Global Obesity Prescription Drug Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

4.57 Billion

2025

2033

USD

2.47 Billion

USD

4.57 Billion

2025

2033

| 2026 –2033 | |

| USD 2.47 Billion | |

| USD 4.57 Billion | |

|

|

|

|

Obesity Prescription Drug Market Size

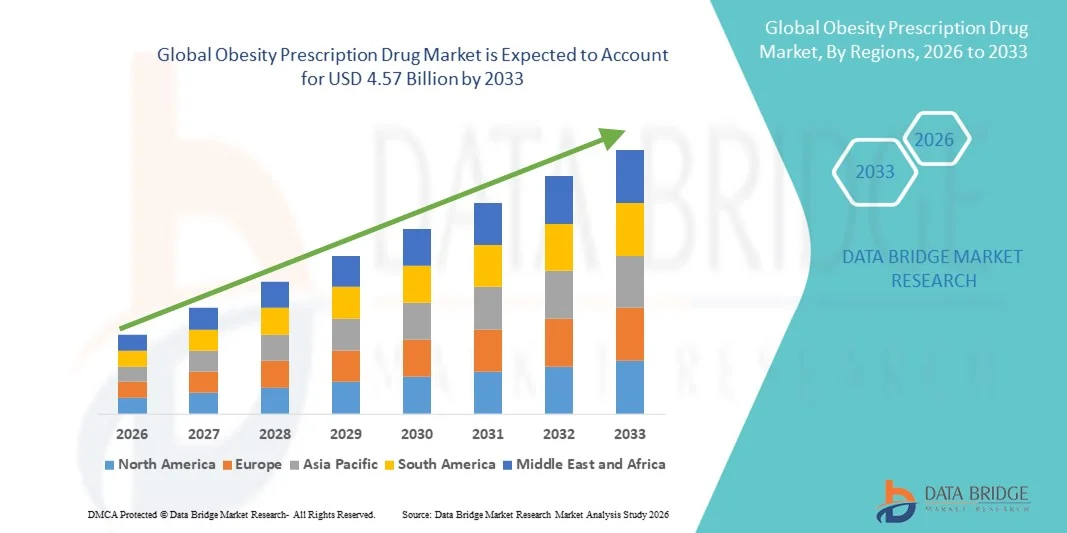

- The global obesity prescription drug market size was valued at USD 2.47 billion in 2025 and is expected to reach USD 4.57 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by increasing prevalence of obesity worldwide, rising awareness of obesity-related health risks, and growing adoption of prescription drugs as a preferred treatment option over surgical interventions

- Furthermore, advancements in drug formulations, development of combination therapies, and strong support from healthcare providers are accelerating the uptake of Obesity Prescription Drug solutions, thereby significantly boosting the industry's growth

Obesity Prescription Drug Market Analysis

- Obesity prescription drugs, offering clinically validated pharmacological support for weight management and metabolic regulation, are increasingly vital components of modern obesity treatment strategies in both hospital-based and outpatient care settings due to their proven efficacy, convenience of use, and integration with comprehensive lifestyle and medical management programs

- The escalating demand for obesity prescription drugs is primarily fueled by the rising global prevalence of obesity, increasing awareness of obesity-related chronic conditions, growing physician preference for early pharmacological intervention, and a strong shift toward effective, long-term, non-surgical weight-loss solutions

- North America dominated the obesity prescription drug market with the largest revenue share of 41.6% in 2025, supported by high obesity rates, strong prescription drug adoption, advanced healthcare infrastructure, and the early availability of novel FDA-approved weight-loss medications in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the obesity prescription drug market during the forecast period, registering a CAGR of 9.9%, driven by rapidly increasing obesity prevalence, changing lifestyles, rising healthcare expenditure, and growing awareness in countries such as China and India

- The GLP-1 Receptor Agonists segment dominated the largest market revenue share of approximately 48.6% in 2025, driven by strong clinical efficacy in weight reduction, appetite control, and glycemic regulation

Report Scope and Obesity Prescription Drug Market Segmentation

|

Attributes |

Obesity Prescription Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Novo Nordisk (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Obesity Prescription Drug Market Trends

Rising Focus on Effective Weight Management and Obesity Prevention

- A significant and accelerating trend in the global obesity prescription drug market is the growing emphasis on pharmacological solutions for obesity management, driven by the rising prevalence of obesity, lifestyle-related disorders, and metabolic syndromes across developed and developing regions

- For instance, in 2024, Novo Nordisk expanded the global reach of its GLP-1 receptor agonist therapy across North America, Europe, and Asia-Pacific, targeting patients with obesity and related comorbidities such as type 2 diabetes and cardiovascular disorders

- Advancements in drug formulations, such as combination therapies, extended-release versions, and improved efficacy with minimal side effects, are attracting a larger patient base and expanding treatment options

- The integration of obesity prescription drugs with digital health platforms for patient monitoring, adherence tracking, and outcome measurement is further enhancing the overall management of obesity worldwide

- Growing awareness about obesity-related health risks and an increasing number of healthcare initiatives promoting weight management programs are reinforcing demand for pharmacological interventions

- This trend toward evidence-based, clinically supported obesity treatments is transforming the global obesity management landscape and reshaping the approach to preventive and therapeutic care

Obesity Prescription Drug Market Dynamics

Driver

Rising Prevalence of Obesity and Lifestyle Disorders

- The global increase in obesity rates, sedentary lifestyles, unhealthy dietary patterns, and associated comorbidities is a primary driver for the growth of the obesity prescription drug market

- For instance, in 2023, Eli Lilly reported a surge in the adoption of its obesity medication across multiple regions including North America, Europe, and Latin America, reflecting the growing clinical demand for effective pharmacological interventions

- Healthcare providers and policymakers are emphasizing early intervention and long-term management strategies, prompting more patients to seek prescription-based treatments alongside lifestyle modification programs

- Government initiatives, reimbursement policies, and public awareness campaigns aimed at reducing obesity prevalence are also driving market expansion

- The rising acceptance of pharmacological therapies as part of comprehensive obesity management programs is further contributing to the market’s steady growth

Restraint/Challenge

High Cost, Side Effects, and Limited Accessibility

- The high cost of advanced obesity prescription drugs can limit patient access, particularly in low- and middle-income countries where healthcare coverage is limited

- For instance, in 2024, several healthcare systems in Southeast Asia delayed adoption of newer GLP-1 receptor agonist therapies due to pricing and reimbursement challenges

- Potential side effects, including gastrointestinal discomfort, nausea, and risk of long-term complications, can reduce patient adherence and limit widespread use

- Regulatory restrictions, varying approval timelines across regions, and the need for rigorous clinical validation for new drugs can also impede market growth

- Addressing these challenges through more affordable treatment options, patient education programs, expanded insurance coverage, and continuous safety monitoring will be crucial for sustained growth in the global Obesity Prescription Drug market

Obesity Prescription Drug Market Scope

The market is segmented on the basis of type and end user.

- By Type

On the basis of type, the Obesity Prescription Drug market is segmented into Lipase Inhibitors, Appetite Suppressants, GLP-1 Receptor Agonists, Combination Therapy, and Others. The GLP-1 Receptor Agonists segment dominated the largest market revenue share of approximately 48.6% in 2025, driven by strong clinical efficacy in weight reduction, appetite control, and glycemic regulation. These drugs have gained rapid physician and patient acceptance due to proven long-term outcomes and favorable safety profiles. Increasing prevalence of obesity-related comorbidities such as type-2 diabetes and cardiovascular diseases further supports adoption. Regulatory approvals across major markets and strong reimbursement coverage enhance accessibility. Pharmaceutical innovation, including once-weekly injectable formulations, improves patient adherence. Aggressive marketing strategies by leading players also contribute to dominance. Rising prescription volumes in North America and Europe reinforce market leadership. Clinical trial success and guideline inclusion strengthen physician confidence. Growing awareness of metabolic health further fuels demand. The segment benefits from strong pipeline development. Overall, GLP-1 drugs remain the cornerstone of pharmacological obesity management.

The Combination Therapy segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by increasing demand for multi-mechanism treatment approaches. Combination drugs offer synergistic benefits by addressing appetite, metabolism, and fat absorption simultaneously. Physicians increasingly prescribe combination therapies for patients with severe or treatment-resistant obesity. Clinical evidence demonstrating improved efficacy over monotherapy supports growth. Rising R&D investments accelerate development of novel combinations. Regulatory agencies are showing greater acceptance of combination drug approvals. Expanding patient populations seeking personalized treatment further boost demand. Improved tolerability profiles enhance compliance. Adoption is growing rapidly in both developed and emerging markets. Increased obesity prevalence among younger adults supports uptake. Strategic partnerships between pharmaceutical companies accelerate commercialization. This segment represents the future of obesity drug innovation.

- By End User

On the basis of end user, the Obesity Prescription Drug market is segmented into Adults and Pediatric. The Adults segment accounted for the largest market revenue share of approximately 72.9% in 2025, driven by the high prevalence of obesity among working-age and elderly populations. Sedentary lifestyles, unhealthy dietary patterns, and rising stress levels significantly increase obesity rates in adults. Adults are more likely to seek pharmacological treatment due to obesity-related complications such as diabetes and hypertension. Higher healthcare spending capacity supports prescription drug adoption. Physicians commonly prescribe long-term obesity medications for adults. Strong insurance coverage in developed countries further supports dominance. Growing awareness of weight-related health risks encourages early intervention. Adult clinical trial availability accelerates drug approvals. Corporate wellness programs indirectly promote treatment uptake. Rising urbanization contributes to sustained demand. Adults remain the primary target population for obesity pharmacotherapy.

The Pediatric segment is projected to register the fastest CAGR of 20.1% from 2026 to 2033, driven by the alarming rise in childhood obesity globally. Increasing screen time, reduced physical activity, and poor nutrition habits contribute to pediatric obesity. Governments and healthcare organizations are emphasizing early intervention strategies. Expanding clinical research on safe pediatric obesity drugs supports market growth. Regulatory approvals for adolescent obesity treatments are increasing. Parental awareness regarding long-term health consequences fuels demand. Pediatric endocrinologists increasingly recommend pharmacotherapy alongside lifestyle modification. School health screening programs support early diagnosis. Pharmaceutical companies are investing in age-specific formulations. Improved safety data increases physician confidence. Emerging markets show strong growth potential. This segment is expected to gain significant traction over the forecast period.

Obesity Prescription Drug Market Regional Analysis

- North America dominated the obesity prescription drug market with the largest revenue share of 41.6% in 2025, supported by high obesity prevalence, strong prescription drug adoption, advanced healthcare infrastructure, and the early availability of FDA-approved weight-loss medications

- The region benefits from widespread physician awareness, strong reimbursement frameworks, and rapid uptake of novel pharmacological therapies targeting chronic weight management

- Increasing demand for long-term obesity treatment, combined with continuous clinical advancements and strong pharmaceutical R&D activity, continues to reinforce North America’s leading position across both public and private healthcare settings

U.S. Obesity Prescription Drug Market Insight

The U.S. obesity prescription drug market accounted for the largest revenue share within North America in 2025, driven by high obesity incidence, early regulatory approvals of next-generation weight-loss drugs, and strong patient access to prescription therapies. The presence of major pharmaceutical companies, extensive clinical trial activity, and favorable insurance coverage for obesity treatment are accelerating market growth. Additionally, rising awareness of obesity-related comorbidities such as diabetes and cardiovascular diseases is increasing long-term demand for prescription-based weight management solutions.

Europe Obesity Prescription Drug Market Insight

The Europe obesity prescription drug market is projected to expand at a steady CAGR during the forecast period, supported by growing obesity awareness, improving access to pharmacological treatments, and increasing healthcare expenditure. Regulatory approvals of innovative anti-obesity drugs and expanding physician acceptance of prescription-based interventions are contributing to market expansion. Growth is being observed across both hospital and outpatient settings, particularly in Western European countries.

U.K. Obesity Prescription Drug Market Insight

The U.K. obesity prescription drug market is anticipated to grow at a notable CAGR, driven by rising obesity prevalence and increasing government focus on preventive healthcare. The National Health Service (NHS) is gradually expanding access to prescription obesity treatments, particularly for high-risk patient populations. Growing public awareness campaigns and improving clinical guidelines for obesity management are further supporting market growth.

Germany Obesity Prescription Drug Market Insight

The Germany obesity prescription drug market is expected to expand at a considerable CAGR, supported by strong healthcare infrastructure and increasing acceptance of pharmaceutical obesity treatments. Rising diagnosis rates, growing physician adoption of evidence-based weight-loss medications, and favorable reimbursement policies are strengthening demand. Germany’s emphasis on chronic disease management aligns well with the growing role of prescription drugs in obesity treatment.

Asia-Pacific Obesity Prescription Drug Market Insight

The Asia-Pacific obesity prescription drug market is expected to be the fastest growing region during the forecast period, registering a CAGR of 9.9%. Growth is driven by rapidly increasing obesity rates, changing dietary habits, rising disposable incomes, and expanding access to healthcare services. Governments across the region are placing greater emphasis on obesity management as part of broader public health initiatives, creating strong growth opportunities for prescription drug manufacturers.

Japan Obesity Prescription Drug Market Insight

The Japan obesity prescription drug market is witnessing gradual growth due to increasing lifestyle-related health issues and rising awareness of obesity-associated risks. While traditionally conservative in obesity pharmacotherapy adoption, growing clinical evidence and physician acceptance of prescription treatments are supporting market expansion. An aging population and increasing metabolic disorder prevalence are also contributing factors.

China Obesity Prescription Drug Market Insight

The China obesity prescription drug market accounted for the largest revenue share in Asia-Pacific in 2025, driven by a rapidly expanding obese population, urbanization, and changing lifestyles. Increasing government focus on chronic disease prevention, improving access to prescription therapies, and growing investments by domestic and multinational pharmaceutical companies are accelerating market growth. Rising awareness and expanding healthcare coverage are expected to further strengthen China’s position in the regional market.

Obesity Prescription Drug Market Share

The Obesity Prescription Drug industry is primarily led by well-established companies, including:

• Novo Nordisk (Denmark)

• Eli Lilly and Company (U.S.)

• Pfizer Inc. (U.S.)

• F. Hoffmann-La Roche Ltd. (Switzerland)

• AstraZeneca plc (U.K.)

• Sanofi S.A. (France)

• Boehringer Ingelheim (Germany)

• GlaxoSmithKline plc (U.K.)

• AbbVie Inc. (U.S.)

• Takeda Pharmaceutical Company Limited (Japan)

• Amgen Inc. (U.S.)

• Bayer AG (Germany)

• Johnson & Johnson (U.S.)

• Merck & Co., Inc. (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• VIVUS Inc. (U.S.)

• Currax Pharmaceuticals LLC (U.S.)

• Arena Pharmaceuticals (U.S.)

• Orexigen Therapeutics (U.S.)

• Zydus Lifesciences Ltd. (India)

Latest Developments in Global Obesity Prescription Drug Market

- In December 2025, the U.S. Food and Drug Administration (FDA) approved the first ever daily oral version of Wegovy, an obesity drug containing 25 mg of semaglutide, designed for chronic weight management in adults. This oral GLP-1 receptor agonist marks a significant milestone in obesity treatment by offering an alternative to weekly injections, improving convenience and adherence for patients with obesity or overweight conditions with comorbidities. Clinical trial data showed meaningful weight loss, comparable to the injectable version, with about 16.6% mean body weight reduction, and highlighted benefits on cardiovascular risk — underscoring a shift toward more accessible pharmacological therapies for obesity

- In March 2025, Eli Lilly officially launched its weight-loss drug Mounjaro (tirzepatide) in India after receiving approval from the country’s drug regulator. The launch expanded access in one of the world’s largest and fastest-growing markets for obesity and metabolic disease therapies, addressing the dual burden of obesity and type 2 diabetes in the region. This move aligned with Lilly’s global strategy to broaden the reach of its dual-acting GIP/GLP-1 receptor agonist, strengthening its presence in emerging markets alongside established markets in Europe and North America

- In May 2025, Danish pharmaceutical leader Novo Nordisk prepared to introduce its blockbuster injectable obesity medication Wegovy in India, preparing to tap into a rapidly expanding treatment landscape as local demand for GLP-1–based therapies grows. Wegovy’s entry into India represents a key strategic expansion in Asia, as it builds on global prescription trends and rising obesity awareness

- In December 2024, major head-to-head trial results published in the New England Journal of Medicine showed Zepbound outperformed Wegovy in average weight loss among adults with obesity, with roughly 20% body weight reduction compared to about 14% with Wegovy, reinforcing the competitive shift toward dual-agonist therapies that engage both GLP-1 and GIP pathways

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.