Global Offshore Drilling Fluid Market

Market Size in USD Billion

CAGR :

%

USD

9.39 Billion

USD

17.51 Billion

2025

2033

USD

9.39 Billion

USD

17.51 Billion

2025

2033

| 2026 –2033 | |

| USD 9.39 Billion | |

| USD 17.51 Billion | |

|

|

|

|

Global Offshore Drilling Fluid Market Size

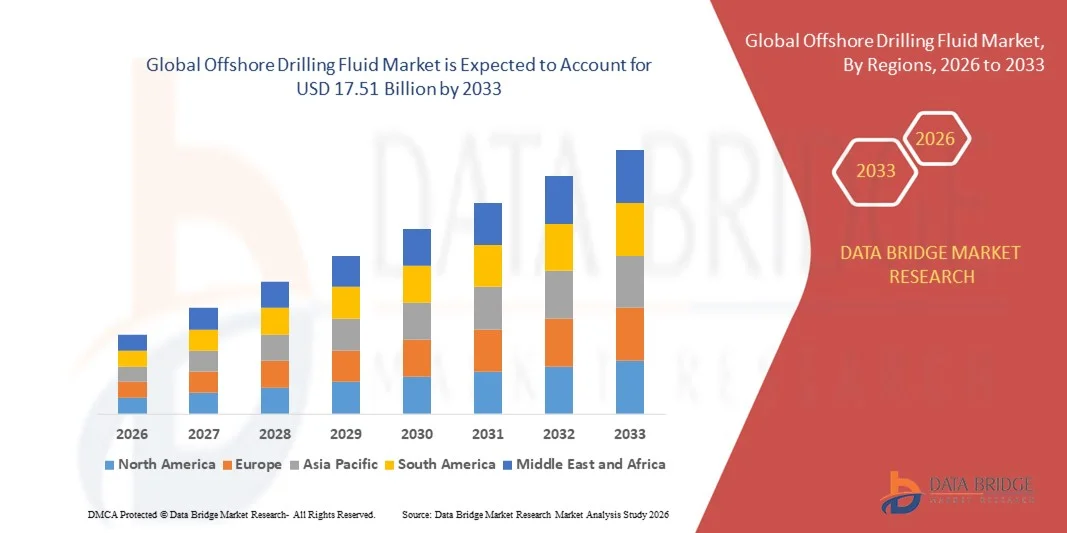

- The global Offshore Drilling Fluid Market size was valued at USD 9.39 billion in 2025 and is expected to reach USD 17.51 billion by 2033, at a CAGR of 8.10% during the forecast period.

- The market growth is largely driven by increasing offshore oil and gas exploration activities, coupled with technological advancements in drilling fluid formulations that enhance efficiency, stability, and environmental compliance.

- Furthermore, rising demand for high-performance drilling fluids capable of operating under extreme temperatures and pressures is encouraging the adoption of advanced solutions. These factors are collectively propelling the growth of the offshore drilling fluid market, making it a critical component of modern offshore drilling operations.

Global Offshore Drilling Fluid Market Analysis

- Offshore drilling fluids, also known as drilling muds, are essential for the safe and efficient drilling of oil and gas wells, providing wellbore stability, lubrication, and cuttings transport, making them critical components of offshore exploration and production operations.

- The growing demand for offshore drilling fluids is primarily driven by increased offshore oil and gas exploration activities, stricter regulatory standards for environmental compliance, and the need for advanced fluid formulations capable of withstanding extreme drilling conditions.

- North America dominated the Global Offshore Drilling Fluid Market with the largest revenue share of 33.6% in 2025, supported by established offshore oil and gas infrastructure, high investment in exploration projects, and a strong presence of major market players, with the U.S. leading in technological advancements in fluid formulations and performance monitoring systems.

- Asia-Pacific is expected to be the fastest-growing region in the Global Offshore Drilling Fluid Market during the forecast period due to increasing offshore exploration activities, rising energy demand, and supportive government policies for energy sector expansion.

- The water-based fluids (WBF) segment dominated the market with the largest revenue share of 43.2% in 2025, driven by their cost-effectiveness, environmental friendliness, and wide applicability across various offshore drilling conditions.

Report Scope and Global Offshore Drilling Fluid Market Segmentation

|

Attributes |

Offshore Drilling Fluid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Offshore Drilling Fluid Market Trends

Enhanced Efficiency Through AI and Real-Time Monitoring

- A significant and accelerating trend in the Global Offshore Drilling Fluid Market is the growing integration of artificial intelligence (AI) and real-time monitoring systems into drilling fluid operations. This fusion of technologies is significantly enhancing operational efficiency, predictive maintenance, and overall well safety.

- For instance, AI-driven fluid management platforms can continuously analyze drilling parameters and fluid properties to optimize viscosity, density, and chemical composition in real time, reducing non-productive time and improving wellbore stability. Similarly, advanced monitoring sensors allow operators to track temperature, pressure, and fluid performance remotely, enabling more precise and timely adjustments.

- AI integration in drilling fluids enables predictive analytics for anticipating potential drilling issues, such as wellbore instability or equipment wear, and providing actionable recommendations for corrective measures. For example, some Baker Hughes and Schlumberger systems utilize AI to forecast fluid degradation patterns and suggest optimal additive formulations, minimizing downtime and operational costs.

- The seamless integration of AI with digital control systems facilitates centralized management of drilling operations, allowing engineers to monitor fluid performance alongside other critical parameters such as torque, pump pressure, and drill bit conditions, creating a unified and automated operational workflow.

- This trend toward more intelligent, responsive, and interconnected drilling fluid management systems is fundamentally reshaping industry expectations for offshore drilling efficiency and safety. Consequently, companies such as Halliburton and NOV are developing AI-enabled fluid solutions with predictive adjustment capabilities, real-time alerts, and automated dosing systems.

- The demand for AI-integrated and real-time monitored offshore drilling fluids is growing rapidly across global exploration and production sites, as operators increasingly prioritize operational efficiency, safety, and environmental compliance.

Global Offshore Drilling Fluid Market Dynamics

Driver

Growing Need Due to Expanding Offshore Exploration and Energy Demand

- The increasing global demand for energy, coupled with expanding offshore oil and gas exploration activities, is a significant driver for the heightened demand for advanced offshore drilling fluids.

- For instance, in 2025, Schlumberger launched an advanced environmentally compliant drilling fluid system designed for ultra-deepwater operations, highlighting how innovations by key companies are expected to propel offshore drilling fluid market growth during the forecast period.

- As exploration moves into deeper and more technically challenging reservoirs, high-performance drilling fluids offer critical benefits such as maintaining wellbore stability, optimizing drilling efficiency, and reducing non-productive time, making them essential over conventional fluid solutions.

- Furthermore, stricter environmental regulations and the push for safer offshore operations are driving the adoption of specialized water-based, synthetic-based, and biodegradable drilling fluids that minimize ecological impact while maximizing operational performance.

- Operational advantages such as enhanced thermal stability, improved cuttings transport, and compatibility with advanced drilling techniques are key factors propelling the adoption of sophisticated offshore drilling fluids in both shallow and deepwater operations. The trend toward automation and real-time fluid monitoring further contributes to market growth.

Restraint/Challenge

Environmental Compliance and High Operational Costs

- Environmental regulations regarding offshore drilling fluid discharge and waste management pose a significant challenge to broader market penetration. Fluids that do not meet regulatory standards can result in fines, operational delays, and reputational risks for oil and gas operators.

- For instance, stringent regulations in the North Sea and Gulf of Mexico require companies to use low-toxicity or biodegradable drilling fluids, creating additional compliance costs for operators.

- Addressing these challenges through the development of eco-friendly fluid formulations, rigorous testing, and certification is crucial for maintaining regulatory compliance and operational continuity. Companies such as Halliburton and Baker Hughes emphasize their environmentally responsible fluid solutions in marketing and client communications to reassure stakeholders.

- Additionally, the high initial cost of advanced drilling fluids, combined with the need for specialized equipment and trained personnel for deployment, can be a barrier for smaller operators or those in developing regions. While water-based and synthetic-based fluids are gradually becoming more cost-effective, premium formulations designed for extreme environments remain expensive.

- Overcoming these challenges through innovation in cost-efficient, environmentally compliant fluids, operator training, and technological support will be vital for sustained growth in the offshore drilling fluid market.

Global Offshore Drilling Fluid Market Scope

Offshore drilling fluid market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the Global Offshore Drilling Fluid Market is segmented into Oil-Based Fluids (OBF), Water-Based Fluids (WBF), and Synthetic-Based Fluids (SBF). The water-based fluids (WBF) segment dominated the market with the largest revenue share of 43.2% in 2025, driven by their cost-effectiveness, environmental friendliness, and wide applicability across various offshore drilling conditions. WBFs are often preferred in regions with strict environmental regulations due to their low toxicity and biodegradability. Additionally, water-based fluids are easier to handle, treat, and dispose of compared to oil-based alternatives, making them highly suitable for both shallow and deepwater drilling operations.

The synthetic-based fluids (SBF) segment is anticipated to witness the fastest growth rate of 21.7% from 2026 to 2033, fueled by the increasing demand for high-performance fluids capable of operating under extreme temperatures and pressures, improving drilling efficiency and wellbore stability in complex offshore environments.

- By Application

On the basis of application, the Global Offshore Drilling Fluid Market is segmented into shallow water, deepwater, and ultra-deepwater operations. The shallow water segment accounted for the largest market revenue share of 42.5% in 2025, owing to the higher volume of shallow water drilling projects globally and the relatively lower operational complexity compared to deeper offshore wells. Shallow water drilling continues to benefit from mature infrastructure and cost-efficient fluid solutions, with water-based and oil-based fluids widely deployed for stable and productive operations.

The ultra-deepwater segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by growing exploration in extreme offshore environments, rising energy demand, and technological advancements in high-performance synthetic-based fluids that ensure wellbore stability and efficient drilling under high-pressure, high-temperature (HPHT) conditions. Increasing investments in deepwater and ultra-deepwater projects by major oil and gas operators are further accelerating market growth in this segment.

Global Offshore Drilling Fluid Market Regional Analysis

- North America dominated the Global Offshore Drilling Fluid Market with the largest revenue share of 33.6% in 2025, driven by the presence of established offshore oil and gas infrastructure, high investment in exploration projects, and advanced technological capabilities in drilling operations.

- Operators in the region highly prioritize high-performance drilling fluids that ensure wellbore stability, optimize drilling efficiency, and comply with strict environmental regulations, making water-based, oil-based, and synthetic-based fluids critical for both shallow and deepwater projects.

- This strong market presence is further supported by significant R&D investments, a skilled workforce, and the adoption of AI-driven and real-time fluid monitoring technologies. The combination of these factors establishes North America as a leading hub for offshore drilling fluid consumption, with continuous demand from both mature offshore fields and new exploration projects in the Gulf of Mexico and other key offshore basins.

U.S. Offshore Drilling Fluid Market Insight

The U.S. offshore drilling fluid market captured the largest revenue share of 81% in North America in 2025, driven by extensive offshore exploration activities in the Gulf of Mexico and advanced technological adoption in drilling operations. Operators are increasingly prioritizing high-performance fluids to maintain wellbore stability, optimize drilling efficiency, and ensure compliance with strict environmental regulations. The growing use of AI-enabled and real-time fluid monitoring systems further boosts demand, allowing for precise control of drilling parameters. Moreover, the expansion of deepwater and ultra-deepwater projects, along with the presence of key market players such as Schlumberger, Halliburton, and Baker Hughes, continues to propel the growth of the U.S. offshore drilling fluid market.

Europe Offshore Drilling Fluid Market Insight

The Europe offshore drilling fluid market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations, the need for advanced wellbore stability solutions, and increased offshore exploration in the North Sea. Growing investments in renewable energy coexist with conventional oil and gas operations, promoting the adoption of environmentally compliant water-based and synthetic-based drilling fluids. Countries such as Norway and the U.K. are seeing a surge in demand for high-performance, low-toxicity fluids in both mature and new offshore fields.

U.K. Offshore Drilling Fluid Market Insight

The U.K. offshore drilling fluid market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by ongoing exploration in the North Sea and a strong focus on regulatory compliance and sustainable drilling practices. Operators increasingly prefer advanced fluid formulations that enhance operational safety, reduce non-productive time, and minimize environmental impact. The market is further supported by technological advancements in fluid monitoring systems and real-time data analytics, which allow for optimized drilling operations and efficient resource utilization.

Germany Offshore Drilling Fluid Market Insight

The Germany offshore drilling fluid market is expected to expand at a considerable CAGR during the forecast period, fueled by increased offshore exploration in the North Sea and the growing emphasis on environmentally responsible drilling practices. The country’s commitment to sustainability and adoption of advanced drilling technologies promotes the use of synthetic-based and biodegradable fluids. Moreover, strong industrial infrastructure and a focus on innovation are driving demand for high-performance fluids capable of supporting complex offshore projects.

Asia-Pacific Offshore Drilling Fluid Market Insight

The Asia-Pacific offshore drilling fluid market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing offshore exploration in countries such as China, India, Malaysia, and Australia. Rising energy demand, government support for oil and gas exploration, and technological advancements in high-performance drilling fluids are fueling market expansion. Additionally, the region’s emergence as a manufacturing hub for drilling fluid additives and equipment is enhancing affordability and accessibility, further accelerating adoption in both shallow and deepwater operations.

Japan Offshore Drilling Fluid Market Insight

The Japan offshore drilling fluid market is gaining momentum due to the country’s investment in offshore exploration and technological advancements in drilling operations. High-performance drilling fluids, including water-based and synthetic-based fluids, are being increasingly adopted to ensure wellbore stability and operational safety in challenging environments. Japan’s focus on integrating advanced monitoring systems and eco-friendly formulations in offshore projects is further driving market growth.

China Offshore Drilling Fluid Market Insight

The China offshore drilling fluid market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid offshore exploration in the South China Sea, strong domestic manufacturing capabilities, and government initiatives promoting energy security. The increasing number of deepwater and ultra-deepwater projects, coupled with the adoption of high-performance and environmentally compliant drilling fluids, is driving market growth. Strong domestic players and the availability of cost-effective fluid solutions further strengthen China’s position as a key contributor to the regional offshore drilling fluid market.

Global Offshore Drilling Fluid Market Share

The Offshore Drilling Fluid industry is primarily led by well-established companies, including:

• Schlumberger Ltd. (U.S.)

• Halliburton Company (U.S.)

• Baker Hughes Company (U.S.)

• Weatherford International (Switzerland)

• ExxonMobil Corporation (U.S.)

• National Oilwell Varco (NOV) (U.S.)

• KCA Deutag (U.K.)

• China National Offshore Oil Corporation (CNOOC) (China)

• Saudi Aramco (Saudi Arabia)

• TotalEnergies SE (France)

• PetroChina Company Limited (China)

• Rosneft Oil Company (Russia)

• TechnipFMC (U.S.)

• ADNOC Drilling (U.A.E.)

• CosL (China)

• Nabors Industries Ltd. (U.S.)

• Hallin Marine (U.K.)

• Ensign Energy Services Inc. (Canada)

• Schlumberger Oilfield Services (U.S.)

• Pioneer Energy Services (U.S.)

What are the Recent Developments in Global Offshore Drilling Fluid Market?

- In April 2024, Schlumberger Ltd., a global leader in oilfield services, announced the launch of its advanced synthetic-based drilling fluid system for deepwater projects in the Gulf of Mexico. This initiative emphasizes Schlumberger’s commitment to improving drilling efficiency, wellbore stability, and environmental compliance in challenging offshore environments, reinforcing its position in the global offshore drilling fluid market.

- In March 2024, Halliburton Company introduced its next-generation water-based drilling fluid technology designed for ultra-deepwater operations in West Africa. The system enhances drilling performance, minimizes non-productive time, and meets stringent environmental regulations, highlighting Halliburton’s focus on innovation and sustainable offshore solutions.

- In March 2024, Baker Hughes successfully deployed its high-performance oil-based drilling fluid solution for the South China Sea Ultra-Deepwater Exploration Project. The project leverages advanced real-time monitoring and automated fluid management technologies, demonstrating Baker Hughes’ commitment to operational efficiency, safety, and reduced environmental impact in offshore drilling.

- In February 2024, ExxonMobil announced a strategic partnership with a leading drilling contractor in the North Sea to implement its environmentally friendly synthetic-based drilling fluids for ongoing offshore projects. The collaboration aims to enhance wellbore stability, reduce operational risks, and improve environmental performance, showcasing ExxonMobil’s dedication to technological innovation and sustainability.

- In January 2024, Weatherford International unveiled its latest water-based drilling fluid system at the Offshore Technology Conference (OTC) 2024. Designed for high-temperature, high-pressure offshore wells, the solution enables improved drilling efficiency and real-time monitoring of fluid properties, reflecting Weatherford’s focus on delivering advanced, reliable, and environmentally compliant drilling fluid technologies to global markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Offshore Drilling Fluid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Offshore Drilling Fluid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Offshore Drilling Fluid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.