Global Offshore Wind Market

Market Size in USD Billion

CAGR :

%

USD

48.50 Billion

USD

142.29 Billion

2024

2032

USD

48.50 Billion

USD

142.29 Billion

2024

2032

| 2025 –2032 | |

| USD 48.50 Billion | |

| USD 142.29 Billion | |

|

|

|

|

Offshore Wind Market Size

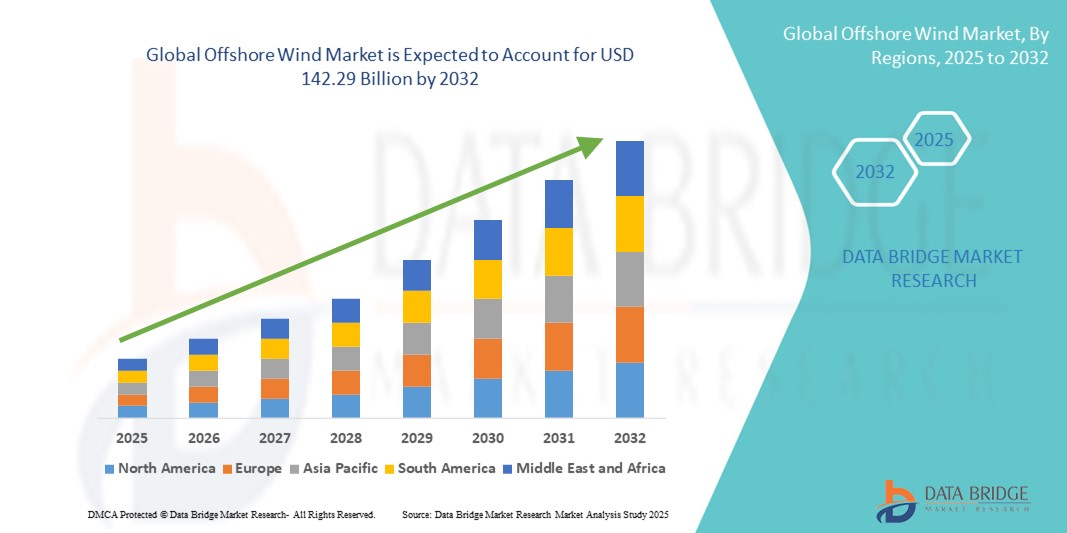

- The global offshore wind market size was valued at USD 48.50 billion in 2024 and is expected to reach USD 142.29 billion by 2032, at a CAGR of 14.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of renewable energy and continuous technological advancements in wind turbine design, grid integration, and floating offshore platforms, which are driving large-scale deployment of offshore wind projects across coastal regions

- Furthermore, rising demand for sustainable and low-carbon energy sources from both governments and private sectors is establishing offshore wind as a key component of the global clean energy transition. These converging factors are accelerating the uptake of offshore wind solutions, thereby significantly boosting the industry's growth across utility-scale energy production and grid decarbonization efforts

Offshore Wind Market Analysis

- Offshore wind energy, involving the generation of electricity from wind turbines located in ocean or sea waters, is rapidly gaining momentum due to its vast energy potential, reduced land use, and increasing investments in clean and renewable energy sources by governments and private entities across the globe

- The growing demand for offshore wind is primarily fueled by rising energy needs, stringent carbon reduction targets, and technological advancements in turbine design, floating platforms, and subsea cabling

- Europe dominated the offshore wind market with the largest revenue share of 38.5% in 2024, driven by mature infrastructure, favorable regulatory frameworks, and substantial investments in offshore wind farms across the U.K., Germany, the Netherlands, and Denmark. The region leads in both installed capacity and technological innovation, supported by ambitious EU targets aiming for climate neutrality by 2050 and scaling offshore wind to at least 111 GW by 2030

- Asia-Pacific is expected to be the fastest-growing region in the offshore wind market during the forecast period, driven by accelerated coastal development in China, Japan, South Korea, and emerging projects in India and Southeast Asia. This growth is propelled by strong government support, favorable wind conditions, and significant investment in floating offshore wind technology

- The commercial segment dominated the offshore wind market with a share of 91.3% in 2024, driven by large-scale projects tied to national clean energy targets

Report Scope and Offshore Wind Market Segmentation

|

Attributes |

Offshore Wind Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Offshore Wind Market Trends

Technological Advancements and Grid Integration Driving Offshore Wind Expansion

- A significant and accelerating trend in the global offshore wind market is the increasing investment in next-generation turbine technologies, floating foundations, and enhanced grid interconnection infrastructure, enabling deployment in deeper waters and more remote coastal regions

- For instance, the deployment of 15+ MW turbines by leading manufacturers such as Siemens Gamesa and GE Vernova is transforming offshore wind project economics by delivering higher capacity factors and reducing the levelized cost of energy (LCOE)

- Innovations in offshore substation design and high-voltage direct current (HVDC) transmission systems are allowing offshore wind farms to connect more efficiently to onshore grids, improving power reliability and enabling long-distance electricity delivery

- The seamless integration of offshore wind with broader renewable energy systems—including solar and energy storage—is becoming increasingly feasible, supporting grid balancing and enabling more stable, continuous power supply

- This trend toward larger-scale, more intelligent, and interconnected offshore wind infrastructure is fundamentally reshaping the global energy transition, especially in markets such as the U.S., U.K., and Asia-Pacific. Leading developers such as Ørsted, BP, and Equinor are accelerating investments in digital asset monitoring, predictive maintenance, and hybrid renewable configurations

- The demand for offshore wind solutions is growing rapidly across both developed and emerging economies as governments prioritize energy security, decarbonization, and long-term sustainability goals

Offshore Wind Market Dynamics

Driver

Growing Demand Due to Energy Security and Renewable Transition Commitments

- The increasing urgency to reduce carbon emissions, ensure long-term energy security, and transition to clean energy sources is a significant driver for the rising demand for offshore wind energy

- For instance, in April 2024, the U.S. Department of Energy (DOE) announced new funding of USD 48 million for offshore wind research and development, focusing on floating wind turbine technologies and grid integration. Such initiatives are expected to significantly drive the offshore wind industry growth during the forecast period

- As nations and energy providers shift away from fossil fuels, offshore wind offers a reliable and scalable renewable alternative, with advanced turbines delivering high-capacity output and stable performance compared to onshore alternatives

- Furthermore, the growing popularity of green hydrogen production and the push for electrification in industrial sectors are making offshore wind a critical component of broader energy strategies, enabling integration with green ammonia, battery storage, and hydrogen fuel supply chains

- The ability of offshore wind farms to support massive energy demands through utility-scale projects, along with expanding investment from both governments and private energy firms, is accelerating adoption globally. The trend toward floating offshore platforms and deeper water installations is further broadening the scope of project development in regions with less favorable seabed conditions

Restraint/Challenge

High Initial Capital Investment and Regulatory Complexities

- High capital expenditure remains one of the primary challenges limiting offshore wind deployment, especially in developing economies. Offshore wind farms involve significant costs for turbine installation, subsea cabling, floating foundations, and grid interconnection

- For instance, large-scale offshore projects in the U.S. such as Vineyard Wind 1 and Empire Wind require multibillion-dollar investments, which can be a barrier for smaller energy developers or regions with limited infrastructure funding

- Regulatory hurdles—including lengthy permitting timelines, environmental impact assessments, and local opposition—also pose significant obstacles. Complex jurisdictional overlaps between federal and state authorities in regions such as the U.S. coastal waters can delay or limit project approvals

- Moreover, concerns about marine ecosystem disruption, fishing industry conflicts, and coastal aesthetics add layers of complexity to the project planning and stakeholder negotiation process

- While advancements in turbine design and government incentives are gradually improving the economic feasibility of offshore wind, overcoming these regulatory and cost-related challenges will be essential for achieving global deployment targets

Offshore Wind Market Scope

The market is segmented on the basis of component, depth, installation, location, and application.

- By Component

On the basis of component, the offshore wind market is segmented into turbines, substructure, and electrical infrastructure. The turbines segment held the largest market share of 52.4% in 2024, driven by continued advancements in turbine capacity and blade design.

The electrical infrastructure segment is projected to grow at the highest CAGR of 17.6% from 2025 to 2032, due to rising investments in offshore substations, cables, and grid integration systems.

- By Depth

On the basis of depth, the offshore wind market is segmented into > 0 ≤ 30 m, > 30 ≤ 50 m, and > 50 m. The > 0 ≤ 30 m segment dominated the market with a 44.1% share in 2024, as these locations support cost-effective fixed-bottom turbine installations.

The > 50 m segment is expected to expand at the fastest CAGR of 19.2% during 2025–2032, driven by growing adoption of floating wind platforms in deeper waters.

- By Installation

On the basis of installation, the offshore wind market is segmented into fixed structure and floating structure. The fixed structure segment accounted for the largest share of 70.6% in 2024, benefiting from technological maturity and well-established infrastructure.

The floating structure segment is anticipated to grow at a CAGR of 20.4% from 2025 to 2032, enabled by advances in floating foundations and favorable policies in countries with deeper coastlines.

- By Location

On the basis of location, the offshore wind market is segmented into shallow water, transitional water, and deepwater. The shallow water segment led with a 46.8% market share in 2024, due to favorable construction conditions and accessibility.

The deepwater segment is projected to witness the fastest growth with a CAGR of 18.7% through 2032, supported by floating wind innovation and deeper site exploration.

- By Application

On the basis of application, the offshore wind market is segmented into commercial and demonstration. The commercial segment held the largest share of 91.3% in 2024, driven by large-scale projects tied to national clean energy targets.

The demonstration segment is forecast to grow at a CAGR of 11.8% from 2025 to 2032, particularly in emerging offshore wind markets conducting pilot deployments.

Offshore Wind Market Regional Analysis

- Europe dominated the market with 38.5% of the global offshore wind market revenue in 2024, cementing its leadership in the global clean energy transition

- This dominance is attributed to mature policy frameworks, advanced grid infrastructure, and long-standing investments across countries such as the U.K., Germany, the Netherlands, and Denmark

- The region is spearheading innovation in both fixed-bottom and floating offshore wind technologies, with strong public-private collaboration driving deployment, cost reductions, and supply chain localization

U.K. Offshore Wind Market Insight

The U.K. global offshore wind market dominated the Europe offshore wind market with a 52% revenue share in 2024, fueled by large-scale project deployments, robust policy support, and consistent investment in offshore wind infrastructure. Key developments include Dogger Bank Wind Farm (3.6 GW), Hornsea Two (1.3 GW), and the recently operational Seagreen project (1.1 GW), reinforcing the U.K.’s position as the leading offshore wind market in Europe. With over 13.6 GW of installed capacity in 2024, the U.K. leads in both grid-connected and floating wind projects. Growth is supported by government policies such as the Renewable Energy CfD scheme, new seabed leasing rounds by The Crown Estate, and increasing investments in floating wind platforms in Scotland and Wales. The U.K. is also integrating offshore wind into its hydrogen economy and advanced energy storage systems to ensure long-term reliability and grid balancing.

Germany Offshore Wind Market Insight

The Germany offshore wind market is growing at a steady CAGR, underpinned by its strong commitment to energy transition through the Energiewende framework. With ambitious goals of achieving 30 GW by 2030 and 70 GW by 2045, the country is scaling offshore wind farms in the North Sea and Baltic Sea regions. Germany's well-established port infrastructure, cross-border transmission projects, and advanced research in hydrogen-based energy islands make it a regional leader in offshore wind innovation. Collaborations with the Netherlands and Denmark on shared offshore hubs, as well as integration with industrial decarbonization plans, are further accelerating market development.

Asia-Pacific Offshore Wind Market Insight

The Asia-Pacific offshore wind market is expected to register the fastest from 2025 to 2032, driven by rapid coastal development, rising energy consumption, and supportive regulatory frameworks in countries such as China, Japan, South Korea, Taiwan, and India. Governments in the region are investing heavily in floating wind technologies to unlock deepwater potential and overcome geographical constraints. Policies supporting domestic manufacturing, green energy financing, and transmission upgrades are accelerating project execution. The region is also emerging as a key exporter of offshore wind components and turbines, with China and South Korea playing dominant roles in the global supply chain.

Japan Offshore Wind Market Insight

The Japan offshore wind market is gaining significant traction, driven by its strategic focus on energy security, post-nuclear energy transition, and climate change mitigation. The government aims to install 10 GW of offshore wind capacity by 2030 and 30-45 GW by 2040, with several floating wind demonstration projects already underway. Japan’s unique coastal geography makes floating offshore wind particularly relevant. The integration of offshore wind with smart grid infrastructure and hydrogen production is also advancing, supported by local innovation and public-private partnerships.

China Offshore Wind Market Insight

The China global offshore wind market accounted for the largest offshore wind capacity addition globally in 2023, contributing nearly 50% of global offshore wind installations with over 39.1 GW connected as of 2024. The country’s market growth is supported by robust government targets, industrial-scale manufacturing capabilities, and large-scale deployment along the eastern coastline. China is expanding its floating offshore wind footprint and aims to surpass 60 GW of total capacity by 2030, leveraging economies of scale, state-owned enterprise involvement, and integrated port infrastructure.

Offshore Wind Market Share

The offshore wind industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Vestas (Denmark)

- Siemens (Germany)

- Goldwind (China)

- Shanghai Electric (China)

- ABB (Switzerland)

- Doosan Corporation (South Korea)

- Hitachi Energy Ltd. (Japan)

- Nordex SE (Germany)

- EEW Holding GmbH & Co (Germany)

- Nexans (France)

- DEME (Belgium)

- Envision Group (China)

- Rockwell Automation Inc. (U.S.)

- Hyundai Motor Company (South Korea)

- Schneider Electric (France)

- Zhejiang Windey Co., Ltd. (China)

- Taiyuan Heavy Industry Co. (China)

- Sinovel Wind Group Co., Ltd. (China)

Latest Developments in Global Offshore Wind Market

- In July 2025, the UK’s Crown Estate announced an investment of GBP 400 million to upgrade port infrastructure to support the expansion of offshore wind power, including floating wind developments. This initiative aims to unlock 20–30 GW of new offshore wind capacity by 2030, supporting faster deployment of turbines and greater energy security

- In July 2025, the U.S. Department of the Interior rescinded over 3.5 million acres of designated wind energy areas, effectively halting new offshore wind leasing in federal waters. This decision marks a significant policy reversal and may delay several planned offshore wind projects

- In July 2025, Japan's Ministry of Economy, Trade and Industry (METI) designated two new offshore wind zones—Matsumae and Hiyama in Hokkaido—as part of its strategy to reach 45 GW of offshore wind capacity by 2040. The move is expected to accelerate project development in Japan’s nascent offshore sector

- In April 2024, the Green Volt floating offshore wind project off the coast of Scotland received final planning consent. The 560 MW project will consist of 35 floating turbines and is expected to be operational by 2029, becoming one of the largest floating wind farms in Europe

- In November 2022, Equinor’s Hywind Tampen, the world’s largest floating offshore wind farm, became fully operational off the coast of Norway. The 88 MW project supplies renewable power to offshore oil and gas platforms, marking a major milestone for hybrid offshore energy systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.