Global Oilseeds And Pulses Seeds Processing Market

Market Size in USD Billion

CAGR :

%

USD

358.09 Billion

USD

573.76 Billion

2025

2033

USD

358.09 Billion

USD

573.76 Billion

2025

2033

| 2026 –2033 | |

| USD 358.09 Billion | |

| USD 573.76 Billion | |

|

|

|

|

Oilseeds and Pulses Seeds Processing Market Size

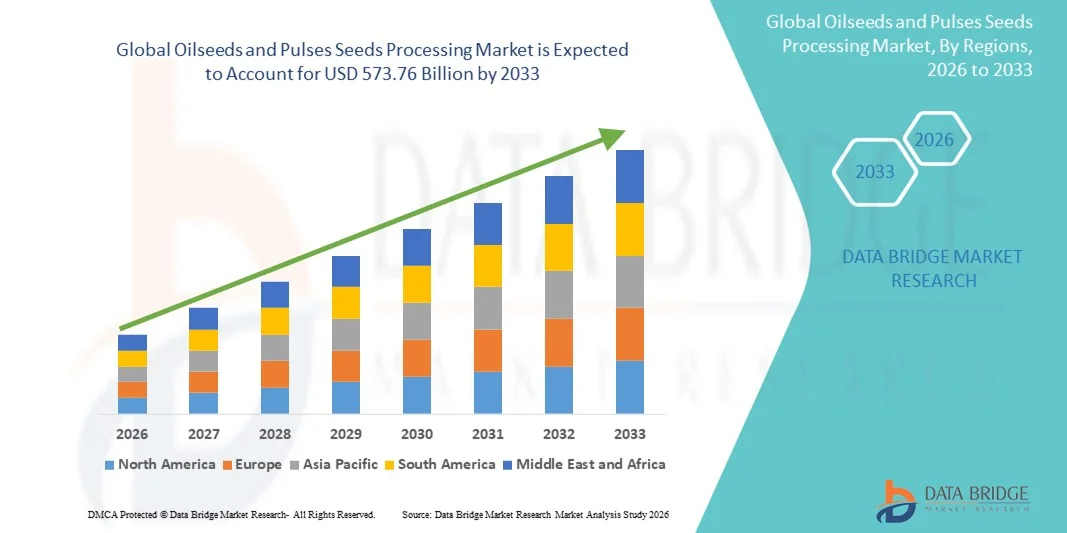

- The global oilseeds and pulses seeds processing market size was valued at USD 358.09 billion in 2025 and is expected to reach USD 573.76 billion by 2033, at a CAGR of 6.07% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality edible oils, plant-based protein products, and improved seed varieties that enhance yield and resistance to diseases

- Growing consumer inclination toward healthy, protein-rich food sources and the expanding global population are further driving the demand for processed oilseeds and pulses

Oilseeds and Pulses Seeds Processing Market Analysis

- The global oilseeds and pulses seeds processing market is experiencing robust growth, driven by rising awareness about nutritional benefits, sustainability, and food security. Increasing urbanization and dietary shifts toward plant-based diets are encouraging manufacturers to invest in advanced seed processing systems that ensure higher output and improved product quality

- Technological innovations such as automation, precision processing, and digital monitoring are enhancing operational efficiency and minimizing wastage across the processing chain. The demand for processed oilseeds such as soybean, sunflower, and canola, along with pulses such as lentils and chickpeas, continues to grow across food, feed, and industrial sectors

- North America dominated the oilseeds and pulses seeds processing market with the largest revenue share in 2025, driven by advanced agricultural infrastructure, strong adoption of mechanized processing systems, and a growing demand for high-quality plant-based food products. The presence of well-established processing facilities and supportive government policies further strengthen the region’s position in the global market

- Asia-Pacific region is expected to witness the highest growth rate in the global oilseeds and pulses seeds processing market, driven by rapid urbanization, increasing food demand, and government initiatives promoting sustainable and value-added agriculture

- The seed treatment segment held the largest market revenue share in 2025, driven by the growing demand for high-quality, disease-free, and high-germination seeds to enhance agricultural productivity. Seed treatment plays a critical role in protecting seeds from pathogens, improving crop yield, and ensuring uniform seedling emergence, which makes it highly preferred among large-scale and commercial farmers. Increasing government initiatives promoting sustainable farming practices and reduced chemical pesticide use further support the growth of this segment

Report Scope and Oilseeds and Pulses Seeds Processing Market Segmentation

|

Attributes |

Oilseeds and Pulses Seeds Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oilseeds and Pulses Seeds Processing Market Trends

Rise Of Sustainable And Eco-Friendly Processing Technologies

- The growing emphasis on sustainability and environmental responsibility is reshaping the oilseeds and pulses seeds processing industry. Manufacturers are increasingly adopting eco-friendly technologies such as cold-press extraction and solvent-free processing to minimize environmental impact and preserve nutritional quality. These sustainable approaches are gaining traction as global regulations tighten around emissions and chemical use in food production. In addition, there is a clear shift toward life-cycle-based sustainability assessments and certification programs that encourage processors to adopt greener practices and transparent supply chains

- The adoption of green processing technologies not only reduces carbon footprints but also improves product quality and consumer perception. Processors are leveraging innovations such as enzymatic extraction and bio-based solvents to enhance oil yield and purity while reducing waste generation. This trend aligns with the rising demand for organic and clean-label food ingredients among health-conscious consumers. Furthermore, advanced digital monitoring systems and AI-based optimization tools are helping processors reduce energy consumption and enhance process control for improved sustainability outcomes

- In addition, leading players are investing in renewable energy-powered facilities and waste-to-value initiatives to enhance circular economy practices. The integration of energy-efficient machinery and automation systems further supports the industry’s shift toward sustainable production. These efforts are expected to significantly improve operational efficiency and cost-effectiveness. Companies are also collaborating with agricultural cooperatives to promote low-carbon farming practices, ensuring that sustainability is implemented throughout the entire value chain from field to finished product

- For instance, in 2023, several European oilseed processing plants integrated renewable energy systems and water recycling technologies into their operations, resulting in up to 25% reduction in energy consumption and a notable improvement in sustainability ratings. These developments are setting new benchmarks for the global processing industry. The focus on energy recovery, reduced waste discharge, and green packaging materials is positioning Europe as a model region for sustainable seed processing practices, inspiring similar initiatives in Asia-Pacific and North America

- While sustainability-driven innovations are gaining momentum, the long-term success of eco-friendly processing depends on affordability, technological accessibility, and collaboration among industry stakeholders to ensure widespread implementation across both developed and emerging markets. Governments and trade bodies are expected to play a key role by providing subsidies, promoting technology transfer, and supporting innovation clusters that focus on sustainable agri-processing

Oilseeds and Pulses Seeds Processing Market Dynamics

Driver

Rising Demand For Plant-Based Proteins And Nutrient-Rich Products

- The surging popularity of plant-based diets and protein alternatives is a major factor driving the oilseeds and pulses seeds processing market. Consumers are increasingly shifting toward healthier and more sustainable food sources, boosting the demand for processed seeds used in protein isolates, flours, and oils. This trend is strongly influenced by growing health awareness and the global movement toward vegan and vegetarian lifestyles. Foodservice operators and global brands are also introducing plant-based menu options, further amplifying demand for processed seed ingredients across diverse applications

- Food manufacturers are utilizing processed oilseeds and pulses as key ingredients in meat substitutes, dairy alternatives, and fortified foods. Their high nutritional value, rich amino acid profiles, and functional properties make them ideal for a variety of food formulations. The growing preference for clean-label and non-GMO products further enhances the market appeal of these ingredients. The ability of these seeds to improve texture, stability, and shelf life in food products also provides manufacturers with a competitive advantage in product innovation

- Governments and food industry players are also promoting plant-based proteins through funding, research, and product development initiatives. This has accelerated the establishment of modern processing facilities designed to enhance extraction efficiency and maintain product integrity. Strategic partnerships between agri-tech firms and food processors are leading to breakthroughs in high-protein pulse concentrates and improved oil recovery technologies, further driving market expansion

- For instance, in 2023, several North American companies expanded their seed processing capacities to meet the escalating demand for plant-based proteins across food and nutraceutical sectors, marking a major step toward sustainable protein supply chains. This expansion not only helped stabilize regional supply but also reduced reliance on imports, supporting domestic agricultural economies and strengthening local value chains

- As the global protein consumption pattern continues to evolve, oilseeds and pulses seeds processing will remain a vital component of food innovation and sustainable nutrition strategies. Market participants are expected to focus on capacity expansion, technology upgradation, and quality assurance to capitalize on this rapidly growing demand segment

Restraint/Challenge

High Processing Costs And Inconsistent Raw Material Supply

- The high capital investment and operational costs associated with advanced seed processing technologies pose significant challenges to market growth. Equipment such as extrusion systems, decorticators, and solvent extractors require substantial financial outlays, making entry difficult for small and mid-sized processors. High maintenance expenses and energy-intensive operations further constrain profitability. In addition, fluctuating input costs for electricity and fuel significantly affect overall cost efficiency, particularly in developing economies with limited energy infrastructure

- Variability in raw material quality and inconsistent seed supply due to climate fluctuations, poor storage conditions, and limited access to high-yield crop varieties affect production efficiency. This irregularity can lead to increased costs and difficulties in maintaining consistent product quality, especially for export-oriented companies. Unpredictable rainfall patterns and extreme weather events further exacerbate supply risks, compelling processors to diversify sourcing strategies and build stronger supplier networks

- In developing regions, inadequate infrastructure, limited access to advanced machinery, and insufficient farmer training exacerbate the supply chain inefficiencies. These factors hinder the widespread adoption of modern processing technologies and reduce the competitiveness of local players in the global market. The absence of standardized processing protocols and lack of technical expertise also limit the scalability of operations, making it challenging for regional firms to compete with multinational corporations

- For instance, in 2023, seed processors in Southeast Asia reported a 30% rise in production costs due to inconsistent pulse harvests and increased machinery expenses, highlighting the urgent need for supply stabilization and technological support. Many firms are now exploring contract farming and digital supply chain monitoring tools to enhance predictability and traceability in raw material sourcing

- Overcoming these challenges requires strategic investments in technology transfer, government-backed incentives, and collaboration between farmers and processors to establish resilient, efficient, and cost-effective processing ecosystems. Long-term policy frameworks focusing on agricultural innovation, post-harvest management, and infrastructure development will be essential to improve supply reliability and lower processing costs across the global market

Oilseeds and Pulses Seeds Processing Market Scope

The market is segmented on the basis of type and equipment.

- By Type

On the basis of type, the oilseeds and pulses seeds processing market is segmented into seed treatment and seed coating material. The seed treatment segment held the largest market revenue share in 2025, driven by the growing demand for high-quality, disease-free, and high-germination seeds to enhance agricultural productivity. Seed treatment plays a critical role in protecting seeds from pathogens, improving crop yield, and ensuring uniform seedling emergence, which makes it highly preferred among large-scale and commercial farmers. Increasing government initiatives promoting sustainable farming practices and reduced chemical pesticide use further support the growth of this segment.

The seed coating material segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the increasing adoption of advanced coating technologies for enhanced seed performance and nutrient delivery. The segment benefits from innovations such as polymer-based coatings and bio-stimulant-infused materials that improve seed protection and field performance. In addition, the growing emphasis on precision agriculture and eco-friendly inputs is encouraging the use of customized seed coatings that enhance germination efficiency and field resilience.

- By Equipment

On the basis of equipment, the oilseeds and pulses seeds processing market is segmented into cleaners, gravity separators, dryers, graders, de-stoners, seed treatment, and other equipment. The cleaners segment accounted for the largest market share in 2025, attributed to the essential role of cleaning machinery in removing impurities, dust, and foreign materials to improve overall seed quality. Advanced cleaner systems equipped with automated sorting and high-efficiency filtration mechanisms are increasingly being adopted to ensure better productivity and compliance with international quality standards.

The gravity separators segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for precision separation of seeds based on density and weight. These machines are crucial in ensuring uniform seed grading and purity, which directly impacts oil extraction efficiency and product quality. Moreover, growing technological advancements in automated control systems and capacity expansion among leading processors are enhancing operational reliability and throughput efficiency, contributing to the robust growth of this segment.

Oilseeds and Pulses Seeds Processing Market Regional Analysis

- North America dominated the oilseeds and pulses seeds processing market with the largest revenue share in 2025, driven by advanced agricultural infrastructure, strong adoption of mechanized processing systems, and a growing demand for high-quality plant-based food products. The presence of well-established processing facilities and supportive government policies further strengthen the region’s position in the global market

- The region also benefits from robust investments in research and development aimed at enhancing oil extraction efficiency and seed quality. The shift toward sustainable farming practices and the increasing popularity of plant-derived proteins have further stimulated market expansion across the U.S. and Canada

- High consumer demand for clean-label, organic, and non-GMO food products continues to accelerate innovation in seed processing technologies, positioning North America as a major contributor to global market advancement

U.S. Oilseeds and Pulses Seeds Processing Market Insight

The U.S. oilseeds and pulses seeds processing market captured the largest revenue share in 2025 within North America, supported by strong demand for processed soybeans, canola, and lentils used in food, feed, and industrial applications. The increasing popularity of plant-based proteins, combined with technological advancements in seed treatment and coating, is driving market growth. Furthermore, investments in automated and energy-efficient processing systems are enhancing production efficiency. The presence of major food manufacturers and a robust export network further supports the U.S. market’s leadership position.

Europe Oilseeds and Pulses Seeds Processing Market Insight

The Europe oilseeds and pulses seeds processing market is expected to witness significant growth from 2026 to 2033, driven by stringent quality standards, growing environmental awareness, and a shift toward sustainable food production. European countries are increasingly focusing on the development of eco-friendly seed processing technologies to meet rising consumer demand for organic and plant-based products. The region is also witnessing substantial investments in advanced seed treatment and coating equipment, particularly in nations such as Germany, France, and the U.K. The strong regulatory framework and emphasis on traceability are fostering innovation and quality enhancement across the European market.

U.K. Oilseeds and Pulses Seeds Processing Market Insight

The U.K. oilseeds and pulses seeds processing market is expected to expand considerably from 2026 to 2033, fuelled by the increasing consumption of plant-based foods and protein-rich diets. The government’s focus on sustainable agriculture and reduction of carbon emissions is encouraging the adoption of energy-efficient processing systems. In addition, the presence of leading food processors and rising consumer awareness about health and nutrition are driving demand for high-quality seed-based ingredients. The integration of digital technologies for process optimization and quality control further supports market expansion in the U.K.

Germany Oilseeds and Pulses Seeds Processing Market Insight

The Germany oilseeds and pulses seeds processing market is expected to expand considerably from 2026 to 2033, driven by the country’s strong technological base, emphasis on sustainability, and innovation in agri-processing equipment. German processors are adopting automation, sensor-based sorting, and green extraction technologies to enhance productivity and minimize waste. The growing popularity of protein isolates, flours, and oils derived from oilseeds and pulses aligns with consumer demand for natural, eco-friendly, and nutrient-rich food products. Moreover, Germany’s strong export network and collaboration between food companies and research institutions are bolstering market growth.

Asia-Pacific Oilseeds and Pulses Seeds Processing Market Insight

The Asia-Pacific oilseeds and pulses seeds processing market is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing agricultural modernization, expanding food processing industries, and rising demand for plant-based nutrition. Countries such as China, India, and Japan are investing heavily in seed treatment technologies and advanced processing facilities. The region’s large population base, improving income levels, and expanding vegetarian and vegan consumer segments are driving the market forward. In addition, government initiatives promoting agricultural efficiency and food security are boosting adoption of modern seed processing technologies across the region.

Japan Oilseeds and Pulses Seeds Processing Market Insight

The Japan oilseeds and pulses seeds processing market is anticipated to register strong growth between 2026 to 2033, driven by the nation’s focus on food self-sufficiency and innovation in food technology. Japanese processors are adopting automation, cold-press extraction, and precision seed treatment technologies to enhance quality and minimize losses. The increasing consumer demand for premium plant-based foods and functional ingredients is further stimulating market development. Moreover, collaborations between food manufacturers and agricultural research institutes are advancing the efficiency and sustainability of Japan’s seed processing industry.

China Oilseeds and Pulses Seeds Processing Market Insight

The China oilseeds and pulses seeds processing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by its vast agricultural base, rapid industrialization of food processing, and growing domestic consumption of plant-based products. China’s large-scale investments in modern processing infrastructure and technological innovation are strengthening its global competitiveness. The government’s emphasis on self-reliance in food production and expansion of oilseed crushing facilities further enhance market growth. In addition, the increasing focus on sustainable practices and high-quality exports positions China as a key growth engine in the regional market.

Oilseeds and Pulses Seeds Processing Market Share

The Oilseeds and Pulses Seeds Processing industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• Bayer AG (Germany)

• Corteva (U.S.)

• Syngenta Crop Protection AG (Switzerland)

• Nufarm Ltd (Australia)

• LANXESS (Germany)

• Clariant (Switzerland)

• Croda International Plc (U.K.)

• Sensient Colors LLC (U.S.)

• A/S CIMBRIA (Denmark)

• Alvan Blanch Development Company Limited (U.K.)

• PETKUS Technologie GmbH (Germany)

• Lewis M. Carter Manufacturing, LLC (U.S.)

• WESTRUP A/S (Denmark)

• AKYUREK TECHNOLOGY (Turkey)

• Seed Dynamics (U.S.)

• Germains Seed Technology (U.K.)

• Chromatech Incorporated (U.S.)

• Centor Group (Australia)

• Precision Laboratories, LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.