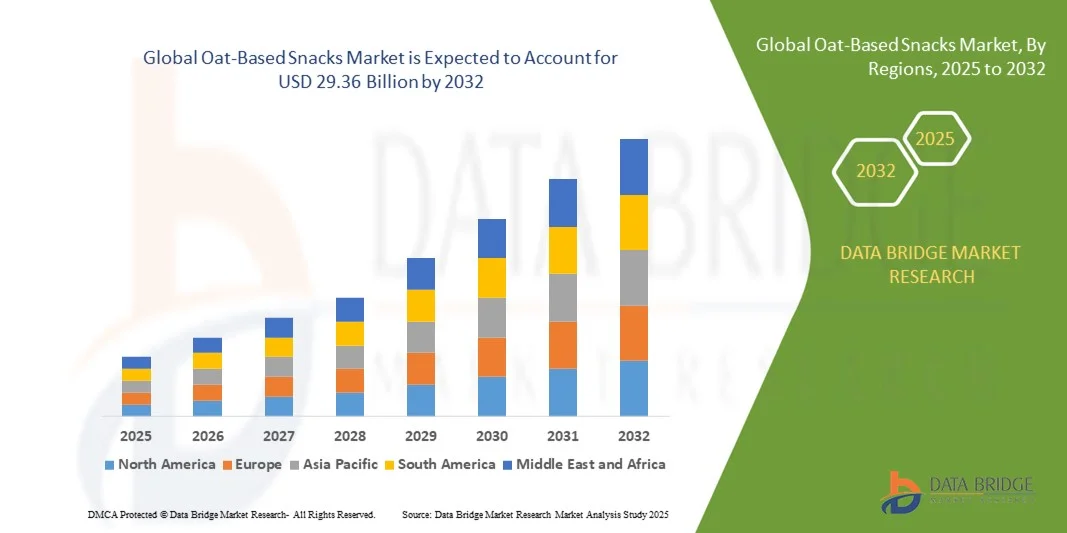

- North America dominated the Global Oat-Based Snacks Market with the largest revenue share of 33.3% in 2024, driven by strong consumer preference for healthier snack options, widespread product availability, and the presence of major food brands launching innovative oat-based lines, particularly in the U.S., which has seen rapid adoption of organic and gluten-free snacks.

- Asia-Pacific is expected to be the fastest growing region in the Global Oat-Based Snacks Market during the forecast period due to increasing urbanization, growing middle-class population, and rising awareness of the health benefits associated with oat consumption.

- The oat-based bakery and bars segment dominated the market with the largest revenue share of 58.6% in 2024, driven by rising consumer preference for convenient, nutritious, and portable snacks

Report Scope and Global Oat-Based Snacks Market Segmentation

|

Attributes |

Oat-Based Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Oat-Based Snacks Market Trends

Product Innovation and Functional Health Benefits Driving Market Evolution

- A significant and accelerating trend in the global Oat-Based Snacks Market is the increasing focus on product innovation that aligns with consumer demands for functional health benefits, clean-label ingredients, and convenient formats. This trend is reshaping the competitive landscape as brands introduce oat-based products fortified with proteins, vitamins, minerals, and plant-based components to cater to a health-conscious population.

- For instance, General Mills has expanded its Nature Valley line to include oat-based protein bars with added superfoods such as chia and flax seeds, targeting fitness-focused consumers. Similarly, BOBO’S has introduced oat bars that are certified gluten-free, non-GMO, and made with minimal ingredients, aligning with the clean-eating movement.

- Functional oats are increasingly being used as carriers for health-promoting ingredients such as prebiotics, probiotics, and heart-healthy fibers like beta-glucan. These components support digestive wellness, cholesterol reduction, and sustained energy release—attributes highly valued by today’s health-aware consumers. For example, Quaker’s heart-health oat range leverages beta-glucan messaging to appeal to consumers managing cholesterol levels.

- The integration of health-forward innovations with convenience-based formats—like ready-to-eat oat bites, single-serve pouches, and shelf-stable oat beverages—is broadening market appeal. These developments are particularly resonating with busy professionals, students, and urban dwellers seeking nutritious snacking alternatives on the go.

- This innovation-driven approach is also leading to the emergence of niche oat-based products tailored to dietary needs such as keto-friendly, low-sugar, vegan, or allergen-free options. Companies like Libre Naturals are tapping into this space with allergen-conscious oat snacks that cater to families and individuals with dietary restrictions.

- The growing demand for oat-based snacks that deliver both convenience and functional health benefits is accelerating across global markets, especially among millennials and Gen Z consumers who value transparency, nutrition, and sustainability in their food choices.

Global Oat-Based Snacks Market Dynamics

Driver

Growing Demand Fueled by Health Awareness and Snacking Convenience

-

The rising global awareness around health and wellness, coupled with changing consumer lifestyles, is a major factor driving increased demand for oat-based snacks. Consumers are actively seeking nutritious, on-the-go alternatives that align with dietary goals such as high fiber intake, weight management, and plant-based nutrition.

- For instance, in March 2024, General Mills expanded its Nature Valley line with high-protein oat snack bars targeting active consumers and those seeking sustained energy. Similar initiatives by leading companies are expected to continue fueling growth in the oat-based snacks segment throughout the forecast period.

- As consumers shift away from traditional high-sugar and high-fat snack options, oat-based products are being favored for their whole grain content, heart-health benefits, and natural ingredients. These snacks often contain minimal processing, clean-label formulations, and functional benefits such as cholesterol-lowering beta-glucan.

- Furthermore, the growing trend of meal skipping—especially among urban professionals and students—has increased the popularity of convenient, portable snack formats. Oat-based bars, bites, cookies, and drinks are becoming staple choices in modern snacking, fitting easily into busy routines without compromising nutritional value.

- The rise of e-commerce and health-focused retail platforms has made oat-based snacks more accessible than ever, while increasing visibility through digital marketing, influencer endorsements, and sustainability-focused branding is strengthening consumer engagement across global markets.

Restraint/Challenge

High Competition and Perceived Bland Taste Among Certain Consumer Segments

- Despite growing popularity, the oat-based snacks market faces challenges from intense competition in the healthy snacks segment, where consumers have access to a wide range of alternatives including nut-based bars, fruit snacks, and protein-fortified products. This saturation makes brand differentiation increasingly difficult.

- For Instance, while oats are recognized for their health benefits, some consumers perceive oat-based snacks as bland or texturally monotonous compared to more indulgent or exotic snack options. This perception can limit appeal, especially among younger demographics seeking more flavor variety or novelty.

- To address these concerns, leading brands are investing in recipe innovation, combining oats with exciting ingredients such as dark chocolate, exotic fruits, spices, or superfoods to enhance flavor and mouthfeel. For instance, BOBO’S and Stoats have introduced flavor-rich variants like peanut butter and coconut to attract a broader audience.

- Another challenge is pricing. Oat-based snacks, particularly organic or specialty options, can be priced higher than traditional snacks, making them less accessible to price-sensitive consumers in developing regions.

- Overcoming these barriers will require continued investment in flavor innovation, competitive pricing strategies, and effective marketing that highlights both the taste and health benefits of oat-based snacks to win over skeptical or cost-conscious consumers.

Global Oat-Based Snacks Market Scope

The oat-based snacks market is segmented on the basis of product and distribution channel.

- By Product

On the basis of product, the Global Oat-Based Snacks Market is segmented into oat-based bakery and bars, oat-based savory, and others. The oat-based bakery and bars segment dominated the market with the largest revenue share of 58.6% in 2024, driven by rising consumer preference for convenient, nutritious, and portable snacks. Products like granola bars, oat cookies, and breakfast bars are widely popular due to their high fiber content, natural ingredients, and energy-boosting properties. Their appeal to health-conscious individuals, busy professionals, and fitness enthusiasts contributes to consistent demand.

The oat-based savory segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing innovation in salty oat snacks such as oat crisps, chips, and crackers. These products offer a healthier alternative to traditional salty snacks, tapping into demand for guilt-free snacking. Growing interest in functional savory snacks with added spices, seeds, or superfoods is expected to further fuel this segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the Global Oat-Based Snacks Market is segmented into hypermarkets and supermarkets, convenience stores, retailers, and others. The hypermarkets and supermarkets segment accounted for the largest market revenue share of 44.3% in 2024, as these outlets remain the most preferred shopping destination for packaged food and snacks. Their widespread presence, coupled with the availability of a broad product range, promotional deals, and product visibility, drives consumer preference for purchasing oat-based snacks through this channel.

The online retailers sub-segment within "others" is projected to witness the fastest CAGR from 2025 to 2032, driven by the rapid expansion of e-commerce platforms, increased digital penetration, and changing consumer behavior towards online grocery shopping. The ease of doorstep delivery, product comparison, availability of niche brands, and subscription-based health snack services are significantly enhancing the growth of oat-based snack sales through online platforms, especially among millennials and urban consumers.

Global Oat-Based Snacks Market Regional Analysis

- North America dominated the Global Oat-Based Snacks Market with the largest revenue share of 33.3% in 2024, driven by increasing consumer health awareness, busy lifestyles, and high demand for convenient, nutritious snack options.

- Consumers in the region prioritize products that offer clean-label ingredients, functional health benefits, and on-the-go convenience, fueling the popularity of oat-based bakery items, bars, and savory snacks.

- This strong market position is further supported by well-established retail infrastructure, widespread availability in supermarkets and convenience stores, and growing online sales channels. Additionally, rising interest in plant-based and sustainable foods among North American consumers is encouraging innovation and new product launches in the oat-based snacks category.

U.S. Oat-Based Snacks Market Insight

The U.S. oat-based snacks market captured the largest revenue share of 81% in 2024 within North America, driven by heightened consumer focus on health, wellness, and convenience. Busy lifestyles and increasing demand for nutritious, on-the-go snacking options are fueling the popularity of oat-based bars, bakery items, and savory snacks. The expanding availability of clean-label, organic, and functional oat snacks through both brick-and-mortar retailers and e-commerce platforms further supports market growth. Additionally, growing interest in plant-based diets and sustainable food products is encouraging innovation and product diversification in the U.S. market.

Europe Oat-Based Snacks Market Insight

The Europe oat-based snacks market is projected to experience significant CAGR growth during the forecast period, supported by rising health awareness and increasing demand for natural, minimally processed snacks. Regulatory emphasis on clean-label and nutritional standards is pushing manufacturers to innovate oat-based products with functional benefits such as high fiber and protein content. Urbanization, coupled with changing snacking habits, is driving adoption across residential and workplace environments. The market also benefits from a strong presence of established snack brands and growing consumer preference for plant-based and sustainable food options.

U.K. Oat-Based Snacks Market Insight

The U.K. oat-based snacks market is expected to grow at a notable CAGR over the forecast period, fueled by the increasing trend toward healthy snacking and functional foods. Consumers are seeking convenient oat-based products that fit into busy lifestyles without compromising nutrition. Additionally, the U.K.’s well-developed retail and online grocery sectors enhance product accessibility. Concerns over obesity and lifestyle-related diseases are encouraging both consumers and retailers to prioritize wholesome oat snacks. Innovations targeting flavor variety and clean-label ingredients are also boosting demand.

Germany Oat-Based Snacks Market Insight

The Germany oat-based snacks market is set to expand steadily during the forecast period, driven by rising health consciousness and a growing preference for whole grain and fiber-rich foods. Germany’s emphasis on sustainability and quality standards supports the adoption of organic and natural oat-based products. The presence of a mature retail network and increasing interest in plant-based diets further boost market prospects. German consumers also favor snacks with functional benefits, such as digestive health and cholesterol reduction, positioning oat-based snacks as a preferred choice.

Asia-Pacific Oat-Based Snacks Market Insight

The Asia-Pacific oat-based snacks market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and evolving consumer preferences toward healthier snacking. Countries like China, Japan, and India are witnessing increasing demand for convenient, nutritious snacks as busy lifestyles and health awareness grow. Government initiatives promoting better nutrition and food innovation are further propelling market expansion. The region also benefits from growing modern retail infrastructure and e-commerce penetration, improving product accessibility.

Japan Oat-Based Snacks Market Insight

The Japan oat-based snacks market is gaining traction due to the country’s aging population, high health consciousness, and preference for functional foods. Japanese consumers prioritize convenience alongside nutritional benefits, driving demand for ready-to-eat oat-based snacks integrated with traditional and superfood ingredients. The integration of oats in snack bars, biscuits, and savory products aligns with Japan’s culture of balanced diets. Additionally, technological advancements in food processing and packaging are enhancing product appeal and shelf life.

China Oat-Based Snacks Market Insight

The China oat-based snacks market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, a growing middle class, and increased health awareness. Oat-based snacks are becoming popular as consumers seek healthier alternatives to conventional snacks amid rising concerns about diet-related health issues. The government’s push towards healthier eating habits and smart city initiatives supporting food innovation contribute to the market’s growth. Furthermore, domestic manufacturers are expanding product portfolios and offering affordable oat-based options, broadening consumer reach.

Global Oat-Based Snacks Market Share

The Oat-Based Snacks industry is primarily led by well-established companies, including:

• Kellogg NA Co. (U.S.)

• Mondelez International (U.S.)

• Britannia Industries Ltd. (India)

• Nairn's Oatcakes Limited (U.K.)

• The Quaker Oats Company (U.S.)

• BOBO'S (U.S.)

• Uncle Tobys (Australia)

• Libre Naturals Inc. (U.S.)

• STOATS (Ireland)

• SERIOUS FOODS BELGIUM sprl (Belgium)

• Seven Sundays (U.S.)

• Del Monte Foods, Inc. (U.S.)

• Chicago Bar Company LLC (U.S.)

• Hearthside Food Solutions LLC (U.S.)

• Paterson Arran (U.K.)

• Nature Delivered Ltd. (U.K.)

• General Mills Inc. (U.S.)

What are the Recent Developments in Global Oat-Based Snacks Market?

- In April 2023, General Mills Inc., a key player in the oat-based snacks segment, launched a new line of gluten-free oat snack bars under its Nature Valley brand. This product line is tailored to meet the growing demand for allergen-free, clean-label snacks that provide both convenience and nutrition. The launch reinforces General Mills’ strategic focus on health-forward product innovation and strengthens its position in the competitive North American oat snacks market, especially among health-conscious consumers seeking functional, on-the-go options.

- In March 2023, Britannia Industries Ltd., a leading Indian food manufacturer, introduced its Oats and Honey NutriChoice biscuits across key urban markets in India. This product targets the growing segment of consumers looking for digestive health and energy-boosting snack options. The initiative reflects Britannia’s ongoing efforts to modernize its biscuit portfolio by incorporating whole grains like oats, addressing the increasing preference for functional and nutritious snacks in the region’s rapidly evolving food landscape.

- In March 2023, NAIRN’S Oatcakes Limited expanded its product offerings in the U.K. by launching a new line of oat-based savory thins made with natural ingredients and no artificial preservatives. These snacks are positioned as healthy alternatives to conventional chips and crackers, catering to consumers seeking guilt-free indulgence. This move highlights Nairn’s strategy to diversify its oat product portfolio and capitalize on the rising demand for better-for-you savory snacks in European markets.

- In February 2023, BOBO’S, a U.S.-based oat snack manufacturer, announced its entry into the Canadian market through a partnership with a major health-focused retail distributor. This expansion is part of BOBO’S growth strategy to tap into new geographies where demand for clean-label, plant-based snacks is on the rise. The company aims to leverage its existing brand appeal and product transparency to gain traction among Canadian consumers prioritizing health, sustainability, and ingredient simplicity.

- In January 2023, Mondelez International unveiled a new oat-based granola cluster product under its belVita brand in select European and North American markets. This innovation combines oats with superfood ingredients such as flax seeds and dried berries to appeal to the breakfast and healthy snacking categories. The launch aligns with Mondelez’s broader strategy to drive growth through wellness-oriented snacking solutions and respond to evolving consumer preferences for nutrient-rich, functional foods.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oat Based Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oat Based Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oat Based Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.