Global Ocular Pain Intraocular Treatment Market

Market Size in USD Million

CAGR :

%

USD

101.54 Million

USD

182.85 Million

2024

2032

USD

101.54 Million

USD

182.85 Million

2024

2032

| 2025 –2032 | |

| USD 101.54 Million | |

| USD 182.85 Million | |

|

|

|

|

Ocular Pain Intraocular Treatment Market Size

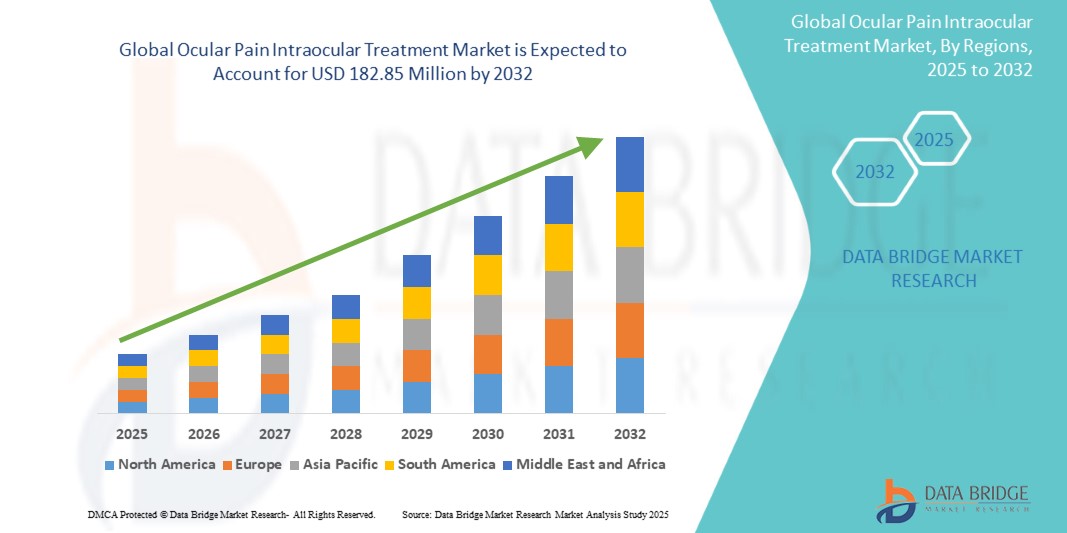

- The global ocular pain intraocular treatment market size was valued at USD 101.54 million in 2024 and is expected to reach USD 182.85 million by 2032, at a CAGR of 7.63% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ocular disorders, rising incidences of postoperative eye pain, and growing awareness of advanced intraocular treatment options among patients and healthcare providers

- Furthermore, technological advancements in drug formulations, delivery methods, and minimally invasive intraocular procedures are driving the adoption of ocular pain treatments, enabling more effective management of pain and faster patient recovery. These converging factors are accelerating the uptake of ocular pain intraocular treatment solutions, thereby significantly boosting the industry’s growth

Ocular Pain Intraocular Treatment Market Analysis

- The ocular pain intraocular treatment market is witnessing substantial growth globally, driven by the increasing prevalence of ocular disorders, rising patient awareness, and the growing adoption of advanced intraocular therapies across hospitals, clinics, and ophthalmology center

- The escalating demand for minimally invasive procedures, sustained-release implants, and innovative drug delivery systems is fueling market expansion, as patients and ophthalmologists increasingly prefer precision-based treatment options for ocular pain management

- North America dominated the ocular pain intraocular treatment market with the largest revenue share of 47% in 2024, driven by high adoption of advanced ophthalmic therapies, strong healthcare infrastructure, and the presence of leading market players. The U.S. market experienced substantial growth due to rising awareness about ocular health, increasing prevalence of eye disorders, and the availability of innovative intraocular treatment options, including minimally invasive and targeted therapies

- Asia-Pacific is expected to be the fastest-growing region in the ocular pain intraocular treatment market during the forecast period, owing to rapid urbanization, rising healthcare expenditure, increasing prevalence of ocular disorders, and growing awareness about advanced eye care solutions. Countries such as China, India, and Japan are witnessing significant adoption of intraocular treatments due to expanding ophthalmology infrastructure and patient access to modern therapies

- The treatment segment dominated the ocular pain intraocular treatment market with a revenue share of 60.2% in 2024, driven by the primary role of intraocular therapies in alleviating postoperative and chronic ocular pain. Treatment applications include post-cataract surgery pain control, glaucoma-related discomfort, and management of retinal or corneal injuries

Report Scope and Ocular Pain Intraocular Treatment Market Segmentation

|

Attributes |

Ocular Pain Intraocular Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Intraocular Treatment Market Trends

Enhanced Convenience and Patient-Centric Treatment Options

- A significant and accelerating trend in the global Ocular Pain Intraocular Treatment market is the growing focus on patient-centric therapies that offer improved convenience, ease of administration, and better clinical outcomes. This includes minimally invasive intraocular procedures, targeted drug delivery systems, and sustained-release formulations that reduce the frequency of treatments

- For instance, Novartis has developed intravitreal corticosteroid implants that provide extended pain relief and inflammation control following ophthalmic surgeries, reducing the need for repeated injections and follow-ups. Similarly, AbbVie and Bausch + Lomb offer ocular analgesics with advanced formulations designed to minimize discomfort and enhance patient compliance

- Advancements in delivery systems enable more precise targeting of ocular tissues, improving therapeutic efficacy while minimizing systemic side effects. For instance, sustained-release implants and microcatheter-based delivery systems allow controlled drug release over extended periods, reducing patient burden and improving treatment adherence

- The integration of these innovative treatment options into standard ophthalmic care is transforming patient experiences by offering more efficient, less invasive, and highly effective pain management solutions

- This trend toward convenient, patient-friendly, and clinically effective ocular pain treatments is driving growth in hospitals, specialty eye care centers, and clinics, as providers increasingly adopt these solutions to enhance patient satisfaction and outcomes

- The demand for advanced ocular pain intraocular treatments is expected to continue rising as awareness increases among patients and healthcare professionals regarding the benefits of minimally invasive, long-acting, and targeted therapies in postoperative and chronic ocular pain management

Ocular Pain Intraocular Treatment Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Ocular Disorders and Postoperative Pain

- The increasing prevalence of ocular disorders, postoperative complications, and chronic eye pain is a significant driver for the heightened demand for ocular pain intraocular treatments. Patients undergoing cataract surgery, glaucoma procedures, or retinal interventions increasingly require effective pain management and targeted intraocular therapies to ensure faster recovery and improved outcomes

- For instance, in April 2024, Novartis launched a next-generation intravitreal implant designed to provide extended pain relief and anti-inflammatory benefits following ophthalmic surgeries. Such innovations by key companies are expected to drive the ocular pain intraocular treatment industry growth during the forecast period

- As healthcare providers and patients become more aware of the benefits of advanced intraocular treatments, these solutions offer improved efficacy, precise targeting of ocular tissues, and reduced frequency of administration, providing a compelling upgrade over traditional eye drop or systemic therapies

- Furthermore, the development of sustained-release implants, microcatheter-based delivery systems, and combination therapies is making ocular pain intraocular treatments an integral component of modern ophthalmic care, offering more consistent and reliable pain management outcomes

- The convenience of minimally invasive procedures, reduced treatment burden, and improved patient adherence are key factors propelling the adoption of ocular pain intraocular treatments across hospitals, specialty eye care centers, and clinics. Rising investments in research and development, as well as the expansion of advanced ophthalmic facilities, further contribute to market growth

Restraint/Challenge

High Treatment Costs and Regulatory Barriers

- The relatively high cost of advanced ocular pain intraocular treatments can pose a barrier to adoption, particularly in developing regions or for patients with limited healthcare access. Premium products such as sustained-release implants or novel drug delivery systems often come with a higher price tag compared to conventional therapies, limiting widespread usage

- Regulatory requirements and stringent approval processes in different regions can also slow the introduction of innovative intraocular treatments, impacting market expansion and delaying patient access to new therapies

- Addressing these challenges through cost optimization, patient assistance programs, and streamlined regulatory pathways is crucial for increasing accessibility and driving market growth. Companies such as Bausch + Lomb, AbbVie, and Santen emphasize clinical evidence, safety, and patient education to build confidence in these advanced therapies

- While prices for some therapies are gradually decreasing, the perceived premium for next-generation ocular pain treatments may still hinder adoption among budget-conscious patients or smaller healthcare facilities

- Overcoming these challenges through affordable treatment options, increased clinician awareness, and supportive healthcare policies will be vital for sustained growth in the ocular pain intraocular treatment market

Ocular Pain Intraocular Treatment Market Scope

The market is segmented on the basis of type, route of administration, end user, and application.

• By Type

On the basis of type, the global ocular pain intraocular treatment market is segmented into topical NSAIDs, corticosteroids, analgesics, antibiotics, and others. The corticosteroids segment dominated the market with a revenue share of 42.5% in 2024, owing to their strong anti-inflammatory properties and effectiveness in managing postoperative ocular pain. Corticosteroids are widely preferred by ophthalmologists for both acute and chronic pain conditions, and their well-established clinical efficacy supports high adoption across hospitals and specialty eye care centers. Additionally, new sustained-release corticosteroid implants are increasing patient compliance and reducing the frequency of intravitreal injections. The segment’s dominance is also reinforced by strong research and development pipelines from leading pharmaceutical companies. Market demand is further driven by increasing awareness of advanced ocular therapies and the rising number of ophthalmic surgeries globally.

The topical NSAIDs segment is expected to witness the fastest CAGR of 19.2% from 2025 to 2032, fueled by growing preference for non-steroidal options in postoperative pain management and for patients contraindicated for corticosteroids. Topical NSAIDs offer convenient administration, lower systemic side effects, and compatibility with standard ophthalmic procedures. Rising clinician confidence in NSAID efficacy, along with innovations in formulations for enhanced ocular penetration, is driving rapid adoption. The segment benefits from increasing awareness among patients and ophthalmologists about alternatives to corticosteroids. Expanding availability in emerging markets and improved insurance coverage for topical therapies also contribute to the growth.

• By Route of Administration

On the basis of route of administration, the global ocular pain intraocular treatment market is segmented into topical, oral, parenteral, and others. The Topical route dominated the market with a revenue share of 48.7% in 2024, driven by patient preference for easy-to-use eye drops and gels that can be self-administered post-surgery. Topical administration ensures direct delivery to the ocular tissues with minimal systemic exposure, making it ideal for managing localized pain and inflammation. Ophthalmologists recommend topical therapy as first-line treatment for postoperative and chronic ocular pain. Convenience, affordability, and wide availability in pharmacies further reinforce this segment’s dominance. Sustained-release topical formulations are also enhancing patient adherence and outcomes.

The Parenteral route is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, supported by the growing adoption of intravitreal injections and implants for targeted, long-acting pain control. Parenteral delivery allows precise dosing directly into the vitreous or periocular space, enhancing therapeutic efficacy for severe ocular pain conditions. Increasing numbers of advanced ophthalmic procedures and innovations in minimally invasive delivery systems are driving this rapid growth. Parenteral treatments are particularly preferred in hospitals and specialty centers for complex cases. Rising clinician expertise and improved safety profiles also encourage broader adoption.

• By End User

On the basis of end user, the global ocular pain intraocular treatment market is segmented into hospitals, clinics, specialty eye care centers, research institutes, and others. The Hospitals segment dominated the market with a revenue share of 55.3% in 2024, owing to their access to high-volume surgeries, advanced infrastructure, and a large pool of postoperative patients. Hospitals offer both inpatient and outpatient ocular pain management services, making them primary users of intraocular treatment products. Adoption is further supported by established procurement systems and strong collaboration with pharmaceutical suppliers. The dominance is also driven by increasing hospital investments in ophthalmic care facilities. Specialized staff and training in ocular procedures ensure effective implementation of intraocular therapies, reinforcing demand.

The specialty eye care centers segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, as these centers focus exclusively on ophthalmic care and provide personalized, targeted treatment options. Their growing presence in urban areas and high patient throughput for eye surgeries fuel rapid adoption of advanced intraocular therapies. Specialized centers offer innovative treatment techniques, including minimally invasive procedures and sustained-release implants. Increasing patient awareness and preference for specialized care accelerate growth. Partnerships with pharmaceutical and medtech companies for clinical studies and product launches further boost adoption.

• By Application

On the basis of application, the global ocular pain intraocular treatment market is segmented into diagnosis, treatment, management, and others. The treatment segment dominated the market with a revenue share of 60.2% in 2024, driven by the primary role of intraocular therapies in alleviating postoperative and chronic ocular pain. Treatment applications include post-cataract surgery pain control, glaucoma-related discomfort, and management of retinal or corneal injuries. High adoption is supported by clinician preference for evidence-based interventions that provide rapid symptom relief. Increasing numbers of ophthalmic surgeries and rising patient awareness are further boosting this segment. The dominance is also reinforced by the availability of advanced drug delivery systems and implants, which enhance therapeutic outcomes.

The management segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by the growing demand for long-term ocular pain management solutions, including sustained-release implants and combination therapies. These treatments allow continuous drug delivery, reducing the need for frequent hospital visits and improving patient compliance. Rising prevalence of chronic ocular conditions, such as diabetic retinopathy and post-surgical inflammation, drives adoption. Technological innovations in delivery mechanisms and increasing acceptance among ophthalmologists further accelerate growth. Patient-centric approaches and improved safety profiles also support the expansion of this segment globally.

Ocular Pain Intraocular Treatment Market Regional Analysis

- North America dominated the ocular pain intraocular treatment market with the largest revenue share of 47% in 2024, driven by high adoption of advanced ophthalmic therapies, well-established healthcare infrastructure, and the presence of leading market players

- Hospitals, specialized eye clinics, and outpatient centers are increasingly implementing minimally invasive procedures and targeted intraocular treatments, improving patient outcomes and reducing recovery times. The region’s robust research ecosystem and rapid integration of innovative ophthalmic technologies further strengthen market demand

- Consumers and healthcare providers in the region are showing increasing preference for cutting-edge intraocular treatment options, including laser-assisted therapies, precision-guided injections, and pharmacological interventions. Rising prevalence of ocular disorders such as glaucoma, diabetic retinopathy, cataracts, and age-related macular degeneration, coupled with growing awareness of early diagnosis and preventive eye care, is driving adoption

U.S. Ocular Pain Intraocular Treatment Market Insight

The U.S. ocular pain intraocular treatment market captured the largest revenue share in 2024 within North America, fueled by the rapid uptake of innovative intraocular therapies and high patient awareness regarding ocular health. Increasing investment in ophthalmology infrastructure, availability of specialized eye centers, and expanding insurance coverage for advanced procedures are facilitating market growth. Minimally invasive surgeries, advanced diagnostic imaging, and personalized pharmacological treatments are key factors boosting adoption.

Europe Ocular Pain Intraocular Treatment Market Insight

The Europe ocular pain intraocular treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing patient awareness, stringent healthcare regulations, and rising prevalence of eye disorders. Countries such as Germany, France, and the U.K. are experiencing growing integration of advanced intraocular treatments into clinical practice. Innovations in surgical techniques and improved access to modern ophthalmology centers are supporting the expansion of the market.

U.K. Ocular Pain Intraocular Treatment Market Insight

The U.K. ocular pain intraocular treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for minimally invasive procedures and state-of-the-art intraocular therapies. Increased awareness about eye health, supportive healthcare policies, and investments in ophthalmology infrastructure are encouraging both public and private healthcare providers to adopt advanced treatment options, including laser-assisted surgeries and targeted pharmacological interventions.

Germany Ocular Pain Intraocular Treatment Market Insight

The Germany ocular pain intraocular treatment market is expected to expand at a considerable CAGR during the forecast period, driven by the availability of technologically advanced intraocular procedures and well-established healthcare infrastructure. Hospitals and specialized eye clinics are increasingly adopting modern ophthalmic solutions, emphasizing early detection, precise intervention, and patient-centered care. Germany’s focus on innovation, research, and sustainable healthcare solutions is further supporting market growth.

Asia-Pacific Ocular Pain Intraocular Treatment Market Insight

The Asia-Pacific ocular pain intraocular treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising prevalence of ocular disorders, growing awareness about advanced eye care, and rapid urbanization. Countries such as China, India, and Japan are witnessing a significant surge in adoption of modern intraocular treatments, including laser-assisted surgeries, minimally invasive procedures, and pharmacological therapies. Expansion of ophthalmology infrastructure, government initiatives to improve eye care, and increasing patient access to specialized treatments are key growth factors.

Japan Ocular Pain Intraocular Treatment Market Insight

The Japan ocular pain intraocular treatment market is gaining momentum due to the country’s advanced healthcare system, high-tech ophthalmology solutions, and aging population. Hospitals and clinics are adopting minimally invasive procedures and precision-guided therapies, ensuring better treatment outcomes. The integration of diagnostic imaging with therapeutic interventions is driving efficient patient management and accelerating market growth.

China Ocular Pain Intraocular Treatment Market Insight

The China ocular pain intraocular treatment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing healthcare expenditure, and expanding ophthalmology infrastructure. High patient awareness, supportive government policies, and accessibility to advanced intraocular therapies, including laser-assisted treatments and targeted injections, are fueling market expansion. China’s large patient base and the growing number of specialty eye centers are creating a robust growth environment for intraocular treatment solutions.

Ocular Pain Intraocular Treatment Market Share

The ocular pain intraocular treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc (U.S.)

- Bausch + Lomb (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Théa Pharma (France)

- Sun Pharmaceutical Industries Ltd. (India)

- KALA BIO (U.S.)

- Eyevance Pharmaceuticals (U.S.)

- Alcon Inc. (U.S.)

- Harrow, Inc. (U.S.)

- Glaukos Corporation (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Regeneron Pharmaceuticals Inc. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Aura Biosciences, Inc. (U.S.)

Latest Developments in Global Ocular Pain Intraocular Treatment Market

- In June 2024, Balance Ophthalmics received FDA approval for the FSYX Ocular Pressure Adjusting Pump, marking it as the first non-surgical, non-pharmaceutical intraocular pressure (IOP)-lowering therapy for patients with open-angle glaucoma. This device combines a compact, portable pump with pressure-sensing goggles designed to be worn at night, addressing unmet needs in glaucoma management by providing 24-hour IOP control

- In May 2025, EyeCool Therapeutics announced positive results from a pilot study of its investigational device, ETX-4143. The device gently cools the ocular surface for 4 minutes, targeting myelinated long ciliary nerves responsible for ocular pain. Many patients experienced immediate relief and lasting effects, with improvement over the following weeks. The company plans to begin a U.S. pivotal trial after receiving approval from the FDA for an investigational device exemption

- In October 2024, statistics revealed by the World Health Organization (WHO) stated that there were 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of people in the world who are 60 years of age or older is expected to double to 2.1 billion by 2050. This demographic shift is placing additional strain on healthcare systems, prompting increased demand for ocular pain products

- In May 2025, ETX-4143 was designed to cool the ocular surface for 4 minutes, targeting the myelinated long ciliary nerves responsible for pain. The company reported that the nerves, in the months following treatment, regenerate myelin, which may require retreatment. The company plans to begin a U.S. pivotal trial after receiving approval from the FDA for an investigational device exemption

- In July 2025, BIS Research reported that the global acute ocular pain market is set to grow substantially in the next 10 years, up from USD340 million in 2024. The growth is driven by advancements in ocular pain relief products, growing awareness prompting early diagnosis and timely medical intervention, and increased R&D investment fueling innovation in eye care solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.