Global Occupant Classification System Ocs Market

Market Size in USD Billion

CAGR :

%

USD

2.26 Billion

USD

3.98 Billion

2025

2033

USD

2.26 Billion

USD

3.98 Billion

2025

2033

| 2026 –2033 | |

| USD 2.26 Billion | |

| USD 3.98 Billion | |

|

|

|

|

What is the Global Occupant Classification System (OCS) Market Size and Growth Rate?

- The global occupant classification system (OCS) market size was valued at USD 2.26 billion in 2025 and is expected to reach USD 3.98 billion by 2033, at a CAGR of7.31% during the forecast period

- Increasing demand for advanced passenger safety features, rising adoption of smart airbags and seatbelt systems, growing integration of electronic sensors in vehicles, proliferation of connected and autonomous vehicles, and stringent government safety regulations are some of the key factors driving the growth of the occupant classification system (OCS) market

What are the Major Takeaways of Occupant Classification System (OCS) Market?

- Rising demand for safer vehicles, increasing automotive production in developing regions, and expansion of research and development initiatives in advanced safety systems are expected to generate significant opportunities for the Occupant Classification System (OCS) market

- Challenges such as high system complexity, integration issues with existing vehicle electronics, and lack of skilled engineers for advanced OCS design may act as restraints limiting market growth

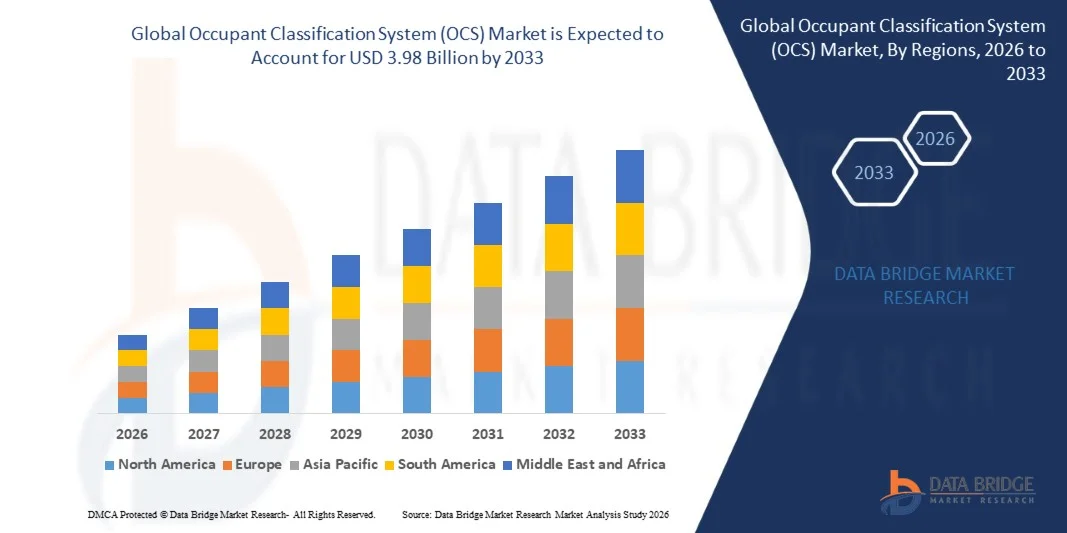

- Asia-Pacific dominated the occupant classification system (OCS) market with a 38.87% revenue share in 2025, driven by massive expansion in automotive production, semiconductor manufacturing, embedded systems development, and strong government support for digital innovation across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by growing adoption of AI-assisted OCS, smart vehicles, connected mobility solutions, and advanced ADAS technologies across the U.S. and Canada

- The Sensor-Based Systems segment dominated the market with a 42.1% share in 2025, driven by widespread integration in passenger vehicles, commercial vehicles, and luxury automobiles

Report Scope and Occupant Classification System (OCS) Market Segmentation

|

Attributes |

Occupant Classification System (OCS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Occupant Classification System (OCS) Market?

“Increasing Shift Toward Smart, Compact, and High-Precision Occupant Classification Systems (OCS)”

- The occupant classification system (OCS) market is witnessing strong adoption of compact, sensor-integrated, and high-accuracy OCS devices designed to support passenger safety, real-time occupant detection, and advanced airbag deployment systems

- Manufacturers are introducing multi-sensor, AI-enabled, and software-defined OCS solutions that offer enhanced detection accuracy, integration with vehicle electronic control units (ECUs), and compatibility with modern automotive platforms

- Growing demand for cost-efficient, lightweight, and modular OCS units is driving usage across passenger vehicles, commercial fleets, and luxury automobiles

- For instance, companies such as Continental, Denso, Toyota, Ford, and Infineon have upgraded their OCS solutions with multi-zone sensing, pressure-based and weight classification systems, and advanced machine learning algorithms

- Increasing need for rapid occupant detection, real-time airbag activation, and multi-occupant monitoring is accelerating the adoption of intelligent, embedded OCS units

- As vehicles become more automated and safety regulations stricter, OCSs remain critical for reducing injuries, enhancing safety, and meeting regulatory compliance globally

What are the Key Drivers of Occupant Classification System (OCS) Market?

- Rising demand for smart safety systems, weight and presence detection, and multi-occupant monitoring in passenger and commercial vehicles is driving OCS adoption

- For instance, in 2025, leading companies such as Continental, Denso, Infineon, Toyota, and Ford enhanced their OCS portfolios with AI-based sensors, embedded software solutions, and advanced pressure and weight classification capabilities

- Growing adoption of electric vehicles, autonomous vehicles, and connected cars is increasing demand for integrated, high-precision OCS technologies across North America, Europe, and Asia-Pacific

- Advancements in sensor technologies, AI-driven analytics, software integration, and low-power designs have strengthened OCS performance, reliability, and scalability

- Increasing regulatory requirements for passenger safety, airbag optimization, and collision prevention are fueling multi-region OCS deployment

- Supported by ongoing automotive R&D, rising vehicle production, and smart mobility initiatives, the Occupant Classification System (OCS) market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Occupant Classification System (OCS) Market?

- High costs associated with premium multi-sensor, AI-enabled OCS units restrict adoption in low-cost vehicles and emerging automotive segments

- For instance, during 2024–2025, fluctuations in semiconductor and sensor prices, along with global supply chain disruptions, increased manufacturing costs for leading vendors

- Complexity in integrating OCS with multiple ECUs, airbags, and vehicle safety modules increases the need for specialized engineering expertise and calibration

- Limited awareness among small OEMs and retrofit markets regarding OCS benefits and installation challenges slows adoption

- Competition from alternative occupant detection systems, simplified seatbelt sensors, and legacy airbag control modules creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on cost-optimized designs, scalable sensor modules, embedded AI algorithms, and automotive-grade software platforms to drive global adoption of occupant classification systems (OCS)

How is the Occupant Classification System (OCS) Market Segmented?

The market is segmented on the basis of technology, component, end use, and application.

• By Technology

On the basis of technology, the occupant classification system (OCS) market is segmented into Sensor-Based Systems, Pressure-Based Systems, Weight Classification Systems, and Infrared Detection Systems. The Sensor-Based Systems segment dominated the market with a 42.1% share in 2025, driven by widespread integration in passenger vehicles, commercial vehicles, and luxury automobiles. These systems leverage advanced sensors for real-time occupant detection, enabling precise airbag deployment, adaptive restraint systems, and enhanced in-vehicle safety monitoring. Sensor-based OCS solutions offer compact design, high detection accuracy, and compatibility with vehicle electronic control units (ECUs), making them the preferred choice for OEMs.

The Infrared Detection Systems segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by adoption in smart vehicles, autonomous systems, and high-end commercial fleets. Rising demand for non-contact detection, improved passenger monitoring, and integration with advanced driver-assistance systems (ADAS) is accelerating growth in infrared-based occupant detection technologies.

• By Component

On the basis of component, the market is segmented into Sensors, Microcontrollers, Software, and Algorithms. The Sensors segment dominated with a 45.3% share in 2025, as it forms the core of OCS devices, providing real-time occupant presence, weight, and position data to ECUs. Modern vehicles rely on multi-zone and multi-type sensors for enhanced safety, enabling AI-assisted detection, predictive airbag deployment, and seamless integration with in-vehicle networks. Sensor technology advancements, including low-power consumption, high sensitivity, and modular design, are driving widespread adoption across OEMs and aftermarket solutions.

The Algorithms segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by AI and machine learning integration that enables adaptive occupant recognition, multi-occupant differentiation, and predictive safety response. Enhanced software intelligence allows OCS units to accurately classify occupant type, posture, and movement, supporting next-generation automated and autonomous vehicle safety systems.

• By End Use

On the basis of end use, the occupant classification system (OCS) market is segmented into OEMs and Aftermarket. The OEM segment dominated with a 61.7% share in 2025, supported by mandatory integration of OCS in new passenger vehicles, commercial vehicles, and trucks to comply with global safety regulations. OEMs benefit from incorporating OCS during vehicle design, ensuring seamless integration with airbags, seatbelt pre-tensioners, and ADAS systems. Growing focus on smart mobility, vehicle automation, and connected cars is further strengthening OEM adoption.

The Aftermarket segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by retrofitting demand in older vehicles, commercial fleets, and specialty vehicles. Increasing awareness of occupant safety, regulatory pressures, and growing availability of plug-and-play OCS retrofit solutions are boosting aftermarket deployment globally.

• By Application

On the basis of application, the market is segmented into Passenger Vehicles, Commercial Vehicles, Motorcycles, and Heavy-Duty Vehicles. The Passenger Vehicles segment dominated with a 48.2% share in 2025, due to rising production of cars equipped with advanced airbags, ADAS, and intelligent seatbelt systems. Passenger vehicle manufacturers are increasingly deploying OCS to ensure regulatory compliance, improve safety ratings, and reduce occupant injury risk during collisions. These systems provide real-time occupant weight and position classification, supporting adaptive airbag deployment and predictive safety functions.

The Heavy-Duty Vehicles segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by adoption in trucks, buses, and commercial fleets. Increasing safety regulations, integration with fleet telematics, and demand for occupant detection in multi-passenger cabins are driving growth in the heavy-duty segment, particularly across North America and Asia-Pacific regions.

Which Region Holds the Largest Share of the Occupant Classification System (OCS) Market?

- Asia-Pacific dominated the occupant classification system (OCS) market with a 38.87% revenue share in 2025, driven by massive expansion in automotive production, semiconductor manufacturing, embedded systems development, and strong government support for digital innovation across China, Japan, India, South Korea, and Southeast Asia. High adoption of advanced sensors, weight detection systems, and infrared occupant detection technologies continues to fuel demand for OCS across passenger vehicles, commercial vehicles, and heavy-duty fleets in the region

- Leading companies in Asia-Pacific are introducing advanced occupant classification solutions with multi-sensor integration, AI-driven algorithms, real-time data analytics, and wireless connectivity, strengthening the region’s technological edge. Continuous investments in smart mobility, ADAS, and vehicle electrification further accelerate market expansion

- Strong automotive clusters, high production capacity, and growing OEM collaborations reinforce Asia-Pacific’s market leadership and long-term dominance

China Occupant Classification System (OCS) Market Insight

China is the largest contributor to Asia-Pacific due to world-leading automotive and electronics manufacturing infrastructure, massive semiconductor investments, and proactive government initiatives for smart mobility. Rising adoption of AI-based detection, weight classification, and infrared sensing technologies in vehicles drives demand for highly reliable OCS solutions. OEMs and Tier-1 suppliers increasingly integrate these systems into new vehicles to meet stringent safety regulations, improve occupant protection, and enhance ADAS functionality. Local manufacturing capabilities and cost-competitive production expand domestic and export adoption across global markets.

Japan Occupant Classification System (OCS) Market Insight

Japan shows steady growth supported by advanced automotive technology, precision electronics manufacturing, and increasing adoption of automated vehicles. Strong emphasis on high-quality engineering, safety compliance, and sensor accuracy drives premium OCS integration in passenger and commercial vehicles. Increasing use of multi-sensor systems, robotics, and connected car applications reinforces long-term market expansion and contributes to Asia-Pacific dominance.

India Occupant Classification System (OCS) Market Insight

India is emerging as a major growth hub within Asia-Pacific, fueled by expanding automotive R&D centres, rising domestic production, and government-backed smart manufacturing initiatives. Growing demand for weight- and sensor-based occupant detection in EVs, commercial vehicles, and connected mobility platforms is driving adoption. Increasing R&D investments, startup innovations, and digital infrastructure expansion further strengthen regional market growth.

South Korea Occupant Classification System (OCS) Market Insight

South Korea contributes significantly due to rising automotive electronics adoption, high-performance consumer vehicle production, and strong semiconductor development. Rapid deployment of AI-driven occupant monitoring systems, smart vehicle technologies, and advanced sensors accelerates the demand for OCS solutions. High manufacturing efficiency, technological innovation, and export-oriented automotive production reinforce regional market dominance.

North America Occupant Classification System (OCS) Market

North America is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by growing adoption of AI-assisted OCS, smart vehicles, connected mobility solutions, and advanced ADAS technologies across the U.S. and Canada. High-volume vehicle production, advanced electronics integration, and regulatory compliance are accelerating the uptake of sensor-based, pressure-based, and infrared OCS solutions. Expanding OEM collaborations, technology innovation, and rising R&D investment in electric and autonomous vehicles strengthen North America’s growth trajectory and long-term market potential.

Which are the Top Companies in Occupant Classification System (OCS) Market?

The occupant classification system (OCS) industry is primarily led by well-established companies, including:

- Toyota (Japan)

- General Motors (U.S.)

- Aisin Seiki (Japan)

- Texas Instruments (U.S.)

- Denso (Japan)

- Nissan (Japan)

- Infineon Technologies (Germany)

- Continental (Germany)

- Ford (U.S.)

- Bosch (Germany)

- Toshiba (Japan)

- Mercedes Benz (Germany)

- Teledyne FLIR (U.S.)

- Valeo (France)

What are the Recent Developments in Global Occupant Classification System (OCS) Market?

- In January 2025, Aptiv presented its Cabin and Driver Monitoring System, designed to enhance occupant safety and driver awareness, integrating occupant detection, child seat recognition, seat belt tracking, and restraint optimization, while also managing airbag deployment and crash presence detection, along with monitoring drowsiness, distraction, microsleep, head pose, and eye gaze to improve road safety, marking a significant step forward in smart vehicle occupant protection

- In September 2024, Denso Corporation revealed plans to expand its Zenmyo facility in Nishio City, Japan, with construction expected to begin in the first half of FY2025 and operations scheduled for the first half of FY2028, featuring a production system capable of rapidly scaling to meet future market expansion and customer demands, strengthening its capacity in manufacturing large-scale integrated ECUs

- In September 2024, ZF Friedrichshafen AG announced that ZF LIFETEC is developing comprehensive hybrid (physical and virtual) test methods, aimed at improving occupant protection and accelerating development cycles at competitive costs, ensuring that seat belts, airbags, and steering wheels are tested under the most demanding conditions, reinforcing automotive safety standards

- In July 2024, ZF LIFETEC created a Pre-Crash Dual Stage Side Airbag, which uses vehicle sensors to activate milliseconds before a collision, first pushing occupants inward by 60 mm to create extra space, followed by traditional inflation for enhanced protection, reducing injury risks in side and pole impacts and helping automakers achieve higher Euro NCAP safety ratings, demonstrating cutting-edge safety innovation

- In February 2024, ZF Friedrichshafen AG introduced an intelligent seat belt system, designed to mitigate accident impacts and facilitate compliance with the NCAP Roadmap 2030 restraint requirements, improving vehicle occupant safety and supporting automakers in meeting evolving regulatory standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.