Global Office Furniture Market

Market Size in USD Billion

CAGR :

%

USD

107.26 Billion

USD

180.20 Billion

2024

2032

USD

107.26 Billion

USD

180.20 Billion

2024

2032

| 2025 –2032 | |

| USD 107.26 Billion | |

| USD 180.20 Billion | |

|

|

|

|

Office Furniture Market Size

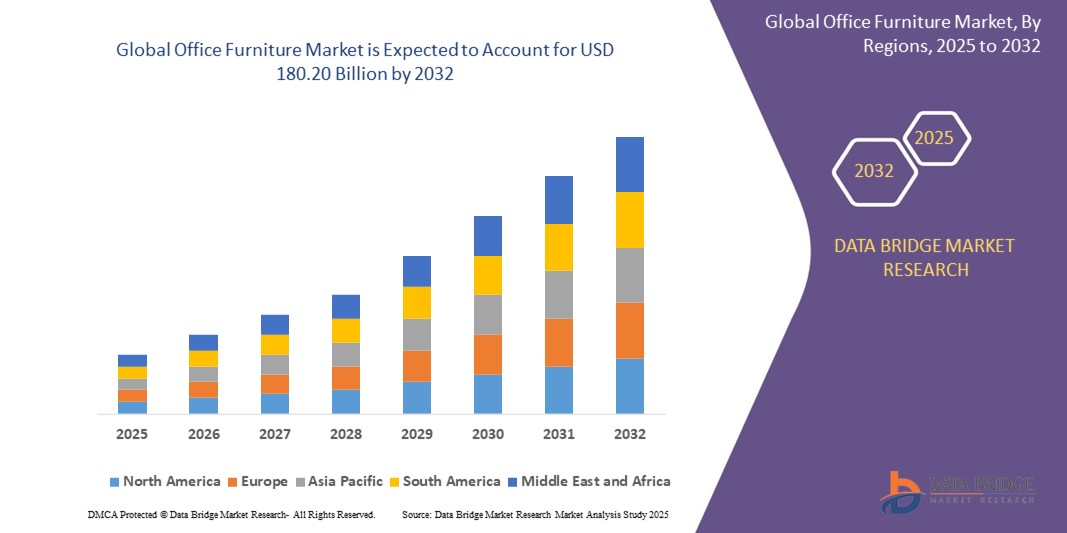

- The global office furniture market was valued at USD 107.26 billion in 2024 and is expected to reach USD 180.20 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.70%, primarily driven by the increasing demand for ergonomic and customizable office furniture

- This growth is driven by factors such as the shift towards flexible workspaces and the growing emphasis on employee wellness and productivity

Office Furniture Market Analysis

- The global office furniture market is experiencing notable growth, influenced by evolving workplace dynamics and technological advancements

- Office chairs are expected to hold the largest market share in 2025, driven by the growing need for ergonomic seating solutions that promote employee comfort and productivity

- There's a rising demand for furniture made from sustainable materials, such as reclaimed wood and recycled metals, reflecting a broader commitment to environmental responsibility within corporate settings

- The incorporation of smart technologies into office furniture, such as adjustable desks with memory settings and chairs with posture support features, is enhancing user experience and operational efficiency

- The shift towards hybrid work models has increased demand for versatile and adaptable furniture solutions, such as modular workstations and collaborative spaces, to accommodate diverse work styles

- For instance, the introduction of ergonomic chairs with built-in posture correction technology by companies such as Steelcase has significantly improved employee comfort and productivity, exemplifying the market's response to modern workplace needs

- These developments underscore the office furniture market's responsiveness to changing work environments, technological progress, and sustainability considerations, shaping the future of workspace design

Report Scope and Office Furniture Market Segmentation

|

Attributes |

Office Furniture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Office Furniture Market Trends

“Emphasis on Ergonomic and Sustainable Furniture”

- There's a growing awareness of the importance of ergonomics in the workplace, leading companies to invest in furniture that promotes employee well-being and productivity. Ergonomically designed chairs, adjustable desks, and supportive accessories are becoming standard in modern offices

- For Instance, brands such as Herman Miller and Steelcase are launching AI-powered chairs that automatically adjust to support spinal alignment

- Sustainability has become a key consideration, with manufacturers focusing on eco-friendly materials and processes to meet consumer demand for environmentally responsible products.

- This includes the use of reclaimed materials, implementation of sustainable production methods, and offering furniture with a longer lifecycle to reduce waste

- For Instance, companies such as AFC Furniture Solution are developing modular, upcycled office furniture to reduce waste and increase durability as part of their commitment to social responsibility

- The focus on employee health has led to the development of more versatile and flexible office furniture. Conventional, fixed office space arrangements are being exchanged for multi-purpose and modular setups that can adapt to changes in working patterns and team compositions

- The COVID-19 pandemic has accelerated the adoption of remote work, resulting in increased demand for home office furniture. Employees are seeking comfortable and functional furniture to create productive workspaces at home. This shift has prompted manufacturers to develop versatile and space-efficient furniture solutions tailored to residential environments

Office Furniture Market Dynamics

Driver

“Technological Advancements in Office Furniture”

- Modern office furniture increasingly incorporates technology to enhance functionality and productivity. Features such as built-in charging ports, adjustable settings, and connectivity options are becoming standard, meeting the evolving needs of contemporary workspaces

- For instance, companies such as MillerKnoll have reported a resurgence in demand for such technologically integrated furniture, indicating a market shift towards these innovations

- With a growing emphasis on employee wellness, ergonomic furniture designed to reduce physical strain and promote better posture is in high demand. Investments in ergonomic chairs, desks, and workstations are seen as essential for improving productivity and reducing absenteeism due to health issues

- The rise of hybrid work arrangements has increased the need for flexible and adaptable office furniture solutions. Modular designs that can be easily reconfigured to accommodate different work styles and collaborative activities are gaining popularity, supporting the dynamic nature of modern work environments

- Environmental concerns are prompting manufacturers to adopt sustainable practices, such as using recycled materials and eco-friendly production processes. This shift not only meets consumer demand for green products but also enhances brand reputation and complies with regulatory standards

Opportunity

“Growth of Co-Working Spaces”

- The increasing popularity of co-working spaces presents a significant opportunity for office furniture manufacturers. These environments require furniture that is flexible, modular, and conducive to collaboration, driving demand for innovative solutions

- Co-working spaces prioritize adaptable furniture that can accommodate various activities and user preferences. This trend encourages manufacturers to develop products that are versatile and support dynamic workstyles, fostering a collaborative community among diverse professionals

- As remote work becomes more prevalent, there's a growing demand for home office furniture. Furniture manufacturers are expanding their product offerings to cater to the unique needs of remote workers, including compact desks, ergonomic chairs, and versatile storage solutions optimized for smaller spaces

- The proliferation of co-working spaces is influencing urban planning and infrastructure development, as cities adapt to accommodate the evolving needs of a mobile workforce. This trend opens avenues for furniture companies to collaborate on designing spaces that align with modern work preferences

Restraint/Challenge

“Fluctuations in Raw Material Prices”

- Volatility in the prices of essential raw materials such as wood, metal, and plastic poses a significant challenge for office furniture manufacturers. Sudden increases in material costs can lead to higher production expenses, squeezing profit margins and potentially leading to increased prices for consumers

- Global supply chain disruptions, including trade tariffs and geopolitical tensions, contribute to the unpredictability of raw material availability and pricing. These uncertainties make it difficult for manufacturers to forecast costs accurately and plan production schedules effectively

- The inability to fully pass on increased material costs to customers due to competitive pressures or price sensitivity can lead to reduced profitability for furniture companies. Balancing cost absorption with competitive pricing remains a delicate challenge in such a volatile environment

- The unpredictability of raw material costs can deter manufacturers from making long-term investments in capacity expansion or new product development. Uncertainty in input costs complicates financial planning and risk assessment, potentially hindering strategic growth initiatives

Office Furniture Market Scope

The market is segmented on the basis material, product, sales channel, price range, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Product |

|

|

By Sales Channel |

|

|

By Price Range |

|

|

By End-User |

|

Office Furniture Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Office Furniture Market”

- The Asia-Pacific region holds a significant share of the global office furniture market, driven by rapid industrialization and urbanization

- For Instance, countries such as China, India, and Japan are experiencing substantial growth in office furniture demand, influenced by expanding commercial real estate and a burgeoning startup culture

- The region's robust manufacturing capabilities and cost-effective production further enhance its dominance in the office furniture sector

- The proliferation of co-working spaces in major cities such as Singapore, Hong Kong, and Shanghai contribute to the increasing demand for modern office furniture solutions

- China, in particular, stands as the largest market within the Asia-Pacific region, with a growing preference for ergonomic and sustainable office furniture

“North America is Projected to Register the Highest Growth Rate”

- The proliferation of startups, particularly in the U.S., drives demand for innovative and flexible office furniture solutions

- The adoption of remote and hybrid work models has led to increased investments in ergonomic and adaptable office furnishings to enhance productivity

- There is a growing emphasis on sustainable and eco-friendly office furniture options, aligning with broader environmental goals

- The expansion of co-working spaces and the establishment of new corporate offices contribute to the dynamic growth of the office furniture market in North America

- These regional dynamics underscore the evolving landscape of the office furniture market, influenced by economic development, workplace trends, and cultural shifts

Office Furniture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Al Meera Holding Company LLC(Qatar)

- American Woodmark Corporation(U.S.)

- Ballingslöv AB(Sweden)

- Black Red White(Poland)

- Boffi S.p.A.(Italy)

- Bulthaup GmbH & Co KG (Germany)

- Cabico Inc. (Canada)

- Cabinetworks Group (U.S.)

- Godrej Interio (India)

- Goldenhome International Inc. (U.S.)

- Häcker Küchen (Germany)

- Haier Inc. (China)

- Hanssem Co., Ltd. (South Korea)

- Howden Joinery Ltd (U.K.)

- Inter IKEA Systems B.V. (Netherlands)

- Interwood (India)

Latest Developments in Global Office Furniture Market

- In April 2024, Bentley Home, the luxury furniture brand associated with the renowned U.K. car manufacturer Bentley Motors, made its entry into the office furniture market at the Milan Design Week. This highly anticipated launch highlighted Bentley Home's dedication to infusing its signature style and craftsmanship into office furnishings

- In February 2024, Fast Office Furniture launched its latest collection, featuring a diverse array of office furniture and accessories that blend style with functionality. This collection includes office chairs, desks, storage solutions, and accessories, all designed to enhance the office's aesthetic while promoting employee efficiency and comfort. By integrating these pieces into their workspaces, businesses can elevate their office design, improve productivity, and foster an environment conducive to success

- In July 2023, Knock on Wood, a well-known leader in furniture design and advanced manufacturing, unveiled its eagerly awaited collection of office furniture. This launch represented a significant milestone for the brand, aiming to redefine contemporary office spaces by merging exceptional craftsmanship with innovative designs

- In February 2023, CoLab introduced an innovative line of collaborative and customizable furniture intended to revolutionize the learning and working experience in modern environments. This cutting-edge collection is specifically designed to address the evolving needs of educational institutions, offices, and co-working spaces, promoting a culture of collaboration, creativity, and flexibility

- In April 2021, PPG Industries Ohio Inc. (PPG) unveiled its PPG ERGOLUXE powder coatings specifically designed for metal office furniture. These innovative coatings utilize a distinctive polyester-hybrid technology, delivering both aesthetic appeal and sustainability advantages compared to conventional liquid or solvent-based coatings for chairs, desks, and cabinets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.