Global Office Presentation Board Market

Market Size in USD Billion

CAGR :

%

USD

2.79 Billion

USD

4.51 Billion

2024

2032

USD

2.79 Billion

USD

4.51 Billion

2024

2032

| 2025 –2032 | |

| USD 2.79 Billion | |

| USD 4.51 Billion | |

|

|

|

|

Office Presentation Board Market Size

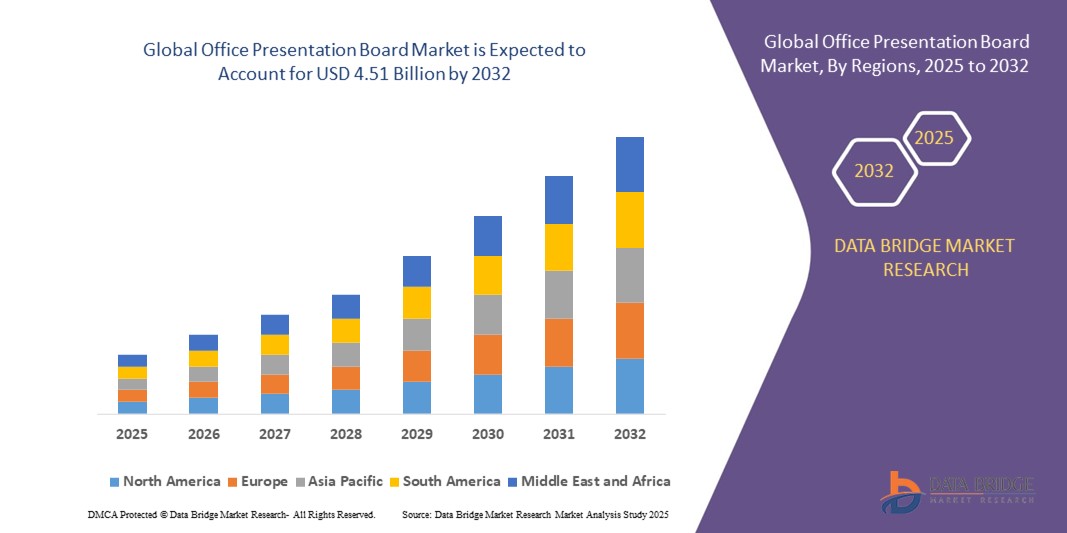

- The global office presentation board market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 4.51 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of modern office setups, rising demand for collaborative work environments, and the growing need for effective visual communication tools in corporate and educational settings

- Rising awareness of productivity-enhancing tools, coupled with advancements in board technologies such as interactive and digital boards, is further supporting market expansion

Office Presentation Board Market Analysis

- Growing emphasis on effective communication and brainstorming in corporate and educational institutions is boosting the adoption of presentation boards

- Technological advancements, including interactive, magnetic, and digital boards, are enhancing usability and engagement, making them increasingly preferred over traditional whiteboards and flip charts

- North America dominated the office presentation board market with the largest revenue share of 41.20% in 2024, driven by widespread adoption of digital and interactive boards in corporate offices, educational institutions, and government organizations, as well as increasing emphasis on workplace efficiency and collaboration

- Asia-Pacific region is expected to witness the highest growth rate in the global office presentation board market, driven by increasing office automation, government initiatives supporting smart workplaces, and growing investments in interactive and digital office infrastructure in countries such as China, Japan, and India

- The whiteboard segment held the largest market revenue share in 2024, driven by its extensive adoption in corporate offices, educational institutions, and training centers for presentations, collaborative sessions, and brainstorming. Whiteboards are preferred due to their durability, ease of cleaning, and compatibility with various markers, making them a reliable choice across professional and academic environments

Report Scope and Office Presentation Board Market Segmentation

|

Attributes |

Office Presentation Board Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Office Presentation Board Market Trends

Rise of Digital and Interactive Presentation Solutions

- The growing adoption of digital and interactive office presentation boards is transforming workplace communication by enabling real-time, engaging presentations. These boards allow seamless collaboration during meetings, enhancing productivity and decision-making efficiency. Moreover, advanced features such as multi-touch capabilities and cloud connectivity support collaborative brainstorming and interactive training sessions across departments

- Increasing demand for versatile boards in remote and hybrid work environments is driving the use of portable and multi-functional presentation boards. Such solutions enable teams to collaborate effectively across locations, reducing meeting downtime and improving workflow. In addition, features such as wireless screen sharing and integration with video conferencing platforms are expanding their applicability in modern workspaces

- The affordability and user-friendly interfaces of modern interactive boards are making them attractive for small and medium-sized enterprises, as well as large organizations. Easy integration with conferencing tools and presentation software supports more frequent usage and improves overall office communication. Enhanced compatibility with mobile devices and laptops further strengthens their adoption in dynamic office setups

- For instance, in 2023, several multinational corporations implemented interactive boards in regional offices, resulting in more engaging meetings and streamlined team collaboration. The deployment allowed real-time annotation, video conferencing integration, and cloud connectivity, boosting operational efficiency. These implementations also contributed to significant reductions in meeting time and paper usage, aligning with sustainability initiatives

- While interactive and digital boards are accelerating workplace collaboration, their adoption depends on continued innovation, user training, and cost-effectiveness. Manufacturers must focus on customizable solutions, scalable features, and easy deployment to maximize market potential. Continuous software updates, intuitive interfaces, and reliable technical support are critical to sustaining long-term usage

Office Presentation Board Market Dynamics

Driver

Growing Demand for Efficient Workplace Communication and Collaboration Tools

- The rising emphasis on productivity and efficient communication in offices is driving the adoption of advanced presentation boards. Companies are seeking solutions that enable interactive, real-time information sharing to support business decision-making. Enhanced analytics, annotation tools, and connectivity with enterprise platforms are further driving interest across multiple sectors

- Organizations are increasingly aware of the benefits of integrating digital presentation boards into meeting spaces, including enhanced employee engagement and reduced reliance on traditional whiteboards and printed materials. These boards also facilitate hybrid meetings, allowing in-office and remote employees to collaborate seamlessly and share ideas instantly

- Government initiatives and corporate programs encouraging smart offices and technology-enabled workplaces are fostering market growth. Subsidized adoption and training programs are boosting awareness and facilitating deployment across industries. Incentives for digitization, energy-efficient devices, and sustainable office solutions further promote widespread adoption

- For instance, in 2022, leading technology firms in Europe implemented interactive board solutions across multiple offices, resulting in improved collaboration and reduced meeting inefficiencies. This trend has encouraged other companies to adopt similar technologies. The deployment also enabled faster decision-making processes and reduced project delays through real-time data visualization

- While growing workplace efficiency and institutional support are driving the market, there is still a need to improve affordability, standardize software integration, and ensure easy maintenance to sustain adoption. Investments in employee training and post-purchase support are essential to maintain operational efficiency and customer satisfaction

Restraint/Challenge

High Cost of Advanced Digital Boards and Limited Adoption in Small Offices

- The high price of interactive and smart office presentation boards, including touch-enabled displays and integrated software solutions, restricts access for small businesses and budget-conscious organizations. Premium systems are often limited to large enterprises or educational institutions. Additional installation and maintenance costs can further discourage adoption among cost-sensitive buyers

- In many workplaces, employees lack sufficient training to use complex interactive features, limiting the effectiveness and adoption of these boards. The absence of IT support and infrastructure further reduces utilization. Frequent software updates and troubleshooting requirements may also cause temporary workflow disruptions, discouraging long-term usage

- Supply chain and production challenges, including sourcing high-quality display panels and connectivity modules, may lead to delays and increased prices, affecting market penetration. These disruptions can result in project postponements and difficulty in meeting rising demand for modern office solution

- For instance, in 2023, several small and medium-sized enterprises in Asia-Pacific reported hesitancy in adopting digital boards due to cost and maintenance concerns, relying instead on traditional whiteboards and projectors. Some organizations also delayed upgrades due to uncertainty regarding compatibility with existing IT systems

- While office presentation boards continue to evolve technologically, addressing cost, training, and integration challenges remains critical. Stakeholders must focus on affordable, user-friendly, and scalable solutions to expand adoption and unlock long-term growth potential. Emphasizing modular design, cloud-based software, and local service support can further improve accessibility and reliability

Office Presentation Board Market Scope

The market is segmented on the basis of product type, material type, application, and sales channel.

- By Product Type

On the basis of product type, the office presentation board market is segmented into whiteboards, pin boards, glass boards, green boards, and chalkboards. The whiteboard segment held the largest market revenue share in 2024, driven by its extensive adoption in corporate offices, educational institutions, and training centers for presentations, collaborative sessions, and brainstorming. Whiteboards are preferred due to their durability, ease of cleaning, and compatibility with various markers, making them a reliable choice across professional and academic environments.

The glass board segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its sleek design, ease of maintenance, and compatibility with dry-erase markers and digital annotation tools. Glass boards are increasingly used in corporate offices, co-working spaces, and modern classrooms for interactive presentations, team collaboration, and visual planning, offering both aesthetic appeal and functional versatility.

- By Material Type

On the basis of material type, the market is segmented into wooden frames, aluminum frames, plastic/polymer frames, and glass. The aluminum frame segment held the largest revenue share in 2024, driven by its lightweight construction, durability, and modern look, making it suitable for corporate, educational, and healthcare applications. Aluminum-framed boards are widely adopted for both wall-mounted and movable setups, providing long-lasting performance with minimal maintenance.

The glass material segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for premium, stylish, and easy-to-clean boards. Glass boards offer enhanced visibility, durability, and compatibility with interactive markers, making them ideal for high-end offices, collaborative workspaces, and advanced educational environments.

- By Application

On the basis of application, the market is segmented into corporate office, educational institutions, government offices, and healthcare. The corporate office segment held the largest market share in 2024, driven by the growing need for effective communication tools, team collaboration, and interactive presentations. Organizations are increasingly integrating presentation boards into meeting rooms, conference halls, and training centers to improve productivity and information sharing.

The educational institutions segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising focus on digital classrooms, interactive teaching methods, and collaborative learning environments. Schools, colleges, and universities are adopting modern boards to enhance student engagement and streamline lesson delivery, supporting academic performance and learning outcomes.

- By Sales Channel

On the basis of sales channel, the market is segmented into offline and online channels. The offline channel held the largest market revenue share in 2024, driven by established distribution networks, direct business-to-business sales, and the ability to provide customized board solutions for offices and educational institutions. Retailers and distributors play a key role in demonstrating product features and ensuring timely delivery.

The online channel is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing preference for e-commerce platforms, wider product selection, competitive pricing, and convenient delivery options. Online sales are increasingly popular among small and medium-sized enterprises and educational institutions seeking easy access to quality presentation boards with minimal procurement effort.

Office Presentation Board Market Regional Analysis

- North America dominated the office presentation board market with the largest revenue share of 41.20% in 2024, driven by widespread adoption of digital and interactive boards in corporate offices, educational institutions, and government organizations, as well as increasing emphasis on workplace efficiency and collaboration

- Consumers and institutions in the region highly value the convenience, advanced features, and seamless integration offered by modern boards with collaborative software, video conferencing, and cloud platform

- This widespread adoption is further supported by high disposable incomes, technologically advanced infrastructure, and government initiatives promoting smart offices and digital classrooms, establishing office presentation boards as a preferred solution across multiple sectors

U.S. Office Presentation Board Market Insight

The U.S. office presentation board market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of interactive and digital boards in corporate offices, educational institutions, and training centers. Organizations are increasingly seeking solutions that enable real-time collaboration, remote connectivity, and interactive presentations to enhance productivity and decision-making. Moreover, the growing integration of smart office technologies and hybrid work models is significantly contributing to market growth.

Europe Office Presentation Board Market Insight

The Europe office presentation board market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising adoption of digital and interactive boards in offices, schools, and government institutions. Urbanization, coupled with the increasing focus on digital classrooms and modern workplace solutions, is fostering market growth. European consumers are also drawn to boards that support collaboration, sustainability, and energy efficiency, promoting adoption across commercial and educational applications.

U.K. Office Presentation Board Market Insight

The U.K. office presentation board market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for smart classrooms, corporate training, and interactive office solutions. Organizations and institutions are adopting advanced boards to improve employee engagement, streamline meetings, and enhance learning experiences. The U.K.’s robust e-commerce infrastructure and technology-driven initiatives are expected to continue supporting market growth.

Germany Office Presentation Board Market Insight

The Germany office presentation board market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the demand for modern office solutions and technologically advanced educational tools. Germany’s emphasis on innovation, sustainability, and digital learning infrastructure promotes the adoption of interactive and digital boards. Integration with collaborative software, video conferencing, and IoT-enabled features is also encouraging widespread usage in both corporate and educational environments.

Asia-Pacific Office Presentation Board Market Insight

The Asia-Pacific office presentation board market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, rising corporate and educational infrastructure investment, and technological advancements in countries such as China, Japan, and India. The region’s growing inclination toward smart classrooms and digital workplaces, supported by government initiatives promoting technology adoption, is fueling demand. Furthermore, as APAC emerges as a manufacturing hub for interactive board components, affordability and accessibility are expanding market reach.

Japan Office Presentation Board Market Insight

The Japan office presentation board market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, rapid urbanization, and strong focus on efficient learning and workplace collaboration. Adoption is driven by an increasing number of digital classrooms and smart offices. The integration of interactive boards with other digital tools, including IoT and collaborative software, is supporting market growth. Moreover, Japan’s aging population is likely to spur demand for user-friendly, accessible presentation solutions in educational and corporate settings.

China Office Presentation Board Market Insight

The China office presentation board market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, technological adoption, and government initiatives promoting smart offices and digital learning. China stands as one of the largest markets for interactive and digital boards in corporate, educational, and government sectors. The expansion of smart classrooms, combined with domestic manufacturing capabilities and affordable solutions, is driving widespread adoption and accelerating market growth.

Office Presentation Board Market Share

The Office Presentation Board industry is primarily led by well-established companies, including:

- Steelcase Inc. (U.S.)

- Herman Miller Inc. (U.S.)

- Knoll Inc. (U.S.)

- Upright Display Systems (U.K.)

- Quartet Manufacturing Inc. (U.S.)

- Bi-Silque (Portugal)

- BIC (France)

- Newell Brands (U.S.)

- Legamaster (Netherlands)

- Samsill Corporation (U.S.)

- 3M (U.S.)

- Durable (Germany)

- OfficeSource (U.S.)

- Cando (U.S.)

- MasterVision (Portugal)

- Kensington (U.S.)

- Egan Visual (U.S.)

- Elmo (Japan)

- Wunderwerke (Germany)

- AdirOffice (U.S.)

Latest Developments in Office Presentation Board Market

- In March 2023, Microsoft and Google upgraded their interactive whiteboards to offer better integration with collaboration platforms such as Microsoft Teams and Google Workspace. These enhancements facilitated improved real-time editing, screen sharing, and more seamless remote collaboration, particularly in hybrid work environments. This development highlights the growing demand for advanced interactive presentation solutions that support enhanced collaboration in the workplace

- In June 2023, SMART Technologies, a leading manufacturer of interactive boards, introduced AI-powered features including voice commands, automatic handwriting recognition, and intelligent content organization. These innovations are designed to enhance workflow efficiency in both corporate and educational environments. This advancement underscores the growing demand for smarter and more efficient interactive presentation boards

- In April 2023, Samsung and other manufacturers launched portable, lightweight digital whiteboards tailored for co-working spaces and remote work environments. These products provide flexible solutions designed to meet the needs of the mobile workforce. This innovation reflects the increasing demand for versatile and mobile-friendly presentation tools as businesses continue to embrace remote and hybrid work models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.