Global Oil And Gas Pipeline Market

Market Size in USD Billion

CAGR :

%

USD

104.20 Billion

USD

175.05 Billion

2025

2033

USD

104.20 Billion

USD

175.05 Billion

2025

2033

| 2026 –2033 | |

| USD 104.20 Billion | |

| USD 175.05 Billion | |

|

|

|

|

What is the Global Oil and Gas Pipeline Market Size and Growth Rate?

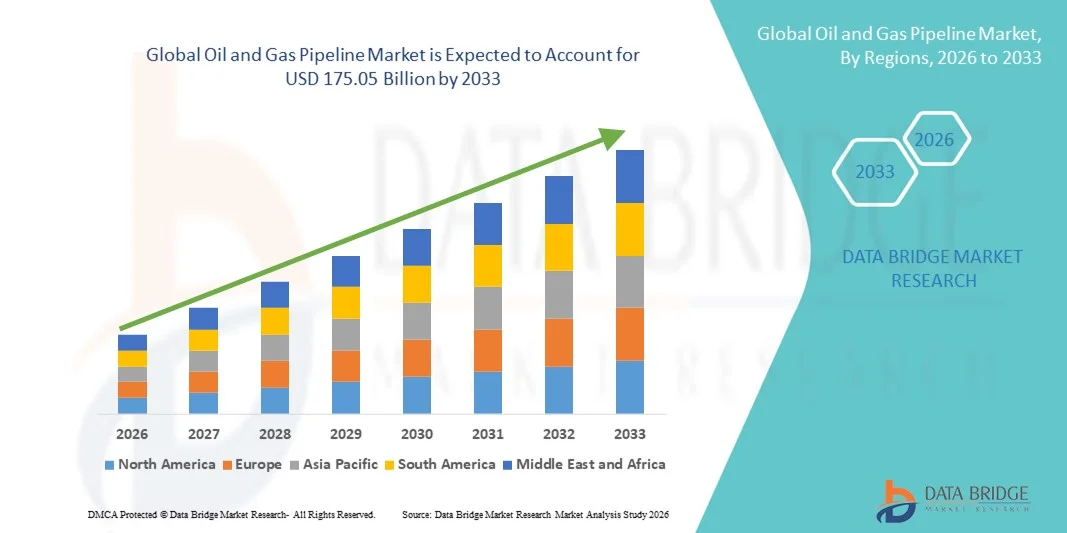

- The global oil and gas pipeline market size was valued at USD 104.20 billion in 2025 and is expected to reach USD 175.05 billion by 2033, at a CAGR of 6.70% during the forecast period

- Growth of the market is driven by rising global energy demand, increasing investments in oil & gas exploration and production, expansion of cross-border and long-distance pipeline networks, and growing need for safe, cost-efficient transportation of crude oil, natural gas, and refined products. Increasing focus on energy security, modernization of aging pipeline infrastructure, and adoption of advanced pipeline monitoring, automation, and corrosion-resistant materials are further accelerating market growth

What are the Major Takeaways of Oil and Gas Pipeline Market?

- Rapid expansion of natural gas pipelines, increasing LNG trade, and growing investments in midstream infrastructure across emerging economies are creating significant growth opportunities for the oil and gas pipeline market

- Pipeline replacement and rehabilitation projects in North America and Europe, along with new pipeline construction in Asia-Pacific and the Middle East, are strengthening long-term market demand

- However, high capital investment requirements, stringent environmental regulations, land acquisition challenges, and geopolitical risks may act as key restraints impacting market growth during the forecast period

- Asia-Pacific dominated the oil and gas pipeline market with the largest revenue share of 31.15% in 2025, driven by rapid expansion of energy infrastructure, rising oil and gas consumption, and large-scale investments in pipeline construction across China, India, Southeast Asia, and Australia

- North America is expected to register the fastest CAGR of 7.36% from 2026 to 2033, driven by modernization of aging pipeline infrastructure, shale gas expansion, LNG export growth, and increased focus on pipeline safety and monitoring

- The CAPEX segment dominated the market with around 58–60% share in 2025, driven by large-scale investments in new pipeline construction, cross-border transmission projects, LNG connectivity pipelines, and capacity expansion initiatives

Report Scope and Oil and Gas Pipeline Market Segmentation

|

Attributes |

Oil and Gas Pipeline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil and Gas Pipeline Market?

Increasing Shift Toward High-Capacity, Digitally Monitored, and Cross-Border Pipeline Infrastructure

- The oil and gas pipelines market is witnessing a growing shift toward high-capacity transmission pipelines designed to support long-distance transportation of crude oil, natural gas, and refined products

- Operators are increasingly integrating digital monitoring systems, SCADA, IoT sensors, and real-time leak detection technologies to improve safety, efficiency, and regulatory compliance

- Rising focus on cross-border and transnational pipeline projects is strengthening energy security and reducing dependency on maritime transport

- For instance, major players such as Enbridge, Kinder Morgan, TransCanada, Gazprom, and TotalEnergies are investing in pipeline modernization, automation, and integrity management solutions

- Growing emphasis on reducing transportation losses, operational downtime, and environmental risks is accelerating adoption of smart pipeline technologies

- As global energy demand rises, oil and gas pipelines will remain critical for reliable, cost-effective, and large-scale energy transportation

What are the Key Drivers of Oil and Gas Pipeline Market?

- Rising global demand for crude oil and natural gas driven by industrialization, urbanization, and power generation requirements

- For instance, during 2024–2025, several countries expanded natural gas pipeline networks to support LNG imports, city gas distribution, and cleaner energy transitions

- Increasing investments in upstream and midstream oil & gas infrastructure across Asia-Pacific, the Middle East, and North America

- Expansion of cross-country and cross-border pipelines to improve energy trade and supply stability

- Growing adoption of natural gas as a transition fuel to reduce carbon emissions compared to coal and oil

- Supported by long-term energy consumption growth and infrastructure investments, the Oil and Gas Pipelines market is expected to witness steady expansion

Which Factor is Challenging the Growth of the Oil and Gas Pipeline Market?

- High capital expenditure associated with pipeline construction, land acquisition, and maintenance restricts rapid project execution

- For instance, during 2024–2025, several pipeline projects faced delays due to regulatory approvals, environmental clearances, and geopolitical tensions

- Stringent environmental regulations and public opposition related to land use, safety, and ecological impact

- Risks related to pipeline leaks, corrosion, and aging infrastructure increase operational and compliance costs

- Volatility in oil and gas prices affects investment decisions and project feasibility

- To address these challenges, companies are focusing on advanced materials, predictive maintenance, digital monitoring, and sustainable pipeline development practices

How is the Oil and Gas Pipeline Market Segmented?

The market is segmented on the basis of activity, function, and location of deployment.

- By Activity

On the basis of activity, the oil and gas pipeline market is segmented into CAPEX and OPEX. The CAPEX segment dominated the market with around 58–60% share in 2025, driven by large-scale investments in new pipeline construction, cross-border transmission projects, LNG connectivity pipelines, and capacity expansion initiatives. Rising energy demand, energy security concerns, and government-backed infrastructure programs continue to support high capital spending on pipeline networks.

The OPEX segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing focus on pipeline maintenance, integrity management, digital monitoring, corrosion control, and operational efficiency. Aging pipeline infrastructure, stringent safety regulations, and adoption of smart monitoring technologies are accelerating operational expenditure across global oil and gas operators.

- By Function

On the basis of function, the market is segmented into Gathering Lines, Transmission Lines, and Distribution Lines. The Transmission Lines segment dominated the market with nearly 46–48% share in 2025, as these pipelines form the backbone of long-distance transportation of crude oil, natural gas, and refined products across regions and countries. Expansion of cross-country and cross-border energy corridors strongly supports this segment.

The Distribution Lines segment is projected to grow at the fastest CAGR during the forecast period, driven by rising city gas distribution networks, urbanization, and increasing adoption of natural gas for residential, commercial, and industrial applications. Growing emphasis on last-mile energy delivery further strengthens demand.

- By Location of Deployment

On the basis of deployment location, the oil and gas pipeline market is segmented into Onshore and Offshore. The Onshore segment dominated the market with approximately 67–69% share in 2025, owing to extensive onshore pipeline networks, lower installation costs, easier maintenance, and large-scale inland energy transportation requirements.

The Offshore segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising offshore oil and gas exploration, deepwater projects, and subsea pipeline developments, supported by technological advancements and increasing offshore investments.

Which Region Holds the Largest Share of the Oil and Gas Pipeline Market?

- Asia-Pacific dominated the oil and gas pipeline market with the largest revenue share of 31.15% in 2025, driven by rapid expansion of energy infrastructure, rising oil and gas consumption, and large-scale investments in pipeline construction across China, India, Southeast Asia, and Australia. Strong growth in refining capacity, LNG import terminals, cross-country transmission networks, and city gas distribution projects continues to support regional dominance

- Governments across Asia-Pacific are prioritizing energy security, pipeline connectivity, and transition fuels such as natural gas, resulting in sustained investments in onshore and offshore pipeline projects

- Presence of large-scale manufacturing hubs, expanding industrial bases, and rising urban energy demand further reinforce the region’s leadership

China Oil and Gas Pipeline Market Insight

China is the largest contributor in Asia-Pacific, supported by massive investments in crude oil, natural gas, and LNG pipeline networks. Expansion of long-distance transmission pipelines, shale gas development, and strategic energy corridors continues to drive strong market growth.

India Oil and Gas Pipeline Market Insight

India is witnessing rapid expansion driven by city gas distribution networks, refinery connectivity projects, and government initiatives to increase natural gas share in the energy mix. Rising urbanization and industrial demand are accelerating pipeline deployment.

North America Oil and Gas Pipeline Market

North America is expected to register the fastest CAGR of 7.36% from 2026 to 2033, driven by modernization of aging pipeline infrastructure, shale gas expansion, LNG export growth, and increased focus on pipeline safety and monitoring. Strong investments in pipeline rehabilitation, capacity expansion, and digital monitoring technologies across the U.S. and Canada support accelerated growth

U.S. Oil and Gas Pipeline Market Insight

The U.S. leads regional growth due to extensive shale production, expanding LNG export terminals, and large-scale transmission and gathering pipeline networks supporting oil and gas transportation.

Canada Oil and Gas Pipeline Market Insight

Canada contributes significantly through cross-border pipelines, oil sands transportation projects, and increasing investments in pipeline integrity and environmental compliance systems.

Which are the Top Companies in Oil and Gas Pipeline Market?

The oil and gas pipeline industry is primarily led by well-established companies, including:

- TransCanada (Canada)

- Enbridge (Canada)

- Kinder Morgan (U.S.)

- Williams Companies (U.S.)

- Cheniere Energy (U.S.)

- TotalEnergies (France)

- BP (U.K.)

- Shell (U.K.)

- Equinor (Norway)

- Gazprom (Russia)

What are the Recent Developments in Global Oil and Gas Pipeline Market?

- In January 2025, TC Energy completed the USD 4.5 billion Southeast Gateway Pipeline, adding 1.5 billion cubic feet per day (Bcf/d) of natural gas capacity to connect Texas supply with Florida demand centers, strengthening long-distance gas transmission and regional energy security

- In December 2024, ONEOK finalized its USD 18.8 billion acquisition of Magellan Midstream, creating North America’s largest integrated midstream platform, enhancing operational scale, asset integration, and market competitiveness

- In November 2024, Saipem secured a USD 2.8 billion contract from Petrobras to install 180 km of flexible subsea flowlines at the Mero field in 2,000 meters of water depth, reinforcing deepwater infrastructure development and offshore production efficiency

- In October 2024, Energy Transfer approved USD 6 billion for the Warrior Pipeline, a 200-mile, 42-inch natural gas pipeline linking Appalachian production to Gulf Coast LNG hubs, supporting LNG export growth and inter-basin connectivity

- In September 2024, Tenaris inaugurated its USD 1.2 billion Bay City mill, the first U.S. facility dedicated to hydrogen-ready seamless pipes, advancing low-carbon infrastructure readiness and future energy transition goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.