Global Offshore Lubricants Market

Market Size in USD Million

CAGR :

%

USD

180.27 Million

USD

237.38 Million

2024

203

USD

180.27 Million

USD

237.38 Million

2024

203

| 2025 –203 | |

| USD 180.27 Million | |

| USD 237.38 Million | |

|

|

|

|

Offshore Lubricants Market Size

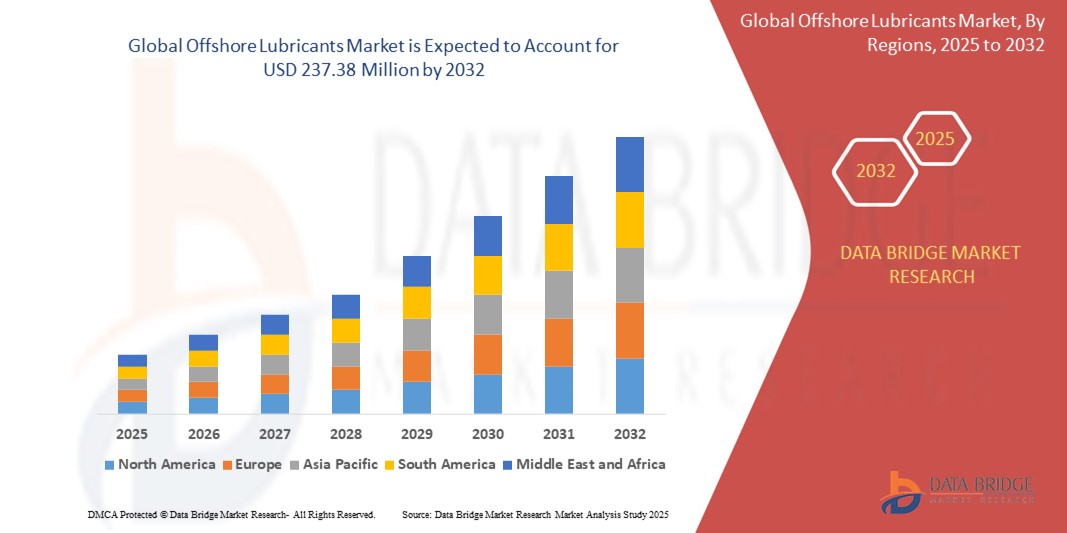

- The global offshore lubricants market size was valued at USD 180.27 million in 2024 and is expected to reach USD 237.38 million by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing offshore oil and gas exploration activities, rising demand for high-performance lubricants, and stringent environmental regulations promoting the use of biodegradable lubricants

- The expansion of offshore wind energy projects and marine infrastructure development is also contributing to the rising consumption of offshore lubricants

Offshore Lubricants Market Analysis

- The offshore lubricants market is primarily driven by the rising global energy demand, which has led to an upsurge in offshore drilling operations in regions such as the North Sea, Gulf of Mexico, and Asia-Pacific

- Technological advancements in drilling equipment and machinery have increased the need for specialized lubricants that offer superior protection and performance under high pressure and extreme conditions

- North America dominated the offshore lubricants market with the largest revenue share of 37.9% in 2024, driven by the well-established offshore oil and gas industry, particularly in the Gulf of Mexico. The region's mature exploration infrastructure and consistent investment in offshore production support stable lubricant consumption

- Asia-Pacific region is expected to witness the highest growth rate in the global offshore lubricants market, driven by expanding offshore exploration projects, rising energy demand, and increasing investment in deep-water and ultra-deep-water drilling across countries such as China, India, and Southeast Asia

- The engine oil segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its essential role in reducing friction, cooling engine components, and extending the service life of offshore equipment. Engine oils are widely used across offshore vessels and drilling rigs to ensure optimal performance under high-load and high-temperature conditions. Their proven effectiveness in maintaining reliability in harsh marine environments continues to support demand in this segment

Report Scope and Offshore Lubricants Market Segmentation

|

Attributes |

Offshore Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• BP Plc (U.K.)

|

|

Market Opportunities |

• Growth in Offshore Wind Energy Projects • Rising Demand for High-Performance Synthetic Lubricants |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Offshore Lubricants Market Trends

“Rising Adoption of Bio-Based and Environmentally Acceptable Lubricants (EALs)”

- Growing environmental regulations, such as the U.S. EPA’s Vessel General Permit (VGP), are encouraging the use of Environmentally Acceptable Lubricants (EALs) in offshore operations

- EALs offer high biodegradability, low toxicity, and reduced bioaccumulation, making them suitable for sensitive marine ecosystems

- Oil and gas companies are incorporating EALs to meet sustainability goals and improve compliance with international marine safety and environmental standards

- Technological advancements in bio-based formulations have enhanced the performance of EALs, making them comparable to traditional mineral-based lubricants

- For instance, ExxonMobil introduced the Mobil SHC Aware series, a line of high-performance EALs tailored for marine and offshore applications, to meet rising demand for eco-friendly solutions

Offshore Lubricants Market Dynamics

Driver

“Expansion of Deep-Water and Ultra-Deep-Water Oil Exploration”

- Declining onshore reserves and rising global energy demand are accelerating investments in offshore exploration, especially in deep-water and ultra-deep-water fields

- Offshore operations in regions such as the Gulf of Mexico, Brazil, and the North Sea are increasingly deploying advanced machinery that requires high-performance lubricants

- These lubricants must withstand extreme pressure, high salinity, and wide temperature variations, ensuring protection and reliability for critical offshore equipment

- The use of synthetic and long-lasting lubricants helps reduce maintenance frequency and downtime, contributing to cost efficiency in offshore operations

- For instance, BP’s Mad Dog Phase 2 deep-water project in the Gulf of Mexico extensively utilizes premium synthetic lubricants to enhance operational performance and equipment life

Restraint/Challenge

“Crude Oil Price Volatility and High Operational Costs”

- The offshore lubricants market is highly sensitive to fluctuations in global crude oil prices, which directly impact exploration budgets and project feasibility

- Falling oil prices often lead to delays, suspension, or cancellation of offshore projects, significantly reducing lubricant demand

- Offshore operations involve high capital and operational expenditures due to complex logistics, strict safety norms, and advanced technology requirements

- In low-price environments, companies often shift to cost-cutting strategies, including reduced lubricant usage or opting for lower-cost alternatives

- For instance, during the 2020 COVID-19 pandemic oil price collapse, multiple offshore drilling projects were postponed globally, leading to a notable decline in offshore lubricant consumption

Offshore Lubricants Market Scope

The offshore lubricants market is segmented on the basis of application and end-use.

• By Application

On the basis of application, the offshore lubricants market is segmented into engine oil, hydraulic oil, gear oil, and grease. The engine oil segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its essential role in reducing friction, cooling engine components, and extending the service life of offshore equipment. Engine oils are widely used across offshore vessels and drilling rigs to ensure optimal performance under high-load and high-temperature conditions. Their proven effectiveness in maintaining reliability in harsh marine environments continues to support demand in this segment.

The hydraulic oil segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing deployment of hydraulic systems in offshore rigs and vessels for operations such as lifting, positioning, and control. The growing preference for high-performance, anti-wear hydraulic oils that offer stability under extreme pressure and temperature is fueling segment growth. These oils are vital for ensuring smooth functioning of offshore mechanical systems and preventing unplanned equipment downtime.

• By End-Use

On the basis of end-use, the offshore lubricants market is segmented into offshore rigs, FPSOs (Floating, Production, Storage & Offloading Vessels), and OSVs (Offshore Support Vessels). The offshore rigs segment held the largest revenue share in 2024 due to the high volume of lubricant consumption across drilling equipment, engines, and hydraulic systems. These rigs operate under intense mechanical stress and require consistent lubrication to maintain efficiency and reduce equipment wear, driving substantial lubricant demand.

The FPSOs segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing number of offshore oil production projects utilizing FPSOs for their operational flexibility and cost-efficiency. As FPSOs handle production, processing, and storage of oil on a single vessel, they require a wide range of lubricants to support multiple critical systems. The rising adoption of FPSOs in deep-water fields across Latin America, West Africa, and Southeast Asia further boosts demand in this segment.

Offshore Lubricants Market Regional Analysis

- North America dominated the offshore lubricants market with the largest revenue share of 37.9% in 2024, driven by the well-established offshore oil and gas industry, particularly in the Gulf of Mexico. The region's mature exploration infrastructure and consistent investment in offshore production support stable lubricant consumption.

- The demand is further bolstered by stringent operational safety standards and the widespread use of high-performance synthetic and biodegradable lubricants to comply with environmental regulations.

- Technological advancements in drilling equipment and growing interest in extending equipment life cycles through predictive maintenance are also contributing to sustained lubricant demand in North America.

U.S. Offshore Lubricants Market Insight

The U.S. offshore lubricants market captured the largest revenue share of 84.7% in 2024 within North America, propelled by the country’s leadership in deep-water drilling and substantial offshore production capacity. Offshore operations in the Gulf of Mexico continue to require extensive use of engine oils, hydraulic fluids, and gear lubricants to ensure reliability and efficiency. In addition, growing exploration activities in newly leased offshore blocks and efforts to reduce unplanned downtime further amplify lubricant demand. Increasing adoption of EALs (Environmentally Acceptable Lubricants) in compliance with EPA regulations also plays a pivotal role in shaping market dynamics.

Europe Offshore Lubricants Market Insight

The Europe offshore lubricants market is expected to witness the fastest growth rate from 2025 to 2032, driven by the resurgence of offshore projects in the North Sea and continued investment in sustainable energy and oil extraction technologies. As regional governments emphasize carbon footprint reduction, the use of high-performance, environmentally friendly lubricants is gaining momentum. The region also benefits from a strong presence of major lubricant manufacturers and robust R&D support, enabling advancements in formulations tailored for offshore conditions. Europe’s focus on enhancing equipment life and minimizing maintenance costs under harsh marine environments supports growing lubricant consumption.

U.K. Offshore Lubricants Market Insight

The U.K. offshore lubricants market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing redevelopment of mature North Sea fields and extended use of existing offshore rigs. The country’s drive to balance energy security with environmental responsibility is leading to broader adoption of synthetic and biodegradable lubricants. Government incentives aimed at reviving production from aging infrastructure and improving the sustainability of offshore operations are key contributors to lubricant demand. In addition, the U.K.'s active offshore service and maintenance sector plays a crucial role in maintaining consistent lubricant usage.

Germany Offshore Lubricants Market Insight

The Germany offshore lubricants market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on innovation and sustainable practices. Though Germany has limited offshore oil production, it is a significant consumer and exporter of high-performance marine lubricants used across Europe. German manufacturers are at the forefront of developing environmentally compliant lubricant technologies that meet EU standards, making the country a critical hub for offshore lubricant R&D and supply. The country’s emphasis on green technology integration in marine and energy sectors enhances the long-term outlook.

Asia-Pacific Offshore Lubricants Market Insight

The Asia-Pacific offshore lubricants market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing offshore exploration and production in emerging economies such as China, India, and Southeast Asia. Growing investments in deep-water drilling, along with rising energy demand, are supporting expansion across the region. Government support for offshore infrastructure development and strategic exploration initiatives are fueling lubricant requirements. In addition, APAC’s role as a manufacturing base for cost-effective offshore equipment components ensures accessibility and affordability of lubricants across key end-use sectors.

Japan Offshore Lubricants Market Insight

The Japan offshore lubricants market is expected to witness the fastest growth rate from 2025 to 2032, due to increasing focus on maritime sustainability and advanced offshore technologies. Although Japan has a limited number of oil fields, it remains a critical importer and user of marine lubricants across offshore support vessels (OSVs) and FPSOs. The country’s maritime sector emphasizes operational reliability, and the adoption of high-grade lubricants that align with environmental norms is accelerating. Japan’s technological expertise and commitment to energy efficiency continue to drive lubricant consumption in offshore and marine segments.

China Offshore Lubricants Market Insight

The China offshore lubricants market held the largest revenue share in Asia-Pacific in 2024, fueled by rapid expansion of offshore oil and gas activities in the Bohai Bay, South China Sea, and East China Sea. The country is heavily investing in offshore field development and drilling infrastructure, which significantly increases the demand for engine, hydraulic, and gear oils. In addition, China’s domestic production of lubricant base oils and strong presence of local manufacturers enable cost-efficient and large-scale supply. Supportive government policies and rising adoption of digitalized offshore platforms are further accelerating lubricant usage.

Offshore Lubricants Market Share

The Offshore Lubricants industry is primarily led by well-established companies, including:

- BP Plc. (U.K.)

- Chevron Corporation (U.S.)

- ExxonMobil Corporation (U.S.)

- Shell Plc (Netherlands)

- TotalEnergies (France)

- Valvoline (U.S.)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Lukoil (Russia)

- Idemitsu Kosan Co. Ltd (Japan)

- China Petrochemical Corporation (China)

- JX Nippon Oil & Energy Corporation (Japan)

- Gulf Oil Corporation Ltd. (U.S.)

- ENOC Company (UAE)

- Indian Oil Corporation Ltd (India)

- PetroChina Company Limited (China)

Latest Developments in Global Offshore Lubricants Market

- In April 2024, Castrol, a leading global lubricant brand, introduced its updated Castrol TLX product range, specifically tailored for medium-speed four-stroke engines. This newly reformulated range is set to replace the existing Castrol TLX Xtra and TLX Plus fluids. The refreshed product line aims to accommodate a wider variety of engine types and applications, while maintaining superior engine protection, reliability, and performance

- In July 2022, Chevron Marine Lubricants proudly announced the release of its Clarity Synthetic EA Grease 0. This new product is an anhydrous calcium thickened lubricating grease formulated with biodegradable synthetic esters. It complies with the parameters outlined in the 2013 Vessel General Permit (VGP) regulations for environmentally acceptable lubricants set forth by the U.S. Environmental Protection Agency (EPA)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OFFSHORE LUBRICANTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OFFSHORE LUBRICANTS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL OFFSHORE LUBRICANTS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL OFFSHORE LUBRICANTS MARKET, BY TYPE, 2022-2031, USD MILLION

10.1 OVERVIEW

10.2 GREASES

10.3 OFFSHORE DIESEL ENGINES

10.4 CYLINDER OILS

10.5 SYSTEM OILS

10.6 HYDRAULIC OILS

10.7 GEAR OILS

10.8 BEARING AND CIRCULATING OILS

10.9 TURBINE OILS

10.1 TRANSMISSION OILS

10.11 HEAT TRANSFER FLUIDS

10.12 SYSTEM OIL

10.13 ENGINE OILS

10.13.1 SLOW-SPEED ENGINE OILS

10.13.2 MEDIUM-SPEED ENGINE OILS

10.13.3 HIGH-SPEED ENGINE OILS

10.13.4 DIESEL ENGINE OILS

10.13.5 OTHERS

10.14 OTHERS

11 GLOBAL OFFSHORE LUBRICANT MARKET, BY RAW MATERIAL , 2022-2031, USD MILLION

11.1 OVERVIEW

11.2 BASE OIL

11.2.1 MINERAL OIL

11.2.1.1. SILICON OIL

11.2.1.2. NAPHTHANIC OIL

11.2.1.3. PARRAFINIC OIL

11.2.2 SYNTHETIC OIL

11.3 BIO-BASED OILS

11.3.1 PLANT OIL

11.3.1.1. VEGETABLE OIL

11.3.1.2. SOYBEAN OIL

11.3.1.3. OTHERS

11.3.2 ANIMAL OIL

12 GLOBAL OFFSHORE LUBRICANTS MARKET, BY END-USER, 2022-2031, USD MILLION

12.1 OVERVIEW

12.2 OFFSHORE RIGS

12.2.1 OFFSHORE RIGS, BY TYPE

12.2.1.1. GREASES

12.2.1.2. OFFSHORE DIESEL ENGINES

12.2.1.3. CYLINDER OILS

12.2.1.4. SYSTEM OILS

12.2.1.5. HYDRAULIC OILS

12.2.1.6. GEAR OILS

12.2.1.7. BEARING AND CIRCULATING OILS

12.2.1.8. TURBINE OILS

12.2.1.9. TRANSMISSION OILS

12.2.1.10. HEAT TRANSFER FLUIDS

12.2.1.11. SYSTEM OIL

12.2.1.12. ENGINE OILS

12.2.1.13. OTHERS

12.3 FPSO (FLOATING, PRODUCTION, STORAGE AND OFFLOADING VESSELS)

12.3.1 FPSO (FLOATING, PRODUCTION, STORAGE AND OFFLOADING VESSELS), BY TYPE

12.3.1.1. GREASES

12.3.1.2. OFFSHORE DIESEL ENGINES

12.3.1.3. CYLINDER OILS

12.3.1.4. SYSTEM OILS

12.3.1.5. HYDRAULIC OILS

12.3.1.6. GEAR OILS

12.3.1.7. BEARING AND CIRCULATING OILS

12.3.1.8. TURBINE OILS

12.3.1.9. TRANSMISSION OILS

12.3.1.10. HEAT TRANSFER FLUIDS

12.3.1.11. SYSTEM OIL

12.3.1.12. ENGINE OILS

12.3.1.13. OTHERS

12.4 OFFSHORE CIVIL STRUCTURES

12.4.1 OFFSHORE CIVIL STRUCTURES, BY TYPE

12.4.1.1. GREASES

12.4.1.2. OFFSHORE DIESEL ENGINES

12.4.1.3. CYLINDER OILS

12.4.1.4. SYSTEM OILS

12.4.1.5. HYDRAULIC OILS

12.4.1.6. GEAR OILS

12.4.1.7. BEARING AND CIRCULATING OILS

12.4.1.8. TURBINE OILS

12.4.1.9. TRANSMISSION OILS

12.4.1.10. HEAT TRANSFER FLUIDS

12.4.1.11. SYSTEM OIL

12.4.1.12. ENGINE OILS

12.4.1.13. OTHERS

12.5 OSVS (OFFSHORE SUPPORT VEHICLES)

12.5.1 OSVS (OFFSHORE SUPPORT VEHICLES), BY TYPE

12.5.1.1. GREASES

12.5.1.2. OFFSHORE DIESEL ENGINES

12.5.1.3. CYLINDER OILS

12.5.1.4. SYSTEM OILS

12.5.1.5. HYDRAULIC OILS

12.5.1.6. GEAR OILS

12.5.1.7. BEARING AND CIRCULATING OILS

12.5.1.8. TURBINE OILS

12.5.1.9. TRANSMISSION OILS

12.5.1.10. HEAT TRANSFER FLUIDS

12.5.1.11. SYSTEM OIL

12.5.1.12. ENGINE OILS

12.5.1.13. OTHERS

12.6 OTHERS

12.6.1 OTHERS, BY TYPE

12.6.1.1. GREASES

12.6.1.2. OFFSHORE DIESEL ENGINES

12.6.1.3. CYLINDER OILS

12.6.1.4. SYSTEM OILS

12.6.1.5. HYDRAULIC OILS

12.6.1.6. GEAR OILS

12.6.1.7. BEARING AND CIRCULATING OILS

12.6.1.8. TURBINE OILS

12.6.1.9. TRANSMISSION OILS

12.6.1.10. HEAT TRANSFER FLUIDS

12.6.1.11. SYSTEM OIL

12.6.1.12. ENGINE OILS

12.6.1.13. OTHERS

13 GLOBAL OFFSHORE LUBRICANTS MARKET, BY GEOGRAPHY, 2022-2031, USD MILLION

GLOBAL OFFSHORE LUBRICANTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 SWITZERLAND

13.2.7 RUSSIA

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA AND NEW ZEALAND

13.3.6 SINGAPORE

13.3.7 HONG KONG

13.3.8 TAIWAN

13.3.9 THAILAND

13.3.10 INDONESIA

13.3.11 MALAYSIA

13.3.12 PHILIPPINES

13.3.13 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AMERICA

14 GLOBAL OFFSHORE LUBRICANTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT ANALYSIS

16 GLOBAL OFFSHORE LUBRICANTS MARKET- COMPANY PROFILES

16.1 BP INTERNATIONAL LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CHEVRON CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 EXXON MOBIL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 ROYAL DUTCH SHELL PLC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TOTAL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 LUKOIL

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 AEGEAN OFFSHORE PETROLEUM NETWORK INC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 IDEMITSU KOSAN CO., LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 INDIAN OIL CORPORATION LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 CHINA PETROLEUM & CHEMICAL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 H&R GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 STANLEY BLACK & DECKER, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 AVINOIL S.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 FUCHS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 HINDUJA GROUP LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 JXTG NIPPON OIL & ENERGY CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 PETRONAS LUBRICANTS INTERNATIONAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 VICKERS & SONS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 WORLD FUEL SERVICES CORPORATION.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 GAZPROMNEFT - LUBRICANTS, LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 KIMBRO OIL COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TOTAL LUBOFFSHORE

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 COCKETT OFFSHORE OIL

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 NAUTA ALBA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 NORTH SEA LUBRICANTS B.V.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Offshore Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Offshore Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Offshore Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.