Global Ocular Pain Retrobulbar Treatment Market

Market Size in USD Million

CAGR :

%

USD

5.99 Million

USD

10.15 Million

2024

2032

USD

5.99 Million

USD

10.15 Million

2024

2032

| 2025 –2032 | |

| USD 5.99 Million | |

| USD 10.15 Million | |

|

|

|

|

Ocular Pain Retrobulbar Treatment Market Size

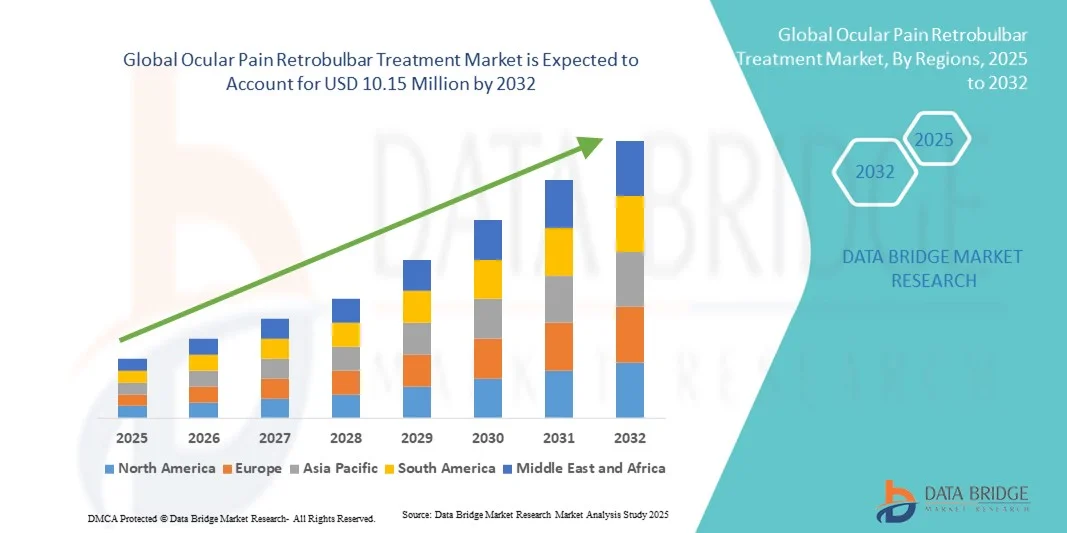

- The global ocular pain retrobulbar treatment market size was valued at USD 5.99 million in 2024 and is expected to reach USD 10.15 million by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of ophthalmic disorders, increasing surgical volumes such as cataract and glaucoma procedures, and the growing use of regional anesthesia techniques in ophthalmology

- Furthermore, rising demand for effective pain management in blind painful eyes and perioperative care, coupled with advancements in anesthetic and neurolytic agents, is establishing retrobulbar treatments as a critical therapeutic approach. These converging factors are accelerating the adoption of ocular pain management solutions, thereby significantly boosting the industry’s growth

Ocular Pain Retrobulbar Treatment Market Analysis

- Retrobulbar treatments, involving targeted anesthetic or neurolytic injections into the retrobulbar space, are increasingly vital in ophthalmology for managing severe ocular pain and providing perioperative anesthesia during eye surgeries due to their effectiveness, localized action, and ability to preserve patient comfort

- The escalating demand for retrobulbar treatment is primarily fueled by the rising prevalence of blinding eye diseases such as glaucoma and corneal disorders, the increasing number of ophthalmic surgical procedures, and the growing need for long-term pain relief in blind painful eyes

- North America dominated the ocular pain retrobulbar treatment market with the largest revenue share of 40.3% in 2024, supported by advanced healthcare infrastructure, high surgical volumes, and the strong presence of specialized ophthalmology centers, with the U.S. experiencing substantial adoption due to wider use of retrobulbar blocks in cataract and vitreoretinal surgeries

- Asia-Pacific is expected to be the fastest growing region in the ocular pain retrobulbar treatment market during the forecast period due to its rapidly aging population, increasing awareness of ophthalmic pain management, and expanding access to advanced surgical procedures

- The retrobulbar neurolytic injection segment dominated the ocular pain retrobulbar treatment market with a 42.1% share in 2024, driven by its established role in providing long-lasting pain relief for blind painful eyes and its cost-effectiveness compared to alternative surgical interventions such as enucleation or evisceration

Report Scope and Ocular Pain Retrobulbar Treatment Market Segmentation

|

Attributes |

Ocular Pain Retrobulbar Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Retrobulbar Treatment Market Trends

Advancements in Targeted Pain Management and Minimally Invasive Techniques

- A significant and accelerating trend in the ocular pain retrobulbar treatment market is the development of minimally invasive injection techniques and precision delivery systems that improve patient comfort and reduce procedure-related complications

- For instance, newer retrobulbar neurolytic and anesthetic injection protocols enable ophthalmologists to deliver accurate doses with minimal tissue trauma, enhancing efficacy in blind painful eye management and perioperative analgesia

- Technological innovations also include combination therapies, such as local anesthetics with adjuvants, which provide longer-lasting pain relief and reduce the frequency of repeat procedures. Some advanced injection systems now incorporate imaging guidance to improve accuracy and safety, lowering the risk of complications such as globe perforation or hemorrhage

- The integration of these innovative techniques into routine ophthalmic practice facilitates more predictable outcomes and greater patient satisfaction. Clinics adopting these solutions can manage ocular pain more effectively while maintaining high safety standards

- This trend towards more precise, patient-friendly, and outcome-driven treatments is fundamentally reshaping expectations in ocular pain management. Consequently, leading ophthalmology centers are increasingly implementing advanced retrobulbar delivery systems and standardized protocols to ensure consistent results

- The demand for minimally invasive, highly effective retrobulbar treatments is growing rapidly, driven by both clinical efficacy and patient preference for less painful, more controlled procedures

Ocular Pain Retrobulbar Treatment Market Dynamics

Driver

Rising Prevalence of Ophthalmic Disorders and Surgical Procedures

- The increasing incidence of blinding eye diseases such as glaucoma, corneal disorders, and other end-stage ocular conditions, combined with the rising number of ophthalmic surgeries, is a key driver for the growing adoption of retrobulbar treatments

- For instance, in 2024, several tertiary eye hospitals in North America and Europe reported higher utilization of retrobulbar neurolytic injections for blind painful eyes, reflecting growing clinical awareness and demand

- As patients and clinicians seek effective pain relief and improved perioperative anesthesia, retrobulbar treatments offer targeted analgesia, long-lasting efficacy, and reduced systemic side effects, making them preferable over systemic pain medications

- Growing patient awareness and education regarding ocular pain management options are encouraging more individuals to opt for retrobulbar treatments rather than invasive surgical alternatives

- Expansion of insurance coverage and reimbursement policies for ophthalmic pain management procedures in key markets is facilitating wider adoption and increasing procedural volumes

- Furthermore, increasing investments in ophthalmology centers, rising geriatric populations, and greater access to advanced surgical procedures are propelling market growth globally

Restraint/Challenge

Procedure-Related Risks and Limited Awareness in Emerging Regions

- Despite their efficacy, retrobulbar injections carry potential complications, including ptosis, strabismus, hemorrhage, or globe perforation, which can limit broader adoption, especially among less experienced practitioners

- For instance, reports of injection-related complications in clinics without specialized ophthalmic training have made some patients hesitant to opt for retrobulbar procedures

- Addressing these concerns through clinician training, standardized protocols, and improved delivery systems is crucial for building trust and increasing adoption

- In addition, in emerging regions, limited awareness of advanced ocular pain management techniques and restricted access to trained specialists can slow market growth. Expanding educational initiatives and establishing specialized ophthalmology centers will be vital to overcome these barriers

- The high cost of advanced neurolytic and anesthetic agents in certain regions can act as a barrier for patients and clinics, particularly in low- and middle-income countries

- Variability in regulatory approvals and clinical practice guidelines across countries may slow the introduction of newer retrobulbar treatments, limiting access to the latest therapies in some markets

- While the market is gradually expanding, ensuring procedural safety, clinician expertise, and patient education remains critical for sustained growth and adoption of retrobulbar treatments globally

Ocular Pain Retrobulbar Treatment Market Scope

The market is segmented on the basis of treatment type, indication, procedure, and end user.

- By Treatment Type

On the basis of treatment type, the ocular pain retrobulbar treatment market is segmented into retrobulbar neurolytic injections, retrobulbar/local anesthetic blocks, alternative orbital blocks, and topical & systemic ocular analgesics. The retrobulbar neurolytic injection segment dominated the market with the largest revenue share of 42.1% in 2024, driven by its established effectiveness in providing long-term pain relief for blind, painful eyes. Neurolytic agents such as alcohol and chlorpromazine are widely used in tertiary eye centers to manage end-stage ocular disorders, minimizing the need for repeated interventions. Hospitals and ophthalmology clinics prefer this treatment due to predictable outcomes, cost-effectiveness compared to surgical alternatives, and standardized administration protocols. Growing geriatric populations and the rising prevalence of glaucoma and corneal diseases further strengthen this segment. Clinical awareness and patient preference for minimally invasive pain management support dominance. In addition, the segment benefits from ongoing research and innovation in delivery systems.

The retrobulbar/local anesthetic block segment is expected to witness the fastest growth from 2025 to 2032, driven by rising ophthalmic surgical volumes including cataract, vitreoretinal, and glaucoma procedures. Local anesthetic blocks provide temporary but highly effective analgesia and akinesia, improving patient comfort and surgical precision. Precision delivery systems, minimally invasive injection techniques, and safer anesthetic formulations are boosting adoption. Outpatient and ambulatory surgical centers increasingly prefer anesthetic blocks due to low systemic side effects. The segment benefits from rising awareness among ophthalmologists and patients regarding perioperative pain management. Expanding access to advanced ophthalmic surgeries in emerging markets further supports rapid growth.

- By Indication

On the basis of indication, the ocular pain retrobulbar treatment market is segmented into blind, painful eye, perioperative analgesia, acute ocular pain, and neuropathic ocular pain. The blind, painful eye segment dominated the market in 2024, reflecting a high clinical need for retrobulbar neurolytic treatments. Patients with glaucoma, phthisis bulbi, or corneal disorders rely on neurolytic injections to alleviate severe chronic pain without enucleation. Hospitals and specialized eye centers have established protocols for safe administration, ensuring predictable outcomes and high patient satisfaction. The segment benefits from growing awareness of ocular pain management in developed regions. Increasing prevalence of end-stage ocular diseases in aging populations ensures sustained demand. Long-lasting efficacy and cost-effectiveness enhance repeat usage and market dominance.

The perioperative analgesia segment is expected to witness the fastest growth from 2025 to 2032 due to increasing surgical volumes in cataract, vitreoretinal, and glaucoma procedures globally. Retrobulbar and peribulbar anesthetic blocks are preferred for precise analgesia and improved surgical outcomes. Safer injection devices, advanced formulations, and minimally invasive techniques support adoption. The trend toward outpatient and day-care surgeries is increasing segment growth. Rising awareness among surgeons and patients about effective pain management further boosts adoption. Expansion of ophthalmology infrastructure in emerging markets accelerates segment growth.

- By Procedure

On the basis of procedure, the ocular pain retrobulbar treatment market is segmented into retrobulbar injection, peribulbar injection, sub-tenon injection, topical ocular, and systemic. The retrobulbar injection segment dominated the market in 2024, being the most widely used procedure for blind painful eyes and perioperative analgesia. It delivers targeted analgesia and neurolysis with predictable outcomes, making it a preferred choice in tertiary hospitals and specialized clinics. Standardized protocols, trained personnel, and clinical familiarity contribute to high adoption. Retrobulbar injections minimize systemic side effects compared to oral or IV analgesics. The segment benefits from growing surgical volumes, aging populations, and increasing awareness of ocular pain management. High procedural efficiency and low recurrence rates further strengthen its market dominance.

The peribulbar injection segment is expected to witness the fastest growth from 2025 to 2032, driven by its safer profile and lower risk of complications such as globe perforation. It is increasingly preferred in cataract and vitreoretinal surgeries, particularly in outpatient and ambulatory surgical centers. Imaging-guided injection techniques and combination anesthetic protocols enhance safety and efficacy. Rising adoption of minimally invasive procedures and demand for pain-free perioperative experiences contribute to growth. Emerging markets are adopting peribulbar injections due to easier training requirements and reduced procedural risks. Expansion of outpatient ophthalmology services supports rapid growth.

- By End User

On the basis of end user, the ocular pain retrobulbar treatment market is segmented into hospitals, ambulatory surgical centers, ophthalmology clinics, and eye hospitals. Hospitals dominated the market in 2024, reflecting their role as primary centers for ophthalmic surgeries and complex ocular pain management. Large tertiary hospitals and specialized eye centers perform high volumes of procedures for blind painful eyes and perioperative analgesia, contributing the largest revenue share. Hospitals are early adopters of advanced neurolytic and anesthetic delivery systems and follow standardized safety protocols. High patient inflow, clinical expertise, and availability of trained personnel drive adoption. Hospitals often lead clinical research and trials, promoting wider use of retrobulbar treatments. The combination of high procedural volumes and strong infrastructure ensures continued dominance of this segment.

Ambulatory surgical centers are expected to witness the fastest growth from 2025 to 2032 due to increasing outpatient ophthalmic procedures and preference for minimally invasive pain management techniques. Retrobulbar and peribulbar blocks reduce recovery time and improve patient throughput, making them ideal for day-care surgical centers. Rising cataract and vitreoretinal surgeries, expanding specialized ophthalmology clinics, and growing patient awareness contribute to adoption. The trend of cost-efficient, high-volume surgeries supports the segment’s growth. Advanced local anesthetic techniques and portable delivery systems make ambulatory centers attractive for retrobulbar treatments. The increasing number of outpatient ophthalmic centers in emerging markets accelerates growth.

Ocular Pain Retrobulbar Treatment Market Regional Analysis

- North America dominated the ocular pain retrobulbar treatment market with the largest revenue share of 40.3% in 2024, supported by advanced healthcare infrastructure, high surgical volumes, and the strong presence of specialized ophthalmology centers, with the U.S. experiencing substantial adoption due to wider use of retrobulbar blocks in cataract and vitreoretinal surgeries

- Patients and clinicians in the region highly value the effectiveness, precision, and long-term pain relief offered by retrobulbar neurolytic and anesthetic injections for blind, painful eyes and perioperative analgesia

- This widespread adoption is further supported by high clinical awareness, well-established treatment protocols, and the presence of trained ophthalmologists, establishing retrobulbar treatments as a preferred solution for managing severe ocular pain in both hospitals and specialized eye centers

U.S. Ocular Pain Retrobulbar Treatment Market Insight

The U.S. ocular pain retrobulbar treatment market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of glaucoma, corneal disorders, and end-stage ocular conditions. Patients increasingly prefer minimally invasive retrobulbar neurolytic and anesthetic injections for blind, painful eyes and perioperative analgesia. The adoption is supported by advanced healthcare infrastructure, the availability of trained ophthalmologists, and widespread awareness of ocular pain management options. Outpatient and ambulatory surgical centers are increasingly offering these procedures, driven by the demand for safe and effective pain relief. Moreover, the integration of modern delivery systems and imaging-guided injections enhances procedural precision and safety, further propelling market growth.

Europe Ocular Pain Retrobulbar Treatment Market Insight

The Europe ocular pain retrobulbar treatment market is projected to expand at a substantial CAGR during the forecast period, driven by well-established healthcare systems, increasing surgical volumes, and rising awareness of ocular pain management among patients and clinicians. The region benefits from strong regulatory frameworks ensuring procedural safety and standardization of retrobulbar and peribulbar injection techniques. Hospitals and specialized eye centers are adopting minimally invasive neurolytic and anesthetic procedures for blind, painful eyes and perioperative analgesia. Increasing geriatric populations and rising incidence of ocular disorders further support market growth. Expansion across residential, outpatient, and tertiary care ophthalmology centers ensures widespread adoption across multiple treatment settings.

U.K. Ocular Pain Retrobulbar Treatment Market Insight

The U.K. ocular pain retrobulbar treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of ocular pain management, rising ophthalmic surgical volumes, and demand for minimally invasive procedures. Patients and clinicians are increasingly opting for retrobulbar neurolytic and anesthetic injections over surgical alternatives due to predictable outcomes and lower systemic risks. Hospitals, ophthalmology clinics, and ambulatory surgical centers are expanding procedural offerings to meet the growing demand. The U.K.’s adoption of advanced delivery systems and imaging-guided injections further enhances safety and precision. In addition, public and private investments in ophthalmology infrastructure are expected to continue supporting market growth.

Germany Ocular Pain Retrobulbar Treatment Market Insight

The Germany ocular pain retrobulbar treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of ocular pain management and the demand for technologically advanced injection systems. Hospitals and specialized eye centers prefer retrobulbar and peribulbar neurolytic treatments for blind, painful eyes due to their predictable outcomes and long-term efficacy. Advanced procedural techniques, including imaging-guided injections and minimally invasive protocols, are widely adopted. Germany’s well-developed healthcare infrastructure and emphasis on patient safety promote widespread utilization. Rising surgical volumes and the aging population further contribute to steady market expansion. The integration of precision delivery systems ensures continued adoption across both residential and commercial ophthalmic care settings.

Asia-Pacific Ocular Pain Retrobulbar Treatment Market Insight

The Asia-Pacific ocular pain retrobulbar treatment market is poised to grow at the fastest CAGR during the forecast period, driven by rising geriatric populations, increasing prevalence of ocular disorders, and expanding access to ophthalmic surgical procedures. Countries such as China, Japan, and India are witnessing rapid adoption of retrobulbar neurolytic and anesthetic injections due to growing awareness and improving healthcare infrastructure. Government initiatives promoting advanced ophthalmology care and minimally invasive procedures are supporting adoption. Rising disposable incomes, urbanization, and the expansion of outpatient ophthalmic centers further accelerate market growth. Technological advancements in delivery systems and increased availability of training programs for ophthalmologists also contribute to the region’s rapid growth.

Japan Ocular Pain Retrobulbar Treatment Market Insight

The Japan ocular pain retrobulbar treatment market is gaining momentum due to the country’s high standard of healthcare, aging population, and increasing number of ophthalmic surgeries. Patients prioritize minimally invasive retrobulbar injections for both blind, painful eyes and perioperative analgesia. The integration of precision delivery systems and imaging-guided procedures enhances procedural safety and efficacy. Japan’s emphasis on patient comfort, clinical training, and advanced healthcare infrastructure supports rapid adoption. In addition, the increasing demand for outpatient ophthalmic care and day-care surgeries drives the growth of retrobulbar treatments. The focus on long-term pain relief and minimally invasive protocols is expected to sustain market expansion.

India Ocular Pain Retrobulbar Treatment Market Insight

The India ocular pain retrobulbar treatment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and increasing access to ophthalmic care. Hospitals, ophthalmology clinics, and ambulatory surgical centers are increasingly adopting retrobulbar neurolytic and anesthetic injections for blind, painful eyes and perioperative analgesia. Government initiatives promoting eye care and the push toward establishing specialty eye hospitals enhance procedural adoption. Affordable delivery systems and minimally invasive protocols make these treatments accessible to a larger patient population. The growing prevalence of glaucoma, corneal disorders, and other ocular conditions further supports market growth. The expanding ophthalmology infrastructure ensures sustainable growth across both urban and semi-urban areas.

Ocular Pain Retrobulbar Treatment Market Share

The ocular pain retrobulbar treatment industry is primarily led by well-established companies, including:

- EyeCool Therapeutics, Inc. (U.S.)

- Formosa Pharmaceuticals, Inc. (Taiwan)

- Ocular Therapeutix, Inc. (U.S.)

- KALA BIO (U.S.)

- Oculis (Switzerland)

- Surface Ophthalmics, Inc. (U.S.)

- SALVAT (Spain)

- Visiox Pharma, Inc. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Alcon Inc. (Switzerland)

- Harrow, Inc. (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- AbbVie (U.S.)

- Novartis AG (Switzerland)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Bausch + Lomb (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

What are the Recent Developments in Global Ocular Pain Retrobulbar Treatment Market?

- In July 2025, Harrow and Formosa Pharmaceuticals announced the FDA approval of Byqlovi (clobetasol propionate ophthalmic suspension) 0.05% for the treatment of postoperative inflammation and pain following ocular surgery. This development introduces a new therapeutic option for managing ocular pain, complementing existing retrobulbar treatments

- In July 2025, Alcon announced the U.S. launch of TRYPTYR (acoltremon) ophthalmic solution, a neuromodulator eye drop designed to rapidly increase natural tear production in patients with dry eye disease. This first-in-class treatment offers a new approach to managing ocular surface pain by addressing the underlying cause of dryness and discomfort

- In June 2025, the FDA cleared the FYSX Ocular Pressure Adjusting Pump, a noninvasive device designed to lower intraocular pressure (IOP) during sleep in patients with glaucoma. The device offers a novel approach to managing IOP, potentially reducing the need for retrobulbar injections in glaucoma patients by providing continuous pressure adjustment throughout the night

- In May 2025, EyeCool Therapeutics announced positive results from a pilot study of ETX-4143, a novel device designed to gently cool the ocular surface to alleviate chronic ocular surface pain. This non-invasive approach offers a potential alternative to traditional retrobulbar injections, aiming to enhance patient comfort and compliance

- In May 2025, Channel Therapeutics announced positive efficacy results for its investigational eye drop formulation, CT2000, targeting NaV1.7 channels to treat both acute ocular pain and chronic ocular surface pain associated with dry eye disease. The preclinical in vivo models demonstrated that CT2000 effectively alleviated pain, positioning it as a potential non-opioid therapeutic option for ocular pain management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.