Global Ocular Pain Subtenon Treatment Market

Market Size in USD Million

CAGR :

%

USD

11.63 Million

USD

20.23 Million

2024

2032

USD

11.63 Million

USD

20.23 Million

2024

2032

| 2025 –2032 | |

| USD 11.63 Million | |

| USD 20.23 Million | |

|

|

|

|

Ocular Pain Subtenon Treatment Market Size

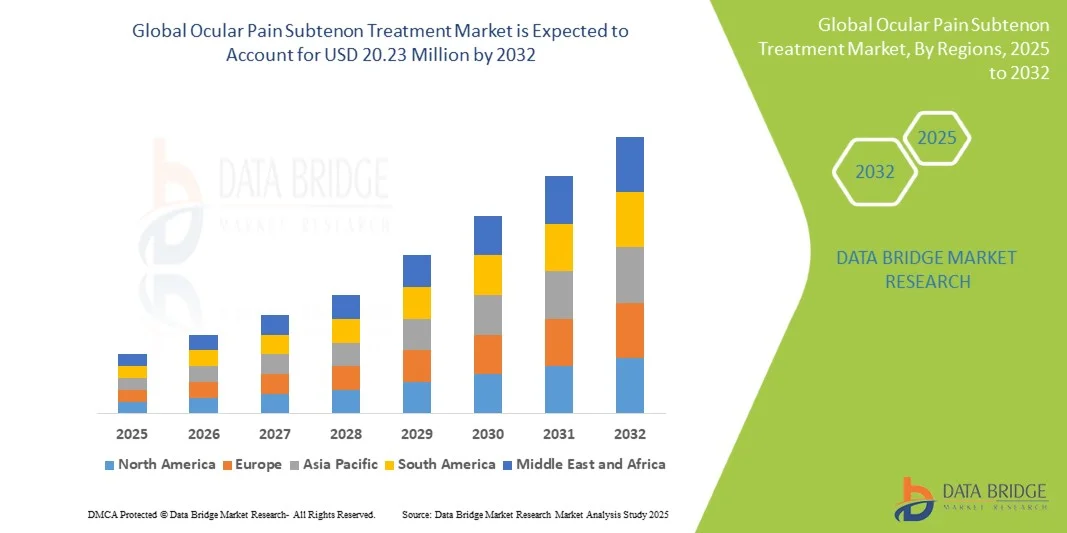

- The global ocular pain subtenon treatment market size was valued at USD 11.63 million in 2024 and is expected to reach USD 20.23 million by 2032, at a CAGR of 7.16% during the forecast period

- The market growth is primarily driven by the rising incidence of ocular surgeries, post-operative inflammation, and ocular inflammatory disorders, which are increasing the demand for targeted and effective pain management solutions

- Moreover, advancements in periocular drug delivery methods, coupled with the growing preference for minimally invasive and sustained-release therapies, are positioning subtenon treatments as a preferred option. These converging factors are propelling the adoption of subtenon injections and devices, thereby significantly strengthening market expansion

Ocular Pain Subtenon Treatment Market Analysis

- Ocular Subtenon treatments, involving periocular administration of corticosteroids, anesthetics, or long-acting depots, are increasingly recognized as critical modalities for managing ocular pain and inflammation across surgical and chronic ophthalmic indications, owing to their targeted delivery, reduced systemic side effects, and suitability for minimally invasive procedures

- The rising prevalence of ocular surgeries such as cataract and vitrectomy, combined with the growing burden of uveitis and macular edema, is fueling demand for effective subtenon pain management therapies, further supported by technological advancements in sustained-release formulations and improved delivery devices

- North America dominated the ocular pain subtenon treatment market with the largest revenue share of 39% in 2024, supported by a high volume of ophthalmic procedures, strong reimbursement structures, and the presence of leading pharmaceutical and device manufacturers, with the U.S. showing notable uptake due to early adoption of advanced periocular drug delivery solutions

- Asia-Pacific is projected to be the fastest growing region during the forecast period, driven by the high cataract burden, expanding access to ophthalmic care, and rising investments in healthcare infrastructure across emerging economies

- Corticosteroid segment dominated the ocular pain subtenon treatment market with the largest market share of 47.2% in 2024, attributed to its well-established efficacy in reducing post-operative pain and ocular inflammation, alongside its widespread use in managing chronic ophthalmic inflammatory conditions

Report Scope and Ocular Pain Subtenon Treatment Market Segmentation

|

Attributes |

Ocular Pain Subtenon Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Subtenon Treatment Market Trends

“Advancement of Sustained-Release and Targeted Delivery Therapies”

- A significant and accelerating trend in the global ocular pain subtenon treatment market is the advancement of sustained-release corticosteroid depots and targeted periocular delivery systems, enabling prolonged therapeutic effects and reduced frequency of injections

- For instance, sustained-release triamcinolone acetonide depots are being developed to provide long-term control of inflammation and pain following ocular surgeries, reducing patient burden and improving compliance

- Innovation in delivery methods allows controlled drug diffusion directly into periocular tissues, minimizing systemic exposure and potential side effects while improving the safety profile of treatment

- For instance, specialized cannulas and sterile kits for subtenon injections are designed to optimize precision, ease of use, and patient comfort during administration, contributing to higher procedural adoption rates

- The integration of biodegradable polymers and implantable delivery platforms supports gradual drug release over weeks to months, ensuring consistent therapeutic outcomes with fewer clinical visits

- This trend towards more effective, less invasive, and patient-friendly subtenon therapies is reshaping clinical practice, encouraging pharmaceutical companies to invest in advanced periocular drug delivery research

- For instance, several pipeline therapies are exploring depot-based biologics for subtenon delivery, targeting uveitis and macular edema to broaden treatment applications beyond corticosteroids

- The demand for subtenon treatments that offer extended efficacy, reduced side effects, and improved patient adherence is growing rapidly across both developed and emerging markets, strengthening the shift towards advanced ocular pain management solutions

Ocular Pain Subtenon Treatment Market Dynamics

Driver

“Rising Prevalence of Ocular Surgeries and Inflammatory Disorders”

- The increasing global volume of cataract and vitreoretinal surgeries, coupled with a rising incidence of ocular inflammatory disorders, is a significant driver fueling demand for subtenon pain management therapies

- For instance, in March 2024, new periocular corticosteroid delivery trials demonstrated enhanced outcomes in post-cataract surgery pain control, underlining the growing clinical preference for this approach

- As patients and clinicians seek safer alternatives to systemic medications, subtenon injections provide targeted delivery with reduced systemic risks, positioning them as a compelling therapeutic option

- Furthermore, the growing elderly population and the higher burden of chronic eye diseases are driving sustained demand for effective ocular pain treatments in both outpatient and hospital settings

- The targeted action of subtenon therapies enables rapid pain relief and inflammation control, enhancing post-surgical recovery and reducing the risk of complications compared to topical or systemic drugs

- For instance, corticosteroid subtenon injections are increasingly used as standard adjuncts in cataract and vitrectomy procedures to improve patient comfort and visual outcomes

- The increasing availability of specialized periocular injection devices and rising clinical awareness are expanding the adoption of subtenon treatments across ophthalmic practices worldwide

- The convenience of localized administration and the ability to tailor dosage to specific ocular conditions are key factors propelling subtenon therapy adoption in both developed and emerging healthcare systems

Restraint/Challenge

“Procedural Risks and Regulatory Approval Hurdles”

- Concerns surrounding potential complications of subtenon injections, including ocular tissue damage, elevated intraocular pressure, or rare infections, pose a significant challenge to broader clinical adoption

- For instance, reported adverse effects in certain corticosteroid subtenon therapies have raised hesitancy among clinicians regarding routine use, particularly in high-risk patients

- Addressing these safety issues through improved delivery devices, clinician training, and post-procedure monitoring is crucial for building confidence in subtenon treatments

- Furthermore, the complex regulatory pathways for novel periocular sustained-release formulations can delay market entry, restricting access to innovative therapies for patients in need

- The relatively high treatment cost of advanced depot-based subtenon therapies compared to conventional eye drops or systemic drugs can be a barrier to adoption, particularly in cost-sensitive healthcare systems

- For instance, while traditional injections remain relatively affordable, newer long-acting depots and implantable systems often involve premium pricing, limiting access in developing markets

- While innovation continues, the pace of regulatory approvals and reimbursement decisions will strongly influence the widespread availability of next-generation subtenon treatments

- Overcoming these barriers through safety optimization, accelerated clinical trials, and pricing strategies will be vital for sustaining long-term growth in the ocular pain subtenon treatment market

Ocular Pain Subtenon Treatment Market Scope

The market is segmented on the basis of drug class, route of administration, indication, end user, and distribution channel.

- By Drug Class

On the basis of drug class, the ocular pain subtenon treatment market is segmented into corticosteroids, NSAIDs, anesthetics, biologics, and anti-VEGF depot candidates. The corticosteroids segment dominated the market with the largest revenue share of 47.2% in 2024, supported by their widespread use in reducing ocular inflammation and pain in post-operative conditions, uveitis, and macular edema. Their well-established clinical efficacy, rapid onset of action, and broad physician familiarity ensure high adoption rates across hospitals and specialty clinics. Corticosteroid injections remain the gold standard for periocular drug delivery, with strong demand for both generic and branded formulations. In addition, reimbursement coverage for corticosteroid therapies in several regions strengthens their utilization. The cost-effectiveness and ability to provide targeted, localized relief without systemic side effects further enhance their market leadership. Overall, corticosteroids have maintained a long-standing role in ophthalmic pain management, making them the most reliable and trusted subtenon drug class.

The biologics and anti-VEGF depot candidates segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising R&D in innovative ocular drug delivery systems and the growing need for therapies beyond corticosteroids. These advanced agents target specific inflammatory or vascular pathways, offering improved outcomes in chronic ocular conditions such as uveitis and macular edema. The subtenon delivery route is increasingly being explored for depot formulations of biologics and anti-VEGFs, ensuring sustained therapeutic levels and reducing treatment burden. As more clinical trials demonstrate efficacy and safety, the adoption of these high-value therapies is expected to rise sharply. Increasing interest from biotech firms and investments in periocular depot pipelines are fueling this growth. Furthermore, premium pricing and the expanding prevalence of retinal diseases support strong revenue potential in this segment.

- By Route of Administration

On the basis of route of administration, the ocular pain subtenon treatment market is segmented into sub-Tenon, topical, intraocular, subconjunctival, and peribulbar. The sub-Tenon route dominated the market in 2024, reflecting its position as the primary mode of periocular delivery for managing post-operative pain and ocular inflammation. Its targeted delivery directly into periocular tissue allows for high local drug concentrations while minimizing systemic exposure. Physicians favor the sub-Tenon route due to its effectiveness, relative safety compared to intravitreal injections, and suitability for repeat administration. The use of specialized cannulas and sterile kits has also simplified the procedure, making it more accessible in both hospital and outpatient settings. Sub-Tenon injections are particularly favored for corticosteroid therapies, where they provide reliable inflammation control and faster patient recovery. The increasing adoption in developed regions underlines their clinical relevance as a standard of care.

The intraocular route (intravitreal delivery) is projected to grow at the fastest rate during the forecast period, driven by its expanding use in retinal diseases and sustained-release depot therapies. Although primarily used for anti-VEGF and biologics, ongoing innovation is extending intravitreal options for pain and inflammation management. The rise in retinal disease prevalence, coupled with physician expertise in intravitreal procedures, contributes to its accelerating adoption. Moreover, high investments in intravitreal sustained-release implants are fueling the growth of this segment. As new biologics and depot-based drugs enter the market, the intraocular route is expected to play a central role in long-term ocular therapy strategies. Its precision and strong clinical evidence base make it the fastest-growing route segment in the forecast horizon.

- By Indication

On the basis of indication, the ocular pain subtenon treatment market is segmented into post-operative ocular pain & inflammation, uveitis, macular edema, and acute ocular pain. The post-operative ocular pain & inflammation segment held the largest market share in 2024, supported by the high global volume of cataract and vitreoretinal surgeries. Subtenon corticosteroid injections are widely used as adjunct therapies to minimize post-surgical discomfort, accelerate healing, and reduce complications. Hospitals and ASCs routinely incorporate periocular injections into standard post-operative care protocols, further driving demand. The aging population and rising surgical volumes, particularly in developed countries, reinforce the dominance of this segment. Reimbursement support for cataract-related procedures also facilitates broader use of subtenon treatments. Moreover, strong clinical outcomes and consistent patient benefits sustain its leading position across markets.

The uveitis segment is expected to witness the fastest growth from 2025 to 2032, owing to the rising global prevalence of autoimmune and inflammatory eye disorders. Chronic uveitis requires sustained, localized anti-inflammatory therapies, making subtenon corticosteroids and depot formulations a critical solution. Increasing awareness among clinicians about the long-term benefits of localized delivery in uveitis management is accelerating adoption. Biologics and advanced depot injections are also expanding the treatment landscape for this indication. Clinical pipeline activity focused on non-infectious uveitis is another growth catalyst. Furthermore, the need for effective therapies that reduce systemic side effects strengthens the appeal of subtenon options in this segment.

- By End User

On the basis of end user, the ocular pain subtenon treatment market is segmented into hospitals, ambulatory surgical centers (ASCs), specialty eye clinics, private ophthalmologists & multispecialty clinics, and home healthcare. The hospital segment dominated the market in 2024, driven by the large volume of ophthalmic surgeries performed in hospital settings, where subtenon injections are routinely administered as part of post-operative care. Hospitals also benefit from advanced infrastructure, reimbursement coverage, and access to trained ophthalmologists for periocular drug delivery. Their central role in handling complex ocular conditions ensures consistent demand for subtenon therapies. Large-scale procurement through hospital pharmacy networks supports stable supply and adoption. In addition, hospitals serve as referral centers for advanced treatments, further reinforcing their dominance. Patients with severe ocular pain or inflammatory conditions often seek hospital-based care, which boosts procedure volumes.

The ambulatory surgical centers (ASCs) segment is projected to grow the fastest during the forecast period, fueled by the global trend toward outpatient ophthalmic procedures. ASCs provide a cost-effective and efficient alternative for cataract and vitreoretinal surgeries, which commonly require subtenon therapies for post-operative pain control. Their growth is supported by increasing healthcare cost pressures, driving the shift from inpatient to outpatient care. ASCs also offer convenience for patients, shorter wait times, and high procedure throughput. Technological advances in minimally invasive ophthalmic surgeries align with ASC capabilities, boosting demand for periocular therapies in this setting. The expansion of private ASCs in Asia-Pacific and North America is accelerating this growth further.

- By Distribution Channel

On the basis of distribution channel, the ocular pain subtenon treatment market is segmented into hospital procurement, hospital & specialty pharmacy, retail pharmacy, and online pharmacy. The hospital procurement segment dominated the market with the largest revenue share in 2024, as hospitals remain the primary hubs for ophthalmic surgeries and advanced ocular pain treatments. Bulk procurement by hospitals ensures consistent availability of subtenon injection kits, corticosteroids, and consumables for periocular procedures. Centralized tender systems and negotiated contracts with suppliers strengthen the purchasing power of hospitals, lowering costs while ensuring product access. Hospitals also act as primary centers for new therapy adoption, making them the largest distribution channel for subtenon treatments. The volume of ophthalmic procedures performed in hospital environments directly reinforces this dominance. Reimbursement support further enhances hospital-driven consumption of periocular therapies.

The online pharmacy segment is anticipated to grow at the fastest rate during the forecast period, supported by the expanding digitalization of healthcare and rising adoption of e-commerce channels for specialty drugs and devices. Online platforms offer convenience, broader product access, and competitive pricing, which is increasingly appealing to specialty eye clinics and private practitioners. Growth in telemedicine and remote ophthalmology consultations is also fueling demand for online ordering of periocular therapies. In emerging markets, online channels bridge gaps in access to advanced ophthalmic products. Furthermore, improvements in cold-chain logistics and regulatory approvals for digital pharmacies are enhancing trust and adoption. As digital health ecosystems expand, online distribution is expected to capture a growing share of the subtenon treatment supply chain.

Ocular Pain Subtenon Treatment Market Regional Analysis

- North America dominated the ocular pain subtenon treatment market with the largest revenue share of 39% in 2024, supported by a high volume of ophthalmic procedures, strong reimbursement structures, and the presence of leading pharmaceutical and device manufacturers

- Patients and clinicians in the region highly value the efficacy, rapid pain relief, and lower systemic side-effect profile associated with subtenon therapies compared to traditional systemic treatments

- This adoption is further supported by favorable reimbursement policies, a rising number of ophthalmic surgical procedures, and growing prevalence of conditions such as uveitis and post-operative ocular inflammation, establishing subtenon injections as a preferred therapeutic option in both hospitals and specialty eye clinics

U.S. Ocular Pain Subtenon Treatment Market Insight

The U.S. ocular pain subtenon treatment market captured the largest revenue share of 79% in 2024 within North America, fueled by the increasing prevalence of ocular surgeries and uveitis cases. Patients and providers are prioritizing subtenon corticosteroid and anesthetic injections for their localized action and minimized systemic side effects. The rising trend of outpatient ophthalmic procedures, combined with strong adoption in ambulatory surgical centers (ASCs) and specialty eye clinics, is further propelling the market. Moreover, favorable reimbursement frameworks and integration of advanced biologics into treatment protocols are significantly contributing to market expansion.

Europe Ocular Pain Subtenon Treatment Market Insight

The Europe ocular pain subtenon treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by an increasing elderly population with age-related ocular conditions. The demand for localized pain management therapies is growing in hospitals and private ophthalmology practices. European patients are also drawn to the reduced systemic complications of subtenon therapies compared to systemic drug delivery. The region is experiencing notable growth across post-surgical pain management and uveitis care, with treatments being incorporated into both primary and specialty settings.

U.K. Ocular Pain Subtenon Treatment Market Insight

The U.K. ocular pain subtenon treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising incidence of ocular inflammation and a strong emphasis on patient-centric ophthalmic care. Concerns about systemic drug toxicity are encouraging both ophthalmologists and patients to choose subtenon administration. The U.K.’s established network of NHS hospitals and private eye care centers, alongside increasing adoption of biologics for ocular pain and inflammation, is expected to stimulate market growth.

Germany Ocular Pain Subtenon Treatment Market Insight

The Germany ocular pain subtenon treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced ophthalmic treatments and demand for precision-based drug delivery. Germany’s strong healthcare infrastructure, combined with its emphasis on innovative biologics and anti-VEGF candidates, promotes adoption. Subtenon injections are increasingly integrated into hospital-based and specialty ophthalmology practices, with a focus on minimizing systemic risks while addressing post-operative ocular pain and macular edema.

Asia-Pacific Ocular Pain Subtenon Treatment Market Insight

The Asia-Pacific ocular pain subtenon treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising surgical volumes, increasing prevalence of ocular disorders, and growing healthcare access in countries such as China, Japan, and India. The region's inclination towards cost-effective and minimally invasive treatments is driving adoption of subtenon injections. Furthermore, as APAC emerges as a hub for generic corticosteroids and affordable ophthalmic formulations, accessibility of treatments is expanding to a broader patient base.

Japan Ocular Pain Subtenon Treatment Market Insight

The Japan ocular pain subtenon treatment market is gaining momentum due to the country’s advanced healthcare system, rapid aging population, and demand for efficient pain management. The Japanese market places high emphasis on innovation and quality-of-life improvements, driving use of subtenon biologics and corticosteroids. Integration of subtenon therapies with routine post-cataract and refractive surgery care is fueling adoption. Moreover, Japan’s focus on minimally invasive techniques is such asly to spur greater demand in both hospitals and specialty clinics.

India Ocular Pain Subtenon Treatment Market Insight

The India ocular pain subtenon treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s large patient pool, rapid growth in ophthalmic surgeries, and increasing awareness of advanced ocular pain management. India stands as one of the fastest-growing markets for ophthalmic drugs, with subtenon therapies becoming popular in tertiary hospitals, specialty eye institutes, and private clinics. The push towards affordable eye care, expansion of multispecialty hospitals, and rising government initiatives in eye health are key factors propelling the market in India.

Ocular Pain Subtenon Treatment Market Share

The Ocular Pain Subtenon Treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Ocular Therapeutix, Inc. (U.S.)

- KALA BIO. (U.S.)

- Oculis (Switzerland)

- Surface Ophthalmics, Inc. (U.S.)

- Formosa Pharmaceuticals, Inc. (Taiwan)

- Salvat Laboratories (Spain)

- Visiox Pharma (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Chengdu Kanghong Pharmaceutical Group Co., Ltd. (China)

- Alcon Inc. (Switzerland)

- Bausch + Lomb (U.S.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

What are the Recent Developments in Ocular Pain Subtenon Treatment Market?

- In July 2025, Amneal Pharmaceuticals announced the FDA approval of prednisolone acetate ophthalmic suspension, 1%, a sterile, topical anti-inflammatory agent for ophthalmic use. This product is indicated for treating steroid-responsive ocular inflammation, including postoperative inflammation and pain following ocular surgery. The product launch is planned for Q3 of 2025

- In July 2025, Harrow announced a licensing agreement with Formosa Pharmaceuticals, acquiring the exclusive U.S. commercial rights for Byqlovi (clobetasol propionate ophthalmic suspension) 0.05%. Byqlovi was recently approved by the FDA for the treatment of postoperative inflammation and pain following ocular surgery. The product is expected to be available in the fourth quarter of 2025

- In July 2025, Johnson & Johnson launched Acuvue Oasys Max 1-Day Multifocal for Astigmatism, the first and only daily disposable contact lens for people with both astigmatism and presbyopia. This contact lens provides patients with crisp, clear, stable vision at all distances and in all lighting conditions, along with comfort that lasts all day

- In May 2025, Alcon announced the FDA approval of TRYPTYR (acoltremon ophthalmic solution 0.003%), a first-in-class neuromodulator eye drop for the treatment of dry eye disease. TRYPTYR demonstrated a statistically significant increase in natural tear production as early as day one. The product is expected to be launched in the U.S. during the third quarter of 2025

- In October 2023, Orasis Pharmaceuticals received FDA approval for pilocarpine hydrochloride ophthalmic solution (0.4%) for the treatment of presbyopia in adults. This novel, corrective prescription eye drop is now available to prescribe in the U.S., offering patients the flexibility of using one drop in each eye for improved near vision for a specific occasion or activity, and up to two drops per day for an extended effect lasting up to eight hours

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.