Global Oil And Gas Composites Market

Market Size in USD Billion

CAGR :

%

USD

2.30 Billion

USD

3.42 Billion

2024

2032

USD

2.30 Billion

USD

3.42 Billion

2024

2032

| 2025 –2032 | |

| USD 2.30 Billion | |

| USD 3.42 Billion | |

|

|

|

Oil and Gas Composites Market Analysis

Over the last few years, there has been immense growth in the chemical industry. Additionally, the composites market have largely flourished. Composites are primarily employed within the oil and gas industry because of their unique qualities, such as lightweight, corrosion resistance, and ease of installation, making them ideal for demanding applications. The increased usage of composites in oil and gas industry will largely aid the market growth even within the forecasted period.

Oil and Gas Composites Market Size

Global oil and gas composites market size was valued at USD 2.30 billion in 2024 and is projected to reach USD 3.42 billion by 2032, with a CAGR of 5.10% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Oil and Gas Composites Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

DOW (U.S.), Halocarbon, LLC (U.S.) Freudenberg SE (Germany), The Chemours Company (U.S.), Metalubgroup (Israel), Huntsman International LLC (U.S.), Bostik (France), H.B. Fuller Company (U.S.), Sika AG (Switzerland), Cardolite Corporation (U.S.), DAIKIN (Japan), Kukdo Chemical Co., Ltd., (South Korea), BASF SE(Germany), Covestro AG (Germany), LANXESS (Germany), Dupont (U.S.), SOLVAY (Belgium), Wanhua (China), Arkema (France), Hexion (U.S.) and Woodbridge (Canada) |

|

Market Opportunities |

|

Oil and Gas Composites Market Definition

In the oil and gas business, composites are created by combining various elements in a matrix. The most common composites are constructed with glass fibers, carbon fibers, or aramid fibers in an epoxy, phenolic, or polymer (polyethylene, polyvinyl-dienefluoride, and polyamide) matrix. The oil and gas business must meet certain technical, technological, and economic requirements. This is most noticeable in construction materials, which are expected to withstand corrosion, fatigue, and weight. Offshore projects are more risky and expensive as a result of these factors.

Oil and Gas Composites Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increased Demand for Oil and Gas Composites

The growing demand of the non- corrosive, as well as the light weight material from oil and gas industry, is estimated to carve a way for the growth of the market. Moreover, growing demand for glass- fiber reinforced polymer composite in piping systems will also drive market value growth over the forecasted period.

The rising applications from emerging economies and the adoption of natural composites will further propel the growth rate of the oil and gas composites market. The low maintenance cost of composites is projected to bolster the market's growth.

Opportunities

- Surging Awareness, Development and Hydraulic Fracturing

Furthermore, rising awareness about the advantages of corrosion such as high corrosion resistance, lightweight, and developments in the field of composite pipelines and fluid management are estimated to extend profitable opportunities to the market players in the forecast period of 2025 to 2032. Additionally, the booming hydraulic fracturing will further expand the future growth of the oil and gas composites market.

Restraints/Challenges

- Price Volatility and High Costs

The high production cost coupled with the volatility in the cost of oil and gas will create hindrances for the growth of the oil and gas composites market.

- Availability Of Alternatives

Also, the availability of alternatives in the market will prove to be a demerit for the oil and gas composites market. Therefore, this will challenge the oil and gas composites market growth rate.

This oil and gas composites market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the oil and gas composites market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Oil and Gas Composites Market Scope

The oil and gas composites market is segmented on the basis of resin type, fiber type, product type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Resin Type

- Epoxy

- Polyester

- Phenolic

- Others

Fiber Type

- Glass Fiber

- Carbon Fiber

Product Type

- Glass Reinforced Plastics

- Glass Reinforced Epoxy Resin

- Glass Reinforced Vinyl Ester

- Reinforced Thermoplastic

Application

- Piping System

- Grinds/Grating

- Flexible Tubes

- Composite Risers

- Caissons and Pull Tubes

- Top Side Applications

- Pipes

- Others

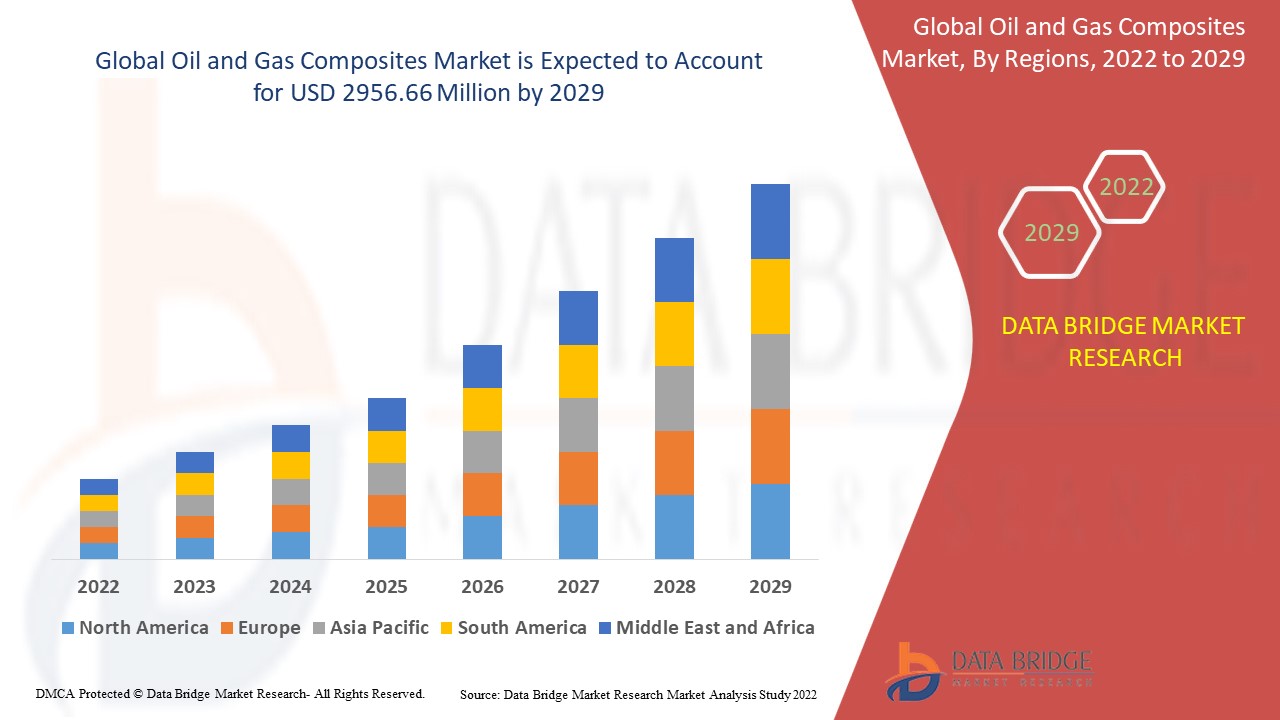

Oil and Gas Composites Market Regional Analysis

The oil and gas composites market is analyzed and market size insights and trends are provided by country, resin type, fiber type, product type and application as referenced above.

The countries covered in the oil and gas composites market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the oil and gas composites market because of the aging oil and gas transportation infrastructure and growing focus in the direction of unconventional sources of energy within the region.

On the other hand, Asia-Pacific is estimated to show lucrative growth during the forecast period of 2025 to 2032 due to the increasing awareness about the superior properties by the product and increasing partnerships and acquisitions within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Oil and Gas Composites Market Share

The oil and gas composites market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to oil and gas composites market.

Oil and Gas Composites Market Leaders Operating in the Market Are:

- DOW (U.S.)

- Halocarbon, LLC (U.S.)

- Freudenberg SE (Germany)

- The Chemours Company (U.S.)

- Metalubgroup (Israel)

- Huntsman International LLC (U.S.)

- Bostik (France)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Cardolite Corporation (U.S.)

- DAIKIN (Japan)

- Kukdo Chemical Co., Ltd., (South Korea)

- BASF SE (Germany)

- Covestro AG (Germany)

- LANXESS (Germany)

- Dupont (U.S.)

- SOLVAY (Belgium)

- Wanhua (China)

- Arkema (France)

- Hexion (U.S.)

- Woodbridge (Canada)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oil And Gas Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oil And Gas Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oil And Gas Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.