Global Ocular Pain Tablets Market

Market Size in USD Million

CAGR :

%

USD

18.60 Million

USD

33.69 Million

2024

2032

USD

18.60 Million

USD

33.69 Million

2024

2032

| 2025 –2032 | |

| USD 18.60 Million | |

| USD 33.69 Million | |

|

|

|

|

Ocular Pain Tablets Market Size

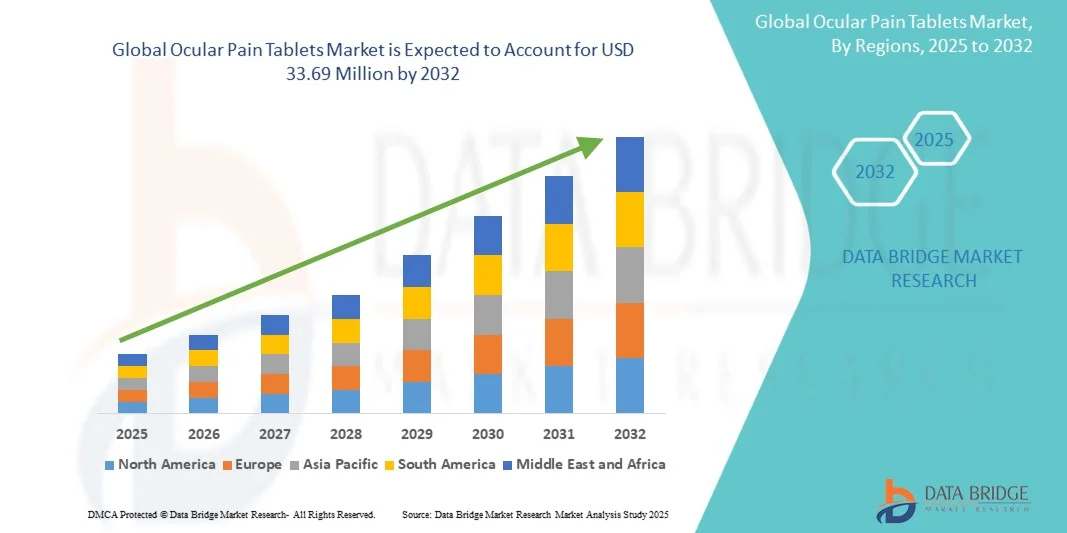

- The global ocular pain tablets market size was valued at USD 18.60 million in 2024 and is expected to reach USD 33.69 million by 2032, at a CAGR of 7.71% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ocular disorders, rising awareness about eye health, and growing adoption of advanced pharmaceutical treatments. Innovations in formulation, ease of administration, and improved efficacy of Ocular Pain Tablets are further driving their uptake across global markets

- Furthermore, the expanding patient pool, coupled with rising healthcare accessibility and focus on preventive eye care, is boosting demand for effective ocular pain management solutions. These converging factors are accelerating the adoption of Ocular Pain Tablets, thereby significantly contributing to the market’s growth

Ocular Pain Tablets Market Analysis

- The ocular pain tablets market growth is primarily driven by the increasing prevalence of ocular disorders, rising awareness about eye health, and the growing adoption of effective pharmaceutical solutions for ocular pain management. Advanced formulations, improved bioavailability, and targeted therapeutic effects are further encouraging adoption across hospitals, clinics, and retail pharmacies

- The escalating demand for ocular pain tablets market is fueled by the rising incidence of eye conditions such as dry eyes, inflammation, and post-operative discomfort, alongside growing patient preference for convenient oral therapies. Enhanced patient compliance, ease of administration, and proven clinical efficacy are key factors propelling market expansion

- North America dominated the ocular pain tablets market with the largest revenue share of 32.5% in 2024, supported by a well-established healthcare infrastructure, high awareness of ocular health, and strong presence of leading pharmaceutical companies. The U.S. witnessed substantial growth in the Ocular Pain Tablets segment due to increasing patient access, government-backed eye care initiatives, and innovations in tablet formulations targeting various ocular conditions

- Asia-Pacific is expected to be the fastest-growing region in the ocular pain tablets market during the forecast period, driven by rising healthcare accessibility, growing prevalence of eye disorders, urbanization, and increasing disposable incomes. Expanding pharmaceutical manufacturing capabilities and a larger patient population are further boosting adoption across the region

- The Immediate Release segment dominated the ocular pain tablets market with the largest market revenue share of 61.3% in 2024, due to its effectiveness in delivering quick pain relief for patients experiencing acute ocular pain following surgeries, injuries, or infections

Report Scope and Ocular Pain Tablets Market Segmentation

|

Attributes |

Ocular Pain Tablets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Tablets Market Trends

“Enhanced Convenience Through Advanced Formulations and Digital Health Integration”

- A significant trend in the global ocular pain tablets market is the integration of advanced drug delivery technologies and digital health monitoring, enhancing treatment convenience and adherence for patients with ocular conditions

- For instance, pharmaceutical companies are developing novel sustained-release tablet formulations and patient-friendly packaging that allow precise dosing and reduce the frequency of administration, improving overall patient compliance

- Integration with digital health platforms, such as mobile apps for tracking ocular pain, reminders for dosage, and symptom monitoring, is helping patients manage their treatment more effectively

- These innovations are enabling patients to maintain consistent therapeutic regimens, receive real-time feedback on their treatment, and share data with healthcare providers for improved outcomes

- The trend towards more patient-centric, technology-enabled ocular pain management is fundamentally reshaping expectations for convenience, efficacy, and safety in ocular therapeutics

- Companies such as Alcon, Novartis, and Sun Pharma are investing in digital health-linked ocular pain solutions that combine improved pharmacokinetics, patient monitoring, and ease of administration

- The demand for such integrated solutions is growing rapidly across both hospital and homecare settings, as patients increasingly prioritize convenience, adherence, and comprehensive management of ocular discomfort

Ocular Pain Tablets Market Dynamics

Driver

“Rising Prevalence of Ocular Disorders and Growing Patient Awareness”

- The increasing incidence of ocular disorders such as dry eyes, post-operative discomfort, and inflammatory eye conditions is a key driver for the Ocular Pain Tablets market. Patients are actively seeking effective, fast-acting, and convenient treatment options

- For instance, in March 2024, Novartis launched a novel extended-release ocular pain tablet formulation, designed to provide sustained relief for post-surgical patients, improving compliance and patient outcomes. Such product innovations are expected to drive the market forward during the forecast period

- As awareness of eye health and early intervention grows, patients prefer oral pharmaceutical solutions that are easy to administer and offer consistent therapeutic effects

- The rising adoption of ocular pain tablets is also supported by the expansion of pharmacies, hospitals, and e-commerce distribution channels, improving accessibility and convenience for end-users

- Healthcare providers increasingly recommend tablets for chronic or recurring ocular pain due to their precision dosing, predictable pharmacokinetics, and ability to complement other ophthalmic treatments.

Restraint/Challenge

“Regulatory Barriers and Pricing Challenges”

- Stringent regulatory requirements and approval processes for new ocular pain tablets can delay product launches, impacting market expansion. Regulatory compliance related to safety, efficacy, and quality is critical, particularly in North America and Europe

- For instance, some new formulations undergo extended clinical trials before approval, which can increase development costs and delay availability to patients

- High prices of advanced or extended-release ocular pain tablets may also limit adoption in price-sensitive regions, especially in emerging markets. While generic options are available, innovative products with improved efficacy or convenience often carry a premium

- Healthcare providers and patients may hesitate to switch to higher-cost treatments unless clear clinical benefits are demonstrated, which can slow market penetration

- Overcoming these challenges through strategic pricing, patient education on therapeutic benefits, and faster regulatory approvals will be essential for sustained growth in the Ocular Pain Tablets market

- Limited awareness about ocular pain management in underdeveloped regions further acts as a barrier, as patients often resort to self-medication or ignore early symptoms, reducing demand for prescribed ocular pain tablets

- Side effects associated with long-term use of certain ocular pain medications, such as gastrointestinal discomfort, drowsiness, or systemic complications, can discourage both physicians and patients from prescribing or consuming them

- Supply chain disruptions, particularly in raw material sourcing and pharmaceutical distribution, may lead to product shortages, especially in regions with heavy import dependency, hampering market accessibility

- Patent expirations of key branded ocular pain tablets expose them to generic competition, which, while increasing affordability, can erode revenue for established players and reduce investments in R&D for innovative formulations

Ocular Pain Tablets Market Scope

The market is segmented on the basis of type, route of administration, formulation, and application.

• By Type

On the basis of type, the ocular pain tablets market is segmented into nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroids, analgesics, combination drugs, and others. The NSAIDs segment dominated the market with the largest revenue share of 38.6% in 2024, primarily due to their proven effectiveness in reducing inflammation and pain following ocular surgeries, infections, and trauma. Their affordability, wide availability in generic forms, and established use in ophthalmic care contribute significantly to their strong uptake. NSAIDs such as ibuprofen and diclofenac tablets are widely prescribed to manage mild-to-moderate ocular pain, and they are often the first line of treatment, making them indispensable in ophthalmology practices. In addition, increasing awareness among physicians about the reduced risk of steroid-related side effects further supports their dominance. Healthcare providers also prefer NSAIDs due to their broad application range, including postoperative care, inflammatory disorders, and general ocular pain, reinforcing their widespread clinical acceptance. The integration of NSAIDs into both hospital and retail pharmacy channels ensures consistent patient access, further solidifying their market position.

The Combination Drugs segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, as healthcare professionals increasingly prescribe multi-therapy approaches that combine analgesics, NSAIDs, or corticosteroids for synergistic pain relief. Combination drugs reduce the pill burden, improve patient compliance, and provide comprehensive symptom management, especially in complex conditions such as glaucoma-related pain or severe postoperative discomfort. Their ability to address both pain and inflammation simultaneously makes them highly attractive for ophthalmologists, and the growing trend toward personalized medicine and multi-modal therapies is further propelling their demand.

• By Route of Administration

On the basis of route of administration, the ocular pain tablets market is segmented into oral tablets, sublingual tablets, and others. The oral tablets segment dominated with the largest market revenue share of 56.7% in 2024, owing to their ease of administration, high patient compliance, and widespread acceptance in routine prescriptions. Oral tablets are particularly favored in postoperative pain management and inflammatory ocular conditions, where systemic absorption provides consistent relief. Their cost-effectiveness and mass production also make them highly accessible, with both branded and generic variants available across retail and hospital pharmacies. In addition, oral tablets are backed by strong physician preference due to their predictable pharmacokinetics and broad applicability across various ocular disorders. Growing demand in both developed and developing markets is fueled by the simplicity of oral dosing, which minimizes patient training requirements, making them the most reliable option for long-term ocular pain management.

The Sublingual Tablets segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by their rapid onset of action, bypassing of first-pass metabolism, and improved bioavailability compared to oral formulations. Sublingual tablets are increasingly favored in acute ocular pain cases, where immediate relief is critical, such as after laser eye surgeries or sudden inflammatory flare-ups. Their compact dosage form, patient-friendly design, and growing development by pharmaceutical companies targeting faster relief and higher efficacy make them a promising segment in the years ahead.

• By Formulation

On the basis of formulation, the ocular pain tablets market is segmented into immediate release, extended release, and others. The Immediate Release segment dominated with the largest market revenue share of 61.3% in 2024, due to its effectiveness in delivering quick pain relief for patients experiencing acute ocular pain following surgeries, injuries, or infections. Immediate release formulations are preferred by both physicians and patients for their fast-acting therapeutic outcomes and ease of dose adjustment based on patient needs. Their wide availability across multiple drug categories such as NSAIDs, corticosteroids, and analgesics ensures that immediate release remains the most common and trusted choice. The increasing frequency of outpatient eye surgeries and rising prevalence of age-related ocular diseases further strengthens the reliance on fast-acting tablets, making this segment the cornerstone of ocular pain management.

The extended release segment is expected to witness the fastest CAGR of 9.6% from 2025 to 2032, driven by the growing demand for long-lasting pain management solutions, particularly in chronic ocular conditions such as glaucoma and inflammatory disorders. Extended release formulations reduce dosing frequency, enhance patient compliance, and ensure sustained therapeutic benefits over time. They are especially beneficial for elderly patients or those with complex treatment regimens, minimizing the risk of missed doses. Pharmaceutical companies are investing in innovative delivery mechanisms to optimize extended release tablets, further fueling their adoption globally.

• By Application

On the basis of application, the ocular pain tablets market is segmented into postoperative pain, eye infections, inflammatory conditions, glaucoma-associated pain, and others. The Postoperative Pain segment dominated with the largest market revenue share of 34.7% in 2024, fueled by the rising number of ophthalmic surgical procedures worldwide, including cataract, LASIK, and retinal surgeries. Patients undergoing these procedures often require effective pain management during recovery, and ocular pain tablets remain a primary solution. NSAIDs, corticosteroids, and analgesics are widely prescribed in postoperative care protocols, strengthening this segment’s dominance. Increasing advancements in surgical techniques, growing geriatric population, and higher global surgical volumes ensure steady demand for postoperative pain management solutions, with ocular pain tablets forming an integral part of the recovery process. Their role in reducing discomfort, preventing complications, and ensuring patient satisfaction makes them indispensable in modern ophthalmic practices.

The Glaucoma-Associated Pain segment is expected to witness the fastest CAGR of 10.4% from 2025 to 2032, driven by the rising global prevalence of glaucoma, which is one of the leading causes of irreversible blindness. Patients with advanced glaucoma often experience significant discomfort and pressure-induced ocular pain, necessitating effective long-term management. Ocular pain tablets provide symptomatic relief, complementing pressure-lowering therapies, and improving overall quality of life. The increasing elderly population, expanding diagnostic capabilities, and the availability of specialized formulations for glaucoma-related complications are contributing to the rapid growth of this segment.

Ocular Pain Tablets Market Regional Analysis

- North America dominated the ocular pain tablets market with the largest revenue share of 32.5% in 2024, supported by a well-established healthcare infrastructure, high awareness of ocular health, and strong presence of leading pharmaceutical companies

- The region’s market growth is also driven by increasing patient access to advanced therapies, favorable reimbursement policies, and government-backed eye care initiatives. In particular, innovations in tablet formulations targeting conditions such as postoperative pain, inflammatory eye disorders, and glaucoma-associated discomfort have strengthened demand

- The adoption of novel drug delivery methods further enhances patient compliance, making ocular pain tablets a preferred treatment option across clinical settings

U.S. Ocular Pain Tablets Market Insight

The U.S. ocular pain tablets market accounted for the largest revenue share in North America in 2024, fueled by the rapid adoption of advanced pharmaceutical products and the increasing prevalence of ocular disorders. Rising investments in ophthalmic R&D, coupled with expanding access to specialized eye care services, are significantly driving market growth. The U.S. healthcare system’s focus on patient-centric treatment approaches, including convenient oral therapies, is enhancing uptake. In addition, collaborations between pharmaceutical companies and research institutions are accelerating innovation, positioning the U.S. as a global leader in the ocular pain tablets market.

Europe Ocular Pain Tablets Market Insight

The Europe ocular pain tablets market is projected to expand at a steady CAGR throughout the forecast period, driven by a rising burden of ocular diseases, favorable healthcare infrastructure, and increasing access to prescription medicines. The region’s regulatory emphasis on patient safety and effective treatments fosters the adoption of standardized ocular therapies. Growth is supported by aging populations, rising incidence of eye infections and surgeries, and pharmaceutical advancements targeting ocular inflammation and postoperative recovery. Market expansion is also stimulated by strong uptake in both public and private healthcare systems across major economies.

U.K. Ocular Pain Tablets Market Insight

The U.K. ocular pain tablets market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of ocular health, growing rates of eye surgeries, and increasing availability of advanced ophthalmic products. Patients are becoming more proactive in addressing eye discomfort, encouraging physicians to prescribe more targeted pain management therapies. Government-backed initiatives for accessible healthcare, combined with the robust pharmaceutical supply chain, ensure consistent availability of ocular pain tablets across the country.

Germany Ocular Pain Tablets Market Insight

The Germany ocular pain tablets market is anticipated to expand at a considerable CAGR, supported by its strong pharmaceutical manufacturing base, advanced healthcare infrastructure, and increasing patient demand for innovative ocular treatments. The country’s emphasis on research-driven healthcare fosters the development of improved formulations with higher bioavailability and safety profiles. Germany’s aging demographic and rising number of eye surgeries, particularly cataract and glaucoma-related procedures, further contribute to the steady demand for ocular pain tablets.

Asia-Pacific Ocular Pain Tablets Market Insight

The Asia-Pacific ocular pain tablets market is expected to register the fastest CAGR from 2025 to 2032, driven by rapid urbanization, expanding healthcare access, and a rising prevalence of ocular conditions such as infections, inflammation, and postoperative pain. Growing disposable incomes and awareness of eye care are encouraging patients to seek advanced treatment solutions. Expanding pharmaceutical manufacturing capabilities in countries such as India and China are improving affordability and accessibility, making ocular pain tablets widely available. Government-led health programs and increasing collaborations with global pharmaceutical companies are also fueling market penetration across the region.

Japan Ocular Pain Tablets Market Insight

The Japan ocular pain tablets market growth is fueled by its strong healthcare infrastructure, high healthcare expenditure, and early adoption of advanced ophthalmic therapies. The country’s rapidly aging population, coupled with rising cases of glaucoma and age-related ocular conditions, is spurring demand. Pharmaceutical innovations and strong physician adoption of oral therapies for managing ocular pain are supporting steady expansion. Japan’s patient population also values convenience and precision in treatments, which aligns with the growing acceptance of tablet-based solutions.

China Ocular Pain Tablets Market Insight

The China ocular pain tablets market held the largest revenue share in Asia-Pacific in 2024, supported by its large patient population, rapid urbanization, and significant government investment in healthcare infrastructure. The country’s expanding middle class and increased health awareness are fueling demand for effective and affordable ocular treatments. Strong domestic pharmaceutical manufacturing capabilities, combined with government programs promoting accessible eye care, have strengthened market penetration. The rising number of ophthalmic procedures, coupled with growing adoption of oral therapies, further supports China’s leadership in the regional ocular pain tablets market.

Ocular Pain Tablets Market Share

The Ocular Pain Tablets industry is primarily led by well-established companies, including:

- Alcon Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Sun Pharmaceutical Industries Ltd. (India)

- AbbVie Inc. (U.S.)

- Ocular Therapeutix, Inc. (U.S.)

- KALA BIO (U.S.)

- Formosa Pharmaceuticals, Inc. (Taiwan)

- Vyluma, Inc. (U.S.)

- Sylentis S.A. (Spain)

- Aldeyra Therapeutics, Inc. (U.S.)

- Salvat (Spain)

- Oculis (Switzerland)

- Surface Ophthalmics (U.S.)

- OCUVEX THERAPEUTICS INC. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Cipla Inc. (India)

Latest Developments in Global Ocular Pain Tablets Market

- In May 2025, Alcon announced the FDA approval of TRYPTYR (acoltremon ophthalmic solution 0.003%), a neuromodulator eye drop designed to rapidly increase natural tear production in patients with dry eye disease. The company plans to launch TRYPTYR in the U.S. in the third quarter of 2025, aiming to provide a new treatment option for millions of dry eye sufferers

- In September 2025, research indicated that pregabalin, an FDA-approved oral medication for neuropathic pain, can be reformulated into eye drops to deliver targeted pain relief for ocular conditions. Early studies suggest that pregabalin eye drops may also help treat glaucoma and ocular hypertension, offering a potential new approach to managing ocular pain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.