Global Off Highway Electric Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

13.54 Billion

2024

2032

USD

2.89 Billion

USD

13.54 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 13.54 Billion | |

|

|

|

Off-highway Electric Vehicle Market Analysis

The off-highway electric vehicle market is experiencing significant growth due to increasing environmental regulations, advancements in battery technology, and rising demand for sustainable alternatives in industries such as construction, mining, agriculture, and forestry. The shift toward electrification is driven by stringent emission norms, government incentives, and the need to reduce operational costs. Technological advancements, including high-capacity lithium-ion batteries, fast-charging solutions, and regenerative braking systems, are enhancing the efficiency and performance of electric off-highway vehicles. Companies such as Caterpillar, Deere & Company, and Komatsu are introducing electric excavators, loaders, and tractors to meet the growing demand for zero-emission equipment. Moreover, the integration of autonomous driving and IoT-enabled fleet management is further transforming the industry, improving productivity and reducing maintenance expenses. The Asia-Pacific region is emerging as a key market due to the presence of major OEMs and lower manufacturing costs, while North America and Europe are witnessing a surge in electric equipment adoption due to stringent environmental policies. The increasing focus on electrification is set to redefine the future of the off-highway vehicle market, making it more sustainable and cost-efficient.

Off-highway Electric Vehicle Market Size

The global off-highway electric vehicle market size was valued at USD 2.89 billion in 2024 and is projected to reach USD 13.54 billion by 2032, with a CAGR of 21.30% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Off-highway Electric Vehicle Market Trends

“Growing Adoption of Fast-Charging Infrastructure”

One key trend shaping the off-highway electric vehicle market is the growing adoption of fast-charging infrastructure to enhance operational efficiency and reduce downtime. As industries such as construction, mining, and agriculture transition to electric machinery, the need for rapid charging solutions has intensified. Manufacturers are developing high-capacity lithium-ion batteries and integrating fast-charging technology to support long working hours. For instance, Caterpillar and Komatsu have introduced electric excavators and loaders with fast-charging capabilities, allowing equipment to recharge during short breaks, improving productivity. In addition, wireless and mobile charging stations are being deployed at remote mining and construction sites, reducing reliance on traditional power grids. The integration of DC fast chargers and battery swap technology further accelerates equipment turnaround time. This shift supports sustainable and zero-emission operations and addresses one of the major challenges of electrification charging downtime making electric off-highway vehicles more viable for large-scale industrial use.

Report Scope and Off-highway Electric Vehicle Market Segmentation

|

Attributes |

Off-highway Electric Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Komatsu (Japan), AB Volvo (Sweden), Deere & Company (U.S.), CNH Industrial N.V. (U.K.), Sandvik AB (Sweden), Liebherr Group (Switzerland), Epiroc Mining India Limited (India), Terex Corporation (U.S.), DEUTZ AG (Germany), Atlas Copco UK Holdings (U.K.), AGCO Corporation (U.S.), Zoomlion Heavy Industry Science & Technology Co., Ltd. (China), KUBOTA Corporation (Japan), Rockwell Automation (U.S.), Hitachi Construction Machinery Co., Ltd. (Japan), and Caterpillar (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Off-highway Electric Vehicle Market Definition

Off-highway electric vehicles (EVs) refer to battery-powered or hybrid-electric machinery designed for use in industries such as construction, mining, agriculture, and forestry, where traditional road vehicles cannot operate. These vehicles include electric excavators, loaders, dump trucks, tractors, and sprayers, among others, and are engineered to perform heavy-duty tasks with reduced environmental impact.

Off-highway Electric Vehicle Market Dynamics

Drivers

- Stringent Emission Regulations and Sustainability Goals

Governments worldwide are implementing strict emission regulations to reduce carbon footprints and achieve sustainability goals, driving the adoption of electric off-highway vehicles (EVs). Regulatory bodies such as the European Union (EU), U.S. Environmental Protection Agency (EPA), and China’s National Development and Reform Commission (NDRC) have imposed stringent standards to limit diesel emissions in industries such as construction, mining, and agriculture. The EU’s Stage V emission regulations have compelled companies to replace traditional diesel-powered equipment with low-emission or fully electric machinery. As a result, manufacturers such as Caterpillar, Volvo CE, and Komatsu have increased investments in battery-powered excavators, electric wheel loaders, and zero-emission dump trucks. For instance, Volvo’s EC230 Electric Excavator is being widely used in urban construction projects, significantly reducing carbon emissions and aligning with global decarbonization goals. These policies are expected to accelerate the off-highway EV market growth, pushing manufacturers to innovate and meet evolving regulatory standards.

- Rising Fuel Costs and Lower Operational Expenses

The increasing price of diesel and gasoline is making off-highway EVs a more financially viable alternative, as they offer lower fuel and maintenance costs. The volatility in fuel prices, driven by global supply chain disruptions and geopolitical factors, has intensified the need for cost-effective alternatives in industries relying on heavy equipment. Unlike traditional diesel-powered machines, electric off-highway vehicles eliminate the need for fuel storage, regular engine servicing, and expensive hydraulic systems, significantly reducing long-term ownership costs. Companies such as John Deere and Volvo CE are at the forefront of this shift, offering electric models that enhance efficiency while cutting fuel expenses by up to 30%. For instance, John Deere’s electric tractors and Volvo’s electric wheel loaders have gained traction in agriculture and construction sectors, providing sustainable and cost-efficient solutions. This cost advantage is a major market driver, encouraging businesses to transition toward electrified machinery to achieve both economic and environmental benefits.

Opportunities

- Increasing Technological Advancements in Battery and Charging Infrastructure

The rapid evolution of battery technology and charging infrastructure is significantly improving the feasibility of off-highway electric vehicles (EVs), creating a lucrative market opportunity. The development of high-capacity lithium-ion batteries, solid-state batteries, and fast-charging solutions has enhanced the performance and reliability of electric construction, mining, and agricultural equipment. Advancements such as swappable battery technology, regenerative braking, and AI-driven energy management systems are optimizing energy consumption and reducing downtime. Companies such as Caterpillar and Komatsu are pioneering autonomous electric dump trucks equipped with smart battery management systems, ensuring prolonged operational efficiency. For instance, Komatsu’s Autonomous Haulage System (AHS) enables electric mining trucks to operate with enhanced precision and reduced energy waste, making EV adoption more practical for heavy industries. These advancements are increasing fleet efficiency and making off-highway EVs a more attractive option for industries aiming for sustainability and cost savings.

- Growing Investments in Electrification by OEMs and Key Players

The off-highway EV market is witnessing substantial investments in electrification from leading original equipment manufacturers (OEMs) and key industry players, creating significant growth opportunities. Companies such as Hitachi Construction Machinery, Volvo CE, and AGCO Corporation are actively developing fully electric and hybrid construction, agricultural, and mining equipment to align with zero-emission regulations and sustainability targets. These investments include the production of battery-powered mining trucks, autonomous tractors, and fully electric excavators. For instance, Volvo CE’s EC230 Electric Excavator is being widely adopted for urban construction projects, helping companies comply with emission reduction goals while improving operational efficiency. Similarly, John Deere and AGCO Corporation are introducing autonomous electric tractors for precision farming, enhancing productivity with lower operating costs. These developments signal a strong market shift toward sustainable heavy equipment solutions, accelerating the transition to off-highway EVs and expanding business opportunities in this sector.

Restraints/Challenges

- High Initial Investment and Total Cost of Ownership

One of the biggest challenges in the Off-highway Electric Vehicle Market is the high initial investment and total cost of ownership (TCO). Unlike traditional diesel-powered off-highway vehicles, electric construction equipment, mining trucks, and agricultural machinery require advanced battery technology, specialized powertrains, and robust charging infrastructure, making them significantly more expensive upfront. The cost of a battery-powered excavator or loader can be 30-50% higher than its diesel equivalent, discouraging many businesses from switching to electric. Moreover, battery replacement costs, maintenance expenses, and downtime due to charging requirements add to the total ownership cost. For instance, in the mining sector, companies need vehicles that can operate for long hours without frequent charging, but the current battery technology struggles to match the endurance of diesel engines. While electric vehicles (EVs) offer long-term fuel savings and lower emissions, the high capital expenditure (CAPEX) and operational costs (OPEX) remain a significant barrier, especially for small and medium-sized enterprises (SMEs). Without substantial government incentives, tax benefits, or leasing options, many fleet operators hesitate to make the transition to electric, slowing down market growth.

- Competition from Hybrid and Hydrogen-Powered Alternatives

While fully electric off-highway vehicles (EVs) present a sustainable alternative to diesel-powered machinery, they face stiff competition from hybrid and hydrogen-powered alternatives, which offer longer operational hours, greater energy efficiency, and faster refueling times. Hybrid models, which combine electric and diesel powertrains, provide extended working hours without range anxiety, making them more attractive for industries such as construction, mining, and agriculture, where vehicles operate continuously for long durations. Hydrogen-powered off-highway vehicles are also gaining traction, especially in sectors requiring high power output and minimal downtime. For instance, Caterpillar and Komatsu have been investing in hydrogen fuel cell technology for mining trucks, as hydrogen allows rapid refueling in minutes, unlike electric alternatives that require hours to recharge. In addition, major governments and industries are supporting hydrogen adoption through subsidies and research funding, creating an alternative growth path that competes with battery-electric solutions. As a result, businesses are often more inclined to adopt hybrid or hydrogen-based systems rather than fully electric vehicles, which can hinder the widespread adoption of off-highway electric vehicles in the near term.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Off-highway Electric Vehicle Market Scope

The market is segmented on the basis of equipment, battery type, battery capacity, propulsion type, power output, electric trator equipment, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment

- Dump Truck

- Dozer

- Excavator

- Motor Grader

- LHD

- Loader

- Lawn Mower

- Sprayer

- Tractor

Battery Type

- Lithium-ion

- Nickel Metal Hydride

- Lead-Acid

- Others

Battery Capacity

- 500 kWh

Propulsion Type

- Battery Electric

- Hybrid Electric

Power Output

- 300 HP

Electric Tractor Equipment

- Lawn Mower

- Sprayer

- Tractor

Application

- Construction

- Mining

- Agriculture

- Gardening

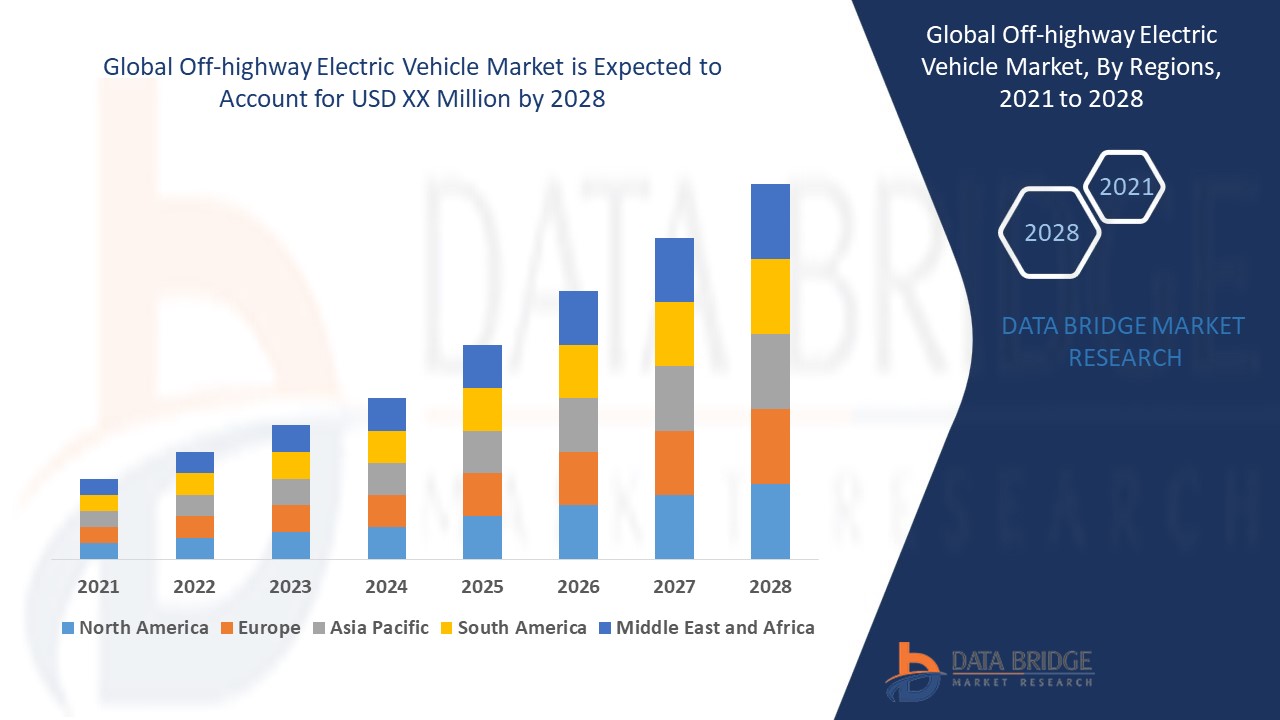

Off-highway Electric Vehicle Market Regional Analysis

The market is analysed and market size insights and trends are provided by equipment, battery type, battery capacity, propulsion type, power output, electric trator equipment, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the off-highway electric vehicle market, driven by rising concerns over greenhouse gas emissions and the push for environmentally friendly alternatives in construction, mining, and agriculture. The strict government regulations promoting electrification and sustainability initiatives have further accelerated the adoption of electric off-highway vehicles. In addition, major manufacturers in the region are continuously introducing new electric models with advanced battery technologies to enhance performance and efficiency. This growing focus on reducing carbon footprints and innovating within the sector is expected to fuel market expansion across North America.

Asia-Pacific is projected to experience significant growth in the off-highway electric vehicle market from 2025 to 2032, driven by the strong presence of original equipment manufacturers (OEMs) and the cost-effective production environment. The region benefits from high-volume manufacturing capabilities, enabling companies to produce electric off-highway vehicles at lower costs, making them more accessible to global markets. In addition, rising investments in industrial automation and infrastructure development are fueling demand for electric construction, mining, and agricultural machinery. With supportive government policies and a shift toward sustainable mobility solutions, Asia-Pacific is set to become a key hub for off-highway electric vehicle adoption.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Off-highway Electric Vehicle Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Off-highway Electric Vehicle Market Leaders Operating in the Market Are:

- Komatsu (Japan)

- AB Volvo (Sweden)

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- Sandvik AB (Sweden)

- Liebherr Group (Switzerland)

- Epiroc Mining India Limited (India)

- Terex Corporation (U.S.)

- DEUTZ AG (Germany)

- Atlas Copco UK Holdings (U.K.)

- AGCO Corporation (U.S.)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- KUBOTA Corporation (Japan)

- Rockwell Automation (U.S.)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Caterpillar (U.S.)

Latest Developments in Off-highway Electric Vehicle Market

- In August 2023, CASE IH, a CNH Industrial company, announced its plans to introduce the Farmall Subcompact tractor in Australia. The Farmall Subcompact 25SC model will be the smallest in its series, designed to meet the increasing demand for compact agricultural machinery in the region

- In October 2022, John Deere disclosed its strategy to manufacture a fully autonomous BR farm tractor, eliminating the need for an operator behind the wheel. Currently, the global fleet of such autonomous tractors is estimated to be fewer than 50 units

- In August 2022, AGCO introduced the Fendt 700 Vario series tractors to serve the North American market, with availability for orders through Fendt dealerships and scheduled delivery in 2023. This latest version of Fendt’s best-selling tractor range features an enhanced powertrain, VarioDrive transmission, Fendt iD low engine speed concept, a larger frame, and greater hydraulic capacity

- In May 2022, Caterpillar, a leading construction equipment manufacturer, launched two next-generation products in India—the Cat 303 CR Mini Excavator and the Cat 120 GC Motor Grader. These products are expected to strengthen Caterpillar’s presence in the infrastructure, mining, and energy sectors within the country

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.