Global Oilfield Surfactants Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

1.74 Billion

2024

2032

USD

1.05 Billion

USD

1.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.05 Billion | |

| USD 1.74 Billion | |

|

|

|

|

Oilfield Surfactants Market Size

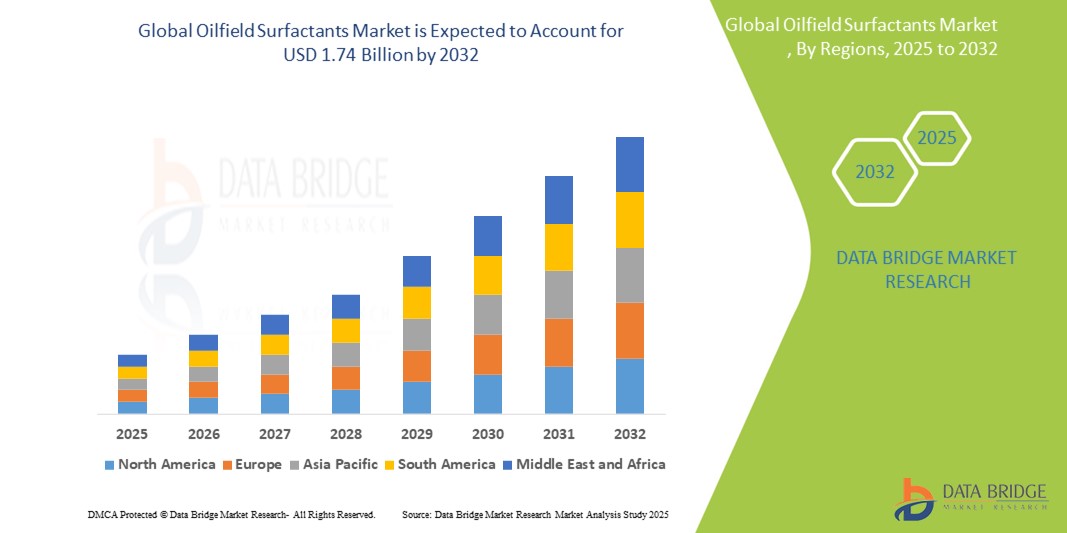

- The global oilfield surfactants market was valued at USD 1.05 billion in 2024 and is expected to reach USD 1.74 billion by 2032

- During the forecast period of 2025 to 2032 this market is such as to grow at a CAGR of 6.50%, primarily driven by the rising demand for enhanced oil recovery techniques

- This growth is driven by factors such as increasing focus on sustainable and high-performance surfactant formulations

Oilfield Surfactants Market Analysis

- The global oilfield surfactants market is witnessing steady growth driven by increasing demand for more efficient oil extraction methods across both conventional and unconventional reserves

- Companies are focusing on developing advanced formulations that perform better under extreme conditions such as high temperature and salinity commonly found in deep wells

- There is a growing preference for eco-friendly and biodegradable surfactants as the industry aligns more with sustainable and environmentally responsible practices

- New technologies such as nano-surfactants are being integrated to enhance oil recovery by improving fluid behavior and reducing interfacial tension in oil reservoirs

- For instance, several oilfield operators have begun incorporating green surfactants in their enhanced oil recovery techniques, resulting in improved operational efficiency and reduced ecological impact

- In conclusion, efficient and sustainable extraction methods. Innovations like nano-surfactants and eco-friendly formulations are enhancing performance while supporting environmental goals

Report Scope and Oilfield Surfactants Market Segmentation

|

Attributes |

Oilfield Surfactants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Oilfield Surfactants Market Trends

“Surging Demand for Advanced Oilfield Surfactants”

- The oilfield surfactants market is showing a strong upward trend as companies focus on increasing efficiency and maximizing oil recovery from both new and existing wells

- There is growing interest in plant-based and biodegradable surfactants as the industry embraces more sustainable and eco-friendly practices in daily operations

- Innovation in surfactant chemistry, especially with the use of nanotechnology, is enhancing product performance by improving their ability to function in high-pressure and high-temperature environments

- The use of advanced oil recovery methods such as micellar flooding and alkali-surfactant-polymer flooding is becoming more common, which has led to rising demand for highly specialized surfactant formulations

- For instance, the integration of smart technologies and automated systems in oilfield processes is pushing the development of surfactants that are not only effective but also compatible with digital monitoring and control setups

- In conclusion, efficient and environmentally responsible oil recovery. Emerging smart technologies are further shaping product development for modern extraction methods

Oilfield Surfactants Market Dynamics

Driver

“Rising Focus on Enhanced Oil Recovery”

- Oil producers are increasingly adopting enhanced oil recovery techniques as conventional reserves decline and global energy demand rises

- Surfactants help reduce interfacial tension between oil and water, improving recovery from mature fields where traditional methods are no longer effective

- Companies are investing in chemical-based recovery methods such as alkali-surfactant-polymer and micellar-polymer flooding which have proven successful in boosting output levels

- For instance, China National Petroleum Corporation implemented surfactant-based flooding in the Daqing oilfield which led to a noticeable increase in extraction efficiency and the increasing adoption of surfactants for enhanced oil recovery is driving market growth by improving extraction efficiency and maximizing resource recovery from mature fields

- Research and development efforts are focused on creating high-performance surfactants tailored for harsh reservoir conditions such as high temperature and salinity which enhances field applicability and long-term value

Opportunity

“Shift Toward Sustainable and Bio-Based Surfactants”

- The oilfield surfactants market is shifting towards bio-based solutions as industries face increasing pressure to reduce their environmental footprint

- Bio-based surfactants, derived from renewable sources such as vegetable oils and agricultural waste, are gaining popularity due to their biodegradability and low toxicity

- Companies are integrating green chemistry principles into formulations, aiming to balance performance efficiency with sustainability in oilfield operations

- For instance, BASF and Solvay have launched bio-based surfactants that meet the growing demand for eco-friendly solutions in oil and gas extraction and the shift to bio-based surfactants is helping companies align with sustainability goals while driving long-term growth in the oilfield surfactants market

- Environmental regulations in some regions are promoting the use of eco-friendly chemicals, encouraging companies to adopt more sustainable practices and gain a competitive edge

Restraint/Challenge

“High Cost and Complex Formulation Requirements”

- The high cost of developing surfactants that can withstand harsh oilfield conditions such as extreme temperatures, high salinity, and variable pH levels poses a significant challenge for the market

- Smaller operators may find the upfront costs of advanced surfactants difficult to justify, especially in regions with fluctuating oil prices, limiting their adoption

- Tailoring surfactant formulations for unique oilfield conditions requires extensive customization, leading to longer development timelines and higher production costs

- For instance, Shell has faced challenges in ensuring compatibility between surfactants and other chemicals during oil recovery processes, which increases formulation complexity and costs and complexity of surfactant formulations in the oilfield industry

- Regulatory approvals and environmental assessments can further delay the introduction of new surfactants, adding both time and financial burdens to the market

Oilfield Surfactants Market Scope

The market is segmented on the basis of product, source, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Source |

|

|

By Application |

|

Oilfield Surfactants Market Regional Analysis

“North America is the Dominant Region in the Oilfield Surfactants Market”

- North America is the dominant region in the global oilfield surfactants market, driven by the significant growth of shale oil and gas production, particularly in the United States and Canada

- The United States remains a key player, with the shale revolution propelling demand for enhanced oil recovery techniques, which rely heavily on surfactants for efficient extraction

- The presence of major oilfield service providers and chemical manufacturers in North America contributes to the region’s leading market share

- North America accounted for approximately 35% of the market share in 2023, making it the largest region for oilfield surfactants

- The region’s strong emphasis on technological advancements and regulatory support for energy production ensures the continued dominance of North America in the oilfield surfactants market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia Pacific region is witnessing rapid growth in the oilfield surfactants market due to increasing energy demands, especially in emerging economies such as China, India, and Indonesia

- Rising exploration and production activities in offshore and onshore reserves in the region are driving the demand for advanced surfactants in oil recovery processes

- The region is expected to grow at a compound annual growth rate of 6%, making it the fastest-growing market for oilfield surfactants

- Significant investments in oil and gas infrastructure by governments, coupled with growing foreign investments, have further accelerated the need for specialized surfactant solutions

- The shift towards more sustainable and eco-friendly surfactants in the Asia Pacific region is also contributing to its rapid market growth as businesses and governments increasingly focus on environmental regulations and sustainability

Oilfield Surfactants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- Akzo Nobel N.V. (Netherlands)

- Albemarle Corporation (U.S.)

- Zirax Limited (United Kingdom)

- BASF SE (Germany)

- Kemira (Finland)

- Solvay (Belgium)

- Ashland (U.S.)

- Baker Hughes Company (U.S.)

- CES Energy Solutions Corp. (Canada)

- Clariant (Switzerland)

- Chevron Phillips Chemical Company (U.S.)

- Flotek Industries, Inc. (U.S.)

- Halliburton (U.S.)

- Huntsman International LLC (U.S.)

- Innospec Oilfield Services (U.S.)

- Ecolab (U.S.)

- Schlumberger Limited (U.S.)

- Scomi Group Bhd (Malaysia)

- Dow (U.S.)

- Stepan Company (U.S.)

- Diamoco Group (U.A.E.)

- EMEC (Egypt)

- Gumpro Drilling Fluids Pvt. Ltd. (India)

- Chemiphase Ltd (U.K.)

- Jiaxing Midas Oilfield Chemical Mfg Co., Ltd (China)

- Imperial Oilfield Chemicals Private Limited (India)

- AES Drilling Fluids (U.S.)

Latest Developments in Global Oilfield Surfactants Market

- In September 2024, Evonik introduced TEGO Wet 570 Terra and TEGO Wet 580 Terra, biosurfactants derived entirely from natural resources. These products enhance performance in coatings and inks by improving pigment wetting, reducing grinding time, and meeting EU Ecolabel standards

- In October 2023, Sasol Chemicals introduced Carinex and Livinex, biosurfactants targeting the personal and home care sectors. Developed in partnership with UK biotech start-up Holiferm, these products are derived from natural, palm-free oils and sugars using fermentation. Carinex is aimed at personal care applications, while Livinex targets home care, technical, institutional, and industrial cleaning sectors. Both are fully biodegradable and serve as detergents, dispersants, emulsifiers, foaming agents, or wetting agents in various products

- In October 2022, BASF and Hannong Chemicals announced plans to establish a joint venture, BASF Hannong Chemicals Solutions Ltd., to produce non-ionic surfactants in the Asia Pacific region. BASF will hold a 51% stake, with Hannong Chemicals owning 49%. The facility will be located at the Daejuk site in Korea's Daesan Industrial Complex. This collaboration aims to meet the increasing demand for non-ionic surfactants in sectors such as home care, personal care, and industrial applications across Asia

- In January 2021, it was projected that the global oilfield surfactants market would reach approximately $798 million by 2025, driven by increased demand in enhanced oil recovery activities and a growing interest in bio-based, environmentally friendly surfactants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oilfield Surfactants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oilfield Surfactants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oilfield Surfactants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.