Global Oil And Gas Analytics And Digitalization Market

Market Size in USD Billion

CAGR :

%

USD

21.50 Billion

USD

62.63 Billion

2025

2033

USD

21.50 Billion

USD

62.63 Billion

2025

2033

| 2026 –2033 | |

| USD 21.50 Billion | |

| USD 62.63 Billion | |

|

|

|

|

Oil and Gas Analytics and Digitalization Market Size

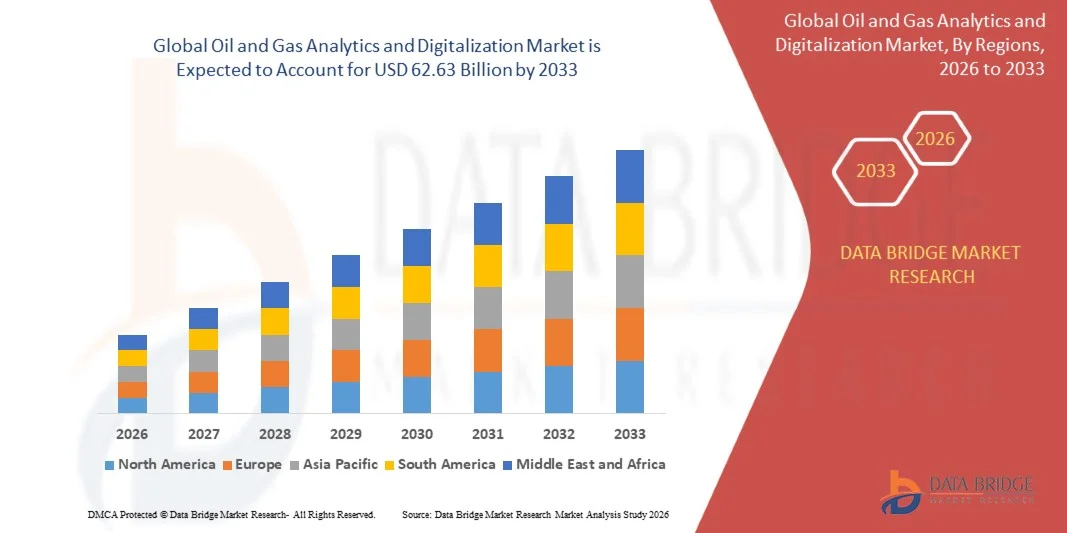

- The global oil & gas analytics & digitalization market size was valued at USD 21.5 billion in 2025 and is expected to reach USD 62.63 billion by 2033, at a CAGR of 14.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytics, artificial intelligence, and digital platforms across oil & gas operations, driving greater digitalization in upstream, midstream, and downstream activities

- Furthermore, rising demand for operational efficiency, cost optimization, and real-time decision-making is positioning analytics and digitalization solutions as critical tools for oil & gas companies. These converging factors are accelerating the deployment of data-driven technologies, thereby significantly strengthening overall market growth

Oil and Gas Analytics and Digitalization Market Analysis

- Oil & gas analytics and digitalization solutions, which enable data-driven optimization of exploration, production, refining, and distribution activities, are becoming essential across the industry due to their ability to enhance asset performance, improve safety, and reduce operational risks

- The growing adoption of these solutions is primarily driven by increasing operational complexity, volatility in energy prices, and the need for predictive insights to support efficient resource management and long-term competitiveness

- North America dominated the oil & gas analytics & digitalization market with a share of 41.35% in 2025, due to early adoption of advanced digital technologies and strong investments in upstream, midstream, and downstream optimization

- Asia-Pacific is expected to be the fastest growing region in the oil & gas analytics & digitalization market during the forecast period due to rising energy demand, expanding refining capacity, and increasing investments in digital infrastructure

- Cloud segment dominated the market with a market share of 66.31% in 2025, due to its scalability, lower infrastructure costs, and ability to support real-time analytics and remote monitoring across geographically dispersed oil & gas operations. Increasing adoption of AI-driven analytics platforms and ease of integration with existing digital tools further strengthened cloud dominance

Report Scope and Oil and Gas Analytics and Digitalization Market Segmentation

|

Attributes |

Oil and Gas Analytics and Digitalization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oil and Gas Analytics and Digitalization Market Trends

“Rising Adoption of Advanced Analytics in Oil & Gas Operations”

- A significant trend in the oil & gas analytics & digitalization market is the increasing adoption of advanced analytics, artificial intelligence, and machine learning across upstream, midstream, and downstream operations, driven by the growing need for operational efficiency, predictive maintenance, and optimized resource management. Companies are leveraging data-driven insights to enhance decision-making, reduce downtime, and improve production yield across complex oilfield operations

- For instance, in September 2023, Datagration collaborated with Origem Energia in Brazil to integrate energy analytics with AI and machine learning, enabling predictive maintenance and optimized drilling decisions. Such initiatives demonstrate how analytics-driven digitalization is transforming operational efficiency in oil & gas exploration and production

- The utilization of digital twins, sensor networks, and real-time monitoring systems is rapidly expanding across drilling, transportation, and refinery processes. This positions analytics and digitalization as critical enablers of safer, more reliable, and cost-efficient operations while reducing environmental impact

- Oilfield operators are increasingly adopting predictive analytics for reservoir management, drilling optimization, and energy efficiency initiatives. These applications allow companies to anticipate equipment failures, enhance asset utilization, and reduce unplanned operational costs, strengthening competitiveness in a volatile energy market

- The midstream and downstream segments are integrating digital platforms to monitor pipeline integrity, optimize distribution, and ensure regulatory compliance. This trend is supporting a transition toward fully connected, intelligent energy infrastructure capable of real-time performance tracking

- The market is witnessing robust growth in integrating digitalization with renewable energy operations and decarbonization initiatives. Companies adopting these technologies are better positioned to align with sustainability targets while improving operational efficiency

Oil and Gas Analytics and Digitalization Market Dynamics

Driver

“Increasing Demand for Operational Efficiency and Cost Optimization”

- The growing need for enhanced operational efficiency, reduced downtime, and cost-effective energy production is driving adoption of analytics and digitalization in oil & gas. Advanced monitoring systems, predictive maintenance, and data-driven decision-making enable companies to optimize resource allocation, production processes, and supply chain operations

- For instance, in January 2024, SLB and Nabors collaborated on automated drilling solutions to improve efficiency in rig operations, demonstrating the industry-wide push toward cost optimization through digitalization. Such solutions allow operators to reduce human error, enhance drilling precision, and lower operational expenses

- The increasing complexity of oilfield operations, coupled with fluctuating energy prices, is accelerating investment in digital solutions that provide actionable insights and predictive analytics. This ensures smoother operations, minimizes downtime, and improves financial performance

- Companies are leveraging integrated software platforms to analyze real-time data from drilling, production, and transportation operations. These platforms support faster decision-making and reduce energy losses, directly contributing to operational efficiency

- The rising emphasis on environmental sustainability is also encouraging the deployment of digital solutions that optimize energy use, monitor emissions, and support compliance with regulations, contributing to both efficiency and cost reduction

Restraint/Challenge

“Integration Complexity Across Legacy Systems”

- The oil & gas analytics & digitalization market faces challenges due to the complexity of integrating modern digital solutions with existing legacy systems, which often vary across upstream, midstream, and downstream operations. Companies must reconcile incompatible platforms, disparate data formats, and outdated infrastructure, increasing implementation difficulty and costs

- For instance, in May 2023, Essar Oil and Gas Exploration and Production Ltd partnered with Sensia for digitalization of field operations, highlighting the need to carefully manage integration with existing equipment and operational protocols. These challenges emphasize the necessity for comprehensive planning and skilled workforce deployment

- Standardizing data from various sensors, equipment, and operational systems across multiple sites is a critical hurdle for operators seeking end-to-end digitalization. Inconsistent data structures can lead to inefficiencies, errors, and delays in analytics-driven decision-making

- The requirement for specialized IT infrastructure, cybersecurity measures, and training of personnel further complicates deployment of digital solutions. Maintaining uninterrupted operations while upgrading systems presents both technical and operational risks

- The market continues to encounter constraints in achieving seamless connectivity and interoperability across diverse technologies, underscoring the importance of standardized solutions and vendor collaboration to ensure successful adoption of analytics and digitalization initiatives

Oil and Gas Analytics and Digitalization Market Scope

The market is segmented on the basis of offering, deployment type, application, and end-user.

• By Offering

On the basis of offering, the oil & gas analytics & digitalization market is segmented into hardware, software, and service. The software segment dominated the market with the largest revenue share in 2025, driven by rising adoption of advanced analytics platforms, digital twins, and AI-based decision-support tools across exploration, production, and refining operations. Oil & gas companies increasingly rely on software solutions to optimize asset performance, improve predictive maintenance, and enhance operational visibility across complex value chains. The ability of software platforms to integrate real-time data from sensors, SCADA systems, and enterprise applications further strengthens their dominance. In addition, continuous updates, scalability, and compatibility with cloud environments support long-term adoption across large-scale operations.

The service segment is expected to register the fastest growth rate from 2026 to 2033, supported by growing demand for consulting, system integration, and managed analytics services. Energy companies are increasingly outsourcing digital transformation initiatives to specialized service providers to reduce implementation complexity and accelerate deployment timelines. Services also play a critical role in cybersecurity, data governance, and workforce training, which are essential for sustaining digital maturity across oil & gas enterprises.

• By Deployment Type

On the basis of deployment type, the market is segmented into on-premises and cloud. The cloud segment held the largest revenue share of 66.31% in 2025, driven by its scalability, lower infrastructure costs, and ability to support real-time analytics and remote monitoring across geographically dispersed oil & gas operations. Increasing adoption of AI-driven analytics platforms and ease of integration with existing digital tools further strengthened cloud dominance.

The on-premises segment is projected to witness the fastest growth during the forecast period, driven by rising concerns around data security, regulatory compliance, and the need for greater control over sensitive operational and production data. Oil & gas companies handling mission-critical applications continue to invest in on-premises systems to ensure reliability, low latency, and data sovereignty.

• By Application

On the basis of application, the oil & gas analytics & digitalization market is categorized into upstream, midstream, and downstream. The upstream segment dominated the market in 2025, supported by high investments in exploration and production optimization. Analytics and digital tools are extensively used in upstream activities for reservoir modeling, seismic data interpretation, drilling optimization, and predictive maintenance of critical equipment. The ability to reduce non-productive time and improve recovery rates makes digitalization essential in upstream operations. High operational risks and capital intensity further reinforce the need for advanced analytics in this segment.

The downstream segment is anticipated to grow at the fastest pace from 2026 to 2033, driven by increasing focus on refinery optimization, demand forecasting, and supply chain efficiency. Digital solutions help downstream operators enhance yield optimization, energy efficiency, and real-time monitoring of refining and distribution processes. Rising competition and margin pressures are accelerating the adoption of advanced analytics across downstream operations.

• By End-User

On the basis of end-user, the market is segmented into small & medium enterprises and large enterprises. Large enterprises accounted for the largest market share in 2025, driven by their substantial financial capacity and large-scale operational footprints. Major oil & gas corporations actively invest in end-to-end digitalization initiatives to improve efficiency, reduce operational risks, and meet sustainability targets. Their ability to deploy integrated analytics platforms across upstream, midstream, and downstream operations supports widespread adoption. In addition, large enterprises often lead pilot projects and innovation programs in advanced digital technologies.

Small & medium enterprises are expected to witness the fastest growth over the forecast period, supported by increasing access to cloud-based and modular digital solutions. SMEs are adopting analytics and digital tools to enhance operational efficiency, reduce downtime, and remain competitive against larger players. Lower upfront costs and flexible deployment models are enabling faster digital adoption among smaller oil & gas operators.

Oil and Gas Analytics and Digitalization Market Regional Analysis

- North America dominated the oil & gas analytics & digitalization market with the largest revenue share of 41.35% in 2025, driven by early adoption of advanced digital technologies and strong investments in upstream, midstream, and downstream optimization

- The region shows high adoption of AI, big data analytics, and cloud-based platforms to enhance operational efficiency, predictive maintenance, and real-time decision-making across oil & gas assets

- This dominance is further supported by the presence of major oil & gas companies, a mature digital infrastructure, and a strong focus on cost reduction, safety improvement, and production optimization, positioning analytics and digitalization as core operational tools

U.S. Oil & Gas Analytics & Digitalization Market Insight

The U.S. oil & gas analytics & digitalization market captured the largest revenue share within North America in 2025, supported by extensive shale operations and large-scale deployment of digital oilfield technologies. Operators increasingly rely on advanced analytics to optimize drilling performance, manage reservoirs, and reduce non-productive time. The integration of AI, machine learning, and real-time data platforms across upstream and downstream operations continues to drive market growth. In addition, strong investments in cloud infrastructure and digital twins are accelerating digital transformation across the U.S. oil & gas sector.

Europe Oil & Gas Analytics & Digitalization Market Insight

The Europe oil & gas analytics & digitalization market is projected to grow at a steady CAGR during the forecast period, driven by stringent environmental regulations and the need for operational efficiency. European oil & gas companies are adopting digital solutions to reduce emissions, improve energy efficiency, and ensure regulatory compliance. Increasing focus on predictive maintenance and asset integrity management is also boosting analytics adoption across offshore and onshore operations. Digitalization is gaining traction across refining and distribution activities to enhance transparency and operational control.

U.K. Oil & Gas Analytics & Digitalization Market Insight

The U.K. oil & gas analytics & digitalization market is expected to expand at a notable CAGR, driven by the modernization of North Sea operations and rising emphasis on cost optimization. Companies are increasingly implementing analytics platforms to extend asset life, improve production efficiency, and manage aging infrastructure. The push toward digital oilfields and data-driven decision-making is further supporting adoption. Integration of analytics with sustainability and decarbonization initiatives is also influencing market growth in the U.K.

Germany Oil & Gas Analytics & Digitalization Market Insight

The Germany oil & gas analytics & digitalization market is anticipated to grow steadily over the forecast period, supported by the country’s strong focus on industrial digitalization and advanced engineering capabilities. German companies emphasize data accuracy, cybersecurity, and system reliability, driving demand for robust analytics platforms. Digital tools are increasingly used to optimize refining operations, supply chain management, and energy efficiency. The alignment of digitalization initiatives with sustainability goals further supports market expansion.

Asia-Pacific Oil & Gas Analytics & Digitalization Market Insight

The Asia-Pacific oil & gas analytics & digitalization market is expected to witness the fastest growth during the forecast period, driven by rising energy demand, expanding refining capacity, and increasing investments in digital infrastructure. Rapid industrialization and urbanization are encouraging oil & gas operators to adopt analytics for operational optimization and risk management. Government initiatives supporting digital transformation and smart industrial systems are accelerating adoption across the region. The growing presence of regional oil & gas companies is further strengthening market growth.

China Oil & Gas Analytics & Digitalization Market Insight

China accounted for the largest revenue share in the Asia-Pacific oil & gas analytics & digitalization market in 2025, driven by large-scale upstream and downstream operations and rapid digital adoption. State-owned and private oil & gas companies are increasingly deploying analytics to improve exploration success rates and refinery efficiency. The focus on smart energy systems and digital oilfields is supporting sustained investment in analytics platforms. Strong domestic technology providers also enhance accessibility and implementation across the Chinese oil & gas sector.

Japan Oil & Gas Analytics & Digitalization Market Insight

The Japan oil & gas analytics & digitalization market is gaining traction due to the country’s emphasis on technological innovation and operational efficiency. Japanese companies are adopting analytics solutions to optimize refining processes, improve supply chain visibility, and enhance safety standards. High reliance on energy imports is driving the need for efficient downstream and logistics management through digital tools. Integration of analytics with automation and IoT systems is further contributing to market growth in Japan.

Oil and Gas Analytics and Digitalization Market Share

The oil & gas analytics & digitalization industry is primarily led by well-established companies, including:

- ConocoPhillips (U.S.)

- Naftogaz (Ukraine)

- Flywheel Energy (U.S.)

- Murphy Oil Corporation (U.S.)

- Essar Oil (India)

- Weatherford (U.S.)

- Olimax Energy (U.S.)

- Devon Energy (U.S.)

- National Energy Services Reunited Corp. (NESR) (U.K.)

- Rockcliff Energy (U.S.)

- ExxonMobil (U.S.)

- Hunt Oil Company (U.S.)

- Covey Park Energy (U.S.)

- EOG Resources (U.S.)

- XTO Energy (U.S.)

Latest Developments in Global Oil and Gas Analytics and Digitalization Market

- In January 2024, SLB and Nabors expanded the oil & gas analytics & digitalization market through their collaboration on automated drilling solutions, with a strong focus on drilling automation applications and advanced rig operating systems. This development enables deeper integration of real-time analytics, automation, and control systems, helping operators reduce drilling variability, lower operational risks, and significantly minimize non-productive time. By improving consistency and efficiency across drilling operations, the collaboration supports higher well performance and faster project execution, reinforcing the role of automation-driven analytics in modern oilfield development

- In November 2023, Halliburton enhanced its strategic partnership with C3 AI to accelerate the adoption of AI-driven analytics across upstream oil & gas operations. The collaboration supports large-scale deployment of predictive maintenance, production optimization, and emissions management solutions powered by artificial intelligence. This development strengthens the market by enabling operators to shift from reactive to predictive decision-making, improve asset reliability, and align operational performance with sustainability and regulatory objectives

- In September 2023, Datagration and Origem Energia collaborated to integrate advanced energy analytics with machine learning and artificial intelligence within Brazil’s oil & gas industry. This initiative improves the ability of operators to analyze complex production data, optimize reservoir performance, and enhance forecasting accuracy. By leveraging AI-powered insights, the collaboration contributes to more efficient field operations, reduced operational uncertainty, and broader adoption of digital intelligence across emerging oil & gas markets

- In May 2023, Essar Oil and Gas Exploration and Production Ltd partnered with Sensia to accelerate the digitalization of oil & gas field operations through integrated automation and analytics solutions. The collaboration enables real-time monitoring, centralized data management, and improved process control across upstream assets. This development strengthens the market by supporting smarter, data-driven operations, improving asset uptime, and enhancing overall operational transparency and efficiency

- In March 2023, Baker Hughes collaborated with Microsoft to expand cloud-based, AI-enabled digital solutions tailored for oil & gas operators. This initiative enhances scalable analytics, cybersecurity, and digital twin capabilities, enabling companies to manage large volumes of operational data more effectively. By combining cloud infrastructure with advanced analytics, the collaboration accelerates digital transformation, improves production optimization, and supports more resilient and efficient oil & gas operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.