Global Oil And Gas Fishing Market

Market Size in USD Billion

CAGR :

%

USD

1.43 Billion

USD

2.72 Billion

2025

2033

USD

1.43 Billion

USD

2.72 Billion

2025

2033

| 2026 –2033 | |

| USD 1.43 Billion | |

| USD 2.72 Billion | |

|

|

|

|

Oil and Gas Fishing Market Size

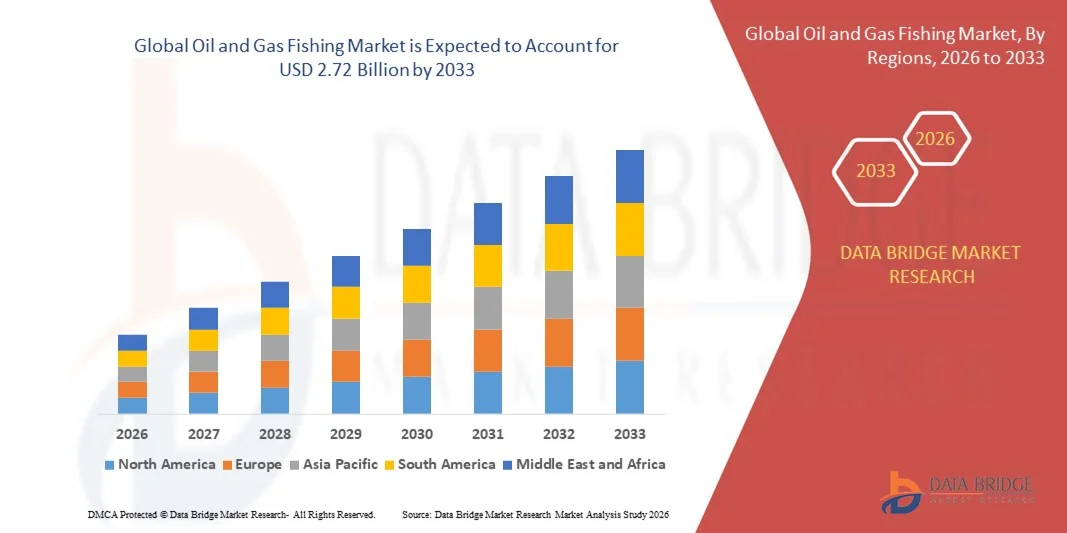

- The global oil and gas fishing market size was valued at USD 1.43 billion in 2025 and is expected to reach USD 2.72 billion by 2033, at a CAGR of 8.29% during the forecast period

- The market growth is largely fuelled by the rising number of drilling and workover operations across both onshore and offshore fields

- Increasing investments in mature oilfields and the need for efficient recovery of stuck or lost equipment during drilling activities are further propelling market expansion

Oil and Gas Fishing Market Analysis

- The oil and gas fishing market is experiencing significant growth due to growing exploration and production (E&P) activities and the rising focus on minimizing downtime and operational costs in drilling operations

- The adoption of advanced fishing tools and technologies, such as hydraulic jars and overshots, is enhancing efficiency and precision in retrieving lost equipment, improving overall productivity in oilfield operations

- North America dominated the oil and gas fishing market with the largest revenue share in 2025, driven by the growing number of exploration, drilling, and well intervention activities across mature offshore and onshore fields. The region’s advanced oilfield infrastructure, coupled with the presence of leading service providers and robust technological capabilities, further supports market growth

- Asia-Pacific region is expected to witness the highest growth rate in the global oil and gas fishing market, driven by rising offshore exploration, technological advancements in fishing tools, and increasing investments in energy infrastructure across emerging economies such as China and India

- The overshoots & spears segment held the largest market revenue share in 2025, driven by their extensive use in retrieving stuck pipes, drill collars, and other tubular components during drilling and completion operations. Their versatility, durability, and ability to perform effectively in both conventional and high-pressure wells make them indispensable tools in fishing operations across onshore and offshore environments

Report Scope and Oil and Gas Fishing Market Segmentation

|

Attributes |

Oil and Gas Fishing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oil and Gas Fishing Market Trends

Advancement in Downhole Fishing Tools and Technologies

- The oil and gas fishing market is witnessing significant innovation in downhole tools designed for efficient retrieval of lost or stuck equipment. Modern advancements such as hydraulic spears, overshots, and magnetic fishing tools are enhancing recovery success rates while reducing downtime and operational costs. These technologies are especially beneficial in deepwater and high-pressure wells where precision and reliability are critical, as they enable operators to address fishing challenges with greater control and minimize the risk of secondary damage to the wellbore during intervention operations

- Automation and digitalization are also transforming fishing operations. The integration of smart sensors and real-time monitoring systems allows operators to assess well conditions more accurately and respond swiftly to fishing challenges. This data-driven approach minimizes non-productive time (NPT) and enhances operational safety across complex well environments, improving decision-making and enabling predictive maintenance that reduces unexpected failures during retrieval

- Manufacturers are focusing on lightweight, durable materials such as high-strength alloys and composites that can withstand extreme temperatures and pressures. These improvements not only increase tool longevity but also optimize performance during high-risk fishing operations. Enhanced material design also ensures that fishing equipment can operate efficiently in corrosive or abrasive environments, contributing to lower maintenance costs and improved tool reliability over extended deployment cycles

- For instance, in 2023, several offshore service providers adopted AI-assisted fishing systems that combined predictive analytics with tool performance tracking, significantly improving recovery efficiency and reducing equipment loss. These intelligent systems analyze data from previous operations to optimize tool selection and retrieval strategy, thereby enhancing accuracy and reducing human error in challenging subsea conditions

- As exploration and production (E&P) activities expand into deeper waters and more complex reservoirs, demand for advanced fishing tools and technologies continues to rise. Companies that invest in innovation and field-proven tool designs are expected to gain a competitive advantage in this evolving market. The growing emphasis on digital twin technology, remote monitoring, and automation-driven operations is further shaping the next generation of fishing tools for both onshore and offshore environments

Oil and Gas Fishing Market Dynamics

Driver

Increasing Exploration and Drilling Activities in Mature Oilfields

- The growing need to maximize production from mature oilfields is driving the demand for fishing services. As wells age, incidents such as stuck pipes, lost tools, and debris accumulation become more frequent, necessitating efficient retrieval operations to maintain productivity and well integrity. The rising number of brownfield redevelopment projects worldwide is reinforcing the importance of fishing services to extend the lifespan of existing wells and minimize capital expenditure on new drilling

- Operators are increasingly focusing on well rehabilitation and re-entry projects, where fishing services play a vital role in clearing obstructions and restoring flow. The surge in secondary and tertiary recovery operations is further fueling market demand. The integration of specialized fishing tools with well intervention technologies has improved operational precision, helping operators minimize downtime and maximize hydrocarbon recovery efficiency

- In addition, the expansion of offshore and unconventional drilling projects has intensified the need for robust fishing tools capable of handling complex well geometries and challenging subsurface conditions. As operators venture into deeper reservoirs and harsher offshore environments, fishing services have become critical to ensuring smooth operations, maintaining safety standards, and reducing potential losses associated with tool failures or equipment jamming

- For instance, in 2023, offshore producers in the Gulf of Mexico reported a notable rise in fishing operations as part of well intervention campaigns, leading to improved recovery rates and reduced non-productive time. The adoption of advanced mechanical and hydraulic fishing technologies contributed to faster retrieval times and enhanced operational efficiency, demonstrating the market’s shift toward more technologically advanced solutions

- The continued push for energy security and resource optimization is expected to sustain the demand for advanced fishing services across both onshore and offshore applications. National oil companies (NOCs) and independent operators alike are investing in next-generation fishing technologies to improve field recovery rates and achieve production targets while maintaining environmental and operational safety standards

Restraint/Challenge

High Operational Costs and Technical Complexities in Offshore Fishing Operations

- Offshore fishing operations are often associated with high costs due to the complexity of well conditions, equipment mobilization, and safety requirements. The need for specialized vessels, remotely operated vehicles (ROVs), and advanced recovery systems further elevates expenses. These high operational costs pose a major challenge for smaller operators and limit the adoption of advanced fishing services in cost-sensitive projects, particularly in volatile oil price environments

- Technical challenges such as high-pressure, high-temperature (HPHT) environments and ultra-deepwater wells demand precision tools and expert handling. Any failure during fishing can lead to costly downtime and potential damage to the wellbore. Operators must also navigate challenges related to tool compatibility, real-time data interpretation, and unpredictable formation pressures, which collectively add to operational risks and necessitate continuous technological adaptation

- Limited availability of skilled personnel trained in advanced fishing techniques adds to operational risks. The shortage of expertise can delay operations and increase the likelihood of unsuccessful retrieval attempts. Furthermore, retaining experienced technicians and engineers is difficult due to cyclical downturns in the oil industry, leading to talent gaps that affect overall efficiency and safety during fishing operations

- For instance, in 2022, several offshore operators in the North Sea reported project delays due to equipment failure and a lack of technical specialists capable of handling complex retrievals in deepwater environments. These incidents led to extended downtime, increased maintenance costs, and a decline in operational efficiency, emphasizing the importance of specialized training and continuous skill development in the fishing services sector

- Addressing these challenges requires continuous investment in personnel training, R&D for tool enhancement, and cost-effective solutions to ensure successful fishing operations while minimizing economic losses and downtime. Collaborative efforts between tool manufacturers, service providers, and oilfield operators can also foster innovation, reduce costs, and improve operational reliability in demanding offshore environments

Oil and Gas Fishing Market Scope

The oil and gas fishing market is segmented on the basis of product and application.

- By Product

On the basis of product, the oil and gas fishing market is segmented into overshoots & spears, milling tools, fishing jars, and casing cutters. The overshoots & spears segment held the largest market revenue share in 2025, driven by their extensive use in retrieving stuck pipes, drill collars, and other tubular components during drilling and completion operations. Their versatility, durability, and ability to perform effectively in both conventional and high-pressure wells make them indispensable tools in fishing operations across onshore and offshore environments.

The milling tools segment is expected to witness the fastest growth rate from 2026 to 2033, attributed to the rising number of well intervention and repair activities in mature fields. Milling tools are widely used for removing obstructions, cutting through metal debris, and ensuring smooth wellbore access for continued operations. Their ability to perform precision cutting in complex well conditions enhances operational efficiency and reduces downtime, making them increasingly popular among service providers.

- By Application

On the basis of application, the oil and gas fishing market is segmented into offshore and onshore. The offshore segment accounted for the largest market revenue share in 2025, fuelled by the growing exploration and production (E&P) activities in deepwater and ultra-deepwater regions. Offshore environments often present complex challenges such as high pressure, extreme temperatures, and limited accessibility, thereby requiring advanced fishing tools and services to ensure safe and efficient equipment retrieval.

The onshore segment is expected to register the fastest growth rate from 2026 to 2033, driven by increasing redevelopment and maintenance operations in mature oilfields. Onshore fishing activities are cost-effective and more accessible, with rising demand for retrieval services to enhance well productivity and extend field life. The segment’s growth is further supported by advancements in portable fishing tools and automation technologies designed to improve precision and reduce operational downtime in land-based wells.

Oil and Gas Fishing Market Regional Analysis

- North America dominated the oil and gas fishing market with the largest revenue share in 2025, driven by the growing number of exploration, drilling, and well intervention activities across mature offshore and onshore fields. The region’s advanced oilfield infrastructure, coupled with the presence of leading service providers and robust technological capabilities, further supports market growth

- The rising need for efficient well maintenance and the recovery of lost or stuck equipment continues to drive fishing service demand. Operators in North America are investing heavily in innovative downhole tools to reduce downtime and improve operational efficiency

- The strong presence of established oil and gas producers, combined with steady capital investments in deepwater projects, ensures the region’s dominant position in the global market. The emphasis on energy security and maximizing production from aging wells continues to reinforce market stability

U.S. Oil and Gas Fishing Market Insight

The U.S. oil and gas fishing market captured the largest revenue share in 2025 within North America, primarily due to its extensive offshore exploration projects in the Gulf of Mexico and numerous onshore drilling operations across Texas, Oklahoma, and North Dakota. Increased focus on well rehabilitation and enhanced recovery operations has elevated the demand for advanced fishing tools and services. Furthermore, ongoing technological innovations and high adoption of automation in fishing equipment have improved recovery success rates, strengthening the market’s overall performance.

Europe Oil and Gas Fishing Market Insight

The Europe oil and gas fishing market is expected to witness steady growth from 2026 to 2033, driven by expanding offshore activities in the North Sea and the region’s growing emphasis on maintaining well integrity in mature oilfields. The push toward maximizing recovery efficiency and minimizing downtime is encouraging greater adoption of specialized fishing services. In addition, the region’s transition toward sustainable operations is leading to investment in energy-efficient fishing tools designed to reduce environmental impact while maintaining operational effectiveness.

U.K. Oil and Gas Fishing Market Insight

The U.K. oil and gas fishing market is projected to grow at a significant rate from 2026 to 2033, supported by ongoing redevelopment projects in the North Sea and the government’s focus on extending the lifespan of mature wells. The market benefits from increased decommissioning activities that often require fishing operations for debris and tool recovery. Moreover, technological advancements and collaborations between service providers and operators are enhancing efficiency in complex offshore environments.

Germany Oil and Gas Fishing Market Insight

The Germany oil and gas fishing market is anticipated to grow moderately through 2033, supported by its contribution to the European energy ecosystem and advancements in precision engineering for fishing tools. Although the country’s domestic oil production is limited, its strong presence in manufacturing and supplying high-quality equipment supports the broader European fishing market. German companies are also investing in automation and data-driven solutions to improve accuracy and reduce non-productive time in well intervention operations.

Asia-Pacific Oil and Gas Fishing Market Insight

The Asia-Pacific oil and gas fishing market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing offshore exploration projects and deepwater drilling in countries such as China, India, and Indonesia. The region’s expanding energy demand and focus on production efficiency are creating significant opportunities for fishing service providers. Moreover, growing investments in subsea development and exploration activities are contributing to the rising adoption of advanced fishing tools and equipment.

Japan Oil and Gas Fishing Market Insight

The Japan oil and gas fishing market is expected to record steady growth from 2026 to 2033, supported by the nation’s focus on optimizing existing offshore assets and ensuring energy stability through improved well maintenance practices. The adoption of precision-engineered fishing tools and remote monitoring solutions is helping reduce operational risks and enhance recovery rates. Japan’s technological leadership and emphasis on safety and sustainability continue to strengthen its position in the regional market.

China Oil and Gas Fishing Market Insight

The China oil and gas fishing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid expansion in drilling operations, particularly across offshore basins and mature onshore fields. Strong government support for domestic production, along with the growing number of state-owned and private energy projects, continues to boost market growth. China’s manufacturing capabilities also play a crucial role in producing cost-effective and high-performance fishing tools, reinforcing its position as a key player in the global market.

Oil and Gas Fishing Market Share

The Oil and Gas Fishing industry is primarily led by well-established companies, including:

- Archer (Norway)

- Ardyne (U.K.)

- Baker Hughes Company (U.S.)

- China Oilfield Services Limited (China)

- Expro Holdings UK 2 Ltd (U.K.)

- National Oilwell Varco (U.S.)

- Odfjell Drilling (Norway)

- Weatherford (U.S.)

- Wellbore Integrity Solutions (U.S.)

- General Electric (U.S.)

- Wellsite Fishing & Rental Services (U.S.)

- Magnum Oil Tools International Ltd (U.S.)

- Bilco (U.S.)

- Nabors Industries Ltd. (Bermuda)

- Ensco plc (U.K.)

- SAIPEM SpA (Italy)

- TechnipFMC plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oil And Gas Fishing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oil And Gas Fishing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oil And Gas Fishing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.