Global Offshore Drilling Market

Market Size in USD Billion

CAGR :

%

USD

42.40 Billion

USD

60.76 Billion

2025

2033

USD

42.40 Billion

USD

60.76 Billion

2025

2033

| 2026 –2033 | |

| USD 42.40 Billion | |

| USD 60.76 Billion | |

|

|

|

|

Offshore Drilling Market Size

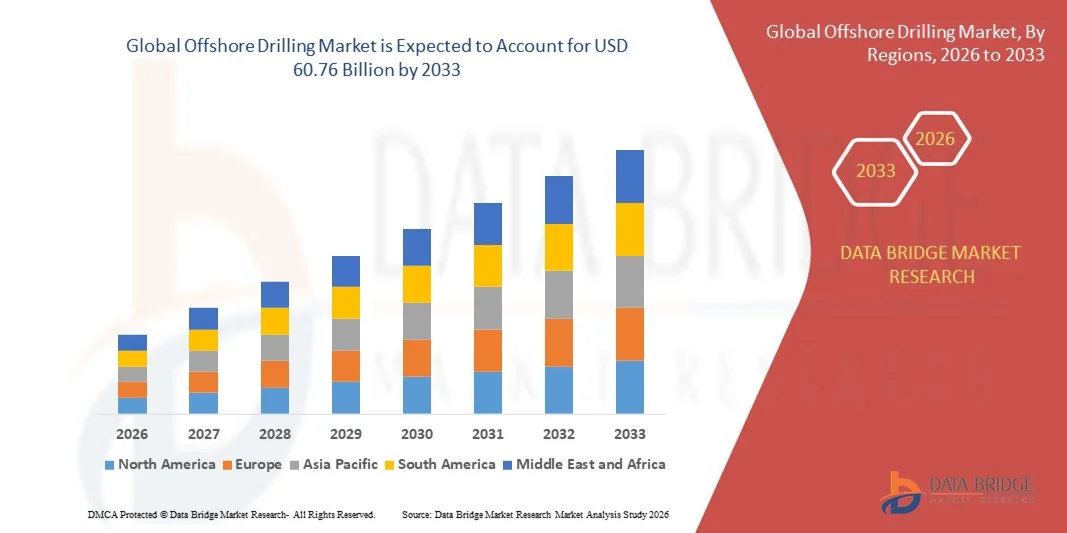

- The global offshore drilling market size was valued at USD 42.40 billion in 2025 and is expected to reach USD 60.76 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by increasing global energy demand and the need to explore untapped offshore oil and gas reserves, leading to heightened investment in both shallow water and deepwater drilling projects

- Furthermore, rising adoption of advanced drilling technologies, such as directional drilling, measurement while drilling (MWD), and logging while drilling (LWD), is enhancing operational efficiency, reducing costs, and improving safety across offshore operations. These converging factors are accelerating the deployment of sophisticated offshore drilling solutions, thereby significantly boosting the industry's growth

Offshore Drilling Market Analysis

- Offshore drilling, involving the exploration and extraction of oil and gas from beneath the seabed, is increasingly vital for meeting global energy needs and securing energy supply in both mature and emerging markets due to the high hydrocarbon potential of offshore reserves

- The escalating demand for offshore drilling services is primarily fueled by rising energy consumption, technological advancements in drilling rigs and subsea equipment, and the strategic focus of oil and gas companies on deepwater and ultra-deepwater exploration projects

- North America dominated the offshore drilling market with a share of over 40% in 2025, due to the presence of established oil and gas operators, advanced drilling infrastructure, and high investment in offshore exploration activities

- Asia-Pacific is expected to be the fastest growing region in the offshore drilling market during the forecast period due to increasing offshore exploration in countries such as China, India, and Australia

- Deepwater drilling segment dominated the market with a market share of 45.8% in 2025, due to the significant reserves of untapped oil and gas located in deepwater regions. Operators prioritize deepwater drilling for its ability to access large hydrocarbon deposits that are inaccessible through conventional methods, providing high returns on investment. Technological advancements in subsea equipment, dynamic positioning rigs, and floating platforms have enhanced the feasibility and safety of deepwater operations. For instance, companies such as BP and Royal Dutch Shell have undertaken major deepwater projects in the Gulf of Mexico, showcasing operational efficiency and technological prowess. The increasing demand for energy security and exploration in mature basins has further bolstered the dominance of deepwater drilling

Report Scope and Offshore Drilling Market Segmentation

|

Attributes |

Offshore Drilling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Offshore Drilling Market Trends

Rising Adoption of Advanced Drilling Technologies

- The offshore drilling market is undergoing a technological transformation driven by the integration of advanced drilling systems designed to enhance accuracy, safety, and efficiency in deepwater and ultra-deepwater operations. The adoption of automation, digital monitoring, and next-generation rig designs is enabling oil and gas companies to optimize performance while reducing downtime and operational risks in challenging marine environments

- For instance, Transocean Ltd. has implemented advanced drilling automation through its Onward platform, which uses real-time analytics to optimize pressure management and improve drilling precision in deepwater projects. Similarly, Halliburton Company has introduced digital well construction systems that leverage AI algorithms to predict drilling conditions and enhance efficiency across offshore rigs

- The deployment of technologies such as managed pressure drilling (MPD), rotary steerable systems, and autonomous downhole tools is improving well stability and minimizing non-productive time. These systems enhance wellbore placement accuracy and mitigate drilling hazards, contributing to improved resource recovery and environmental safety compliance

- Integration of real-time data analytics and IoT-enabled sensors allows continuous monitoring of rig performance and predictive maintenance. This connectivity-driven approach enhances decision-making, reduces equipment failure incidents, and optimizes resource utilization, creating a more streamlined offshore operation

- Offshore operators are also investing in hybrid energy-powered drilling units and automated control systems to reduce carbon footprints and meet sustainability goals. This shift toward low-emission technologies aligns with global climate commitments while maintaining cost efficiency and safety reliability in operations

- The adoption of advanced drilling technologies is redefining the competitiveness and resilience of offshore exploration. As energy companies focus on operational efficiency, data-driven technologies, and automation-led productivity, offshore drilling is positioned for sustainable growth in the evolving global energy landscape

Offshore Drilling Market Dynamics

Driver

Increasing Global Energy Demand and Offshore Exploration

- Rising global energy consumption and ongoing depletion of onshore reserves are fueling a resurgence in offshore exploration activities. The growing reliance on offshore resources, particularly in untapped deepwater and ultra-deepwater basins, is driving long-term investment in drilling infrastructure and rig development

- For instance, Valaris Limited expanded its offshore rig fleet in 2025 with new semi-submersible and drillship contracts across Brazil and West Africa, reflecting the renewed interest of major oil companies in offshore exploration. In addition, Equinor ASA and Petrobras are scaling up exploratory operations in mature and frontier fields, leveraging advanced technology to enable cost-effective extraction of hydrocarbons in deepwater reservoirs

- The drive for energy diversification and national energy security is encouraging governments to support offshore drilling projects through favorable policies and bidding rounds. Major markets in the Middle East, Latin America, and Asia-Pacific are witnessing significant investment inflows to expand exploration capacity and secure long-term production targets

- As offshore projects offer access to substantial reserves compared to declining onshore fields, oil companies are engaging in joint ventures to share costs and technological expertise. These collaborations are improving drilling precision, operational safety, and efficiency in complex underwater environments

- The combination of increasing global energy demand and technological advances in deepwater extraction continues to reinforce offshore exploration’s strategic importance. This momentum is expected to sustain capital deployment in the offshore drilling industry as economies transition toward balanced and diversified energy sources

Restraint/Challenge

High Operational Costs and Regulatory Compliance

- The offshore drilling market faces persistent challenges associated with high operational expenses and stringent regulatory requirements governing safety, environmental protection, and emissions control. Deepwater drilling demands substantial capital investment in rig construction, equipment, logistics, and technical labor, often resulting in extended project payback periods

- For instance, operators such as Noble Corporation and Seadrill Limited have reported rising operating costs for maintaining deepwater rigs and ensuring compliance with international safety standards such as those set by the International Maritime Organization (IMO) and local offshore agencies. This has contributed to financial pressures, particularly during volatile crude price cycles

- Strict environmental regulations concerning marine pollution, carbon emissions, and decommissioning obligations further increase compliance-related expenditure. These frameworks require constant monitoring, frequent inspections, and implementation of safety upgrades to meet evolving standards, adding to overall operational complexity

- Fluctuating oil prices exacerbate the challenge by discouraging new investments during low market periods, as high fixed costs make project profitability sensitive to price changes. This uncertainty discourages smaller firms from entering the offshore drilling space and often delays project approvals for major operators

- Mitigating these challenges requires advancements in automated drilling, cost optimization through digital monitoring, and consistent regulatory collaboration. Over time, balancing high safety standards with economic viability will remain critical to ensuring the long-term profitability and sustainability of the offshore drilling sector

Offshore Drilling Market Scope

The market is segmented on the basis of service type, application, end-user, and solution type.

- By Service Type

On the basis of service type, the offshore drilling market is segmented into contract drilling, directional drilling, logging while drilling (LWD), and measurement while drilling (MWD). The contract drilling segment dominated the market with the largest market revenue share in 2025, driven by its established role in providing comprehensive drilling solutions for oil and gas operators. Oil companies often prefer contract drilling due to its cost-effectiveness, predictable project timelines, and access to specialized rigs and skilled personnel. The segment also benefits from long-term contracts with major operators, ensuring consistent revenue streams and operational efficiency. Contract drilling services are widely adopted across both shallow and deepwater operations, further reinforcing their market leadership. Technological advancements and improved rig capabilities have enhanced the reliability and safety of contract drilling operations, boosting adoption.

The directional drilling segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing exploration in complex offshore reservoirs. Directional drilling allows operators to reach hydrocarbon deposits located beneath challenging geological formations or environmentally sensitive areas, providing greater flexibility in well placement. For instance, companies such as Halliburton and Schlumberger are leveraging advanced rotary steerable systems to enhance accuracy and reduce drilling time. The segment’s growth is also supported by rising demand for maximizing reservoir recovery and minimizing surface footprint. In addition, directional drilling integration with real-time monitoring systems and predictive analytics is improving operational efficiency, safety, and cost savings.

- By Application

On the basis of application, the offshore drilling market is segmented into shallow water drilling, deepwater drilling, and ultra-deepwater drilling. The deepwater drilling segment dominated the market with the largest revenue share of 45.8% in 2025, driven by the significant reserves of untapped oil and gas located in deepwater regions. Operators prioritize deepwater drilling for its ability to access large hydrocarbon deposits that are inaccessible through conventional methods, providing high returns on investment. Technological advancements in subsea equipment, dynamic positioning rigs, and floating platforms have enhanced the feasibility and safety of deepwater operations. For instance, companies such as BP and Royal Dutch Shell have undertaken major deepwater projects in the Gulf of Mexico, showcasing operational efficiency and technological prowess. The increasing demand for energy security and exploration in mature basins has further bolstered the dominance of deepwater drilling.

The ultra-deepwater drilling segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by exploration in ultra-deep offshore basins where conventional drilling is not feasible. Ultra-deepwater drilling allows operators to tap into reserves located at extreme depths, often exceeding 3,000 meters, requiring advanced rigs and sophisticated subsea technologies. For instance, ExxonMobil has successfully deployed ultra-deepwater drilling techniques in the Guyana Basin to access high-quality crude reserves. The growing need for diversifying energy sources and meeting rising global oil demand is driving investments in ultra-deepwater projects. In addition, technological innovations in drilling efficiency, well control, and real-time monitoring are enhancing the viability and safety of ultra-deepwater operations.

Offshore Drilling Market Regional Analysis

- North America dominated the offshore drilling market with the largest revenue share of over 40% in 2025, driven by the presence of established oil and gas operators, advanced drilling infrastructure, and high investment in offshore exploration activities

- Companies in the region highly value technological innovations, safety compliance, and efficiency in offshore operations, which strengthen the adoption of advanced drilling services

- This dominance is further supported by mature regulatory frameworks, high exploration budgets, and the availability of skilled labor, positioning North America as a key hub for both shallow and deepwater drilling operations

U.S. Offshore Drilling Market Insight

The U.S. offshore drilling market captured the largest revenue share within North America in 2025, fueled by substantial offshore reserves in regions such as the Gulf of Mexico and strong government support for offshore energy exploration. The adoption of technologically advanced rigs and subsea equipment is enhancing operational efficiency and safety, attracting both domestic and international players. Moreover, increasing investment in deepwater and ultra-deepwater projects is driving demand for specialized drilling services, with contract drilling and directional drilling being the most sought-after segments.

Europe Offshore Drilling Market Insight

The Europe offshore drilling market is projected to expand at a moderate CAGR during the forecast period, primarily driven by stringent environmental and safety regulations and rising energy security requirements. The adoption of advanced drilling technologies and subsea solutions is increasing across offshore projects, particularly in the North Sea. European operators focus on maximizing reservoir recovery while minimizing environmental impact, fostering the adoption of directional drilling, measurement while drilling, and logging while drilling services. The region is also witnessing growth in both shallow water and deepwater projects, supported by strong infrastructure and skilled technical workforce.

U.K. Offshore Drilling Market Insight

The U.K. offshore drilling market is anticipated to grow at a steady CAGR during the forecast period, driven by the country’s focus on efficient exploration of offshore reserves and enhanced operational safety. The adoption of key technologies, including directional drilling and real-time monitoring systems, is helping operators reduce costs and improve precision. The U.K.’s offshore energy sector benefits from well-established regulations, skilled manpower, and a strategic position in the North Sea, attracting both domestic and international drilling service providers.

Germany Offshore Drilling Market Insight

The Germany offshore drilling market is expected to expand at a moderate CAGR during the forecast period, fueled by technological advancement, strong emphasis on safety, and increasing energy diversification efforts. Germany’s offshore projects prioritize efficient reservoir exploitation and environmentally compliant operations. Investment in advanced drilling technologies, including measurement while drilling and logging while drilling, is supporting the growth of offshore drilling activities in the region, particularly in the North Sea basin.

Asia-Pacific Offshore Drilling Market Insight

The Asia-Pacific offshore drilling market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing offshore exploration in countries such as China, India, and Australia. The region is witnessing rapid adoption of advanced drilling technologies, rising offshore production, and growing foreign investment in deepwater and ultra-deepwater projects. Asia-Pacific’s expanding oil and gas industry, coupled with government initiatives supporting exploration and production, is fueling market growth.

China Offshore Drilling Market Insight

The China offshore drilling market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing demand for energy, robust offshore exploration programs, and strong government backing. Advanced drilling rigs, enhanced subsea equipment, and the deployment of directional and measurement while drilling services are increasing efficiency and safety. China’s strategic focus on tapping deepwater and ultra-deepwater reserves, combined with local manufacturing of offshore equipment, is significantly contributing to the market’s expansion.

Japan Offshore Drilling Market Insight

The Japan offshore drilling market is gaining momentum due to the country’s efforts to secure energy independence and diversify offshore production. Technological adoption, including ultra-deepwater drilling capabilities, advanced monitoring systems, and environmentally compliant practices, is driving the growth of offshore operations. Japan’s focus on innovation and high operational safety standards is attracting international collaborations and investments in offshore drilling projects across its territorial waters.

Offshore Drilling Market Share

The offshore drilling industry is primarily led by well-established companies, including:

- Halliburton (U.S.)

- Schlumberger Limited (U.S.)

- Seadrill Limited (Bermuda)

- Transocean Ltd. (Switzerland)

- Weatherford (U.S.)

- China Oilfield Services Limited (China)

- Diamond Offshore Drilling, Inc. (U.S.)

- Baker Hughes Company (U.S.)

- Dolphin Drilling (Norway)

- Maersk Drilling (Denmark)

- KCA Deutag (U.K.)

- Valaris plc (U.K.)

- Nabors Industries Ltd. (U.S.)

- Paragon Offshore (Bermuda)

- Scientific Drilling International (U.S.)

- Noble Corporation (U.S.)

- Superior Energy Services, Inc. (U.S.)

- Archer (U.K.)

- Helmerich & Payne (U.S.)

- Patterson-UTI Energy, Inc. (U.S.)

Latest Developments in Global Offshore Drilling Market

- In July 2022, IIT Madras developed an indigenous life cycle management system for the Oil and Natural Gas Corporation (ONGC), aimed at reducing the cost of maintenance and rehabilitation of offshore oil platforms. This development is expected to significantly enhance operational efficiency and lower expenditure for ONGC, potentially driving broader adoption of such cost-effective and technologically advanced solutions across the Indian offshore drilling sector. The innovation strengthens India’s domestic capability in offshore asset management, positioning the country as a growing hub for localized technological solutions in offshore operations

- In April 2022, Saipem was awarded two contracts in the Middle East for high-specification jackup drilling units, including workover and drilling operations over a five-year period. The projects involve one newly chartered jackup from CIMC Group and one existing Saipem unit, scheduled to commence in the fourth quarter of 2022. This expansion reflects the rising demand for specialized offshore drilling services in the Middle East, reinforcing Saipem’s market presence and highlighting the region’s strategic importance for high-value offshore drilling operations

- In March 2022, Nabors Industries Ltd. invested USD 8 million in GA Drilling to advance deep drilling technologies for super-hot, ultra-deep rock reservoirs. This strategic investment is aligned with Nabors’ energy transition strategy, targeting low-carbon energy markets with high growth potential. By building multiple ecosystems of complementary clean energy technologies, Nabors is strengthening its competitive edge in both conventional offshore drilling and emerging low-carbon solutions, signaling a shift toward sustainable, technologically advanced drilling practices in the global market

- In January 2022, Saipem secured two offshore contracts in Australia and Guyana valued at USD 1.1 billion for the Engineering, Procurement, Construction, and Installation (EPCI) of subsea Umbilicals, Risers, and Flowlines (SURF). These contracts underscore the increasing demand for integrated offshore infrastructure services and highlight Saipem’s capability to manage complex, large-scale subsea projects. The deals are expected to drive revenue growth in the offshore drilling sector and further strengthen technological and operational expertise in critical deepwater projects

- In December 2021, Petrogas North Sea Ltd. and Maersk Drilling exercised an exclusive option to deploy the harsh-environment jackup rig Maersk Resilient for drilling an appraisal well at the Birgitta field in the North Sea, UK sector. This deployment highlights the growing focus on leveraging advanced rig technology for exploration in challenging offshore environments. It reinforces Maersk Drilling’s strategic position in the North Sea and is indicative of market trends toward high-specification rigs capable of operating in extreme conditions, supporting both operational efficiency and resource optimization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Offshore Drilling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Offshore Drilling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Offshore Drilling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.