Global Ocular Lymphoma Treatment Market

Market Size in USD Billion

CAGR :

%

USD

12.91 Billion

USD

25.92 Billion

2024

2032

USD

12.91 Billion

USD

25.92 Billion

2024

2032

| 2025 –2032 | |

| USD 12.91 Billion | |

| USD 25.92 Billion | |

|

|

|

|

Ocular Lymphoma Treatment Market Size

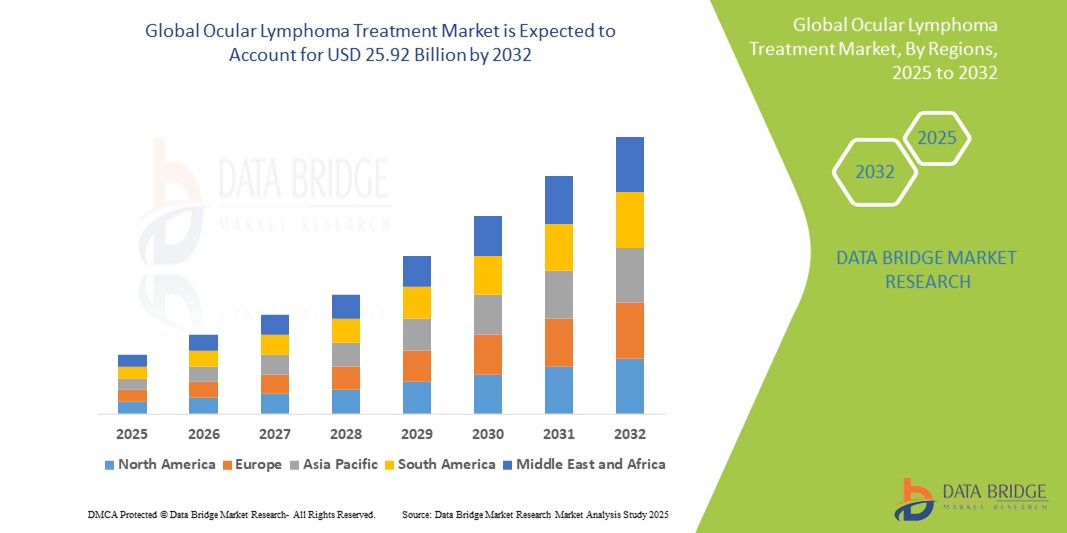

- The global ocular lymphoma treatment market size was valued at USD 12.91 billion in 2024 and is expected to reach USD 25.92 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely driven by increasing awareness, improved diagnostic capabilities, and advances in targeted therapies and immunotherapy that offer more effective and personalized treatment approaches

- Furthermore, the rising incidence of ocular malignancies and greater investment in oncology research are contributing to enhanced treatment options. These combined factors are propelling the adoption of ocular lymphoma therapies, thereby significantly supporting the expansion of this specialized oncology segment

Ocular Lymphoma Treatment Market Analysis

- Ocular lymphoma treatments, targeting rare malignancies affecting ocular tissues, are increasingly vital in oncology and ophthalmology due to advancements in diagnostic imaging, targeted therapies, and personalized treatment strategies that improve prognosis and quality of life for patients

- The growing demand for ocular lymphoma treatment is primarily fueled by heightened awareness, earlier disease detection, and the expanding use of immunotherapy and precision medicine approaches

- North America dominated the ocular lymphoma treatment market with the largest revenue share of 42.2% in 2024, characterized by robust healthcare infrastructure, high diagnostic accuracy, and increased funding for cancer research, with the U.S. witnessing notable growth due to advancements in molecular diagnostics and active clinical trial pipelines

- Asia-Pacific is expected to be the fastest growing region in the ocular lymphoma treatment market during the forecast period due to growing healthcare access, rising cancer incidence, and increased focus on early diagnosis and specialized cancer care

- Chemotherapy segment dominated the ocular lymphoma treatment market with a market share of 45.5% in 2024, driven by its effectiveness in targeting malignant cells systemically and its widespread use in treating B-cell non-Hodgkin’s lymphoma subtypes

Report Scope and Ocular Lymphoma Treatment Market Segmentation

|

Attributes |

Ocular Lymphoma Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Lymphoma Treatment Market Trends

“Rising Adoption of Targeted and Immunotherapy Approaches”

- A significant and accelerating trend in the global ocular lymphoma treatment market is the shift toward targeted therapies and immunotherapy, including monoclonal antibodies such as rituximab and emerging personalized medicine strategies. This evolution is significantly improving treatment specificity, efficacy, and patient outcomes

- For instance, intravitreal rituximab is increasingly used in treating primary vitreoretinal lymphoma due to its direct targeting of CD20-positive B-cells, offering enhanced local control with minimal systemic toxicity. Similarly, newer agents such as ibrutinib and checkpoint inhibitors are being explored for their potential in relapsed or refractory ocular lymphoma cases

- These targeted therapies enable precision treatment by focusing on specific molecular markers expressed by malignant lymphocytes, minimizing off-target effects. In addition, immunotherapeutic approaches enhance the body's natural immune response to eliminate cancer cells, offering longer-lasting remissions

- Furthermore, the integration of these treatments with advanced diagnostic techniques such as flow cytometry and genetic profiling is enabling tailored therapeutic regimens that align with individual tumor biology. This precision-based model is especially impactful in rare malignancies such as ocular lymphoma, where standard treatments may be less effective

- Companies and research institutions are increasingly focusing on novel biologics and combination therapies, with several clinical trials underway to evaluate safety and efficacy in ocular-specific applications. For instance, studies exploring the combination of methotrexate with rituximab or novel kinase inhibitors show promise in enhancing response rates

- The growing demand for highly targeted, less invasive, and more effective treatment modalities is reshaping the ocular lymphoma treatment landscape, particularly in high-income countries where access to advanced oncology care is expanding rapidly across both hospital and specialty clinic settings

Ocular Lymphoma Treatment Market Dynamics

Driver

“Rising Prevalence of Intraocular Lymphoma and Advancements in Targeted Therapies”

- The increasing incidence of intraocular lymphoma, particularly primary vitreoretinal lymphoma associated with central nervous system involvement, is a key driver contributing to the growing demand for effective ocular lymphoma treatments

- For instance, the introduction of intravitreal rituximab as a targeted treatment option, coupled with growing clinical adoption of combination therapy protocols including methotrexate and corticosteroids, reflects the ongoing evolution of therapeutic strategies to improve prognosis and reduce recurrence rates

- As awareness improves among ophthalmologists and oncologists regarding the early detection and multidisciplinary management of ocular lymphoma, patients are benefiting from earlier diagnoses and more effective treatment regimens

- Furthermore, the expanding availability of advanced diagnostic imaging (such as, OCT and MRI) and molecular testing enables precise differentiation between ocular lymphoma subtypes, leading to more targeted and individualized care approaches

- The emergence of personalized oncology, ongoing clinical trials exploring newer biologics and kinase inhibitors, and expanding access to high-cost therapies in developed markets are also key contributors to the growth of this market. Increased investment from pharmaceutical companies and research institutions in orphan ophthalmic oncology treatments further reinforces this trend, particularly in the hospital and specialty clinic segments

Restraint/Challenge

“Limited Awareness and Diagnostic Complexity in Early Detection”

- A significant restraint in the global ocular lymphoma treatment market is the challenge of early and accurate diagnosis, due to the rarity of the disease and its clinical similarities with chronic uveitis and other inflammatory eye conditions. Misdiagnosis or delayed diagnosis can result in progression to central nervous system involvement, complicating treatment and negatively affecting patient outcomes

- For instance, primary vitreoretinal lymphoma often presents with non-specific symptoms such as blurred vision or floaters, which can be mistaken for more common conditions, delaying appropriate therapeutic intervention

- The diagnostic process typically requires a combination of invasive procedures such as vitreous biopsy, immunohistochemistry, and flow cytometry, which are not universally available in all healthcare settings, especially in low-resource regions

- In addition, the lack of standardized treatment protocols and the reliance on off-label use of systemic chemotherapy or intravitreal injections in many regions complicate clinical decision-making and limit accessibility to cutting-edge therapies

- High treatment costs, potential ocular toxicity from repeated intravitreal injections, and limited insurance coverage for rare ophthalmic cancers further pose financial and logistical barriers to patient care

- To overcome these challenges, expanding clinical awareness, investing in early detection tools, and supporting rare cancer drug development and regulatory approvals will be essential for improving patient outcomes and driving long-term market growth

Ocular Lymphoma Treatment Market Scope

The market is segmented on the basis of type, therapy type, treatment, mode of administration, distribution channel, and end user.

- By Type

On the basis of type, the ocular lymphoma treatment market is segmented into Primary Vitreoretinal Lymphoma, Primary Uveal Lymphoma, and Secondary Intraocular Lymphoma. The Primary Vitreoretinal Lymphoma segment dominated the market with the largest revenue share in 2024, driven by its higher prevalence compared to other types and its strong association with central nervous system lymphoma, which necessitates aggressive treatment protocols. This drives demand for targeted therapies and advanced diagnostic methods. Conversely, the Secondary Intraocular

Lymphoma segment is anticipated to register the fastest growth during the forecast period. This is due to improved diagnostic accuracy, increasing awareness among healthcare providers, and rising incidence related to systemic lymphoma metastasizing to the eye.

- By Therapy Type

On the basis of therapy type, the market is segmented into radiation therapy and chemotherapy. The chemotherapy segment led the market with a 45.5% share in 2024, driven by its broad application and proven efficacy in controlling ocular lymphoma progression. The introduction of novel chemotherapeutic agents and targeted delivery systems such as intravitreal injections enhance treatment outcomes and patient compliance.

Radiation Therapy is expected to be the fastest-growing segment during forecast period, as advancements in precise radiation techniques (such as proton therapy and stereotactic radiosurgery) minimize damage to surrounding healthy tissues, reducing side effects and expanding its use as an effective treatment option.

- By Treatment

On the basis of treatment, the market is segmented into medication and surgery. Medication dominated the market in 2024, due to the preference for non-invasive, systemic, and localized drug therapies such as intravitreal chemotherapy, which reduce the need for surgical intervention and associated risks.

Surgery is projected to grow rapidly during forecast period, fueled by innovations in minimally invasive surgical procedures and increased use of vitrectomy for diagnostic and therapeutic purposes, especially in refractory or complicated cases where medication alone is insufficient.

- By Mode Of Administration

On the basis of mode of administration, the market segments include injectable, oral, and others. Injectable segment dominated in 2024 with a 78.7% market share, mainly because intravitreal injections allow for direct, localized delivery of chemotherapeutic drugs into the eye, enhancing efficacy while limiting systemic exposure and toxicity.

The oral segment is expected to witness the fastest growth from 2025 to 2032, propelled by the development of new oral chemotherapeutic and immunomodulatory drugs that offer patient-friendly dosing regimens and improved systemic disease management alongside ocular treatment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies segment dominated the market with a 45.9% share in 2024 due to the need for specialized storage, handling, and administration of ocular lymphoma drugs under controlled clinical settings.

Online Pharmacies are projected to be the fastest-growing during forecast period, benefiting from rising e-commerce adoption, improved regulatory frameworks, and increasing patient preference for convenient home delivery of medications, especially in remote or underserved regions.

- By End User

On the basis of end user, the ocular lymphoma treatment market segments include hospitals, homecare, specialty clinics, and others. Hospitals segment dominated the market in 2024, due to their comprehensive capabilities in diagnostics, treatment, and patient monitoring, making them primary centers for ocular lymphoma care.

However, Homecare is expected to grow the fastest during forecast period, driven by advancements in remote monitoring technologies, telemedicine, and patient preference for receiving treatments such as injectable therapies at home under professional supervision, which enhances comfort and reduces hospital visits.

Ocular Lymphoma Treatment Market Regional Analysis

- North America dominated the ocular lymphoma treatment market with the largest revenue share of 42.2% in 2024, driven by robust healthcare infrastructure, high diagnostic accuracy, and increased funding for cancer research

- Patients and healthcare providers in the region benefit from early diagnosis, availability of specialized ocular oncology centers, and well-established reimbursement frameworks, which facilitate timely and effective treatment

- The widespread adoption of innovative treatment modalities such as intravitreal chemotherapy and targeted radiation therapy is further supported by strong R&D activities and a large patient pool, establishing North America as a leading market for ocular lymphoma treatment globally

U.S. Ocular Lymphoma Treatment Market Insight

The U.S. ocular lymphoma treatment market captured the largest revenue share within North America in 2024, driven by early diagnosis through advanced imaging technologies and strong healthcare infrastructure. The availability of cutting-edge therapies such as intravitreal chemotherapy, radiation therapy, and emerging targeted treatments contributes significantly to market growth. In addition, extensive research funding, ongoing clinical trials, and high patient awareness about ocular cancers support rapid adoption of innovative treatments. The presence of specialized ocular oncology centers and favorable reimbursement policies further bolster the market expansion in the U.S.

Europe Ocular Lymphoma Treatment Market Insight

The Europe ocular lymphoma treatment market is projected to grow steadily during the forecast period, propelled by increasing investments in healthcare research, stringent regulatory frameworks, and rising prevalence of ocular cancers. Countries such as Germany, France, and the U.K. are witnessing enhanced access to advanced treatment options and growing emphasis on early diagnosis. The expansion of specialized treatment centers and growing patient awareness are key factors fostering market adoption in both residential and hospital settings.

U.K. Ocular Lymphoma Treatment Market Insight

The U.K. ocular lymphoma treatment market is expected to grow at a moderate CAGR, driven by improved healthcare delivery systems and growing focus on personalized medicine. Increasing prevalence of intraocular lymphomas and improved diagnostic capabilities are leading to better treatment outcomes. The presence of government-supported health programs and ongoing clinical trials contribute to market growth.

Germany Ocular Lymphoma Treatment Market Insight

The Germany ocular lymphoma treatment market is anticipated to expand significantly due to advanced healthcare infrastructure, government funding in oncology research, and increasing adoption of innovative therapies. Germany’s focus on precision medicine and integrated healthcare services supports the uptake of targeted ocular lymphoma treatments. Growing collaborations between research institutes and pharmaceutical companies are also fueling market growth.

Asia-Pacific Ocular Lymphoma Treatment Market Insight

The Asia-Pacific ocular lymphoma treatment market is poised to register the fastest CAGR during the forecast period, driven by increasing healthcare awareness, rising prevalence of ocular cancers, and expanding healthcare infrastructure in countries such as China, Japan, and India. Growing investments in healthcare technology, improving diagnostic facilities, and increasing patient access to advanced therapies are key growth drivers. Government initiatives to improve cancer care and early detection are also propelling market expansion.

Japan Ocular Lymphoma Treatment Market Insight

The Japan ocular lymphoma treatment market is gaining momentum due to the country’s advanced healthcare system, high healthcare expenditure, and increasing geriatric population susceptible to ocular cancers. Japan's emphasis on cutting-edge medical technologies and growing integration of precision oncology are encouraging adoption of novel treatment options for ocular lymphoma.

India Ocular Lymphoma Treatment Market Insight

The India ocular lymphoma treatment market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rising healthcare awareness, expanding healthcare facilities, and increasing access to affordable treatment options. Rapid urbanization, government healthcare initiatives, and a growing patient population are driving market growth. The presence of local pharmaceutical companies offering cost-effective therapies also supports the expanding market landscape.

Ocular Lymphoma Treatment Market Share

The ocular lymphoma treatment industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Pfizer Inc. (U.S.)

- ELITechGroup (France)

- PerkinElmer (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- AutoGenomics (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

- BioSystems (Spain)

- Sarepta Therapeutics, Inc. (U.S.)

- BioMarin (U.S.)

- Jazz Pharmaceuticals, Inc. (U.K.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Takeda Pharmaceutical Company Limited (Ireland)

- Amgen Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Labcorp Genetics Inc. (U.S.)

- Aetna Inc. (U.S.)

- GeneDx, LLC (U.S.)

What are the Recent Developments in Global Ocular Lymphoma Treatment Market?

- In April 2023, Gossamer Bio announced the initiation of a Phase 1b/2 clinical trial for GB5121, an oral, CNS-penetrant Bruton's tyrosine kinase (BTK) inhibitor, targeting primary central nervous system lymphoma (PCNSL)

- In April 2023, Gossamer Bio announced the termination of all ongoing studies and the discontinuation of GB5121 development due to the FDA's partial clinical hold and the observed adverse events

- In March 2023, Gossamer Bio received a partial clinical hold from the U.S. FDA on all trials of GB5121 following serious adverse events, including a fatal intracranial hemorrhage, observed in the Phase 1b/2 STAR-CNS study

- In July 2022, Pfizer Inc. gained U.S. FDA approval for Xalkori (crizotinib) to treat pediatric and adult patients with ALK-positive inflammatory myofibroblastic tumor (IMT). For adult patients, the recommended dosage is 250 mg, administered orally twice daily until disease progression halts. This approval is anticipated to drive growth in the oral treatment segment

- In October 2021, Gossamer Bio, Inc., a clinical-stage biotechnology company, announced the addition of two CNS-penetrant Bruton's tyrosine kinase (BTK) inhibitors to its product candidate portfolio. The company focuses on discovering, acquiring, developing, and commercializing treatments for conditions related to inflammation, immunology, and cancer. The first of these candidates, GB5121, entered first-in-human clinical trials in the fourth quarter of 2021

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.