Global Oil Country Tubular Goods Market

Market Size in USD Billion

CAGR :

%

USD

21.37 Billion

USD

38.97 Billion

2024

2032

USD

21.37 Billion

USD

38.97 Billion

2024

2032

| 2025 –2032 | |

| USD 21.37 Billion | |

| USD 38.97 Billion | |

|

|

|

|

What is the Global Oil Country Tubular Goods Market Size and Growth Rate?

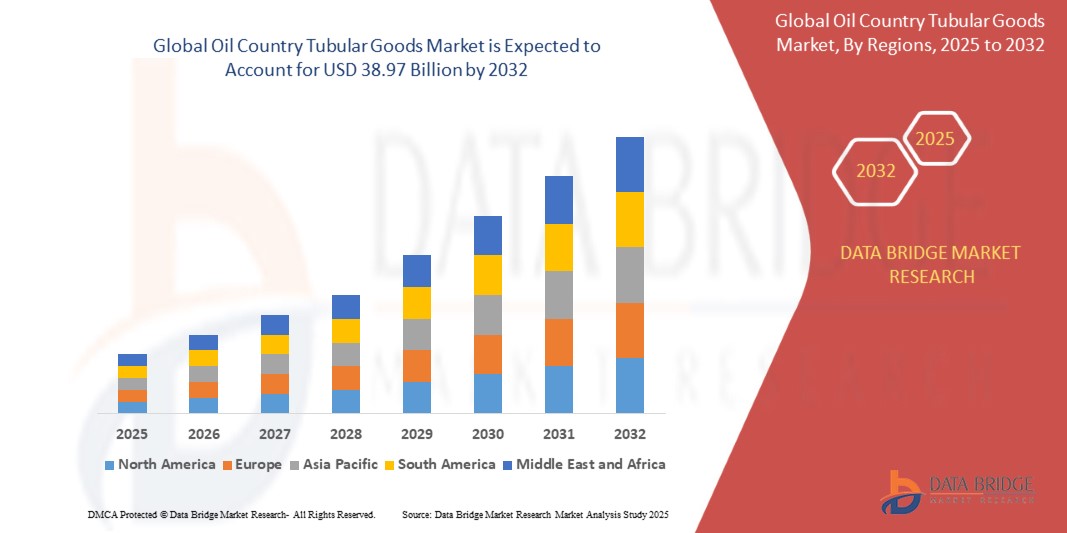

- The global oil country tubular goods market size was valued at USD 21.37 billion in 2024 and is expected to reach USD 38.97 billion by 2032, at a CAGR of 6.90% during the forecast period

- The market expansion is primarily driven by the rising demand for energy resources, increasing exploration and production (E&P) activities, and continuous technological advancements in drilling methods across onshore and offshore operations

- Furthermore, the global shift toward unconventional resources such as shale gas and tight oil, coupled with higher investments in deep-water and ultra-deep-water projects, is significantly boosting OCTG adoption and accelerating overall industry growth

What are the Major Takeaways of Oil Country Tubular Goods Market?

- Oil country tubular goods, including drill pipes, casing pipes, and tubing, are crucial in supporting drilling operations, ensuring well integrity, and enabling safe hydrocarbon production across diverse environments

- The increasing demand for premium-grade OCTG, driven by deeper wells and harsher drilling conditions, along with a rising preference for seamless pipes over welded alternatives, is shaping market trends

- Growing investments in exploration projects, combined with the energy sector’s push toward efficiency and reliability, are making OCTG a critical enabler of global oil and gas production, thereby ensuring strong and sustained market growth

- North America dominated the oil country tubular goods market with the largest revenue share of 39.71% in 2024, driven by rising exploration and production (E&P) activities, technological drilling advancements, and strong investments in unconventional oil & gas projects

- Asia-Pacific OCTG market is forecasted to grow at the fastest CAGR of 4.7% between 2025 and 2032, driven by rapid urbanization, industrialization, and energy demand in China, India, and Southeast Asia

- The seamless segment dominated the OCTG market with the largest market revenue share of 62.5% in 2024, driven by its superior strength, uniformity, and reliability in withstanding high pressure and temperature conditions in oil and gas drilling

Report Scope and Oil Country Tubular Goods Market Segmentation

|

Attributes |

Oil Country Tubular Goods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil Country Tubular Goods Market?

Shift Toward Digitalization and Smart Pipe Monitoring

- A significant and accelerating trend in the global oil country tubular goods (OCTG) market is the adoption of digital technologies such as IoT, AI, and advanced sensors for real-time monitoring of pipelines and drilling activities

- For instance, Tenaris has introduced digital OCTG solutions that provide predictive maintenance insights, reducing downtime and operational risks for oil producers

- Smart OCTG enables operators to detect corrosion, pressure changes, and fatigue early, ensuring longer service life and safety in high-pressure drilling environments

- Integration of digital OCTG with oilfield management systems allows centralized monitoring of well operations, inventory, and performance analytics

- Companies such as Vallourec are advancing “smart tubes” embedded with sensors to collect and transmit real-time well data, enhancing efficiency and reliability

- This digital shift is redefining industry standards, positioning OCTG not just as steel pipes but as intelligent assets critical to next-generation oilfield operations

What are the Key Drivers of Oil Country Tubular Goods Market?

- The rising global demand for energy and the expansion of oil & gas exploration activities are the primary drivers of OCTG adoption

- For instance, in February 2024, ArcelorMittal announced investments in premium seamless OCTG production to meet increasing U.S. shale oilfield demand

- OCTG offers durability, corrosion resistance, and high performance in deep-water and unconventional drilling, making it vital for modern exploration.

- The shale boom in North America and ongoing offshore projects in the Middle East are pushing oilfield operators to invest heavily in premium-grade OCTG

- Furthermore, the global shift towards energy security is encouraging countries to boost domestic oilfield production, thereby driving OCTG demand

- Advancements in heat-treated and high-strength alloys further enhance OCTG capabilities, expanding its role in both onshore and offshore drilling operations

Which Factor is Challenging the Growth of the Oil Country Tubular Goods Market?

- Volatility in crude oil prices remains a major challenge, as it directly impacts exploration budgets and OCTG demand cycles

- For instance, during the oil price fluctuations of 2023, several exploration projects in North America and Asia-Pacific were deferred, lowering OCTG consumption

- In addition, high manufacturing costs for premium OCTG, due to alloying and heat treatment, limit adoption in cost-sensitive regions

- Geopolitical risks and trade restrictions, particularly involving steel imports, also affect the global OCTG supply chain

- Growing environmental regulations and the push toward renewable energy transition create long-term uncertainty for OCTG demand

- Overcoming these challenges will require cost optimization, supply chain resilience, and product innovation, ensuring that OCTG remains a critical enabler of safe and efficient oilfield operations

How is the Oil Country Tubular Goods Market Segmented?

The market is segmented on the basis of process, product, grade, dimension, and application.

• By Process

On the basis of process, the OCTG market is segmented into Electric Resistance Welded (ERW) and Seamless. The seamless segment dominated the OCTG market with the largest market revenue share of 62.5% in 2024, driven by its superior strength, uniformity, and reliability in withstanding high pressure and temperature conditions in oil and gas drilling. Seamless OCTG is widely preferred for critical applications such as deep-water drilling, high-pressure wells, and harsh offshore environments. Its ability to minimize failure risks makes it the preferred choice among exploration and production companies.

The ERW segment is projected to witness the fastest CAGR from 2025 to 2032, supported by its cost-effectiveness, ease of manufacturing, and increasing usage in shallow wells and onshore drilling operations. As global drilling activities expand in cost-sensitive regions, ERW pipes are gaining traction, particularly where moderate performance requirements are sufficient.

• By Product

On the basis of product, the OCTG market is segmented into Drill Pipe, Casing Pipe, Tubing Pipe, and Others. The Casing Pipe segment dominated the OCTG market with a 49.8% revenue share in 2024, as casing is essential for stabilizing well structures, preventing contamination, and ensuring operational safety during drilling. The rising demand for energy and exploration of unconventional reserves has significantly boosted casing pipe consumption across both onshore and offshore projects.

The Tubing Pipe segment is anticipated to record the fastest CAGR from 2025 to 2032, driven by increasing oil production activities and the need for efficient fluid transport from wells to the surface. Tubing pipes play a vital role in production efficiency, particularly in mature oil fields where enhanced oil recovery (EOR) techniques are being adopted. Growing investment in shale oil and tight gas exploration further supports the growth of tubing pipes globally.

• By Grade

On the basis of grade, the OCTG market is segmented into API Grade and Premium Grade. The API Grade segment dominated the OCTG market with 58.6% revenue share in 2024, owing to its widespread acceptance, standardized quality, and cost-efficiency. API grade products are widely used in conventional oil and gas drilling operations, particularly in onshore wells, where standard performance suffices.

The Premium Grade segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for high-performance tubular goods in deep-water drilling, horizontal wells, and high-pressure, high-temperature (HPHT) environments. Premium grade products provide enhanced sealing, superior collapse resistance, and longer service life, making them essential in challenging drilling conditions. The shift towards offshore exploration and unconventional hydrocarbon reserves is expected to accelerate the adoption of premium grade OCTG in the coming years.

• By Dimension

On the basis of dimension, the OCTG market is segmented into Below 140 mm, 141 mm to 200 mm, and Up to 406 mm. The 141 mm to 200 mm segment dominated the market with a 45.1% revenue share in 2024, as this range is widely preferred in standard drilling and casing operations. These dimensions offer versatility and are commonly used in both onshore and offshore wells. Their balanced cost, performance, and wide applicability across exploration projects make them the most utilized category.

The Up to 406 mm segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the expansion of deep-water and ultra-deep-water drilling projects. Larger-diameter OCTG is increasingly required in offshore exploration to support high-capacity wells and advanced casing programs. Growing investment in complex wells with larger borehole designs is driving demand for these high-dimension OCTG pipes.

• By Application

On the basis of application, the OCTG market is segmented into Onshore and Offshore. The Onshore segment dominated the market with a 66.3% revenue share in 2024, driven by the abundance of onshore drilling projects worldwide, lower operational costs, and easier accessibility compared to offshore fields. Many key oil-producing nations, particularly in the Middle East, North America, and Asia-Pacific, continue to rely heavily on onshore reserves, ensuring steady demand for OCTG in this segment.

The Offshore segment is forecasted to witness the fastest CAGR from 2025 to 2032, supported by rising investments in deep-water and ultra-deep-water projects, especially in the Gulf of Mexico, Brazil, and West Africa. Offshore wells demand more advanced OCTG, including premium grades and larger dimensions, to withstand extreme operating conditions. As global oil companies push toward new frontier exploration, the offshore application segment is set to expand significantly.

Which Region Holds the Largest Share of the Oil Country Tubular Goods Market?

- North America dominated the oil country tubular goods market with the largest revenue share of 39.71% in 2024, driven by rising exploration and production (E&P) activities, technological drilling advancements, and strong investments in unconventional oil & gas projects

- The region benefits from shale gas exploration, offshore drilling expansions, and government support for energy independence, creating consistent demand for OCTG products

- Furthermore, the presence of leading oilfield service providers and steel manufacturers strengthens supply chain efficiency, securing North America’s leading position in the global market

U.S. Oil Country Tubular Goods Market Insight

U.S. OCTG market dominated the revenue share of North America in 2024, fueled by robust shale gas development and horizontal drilling activities. Rising investments in the Permian Basin and Eagle Ford are accelerating OCTG consumption. In addition, the adoption of premium-grade and corrosion-resistant tubular products is growing, given the need for durability in deepwater and high-pressure wells. Expanding rig counts and advancements in hydraulic fracturing further reinforce U.S. dominance.

Europe Oil Country Tubular Goods Market Insight

Europe OCTG market is set to expand at a substantial CAGR, supported by ongoing exploration in the North Sea and increased energy security measures. Stricter EU regulations on drilling safety and efficiency drive the adoption of premium connections and seamless pipes. Rising urbanization and demand for energy in industrial hubs continue to strengthen OCTG applications. Europe also focuses on modernizing its oil infrastructure, especially in offshore projects, boosting market growth.

U.K. Oil Country Tubular Goods Market Insight

U.K. OCTG market is projected to grow at a noteworthy CAGR, with investments in offshore exploration in the North Sea and Shetland basin. The country’s strategy for energy diversification and local production is spurring tubular goods demand. Rising concerns around energy security and the government’s push for domestic oil & gas self-reliance further fuel OCTG adoption. The U.K.’s strong engineering and oilfield service sector provide additional growth support.

Germany Oil Country Tubular Goods Market Insight

Germany OCTG market is expected to grow steadily, driven by industrial energy demand and investments in natural gas reserves. Germany emphasizes sustainable and advanced drilling technologies, promoting the use of high-strength and eco-friendly tubular products. The nation’s engineering expertise and infrastructure modernization programs, particularly in natural gas storage and transport, are encouraging the integration of OCTG solutions into both upstream and midstream projects.

Which Region is the Fastest Growing Region in the Oil Country Tubular Goods Market?

Asia-Pacific OCTG market is forecasted to grow at the fastest CAGR of 4.7% between 2025 and 2032, driven by rapid urbanization, industrialization, and energy demand in China, India, and Southeast Asia. Government-backed investments in exploration projects, LNG terminals, and offshore rigs are pushing adoption. With APAC emerging as a manufacturing hub for tubular goods, competitive pricing and high supply availability are expanding the consumer base, making it the fastest-growing market.

Japan Oil Country Tubular Goods Market Insight

Japan OCTG market is gaining traction owing to high technological innovation and offshore exploration projects. Japan’s strong focus on energy security, especially post-nuclear phase-out, is driving natural gas exploration and import-related drilling activities. Growing collaborations with regional suppliers and the adoption of premium seamless pipes for offshore wells further support OCTG demand. The emphasis on automation and smart drilling systems also enhances Japan’s role in the APAC market.

China Oil Country Tubular Goods Market Insight

China OCTG market accounted for the largest revenue share in APAC in 2024, supported by extensive drilling activities in onshore and offshore basins. China’s expanding middle class and rising energy consumption are fueling continuous exploration investments. Domestic manufacturers offer affordable OCTG solutions, making the market highly competitive. Government initiatives for shale gas, deepwater exploration, and smart energy projects are further boosting demand for premium-grade tubular products.

Which are the Top Companies in Oil Country Tubular Goods Market?

The oil country tubular goods industry is primarily led by well-established companies, including:

- Tianjin Pipe Corporation (TPCO) (China)

- Zekelman Industries (U.S.)

- TMK Group (Russia)

- ArcelorMittal (Luxembourg)

- Tenaris (Luxembourg)

- EVRAZ North America (U.S.)

- PAO TMK (Russia)

- JFE Steel Corporation (Japan)

- Vallourec (France)

- Sumitomo Corporation (Japan)

- Nippon Steel & Sumitomo Metal Corporation (Japan)

- ChelPipe Group (Russia)

- National Oilwell Varco (NOV) (U.S.)

- SeAH Steel Corporation (South Korea)

- U.S. Steel Tubular Products (U.S.)

What are the Recent Developments in Global Oil Country Tubular Goods Market?

- In November 2024, Mubadala Investment Company acquired a 49% stake in Tubacex’s Oil Country Tubular Goods (OCTG) business, aiming to enhance Tubacex’s presence in the CRA OCTG sector within the Middle East. This strategic investment is expected to significantly strengthen Tubacex’s regional capabilities

- In July 2024, Ramco Norway, a provider of care and maintenance services for OCTG and drilling tubulars, secured a long-term contract with Equinor to service 80% of the oil and gas pipe volume transported from Fjord Base in Florø to the Norwegian Continental Shelf (NCS). This agreement is anticipated to solidify Ramco’s role as a key service partner for Equinor

- In January 2024, Tenaris finalized a three-year contract with Petrobras for the supply of tubing made from corrosion-resistant alloys (CRA) for offshore operations in Brazil, incorporating TenarisHydril Blue premium connections and Dopeless technology. This collaboration is set to bolster offshore efficiency and reliability for Petrobras

- In May 2023, Tenaris secured a five-year agreement with Neptune Energy for the supply of OCTG and services for drilling projects on the Norwegian Continental Shelf, covering a wide range of casing including high-performance conductor casing. This long-term partnership is expected to enhance Tenaris’s footprint in the Norwegian oil and gas sector

- In January 2022, Jindal SAW formed a joint venture with Hunting Energy Services to establish a premium OCTG threading plant in Nashik, India, under a 51%:49% ownership structure with an investment of USD 20–25 million. This initiative is poised to expand Jindal SAW’s manufacturing and service capabilities in India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.