Global Occlusion Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.00 Billion

USD

6.13 Billion

2024

2032

USD

4.00 Billion

USD

6.13 Billion

2024

2032

| 2025 –2032 | |

| USD 4.00 Billion | |

| USD 6.13 Billion | |

|

|

|

|

Occlusion Devices Market Size

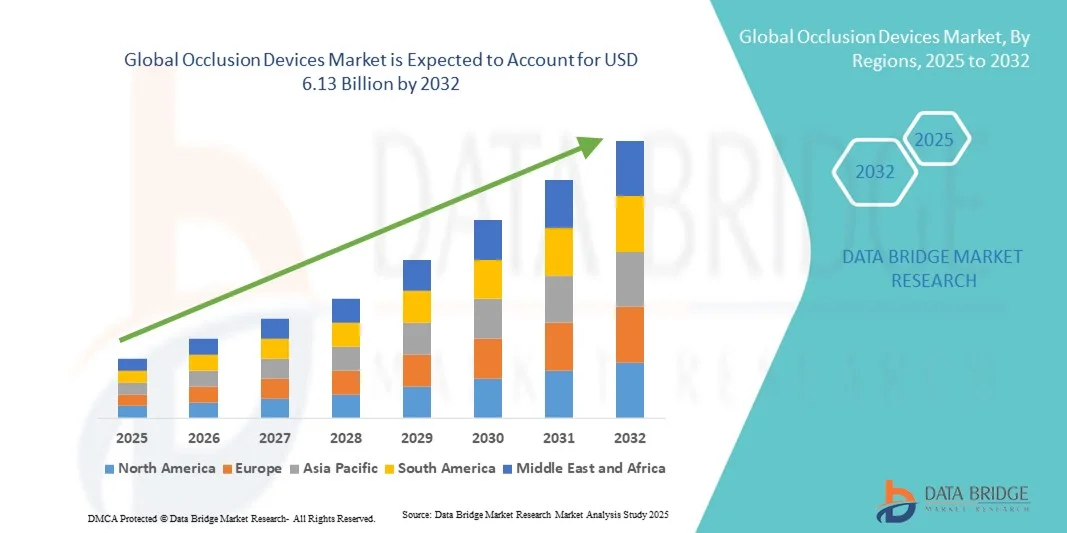

- The global occlusion devices market size was valued at USD 4.00 billion in 2024 and is expected to reach USD 6.13 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in minimally invasive cardiovascular procedures, increasing the use of occlusion devices for conditions such as atrial septal defects, patent foramen ovale, and left atrial appendage closure, leading to improved patient outcomes and reduced procedural risks

- Furthermore, rising demand for safe, reliable, and user-friendly cardiovascular interventions is establishing occlusion devices as a preferred solution in interventional cardiology. These converging factors are accelerating the uptake of occlusion device solutions, thereby significantly boosting the industry's growth

Occlusion Devices Market Analysis

- Occlusion devices, used for minimally invasive closure of cardiac defects, vascular anomalies, and other anatomical openings, are increasingly critical in modern interventional cardiology and vascular procedures due to their precision, safety, and compatibility with advanced imaging technologies

- The escalating demand for occlusion devices is primarily fueled by the growing prevalence of cardiovascular diseases, increasing adoption of minimally invasive procedures, and rising awareness among clinicians and patients about improved procedural outcomes

- North America dominated the occlusion devices market with the largest revenue share of 41.22% in 2024, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key industry players. The U.S. experienced substantial growth in occlusion devices installations, particularly in hospitals and specialized cardiac care centers, driven by innovations from both established companies and emerging technology providers focusing on device precision and integration with imaging systems

- Asia-Pacific is expected to be the fastest-growing region in the occlusion devices market during the forecast period, with a projected CAGR of 9.8%, fueled by rapid urbanization, increasing healthcare expenditure, and the expansion of interventional cardiology facilities. Government healthcare initiatives, hospital network expansions, and rising awareness of minimally invasive cardiac treatments are further supporting growth

- The Direct Sales segment dominated the occlusion devices market with a 52.3% revenue share in 2024, supported by strong manufacturer-hospital relationships, customized solutions, and on-site training programs

Report Scope and Occlusion Devices Market Segmentation

|

Attributes |

Occlusion Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Occlusion Devices Market Trends

Increasing Adoption of Transcatheter Occlusion Devices

- A clear trend in the global occlusion devices market is the rapid shift from open-heart surgeries to transcatheter-based occlusion procedures, driven by reduced patient risk, shorter recovery periods, and the ability to perform procedures in outpatient or minimally invasive settings

- Hospitals and cardiac centers are increasingly favoring transcatheter devices for conditions such as atrial septal defects (ASD) and patent foramen ovale (PFO), reflecting a move toward less invasive treatment options

- Growing patient preference for minimally invasive procedures is fueling demand, as individuals seek reduced pain, shorter hospital stays, and faster return to daily activities compared to traditional surgical approaches

- For Instance, in 2023, Abbott introduced a next-generation transcatheter ASD occluder with improved anatomical adaptability, enabling cardiologists to treat patients with complex heart structures more safely and efficiently, illustrating the growing market preference for catheter-based interventions

- The trend is supported by technological innovations in device design, including flexible delivery systems and bioresorbable materials, which enhance procedural success and patient outcomes

- Clinical evidence and long-term outcomes demonstrating the efficacy and safety of transcatheter procedures are encouraging more hospitals to adopt these devices, boosting confidence among both physicians and patients

- Increased physician training programs and clinical adoption initiatives are further driving the uptake of transcatheter occlusion devices globally, particularly in developed and emerging markets

- Expansion of reimbursement policies and healthcare funding for minimally invasive cardiac interventions in regions such as North America, Europe, and parts of Asia-Pacific is accelerating adoption

- The trend is also influenced by growing collaboration between device manufacturers and healthcare providers, enabling faster access to advanced occlusion solutions and improving patient reach

- Enhanced digital imaging and procedural planning tools are complementing the trend, allowing for precise device placement and improving overall procedural success rates

Occlusion Devices Market Dynamics

Driver

Rising Incidence of Cardiovascular Defects and Expanding Treatment Adoption

- The growing prevalence of cardiovascular conditions requiring occlusion, including atrial septal defects, ventricular septal defects, and patent foramen ovale, is significantly driving market demand

- Increasing awareness among clinicians about the benefits of minimally invasive occlusion procedures compared to traditional open-heart surgeries is boosting adoption rates

- Expansion of specialized cardiac care facilities and interventional cardiology centers in both developed and emerging markets is facilitating access to advanced occlusion therapies

- Technological advancements in device design, including improved material biocompatibility, shape memory alloys, and optimized delivery systems, are enhancing procedural success and patient safety

- Clinical guidelines from leading cardiology associations emphasizing early intervention and minimally invasive management of septal defects are promoting standardized adoption of occlusion devices

- Patient preference for shorter hospital stays, reduced recovery time, and less invasive treatment options is supporting the shift toward device-based intervention

- Increasing research and development initiatives focused on pediatric-specific devices and biodegradable occluders are expanding the target patient population

- Rising healthcare expenditure and government support for cardiac care programs in emerging economies are improving affordability and access to advanced occlusion therapies

- Instance: In 2023, several hospitals in India adopted newly approved transcatheter occlusion devices for atrial septal defect closure, significantly reducing procedure times and improving recovery rates compared to traditional surgical methods

Restraint/Challenge

Safety Concerns, Regulatory Hurdles, and Cost Challenges

- Regulatory restrictions in multiple regions due to patient safety concerns can delay device approvals and market entry. Manufacturers must meet stringent clinical and quality standards to maintain compliance

- For instance: In 2022, a temporary recall of a septal occluder device in North America due to rare device malpositioning highlighted the importance of rigorous safety monitoring and regulatory compliance, emphasizing challenges that manufacturers must address to maintain market trust

- Potential complications, such as device migration, residual shunts, or thrombus formation, can limit adoption among risk-averse clinicians and patients

- High cost of advanced occlusion devices, combined with procedure-related hospital expenses, can be a barrier in price-sensitive healthcare systems

- Limited availability of trained interventional cardiologists and specialized catheterization labs in certain regions may restrict device utilization

- Competition from alternative surgical or catheter-based therapies, including traditional surgical repair or pharmacological management, can impact market penetration

- The need for continuous post-market surveillance and reporting of adverse events increases operational and administrative costs for manufacturers

- Supply chain disruptions and recalls due to device defects can negatively affect market confidence and adoption rates

- Lack of awareness among patients about minimally invasive options in rural or underserved regions can slow adoption

Occlusion Devices Market Scope

The market is segmented into notable segments based on product, application, end-user, and sales channel.

- By Product

On the basis of product, the occlusion devices market is segmented into Occlusion removal devices, embolization devices, tubal occlusion devices, and support devices. The Embolization Devices segment dominated the market with a revenue share of 42.5% in 2024. This dominance is fueled by their extensive adoption in interventional cardiology and peripheral vascular procedures. The minimally invasive nature of embolization devices reduces patient recovery time and procedural complications. They are compatible with advanced imaging systems, which enhances procedural precision. Hospitals and surgical centers prefer these devices for their reliability and accuracy. The rising prevalence of cardiovascular and peripheral vascular diseases contributes to their strong market presence. Continuous technological innovation, including advanced delivery systems and bioresorbable materials, further strengthens adoption. Regulatory approvals in major markets have accelerated their acceptance. Established manufacturers with strong clinical support and training programs reinforce market dominance. Increasing healthcare expenditure and skilled workforce availability are additional growth drivers. The segment also benefits from rising patient awareness and preference for minimally invasive procedures. Embolization devices are widely utilized in both developed and emerging countries, sustaining their top market position.

The Tubal Occlusion Devices segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032. This growth is driven by increasing demand for female sterilization and minimally invasive gynecological solutions. These devices offer improved safety profiles and high procedural success rates, encouraging adoption in hospitals and ambulatory care centers. Rising awareness of reproductive health and government-supported family planning initiatives in emerging markets contribute to growth. Technological advancements, including device miniaturization and improved delivery systems, make procedures less invasive and more patient-friendly. Clinics and surgical centers prefer tubal occlusion devices for outpatient procedures. Expanding healthcare infrastructure and increasing disposable income support broader market penetration. Manufacturers’ strong R&D investment ensures continuous innovation. Increasing availability of training programs for gynecologists enhances confidence in device use. Patient preference for minimally invasive, reliable solutions further drives adoption. Strategic collaborations between hospitals and device manufacturers aid distribution. Regulatory approvals in key countries accelerate market uptake.

- By Application

On the basis of application, the occlusion devices market is segmented into cardiology, peripheral vascular diseases, neurology, urology, oncology, and gynecology. The Cardiology segment dominated with a 38.9% revenue share in 2024, driven by high prevalence of cardiovascular diseases and increasing adoption of minimally invasive interventions. Hospitals prefer these devices for precise, risk-reduced procedures. Integration with advanced imaging and catheterization suites enhances procedural outcomes. Availability of trained interventional cardiologists supports wide adoption. Increasing healthcare infrastructure investments in developed and emerging markets contribute to growth. Rising patient awareness about cardiovascular health encourages elective procedures. Technological innovations, including better occlusion coils and embolic agents, improve efficacy. Regulatory approvals in major markets enhance clinical adoption. Favorable reimbursement policies in key countries accelerate utilization. Strong manufacturer support with clinical training programs reinforces dominance. Expansion of cardiovascular centers and catheterization labs sustains segment leadership. Hospitals prioritize embolization procedures to minimize patient recovery time. Clinical guidelines increasingly recommend device-assisted cardiology interventions.

The Gynecology segment is expected to witness the fastest CAGR of 12.2% from 2025 to 2032, fueled by rising demand for tubal occlusion procedures. Safe, minimally invasive gynecological solutions are gaining traction in both hospitals and ambulatory care centers. Increasing awareness of reproductive health and family planning initiatives supports adoption. Technological improvements, including advanced delivery mechanisms and smaller devices, enhance patient comfort. Outpatient procedures drive operational efficiency in clinics. Government support and reimbursement programs encourage wider use. Rising disposable income in emerging markets enables accessibility. Training programs for gynecologists improve confidence in using devices. Manufacturers focus on innovation to reduce complications. Device safety and reliability further boost adoption. Hospitals and clinics benefit from shorter procedure times and faster patient turnover. Patient preference for minimally invasive, secure procedures drives market growth.

- By End-User

On the basis of end-user, the occlusion devices market is segmented into hospitals, diagnostic centers and surgical centers, ambulatory care centers (ACCs), Research Laboratories, and Academic Institutes. The Hospitals segment dominated with a 45.6% revenue share in 2024, supported by high procedure volumes, availability of specialized clinical expertise, and integration of advanced interventional suites. Hospitals benefit from higher patient throughput, skilled workforce, and access to advanced imaging systems. Established relationships with device manufacturers ensure product reliability and training support. Increasing prevalence of cardiovascular, neurological, and gynecological diseases drives adoption. Hospitals prefer embolization and occlusion procedures to minimize surgical risk and improve recovery times. Investment in healthcare infrastructure and catheterization labs supports utilization. Regulatory approvals facilitate device availability and standardization. Hospitals also gain from advanced reimbursement policies covering interventional procedures. Rising patient awareness encourages elective minimally invasive treatments. The segment’s dominance is reinforced by the presence of highly trained interventional specialists. Hospitals remain central to clinical adoption and research collaborations. The segment continues to lead due to procedural volume, infrastructure, and clinical expertise.

The Ambulatory Care Centers (ACCs) segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, due to cost-effectiveness, patient preference for outpatient procedures, and streamlined workflows. ACCs adopt minimally invasive procedures to enhance operational efficiency. Increasing availability of compact, user-friendly devices facilitates uptake. Government and insurance initiatives supporting outpatient care contribute to growth. Rising awareness and preference for quick recovery procedures drive patient demand. ACCs are expanding in urban and semi-urban areas, widening market reach. Device innovation targeting outpatient settings enhances adoption. Technological integration with imaging and monitoring systems supports procedural accuracy. ACCs offer personalized patient care and scheduling flexibility. Growth is further supported by collaboration with device manufacturers for training. Emerging markets witness rising ACC expansion due to healthcare accessibility improvements. Increasing demand for cost-efficient and high-quality procedures accelerates adoption. ACCs leverage advanced devices to remain competitive in interventional care.

- By Sales Channel

On the basis of sales channel, the occlusion devices market is segmented into direct sales and distributors. The Direct Sales segment dominated with a 52.3% revenue share in 2024, supported by strong manufacturer-hospital relationships, customized solutions, and on-site training programs. Direct sales allow manufacturers to maintain quality control and provide dedicated support. Hospitals and large surgical centers prefer direct relationships to ensure device reliability and service availability. The presence of clinical specialists from manufacturers during initial deployment enhances adoption. High-volume purchasing agreements encourage loyalty and long-term contracts. Customization of devices according to clinical requirements strengthens market leadership. Regulatory compliance is easier to maintain through direct sales. Manufacturers can closely monitor product performance and gather feedback for innovation. Clinical training programs improve procedural outcomes and patient safety. Hospitals and ACCs rely on direct sales for timely device availability. Large healthcare networks favor direct procurement for centralized management. High revenue share results from strategic partnerships with leading institutions.

The Distributor segment is expected to witness the fastest CAGR of 9.6% from 2025 to 2032, driven by expanding distribution networks, penetration into emerging markets, and preference of smaller clinics to procure devices via distributors. Distributors provide accessibility in regions with limited manufacturer presence. Small hospitals and clinics benefit from flexible procurement options. Local distributor support enhances service quality. Growth is supported by increasing awareness of interventional procedures in semi-urban and rural regions. Distributor networks expand product reach to remote healthcare facilities. Technological support from distributors ensures device usability. Partnerships with multiple manufacturers provide clinics with a variety of options. Emerging market expansion accelerates distributor adoption. Distributors also offer training programs for smaller end-users. Regulatory approvals in target countries facilitate smooth distribution. Ease of ordering and cost-effective procurement methods drive distributor growth.

Occlusion Devices Market Regional Analysis

- North America dominated the occlusion devices market with the largest revenue share of 41.22% in 2024, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key industry players

- The market experienced substantial growth in occlusion devices installations, particularly in hospitals and specialized cardiac care centers, driven by innovations from both established companies and emerging technology providers focusing on device precision, integration with imaging systems, and improved procedural outcomes

- The widespread adoption is further supported by increasing prevalence of cardiovascular and peripheral vascular conditions, high patient awareness, and the growing emphasis on minimally invasive treatment approaches, establishing occlusion devices as a preferred solution for interventional cardiology procedures

U.S. Occlusion Devices Market Insight

The U.S. occlusion devices market captured the largest revenue share of 80.5% in 2024 within North America, fueled by the rapid adoption of advanced interventional cardiology techniques, rising patient volumes for minimally invasive procedures, and strong investments in hospital infrastructure. Hospitals and specialized cardiac care centers are increasingly integrating occlusion devices with imaging technologies such as echocardiography and fluoroscopy to enhance procedural accuracy and patient safety. Moreover, collaborations between manufacturers and healthcare providers are accelerating innovation in device design, safety features, and clinical workflow integration, further driving market growth.

Europe Occlusion Devices Market Insight

The Europe occlusion devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of cardiovascular diseases, rising geriatric population, and advancements in minimally invasive cardiac procedures. Well-established healthcare infrastructure, high patient awareness, and reimbursement support for interventional treatments are boosting adoption rates. In addition, the demand for safe and precise occlusion devices in hospitals, surgical centers, and specialized clinics is encouraging manufacturers to develop technologically advanced products tailored for European regulatory standards, further contributing to market expansion.

U.K. Occlusion Devices Market Insight

The U.K. occlusion devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing incidence of structural heart diseases, rising preference for minimally invasive procedures, and adoption of advanced cardiovascular treatment protocols. Hospitals and specialized centers are increasingly deploying occlusion devices for atrial septal defects, patent foramen ovale, and left atrial appendage closures. Government support for interventional cardiology programs, clinical training initiatives, and growing healthcare investments are further propelling market growth in the region.

Germany Occlusion Devices Market Insight

The Germany occlusion devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust healthcare system, high adoption of innovative medical technologies, and increasing awareness of minimally invasive cardiac interventions. The demand for occlusion devices is rising in hospitals, specialized cardiac centers, and research institutes, driven by the need for accurate, safe, and efficient devices. Integration with advanced imaging modalities and ongoing product innovations, including enhanced delivery systems and biocompatible materials, are further boosting adoption.

Asia-Pacific Occlusion Devices Market Insight

The Asia-Pacific occlusion devices market is poised to grow at the fastest CAGR of 9.8% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare expenditure, and the expansion of interventional cardiology facilities. Government initiatives promoting advanced cardiac care, hospital network expansions, and growing awareness of minimally invasive procedures are supporting market growth. Countries such as China, Japan, and India are witnessing substantial adoption of occlusion devices due to increasing prevalence of cardiovascular diseases, rising patient awareness, and improving access to advanced healthcare services.

Japan Occlusion Devices Market Insight

The Japan occlusion devices market is gaining momentum due to the country’s well-developed healthcare system, high adoption of advanced interventional cardiology procedures, and increasing demand for minimally invasive treatments. Hospitals and specialized cardiac centers are implementing occlusion devices for structural heart interventions, with emphasis on procedural safety, precision, and patient recovery. In addition, Japan’s aging population and increasing prevalence of cardiovascular disorders are expected to drive sustained demand for occlusion devices across clinical settings.

China Occlusion Devices Market Insight

The China occlusion devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rapid urbanization, and growing prevalence of cardiovascular diseases. China is witnessing high adoption of occlusion devices in hospitals and cardiac specialty centers, supported by government initiatives for advanced cardiac care and the availability of affordable, high-quality devices from domestic manufacturers. The push towards improving interventional cardiology capabilities, coupled with increasing patient awareness and clinical training programs, are key factors driving the market in China.

Occlusion Devices Market Share

The Occlusion Devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Occlutech (Switzerland)

- W. L. Gore & Associates, Inc. (U.S.)

- Terumo Corporation (Japan)

- B. Braun SE (Germany)

- LifeTech Scientific Corporation (China)

- Cardiovascular Systems, Inc. (U.S.)

- Venus Medtech (China)

- MicroPort Scientific Corporation (China)

- Cook (U.S.)

- Starway Medical Co. Ltd (China)

Latest Developments in Global Occlusion Devices Market

- In June 2021, Embolx announced the limited release of its Sniper Balloon Occlusion Microcatheter in Europe. This device is designed for arterial embolization procedures, offering a minimally invasive option for treating various conditions

- In September 2023, Varian's Embozene microspheres received European CE Mark approval for Genicular Artery Embolization (GAE) to treat knee osteoarthritis. This makes Embozene the first and only embolic agent CE Marked specifically for GAE, a minimally invasive procedure intended to target inflammation and help relieve pain in patients with knee osteoarthritis

- In August 2024, BIOTRONIK launched the FlowGuide and Guidion Short guide extension catheters in selected European countries. These devices are designed to offer enhanced support and facilitate the delivery of devices during complex vascular interventions

- In September 2025, Imperative Care announced the FDA 510(k) clearance of its Symphony Thrombectomy System to treat pulmonary embolism. This large-bore aspiration catheter system for clot removal is designed to combine large-bore power with precise deep vacuum control

- In August 2025, Boston Scientific issued a letter to affected customers recommending updates to the instructions for use of certain WATCHMAN Access Systems to mitigate the risk of air embolism during vascular and transseptal access. This recommendation follows reports of serious adverse outcomes, including 17 deaths, highlighting the company's commitment to patient safety and device optimization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.