Global Oil And Gas Pipes Market

Market Size in USD Billion

CAGR :

%

USD

8.95 Billion

USD

12.95 Billion

2024

2032

USD

8.95 Billion

USD

12.95 Billion

2024

2032

| 2025 –2032 | |

| USD 8.95 Billion | |

| USD 12.95 Billion | |

|

|

|

|

What is the Global Oil and Gas Pipes Market Size and Growth Rate?

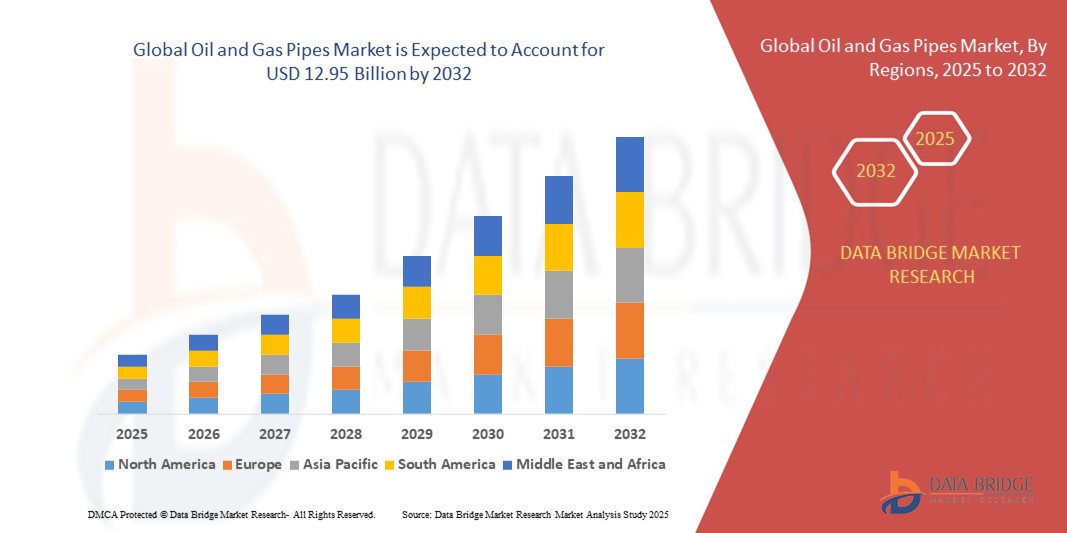

- The global oil and gas pipes market size was valued at USD 8.95 billion in 2024 and is expected to reach USD 12.95 billion by 2032, at a CAGR of 4.20% during the forecast period

- The Abundant natural gas reserves and cost-effective pricing propel its sales, particularly in power generation, fostering demand for oil and gas pipes. A shift to renewable energy sources supplements market growth

- The development of new natural gas resources, including shale gas, responds to rising fuel prices, driving international trade. Industry advancements, driven by government initiatives for smart city development, prioritize integrating pipelines with advanced technologies such as drone monitoring, distributed acoustic sensing, and in-line inspection

- Increasing investments in machine learning, IoT, and sensory technologies aim to boost operational efficiency, aligning with the escalating demand for expanded pipeline networks in the future

What are the Major Takeaways of Oil and Gas Pipes Market?

- The escalating global energy demand remains a prominent driver propelling the need for oil and gas pipelines. As worldwide energy consumption steadily rises, there is an inherent necessity for the expansion and upkeep of pipeline infrastructures. These pipelines play a crucial role in ensuring the efficient transportation of oil and gas resources, meeting the growing demand for energy

- The ongoing demand surge underscores the vital role that well-maintained and expanded pipeline networks play in facilitating the reliable and continuous supply of vital energy resources on a global scale

- North America dominated the oil and gas pipes market with the largest revenue share of 33.12% in 2024, driven by increasing oil and gas exploration activities, substantial investments in shale gas projects, and the modernization of aging pipeline infrastructure

- Asia-Pacific oil and gas pipes market is poised to grow at the fastest CAGR of 9.36% from 2025 to 2032, driven by large-scale pipeline construction projects and rising energy consumption in China, India, and Southeast Asia

- The Stainless Steel segment dominated the oil and gas pipes market with the largest market revenue share of 52.6% in 2024, driven by its superior strength, corrosion resistance, and ability to handle extreme pressures and temperatures in both onshore and offshore applications

Report Scope and Oil and Gas Pipes Market Segmentation

|

Attributes |

Oil and Gas Pipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil and Gas Pipes Market?

Rising Adoption of High-Performance and Sustainable Pipe Materials

- A significant and accelerating trend in the global oil and gas pipes market is the shift toward high-performance materials such as corrosion-resistant alloys (CRA), composite pipes, and thermoplastic materials, aimed at enhancing durability and reducing maintenance costs

- For instance, companies are increasingly deploying thermoplastic composite pipes (TCPs) for offshore operations, offering lightweight, flexible, and corrosion-free alternatives to traditional steel pipes. TechnipFMC and Strohm have advanced TCP applications to reduce operational risks and extend pipeline lifecycles

- Furthermore, the growing focus on sustainability is driving the development of eco-friendly pipes designed to minimize leakage and environmental impact, particularly in regions with stringent emission regulations

- The integration of smart pipeline monitoring technologies—such as IoT-based sensors and AI-driven predictive maintenance—further complements this trend, providing operators with real-time data to prevent failures and optimize asset utilization

- This transition toward innovative, durable, and environmentally responsible piping solutions is reshaping the industry, positioning advanced materials as a cornerstone for future oil and gas infrastructure growth

What are the Key Drivers of Oil and Gas Pipes Market?

- Increasing global energy consumption and new oil & gas discoveries, particularly in deep-water and shale reserves, are fueling demand for high-quality pipelines

- For instance, in March 2024, Tenaris announced a USD 600 million investment to expand seamless pipe production in the U.S., supporting rising shale gas development, while ArcelorMittal introduced high-strength pipes for offshore platforms

- Infrastructure Modernization Initiatives: Ageing pipeline networks in regions such as North America and Europe are undergoing large-scale replacement to meet safety and efficiency standards, driving market expansion

- Technological Advancements: Adoption of digital pipeline monitoring, automated welding, and advanced coatings are enhancing operational efficiency and reducing long-term costs, increasing the attractiveness of premium pipe solutions

- Collectively, these drivers are creating sustained demand for Oil and Gas Pipes across upstream, midstream, and downstream operations globally

Which Factor is challenging the Growth of the Oil and Gas Pipes Market?

- Fluctuating steel and alloy costs significantly impact production expenses, making it difficult for manufacturers to maintain consistent pricing

- For instance, the 2023 surge in steel prices by over 20% globally caused project delays for companies such as Vallourec and Welspun Corp, underscoring the market’s vulnerability to raw material volatility

- Stringent Environmental Regulations: Increasing global pressure to reduce carbon emissions and the gradual transition to renewable energy sources are affecting long-term oil & gas infrastructure investments

- High Installation and Maintenance Costs: Laying and maintaining pipelines, especially in harsh offshore environments, requires substantial capital expenditure, which can deter smaller operators

- Overcoming these challenges will require innovative cost-reduction strategies, adoption of advanced materials, and alignment with sustainability goals, enabling the industry to adapt to evolving energy landscapeS

How is the Oil and Gas Pipes Market Segmented?

The market is segmented on the basis of material and application.

- By Material

On the basis of material, the oil and gas pipes market is segmented into Stainless Steel, HDPE (High-Density Polyethylene), and PVC (Polyvinyl Chloride). The Stainless Steel segment dominated the oil and gas pipes market with the largest market revenue share of 52.6% in 2024, driven by its superior strength, corrosion resistance, and ability to handle extreme pressures and temperatures in both onshore and offshore applications. Stainless steel pipes are widely preferred for transporting crude oil, natural gas, and refined products, especially in harsh environments such as deep-water exploration. In addition, its long service life and compliance with stringent safety standards further strengthen its adoption across global oil and gas projects.

The HDPE segment is anticipated to witness the fastest growth rate of 20.4% from 2025 to 2032, propelled by its increasing use in low-pressure applications such as water injection, gas distribution, and gathering lines. HDPE pipes offer flexibility, lightweight design, and cost efficiency, making them ideal for remote installations. Their chemical resistance and low maintenance needs are driving their rising popularity in emerging economies with expanding oil and gas infrastructure.

- By Application

On the basis of application, the oil and gas pipes market is segmented into External Transportation & Distribution and Internal Processes. The External Transportation & Distribution segment accounted for the largest market revenue share of 61.3% in 2024, supported by the rising demand for extensive pipeline networks to transport crude oil, natural gas, and refined petroleum products from production facilities to end users. Ongoing cross-border pipeline projects and increasing investments in midstream infrastructure further contribute to this segment’s dominance.

The Internal Processes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing adoption of specialized piping systems in refining, petrochemical processing, and offshore platforms. These pipes are designed to withstand high temperatures, aggressive chemicals, and abrasive materials, ensuring safety and operational efficiency in complex oil and gas processing environments.

Which Region Holds the Largest Share of the Oil and Gas Pipes Market?

- North America dominated the oil and gas pipes market with the largest revenue share of 33.12% in 2024, driven by increasing oil and gas exploration activities, substantial investments in shale gas projects, and the modernization of aging pipeline infrastructure

- The region benefits from advanced drilling technologies and extensive midstream networks, which boost the demand for durable and high-performance pipes for upstream, midstream, and downstream operations

- Favorable regulatory frameworks and rising energy exports further position North America as a global leader in oil and gas pipeline development, making it a key hub for industry growth

U.S. Oil and Gas Pipes Market Insight

The U.S. captured the largest revenue share in 2024 within North America, supported by the expansion of shale gas extraction and rising offshore drilling projects in the Gulf of Mexico. Increasing investments in pipeline safety, along with the replacement of aging infrastructure, are major growth drivers. In addition, the U.S. energy export boom—particularly LNG exports—is creating strong demand for new transportation pipelines to connect production sites with terminals.

Europe Oil and Gas Pipes Market Insight

The Europe oil and gas pipes market is projected to grow steadily, driven by the region’s push to diversify energy sources and upgrade its gas distribution network. Increasing reliance on imported natural gas and the expansion of cross-border pipeline projects, such as the Trans Adriatic Pipeline, are boosting market demand. The region’s focus on reducing methane emissions and implementing sustainable materials is also influencing the adoption of advanced, eco-friendly pipe solutions.

U.K. Oil and Gas Pipes Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by offshore oil and gas developments in the North Sea and investments in subsea pipeline infrastructure. The U.K.’s focus on integrating carbon capture and storage (CCS) technologies with existing pipelines further drives market growth, aligning with the country’s energy transition goals.

Germany Oil and Gas Pipes Market Insight

The Germany market is expected to expand at a considerable CAGR, driven by efforts to modernize its gas transportation network and ensure supply security amid shifting energy dynamics. Rising imports of LNG and the integration of hydrogen-ready pipelines to support future energy needs are significant factors shaping demand. Germany’s emphasis on sustainability and advanced materials also supports the adoption of corrosion-resistant and high-strength pipes.

Which Region is the Fastest Growing Region in the Oil and Gas Pipes Market?

Asia-Pacific oil and gas pipes market is poised to grow at the fastest CAGR of 9.36% from 2025 to 2032, driven by large-scale pipeline construction projects and rising energy consumption in China, India, and Southeast Asia. Expanding offshore exploration, coupled with government initiatives to strengthen domestic gas distribution networks, is fueling regional demand.

Japan Oil and Gas Pipes Market Insight

The Japan market is gaining traction due to investments in LNG import terminals and associated pipeline infrastructure. The country’s shift towards cleaner fuels, alongside the development of hydrogen transportation networks, is expected to create new opportunities for advanced piping materials.

China Oil and Gas Pipes Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by massive investments in cross-country pipelines and the expansion of its natural gas grid to meet growing urban demand. Government-backed initiatives for energy security and the emergence of domestic pipe manufacturers are key factors strengthening China’s position as a dominant market player.

Which are the Top Companies in Oil and Gas Pipes Market?

The oil and gas pipes industry is primarily led by well-established companies, including:

- Tenaris (Luxembourg)

- Vallourec (France)

- TMK (Russia)

- Nippon Steel Corporation (Japan)

- ArcelorMittal (Luxembourg)

- JFE Holdings, Inc. (Japan)

- Schlumberger Limited (U.S.)

- Tubacex (Spain)

- Chelpipe (Russia)

- National Oilwell Varco (U.S.)

- TechnipFMC (U.S.)

- Sumitomo Corporation (Japan)

- Welspun Corp Limited (India)

- EVRAZ (U.K.)

- Hyundai Steel Company (South Korea)

What are the Recent Developments in Global Oil and Gas Pipes Market?

- In January 2025, Baker Hughes received an order from Técnicas Reunidas to supply six propane compressors and six gas compression trains for the third phase of Aramco’s Jafurah gas field development in Saudi Arabia. The company will also provide electric motor-driven compression solutions, further strengthening its role in the natural gas value chain. This order complements its long-term collaboration with Aramco, including the initial phases of the gas compression facility, Jafurah gas plant, Hawiyah gas plant, Haradh gas plant, and the third phase of the country’s Master Gas System project. This milestone reinforces Baker Hughes’ growing influence in advanced gas infrastructure projects worldwide

- In January 2025, BP successfully began gas flow from wells at the Greater Tortue Ahmeyim (GTA) Phase 1 LNG project, channeling production to its FPSO vessel for the next stage of commissioning. Once completed, GTA Phase 1 is expected to deliver over 2.3 million tonnes of LNG annually, marking a significant achievement in the company’s expansion strategy. This development strengthens BP’s position in both domestic and global LNG markets

- In September 2024, Exxon Mobil Corporation and Mitsubishi Corporation signed a project framework agreement for Mitsubishi’s participation in Exxon Mobil’s advanced Baytown facility in Texas. The project aims to produce low-carbon hydrogen with 98% carbon capture efficiency alongside low-carbon ammonia, with a planned output of up to 1 billion bcf of hydrogen per day and 1 million tons of ammonia annually. This initiative highlights their joint commitment to advancing sustainable energy solutions

- In December 2023, data from the Global Gas Infrastructure Tracker revealed approximately 69,700 kilometers of gas transmission pipelines under construction globally, valued at USD 193.9 billion. Including announced projects, a total of 228,700 kilometers of pipelines are under development worldwide, with a combined cost of USD 723 billion. This surge in investments underscores the growing importance of pipeline infrastructure for future energy demands

- In May 2023, Kinetik Holdings Inc. announced the completion of its sale and direct transfer of a 16% equity interest in the Gulf Coast Express pipeline to an affiliate of ArcLight Capital Partners LLC for USD 510 million upfront and an additional USD 30 million deferred payment tied to a future capacity expansion project. This transaction enhances Kinetik’s financial flexibility while supporting future pipeline growth initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oil And Gas Pipes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oil And Gas Pipes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oil And Gas Pipes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.