Global Oil Absorbent Pads Market

Market Size in USD Billion

CAGR :

%

USD

2.55 Billion

USD

3.76 Billion

2024

2032

USD

2.55 Billion

USD

3.76 Billion

2024

2032

| 2025 –2032 | |

| USD 2.55 Billion | |

| USD 3.76 Billion | |

|

|

|

|

Oil Absorbent Pads Market Size

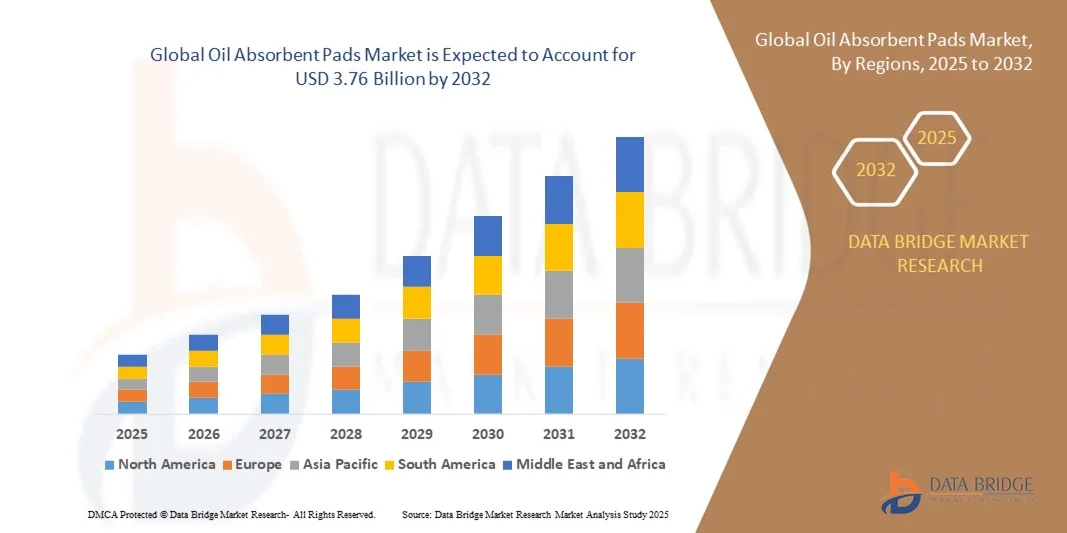

- The global oil absorbent pads market size was valued at USD 2.55 billion in 2024 and is expected to reach USD 3.76 billion by 2032, at a CAGR of 5% during the forecast period

- The market growth of oil absorbent pads is largely driven by increasing industrialization and stringent environmental and workplace safety regulations, which are compelling industries such as oil and gas, chemical, automotive, and manufacturing to adopt effective spill management solutions

- Furthermore, rising awareness of environmental sustainability and the growing need to minimize hazardous waste are encouraging the use of high-performance and reusable absorbent pads. These converging factors are accelerating the adoption of oil absorbent solutions, thereby significantly boosting the market’s expansion

Oil Absorbent Pads Market Analysis

- Oil absorbent pads, used for managing oil spills and chemical leaks, are becoming essential in industrial, commercial, and environmental applications due to their high absorbency, chemical resistance, and ease of use

- The increasing demand is primarily fueled by stringent regulatory frameworks, growing industrial activities, frequent oil spill incidents, and the need for eco-friendly, cost-effective, and reliable spill containment solutions across various end-user sectors

- North America dominated the oil absorbent pads market in 2024, due to stringent environmental regulations, industrial safety standards, and the need for effective spill management solutions

- Asia-Pacific is expected to be the fastest growing region in the oil absorbent pads market during the forecast period due to rapid industrialization, urbanization, and growing oil and gas, automotive, and manufacturing sectors in countries such as China, India, and Japan

- Polypropylene (PP) segment dominated the market with a market share of 46.8% in 2024, due to its superior oil absorption capacity, chemical resistance, and cost-effectiveness. PP pads are widely used across industrial and marine spill cleanup operations due to their hydrophobic nature, allowing them to absorb oil selectively while repelling water. Their durability and reusability make them a preferred choice for large-scale oil containment applications. In addition, the ease of manufacturing PP pads in various thicknesses and forms supports their extensive adoption across diverse end-use industries

Report Scope and Oil Absorbent Pads Market Segmentation

|

Attributes |

Oil Absorbent Pads Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oil Absorbent Pads Market Trends

Growth of Eco-Friendly and Reusable Absorbent Pads

- The oil absorbent pads market is increasingly driven by the surge in demand for sustainable and environmentally friendly spill management solutions. Companies are shifting toward biodegradable and reusable absorbents to reduce waste generation and environmental impact associated with traditional synthetic options

- For instance, 3M Company and Brady Corporation have introduced eco-friendly absorbent pads made from recycled fibers and natural plant-based materials. These products are designed to maintain high oil absorbency levels while minimizing the carbon footprint of oil spill control operations across industrial and marine environments

- The preference for reusable absorbent technologies is expanding across sectors such as oil and gas, shipping, and manufacturing. These pads can withstand multiple cleaning cycles without significant performance degradation, reducing long-term costs and waste disposal requirements for large-scale users

- In addition, the introduction of biodegradable absorbent materials such as cellulose, cotton, and coir fibers is contributing to cleaner spill containment operations. These natural materials offer efficient oil adsorption paired with rapid degradation after use, aligning with global sustainability initiatives and compliance standards

- Industry players are also developing advanced hybrid absorbents that combine natural fibers with polymer layers for improved strength, flexibility, and durability. This ensures effective oil retention in heavy-duty applications such as offshore platforms and fuel storage facilities

- Overall, the growth of eco-friendly and reusable oil absorbent pads marks a significant evolution toward cleaner, cost-efficient, and regulatory-compliant spill management. This trend aligns with the broader transition toward circular economy practices and green manufacturing across industrial supply chains

Oil Absorbent Pads Market Dynamics

Driver

Rising Industrialization and Strict Spill Regulations

- The growing pace of industrialization worldwide has significantly increased the occurrence of oil spills across manufacturing, marine, and energy sectors, thereby driving demand for advanced absorbent solutions. Governments and environmental agencies are strengthening compliance frameworks to ensure safe and effective spill containment practices

- For instance, New Pig Corporation partnered with energy producers in the United States and Canada to supply high-absorption pads meeting stringent EPA spill containment requirements. These pads are used extensively in power plants, refineries, and maintenance workshops to facilitate quick oil recovery and leakage prevention

- Rapid expansion in transportation, construction, and offshore drilling has intensified the need for reliable containment materials capable of handling large-scale oil and chemical spills. Oil absorbent pads offer operators an immediate and efficient solution by preventing spills from contaminating soil and water resources

- In addition, industries are adopting absorbent management programs as part of corporate sustainability strategies. The use of standardized, efficient absorbent systems supports compliance with environmental protection laws while improving workplace safety and incident response efficiency

- The combination of ongoing industrial growth and strict spill control regulations ensures continued market demand. The emphasis on sustainable waste management and pollution control will further boost the adoption of high-performance absorbent pads worldwide

Restraint/Challenge

High Cost of Advanced Absorbents

- The high cost of advanced oil absorbent pads remains a major restraint for many industrial users, especially small and medium-sized enterprises. The increased use of bio-based polymers, recycled fibers, and enhanced absorption technologies drives up production and procurement costs

- For instance, companies such as 3M and ESP US EPA Certified Products face higher manufacturing costs due to the inclusion of premium raw materials and multi-layer fabrication. These expenses make eco-friendly pads more expensive than conventional polypropylene-based alternatives, limiting adoption among price-sensitive customers

- Complex manufacturing processes involving thermal bonding and advanced filtration layering contribute to additional energy consumption and labor costs. These factors make large-scale production challenging, particularly for emerging market producers

- In addition, frequent replacement cycles and costs associated with cleaning or regenerating reusable pads can add to overall operational expenditure. End users in high-spill environments may find it difficult to maintain a balance between performance benefits and lifecycle costs

- Ultimately, addressing cost challenges through material innovation, modular design, and mass production efficiencies will be essential. As manufacturers scale up production and invest in affordable green materials, the market is expected to move toward wider accessibility of advanced oil absorbent solutions across industries

Oil Absorbent Pads Market Scope

The market is segmented on the basis of material type and end-user.

- By Material Type

On the basis of material type, the oil absorbent pads market is segmented into polypropylene (PP), polyethylene (PE), paper, fiber, and others. The polypropylene (PP) segment dominated the market with the largest revenue share of 46.8% in 2024, driven by its superior oil absorption capacity, chemical resistance, and cost-effectiveness. PP pads are widely used across industrial and marine spill cleanup operations due to their hydrophobic nature, allowing them to absorb oil selectively while repelling water. Their durability and reusability make them a preferred choice for large-scale oil containment applications. In addition, the ease of manufacturing PP pads in various thicknesses and forms supports their extensive adoption across diverse end-use industries.

The fiber segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for sustainable and biodegradable absorbent materials. Natural and recycled fiber-based pads are gaining traction among eco-conscious industries seeking to minimize plastic waste and adhere to stringent environmental regulations. The rising use of cellulose, cotton, and other plant-based fibers in spill management reflects a broader market shift toward green alternatives. Fiber pads are also becoming popular for their efficient absorption rates and ease of disposal, particularly in regions emphasizing sustainability in industrial operations.

- By End-User

On the basis of end-user, the oil absorbent pads market is segmented into food and agriculture, oil and gas, medical, chemical, automotive, and others. The oil and gas segment dominated the market in 2024, accounting for the largest revenue share, driven by frequent oil spills, leakage incidents, and maintenance activities in offshore and onshore facilities. These pads are extensively used in refineries, drilling sites, and storage terminals to control and recover spilled hydrocarbons efficiently. The growing emphasis on operational safety and environmental protection in oil extraction and transportation processes further strengthens the demand for high-performance absorbent materials. Strict regulatory frameworks concerning spill control and waste management continue to support the segment’s dominance.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing use of absorbent pads in workshops, service stations, and manufacturing plants. These pads are employed to manage lubricants, engine oils, and fuel leaks during maintenance and production processes. The rapid expansion of the automotive aftermarket and electric vehicle servicing sector further boosts demand for effective spill containment solutions. Moreover, the growing focus on workplace cleanliness, safety standards, and waste minimization encourages manufacturers to adopt advanced absorbent products for day-to-day operations.

Oil Absorbent Pads Market Regional Analysis

- North America dominated the oil absorbent pads market with the largest revenue share in 2024, driven by stringent environmental regulations, industrial safety standards, and the need for effective spill management solutions

- The market growth is supported by high industrial activity in oil and gas, automotive, and chemical sectors, where frequent spills require reliable absorbent materials. The widespread adoption of polypropylene and other high-performance pads is further facilitated by well-established distribution networks and a technologically advanced industrial infrastructure

- Rising awareness of workplace safety and environmental protection measures has cemented North America’s position as a leading region in the adoption of oil absorbent pads

U.S. Oil Absorbent Pads Market Insight

The U.S. oil absorbent pads market captured the largest revenue share in North America in 2024, driven by increasing oil and gas operations, industrial maintenance activities, and stringent OSHA and EPA regulations for spill containment. The demand for high-efficiency absorbents is rising across chemical plants, automotive service centers, and food processing industries. In addition, the trend of adopting environmentally friendly absorbent solutions, combined with technological advancements in polypropylene and fiber-based pads, continues to propel market growth. The U.S. market benefits from strong manufacturing capabilities and an established network of industrial suppliers, ensuring accessibility of advanced oil absorbent solutions.

Europe Oil Absorbent Pads Market Insight

The Europe oil absorbent pads market is projected to expand at a steady CAGR during the forecast period, driven by strict environmental regulations, workplace safety standards, and growing industrial activity in oil and gas, chemical, and automotive sectors. Countries such as Germany, the U.K., and France are witnessing increasing adoption of advanced absorbent materials due to their effectiveness in spill management and compliance with EU directives on hazardous waste disposal. European industries are focusing on sustainable and reusable absorbent pads to reduce environmental impact, further supporting market growth. The rising preference for high-performance and eco-friendly pads in manufacturing, chemical, and food processing units is also a key factor driving demand.

U.K. Oil Absorbent Pads Market Insight

The U.K. oil absorbent pads market is expected to grow at a notable CAGR over the forecast period, driven by stringent health, safety, and environmental regulations, along with a high focus on industrial hygiene. Industrial sectors, particularly oil and gas, chemical, and automotive workshops, are adopting advanced absorbent pads for effective spill containment and waste management. The increasing awareness of environmental sustainability and the demand for reusable, high-efficiency pads support market expansion. Furthermore, well-established industrial infrastructure and strong import-export channels facilitate accessibility of high-quality absorbent pads across commercial and industrial applications.

Germany Oil Absorbent Pads Market Insight

The Germany oil absorbent pads market is anticipated to expand steadily, fueled by growing industrial activity, strong regulatory frameworks for environmental protection, and rising emphasis on occupational safety. German industries are increasingly adopting technologically advanced absorbent pads, including polypropylene and fiber-based solutions, to manage oil, chemical, and hazardous spills effectively. Sustainability initiatives and eco-friendly manufacturing practices further promote the use of reusable and biodegradable pads. The integration of high-performance absorbents in automotive, chemical, and energy sectors is accelerating market growth, supported by Germany’s robust industrial infrastructure.

Asia-Pacific Oil Absorbent Pads Market Insight

The Asia-Pacific oil absorbent pads market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid industrialization, urbanization, and growing oil and gas, automotive, and manufacturing sectors in countries such as China, India, and Japan. The region’s rising focus on industrial safety, environmental regulations, and spill management solutions is accelerating adoption. Increasing production of oil absorbent pads locally, combined with cost-effective availability and technological improvements, is making them more accessible to a wider market. Government initiatives promoting workplace safety and environmental protection are further supporting the expansion of the market in Asia-Pacific.

Japan Oil Absorbent Pads Market Insight

The Japan oil absorbent pads market is gaining momentum due to increasing industrial automation, high safety standards, and the growing need for efficient spill management solutions. The demand is particularly high in chemical manufacturing, automotive, and food processing sectors. Japan’s emphasis on environmental sustainability and industrial efficiency encourages the adoption of high-quality, reusable, and biodegradable absorbent pads. Integration of advanced materials and technologically improved pads further enhances market growth in both commercial and industrial segments.

China Oil Absorbent Pads Market Insight

The China oil absorbent pads market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrial growth, urbanization, and the expansion of oil and gas and automotive sectors. China’s focus on environmental protection and industrial safety has resulted in high adoption of polypropylene and fiber-based absorbent pads. The presence of strong domestic manufacturers and cost-effective production of high-performance pads supports widespread availability. In addition, government regulations promoting spill containment and workplace safety continue to propel the market forward in residential, commercial, and industrial applications.

Oil Absorbent Pads Market Share

The oil absorbent pads industry is primarily led by well-established companies, including:

- Log 9 Materials (India)

- 3M (U.S.)

- SPILL 911 (U.S.)

- WellGro United (U.S.)

- Brady Worldwide, Inc. (U.S.)

- Oil-Dri Corporation of America (U.S.)

- Trico Corporation (U.S.)

- Azapak (U.K.)

- ESP Sorbents (U.S.)

- Fentex Limited (U.K.)

- AbsorbentsOnline (U.S.)

- New Pig Corporation (U.S.)

- Supremex Equipments (India)

- Impact Absorbents (U.S.)

- Elastec (U.S.)

- W.W. Grainger, Inc. (U.S.)

- Spill Control Centre (U.K.)

- Uline (U.S.)

- Matthews Australasia Pty Limited (Australia)

- Enviroguard Solutions LLP (India)

- The Cary Company (U.S.)

Latest Developments in Global Oil Absorbent Pads Market

- In June 2022, 3M introduced a new line of biodegradable oil absorbent mats designed to meet the growing demand for environmentally friendly spill containment solutions. These mats offer high absorbency while minimizing environmental impact, aligning with stricter environmental regulations and sustainability goals across various industries. This launch strengthens 3M’s position in the market by addressing the increasing need for eco-friendly industrial products and supporting adoption of sustainable spill management solutions

- In 2022, several companies introduced high-performance oil absorbent mats designed to meet the stringent demands of industrial applications. These mats offer enhanced durability, increased absorbency, and compatibility with automated cleanup systems, providing efficient and reliable spill management. The introduction of such advanced mats reinforces the market’s shift towards technologically improved solutions that enhance operational efficiency in industrial and commercial sectors

- In 2021, New Pig Corporation expanded its product offerings by introducing a range of high-capacity oil absorbent mats tailored for industrial applications. Designed to handle large volumes of oil spills, these mats enhance safety and compliance in manufacturing and chemical processing environments. This expansion strengthened New Pig’s market presence and addressed the growing industrial need for effective and reliable spill containment products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oil Absorbent Pads Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oil Absorbent Pads Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oil Absorbent Pads Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.