Global Ocular Pain Topical Gels Market

Market Size in USD Million

CAGR :

%

USD

172.87 Million

USD

312.69 Million

2024

2032

USD

172.87 Million

USD

312.69 Million

2024

2032

| 2025 –2032 | |

| USD 172.87 Million | |

| USD 312.69 Million | |

|

|

|

|

Ocular Pain Topical Gels Market Size

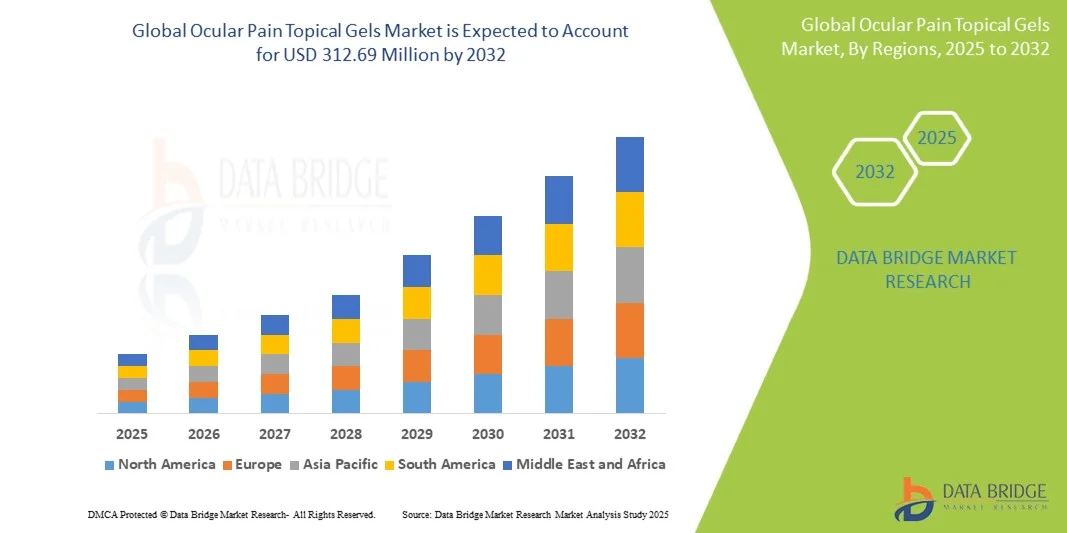

- The global ocular pain topical gels market size was valued at USD 172.87 million in 2024 and is expected to reach USD 312.69 million by 2032, at a CAGR of 7.69% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ocular disorders and rising awareness about effective pain management solutions in ophthalmology. Technological advancements in gel formulations, offering rapid relief, enhanced bioavailability, and improved patient compliance, are further driving market expansion

- In addition, the growing demand for non-invasive, topically administered ocular therapies in both hospital and outpatient settings is supporting the adoption of ocular pain topical gels. The convenience of self-administration and reduced systemic side effects compared to oral or injectable therapies is encouraging usage among patients

Ocular Pain Topical Gels Market Analysis

- Ocular pain topical gels, offering non-invasive and targeted relief for eye pain, are increasingly vital components of modern ophthalmic care in both hospital and outpatient settings due to their rapid action, enhanced bioavailability, and patient-friendly administration

- The escalating demand for ocular pain topical gels is primarily fueled by rising incidences of eye disorders, growing awareness of ocular health, and preference for convenient, self-administered treatments that reduce systemic side effects

- Europe dominated the global ocular pain topical gels market with the largest revenue share of 36.7% in 2024, driven by advanced healthcare infrastructure, high adoption of ophthalmic therapies, and strong R&D in innovative topical gel formulations. Germany continues to lead in both clinical use and hospital adoption of ocular pain gels

- Asia-Pacific is expected to be the fastest-growing region in the global ocular pain topical gels market during the forecast period, with a CAGR of 7.8%, driven by increasing awareness of eye health, rising prevalence of ocular disorders, and improving healthcare access in countries such as India, China, and Japan

- The Post-Operative Pain segment dominated the global ocular pain topical gels market with a revenue share of 46.2% in 2024, due to the high number of ophthalmic surgeries such as cataract, LASIK, and corneal transplants performed worldwide

Report Scope and Ocular Pain Topical Gels Market Segmentation

|

Attributes |

Ocular Pain Topical Gels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Topical Gels Market Trends

Growing Importance of Patient-Friendly Ophthalmic Treatments

- A significant and accelerating trend in the global ocular pain topical gels market is the rising adoption of preservative-free and fast-acting formulations, which provide enhanced comfort and targeted relief for patients suffering from ocular pain

- For instance, several leading pharmaceutical companies have launched novel gel formulations designed for rapid absorption and minimal irritation, improving patient adherence to treatment protocols

- The increasing prevalence of ocular disorders, including dry eye syndrome, post-surgical discomfort, and inflammatory eye conditions, is driving demand for these topical gels in both clinical and homecare settings

- Advanced formulations, such as bioadhesive gels and sustained-release ocular gels, enable longer retention time on the ocular surface, offering prolonged therapeutic effects while reducing the frequency of administration

- The seamless integration of these gels into routine ophthalmic care facilitates better management of pain and inflammation, supporting faster recovery and enhanced patient satisfaction

- This trend toward more convenient, safe, and effective ocular therapies is reshaping expectations among healthcare providers and patients alike, encouraging ongoing innovation in gel formulations

- Consequently, companies such as Novartis, Allergan (AbbVie), and Santen are focusing on developing high-efficacy, patient-friendly ocular pain gels suitable for both hospital and home use

- The demand for ocular pain topical gels is growing rapidly across hospitals, ambulatory care centers, and homecare settings, driven by the need for targeted, easy-to-administer treatments and rising awareness of eye health worldwide

Ocular Pain Topical Gels Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Ocular Disorders and Patient Awareness

- The increasing prevalence of ocular pain conditions, such as post-surgical discomfort, dry eye syndrome, corneal abrasions, and inflammation-related eye disorders, is significantly driving the demand for ocular pain topical gels. These conditions are affecting a growing number of patients worldwide, prompting healthcare providers to seek effective, targeted therapies

- For instance, in March 2024, Santen Pharmaceutical introduced an advanced preservative-free ocular gel designed for rapid relief of ocular pain, improving patient comfort and minimizing irritation. Such initiatives by leading companies are expected to propel the growth of the Ocular Pain Topical Gels market during the forecast period

- Rising patient awareness regarding the potential complications of untreated ocular pain, combined with a stronger focus on eye health, has led to greater adoption of topical gels over traditional treatments. Patients and clinicians increasingly favor gels that provide localized relief, long-lasting effects, and minimal side effects

- The increasing prevalence of chronic eye conditions and post-operative ocular discomfort is motivating hospitals, clinics, and ophthalmologists to recommend gel-based therapies as part of comprehensive treatment plans

- The convenience of self-administration, compatibility with routine ophthalmic regimens, and improved patient adherence to therapy protocols are key factors driving the adoption of ocular pain gels in both clinical and homecare settings. The trend toward formulations with extended retention time and rapid therapeutic action further enhances patient satisfaction and market growth

Restraint/Challenge

Concerns Regarding Device Formulation and Cost

- The relatively high cost of advanced ocular pain topical gels, especially preservative-free or sustained-release formulations, can pose a barrier to adoption, particularly in price-sensitive regions or among patients without sufficient healthcare coverage

- Certain gel formulations may require specific storage conditions or careful handling during application, which can limit immediate usability or adoption by patients and healthcare providers unfamiliar with the products

- Companies are addressing these challenges by developing cost-effective, easy-to-use formulations with broader stability, minimizing administration difficulties while maintaining therapeutic efficacy. Educational initiatives and patient guidance programs are also being offered to ensure correct usage and optimize treatment outcomes

- Although prices are gradually stabilizing, the perceived premium for high-efficacy ocular gels can slow adoption, particularly in regions with limited healthcare infrastructure or reimbursement options

- Overcoming these barriers through improved affordability, expanded patient education on correct administration, and greater availability of high-quality formulations will be critical for sustained growth in the global Ocular Pain Topical Gels market

Ocular Pain Topical Gels Market Scope

The market is segmented on the basis of product type, application, distribution channel, and end user.

• By Product Type

On the basis of product type, the market is segmented into Non-Steroidal Anti-Inflammatory Drug (NSAID) Gels, Steroidal Gels, Anesthetic Gels, and Others. The NSAID Gels segment dominated with the largest revenue share of 42.5% in 2024, driven by their proven efficacy in reducing ocular inflammation and pain without the side effects associated with corticosteroids. Increasing prevalence of post-operative ocular pain, injury-related eye conditions, and chronic eye disorders supports demand. NSAID gels are widely prescribed by ophthalmologists and are integrated into post-surgical care protocols. The availability of preservative-free formulations, improved ocular bioavailability, and favorable safety profiles further strengthen market adoption. The segment is also supported by ongoing clinical trials and new product launches, especially in Europe and North America. Rising awareness among patients and healthcare professionals about effective ocular pain management also drives consistent demand.

The Anesthetic Gels segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by the growing need for rapid-onset, localized pain relief during ophthalmic procedures and acute injuries. Anesthetic gels provide instant numbing effects, which are highly preferred in outpatient surgeries and emergency care. Increasing adoption in ambulatory surgical centers and rising minor eye procedures such as corneal scraping or foreign body removal support segment growth. Enhanced formulations that reduce irritation and improve patient comfort are contributing to market expansion. Moreover, rising preference for combination gels with anti-inflammatory properties creates additional growth opportunities.

• By Application

On the basis of application, the market is segmented into Post-Operative Pain, Injury/Trauma-Induced Ocular Pain, Dry Eye-Associated Pain, and Others. The Post-Operative Pain segment dominated with a revenue share of 46.2% in 2024, due to the high number of ophthalmic surgeries such as cataract, LASIK, and corneal transplants performed worldwide. Patients and surgeons prefer topical gels for fast-acting pain relief and reduced risk of systemic side effects. Clinical guidelines recommend NSAID or steroidal gels for post-surgical ocular care, which reinforces usage. The segment benefits from continuous product innovation and increasing adoption of minimally invasive eye procedures. Growing healthcare infrastructure and rising access to surgical facilities in Europe and North America further support dominance. Awareness campaigns by hospitals and ophthalmology associations on post-operative care enhance patient compliance.

The Dry Eye-Associated Pain segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by the rising prevalence of dry eye syndrome due to aging populations, increased screen time, and environmental factors. Patients increasingly prefer gels over drops for prolonged relief and better retention on the ocular surface. Rising awareness of chronic eye discomfort and the demand for OTC or prescription options contribute to market expansion. Innovative gel formulations targeting lubrication and pain mitigation simultaneously enhance patient adherence. Expansion of eye care clinics and homecare solutions also support segment growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Specialty Clinics. The Hospital Pharmacies segment dominated with a revenue share of 53.4% in 2024, driven by bulk procurement by hospitals for surgical wards, outpatient departments, and ophthalmology units. Hospitals prefer stocking a variety of ocular gels to cater to post-surgical pain and acute injury cases. Strategic contracts with pharmaceutical manufacturers and established supply chains ensure consistent availability. The segment benefits from physician-driven prescriptions and institutional guidelines. Hospitals and surgical centers also drive awareness among patients regarding proper usage and adherence to therapy. The segment’s dominance is supported by increasing ophthalmic surgeries and adoption of standardized pain management protocols.

The Online Pharmacies segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, fueled by growing e-commerce penetration, telemedicine services, and home delivery solutions. Patients increasingly prefer online channels for convenience, especially for chronic ocular conditions like dry eye or recurrent trauma-induced pain. Digital platforms provide access to a wide range of gels, including specialty or combination formulations not always available in retail stores. Subscription services and rapid delivery models enhance accessibility. The segment is also supported by awareness campaigns, digital marketing, and partnerships with ophthalmology centers.

• By End User

On the basis of end user, the market is segmented into Hospitals, Ambulatory Surgical Centers, Homecare, and Ophthalmology Clinics. The Hospitals segment dominated with a revenue share of 58.1% in 2024, due to high adoption of topical gels for inpatient and outpatient pain management. Hospitals serve as primary points for prescription, administration, and post-operative care. Bulk procurement, clinical guidelines, and hospital-based awareness programs further drive segment growth. Advanced gel formulations and integration with surgical protocols enhance clinical outcomes and patient satisfaction. Rising ophthalmic surgeries and the need for standardized ocular pain management support hospital dominance. The segment also benefits from collaborations with pharmaceutical manufacturers for supply and education.

The Homecare segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, driven by increasing patient preference for self-administration, convenience, and accessibility. Patients managing chronic dry eye or recurrent ocular injuries benefit from easy-to-use gels. Growth is supported by homecare kits, patient education programs, and awareness of over-the-counter therapeutic options. Telemedicine consultations and digital prescriptions further encourage adoption. The segment benefits from improved gel formulations that reduce dosing frequency and enhance comfort, supporting broader adoption.

Ocular Pain Topical Gels Market Regional Analysis

- The Europe ocular pain topical gels market dominated the global ocular pain topical gels market with the largest revenue share of 36.7% in 2024. The region’s growth is driven by advanced healthcare infrastructure, high adoption of ophthalmic therapies, and continuous R&D in innovative gel formulations

- Patients and clinicians alike prefer topical gels for their rapid onset, ease of use, and effectiveness in post-operative and chronic ocular pain conditions. Strong hospital networks, widespread specialty clinics, and government healthcare initiatives further strengthen adoption

- Increasing R&D investments by pharmaceutical companies and technological advancements in gel formulations also contribute to the market expansion

U.K. Ocular Pain Topical Gels Market Insight

The U.K. ocular pain topical gels market is expanding steadily due to the increasing awareness of ocular health, rising adoption of outpatient care therapies, and well-established healthcare infrastructure. Topical gels are preferred for post-operative care, trauma-related ocular pain, and dry eye-associated discomfort due to their non-invasive delivery and quick pain relief. Hospitals, ambulatory surgical centers, and specialty eye clinics play a major role in distribution. Additionally, rising patient preference for homecare therapies, combined with insurance coverage and government support programs, contributes to sustained market growth.

Germany Ocular Pain Topical Gels Market Insight

The Germany ocular pain topical gels market continues to lead Europe in the clinical and hospital adoption of ocular pain topical gels. The country’s strong healthcare infrastructure, coupled with a focus on advanced ophthalmic research and high patient awareness, drives market expansion. Hospitals and specialty eye clinics extensively use topical gels for post-operative care, injury-related pain, and chronic conditions. Innovations in gel formulations, along with training programs for clinicians and robust distribution networks, further strengthen market penetration. Germany’s emphasis on patient safety, efficacy, and non-invasive treatments positions it as a pivotal market in Europe.

North America Ocular Pain Topical Gels Market Insight

North America is a highly developed and mature market for ocular pain topical gels, driven by widespread awareness about eye health, advanced healthcare infrastructure, and strong hospital and retail pharmacy networks. The region witnesses high adoption of post-operative care therapies and management of injury or trauma-induced ocular pain. Patients increasingly prefer topical gels due to their non-invasive nature, rapid relief, and ease of administration. The market growth is further supported by specialty eye clinics and outpatient care centers offering modern ophthalmic solutions.

U.S. Ocular Pain Topical Gels Market Insight

The U.S. ocular pain topical gels market dominates the North American market due to its robust healthcare system, high patient awareness, and established distribution channels including hospital pharmacies, retail outlets, and online platforms. The demand is significantly driven by post-operative ocular pain management, dry eye-associated discomfort, and injury-related eye conditions. Specialty eye care clinics and homecare services are rapidly adopting topical gels due to their convenience and effective pain relief. The growing elderly population, increasing surgical procedures, and preference for non-invasive drug delivery systems further propel market growth. Pharmaceutical companies in the U.S. continue to innovate with targeted formulations, supporting the sustained expansion of the market.

Asia-Pacific Ocular Pain Topical Gels Market Insight

The Asia-Pacific ocular pain topical gels market is poised to be the fastest-growing region with a CAGR of 7.8%, driven by increasing awareness of eye health, rising prevalence of ocular disorders, and improving healthcare access across countries such as India, China, and Japan. Rapid urbanization, growing middle-class populations, and expanding hospital and clinic infrastructure contribute to the high adoption of topical gels. Government initiatives promoting eye care awareness, coupled with affordable and effective drug delivery systems, support regional growth.

China Ocular Pain Topical Gels Market Insight

The China ocular pain topical gels market represents the largest market in APAC, fueled by rapid urbanization, rising disposable incomes, and growing awareness of ocular disorders. The country’s expanding hospital networks, specialty eye clinics, and homecare services provide convenient access to topical gels. Increasing post-operative surgeries, higher patient inclination toward non-invasive treatments, and strong domestic pharmaceutical manufacturing contribute to market expansion. Continuous innovation in formulations and local production of cost-effective gels further strengthen China’s position in the regional market.

India Ocular Pain Topical Gels Market Insight

The India ocular pain topical gels market growth is supported by rising awareness of eye health, improving healthcare access, and increasing prevalence of ocular conditions such as dry eye and post-surgical discomfort. Adoption is expanding through hospitals, ambulatory surgical centers, and specialty clinics. Government initiatives promoting eye care, combined with affordable topical gels and growing patient education, support rapid market expansion. Homecare adoption is also increasing as patients prefer convenient self-administered treatments.

Ocular Pain Topical Gels Market Share

The ocular pain topical gels industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Novartis AG (Switzerland)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Bausch + Lomb (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Fresenius Kabi (Germany)

- Akorn, Inc. (U.S.)

- MediTox, Inc. (South Korea)

- Fidia Farmaceutici S.p.A. (Italy)

- GSK plc (U.K.)

- Ocular Therapeutix, Inc. (U.S.)

- KALA BIO (U.S.)

- Aldeyra Therapeutics, Inc. (U.S.)

Latest Developments in Global Ocular Pain Topical Gels Market

- In May 2023, Harrow announced the launch of FDA-approved IHEEZO (chloroprocaine hydrochloride ophthalmic gel) 3% for ocular surface anesthesia at the 2023 American Society of Cataract and Refractive Surgery (ASCRS) Annual Meeting. IHEEZO is a preservative-free, single-patient-use ophthalmic gel preparation designed for safe and effective ocular surface anesthesia, enhancing patient comfort during ocular procedures

- In May 2025, EyeCool Therapeutics reported positive results from a pilot study of ETX-4143, an investigational device designed to treat chronic ocular surface pain (COSP). The study, conducted in 31 patients in Australia, demonstrated a favorable safety profile and significant reductions in patient-reported pain scores, indicating the potential of ETX-4143 as a non-pharmacological treatment option for COSP

- In March 2024, OKYO Pharma announced the initiation of a Phase 2 clinical trial for OK-101, a novel non-opioid therapeutic candidate targeting neuropathic corneal pain. The trial aims to evaluate the safety and efficacy of OK-101 in patients diagnosed with neuropathic corneal pain, a condition for which there are currently no FDA-approved treatments

- In May 2025, Channel Therapeutics announced positive efficacy results for its NaV1.7 inhibitor in the treatment of eye pain. The preclinical in vivo studies demonstrated the compound's potential in alleviating ocular pain, paving the way for future clinical trials and potential therapeutic applications in ocular pain management

- In May 2025, Alcon received FDA approval for acoltremon ophthalmic solution 0.003%, branded as TRYPTYR, for the treatment of dry eye disease. TRYPTYR is a topical TRPM8 agonist that works via ocular surface cold thermoreceptors, offering a novel mechanism of action for dry eye treatment. Alcon plans to launch TRYPTYR in the U.S. in the third quarter of 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.