Global Oil Shale Market

Market Size in USD Billion

CAGR :

%

USD

4.42 Billion

USD

15.64 Billion

2024

2032

USD

4.42 Billion

USD

15.64 Billion

2024

2032

| 2025 –2032 | |

| USD 4.42 Billion | |

| USD 15.64 Billion | |

|

|

|

|

Oil Shale Market Size

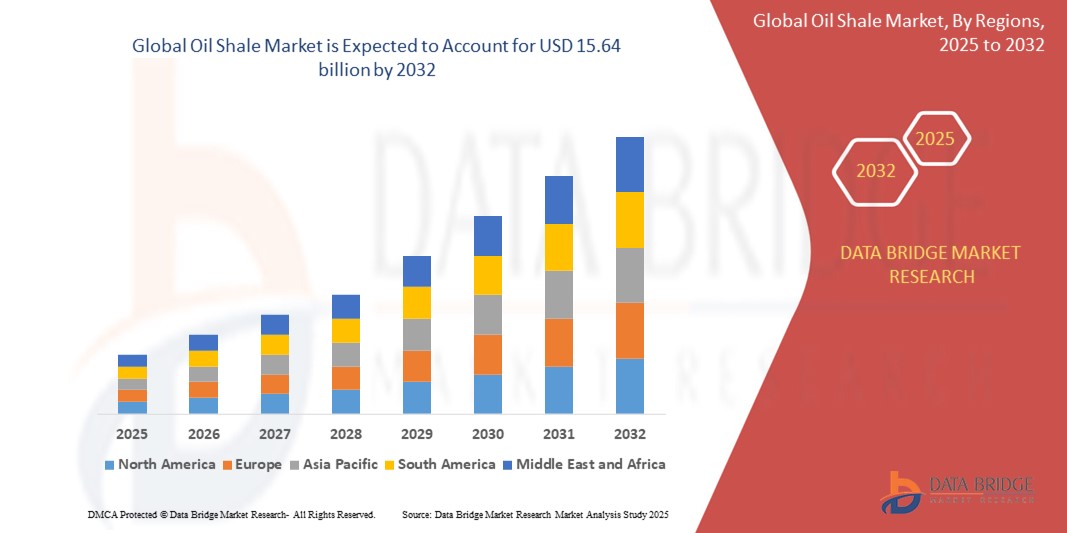

- The global Oil Shale market was valued at USD 4.42 billion in 2024 and is expected to reach USD 15.64 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 17.10%, primarily driven by the increasing demand for alternative energy sources

- This growth is driven by factors such as the rising focus on energy security and the development of unconventional oil resources

Oil Shale Market Analysis

- The global oil shale market is experiencing significant growth, propelled by technological advancements and increasing energy demands

- The market encompasses various products, including shale gasoline, shale diesel, kerosene, and heavy oil. Each product serves distinct applications, contributing to the market's diversification

- Advancements in extraction technologies, such as in-situ and ex-situ methods, have enhanced the efficiency and economic viability of oil shale extraction. These innovations have attracted significant investments from major energy companies

- Oil shale serves multiple purposes, including fuel production, electricity generation, and as a raw material in cement and chemical industries. Its versatility supports its growing demand across various sectors

- Forecasts suggest that the global oil shale market will continue its upward trajectory, with expectations to reach approximately USD 10.0 billion by 2035, driven by sustained technological progress and rising energy consumption

- For instance, Chevron Corporation has recently commenced production from its Anchor project in the Gulf of Mexico's deepwater sector, marking a significant milestone in offshore oil development

Report Scope and Oil Shale Market Segmentation

|

Attributes |

Oil Shale Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oil Shale Market Trends

“Integration of Sustainable Practices in Oil Shale Extraction”

- As global awareness of climate change intensifies, the oil shale industry is adopting sustainable extraction methods to minimize ecological impact. Techniques such as in-situ retorting heat oil shale underground, converting kerogen into hydrocarbons without extensive surface mining, thereby reducing land disturbance and preserving ecosystems.

- Advancements in extraction technologies, including hydraulic fracturing and horizontal drilling, have unlocked previously inaccessible oil shale reserves. These innovations enhance production efficiency and economic viability, contributing to increased energy security

- Stricter environmental regulations are prompting companies to invest in cleaner technologies. Implementing carbon capture and storage (CCS) technologies captures CO₂ emissions from oil shale operations, addressing greenhouse gas concerns and aligning with global emission reduction goals

- For instance, Estonia utilizes oil shale as the primary energy source, with oil shale-fired power stations contributing significantly to the country's electricity generation. This approach demonstrates how integrating sustainable extraction methods can lead to energy independence and economic benefits

Oil Shale Market Dynamics

Driver

“Technological Advancements in Extraction Methods”

- Advancements in extraction technologies, such as in-situ retorting and hydraulic fracturing, have significantly improved the efficiency of oil shale extraction

- For Instance, In-situ retorting involves heating oil shale underground to convert kerogen into hydrocarbons, reducing the need for extensive mining operations and minimizing surface disturbance. This method enhances resource recovery while addressing environmental concerns associated with traditional extraction techniques

- Innovative techniques like Chevron's "triple-frac" method, which involves simultaneously fracturing three wells, have led to a 25% increase in production speed and a 12% reduction in per-well costs. By optimizing the extraction process, companies can achieve higher output with lower operational expenses, making oil shale projects more economically viable

- Technological innovations are also focused on reducing the environmental footprint of oil shale extraction. Implementing carbon capture and storage (CCS) technologies can capture CO₂ emissions from processing activities, addressing greenhouse gas concerns

- Additionally, advancements in water management techniques aim to minimize water usage and prevent contamination, particularly in arid regions where water scarcity is a critical issue

- Advanced drilling and processing technologies have unlocked previously inaccessible oil shale reserves, expanding the resource base. This has opened new opportunities for energy production, especially in regions with substantial untapped oil shale deposits, contributing to global energy security

Opportunity

“Transition Fuel for Renewable Energy”

- Oil shale can serve as a transition fuel, bridging the gap between fossil fuels and renewable energy sources. Its utilization can provide a stable energy supply while renewable technologies are further developed and integrated into the energy mix

- Developing oil shale resources can stimulate economic growth by creating jobs and generating revenue, particularly in regions with abundant deposits. It can also enhance energy access in remote or underserved areas, supporting socioeconomic development and improving living standards

- Investments in oil shale extraction technologies can lead to innovations that benefit other sectors.

- For Instance, advancements in carbon capture and storage (CCS) developed for oil shale processing can be applied to other industries, contributing to broader environmental goals

- Incorporating oil shale into the energy portfolio diversifies energy sources, enhancing energy security and reducing dependence on a single energy type. This diversification is essential for countries seeking to balance energy needs with environmental commitments

Restraint/Challenge

“Environmental and Regulatory Concerns”

- Oil shale extraction and processing are associated with high greenhouse gas emissions, including CO₂ and methane. The energy-intensive nature of these processes contributes significantly to carbon emissions, challenging global efforts to combat climate change

- Extracting oil shale requires substantial water resources, raising concerns in water-scarce regions. Additionally, the process can lead to water contamination with pollutants such as phenols and heavy metals, impacting local ecosystems and communities

- Surface mining of oil shale leads to land degradation, including habitat destruction and soil erosion. Reclaiming mined land is challenging and may not fully restore original ecosystems, leading to long-term environmental impacts

- The oil shale industry faces a complex and evolving regulatory landscape, with varying policies across regions. Uncertainty in regulations regarding environmental standards, land use, and taxation can hinder investment and development, as companies navigate differing requirements and potential policy changes

- Environmental groups and local communities often oppose oil shale projects due to concerns over environmental degradation and health risks. This opposition can lead to legal challenges, project delays, and increased operational costs, affecting the overall feasibility of oil shale developments

Oil Shale Market Scope

The market is segmented on the basis product, technology, application, type, and processes.

|

Segmentation |

Sub-Segmentation |

|

By Product: |

|

|

By Technology: |

|

|

By Application: |

|

|

By Type: |

|

|

By Processes |

|

Oil Shale Market Regional Analysis

“North America is the Dominant Region in the Oil Shale Market”

- The region boasts significant oil shale deposits, notably in the Green River Formation, which is among the world's largest known reserves

- North America has been at the forefront of developing and implementing advanced extraction technologies, such as hydraulic fracturing and electro-thermal heating, enhancing extraction efficiency and economic viability

- Leveraging domestic oil shale resources aligns with the region's goals of reducing reliance on oil imports and bolstering energy security

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is identified as the fastest-growing market for oil shale, driven by increasing energy demands and substantial shale reserves

- For Instance, countries such as China, Thailand, Pakistan, Kazakhstan, and Turkey hold considerable oil shale deposits, offering substantial potential for development

- There is a growing emphasis on investing in advanced extraction technologies to harness these resources efficiently

- Supportive policies and initiatives by governments in the region are fostering the growth of the oil shale industry, aiming to meet the rising energy demands

- The combination of abundant resources, technological advancements, and supportive policies positions Asia-Pacific as a key player in the global oil shale market's growth trajectory

Oil Shale Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- American Shale Oil LLC (U.S.)

- AuraSource, Inc (U.S.)

- Blue Ensign Technologies Ltd (U.K.)

- Chevron Corporation (U.S.)

- Enefit Kaevandused (Estonia)

- Electro-Petroleum Inc (U.S.)

- Exxon Mobil Corporation (U.S.)

- Occidental Petroleum Corporation (U.S.)

- Chesapeake (U.S.)

- Marathon Oil Company (U.S.)

- EOG Resources, Inc (U.S.)

- Pioneer Natural Resources Company (U.S.)

- SM Energy (U.S.)

- ConocoPhillips Company (U.S.)

- Cabot Oil & Gas Corporation (U.S.)

Latest Developments in Global Oil Shale Market

- In April 2025, Saudi Arabia advocated for a substantial increase in oil production within the OPEC+ alliance, aiming to penalize countries like Kazakhstan and Iraq for exceeding production limits. This decision resulted in an 8% drop in oil prices, with Brent crude falling below $65 per barrel, the lowest since 2021

- In November 2024, Exxon Mobil initiated a tender for a USD 75 million project to construct a large oil pipeline in Argentina, aiming to boost oil production in the Vaca Muerta shale play and enhance transportation capabilities

- In May 2024 - ConocoPhillips announced that they are set to acquire Marathon Oil in a $22.5 billion deal, marking one of the largest energy mergers in recent years. This strategic move highlights the ongoing consolidation in the energy sector, driven by companies seeking scale and operational efficiencies amid fluctuating oil prices

- In October 2023, Chevron acquired Hess Corporation in an all-stock deal valued at USD 53 billion. This acquisition opened new opportunities in U.S. shale plays and oil-rich regions like Guyana, enhancing Chevron's global oil and gas portfolio

- In July 2023, Exxon Mobil Corporation declared that it had finalized a deal to purchase Denbury Inc., a seasoned expert in enhanced oil recovery and carbon capture, use, and storage (CCS) systems. Using ExxonMobil's share price, the acquisition is an all-stock deal worth USD 4.9 billion, or USD 89.45 per share

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oil Shale Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oil Shale Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oil Shale Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.